Fill Out Your Commercial Lease Application Form

Completing a Commercial Lease Application form is an essential step for anyone seeking to secure a rental space for their business. This form gathers critical information about the applicant and their business, facilitating the landlord's decision-making process. Key components of the application include details such as the location of the premises, applicant’s personal and business information, and legal names that will appear on the lease. It also requires extensive financial data, including monthly income, expenses, assets, and liabilities to give the landlord a comprehensive view of the applicant's financial standing. Additionally, the form prompts for rental history and contact details for previous landlords, shedding light on the applicant's reliability as a tenant. Consent for a credit check is another crucial element of the process, which allows for a thorough review of the applicant’s credit and criminal history. Together, these components create a holistic picture of the applicant, thus ensuring landlords can make informed and confident decisions regarding their leasing opportunities.

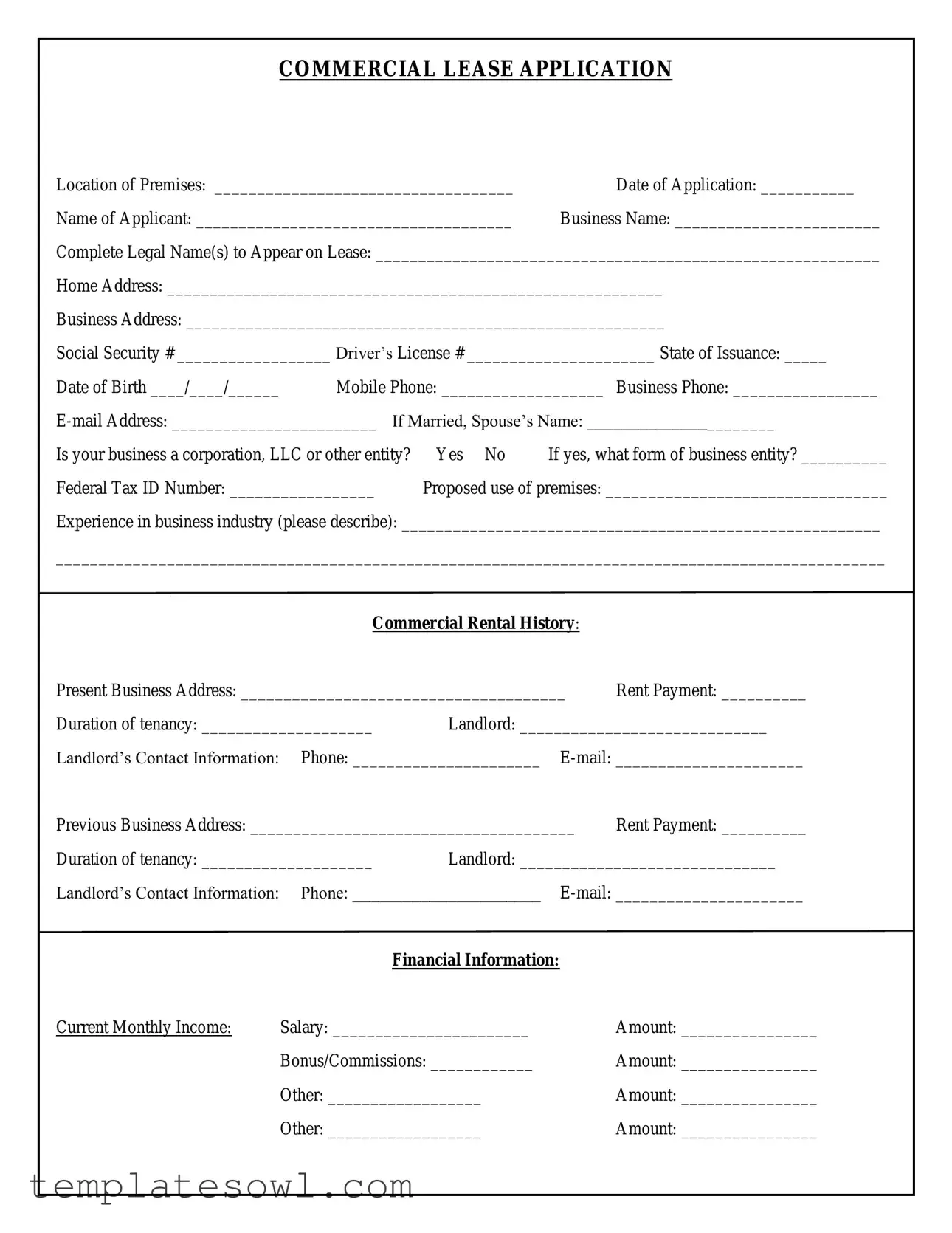

Commercial Lease Application Example

COMMERCIAL LEASE APPLICATION

Location of Premises: ___________________________________ |

Date of Application: ___________ |

Name of Applicant: _____________________________________ |

Business Name: ________________________ |

Complete Legal Name(s) to Appear on Lease: ___________________________________________________________

Home Address: __________________________________________________________

Business Address: ________________________________________________________

Social Security # __________________ Driver’s License # ______________________ State of Issuance: _____

Date of Birth ____/____/______ |

Mobile Phone: ___________________ Business Phone: _________________ |

||

Is your business a corporation, LLC or other entity? |

Yes No |

If yes, what form of business entity? __________ |

|

Federal Tax ID Number: _________________ |

Proposed use of premises: _________________________________ |

||

Experience in business industry (please describe): ________________________________________________________

