Fill Out Your Completion Repairs Form

The Completion Repairs form plays a crucial role in the property insurance process by ensuring that all necessary repairs following damage have been satisfactorily completed. This form is designed to confirm the completion of repairs, providing essential details such as the account number, property address, and specific damages sustained. It outlines the total amount claimed for repairs, emphasizing the importance of certification by the property owners. The certification section is significant as it verifies that all contractors and suppliers have been compensated, reducing the risk of future liens on the property. By confirming that the property has been restored to its pre-damage condition, the form facilitates the disbursement of insurance proceeds, ensuring a smooth transition for all parties involved. As homeowners navigate the challenges of property repairs, understanding this form becomes an essential step in reclaiming peace of mind and financial stability.

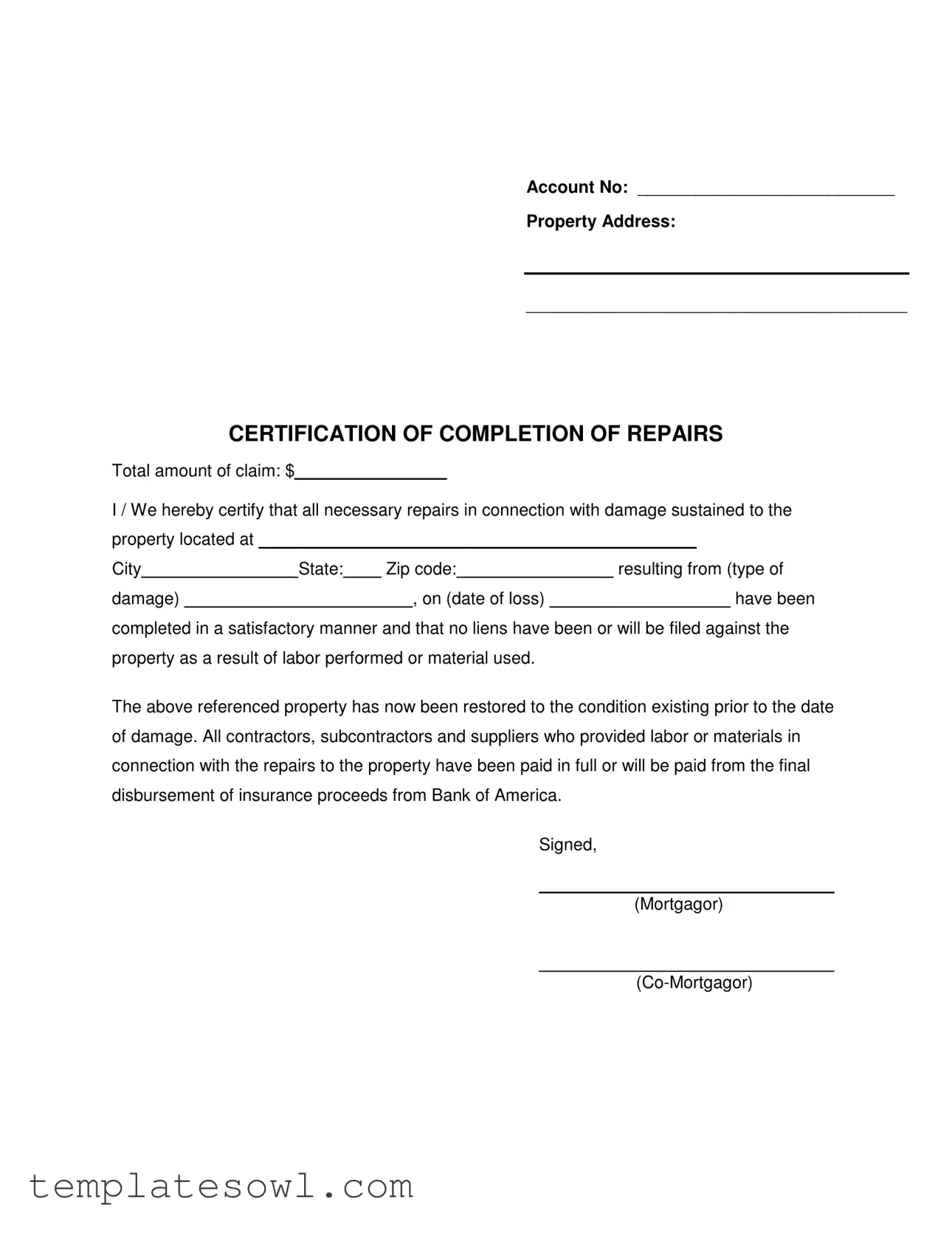

Completion Repairs Example

Account No: ___________________________

Property Address:

