Fill Out Your Colorado Dr 1102 Form

The Colorado DR 1102 form serves an essential function for businesses operating in the state by facilitating the process of notifying the Colorado Department of Revenue about significant changes related to their business status. This form allows business owners to streamline communication regarding updates such as changes in their name, address, or even informing the department of a business closure. It is critical for businesses that have either moved, changed their legal structure, or no longer owe certain taxes, including sales and use tax. The form provides specific sections that guide users through the process of submitting essential information accurately. To ensure prompt processing, users are advised to include their Colorado Account Number (CAN) and any relevant branch identifiers when applicable. The importance of timely and precise completion cannot be overstated, as it directly impacts accurate tax assessment and compliance with state regulations. Additionally, there are procedures in place for the closure of accounts, requiring businesses to indicate the closure date and the type of tax associated with the account. By commemorating these changes correctly, businesses can maintain their licenses and remain in good standing with the state's tax authorities.

Colorado Dr 1102 Example

*DO=NOT=SEND*

DR 1102 (08/23/18)

COLORADO DEPARTMENT OF REVENUE

Registration Center Section - Room 102

PO Box 17087

Denver CO

Colorado.gov/Tax

Address Change or Business Closure Form

Instructions

The address change or closure form must be used to notify the department of name/address changes, or to notify the department that you are no longer liable for Colorado sales tax, withholding tax or retailer’s use tax. If you have a login you can close your account online at Colorado.gov/RevenueOnline File this form now through Revenue Online. Visit

Colorado.gov/RevenueOnline

Revenue Online allows convenient and secure access to conduct business with the Department of Revenue. To learn more about Revenue Online, choose the “Help Link” in the upper left hand corner of the login screen. The “Help Link” gives detailed information of the services available. Third party login access information is included in the list of services.

Change in Ownership

If there has been a change in ownership and you are the new owner, you must complete a Sales Tax / Wage Withholding Account Application (CR 0100) for a new account to be established. Reminder, USE tax is due on the purchase of any tangible personal property.

FEIN

This is your Federal employer identification number. Please enter your Federal employer identification number.

Note: A new FEIN will require a new Department of Revenue account. Please fill out a Sales Tax / Wage Withholding Account Application (CR 0100)

Change of Name/Address

Use the right hand block to change any portion of your name/ address. If you operate in more than one location, you should provide the account and branch number specific to the location that was closed or moved to avoid delays in processing or incorrect billing. Enter the first 8 digits (Colorado Account Number or CAN) in the "Colorado Account Number" field and

the last 4 digits or site/branch ID to the "Branch ID" field. Mail the completed form to the Department of Revenue. If you have changed jurisdiction and are filing a sales tax return please download a single flat DR 0100 form our Web site at Colorado.gov/Tax so that you may collect and remit the correct sales tax for your new location. Once the department has received your Address Change or Business Closure Form, you will begin receiving DR 0100 flats for paper return filing purposes. If you elect to file electronically, you will not receive a flat. See the DR 1002 available on our Web site to verify the tax rates applicable to your new address location. If you are changing a corporate name, you must include the Amended Articles of Incorporation from the Secretary of State’s Office.

Important

DO NOT make changes to the name and address on your returns after you have notified the Department on the Address Change or Closure Form. The Department will send you new updated flats.

Date of Closure

Check the appropriate tax type box and indicate the date your account should be closed. This box should be checked ONLY if:

1.Your business was sold or discontinued.

2.You are no longer liable for the tax indicated.

3.The structure of your business changed and a new Federal Employer I.D. Number (FEIN) was issued.

4.Your corporation merged into another corporation.