_________________________________________________________________________________________________

|

Commercial Rental History: |

|

||

Present Business Address: ______________________________________ |

Rent Payment: __________ |

|||

Duration of tenancy: ____________________ |

Landlord: _____________________________ |

|||

Landlord’s Contact Information: |

Phone: ______________________ |

|||

Previous Business Address: ______________________________________ |

Rent Payment: __________ |

|||

Duration of tenancy: ____________________ |

Landlord: ______________________________ |

|||

Landlord’s Contact Information: |

Phone: ______________________ |

|||

|

|

Financial Information: |

|

|

Current Monthly Income: |

Salary: _______________________ |

|

Amount: ________________ |

|

|

Bonus/Commissions: ____________ |

|

Amount: ________________ |

|

|

Other: __________________ |

|

Amount: ________________ |

|

|

Other: __________________ |

|

Amount: ________________ |

|

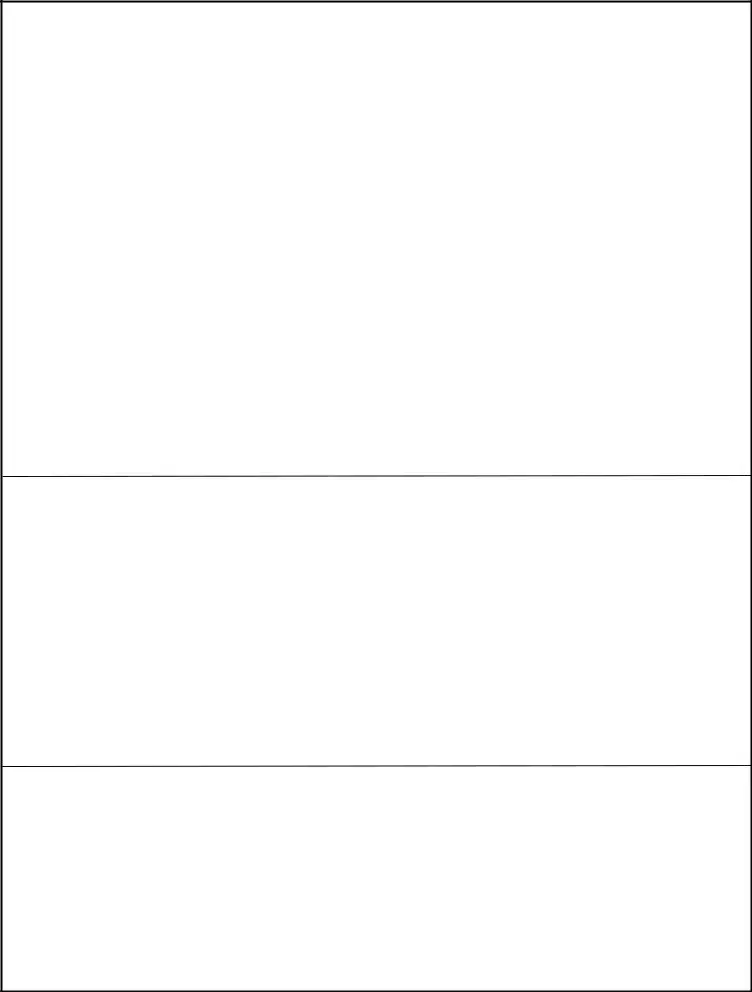

Current Monthly Expenses: |

Home Mortgage: __________________ |

Amount: ________________ |

|

Loan Payments: __________________ |

Amount: ________________ |

|

General Living Expenses: __________ |

Amount: ________________ |

|

Other: __________________ |

Amount: ________________ |

|

Other: __________________ |

Amount: ________________ |

ASSETS |

LIABILITIES |

Cash on Hand & in Banks ____________________ |

Accounts Payable ($ you owe) ___________________ |

Savings Account(s) __________________________ |

Notes/loans Payable to Banks ___________________ |

