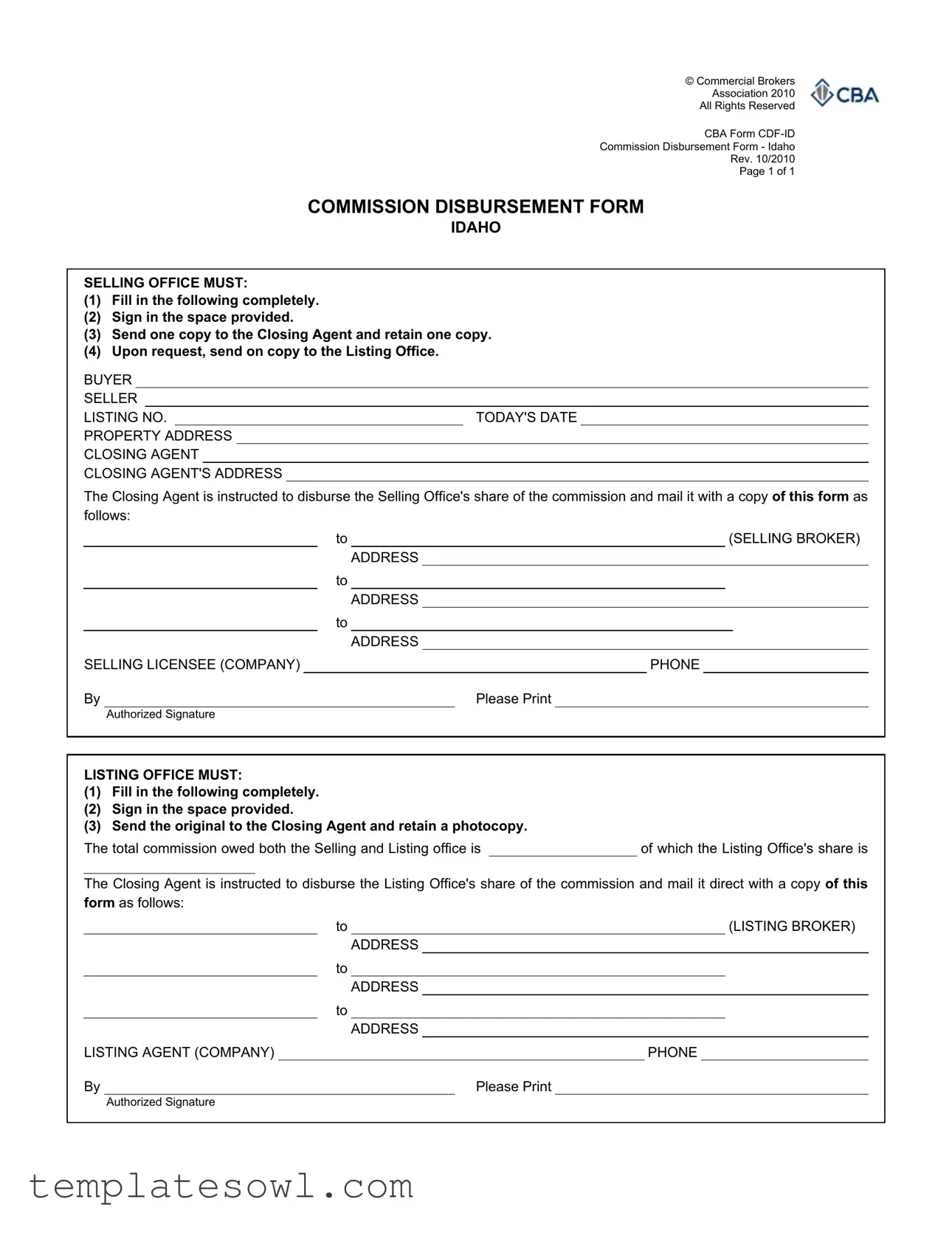

Fill Out Your Commission Disbursement Form

When dealing with real estate transactions, efficient communication and record-keeping are vital. The Commission Disbursement Form plays a crucial role in this process, ensuring the smooth distribution of commissions between the selling and listing offices. This document requires both parties to fill in essential information such as property address, buyer and seller details, and closing agent specifications. Each office must also provide authorized signatures to validate the instructions for disbursement. It further instructs the closing agent to distribute the commission earnings appropriately, thus safeguarding the financial interests of all parties involved. Accurate completion and timely submission of the form are paramount, as they facilitate the transfer of funds and ensure compliance with industry standards. Furthermore, retaining copies of the completed form is necessary for future reference and accountability. Navigating this form correctly can prevent unnecessary delays or disputes, making it an indispensable tool in real estate transactions.