________________________________________

CERTIFICATION OF COMPLETION OF REPAIRS

Total amount of claim: $________________

I / We hereby certify that all necessary repairs in connection with damage sustained to the property located at ______________________________________________

City________________ State:____ Zip code: ________________ resulting from (type of

damage) ________________________, on (date of loss) ___________________ have been

completed in a satisfactory manner and that no liens have been or will be filed against the property as a result of labor performed or material used.

The above referenced property has now been restored to the condition existing prior to the date of damage. All contractors, subcontractors and suppliers who provided labor or materials in connection with the repairs to the property have been paid in full or will be paid from the final disbursement of insurance proceeds from Bank of America.

Signed,

_______________________________

(Mortgagor)

_______________________________

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Completion Repairs form verifies that all necessary repairs after damage have been completed to the property. |

| Certification | By signing, the mortgagor and co-mortgagor attest that the repairs have been executed satisfactorily. |

| Claim Amount | The form requests the total amount of the insurance claim related to the repairs. |

| Property Details | Information about the property address and account number must be filled out for identification purposes. |

| Liens | It affirms that no liens will be filed against the property for labor or materials used in the repair process. |

| Restoration Condition | The property is declared to have been restored to its pre-damage condition as part of the certification. |

| Contractor Payment | All contractors, subcontractors, and suppliers involved in the repairs must be fully compensated. |

| Governing Laws | Specific laws governing the use of this form may vary by state, including rules related to construction and insurance claims. |

Guidelines on Utilizing Completion Repairs

Once the Completion Repairs form is filled out completely, it will need to be signed before submission. This document serves as a declaration that all necessary repairs have been made and that the property is restored to its prior condition. Follow these steps to ensure accuracy in completing the form.

- Locate the form and ensure it is the correct version for your needs.

- Fill in the Account No at the top of the form.

- Enter the Property Address clearly, including city, state, and zip code.

- Under CERTIFICATION OF COMPLETION OF REPAIRS, write the total amount of your claim.

- Complete the section certifying that all necessary repairs have been made. Provide the address of the damaged property again for reference.

- Specify the type of damage that occurred.

- Fill in the date of loss when the damage took place.

- Confirm that the property has been restored and that no liens will be filed.

- State that all contractors, subcontractors, and suppliers have been paid in full or will be paid from the final insurance disbursement.

- Sign the form where indicated as Mortgagor, and have the Co-Mortgagor sign as well.

What You Should Know About This Form

What is the purpose of the Completion Repairs form?

The Completion Repairs form is designed to certify that all necessary repairs to a property have been completed after sustaining damage. It serves as a formal declaration that the property has been returned to its original state prior to the incident, ensuring that all necessary parties are paid and no liens exist on the property as a result of the repair work.

Who needs to fill out the Completion Repairs form?

This form must be completed by the mortgagor, and if applicable, the co-mortgagor. It is often required by insurance companies or lenders to verify that repairs associated with a claim have been finalized before insurance proceeds are disbursed.

What information should be included in the Completion Repairs form?

When filling out the form, essential details like the account number, property address, the total amount of the claim, the specific type of damage incurred, and the date of loss must be included. It is crucial that the information is clear and accurately reflects all repairs made to prevent any disputes in the future.

What does it mean to certify that repairs have been completed satisfactorily?

By certifying satisfactory completion, the signer affirms that all repairs have been executed correctly and are of acceptable quality. This includes ensuring that all necessary contractors, subcontractors, and suppliers have been compensated for their work, satisfying legal and financial obligations linked to the property.

What happens if liens are filed against the property?

Liens against a property can complicate the financial and legal standing of the owner. If liens do arise after the completion of repairs, they must be addressed immediately. The form explicitly states that no liens should exist as a result of the repairs; therefore, failure to uphold this condition can lead to disputes over the insurance claim or further financial encumbrances on the property.

