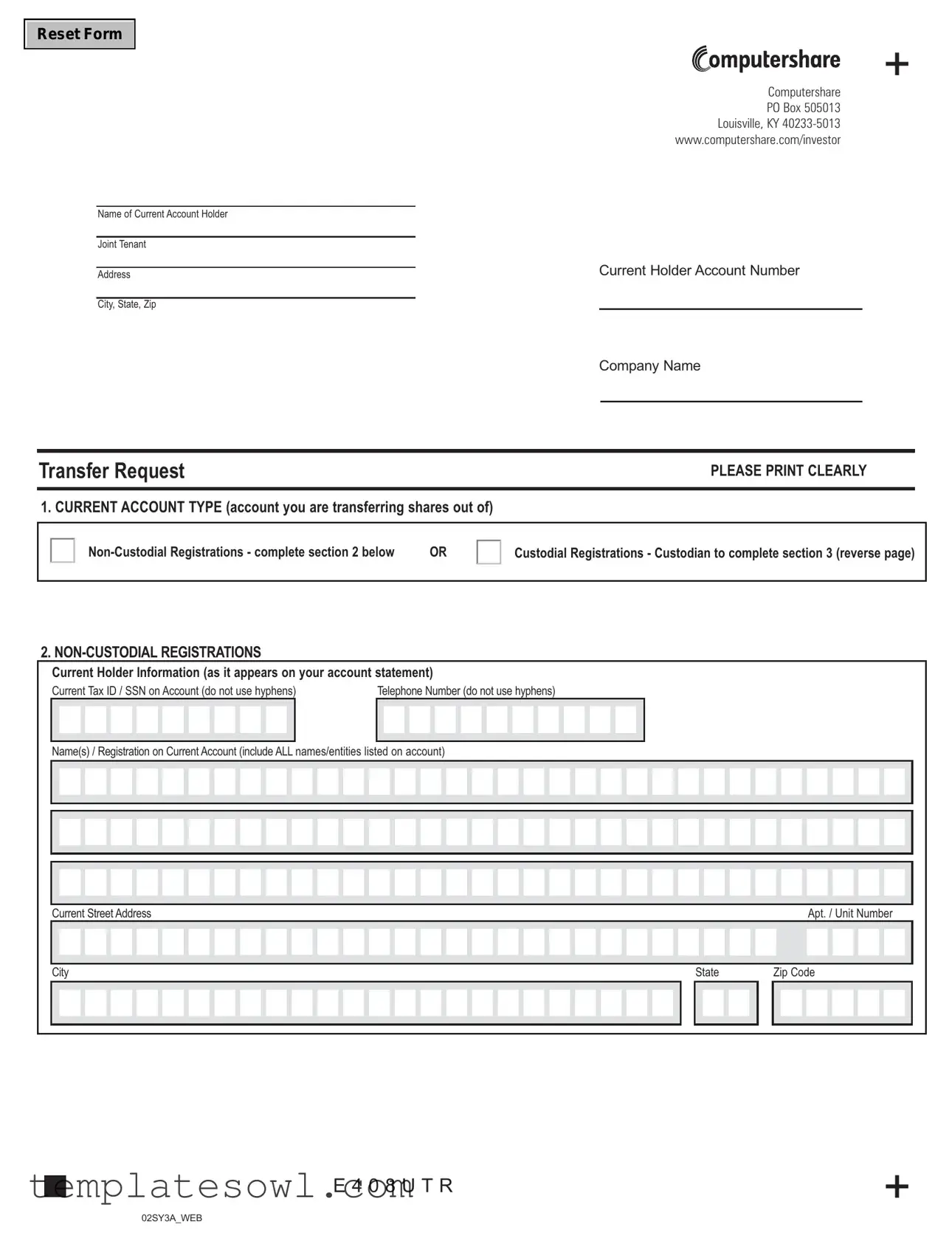

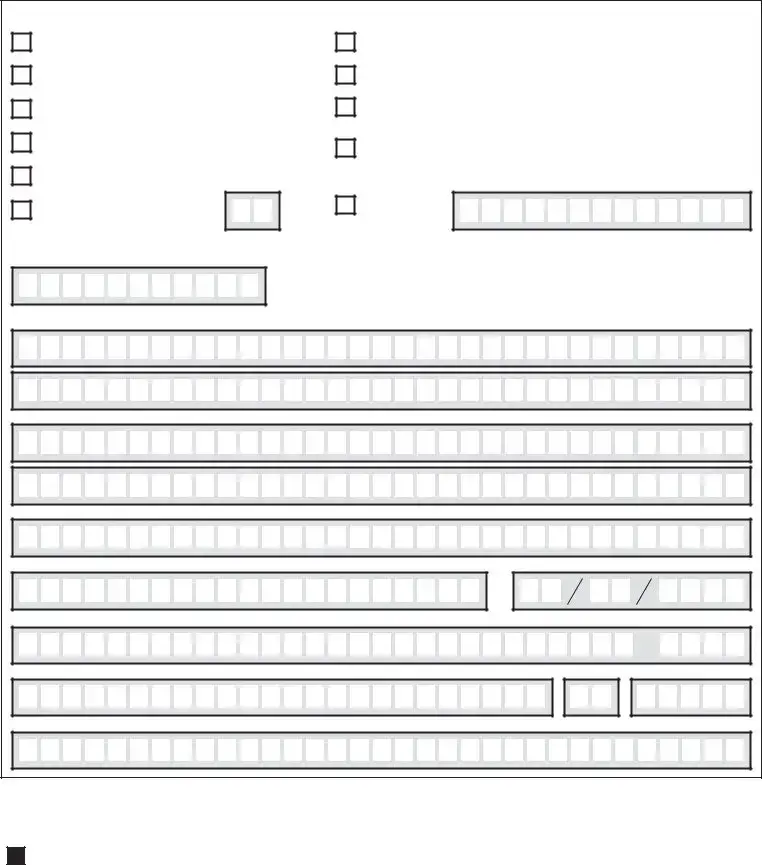

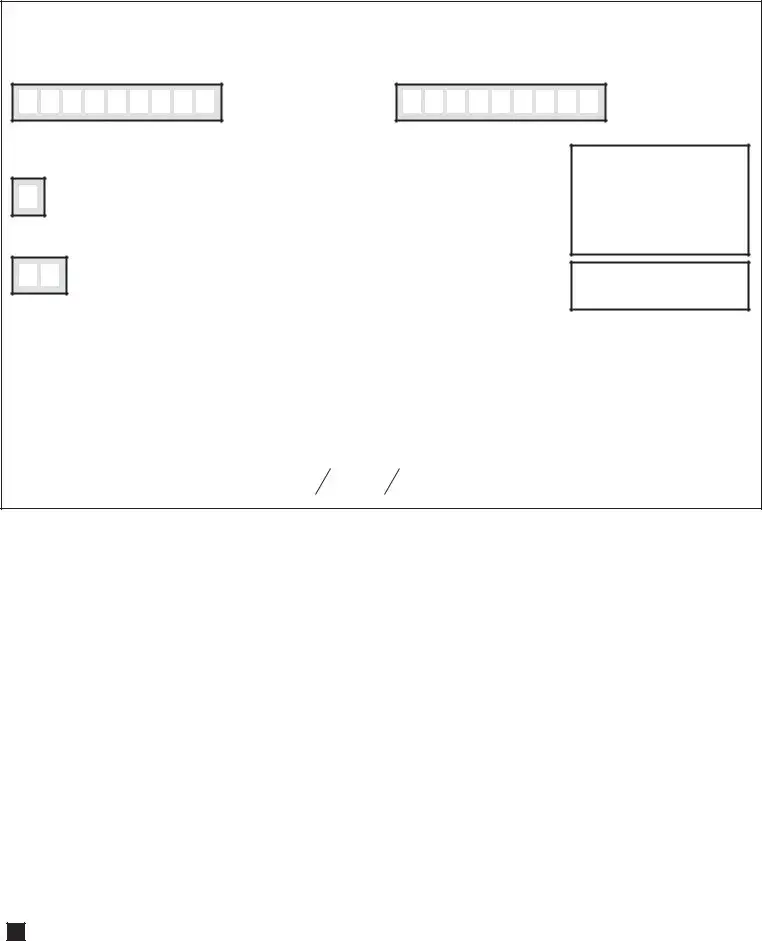

Fill Out Your Computershare Transfer Request Form

The Computershare Transfer Request form serves a crucial role for individuals looking to transfer their securities from one account to another. It initiates the transfer process for various asset types, whether from a non-custodial account or a custodial account. Completing this form requires individuals to provide their current account information, including the name(s) on the account, the current account number, and the address. A detailed section outlines the purpose of the transfer, which can include private sales, gifts, inheritances, or maintaining ownership without change. This section is important for tax purposes and must be completed accurately to avoid complications. Additionally, the form mandates the inclusion of the number of shares being transferred, along with the specific security type. Signatures from all current account holders, or a legally authorized representative, are essential to validate the transfer. These signatures must also be accompanied by a Medallion Signature Guarantee, which offers an extra layer of security and authenticity. Individuals must be meticulous in filling out the New Account Type section, whether transferring to a new non-custodial registration or a custodial account, ensuring that all necessary details are accurately documented to facilitate a smooth transfer process.

Computershare Transfer Request Example

.Reset Form

Name of Current Account Holder

Joint Tenant

Address

City, State, Zip

+

Computershare

PO Box 505013

Louisville, KY

www.computershare.com/investor

Current Holder Account Number

Company Name

Transfer Request |

PLEASE PRINT CLEARLY |

1. CURRENT ACCOUNT TYPE (account you are transferring shares out of)

OR |

Custodial Registrations - Custodian to complete section 3 (reverse page)

2.

Current Holder Information (as it appears on your account statement)

Current Tax ID / SSN on Account (do not use hyphens)Telephone Number (do not use hyphens)

Name(s) / Registration on Current Account (include ALL names/entities listed on account)

Current Street Address

City

Apt. / Unit Number

State |

Zip Code |

E 4 0 8 U T R |

+ |

|

02SY3A_WEB

.