IRA/Retirement Accounts _____________________ |

Automobile Payments _________________________ |

Accounts Receivable ($ owed to you) ____________ |

Other Installment Accounts _____________________ |

Insurance Cash Surrender _____________________ |

Loans on Life Insurance ________________________ |

Stocks & Bonds _____________________________ |

Mortgages on Real Estate (home) _________________ |

Real Estate (personal residence) ________________ |

Unpaid Taxes _________________________________ |

Real Estate (investments) _____________________ |

Outstanding Credit Card Balances _________________ |

Automobiles ________________________________ |

Other Liabilities _______________________________ |

Other Personal Property _______________________ |

Other Liabilities _______________________________ |

Other Assets ________________________________ |

|

Other Assets ________________________________ |

|

TOTAL ASSETS: ____________________________ |

TOTAL LIABILITIES: ________________________ |

NET WORTH (Total Assets minus Total Liabilities) __________________________

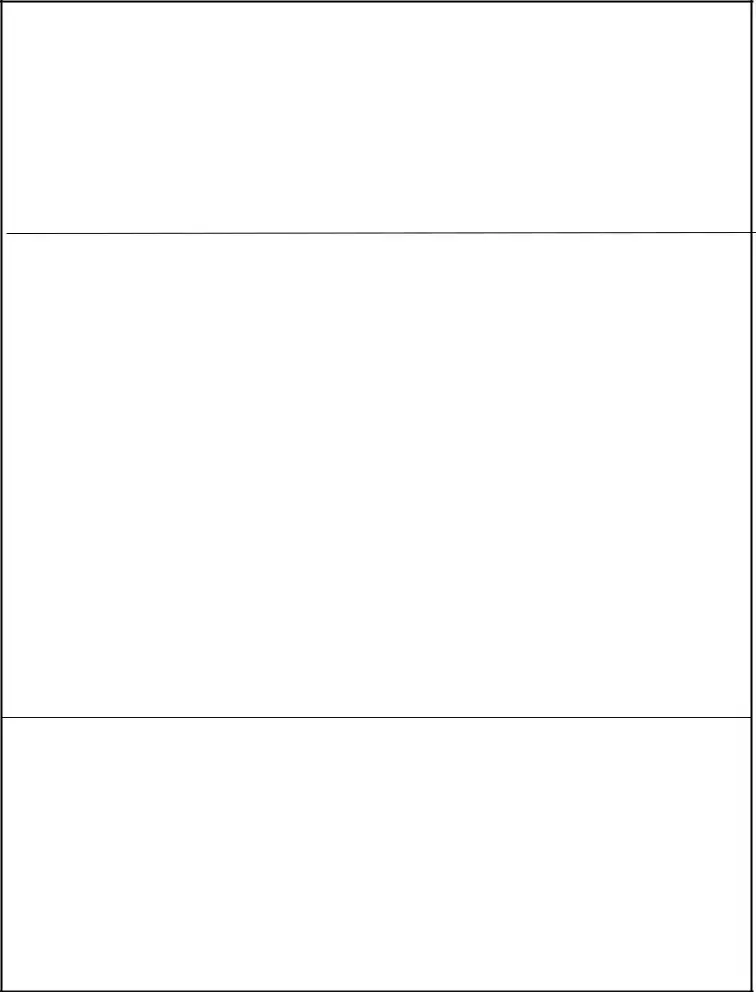

Personal Information

Dependent Children: 1. ____________________DOB: _____________

2. ____________________ DOB: _____________ |

|

3. ____________________ DOB: _____________ |

|

4. ____________________ DOB: _____________ |

|

5. ____________________ DOB: _____________ |

|

Other Dependents: 1. ____________________ DOB: _____________ |

Relation: ______________ |

2. ____________________ DOB: _____________ |

Relation: ______________ |

