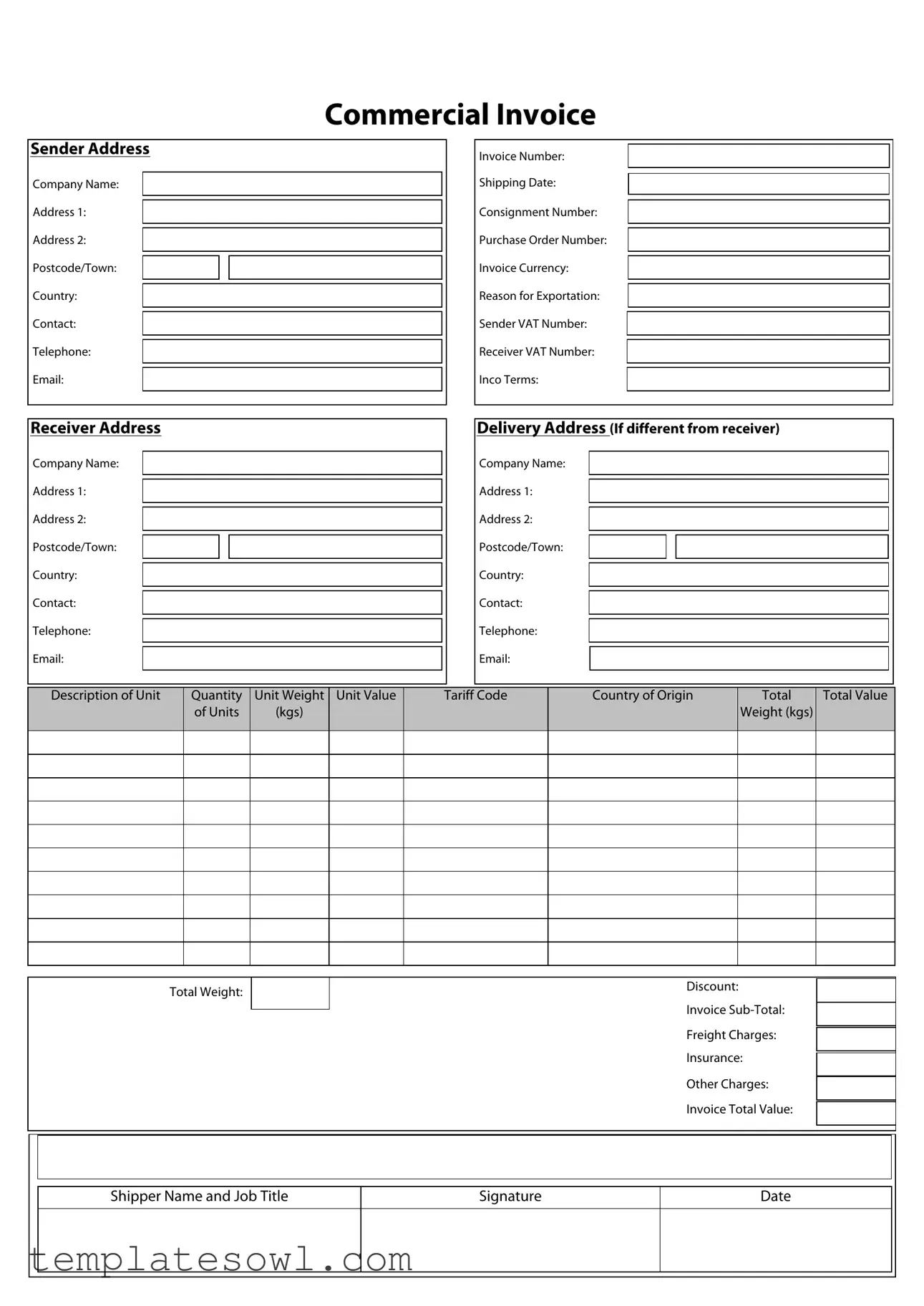

Fill Out Your Commercial Invoice Form

The Commercial Invoice form plays a crucial role in international trade by facilitating the shipment of goods across borders. This document serves multiple purposes, including customs clearance, payment processing, and record keeping. Essential information on the form includes the names and addresses of both the seller and buyer, product descriptions, quantities, and total values of the goods being shipped. Each item is usually listed with its corresponding price, enabling customs officials to assess duties and taxes accurately. Additionally, the form contains important details about the shipping method and terms of sale, which affect the responsibility for transport and insurance. By providing clarity on the transaction, the Commercial Invoice helps to avoid misunderstandings and potential delays at customs. It is vital for anyone engaged in exporting or importing goods to familiarize themselves with this document, as it ensures compliance with various regulations and smooth operation of the trade process.