+

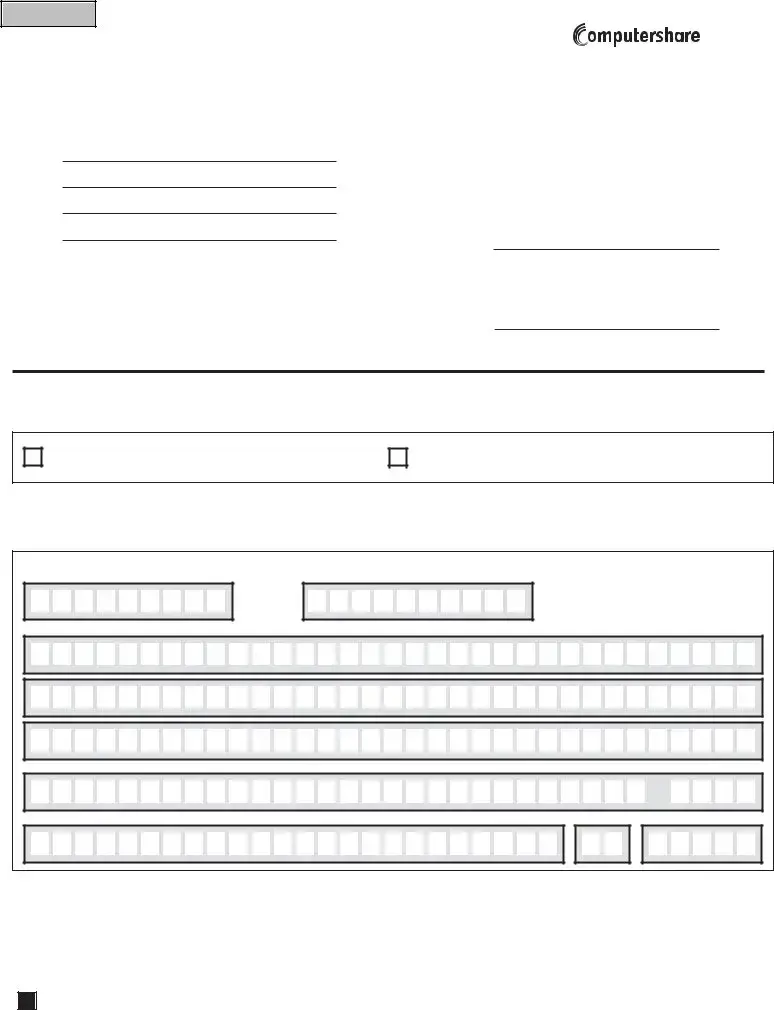

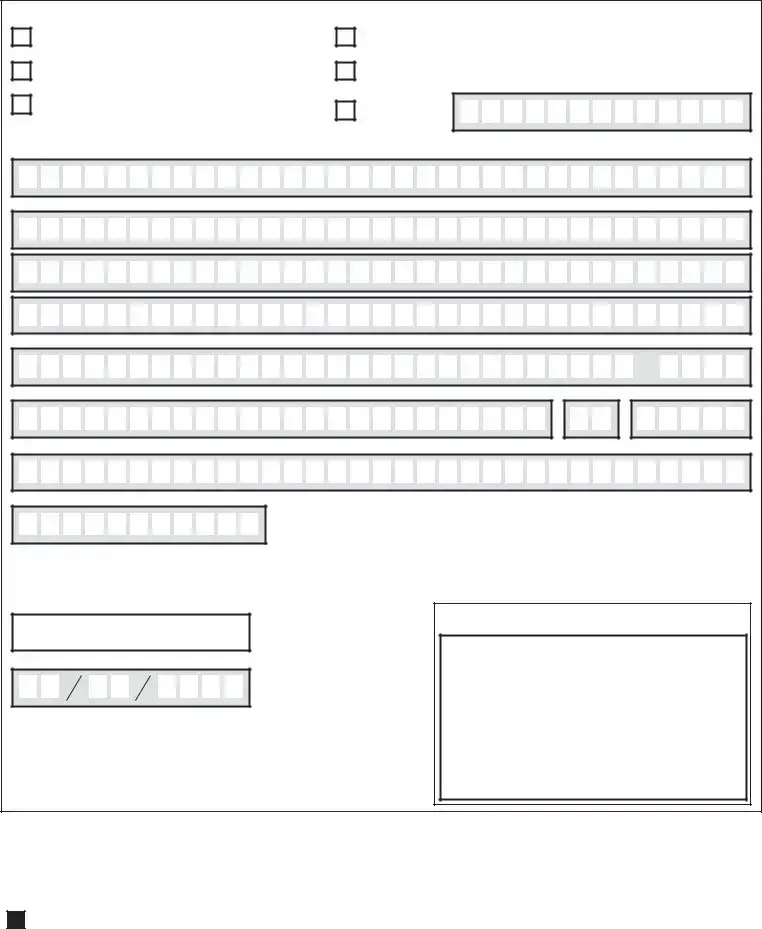

3.CUSTODIAL REGISTRATIONS Current Custodian Information

The Custodian registered to the current account (that you are transferring shares out of) must provide and/or verify the following information:

Name of Custodian

Name(s) / Registration on Current Account (include ALL names/entities listed on account)

Current Street Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Apt. / Unit Number |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City

Custodian Account Number/Investor ID at Custodian |

|

Custodian Taxpayer ID Number (do not use hyphens) |

||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

Zip Code |

Custodian Telephone Number (do not use hyphens) |

|

|

|

Ext. |

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. COST BASIS/REASON FOR TRANSFER

Please check off the applicable purpose of the transfer for shares acquired after 12/31/10. If this section is not fully completed, all transfers will be treated as Gifts, unless we receive documentation that this is a decedent transfer (i.e. Affidavit of Domicile) in which case the transfer will be treated as an inheritance. We recommend that you consult with your tax advisor regarding the tax implications for each type of transfer. Please check ONLY ONE box. If you check more than one box your transfer will be treated as if you had not made any selection.

Private Sale |

|

Date of Sale: |

(If Private Sale) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost Per Share: |

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

US Dollars |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gift |

|

Date of Gift: |

Inheritance |

Date of Death: |

(If blank we will default to the effective date of the transfer.)

No Change of Ownership (please specify)

(If Inheritance) Value Per Share:

.

.

US Dollars

E 4 0 9 U T R |

+ |

|

02SY3A_WEB

.

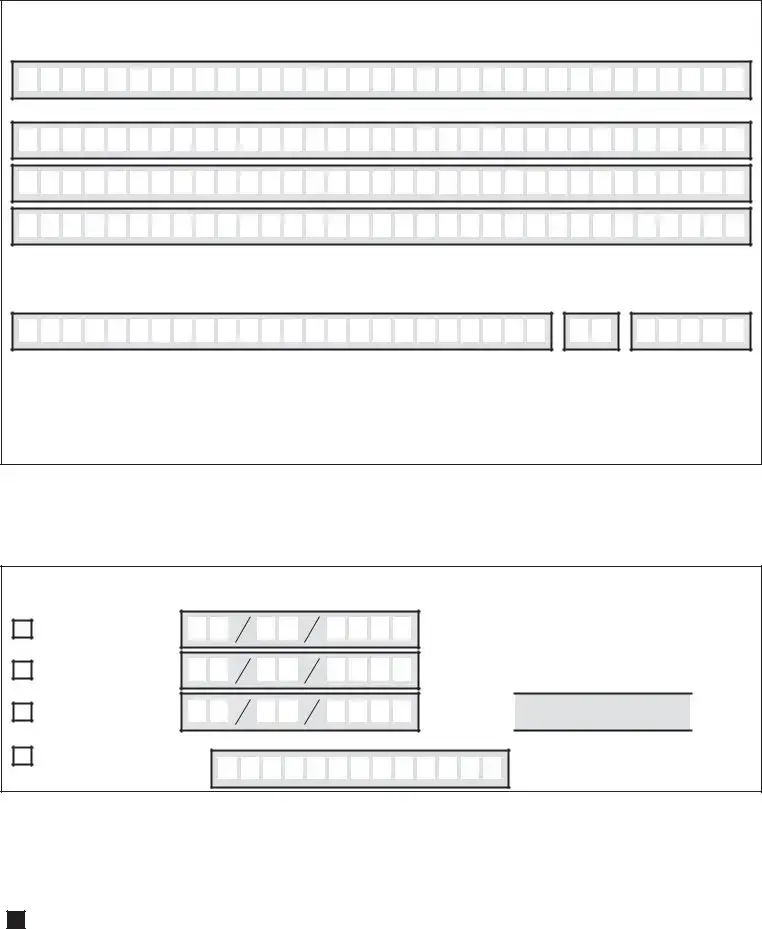

5. SHARE TRANSFER

+

A. Transfer All Securities |

OR |

B. Transfer Shares As Instructed Below

If box B is checked, complete the Security Description/Share Type details below.

