Fill Out Your Community Investment Application Form

The Community Investment Application form serves as a vital tool for organizations seeking to secure funding for projects that foster community growth and development. Designed to streamline the funding process, this form encompasses a variety of elements that applicants must address. Prospective applicants are required to provide detailed information about their project objectives, the intended impact on the community, and a comprehensive budget outline. Additionally, the form emphasizes the importance of demonstrating community involvement and support, which is critical for evaluating the project's potential effectiveness. Various sections account for different aspects of the proposed initiative, such as timelines, expected outcomes, and measurable indicators for success. By carefully filling out this application, organizations not only clarify their vision and goals but also increase their chances of receiving the necessary financial support. Ultimately, this form is not just a checklist; it is an opportunity for community-driven innovation and collaborative efforts that can lead to lasting change.

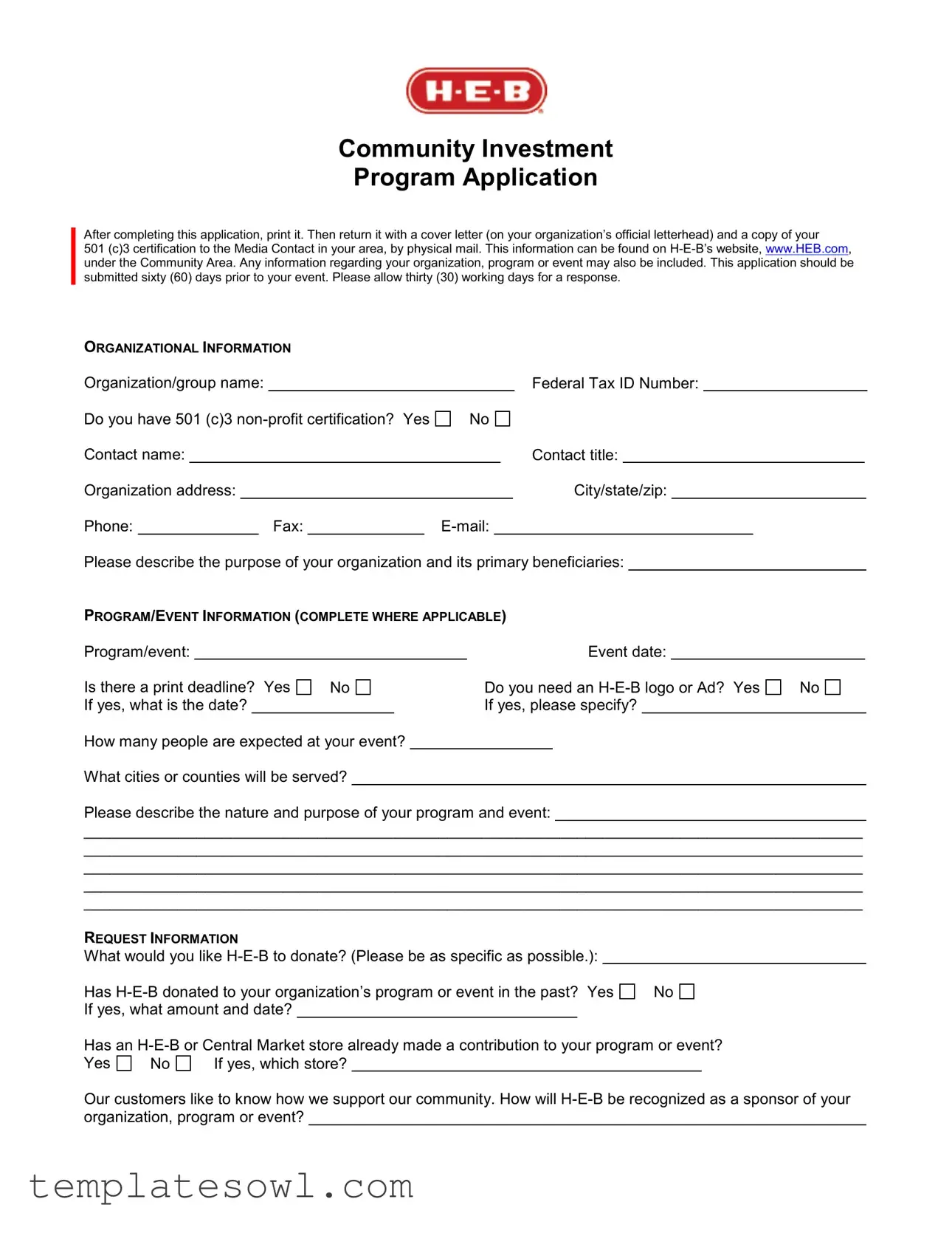

Community Investment Application Example

!"#$$%&'&($%'(

!"#$$%&'&($%'(

#$$

#$$  $)*+!,

$)*+!,

|

|

|

0)123$/ |

||

|

|

|

2 !&45 |

3 |

|

|

|

|

#/ |

#/ |

|

|

|

|

#../ |

||

|

|

|

+/ 0)/ |

'&/ |

|

|

|

|

+$$/ |

||

|

|

|

|

|

|

! " #$ % & |

|

|

|

|

|

+./ |

'/ |

|

|

|

|

145 3 |

2%&'&(45 3 |

|

14 |

14 |

|

|

|

|

%)4

6$4

+$/

777777777777777777777777777777777777777777777777777777777777777777777777777777777777777777

777777777777777777777777777777777777777777777777777777777777777777777777777777777777777777

777777777777777777777777777777777777777777777777777777777777777777777777777777777777777777

777777777777777777777777777777777777777777777777777777777777777777777777777777777777777777

777777777777777777777777777777777777777777777777777777777777777777777777777777777777777777

'( )

6,%&'&(4+$$/

%%&'&(45

3

3

14

14

%%&'&(#",$4

5

3

3

14

14

4

Form Characteristics

| Fact Name | Detail |

|---|---|

| Form Purpose | The Community Investment Application form is designed to gather information necessary for evaluating requests for community investment funding. |

| Eligibility Requirements | Applicants must demonstrate how their project will benefit the community, aligning with specific state regulations. |

| Submission Deadline | Completed forms must be submitted by established deadlines, which vary by state and funding cycle. |

| Required Documentation | Supporting documents are necessary to validate the application, including project plans and financial statements. |

| Governing Laws | The form complies with state-specific laws related to community investment, ensuring all submissions meet legal requirements. |