Commission Disbursement Example

© Commercial Brokers

Association 2010

All Rights Reserved

CBA Form

Commission Disbursement Form - Idaho

Rev. 10/2010

Page 1 of 1

COMMISSION DISBURSEMENT FORM

IDAHO

SELLING OFFICE MUST:

(1) Fill in the following completely.

(2) Sign in the space provided.

(3) Send one copy to the Closing Agent and retain one copy.

(4) Upon request, send on copy to the Listing Office.

BUYER

SELLER

LISTING NO. |

|

TODAY'S DATE |

|

|||

PROPERTY ADDRESS |

|

|

|

|||

CLOSING AGENT |

|

|

|

|||

CLOSING AGENT'S ADDRESS |

|

|

|

|||

The Closing Agent is instructed to disburse the Selling Office's share of the commission and mail it with a copy of this form as follows:

|

|

|

to |

|

|

|

|

|

|

(SELLING BROKER) |

|

|

|

|

|

ADDRESS |

|||||||

|

|

|

to |

|

|

|

|

|

|

|

|

|

|

|

|

ADDRESS |

|||||||

|

|

|

to |

|

|

|

|

|

|

|

|

|

|

|

|

ADDRESS |

|||||||

SELLING LICENSEE (COMPANY) |

|

|

|

|

|

PHONE |

|

||||

By |

|

|

Please Print |

||||||||

|

Authorized Signature |

|

|

|

|

|

|

|

|

||

LISTING OFFICE MUST:

(1)Fill in the following completely.

(2)Sign in the space provided.

(3)Send the original to the Closing Agent and retain a photocopy.

The total commission owed both the Selling and Listing office isof which the Listing Office's share is

The Closing Agent is instructed to disburse the Listing Office's share of the commission and mail it direct with a copy of this form as follows:

|

|

to |

|

|

|

|

(LISTING BROKER) |

|

|

|

ADDRESS |

||||

|

|

to |

|

|

|

|

|

|

|

|

ADDRESS |

||||

|

|

to |

|

|

|

|

|

|

|

|

ADDRESS |

||||

LISTING AGENT (COMPANY) |

|

|

|

PHONE |

|

||

By |

|

Please Print |

|||||

Authorized Signature

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Commission Disbursement Form is used to authorize the disbursement of commissions to both the Selling and Listing Offices upon closing of a real estate transaction. |

| Requirements | Both the Selling Office and Listing Office must complete their respective sections fully and provide signatures to ensure validity. |

| Distribution | After completion, a copy must be sent to the Closing Agent, while a photocopy must be retained by each office involved. |

| Governing Law | In Idaho, this form is governed by state real estate regulations and practices, which dictate the handling of commission disbursements. |

| Important Dates | Today's date must be clearly filled in to ensure accurate and timely processing of the commission disbursement. |

Guidelines on Utilizing Commission Disbursement

Completing the Commission Disbursement form is a key part of the real estate closing process. Each party involved must provide accurate information to ensure timely distribution of commissions. Follow these straightforward steps to fill out the form properly.

- Begin with the Selling Office section:

- Fill in the buyer's name, seller's name, and the listing number.

- Enter today's date.

- Provide the property address.

- Fill in the Closing Agent's name and address.

- Specify the amount to be disbursed to the Selling Broker, along with their address.

- Include information about the Selling Licensee (company name and phone number).

- Sign the form in the designated area, using an authorized signature.

- Next, move to the Listing Office section:

- Complete the same fields: buyer's name, seller's name, and listing number.

- Note the total commission owed to both Selling and Listing Offices.

- Specify the Listing Office's share of the commission.

- Enter the Listing Broker's name and address where the commission should be sent.

- Provide the Listing Agent's company name and phone number.

- Sign this section as well with an authorized signature.

- Final steps:

- Send one copy of the completed form to the Closing Agent.

- Keep one copy for your records.

- Send another copy to the Listing Office upon request.

By following these instructions, all parties can ensure a smooth disbursement process. Take your time to double-check each entry for accuracy before submitting the form. Proper completion is vital for fulfilling contractual obligations and preventing delays.

What You Should Know About This Form

What is the purpose of the Commission Disbursement Form?

The Commission Disbursement Form is used to facilitate the distribution of commission payments between the Selling Office and the Listing Office in a real estate transaction. It provides a clear record of how the total commission, which is agreed upon during the closing, is divided between the two parties. This form must be filled out completely and correct instructions are crucial for ensuring that payments are disbursed to the right recipients quickly and accurately.

Who is responsible for completing the Commission Disbursement Form?

Both the Selling Office and the Listing Office have specific responsibilities when it comes to completing the form. The Selling Office must fill out its section completely and ensure it is signed before sending a copy to the Closing Agent. They should also retain a copy for their records. Similarly, the Listing Office must fill out its portion of the form and follow the same procedure. Both offices need to provide accurate addresses and sign in the designated areas to ensure compliance with transaction requirements.