Business/Occupation: 1. _______________________

2._______________________

3._______________________

|

Credit References: |

Banking Information: |

|

Bank |

Account # |

Business Checking: ________________ #____________________________

Business Checking: _________________#____________________________

Checking: _________________#_________________________

Checking: _________________#_________________________

Savings: __________________#_________________________

Savings: __________________#_________________________

Other: ____________________#_________________________

Other: ____________________#_________________________

Credit Cards: _________________#________________________

_________________#________________________

_________________#________________________

_________________#________________________

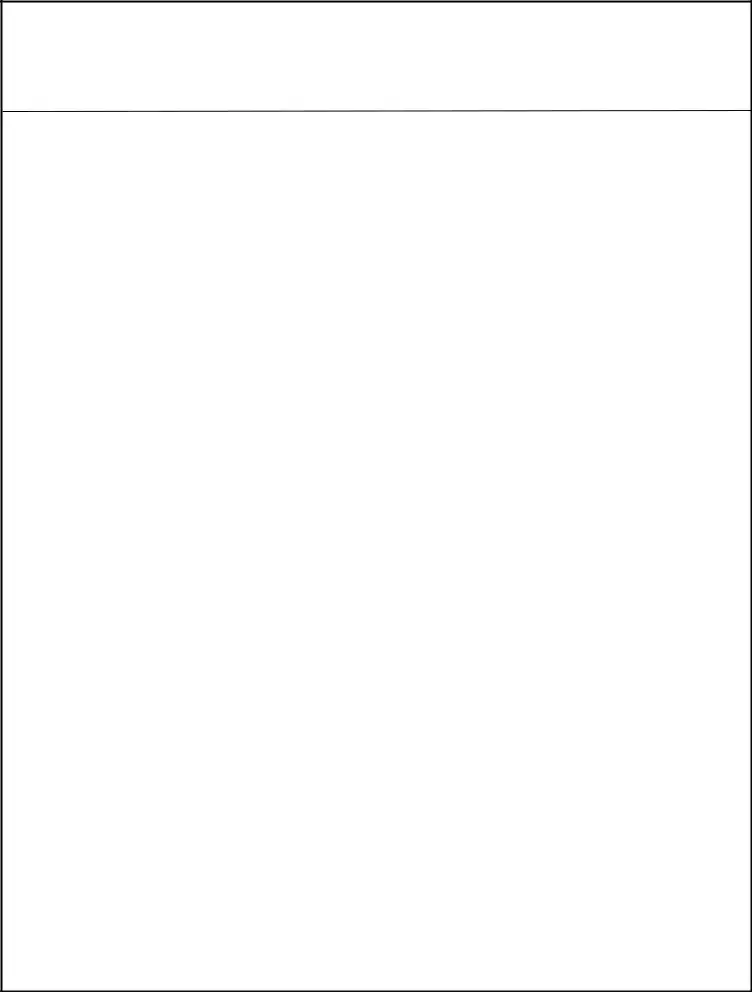

CONSENT TO CREDIT CHECK

I, the undersigned applicant(s), authorize landlord or his/her/their agent to order and review my/our credit and criminal history and investigate the accuracy of the information contained in the application. I/We further authorize all banks, employers, creditors, credit card companies, references, and any and all other persons to provide to Landlord any and all information concerning my/our credit.

By your signature hereon, you agree that the information disclosed by you herein is true, complete and accurate to the best of your knowledge, and you agree that the information disclosed by you herein is material to the potential lessor’s decision with respect to granting or denying your application to enter into a lease agreement.