Guidelines on Utilizing Community Investment Application

Completing the Community Investment Application form requires careful attention to detail. Ensure you have all necessary information and documents at hand before getting started. This process will guide you step-by-step as you fill out the form accurately and completely.

- Begin by downloading the Community Investment Application form from the designated website or office.

- Open the form and review the first section, which typically asks for your personal information, including your name, address, and contact details.

- Fill in the required fields in the personal information section. Ensure all entries are clear and legible.

- Next, move to the section that requests project details. Provide a thorough description of the project for which funding is requested.

- In the project details section, include objectives, target population, and anticipated outcomes. Be concise but informative.

- Complete any financial information that is requested in the next section. This may include budgets, expenses, and funding sources.

- Once all relevant sections are filled out, review the entire form for accuracy. Make corrections as needed.

- Prepare any supporting documents that need to be submitted along with the form. These could include budgets, project plans, or letters of support.

- Once everything is complete, submit the application form and additional documents according to the provided submission guidelines.

- After submission, keep a copy of the completed form and any submitted documents for your records. This can be helpful for follow-up inquiries.

What You Should Know About This Form

What is the purpose of the Community Investment Application form?

The Community Investment Application form is designed to facilitate funding requests from individuals and organizations that seek to improve community resources or provide essential services. The form helps ensure transparency and accountability in how funds are allocated, allowing community members to contribute to local development effectively.

Who is eligible to apply for funding?

Eligibility criteria for the Community Investment Application vary based on the specific funding program. Generally, nonprofit organizations, local government entities, and community groups engaged in projects that benefit the community can apply. It is important to ensure that the proposed project aligns with the goals of community improvement.

What types of projects are considered for funding?

Funding often supports a wide range of projects, including but not limited to community beautification initiatives, educational programs, public health campaigns, and infrastructure improvements. Applicants should clearly articulate how their projects will benefit the community and meet specific needs.