How do insurance proceeds relate to the Completion Repairs form?

Insurance proceeds are often contingent on the completion of repairs. Once the Completion Repairs form is submitted and accepted, it can facilitate the final disbursement of funds from the insurance company. The completed form assures the insurance provider that funds will be used properly to pay off contractors, which can expedite the payment process.

Is the Completion Repairs form legally binding?

Yes, the Completion Repairs form is a legal document. By signing it, the mortgagor and co-mortgagor affirm that the information provided is accurate and can be relied on by third parties, such as lenders and insurance companies. Misrepresentation or failure to comply with the statements made in this document could lead to legal consequences or denial of insurance claims.

Common mistakes

Filling out the Completion Repairs form is crucial for ensuring that your claim is processed smoothly. However, many people make mistakes that can delay their claims or lead to complications. One common error is not providing the proper account number. Always double-check that this information is accurate and clearly written.

Another frequent oversight is neglecting to complete the property address section. This includes not filling in details like city, state, and zip code. Incomplete addresses can cause delays in identifying the property and verifying the claim.

Many individuals forget to specify the type of damage sustained. Without this information, it can be challenging for the insurance company to process the claim correctly. Make sure you clearly describe the damage to avoid confusion.

People often leave out the date of loss, which is another critical piece of information. This date helps establish a timeline for the repair process and ensures that your claim aligns with the events leading up to it.

It’s essential to certify that all repairs have been completed satisfactorily. Some individuals mistakenly assume verbal confirmations from contractors are enough. In reality, the form requires a clear indication that all work has been finalized.

An additional misstep is not acknowledging any liens. The form mandates certification that no liens will be filed against the property. Forgetting to confirm this can cast doubt on your intention to meet financial obligations related to repairs.

Failing to include a complete list of contractors, subcontractors, and suppliers is another issue. This list should include full names and possibly contact information. Omitting these details can hinder the processing of the claims.

Many individuals also neglect the signature section. Not signing the form is a straightforward error that can halt the claims process entirely. Make it a habit to verify that all necessary signatures are present.

Finally, it’s a mistake to submit the form without reviewing it for completeness. Each section must be filled out entirely and accurately. Taking a few moments to check your work can save significant time down the line.

By avoiding these common mistakes, you can enhance the possibility of a successful and timely claims process. Ensuring that all information is accurate and complete will facilitate better communication with your insurance provider.

Documents used along the form

The Completion Repairs form is often accompanied by several other important documents that help to ensure transparency and accountability in the claims process. Below is a list of five commonly used forms and their purposes.

- Insurance Claim Form: This document initiates the claims process with the insurance provider. It outlines the details of the loss, including the type of damage and the amount being claimed for repairs.

- Invoice from Contractor: An invoice provides a breakdown of the costs associated with the repairs performed on the property. It should itemize labor and materials, ensuring clarity on expenditures related to the claim.

- Proof of Payment: This document serves as evidence that all contractors and suppliers have been paid for their services. It can include receipts, canceled checks, or bank statements that confirm payments made.

- Scope of Work Document: This outlines the specific repairs that were completed, detailing the tasks performed and the materials used. It helps to ensure that all aspects of the repair were addressed as per the claim requirements.

- Final Inspection Report: After repairs are completed, an inspection may be conducted to verify that the work meets building codes and safety standards. This report provides assurance to all parties that the property is restored satisfactorily.

Submitting these documents alongside the Completion Repairs form can streamline the claims process and facilitate a smooth resolution. Comprehensive documentation is vital for ensuring all claims are accurate and justified.

Similar forms

When navigating the world of property repairs and insurance claims, it's helpful to understand the various documents that serve similar purposes to the Completion Repairs form. Each of these documents plays a crucial role in ensuring that repairs are certified and that parties involved have fulfilled their obligations. Below are ten documents similar to the Completion Repairs form, along with explanations of how they relate to it:

- Certificate of Completion: This document is issued by contractors to confirm that the work they were hired to do has been finished satisfactorily. Like the Completion Repairs form, it assures parties that all work has been completed according to standards.

- Acknowledgment of Assignment: This document provides confirmation that one party has transferred their rights to receive benefits or claims to another party. It is similar in that it ensures accountability for repair responsibilities.