This application is not a commitment to rent to Applicant(s) or reserve a premises unless a formal lease agreement is fully executed by both parties.

Name: ____________________ |

Signature: _____________________________ |

Date: ____________ |

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | The commercial lease application is designed to assess a potential tenant's suitability for leasing a commercial property. |

| Information Required | Applicants must provide personal, business, and financial information, including names, addresses, and income details. |

| Credit Check Authorization | Signing the application grants the landlord permission to perform credit and criminal history checks on the applicant. |

| Business Structure | Applicants need to disclose whether their business is a corporation, LLC, or other legal entity. |

| Rental History | A comprehensive rental history is part of the application, detailing current and previous landlords and payment amounts. |

| Financial Information | The application requires information about monthly income, expenses, assets, and liabilities to evaluate financial stability. |

| Net Worth Evaluation | Calculating net worth is essential, as it assesses the applicant's financial standing by subtracting liabilities from assets. |

| Dependents | Applicants should list dependent children and other dependents, providing names and dates of birth. |

| Consent Importance | Consent to conduct a credit check is crucial since it influences the landlord’s decision-making process. |

| Legal Framework | Each state may have specific laws governing commercial leases, impacting how applications are processed; state-specific forms should be reviewed accordingly. |

Guidelines on Utilizing Commercial Lease Application

Completing the Commercial Lease Application form is an important step in securing a commercial lease. It gathers necessary information regarding the applicant and their proposed business operations. Follow these steps to ensure accurate completion.

- Fill in the Location of Premises and Date of Application.

- Provide your Name and Business Name.

- Complete the section for Legal Name(s) to Appear on Lease.

- Enter your Home Address and Business Address.

- List your Social Security # and Driver’s License #, including the State of Issuance and Date of Birth.

- Provide your Mobile Phone, Business Phone, and E-mail Address.

- If married, include your spouse’s Name.

- Indicate whether your business is a corporation, LLC, or other entity. Answer Yes or No.

- If applicable, state the Form of Business Entity.

- Input your Federal Tax ID Number.

- Describe the Proposed Use of Premises.

- Detail your Experience in Business Industry.

- For Commercial Rental History, provide your Current Business Address, Rent Payment, Duration of Tenancy, Landlord Name, and Contact Information.

- For any previous rental history, fill in Previous Business Address, Rent Payment, Duration of Tenancy, Landlord Name, and Contact Information.

- Go to Financial Information, listing your Current Monthly Income sources (Salary, Bonus/Commissions, Other) along with their amounts.

- Detail Current Monthly Expenses such as Home Mortgage, Loan Payments, and General Living Expenses.

- Complete the sections for Assets and Liabilities by listing items and their respective amounts.

- Calculate and enter the TOTAL ASSETS, TOTAL LIABILITIES, and your NET WORTH.

- List Dependent Children and any Other Dependents along with their DOB and Relation as applicable.

- Provide Business/Occupation details for yourself and others as required.

- Add your Credit References and Banking Information, including account numbers as necessary.

- Complete the Credit Cards section with relevant numbers.

- Sign and date the Consent to Credit Check section. Include your Name and Signature.

What You Should Know About This Form

What is a Commercial Lease Application form?

The Commercial Lease Application form is a document that potential tenants submit to landlords or property management companies when seeking to rent commercial space. This form collects essential information about the applicant, such as personal details, business information, financial stability, and rental history, all of which help landlords assess the suitability of the applicant for leasing the property.

What information do I need to provide on the application?

You will need to provide various pieces of information, including your name, business name, addresses (home and business), contact numbers, email address, and details about your business entity if applicable. Additionally, the form requires you to disclose your financial information, such as monthly income and expenses, assets and liabilities, as well as any dependents.

Why is my rental history important?

Your rental history is crucial because it gives the landlord insights into your past behavior as a tenant. You'll need to provide details about previous business addresses, rent payment amounts, duration of tenancy, and the contact information of former landlords. This history helps landlords gauge your reliability and responsibility as a tenant.

What is a consent to credit check?

The consent to credit check section of the application allows landlords to obtain and evaluate your credit and criminal history. It serves as an authorization for them to contact banks, employers, and other relevant entities to verify the accuracy of the information provided in your application. This process is a standard procedure to ensure financial security for both the landlord and the applicant.