Security Description / Share Type (ex: Common, Preferred, etc) |

Transfer All |

Enter number of whole and / or fractional shares to transfer, if applicable |

or

or

or

or

.

.

.

.

.

.

.

.

6. AUTHORIZED SIGNATURES

The undersigned does (do) hereby irrevocably constitute and appoint Computershare as attorney to transfer the said stock, as the case may be, on the books of said Company, with full power of substitution in the premises.

The signature(s) below on this Transfer Request form must correspond exactly with the name(s) as shown upon the face of the stock certificate or a

NOTE: Signature(s) must be stamped with a Medallion Signature Guarantee by a qualified financial institution, such as a commercial bank, savings bank, savings and loan, US stockbroker and security dealer, or credit union, that is participating in an approved Medallion Signature Guarantee Program (A NOTARY SEAL IS NOT ACCEPTABLE).

Required ►Medallion Guarantee Stamp

All Current Holder(s) or Legal Rep(s) (Notary Seal Is Not Acceptable)

Date (mm / dd / yyyy)

Signature of all Current Holders or Legal Representative(s)

Required ►Medallion Guarantee Stamp

Current Custodian (Notary Seal Is Not Acceptable)

Required ►Medallion Guarantee Stamp

All Current Holder(s) or Legal Rep(s) - Continued (Notary Seal Is Not Acceptable)

Date (mm / dd / yyyy)

Signature of Current Custodian

Date (mm / dd / yyyy)

Signature of Additional Current Holder(s) or Legal Representative(s)

E 4 1 0 U T R |

+ |

|

02T1GA_WEB

.

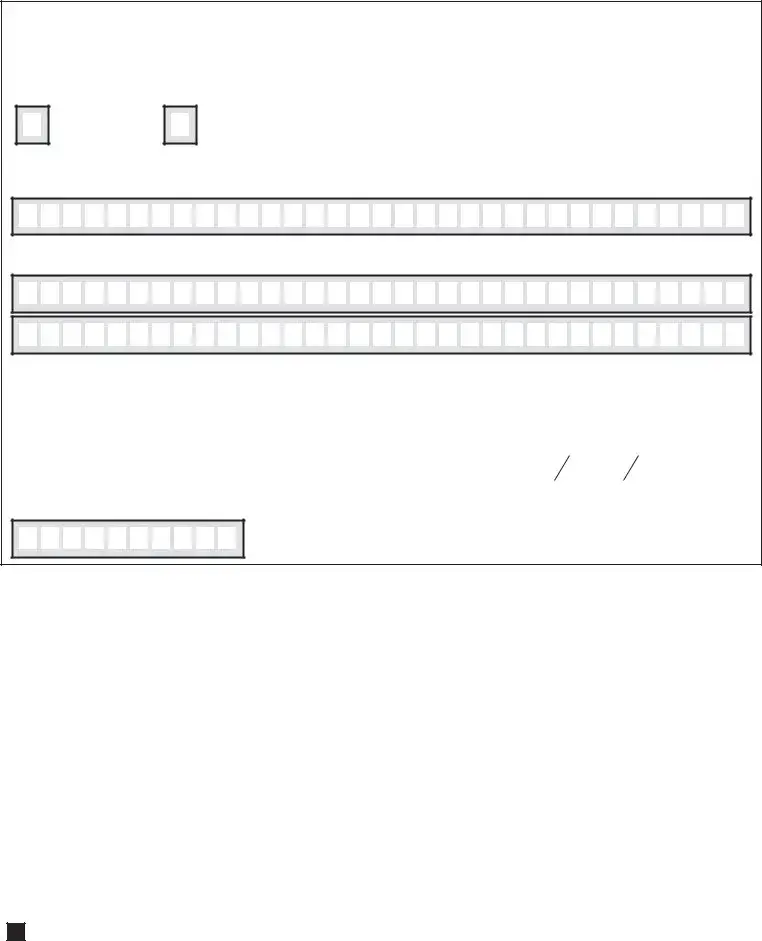

7. NEW ACCOUNT TYPE (account you are transferring shares to) |

+ |

|||

|

|

|

|

|

|

|

|

Custodial Registrations - Custodian to complete section 9 (reverse page) |

|

|

|

|

||

|

|

|

|

|

8.New Account Type (account you are transferring shares to):

Individual

Joint Tenants with Right of Survivorship

Community Property

Tenants in Common

Corporation

Custodial for Minors Act – State of:

B. New Holder Information

New Holder’s Existing Account Number (if applicable)

Name of Individual / Entity / Trustee / Executor / Other

Estate – Include Executor Name, Provide Estate EIN on Form

Qualified Pension Plan

Trust – Include Trustee Names, Trust Name, and Trust

Agreement Date below.

Transfer on Death (“TOD”) – Note: Only 1 TOD beneficiary may be registered per account. List the TOD beneficiary name below.

Other (Specify)

Name of Joint Holder / Minor /

Trust / Estate Name (if applicable)

Trust / Estate Name - continued

Current Street Address

City

Trust Agreement Date (mm / dd / yyyy) (if applicable)

Apt. / Unit Number

State |

Zip Code |

E 4 1 1 U T R |

+ |

|

02T1GA_WEB

.