Is there a submission deadline for the application?

Yes, there is typically a submission deadline for applications. This deadline can vary based on funding cycles or specific program requirements. Applicants should check the official guidelines for the exact date to ensure timely submission, as late applications may not be considered and can miss valuable opportunities.

What information is required on the application form?

The application form usually requires detailed information about the organization, the proposed project, and how the funding will be used. Applicants may need to provide financial projections, project timelines, and descriptions of community impact. It is advisable to prepare this information thoroughly to strengthen the application.

How will the applications be evaluated?

Applications are typically evaluated based on predetermined criteria such as feasibility, community impact, sustainability, and alignment with community needs. An evaluation committee may review the submissions and prioritize projects that demonstrate clear benefits and effective use of funds.

What happens after the application is submitted?

After submission, applicants may receive confirmation that their application has been received. The review process will then take place, during which applicants may be contacted for additional information. Once evaluations are complete, successful applicants will be notified of their funding approval and next steps.

Where can I find assistance with the application process?

Many organizations offer guidance for individuals seeking assistance with the Community Investment Application process. Resources may include workshops, informational sessions, and one-on-one consultations. It's advisable to reach out to local community development organizations or funding entities for support.

Common mistakes

When completing the Community Investment Application form, applicants often make several common mistakes that can hinder their chances of success. Understanding these pitfalls is essential for submitting a strong application.

One frequent error is providing incomplete information. Applicants sometimes skip sections or provide vague responses. Each field on the application is important. Ensure that all requested details are filled out thoroughly and accurately.

Another mistake is failing to follow guidelines. Specific instructions on formatting, document submission, or word counts are often provided. Ignoring these guidelines can lead to immediate disqualification. Therefore, it is crucial to adhere strictly to all application requirements.

Some individuals underestimate the importance of clarity and conciseness in their writing. Using overly complex language, jargon, or lengthy explanations can confuse reviewers. Instead, aim for clear and direct communication. Present ideas in a straightforward manner to enhance understanding.

A number of applicants overlook the significance of proofreading. Typos, grammatical errors, and incorrect information can detract from the overall professionalism of the application. Taking the time to review and edit the submission can prevent these easily avoidable mistakes.

The timing of the submission is also critical. Many applicants fail to submit their forms on time. Late submissions are typically not accepted. Mark deadlines on your calendar and plan ahead to ensure that everything is completed and submitted promptly.

In addition, applicants sometimes forget to include necessary supporting documents. These may include financial statements, project proposals, or letters of support. Failing to attach required documents can leave a significant gap in the application, decreasing its viability.

Lastly, not seeking feedback before submitting can be detrimental. Input from peers or mentors can offer valuable insights. Consider sharing your application with someone who can provide constructive criticism, thus enhancing its overall quality.

Documents used along the form

When applying for a community investment initiative, several forms and documents are typically required in addition to the Community Investment Application form. Each of these documents plays a vital role in assessing eligibility, detailing the project's impact, and ensuring that the funding aligns with community goals.

- Project Budget: This document outlines the financial plan for the project, including anticipated costs, funding sources, and any budgetary constraints. Providing a clear budget is essential for evaluating the project's feasibility.

- Letters of Support: These letters, usually from community leaders or stakeholders, express backing for the project. They can be instrumental in demonstrating community interest and the potential for collaboration.

- Project Timeline: A timeline identifies key milestones and deadlines throughout the project. It helps funders understand the project's schedule and the timeline for achieving various phases.

- Impact Assessment: This document details the expected social, economic, or environmental outcomes of the project. It provides an analysis of how the investment will benefit the community.

- Organizational Chart: It outlines the structure of the organization overseeing the project. This chart helps reviewers comprehend the leadership and management roles involved.

- IRS Tax Exemption Letter: For non-profit applicants, this letter confirms the organization's tax-exempt status. It is crucial for compliance and eligibility for funding.

- Evidentiary Documents: These may include permits, licenses, or other regulatory approvals needed for the project. They demonstrate adherence to local laws and regulations.

- Previous Project Reports: If applicable, these reports showcase past successes or challenges faced by the organization. They offer insights into the organization's experience and effectiveness.