Commercial Invoice Example

$PNNFSDJBM*OWPJDF

4FOEFSEFUBJMT

$PNQBOZ "EESFTTMJOF "EESFTTMJOF 1PTUDPEF$JUZ Location 4FOEFSOBNF 5FMFQIPOF &NBJM

*OWPJDFOVNCFS PQUJPOBM

4IJQQJOHEBUF

4IJQNFOUOVNCFS

$VSSFODZ

3FBTPOGPSFYQPSU 4FOEFS7"5OVNCFS 3FDFJWFS7"5OVNCFS 5FSNTPGTBMF *ODPUFSNT

3FDFJWFSEFUBJMT

$PNQBOZ

"EESFTTMJOF

"EESFTTMJOF

1PTUDPEF$JUZ

Location

3FDFJWFSOBNF

5FMFQIPOF

&NBJM

%FTDSJQUJPOPGHPPET |

2VBOUJUZ |

6OJUXFJHIU |

6OJUWBMVF |

|

LH |

||||

|

|

|

||

|

|

|

|

|

|

|

|

|

%FMJWFSZEFUBJMT JGEJGGFSFOUGSPNSFDFJWFS

$PNQBOZ

"EESFTTMJOF

"EESFTTMJOF

1PTUDPEF$JUZ

Location

%FMJWFSZDPOUBDU

5FMFQIPOF

&NBJM

)4DPEF |

Location PGPSJHJO |

5PUBM |

5PUBMWBMVF |

|

XFJHIU LH |

||||

|

|

|

||

|

|

|

|

|

|

|

|

|

/VNCFSPGQBDLBHFTJOTIJQNFOU |

5PUBMTIJQNFOUWBMVF |

|

||

%JTDPVOU |

|

|||

|

|

|

|

|

|

|

|

4VCUPUBM |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4IJQQJOHDPTUT |

|

|

|

|

*OTVSBODFDPTUT |

|

|

|

|

|

|

|

|

|

0UIFSDPTUT |

|

|

|

|

|

|

|

|

|

5PUBMEFDMBSFEWBMVF |

|

|

|

|

|

|

|

|

|

|

|

%FDMBSBUJPO

*EFDMBSFUIBUUIFDPOUFOUPGUIJTJOWPJDFJTUSVFBOEDPSSFDU

/BNFBOE4JHOBUVSF

$PNQBOZBOE+PCUJUMF

%BUF

"EEJUJPOBMJOGPSNBUJPO FHIB[BSEPVTEFUBJMT &03*OVNCFS &$$/OVNCFS FUD

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Commercial Invoice form serves as a record for the sale of goods between a buyer and a seller. It outlines the details of the transaction, including item descriptions, quantities, and prices. |

| Required Information | This form must include the seller's and buyer's contact information, a detailed list of items sold, total value, and shipping terms. Missing information can lead to delays in customs and delivery. |

| Regulatory Compliance | In the U.S., the Commercial Invoice must comply with U.S. Customs and Border Protection regulations. Misrepresentation can result in fines or sanction. |

| Governing Law | The governing laws relevant to the Commercial Invoice are state-specific, often determined by the Uniform Commercial Code (UCC) as adopted by each state in the U.S. |

Guidelines on Utilizing Commercial Invoice

Filling out a Commercial Invoice accurately is crucial for international shipping. This form serves as an essential record for customs and facilitates the process of shipping goods across borders. Follow these steps to ensure that the Commercial Invoice form is completed properly.

- Gather Required Information: Collect details about the buyer, seller, and the goods being shipped. Ensure you have addresses, contact information, and details about the items including quantities and values.

- Complete the Seller Information: Input the name, address, and contact details of the seller. This information should clearly identify who is sending the goods.

- Input Buyer Information: Enter the name, address, and contact details of the buyer. This enables customs officials to identify the recipient of the goods.

- Describe the Goods: List each item being shipped with a thorough description. Include the quantity, unit price, and total value for each line item.

- Indicate the Country of Origin: Specify where each item was manufactured or produced. This is necessary for customs regulations.

- State the Reason for Export: Select or state the purpose of shipping the items, such as sale, repair, or replacement.

- Sign and Date the Invoice: The seller must sign and date the Commercial Invoice to confirm its accuracy and authenticity.

- Review for Accuracy: Before submission, double-check all entries for completeness and correctness. Ensure that all required fields are filled out.

What You Should Know About This Form

What is a Commercial Invoice?

A Commercial Invoice is a document used in international trade. It provides details about the goods being shipped, including the description, quantity, and the value of the products. This document is essential for customs purposes, as it helps authorities to assess duties and taxes on the items being imported or exported.

Who needs a Commercial Invoice?

If you are involved in international shipping, you will likely need a Commercial Invoice. This includes businesses sending products overseas or individuals mailing goods to friends and family abroad. It is required by customs authorities in the destination country to clear your shipment.