- Proof of Payment: Corresponding to the Completion Repairs form, this document verifies that all bills for labor and materials have been settled. Ensuring that no liens exist is crucial for property owners.

- Repair Completion Affidavit: This sworn statement is provided by a property owner or contractor and affirms that repairs have been done. It functions similarly by providing legal assurance about the completed work.

- Work Completion Letter: Often produced by a contractor, this letter states that all work has been completed efficiently. It mirrors the Completion Repairs form’s purpose of providing documented proof of completion.

- Final Inspection Report: This report evaluates whether the repairs meet applicable standards or codes. It is akin to the Completion Repairs form in that it signifies that the property has been returned to its previous state.

- Notice of Satisfaction: Issued when a loan or obligation is paid in full, this document confirms that all financial responsibilities have been honored. It relates to the Completion Repairs form by ensuring that all payments linked to repairs are complete.

- Lien Waiver: This document releases any claims from contractors or suppliers against a property, confirming they've been paid. It parallels the Completion Repairs form’s intention to ensure no liens will arise from unpaid work.

- Insurance Claim Settlement Statement: This statement details the agreed terms of an insurance claim payment, ensuring that funding due for repairs is acknowledged. Similar to the Completion Repairs form, it confirms financial responsibilities connected to property repairs.

- Contractor's Warranty: This warranty assures that the work done will be free from defects for a certain period. Like the Completion Repairs form, it provides peace of mind to property owners regarding the quality of repairs.

Understanding these documents can streamline communication and build trust between property owners, contractors, and insurance companies. Having these forms in place provides assurance and clarity throughout the repair process.

Dos and Don'ts

When filling out the Completion Repairs form, it's important to follow specific guidelines to ensure everything is completed correctly. Here are some things to keep in mind:

- Do: Provide accurate and complete information for each section of the form.

- Do: Clearly state the total amount of the claim to avoid confusion.

- Do: Certify that all necessary repairs have been completed before submitting the form.

- Do: Double-check that all contractors and subcontractors have been paid in full.

- Don't: Leave any blank spaces on the form; fill everything in as required.

- Don't: Submit the form without carefully reviewing it for accuracy.

- Don't: Forget to provide the correct property address and account number.

By following these guidelines, the process will go more smoothly, and it will be easier to resolve any claims related to the repairs.

Misconceptions

Misconceptions regarding the Completion Repairs form can lead to confusion. Here are five common misunderstandings:

- Only the homeowner can complete the form. Many believe that only the property owner is eligible to fill out this form. However, authorized representatives, such as contractors or agents, can also submit the form on behalf of the homeowner.

- This form guarantees insurance reimbursement. Some people think that completing the Repairs form automatically ensures they will receive payment from their insurance company. While it's a necessary step in the process, reimbursement also depends on the specific terms of the insurance policy.

- All types of repairs are covered. It is a misconception that this form applies to any and all repairs. The form is specifically for repairs related to covered damage under the insurance policy, not for general maintenance or improvements.

- Signing the form confirms the quality of the work. Many mistakenly believe that by signing this document, they are attesting to the quality of the repairs. In fact, the form certifies completion rather than quality, as it does not require inspections or guarantees.

- The form can be submitted later. Some individuals think they can fill out the Completion Repairs form at their convenience post-repair. However, timely submission is often essential to facilitate the processing of insurance claims and final payments.

Key takeaways

Ensure that all necessary repairs are fully completed before filling out the form. This step is crucial for a smooth approval process.

Accurately list the property address and account number at the top of the form to avoid confusion and delays.

Clearly state the total amount of claim. This figure should reflect all repair costs incurred.

Indicate the type of damage and date of loss precisely. Providing accurate information is essential for the insurance review process.

Make sure all parties involved have signed the form. Both the mortgagor and co-mortgagor must certify completion.

Confirm that all contractors, subcontractors, and suppliers have been paid in full to prevent any potential liens against the property.

Browse Other Templates

How Many Exemptions Should I Claim on Mw507 - The form outlines the steps needed for successful electronic filing.

University of Massachusetts Amherst Transcript Request - The maximum number of transcripts you can request is nine.

Pa Tint Exemption Form - Application signatures are mandatory, and rubber stamps are not acceptable.