In summary, submitting a well-prepared Community Investment Application involves several accompanying documents that provide essential context and evidence. Each of these forms contributes to a comprehensive understanding of the proposed project, its impact, and the organization leading it.

Similar forms

- Grant Application Form: This document collects information about the organization’s purpose and how the funds will be used, similar to the Community Investment Application form which seeks details on community benefit.

- Funding Proposal: A funding proposal outlines a project’s goals and budget. Like the Community Investment Application form, it requires a description of the project's impact on the community.

- Partnership Agreement: This agreement specifies the roles and responsibilities of each partner. Both documents emphasize collaboration and support for community projects.

- Community Development Plan: This plan involves strategies for improving community resources. The Community Investment Application form seeks similar information regarding enhancement plans for the community.

- Project Evaluation Report: This report assesses the success and effectiveness of community initiatives. Both documents require detailed descriptions of the expected outcomes and measurements of success.

Dos and Don'ts

When completing the Community Investment Application form, following guidelines can make the process smoother and increase the chances of a successful application. Here’s a list of things you should and shouldn’t do:

- Read the Instructions Carefully: Before you begin, take a moment to fully understand what information is required.

- Provide Accurate Information: Ensure all details are correct, as inaccuracies can lead to delays.

- Gather Necessary Documents: Collect any supporting documentation needed ahead of time. This can streamline your application process.

- Use Clear and Concise Language: Write clearly to avoid confusion. Simplicity is your ally.

- Double-Check Your Work: Review your application for any mistakes or omissions before submission.

- Submit on Time: Make sure your application is submitted by the deadline to be considered.

- Don’t Rush: Taking your time can help prevent errors that could harm your application.

- Don’t Leave Questions Blank: Always provide a response, even if it’s to indicate “not applicable.”

- Don’t Use Jargon: Avoid technical language or acronyms that may not be understood by everyone.

- Don’t Forget to Sign: Ensure all required signatures are included; an unsigned application may be rejected.

- Don’t Assume Information: Never presume that the review team knows the context behind your details; always explain where necessary.

- Don’t Ignore Feedback: If past applications were denied, consider any feedback provided and make adjustments accordingly.

Misconceptions

Misconceptions about the Community Investment Application form can lead to confusion and deter eligible individuals from applying. Here are six common misunderstandings:

- 1. The application is overly complicated. Many believe that the application is excessively complex, but in reality, it is designed to be straightforward. Clear guidelines accompany the form to assist applicants through every step.

- 2. Only large organizations can apply. Some individuals think that only big nonprofits or companies qualify. However, this form is accessible to community groups of all sizes, including small local organizations.

- 3. There is no assistance available when filling out the form. While some may feel alone in the process, help is often available. Many organizations provide resources and support to guide applicants through the process.

- 4. The application process takes too long. A common belief is that the application review process is slow and cumbersome. In fact, many applications are reviewed and decided upon in a timely manner.

- 5. Applying means you will definitely receive funding. While submitting an application is a significant step towards obtaining funding, it does not guarantee approval. The competitive nature of funding means many factors are considered during the review.

- 6. There are hidden fees associated with applying. Applicants may be concerned about unexpected costs, but there are typically no hidden fees involved in simply applying for the funding through this form.

Key takeaways

When filling out and using the Community Investment Application form, keep these key points in mind:

- Start early. Give yourself ample time to complete the form without rushing.

- Read the instructions carefully. Understanding what is required will help prevent errors.

- Be thorough. Ensure that every section of the application is completed with the necessary details.

- Provide valid supporting documents. Attach any required documents to bolster your application.

- Double-check your numbers. Any financial figures should be accurate and verifiable.

- Submit by the deadline. Late applications are typically not considered.

- Keep a copy. Always save a copy of your completed application for your records.

- Follow up. After submitting, check in to ensure that your application was received and is under review.

Browse Other Templates

811 Phone Number - Double-check that provider names match across all documents submitted.

Nj Sellers Permit - Providing a completed ST-3 form protects sellers from potential tax audits related to resale transactions.

Spay and Neuter Voucher - Pets must be within specific age limits to qualify for low-cost services as outlined in the form.