What should I do after completing the Commission Disbursement Form?

After filling out the Commission Disbursement Form, each office should follow their respective steps. The Selling Office should send one copy of the completed form to the Closing Agent and keep a photocopy for their records. If requested, they must also provide a copy to the Listing Office. The Listing Office has to send the original form to the Closing Agent while also retaining a photocopy. These steps are essential for maintaining clear communication and ensuring that all parties involved in the transaction are informed.

What happens if the form is not completed correctly?

If the Commission Disbursement Form is not filled out correctly, it can lead to delays in the payment process. Incorrect information may cause confusion about who is entitled to receive what portion of the commission. This can result in unintended disputes or further administrative work to rectify the mistakes. Therefore, it is important to double-check all entries and to ensure that signatures are provided in the appropriate spaces before submitting the form.

Common mistakes

When completing the Commission Disbursement form, individuals often overlook critical details that can lead to delays or complications in the disbursement process. One common mistake is leaving sections incomplete. Each box must be filled out entirely, including the names of the buyer and seller, the listing number, and the property address. If any information is missing, the form may be rejected by the closing agent.

Another frequent error is the lack of required signatures. Both the selling office and the listing office must sign in the designated spaces. Failing to provide these signatures can render the form invalid. Ensure that all parties involved verify their signatures before submission.

Many people also underestimate the importance of retaining copies of the form. After sending a copy to the closing agent, it is essential to keep a photocopy for personal records. This practice ensures that you have the necessary information on hand if there are questions or disputes later on.

Inattention to the mailing instructions is another area where mistakes occur. The form should clearly specify how to disburse the commission. Any ambiguity in addressing the payment could lead to funds being sent to the wrong party. Clarifying the designated recipients is vital for a smooth transaction.

Calculation errors can also take place when determining the total commission owed. It is critical to verify the total amount and the respective shares for the selling and listing offices. Inadvertently miscalculating these figures can delay the disbursement and create confusion among the parties involved.

Some individuals may neglect to submit additional required documentation. In certain cases, the closing agent may require other supporting documents alongside the commission disbursement form. Always check if any extra information needs to be provided to avoid scene disruptions.

Additionally, failing to provide correct contact information can cause unnecessary complications. Ensure that the phone numbers and addresses for all involved parties are accurate. Incorrect details can result in difficulties in communication during the transaction process.

Finally, procrastination is a mistake that can have serious consequences. Submitting the form promptly is essential. Delaying this process can significantly impact the disbursement timeframe, affecting cash flow and in some cases, the closing of a deal. Timely submission should always be a priority.

Documents used along the form

The Commission Disbursement Form is a crucial document in real estate transactions, ensuring that all parties receive the appropriate commissions upon closing. Alongside this form, several other documents are commonly utilized to facilitate and support the transaction process. Below is a concise list of additional forms that are often used in conjunction with the Commission Disbursement Form.

- Listing Agreement: This document outlines the terms under which a property is listed for sale. It details the responsibilities of the listing agent, the duration of the listing, and the commission structure agreed upon with the seller.

- Buyer Agency Agreement: This agreement formalizes the relationship between a buyer and their agent. It sets out the services the agent will provide and typically includes terms regarding commission, ensuring that the buyer understands their obligations and rights.

- Offer to Purchase: This document is submitted by a prospective buyer to express their interest in buying a property. It typically includes the proposed purchase price, contingencies, and any specific terms that the buyer wishes to negotiate.

- Closing Disclosure Statement: Required by law, this statement outlines the final terms of the mortgage, the loan costs, and details about the closing transaction. It provides transparency, allowing all parties to understand the financial aspects prior to closing.

- HUD-1 Settlement Statement: This form provides a detailed list of all final credits and debits for both the buyer and seller during a real estate sale. It acts as a comprehensive record of the financial transaction and ensures all parties are informed of their costs.

- Commission Agreement: This document specifically outlines how commissions will be divided among the respective parties involved in the transaction. It helps avoid misunderstandings regarding each party's earnings upon closing.

- Withdrawal of Listing Agreement: If a seller decides to remove their property from the market, this document is used. It effectively cancels the prior listing agreement, ensuring that all parties acknowledge the change in status.

- Property Disclosure Statement: This form requires sellers to disclose any known issues with the property. Such disclosures help buyers make informed decisions and can prevent future disputes regarding property conditions.

- Trust Account Agreement: This document regulates how commission funds will be managed in a trust account. It ensures that all disbursements are handled appropriately and according to state regulations.

Understanding these forms can provide clarity and peace of mind when navigating the complexities of real estate transactions. Ensuring that all documents are correctly completed and submitted supports a smooth and transparent closing process for everyone involved.