Mail to and make checks payable to: Department of Revenue Registration Center Section - Room 102 PO Box 17087

Denver CO

*131102==19999*

DR 1102 (08/23/18)

COLORADO DEPARTMENT OF REVENUE

Registration Center Section - Room 102

PO Box 17087

Denver CO

Colorado.gov/Tax

Address Change or Business Closure Form

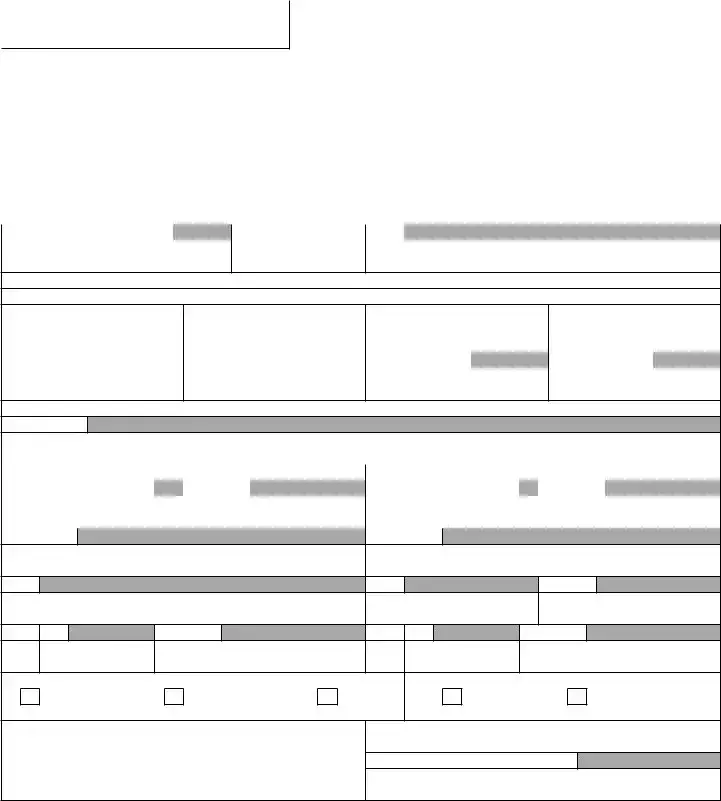

Use this form to notify the department of name and/or address changes or to notify the department that you want to close your account. Your Colorado Account Number (or CAN) is an 8 digit account number that is assigned to you when you open your account with the department. If you have a location based business, your sales tax license from the department should include both an 8 digit account number, as well as a 4 digit branch ID or site ID for each location you operate. To close or update the address of a location based businesses, please include the CAN and the branch ID specific to the location in question. Be sure to include the appropriate effective dates for closures and relocations in order to avoid incorrect assessments of tax liability.

Colorado Account Number (CAN) |

|

Branch/Site ID (last 4 digits) |

FEIN |

|

To close one or more accounts, complete this section.

Date account closed: (MM/DD/YY)

|

|

Withholding Tax |

|

|

Sales Tax |

|

|

Entire Account |

|

|

Other |

||

|

|

|

|

|

|

|

|||||||

Date (MM/DD/YY) (Last Day of Payroll) |

Date (MM/DD/YY) (Last Day of Sales) |

Date (MM/DD/YY) |

|

Date (MM/DD/YY) |

|

||||||||

To change the address or name for one or more accounts, complete this section.

Effective Date

Previous Name and Address |

New Name and Address |

||||||

Last Name or Business Name |

|

First Name |

|

Last Name or Business Name |

|

First Name |

|

|

|

|

|

|

|

|

|

Old Address

New Address

City

City

County

State Zip

Telephone

State

Zip

Telephone

Mailing Address

Physical Address

Both

Inside City

Outside City

Mail to: Colorado Department of Revenue Registration Center Section - Room 102 PO Box 17087

Denver CO

Note: If your retail business location changes during a filing period you must file a separate sales tax return for the taxes collected at each location

Must Be Signed By An Authorized Agent

Form Characteristics

| Fact Name | Detail |

|---|---|

| Purpose | The DR 1102 form is used to notify the Colorado Department of Revenue about changes in business address or to report a business closure. |

| Governing Law | Applicable under the Colorado Revised Statutes, specifically related to taxation and business operations. |

| File Online | Users with login credentials can file the DR 1102 form online via Revenue Online, providing a convenient method to handle business accounts. |

| Account Number Requirement | The form requires the input of the Colorado Account Number (CAN) and, if applicable, the Branch ID for accurate processing. |

| Ownership Changes | In case of a change in ownership, a new account must be established through the Sales Tax / Wage Withholding Account Application (CR 0100). |