What information is included in a Commercial Invoice?

A Commercial Invoice typically includes the following information: the names and addresses of both the seller and the buyer, a detailed description of the goods, their quantities, unit prices, total value, and the terms of sale. Additional details, like shipping method and payment terms, may also be included to facilitate the transaction.

How do I fill out a Commercial Invoice?

To fill out a Commercial Invoice accurately, start with your name and address in the seller section. Next, write the buyer’s name and address. Include a clear description of the items, indicating quantities and values. Lastly, indicate any terms or conditions that apply to the sale. Be sure to double-check all entries before submitting the invoice.

Is a Commercial Invoice the same as a pro forma invoice?

No, a Commercial Invoice is not the same as a pro forma invoice. A Commercial Invoice is a final document required for customs clearance, while a pro forma invoice is a preliminary bill of sale sent to buyers before the actual sale takes place. It outlines the expected costs and details but does not serve as an official invoice.

What happens if I do not include a Commercial Invoice?

If you fail to include a Commercial Invoice with your shipment, it may lead to delays in customs clearance. The package could be held until the necessary documentation is provided. In some cases, your items could be subject to fines or returned to the sender.

Can I modify a Commercial Invoice after it has been issued?

Generally, once a Commercial Invoice is issued, it should not be modified. If you need to change any information, it is best to create a new invoice and reference the original, especially for customs purposes. Clarity and accuracy are essential in ensuring a smooth shipping process.

How can I obtain a Commercial Invoice template?

You can find Commercial Invoice templates online, often available for free. Many shipping companies and trade organizations provide templates that you can customize for your needs. Alternatively, you can create one from scratch by including the required elements as discussed above.

Are there penalties for submitting an incorrect Commercial Invoice?

Yes, submitting an incorrect Commercial Invoice may lead to penalties. Customs authorities may assess fines or other consequences for discrepancies in value or product description. It is important to ensure that all information is accurate to avoid any complications during the shipping process.

Common mistakes

Filling out a Commercial Invoice form can be a straightforward task, but many people unknowingly make mistakes that can lead to delays or complications in shipping. One common error is providing incomplete information. Essential details such as the sender's and recipient's addresses, including country and postal codes, must be accurate and thorough. Without this information, packages may be misrouted or returned, causing frustration and added costs.

Another frequent mistake involves the incorrect declaration of the goods being shipped. Each item must be described clearly, including its value and quantity. If the description is vague or if the values are understated, customs can question the shipment, potentially resulting in fines or seizures. Displaying caution and clarity in these descriptions is crucial.

People often overlook the importance of including all relevant invoices and documentation. A complete set of documents helps customs officials assess and clear shipments promptly. Missing documents can lead to additional scrutiny and delays. Therefore, it is wise to double-check that all accompanying documents are accurate and in place before submission.

Moreover, errors in tax identification numbers or harmonized system codes can cause significant issues. These codes help classify and determine the appropriate duties and taxes for your products. Using the wrong codes can lead to unexpected charges or delays in processing your shipment. Taking the time to verify these codes can save considerable hassle.

Another common error is neglecting to sign and date the invoice. A signature is often required to confirm that the information provided is accurate and true. Failing to do so may lead customs officials to reject the invoice altogether, further complicating the shipping process.

Inconsistent currency declarations also create confusion. If you're shipping internationally, you must indicate the currency in which the transaction is made. Currency fluctuations can significantly impact the value of goods, and not specifying the correct currency can lead to miscalculations in duties and taxes.

People sometimes underestimate the need for thorough packaging. It’s essential to ensure that the goods are well-packaged and protected. Damaged items due to inadequate packing can result in claims disputes and complications with adjustments in the invoice.

Lastly, failing to keep a copy of the Commercial Invoice for personal records is a common oversight. Having a record can be invaluable for tracking shipments or in case any disputes arise. Maintaining a complete and organized document trail helps ensure smoother transactions in the future.

Documents used along the form

When engaging in international trade, several key documents accompany a Commercial Invoice to ensure smooth transactions. Each of these documents provides essential information and helps facilitate customs processes.

- Bill of Lading: This document serves as a receipt for the shipment and a contract between the shipper and the carrier. It outlines the details of the cargo and the terms of transportation.

- Packing List: A detailed list that documents the contents of each package within a shipment. It helps customs agents verify what is being shipped and can assist in any claims if items are missing or damaged.

- Certificate of Origin: This certifies the country where the goods were manufactured. It may be necessary for determining tariffs or trade agreements that apply to the shipment.

- Export License: Required for certain products, this license gives permission from the government to export specific goods. It can vary depending on the commodity and destination.

- Insurance Certificate: This document proves that the goods in transit are insured. It provides protection against loss or damage during shipping.

- Customs Declaration: This statement provides information about the cargo to customs authorities, outlining the value and classification of goods to determine duties and taxes.