Similar forms

The Commission Disbursement Form serves a specific purpose in real estate transactions, but several other documents share similar characteristics and functions. Here are eight documents that are similar to the Commission Disbursement Form, detailing their similarities:

- Real Estate Purchase Agreement: This document outlines the terms of the sale, including purchase price and payment distribution, similar to how the Commission Disbursement Form specifies commission distribution between parties.

- Closing Disclosure: Issued prior to closing, this form provides a breakdown of all closing costs. It includes details on how commissions are allocated, akin to the information found in the Commission Disbursement Form.

- Settlement Statement (HUD-1): This statement provides a detailed account of funds exchanged in a real estate transaction, including commission disbursements, making it comparable to the Commission Disbursement Form.

- Commission Agreement: This document outlines how commissions will be calculated and distributed to agents, functioning like the Commission Disbursement Form in establishing payment terms.

- Bill of Sale: Used in asset transfers, it documents the sale of property along with payment details. It is similar to the Commission Disbursement Form in that it indicates how funds will be allocated.

- Brokerage Agreement: This agreement specifies the relationship between the broker and the client, detailing commission structures that parallel the distribution outlined in the Commission Disbursement Form.

- Authority to Pay Commission: This document instructs payment of commissions to the appropriate parties, similar to the instructions within the Commission Disbursement Form regarding fund distribution.

- Listing Agreement: The document authorizes a broker to list a property and also details how commissions are to be shared, much like the Commission Disbursement Form specifies the division of commissions.

Dos and Don'ts

Filling out the Commission Disbursement form requires attention to detail. Here are four things you should and shouldn’t do to ensure a smooth process.

- Do fill in the required fields completely. Incomplete forms can lead to delays.

- Do sign in the designated space. Your signature confirms the agreement.

- Do send one copy to the Closing Agent and keep another for your records. Documentation is key!

- Do promptly send a copy to the Listing Office if requested.

- Don't leave any sections blank. Every field is essential for processing.

- Don't forget to include the correct addresses for all parties involved. Accuracy is crucial.

- Don't assume that an electronic signature is acceptable unless specified. Check the requirements.

- Don't delay in submitting the form. Timeliness ensures everyone gets paid correctly and on time.

Misconceptions

Many individuals may hold misconceptions regarding the Commission Disbursement form, which can lead to confusion during real estate transactions. Below are several common misunderstandings, clarified for better comprehension.

- Misconception 1: The form only needs to be completed by the Selling Office.

In reality, both the Selling Office and Listing Office must fill out their respective sections of the form. Each office has specific information that needs to be provided. - Misconception 2: Signing the form is optional for the parties involved.

It is crucial for both offices to sign the form. The authorized signatures are a necessary part of the process to ensure proper handling of the commission disbursement. - Misconception 3: Only one copy of the form is required.

Each office should send one copy to the Closing Agent while retaining another for their records. This ensures transparency and accountability in the transaction. - Misconception 4: The Closing Agent can disburse the commission without this form.

The Commission Disbursement form is essential for instructing the Closing Agent on how to disburse the commission. Without it, there may be delays or complications in payment. - Misconception 5: The form is the same across all states.

The Commission Disbursement form may vary by state. It is important to use the appropriate form specific to Idaho, as local regulations can differ. - Misconception 6: Only the Listing Office’s share is included in this form.

The form addresses both the Selling and Listing Offices' shares of the commission. The total commission owed should account for both parties, as indicated on the form. - Misconception 7: Once submitted, the form cannot be altered.

While it is best to complete the form accurately from the beginning, corrections can be made if necessary. However, any changes should not be taken lightly and should be documented properly.

Understanding these misconceptions is important for smooth transactions and timely disbursements. Clear communication among all parties involved can help ensure that the Commission Disbursement form is correctly completed and processed.

Key takeaways

When filling out the Commission Disbursement Form, there are several important considerations to keep in mind to ensure smooth processing and compliance. Here are key takeaways to guide you:

- Complete Information is Crucial: Make sure to fill out every section of the form completely. Missing information can delay the disbursement process.

- Signatures are Mandatory: Both the Listing Office and Selling Office must provide their signatures. Neglecting this step will result in the form being rejected by the Closing Agent.

- Retention of Copies: It is important to keep copies of the completed form. While the Selling Office sends one copy to the Closing Agent, retaining another copy for your records is essential for future reference.

- Direct Mail Instructions: Clearly direct the Closing Agent on how to disburse the commission. Specify mailing addresses for both the Selling and Listing offices to avoid any confusion.

Browse Other Templates

Name Reservation Ga - Successful name reservations can pave the way for a smooth business launch.

Findings on Adoption Suitability - Social workers and other involved parties submit reports that the court considers when making decisions.

Cdl Georgia - A contact number for the DDS is provided for assistance with the form.