| Federal Employer Identification Number (FEIN) | The form requests the FEIN, which is essential for the business's tax identification with the federal government. |

| Processing Timeline | Upon receipt of the DR 1102 form, the Department of Revenue will begin sending updated forms for tax filing, such as the DR 0100. |

| Effective Dates | It's crucial to indicate the appropriate effective dates for closures or address changes to prevent incorrect tax assessments. |

| Closure Reasons | The form includes checkboxes for specific reasons for closure, such as business sale, discontinuation, or structural changes. |

| Mailing Address | Completed forms should be mailed to the Colorado Department of Revenue at the designated address in Denver, Colorado. |

Guidelines on Utilizing Colorado Dr 1102

Filling out the Colorado DR 1102 form is a necessary step if you need to notify the Department of Revenue of an address change or if your business is closing. Follow the steps below carefully to ensure everything is completed correctly.

- Obtain the Form: Download the DR 1102 form from the Colorado Department of Revenue's website.

- Enter Basic Information: Fill in your Federal Employer Identification Number (FEIN) at the top of the form.

- Colorado Account Information: Provide your Colorado Account Number (CAN), which is an 8-digit number. If applicable, add the last 4 digits for the Branch/Site ID.

- Select Account Type: Indicate whether you are closing your Withholding Tax account, Sales Tax account, Entire Account, or Other. Check the appropriate box.

- Date of Account Closure: Specify the last day your account should be closed using the MM/DD/YY format.

- Change of Address or Name: If changing your address or name, complete the appropriate section. Include both old and new information for the business.

- Effective Date: Note the effective date for the name or address change.

- Mailing and Location Details: Include your old and new physical addresses. Check either "Inside City" or "Outside City" as applicable.

- Contact Information: Fill in the telephone numbers for both the old and new addresses.

- Signature: Ensure that the form is signed by an authorized agent of the business.

After completing the form, mail it to the Department of Revenue at the specified address. It is important to ensure that all information provided is accurate, as this will prevent any issues with tax liabilities or accounts. Once processed, you will receive updates regarding your account's status and any further instructions if needed.

What You Should Know About This Form

What is the purpose of the Colorado DR 1102 form?

The Colorado DR 1102 form serves as a notification tool for individuals and businesses to communicate changes regarding their name or address, as well as to inform the Department of Revenue that they are closing their account. It's crucial for maintaining accurate records and ensuring that tax liabilities are managed correctly. This form applies to sales tax, withholding tax, or retailer’s use tax obligations in Colorado.

Who needs to fill out the DR 1102 form?

Any business or individual who has an established account with the Colorado Department of Revenue is required to complete the DR 1102 form when they need to update their business name or address or if they want to close their account. This includes businesses that have undergone ownership changes or those that have stopped being liable for certain taxes.

How can I submit the DR 1102 form?

The form can be submitted in several ways. You may choose to mail the completed form to the Department of Revenue at the specified address: Registration Center Section, Room 102, PO Box 17087, Denver, CO 80217-0087. Alternatively, if you have an online account, you can conveniently file the form through Revenue Online. Accessing Revenue Online provides a secure method to manage your tax obligations and track your submissions.

What information do I need to provide when filling out the DR 1102?

When filling out the DR 1102, you will need to supply your Colorado Account Number (CAN) which consists of eight digits, along with the last four digits of your branch ID or site ID. You must also specify the changes being made, including your previous and new name or address and the date of closure or address change. It is essential to ensure that the effective dates provided are accurate to prevent any miscommunication regarding tax obligations.

What should I do if my business has changed ownership?

If you have acquired a business, you will need to fill out the DR 1102 form in addition to submitting a Sales Tax/Wage Withholding Account Application (CR 0100) to set up a new account. This is necessary because a change in ownership generally requires a new Federal Employer Identification Number (FEIN), which, in turn, mandates the establishment of a new account within the Department of Revenue’s system.

Can I make name and address changes on tax returns after submitting the DR 1102?