+

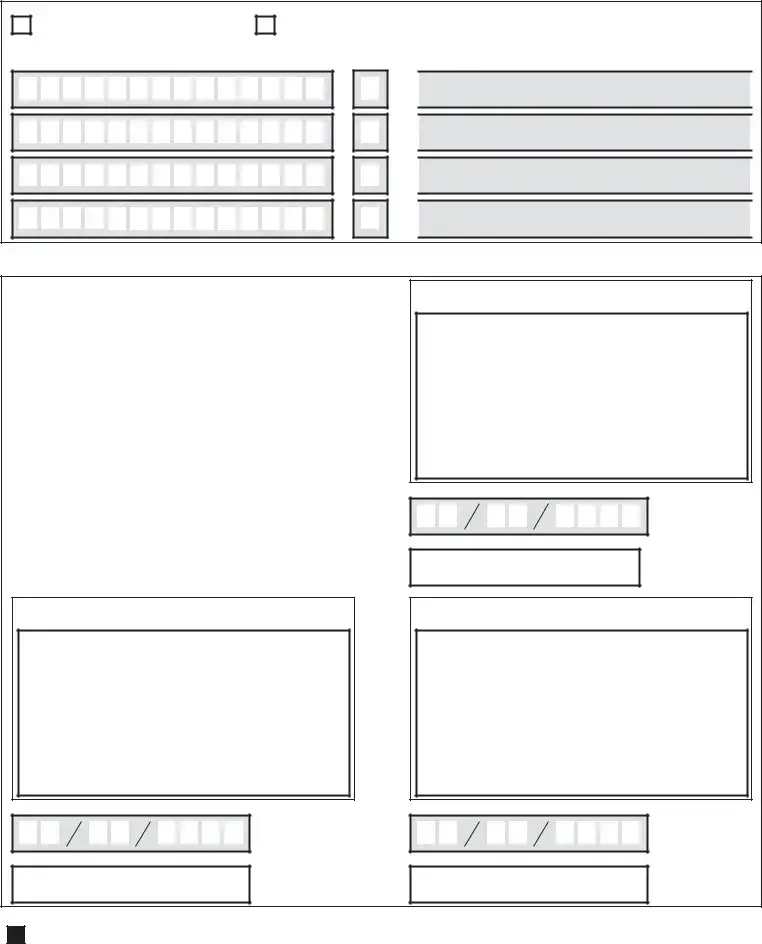

9.New Account Type (account you are transferring shares to): Custodial Registrations A. New Custodial Registration Type

Traditional IRA

Roth IRA

KEOGH Plan

B. New Custodial Information

Simplified Employee Pension/Trust (SEP)

Pension/Profit Sharing Plan

Other (Specify)

Name of Custodian

Beneficial Holder for New Account (include ALL names/entities listed on account)

Current Street Address |

|

Apt. / Unit Number |

City |

State |

Zip Code |

Custodian |

|

|

Custodian Account Number / Investor ID at Custodian |

|

|

Custodian Telephone Number (do not use hyphens) |

|

|

|

Ext. |

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature of New Custodian

NOTE: Signature(s) must be stamped with a Medallion Signature Guarantee by a qualified financial institution, such as a commercial bank, savings bank, savings and loan, US stockbroker and security dealer, or credit union, that is participating in an approved Medallion Signature Guarantee Program (A NOTARY SEAL IS NOT ACCEPTABLE).

Required ►Medallion Guarantee Stamp

New Custodian (Notary Seal Is Not Acceptable)

Date (mm / dd / yyyy)

E 4 1 2 U T R |

+ |

|

02T1GA_WEB

.

+

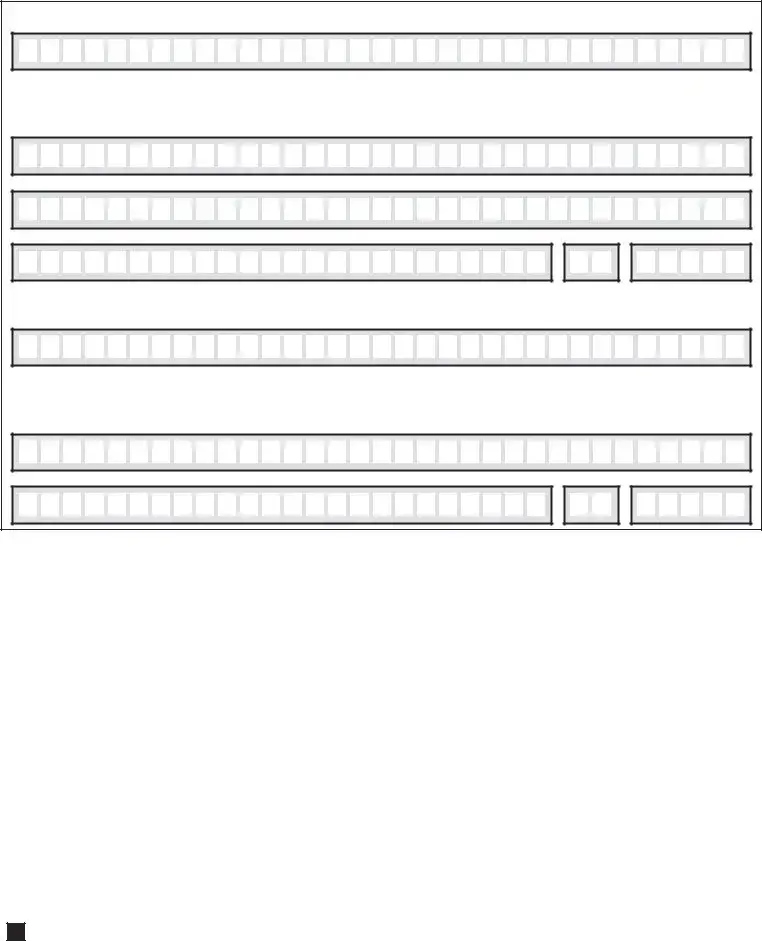

10. Distribution for new account

Bank Routing Number – this is a |

|

Bank Account Number – account numbers vary in length and must not include check numbers. |

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DO NOT USE YOUR CREDIT CARD NUMBER. If you are unsure of your Bank Routing Number or Bank Account Number, please check with your financial institution. Please DO NOT provide a check number in the fields above. This is commonly listed with your Account and Bank Routing Numbers on your check.

Checking Account

Savings Account

Name(s) that appear on the account at your financial institution

Name of Financial Institution

I/We hereby authorize Computershare as disbursing agent for the payer, to initiate credit entries to my (our) account; or if necessary debit entries or adjustments for any credit entries in error. This authority is to remain in effect until my (our) written authorization to terminate electronic funds transfer is received in time to afford Computershare reasonable opportunity to act on it or until this service is terminated by the payer or Computershare. All registered holders as well as all individuals listed on the financial account must sign below.

Signature 1 - Please keep signature within the box. |

|

|

Signature 2 - Please keep signature within the box. |

|

|

Date (mm / dd / yyyy) |

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Telephone Number (do not use hyphens)

E 4 1 3 U T R |

+ |

|

02T1JA_WEB

.

11.FINANCIAL ADVISOR / FINANCIAL INSTITUTION INFORMATION

A. Financial Advisor Information

Financial Advisor Name

Financial Advisor CRD Number |

|

Telephone Number (do not use hyphens) |

|

|

|

|

|

|

|

Ext. |

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial Advisor

Financial Advisor Street Address/PO Box

City

B. Financial Institution Information

Financial Institution Name

State |

Zip Code |

Financial Institution CRD Number |

|

Telephone Number (do not use hyphens) |

|

|

|

|

|

|

|

Ext. |

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial Institution Street Address/PO Box

City |

State |

Zip Code |

E 4 1 4 U T R |

+ |

|

02T1KA_WEB

.