Understanding these documents and their purposes can help streamline your international shipping process, making it easier to navigate customs regulations and ensure compliance. Proper documentation minimizes delays and helps protect your interests during the shipping process.

Similar forms

The Commercial Invoice form is similar to several other documents used in business and trade. Here are eight documents that share similarities:

- Proforma Invoice: Like a Commercial Invoice, this document provides a detailed estimate of goods and is often used for international transactions before shipment occurs.

- Bill of Lading: Both documents include shipment details and are crucial for transporting goods. The Bill of Lading is more focused on the transport aspect.

- Packing List: This document complements the Commercial Invoice by detailing the contents of a shipment, including dimensions and weight, which can aid in customs clearance.

- Sales Order: A Sales Order confirms the purchase details, similar to how a Commercial Invoice lists the items sold and transaction specifics.

- Customs Declaration: Both documents are essential for customs clearance, as they provide information regarding the goods being imported or exported.

- Certificate of Origin: This document provides evidence of where the goods originated, akin to how a Commercial Invoice shows product details and transaction specifics.

- Payment Receipt: While a Payment Receipt confirms payment for goods, the Commercial Invoice serves as a request for payment detailing the transaction.

- Drop Shipment Invoice: Similar to a Commercial Invoice, this document is used in drop shipping scenarios where the goods are shipped directly to the customer from the supplier.

Dos and Don'ts

When filling out the Commercial Invoice form, certain practices can help ensure accuracy and compliance. Below is a list of things you should and shouldn't do:

- Do provide complete and accurate information regarding the items being shipped.

- Do include the correct values for all goods listed on the invoice.

- Do clearly indicate the origin of the goods, including country of manufacture.

- Do check that the shipping and billing addresses are correctly entered.

- Don't leave any fields blank; incomplete forms can lead to delays.

- Don't use vague descriptions of items; be specific to avoid confusion.

Following these guidelines can enhance the efficiency of the shipping process and minimize potential issues with customs clearance.

Misconceptions

Misconceptions about the Commercial Invoice form can lead to confusion for businesses and individuals engaged in international trade. Here are nine common misconceptions explained in detail.

- It is only needed for shipments over a certain value. Many believe that a Commercial Invoice is only required for high-value shipments. In reality, it is necessary for both low and high-value goods, especially for customs clearance.

- It replaces a packing list. Some think the Commercial Invoice serves as a packing list. While both documents are important, they serve different purposes. The invoice details the value and terms of sale, while the packing list outlines the contents of the shipment.

- Only sellers need to fill it out. This misconception suggests that only the seller is responsible for completing the Commercial Invoice. However, both the seller and the buyer should ensure the information is accurate, as it affects customs duties and taxes.

- It is a government form. The Commercial Invoice is often mistaken for a government form. In fact, it is a private document created by the seller, designed to facilitate international trade and customs procedures.

- The information must be in English only. Some people believe that the invoice must be written only in English. While English is commonly accepted, using the language of the importing country can aid in smoother customs processing.

- It is not necessary for gifts. Many assume that if goods are being sent as gifts, a Commercial Invoice isn't needed. However, customs still requires an invoice to determine any applicable duties or taxes, regardless of the shipment's nature.

- All items must have a declared value. A common misunderstanding is that every item shipped must have a declared value listed on the invoice. While each item should be described, the invoice can include a lump sum value for items when appropriate.

- It is the same as a pro forma invoice. Some confuse a Commercial Invoice with a pro forma invoice. A pro forma invoice is primarily an estimate of costs and is sent prior to shipping. The Commercial Invoice contains final details needed for customs.

- It does not need to be kept for records. Lastly, there's a belief that once the shipment is complete, the invoice can be discarded. In truth, businesses should retain copies for their records, as they may be needed for audits or future transactions.

Key takeaways

When filling out and using the Commercial Invoice form, there are several important points to keep in mind:

- Accuracy is crucial. Ensure that all details, such as the description of goods, value, and origin, are correct. Mistakes can lead to delays or customs issues.

- Include complete contact information. Provide accurate names, addresses, and contact details for both the sender and receiver. This information is essential for shipping and communication.

- Clearly state the purpose of the shipment. Indicate whether the items are for sale, a gift, or for personal use. This helps customs determine applicable duties.

- Documentation is key. Attach any required documents along with the invoice. This may include packing lists or shipping labels, which facilitate smoother processing.

Awareness of these factors will help ensure a successful transaction and minimize potential issues with customs.

Browse Other Templates

Icwa California - It captures essential information to ensure the child’s Indian status is properly recognized.

Dd Form 370 April 2021 - The information is vital for the Armed Forces to ensure they select qualified candidates.

Plantation Permit - Property owners should confirm their compliance with local construction laws via a signature.