No, once you have submitted the DR 1102 form, you should refrain from making any further changes to your name and address on your tax returns. The Department of Revenue will send updated forms reflecting your new name and address. To avoid complications or incorrect assessments, adhere closely to your submission and wait for the updated forms to arrive.

What happens after I submit the DR 1102 form?

Upon receipt of your DR 1102 form, the Department of Revenue will process your request. If you have opted for a business closure, you will begin receiving new tax form notifications tailored to your current status. For those who have updated their address but wish to continue their business operations, the department will also ensure that the correct sales tax rates apply for your new location, and you’ll receive the necessary forms for reporting.

Where can I find additional guidance on submitting the DR 1102 form?

If you require more detailed information about the form or its submission process, you can visit Colorado.gov/Tax. This site offers comprehensive resources, including forms, guidelines, and links to Revenue Online for online submissions. The available help links also provide essential support for navigating your tax-related queries efficiently.

Common mistakes

Filling out the Colorado DR 1102 form incorrectly can lead to significant delays and complications. One common mistake is neglecting to provide the correct Colorado Account Number (CAN). This eight-digit number is essential for identifying your account. Omitting or miswriting it will hinder the processing of your request.

Another frequent error involves failing to include the Branch ID. This four-digit number is necessary if your business operates in multiple locations. Providing only partial account information can result in your request being processed for the wrong location, creating more paperwork and confusion.

Many people also overlook the importance of filling in the correct Federal Employer Identification Number (FEIN). This number must match your business records. If you provide an incorrect FEIN, it may require setting up a new account with the Department of Revenue, which can complicate matters further.

Inaccurate address details can also cause issues. The form requires both the previous and new addresses to be filled out thoroughly. Failing to specify the full address, including city and zip code, can lead to miscommunication and delays in updates.

Another common oversight is in not checking the appropriate tax type box. The form specifies that you need to indicate whether you are closing your account for withholding tax, sales tax, or entire account. Skipping this step can lead to the wrong account being closed or left open unnecessarily.

Some users forget to provide effective dates for closures or address changes. Without these dates, processing may be delayed as the department needs additional information to correctly update records. This can be frustrating, especially when timely updates are critical for tax compliance.

Moreover, neglecting to sign the form can halt the entire process. The form must be signed by an authorized agent. A missing signature invalidates the submission, requiring you to redo the entire form.

Additionally, it is crucial to remember not to make any name or address changes on your tax returns after submitting the DR 1102 form. This creates inconsistencies in your tax records, which can lead to complications down the line.

Finally, some individuals fail to review the instructions before completing the form. It is vital to understand all necessary fields and requirements before submission to avoid common pitfalls. Taking a few moments to read the guidelines can ensure a smoother filing experience.

Documents used along the form

The Colorado DR 1102 form is an essential document for business owners in the state, serving to notify the Department of Revenue about address changes or business closures. Along with the DR 1102, several other forms may be relevant for various business situations. Here’s a concise list of forms commonly used in conjunction with the DR 1102:

- CR 0100 – Sales Tax / Wage Withholding Account Application: This form is necessary for new business registrations or to establish new accounts when there is a change in ownership.

- DR 0100 – Sales Tax Return: This form is used to file for sales tax collected from customers. It must be filed for each location where sales are made.

- DR 1002 – Sales Tax Rate Verification: This document helps businesses check the specific tax rates applicable to their new address, ensuring accurate tax collection.

- Articles of Incorporation: If changing a corporate name, businesses must include amended Articles from the Secretary of State's Office as part of their documentation.

- DR 4600 – Colorado Retail Sales Tax License Application: Required to apply for a retail sales tax license, this form must be submitted if opening a new location.

- DR 0440 – Colorado Employer Registration: This form registers entities that have employees and need to comply with withholding tax responsibilities.

- DR 1310 – Request for Tax Clearance: Businesses may use this form to request a certificate showing that all taxes owed have been paid, often required for closing or selling a business.

- DR 0180 – Nonprofit Organization Registration: Nonprofit organizations must complete this form to comply with specific tax exemption requirements in Colorado.

- DR 720 – Use Tax Return: This return is specifically for reporting use tax due on purchases where sales tax was not collected at the point of sale.