+

12.Form

A.Taxpayer Identification Number (TIN)

Enter the TIN for the new Holder or new Custodian in the appropriate box. For individuals, this is your Social Security number (SSN).

For other entities, it is your Employer Identification Number (EIN). For joint tenant accounts, the TIN provided must belong to the first owner on the registration to avoid backup withholding. COMPLETE ONLY ONE BOX.

Social Security Number (do not use hyphens) |

Employer Identification Number (do not use hyphens) |

OR

B. Federal Tax Classification

Check appropriate box (required); check only ONE of the following boxes:

Individual / Sole |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Trust / |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Proprietor or Single- |

|

|

|

C Corporation |

|

|

|

S Corporation |

|

|

|

Partnership |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Estate |

||||

Member LLC |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note: For a

C. Exempt Payee Code (if any)

If you are exempt from backup withholding, enter in the Exemptions box, any code that may apply to you.

See Exempt payee codes on the back of this form.

Limited Liability Company

or

Other Classification

If you are an LLC or Other Classification, do not complete this form. You must complete an IRS Form

Exemption from FATCA reporting code (if any)

Not Applicable

(Applies to accounts maintained outside the U.S.)

D. Certification

Under penalties of perjury, I certify that:

1.The number shown on this form is my correct Taxpayer Identification Number, and

2.I am not subject to backup withholding because: (a) I am exempt from backup withholding, or (b) I have not been notified by the Internal Revenue Service (IRS) that I am subject to backup withholding as a result of a failure to report all interest or dividends, or (c) the IRS has notified me that I am no longer subject to backup withholding, and

3.I am a U.S. citizen or other U.S. person (defined on reverse).

4.The FATCA code(s) entered on this form (if any) indicating that I am exempt from FATCA reporting is correct (defined on reverse).

Certification Instructions. You must cross out item 2 above if you have been notified by the IRS that you are currently subject to backup withholding because you have failed to report all interest and dividends on your tax return.

This form must be signed and dated for us to accept as proper certification. Send form to Computershare. Do not send to the IRS.

Signature - Please keep signature within the box. |

|

|

Date (mm / dd / yyyy) |

|

|

|

|

|

|

|

Telephone Number (do not use hyphens) |

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

E 4 1 5 U T R |

+ |

|

02T1JA_WEB

.

+

How to complete this form

Backup Withholding

The Internal Revenue Service (IRS) requires us to withhold taxes for the applicable rate of backup withholding for U.S. persons without a

Receipt of a completed Form

What Name and Number To Give the Requester

|

For this type of account: |

Give name and SSN of: |

1. |

Individual |

The individual |

2. |

Two or more individuals (joint account) |

The actual owner of the account or, if |

|

|

combined funds, the first individual on |

|

|

the account |

3. |

Custodian account of a minor |

The minor |

|

(Uniform Gift to Minors Act) |

|

4. |

a. The usual revocable savings |

The |

|

trust (grantor is also trustee) |

The actual owner |

|

b. |

|

|

not a legal or valid trust under state |

|

|

law |

|

5. |

Sole proprietorship or disregarded |

The owner |

|

entity owned by an individual |

|

6. |

Grantor trust filing under Optional |

The grantor |

|

Form 1099 Filing Method 1 |

|

|

(see Regulation section |

|

|

|

|

For this type of account: |

Give name and EIN of: |

7. |

Disregarded entity not owned by an |

The owner |

|

individual |

|

8. |

A valid trust, estate, or pension trust |

Legal entity |

9. |

Corporation or LLC electing |

The corporation |

|

corporate status on Form 8832 or |

|

|

Form 2553 |

|

10. |

Association, club, religious, |

The organization |

|

charitable, educational, or other tax- |

|

|

exempt organization |

|

11. |

Partnership or |

The partnership |

12. |

A broker or registered nominee |

The broker or nominee |

13. |

Account with the Department of |

The public entity |

|

Agriculture in the name of a public |

|

|

entity (such as a state or local |

|

|

government, school district, or |

|

|

prison) that receives agricultural |

|

|

program payments |

|

14. |

Grantor trust filing under the Form |

The trust |

|

1041 Filing Method or the Optional |

|

|

Form 1099 Filing Method 2 (see |

|

|

Regulation section |

|

|

|

Exempt payee code. Generally, individuals (including sole proprietors) are not exempt from backup withholding. Corporations are exempt from backup withholding for certain payments, such as interest and dividends. Corporations are not exempt from backup withholding for payments made in settlement of payment card or third party network transactions.

Note. If you are exempt from backup withholding, you should still complete this form to avoid possible erroneous backup withholding.

The following codes identify payees that are exempt from backup withholding:

1

2

3

4

6

7

9

11

12

Limited Liability Company or Other Classification

If you are a Limited Liability Company or Other entity, complete an IRS Form

Definition of a U.S. Person. For federal tax purposes, you are considered a U.S. person if you are:

●An individual who is a U.S. citizen or U.S. resident alien,

●A partnership, corporation, company, or association created or organized in the United States or under the laws of the United States,

●An estate (other than a foreign estate), or

●A domestic trust (as defined in Regulations Section

Exemption from FATCA reporting: If you are submitting this form for an account that is maintained in the United States, you are exempt from FATCA reporting.

E 4 1 6 U T R |

+ |

|

02T1JA_WEB

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | The Computershare Transfer Request form is used for transferring shares from one account to another. |

| Account Holder Information | The form requires the current account holder's name, address, and account number to initiate the transfer. |

| Non-Custodial vs Custodial | Users must indicate whether the account is non-custodial or custodial, affecting how sections of the form are completed. |

| Signature Requirement | All current holders must sign the form, which requires a Medallion Signature Guarantee from a qualified financial institution. |

| Tax Implications | It's advised to consult a tax professional regarding the tax implications of different transfer types, such as gifts or inheritances. |

| Receiving State Law | Each state may have its own laws governing transfers, impacting the form's requirements; ensure compliance with local regulations. |

| Transfer Selections | The form allows the selection of transfer type—such as gift, inheritance, or private sale—only one option should be checked to avoid processing errors. |

| New Account Setup | When transferring shares, new account holder information must be provided, including details on whether it is an individual, corporation, or other entity. |

Guidelines on Utilizing Computershare Transfer Request

Completing the Computershare Transfer Request form requires careful attention to detail. Each section must be filled out accurately to ensure the transfer is processed without delays. After submitting the form, Computershare will begin processing the transfer according to the provided information.