What happens if my application is denied?

If your application is denied, the landlord is typically required to notify you of the decision. However, it is important to note that there may be varying reasons for denial, including past evictions, poor credit history, or insufficient income. If denied, you have the right to request information about the decision, which may help you in future applications.

Is submitting the application a guarantee of leasing the property?

No, submitting the Commercial Lease Application form does not guarantee that you will be allowed to lease the property. It is merely the first step in the evaluation process. A formal lease agreement must be fully executed by both parties before a legal rental commitment exists.

How long does it take to process my application?

The time it takes to process a lease application can vary. On average, landlords may take anywhere from a few days to a week to review applications. The duration is influenced by factors such as the thoroughness of the review process and the responsiveness of references and financial institutions. Keeping your information readily accessible can help expedite the process.

Common mistakes

Filling out the Commercial Lease Application form can be a straightforward process if you avoid common mistakes. One of the most frequent oversights is not providing complete information. Failing to fill out required fields, such as the full legal name of the business or the proposed use of the premises, can lead to delays in processing the application. Every piece of information contributes to the landlord's evaluation, so ensure that all sections are completed thoroughly.

Another common error is providing inaccurate or outdated contact information. This includes both personal and business phone numbers or email addresses. If the landlord cannot reach you for additional questions, it could jeopardize your application. Always double-check your entries to confirm that all contact details are correct.

Many applicants neglect to disclose previous rental history, especially during contexts of gap or inconsistent rental payments. Landlords want a comprehensive view of your history as it relates to rental obligations. Transparency about past experiences with rental properties can demonstrate reliability and build trust with potential landlords.

Another significant mistake involves the financial portion of the application. Some individuals may either inflate or minimize their income and expenses. Providing accurate financial data is essential. Landlords require genuine financial statements to assess your ability to meet rental obligations. Hiding liabilities or overstating assets can lead to disapproval when the inconsistencies are discovered.

People often forget to include credit references. This section serves as a way for landlords to verify your financial responsibility. Missing references can create doubts about your credibility. Always include reliable references that can provide insight into your financial habits.

Finally, failing to sign the application or neglecting to date it can result in outright rejection. The signature indicates that you agree to the terms and authorize a credit check. Without it, the application remains incomplete, and processing cannot proceed. Make sure to review the entire document before submission to confirm all requirements have been met.

Avoiding these common mistakes can significantly improve your chances of a successful application. Attention to detail will not only make the filling process easier but also reflect well on you as a responsible tenant.

Documents used along the form

When applying for a commercial lease, several key documents typically accompany the Commercial Lease Application form. Each of these documents plays a vital role in the assessment of the applicant’s suitability for the lease. Below is a list of other forms and documents that are often required.

- Business Plan: A detailed plan outlining the business's operations, objectives, and strategies. It helps landlords understand the applicant's vision and potential for success.

- Personal Financial Statement: This document provides a clear summary of an individual's financial situation, including assets, liabilities, and net worth, giving a comprehensive view of their financial health.

- Business Financial Statements: Recent income statements and balance sheets for the business are usually required. These documents demonstrate the business's profitability and financial stability.

- Credit Report: A report detailing the credit history of the applicant, which lenders and landlords assess to evaluate financial reliability.

- Tax Returns: Personal and/or business tax returns for the past few years offer insights into income and financial history, establishing credibility and stability.

- References: Contact information for previous landlords or business partners who can provide insight into the applicant's reliability and business conduct.

- Proof of Insurance: Documentation showing that the applicant has adequate insurance coverage, which protects both the business and the landlord against liabilities.

- Lease Agreement: A copy of the proposed lease agreement outlining terms, conditions, and expectations, which the landlord reviews for compliance with their standards.

- Entity Documentation: For businesses structured as corporations or LLCs, incorporation documents or articles of organization must be provided for verification and legitimacy.

Having these documents prepared and ready can streamline the application process and enhance the applicant's chances of securing the desired commercial lease. Each document contributes valuable information for landlords to make informed decisions.

Similar forms

Rental Application Form: Much like the Commercial Lease Application, a Rental Application gathers personal and financial information from potential tenants. It assesses suitability for rental properties by verifying income, credit history, and past rental behavior.