- Form W-9 – Request for Taxpayer Identification Number: This form is used to provide your tax identification number to entities that need it for tax reporting purposes.

Understanding these forms can greatly ease the process of managing a business in Colorado. Each document serves a specific function that corresponds to tax obligations and business operations. Careful attention to detail will help ensure compliance and avoid unnecessary complications.

Similar forms

- Form CR 0100: Similar to the DR 1102 form, the CR 0100 is used for establishing or updating a sales tax or wage withholding account. It requires information about the business but focuses more on the creation of a new account than on notification of changes.

- Form DR 0100: This is a return form that is utilized for filing sales tax. When any address changes are made using the DR 1102, the department sends the DR 0100 for future filings relevant to the new location.

- Form DR 1002: This form checks tax rates applicable to new address locations. Similar to the DR 1102, it is essential for ensuring compliance with tax obligations after a change in business address.

- Form CR 0100A: This form can be filed for reporting changes in ownership of a sales tax account. The connection to the DR 1102 lies in the necessity to report business changes, but it specifically addresses ownership transitions.

- Articles of Incorporation: When changing a corporate name, the amended version must be submitted along with the DR 1102. Both serve to formalize the legal identity of the business post-change.

- Wage Withholding Account Application: When businesses change their ownership or structure, they need to submit this application, similar to the DR 1102, to maintain compliance with tax liabilities after major business changes.

Dos and Don'ts

When filling out the Colorado DR 1102 form, it is important to follow specific guidelines. Here are some do's and don'ts to keep in mind:

- DO fill out all required sections completely before submission.

- DO include your Colorado Account Number (CAN) and Branch ID for accurate processing.

- DO mail the completed form to the correct address provided on the form.

- DO check the appropriate boxes regarding the type of closure or name change.

- DON'T make changes to your name or address on previous returns after submitting the form.

- DON'T forget to sign the form; it must be signed by an authorized agent.

- DON'T leave any fields blank unless explicitly stated as optional.

Misconceptions

1. The Colorado DR 1102 form is only for business closures. Many believe this form is solely dedicated to closing a business. However, it also serves to update address or name changes for active accounts.

2. You cannot submit the DR 1102 form online. Some think that this form must be mailed in only. In fact, it can be conveniently submitted through Revenue Online, streamlining the process.

3. This form is not necessary if the business is legally inactive. It's a common misconception that if a business is not currently operating, there is no need to notify the Department of Revenue. In reality, submitting the form is important to prevent ongoing tax liabilities.

4. A new FEIN is required for every address change. Many assume that changing the address will necessitate obtaining a new Federal Employer Identification Number. Actually, a new FEIN is only needed if there's a change in ownership or business structure.

5. You can pick and choose the information to provide. Some believe they can skip filling out entire sections of the form. However, all relevant sections must be completed to ensure proper processing.

6. Changes made on the DR 1102 form don’t affect tax filings. There is a misconception that notifying the department of changes does not impact future tax obligations. In truth, notifying them is crucial to avoid mismatches during tax assessments.

7. You don’t need to inform the department about changes if you use a third-party service. Some think that third-party tax preparers or services will automatically take care of these notifications. However, it's the business owner's responsibility to ensure that the Department of Revenue is kept informed.

Key takeaways

Filling out the Colorado DR 1102 form is an important task for business owners. Here are key takeaways to consider:

- Use the form for notifying the Department of Revenue about any name or address changes, or to close your tax account.

- Include your Colorado Account Number (CAN) and branch/site ID to ensure proper processing of your request.

- After submitting the form, avoid making additional changes to your name or address on tax returns until you receive updated documentation from the department.

- Be sure to check the appropriate tax type box and specify the closure date if applicable, such as when your business has been sold or is no longer operational.

Pay close attention to these points. Completing this process correctly will help maintain compliance with Colorado tax regulations.

Browse Other Templates

Daily Time Record Sample - Managerial review of CS Form 48 ensures accountability among team members.

How to Write a Eulogy Step by Step - He/She devoted many hours to (hobby or service) and was known for always helping others.

Pediatric Care Plan - The test date for this group was April 19, 2012.