- Write the Name of Current Account Holder in the designated field.

- If applicable, add the Joint Tenant name.

- Enter the Current Address, which includes street address, city, state, and zip code.

- Locate the Current Holder Account Number and provide it in the appropriate section.

- Indicate the Company Name associated with the account.

- Check the box for Current Account Type: either Non-Custodial or Custodial Registrations.

- If Non-Custodial was selected, provide the following information:

- Current Tax ID / SSN on Account (no hyphens).

- Telephone Number (no hyphens).

- Name(s) / Registration on Current Account.

- Current Street Address.

- City, Apt./Unit Number, State, Zip Code.

- If Custodial was selected, have the Custodian provide and verify: Name of Custodian, Name(s) / Registration on Current Account, Current Street Address, Custodian Account Number/Investor ID, and Custodian Taxpayer ID Number.

- In the COST BASIS/REASON FOR TRANSFER section, check one box indicating the reason for the transfer. Complete additional fields as required.

- For the SHARE TRANSFER section, choose either to transfer all securities or specify shares to transfer.

- Go to AUTORIZED SIGNATURES section and have all holders or authorized representatives sign the form. Don't forget to obtain a Medallion Signature Guarantee.

- In the NEW ACCOUNT TYPE section, select either Non-Custodial or Custodial Registrations for the account to which shares will be transferred.

- Complete the New Holder Information or New Custodial Information as applicable, ensuring all required fields are filled out.

- Once all necessary information has been entered, double-check for accuracy, and submit the form to Computershare.

What You Should Know About This Form

What is the Computershare Transfer Request form?

The Computershare Transfer Request form is a document used to facilitate the transfer of shares from one account to another. This form allows individuals to specify whether they are transferring shares from a non-custodial account or a custodial account, and it requires detailed information about both the current account holder and the new account holder.

How do I fill out the transfer request form?

To fill out the form, start by clearly printing all required information. You will indicate your current account type, provide your tax ID or Social Security number, and detail the current holder’s name and address. If you are transferring shares from a custodial account, the custodian will need to complete specific sections. Be sure to check off the purpose of your transfer and indicate the number of shares you wish to transfer.

What information do I need to provide for the transfer?

You need to provide personal details such as your name, address, and account number. If applicable, include information about the custodian, including their name and taxpayer ID. Additionally, specify the reason for the transfer, whether it is a gift, inheritance, or sale, and provide the cost basis if that applies. Complete sections for both the current and new account holders as necessary.

Are there any specific requirements for signatures on the form?

Yes, all signatures on the form must match exactly with the names shown on the stock certificate or Computershare statement. Additionally, every signature must be stamped with a Medallion Signature Guarantee from a qualified financial institution. A notary seal will not be accepted, so ensure you take this step to avoid delays in processing.

What happens if I don’t complete the ‘Cost Basis/Reason for Transfer’ section?

If this section is not fully completed, Computershare defaults all transfers to be treated as gifts. This means you might miss out on important tax implications regarding your transfer. It is essential to indicate if the transfer is a gift, sale, inheritance, or has no change in ownership to ensure accurate processing.

Can I transfer both common and preferred shares using the form?

Yes, you can transfer various types of securities, including common and preferred shares. When filling out the form, specify the type of shares you are transferring under the ‘Share Transfer’ section. It's important to clearly identify the description of each security type being transferred to avoid any confusion during the process.

What do I do if I am dealing with a deceased person's shares?

If you are transferring shares from a deceased person’s account, you will need to provide documentation that verifies the transfer as an inheritance. This typically involves filing an Affidavit of Domicile, which proves the decedent’s estate has the right to transfer the shares. Always consider consulting a tax advisor or legal expert in this situation to ensure compliance with tax laws.

How long does it take for my transfer request to be processed?

The processing time for transfer requests can vary. Typically, it may take several business days to process depending on the complexity of the request and the completeness of the form. For an accurate estimation, it is advisable to contact Computershare directly after submission to inquire about your specific request.

Where can I submit my completed transfer request form?

You can submit your completed Computershare Transfer Request form by mailing it to Computershare at PO Box 505013, Louisville, KY 40233-5013. Be sure to check that all required fields are filled out and signatures are properly guaranteed to avoid any delays in processing your request.

Common mistakes

Filling out the Computershare Transfer Request form can seem straightforward, but many individuals encounter challenges that can delay the process or result in the rejection of their request. One common mistake is failing to provide complete information. Each section of the form requires specific details. For instance, if a person neglects to enter their current account number or tax identification number, the request will likely be processed slowly, if at all.

Another frequent error involves illegible handwriting. It is crucial to print clearly and use accurate spelling throughout the form. If Computershare cannot read the information provided due to smudged ink or poor handwriting, they may be unable to process your request effectively.

Confusion over the current account type also leads to mistakes. Individuals often check more than one box in this section, causing delays or misprocessing of the transfer. Read the options carefully and ensure that only one is selected. This is essential for facilitating a smooth transition of shares.

Additionally, many people incorrectly indicate the reason for transfer. If the cost basis section is left blank or not filled out correctly, Computershare will default to treating the transfer as a gift or inheritance, which may not reflect the intent of the transferor. Thus, thoroughness is key.

Further complicating matters, individuals often forget to include authorized signatures. The form requires signatures from all current account holders or their legally authorized representatives. If any required signature is missing or if the names do not match the records precisely, transfer requests can be invalidated.

Another critical mistake relates to the Medallion Signature Guarantee. This stamp is mandatory, yet individuals sometimes either fail to obtain one or mistakenly provide a notary seal, which is not acceptable. This can prove problematic since without the proper certification, Computershare cannot process the transfer.

People also mistakenly overlook the specifics of transferring shares. If they fail to specify the number of shares or the type of securities they wish to transfer, Computershare will not know how to proceed. It is essential to be explicit in both the quantity of shares and the nature of the securities involved.

Lastly, when completing the sections about the new account type, many individuals neglect to provide relevant information for the new holder. Failing to include required details such as the address, email, or names can result in processing delays. Always cross-check that every field is filled out completely to avoid complications.

Documents used along the form

When you’re looking to transfer shares, the Computershare Transfer Request Form is key. However, it's often accompanied by several other forms and documents that smooth out the process. Below are some commonly used documents that can help ensure your transfer goes off without a hitch.