Business Loan Application: Similar in purpose, a Business Loan Application seeks detailed financial records and personal data. It evaluates the applicant's creditworthiness and the overall financial health of the business seeking funding.

Tenant Screening Application: This document focuses on conducting background checks. Like the Commercial Lease Application, it examines the applicant's credit history, rental history, and sometimes criminal background to determine suitability for leasing.

Employment Application: An Employment Application collects relevant personal information and employment history. Both forms assess a person's background and financial stability, though theirs is for hiring purposes.

Credit Application: This document is used when applying for credit from lenders. Similar to the Commercial Lease Application, it requires detailed financial disclosure to evaluate the applicant's ability to repay debt.

Loan Modification Application: When requesting a change to a loan agreement, this application gathers financial data to assess the borrower's current situation. Like a lease application, it aims to verify financial stability.

Mortgage Application: This application form is used for seeking home mortgages. Similar to the Commercial Lease Application, it collects extensive financial information to determine borrowing eligibility.

Partnership Agreement Application: When entering into a partnership, this application outlines the accountability and expectations of partners. Both documents require transparency regarding financial commitments and personal assets.

Membership Application: Common for gyms or organizations, a Membership Application asks for personal details and payment methods. Much like a lease application, it evaluates the suitability of the applicant for membership.

Dos and Don'ts

Things to do when filling out the Commercial Lease Application form:

- Provide accurate and complete information in all sections.

- Double-check for any spelling errors or typos before submitting.

- Ensure that you include all required documentation, such as financial statements.

- Read the entire application carefully to understand all requirements and obligations.

Things to avoid when filling out the Commercial Lease Application form:

- Don’t leave any fields blank unless specified; provide explanations where necessary.

- Avoid exaggerating or misrepresenting your financial status.

- Do not submit the application without a thorough review.

- Refrain from providing outdated or incorrect contact information.

Misconceptions

When considering a commercial lease application form, several misconceptions often arise. It is important to address these misunderstandings to ensure that applicants are adequately informed about the process and its implications.

- Misconception 1: The form guarantees a lease.

- Misconception 2: Only financial information is considered.

- Misconception 3: Providing personal information is unnecessary.

- Misconception 4: All applications are treated equally.

- Misconception 5: A credit check will negatively impact my score.

Many applicants mistakenly believe that submitting the application automatically secures them a lease. In reality, completing an application does not create any binding agreement. A formal lease must be executed by both parties for an actual lease to exist.

While financial stability is indeed a key factor, landlords also assess the applicant's business experience, rental history, and intended use of the premises. They look for a well-rounded profile that indicates reliability and suitability for the space.

Some applicants think that personal details, like their Social Security number or financial data, are irrelevant. However, this information is crucial. It helps landlords evaluate not just the business but also the individual behind it, ensuring a complete understanding of the applicant's financial background.

Every commercial lease application is subject to scrutiny, but landlords may prioritize certain factors. For instance, local applicants or businesses with an established rental history may receive different consideration than new ventures. Understanding this variability can help applicants better prepare.

Applicants often fear that a credit check from potential landlords will harm their credit score. However, when conducted as part of a rental application, this inquiry typically has minimal impact. It is essential, however, to ensure that such checks are authorized and conducted within legal parameters.

Key takeaways

When filling out a Commercial Lease Application form, consider these key takeaways:

- Accuracy is Essential: Ensure that all provided information is correct. Incorrect details can delay approval.

- Complete All Sections: Every part of the application must be filled out. Missing information might lead to rejection.

- Financial Information Matters: Be prepared to disclose your income, expenses, assets, and liabilities. This provides the landlord a clear picture of your financial standing.

- Credit and Background Checks: Understand that you authorize the landlord to run credit and background checks. This helps them assess your reliability as a tenant.

- Read Before Signing: Always review the application before signing. Make sure you fully understand what you are agreeing to.

Browse Other Templates

What Is a Fee Waiver for College - Qualified applicants may find additional funding opportunities by maintaining their enrollment status.

Military Dependent Id - DD Form 1173 is integral in military member transition situations.

Dd 2345 - The form must not include digital signatures; a physical signature is required.