- Medallion Signature Guarantee: This stamp is required to verify the identity of the individuals involved in the transfer. It's important because it protects against unauthorized transactions. Make sure to get this from a financial institution that's part of an approved Medallion Signature Guarantee Program.

- W-9 Form: If transferring to a new account or holder, a W-9 form may be necessary. This document provides your taxpayer identification number to the new custodian, which is crucial for tax reporting purposes.

- Affidavit of Domicile: If the shares being transferred are part of an inheritance, this form verifies the last known residence of the deceased. It’s particularly important when the transfer is due to a death.

- Transfer of Ownership Documentation: Depending on the circumstances—such as a sale or gift—you might need specific documentation that proves the legality of the transfer. This keeps everything above board.

- Change of Ownership Notice: This serves as a formal notification to Computershare that ownership is changing. It can help clarify any questions about the transfer along the way.

- New Account Application: If the shares are being transferred to a new account, don’t forget to fill out this application. It provides the necessary details to set up the new ownership correctly.

- State-specific Transfer Forms: Some states have their own forms required for stock transfers. Be sure to check local regulations to ensure compliance, as these documents can vary.

By gathering the requisite forms and documents together, you can facilitate a smoother transfer process. Each piece plays a unique role in protecting your interests and ensuring that the transfer is completed efficiently. Always consult with a professional if you have any uncertainties about the paperwork involved.

Similar forms

The Computershare Transfer Request form is essential for transferring shares from one account to another. It serves various purposes similar to other financial documents. Here are five documents that share similarities with it:

- Stock Power Form: Like the Computershare form, a stock power form is used to transfer ownership of shares. It requires information about the current owner as well as the new owner, along with necessary signatures for the transfer to be valid.

- Brokerage Account Transfer Form: This form facilitates the transfer of assets between brokerage accounts. Similar to the Computershare form, it collects the account holder's details and ensures that all transfers comply with regulations.

- Change of Registration Form: This document is often utilized when changing the name or registration details of an account holder. It aligns with the Computershare form by requiring proof of ownership and authorized signatures for the change to take effect.

- Gift Tax Return (Form 709): If shares are being gifted, this IRS form is necessary for reporting the gift. This document relates to the Computershare Transfer Request form in the aspect of recording the purpose of the transfer and determining any tax implications.

- Decedent's Estate Transfer Documents: These documents are key when transferring shares from a deceased individual’s estate. Similar to Computershare’s form, they require a legally appointed representative's signature and sometimes additional verification for the transfer, especially in inheritance cases.

Dos and Don'ts

When filling out the Computershare Transfer Request form, it is essential to follow certain guidelines to ensure accuracy and compliance. The following is a list of dos and don'ts:

- Do print clearly to ensure legibility.

- Do include all necessary personal information, such as the account holder's name and address.

- Do provide the current account number accurately.

- Do complete the cost basis section thoroughly to avoid delays.

- Do include a Medallion Signature Guarantee for all signatures.

- Don't omit information regarding joint tenants or custodians.

- Don't use hyphens when entering the tax ID or telephone numbers.

- Don't check more than one box in the transfer purpose section.

- Don't forget to date the form and provide signatures where required.

- Don't use a notary seal in place of the Medallion Signature Guarantee.

Following these guidelines will assist in the successful processing of the transfer request.

Misconceptions

Understanding the Computershare Transfer Request form can be tricky due to various misunderstandings. Here are six common misconceptions about the form, along with clarifications to help you navigate the process smoothly.

- It’s only for stock transfers. Many believe this form is strictly for transferring stocks. In reality, it can also be used for transferring other types of securities, such as bonds or mutual funds.

- All signatures require notarization. Some think that a notary seal is a must on the form. However, what is actually required is a Medallion Signature Guarantee, which is different from a notary and specifically verifies your identity and authority to make the transfer.

- You can transfer shares without a signature guarantee. There’s a misconception that you can skip the signature guarantee if you know the account holder personally. Unfortunately, this is incorrect; a Medallion Signature Guarantee is always necessary to process the transfer.

- Transfers are automatically processed. Many people assume that once the form is submitted, the transfer happens automatically. In fact, Computershare takes time to review each request, and any errors can delay the process.

- You don’t need to specify the type of transfer. It’s a common error to think that checking any box will suffice. The form requires you to select only one type of transfer; otherwise, it may be treated as a gift, which could lead to different tax implications.

- It’s only for individual accounts. Some believe that this form is not applicable for business or trust accounts. However, both types can also use the Computershare Transfer Request form, as it accommodates various account structures.

Understanding these misconceptions can clarify your experience with the Computershare Transfer Request form. Ensure that you read the instructions carefully and provide accurate information to avoid delays or complications.

Key takeaways

Filling out the Computershare Transfer Request form can seem daunting, but understanding its key components can simplify the process. Here are five essential takeaways to guide you:

- Accuracy is Crucial: When providing your current holder information, ensure that all names, addresses, and identification numbers are entered accurately as they appear on your account statements. Any discrepancies might lead to delays or complications in processing.

- Purpose of Transfer Matters: You must indicate the purpose of the transfer, particularly if your shares were acquired after December 31, 2010. This is essential, as incomplete information will default your transfer to a gift. Understanding the tax implications associated with each option is advisable, and consulting a tax advisor can provide clarity.

- Medallion Signature Guarantee Requirement: Signatures on the form need to be accompanied by a Medallion Signature Guarantee from a qualified financial institution. This step ensures the legitimacy of the request and protects all parties involved in the transfer.

- Clear Instructions for Share Transfer: Decide whether to transfer all securities or specify particular shares. If only selected shares are being transferred, detailed information, including the type and quantity of shares, is required for processing.

- New Account Type Selection: When transferring shares, it is important to indicate the type of account you are transferring to. This may include non-custodial or custodial registrations, and each has specific instructions that must be followed to ensure a smooth transition.

By keeping these key points in mind, you can facilitate a more efficient and correct completion of your Computershare Transfer Request form. If uncertainties arise, seeking assistance or clarification is a prudent step to take.

Browse Other Templates

Free Printable Caregiver Daily Checklist Template - Each entry allows for detailed tracking of arrival and departure times.

Permanent Partial Disability Ohio - Complete and up-to-date record-keeping can expedite the claims process under BWC guidelines.

Capital One Bank Wire Transfer - Remember that the amount you wish to wire is a crucial detail that must be accurate.