Fill Out Your Conduent W2 Form

The Conduent W2 form is a crucial document for employees and employers alike, serving as an essential record of compensation and tax withholding for the year. Each employee receives this form annually, summarizing their earned income, Social Security contributions, and other deductions. Clarity is paramount, as the W2 details not only the total wages earned but also benefits like retirement contributions and health insurance premiums. Employers are responsible for providing accurate information, and any discrepancies can lead to tax complications for employees. Furthermore, all federal, state, and local taxes withheld throughout the year are documented, assisting in the accurate filing of annual tax returns. Understanding the intricacies of the Conduent W2 form helps employees navigate their financial responsibilities, ensuring they remain compliant and informed as the tax season approaches.

Conduent W2 Example

EWHS

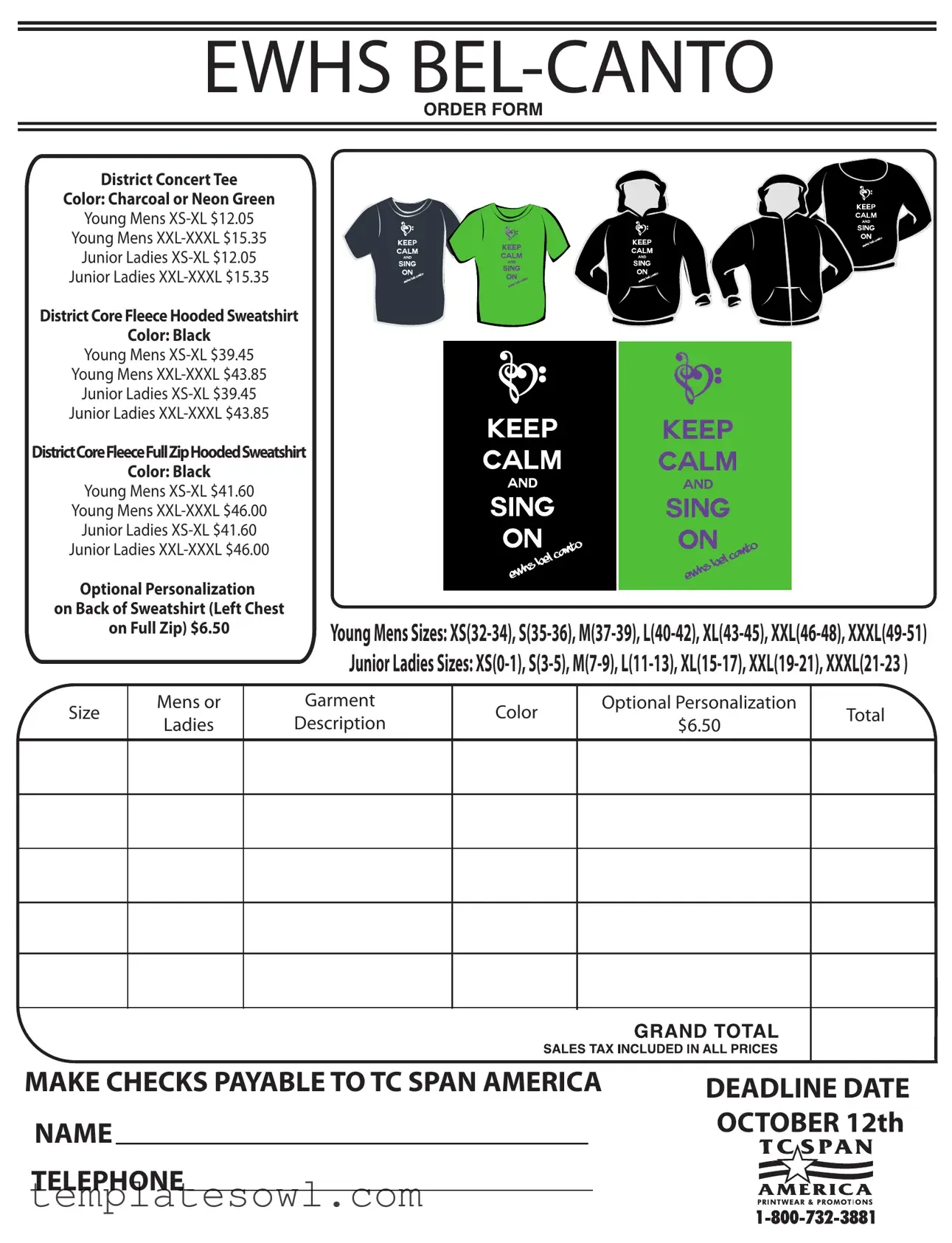

District Concert Tee

Color: Charcoal or Neon Green

Young Mens

Young Mens

Junior Ladies

Junior Ladies

District Core Fleece Hooded Sweatshirt

Color: Black

Young Mens

Young Mens

Junior Ladies

Junior Ladies

DistrictCoreFleeceFullZipHoodedSweatshirt

Color: Black

Young Mens

Young Mens

Junior Ladies

Junior Ladies

Optional Personalization on Back of Sweatshirt (Left Chest

on Full Zip) $6.50Young Mens Sizes:

Size

Mens or

Ladies

Garment

Description

Color

Optional Personalization

$6.50

Total

MAKE CHECKS PAYABLE TO TC SPAN AMERICA |

DEADLINE DATE |

||||

NAME |

|

|

|

|

OCTOBER 12th |

|

|

|

|

|

|

TELEPHONE |

|

|

|

||

Form Characteristics

| Fact Name | Detail |

|---|---|

| Purpose of W-2 | The Conduent W-2 form is used to report wages paid to employees and the taxes withheld from those wages during the year. |

| Filing Deadline | Employers must provide employees with their W-2 forms by January 31st of each year. |

| Governing Laws | Federal regulations, specifically the Internal Revenue Code, govern the issuance of W-2 forms. |

| State Variability | Some states require specific W-2 forms for state tax reporting. For instance, California and New York have additional state-specific requirements. |

| Employee Access | Employees have the right to receive and access their W-2 forms electronically if they consent to electronic delivery. |

| Personal Information | The form includes essential details such as the employee’s name, address, Social Security number, and employer’s identification number. |

| Consequences of Errors | If a W-2 form contains inaccuracies, the employee should notify the employer promptly to ensure corrections are made for tax reporting. |

Guidelines on Utilizing Conduent W2

Once you have gathered all necessary information, including your name, address, and relevant financial details, you can proceed to fill out the Conduent W2 form. This form is crucial for accurate tax reporting. Follow these straightforward steps to complete it properly.

- Start by entering your personal information in the designated sections. This includes your name, address, and Social Security Number.

- Fill in the employer's information. Include the employer’s name, address, and employer identification number (EIN).

- In the income section, report your total earnings for the year. Be sure to use the correct box for wages, tips, and other compensation.

- Complete the tax withholding information. You’ll need to enter the amounts withheld for federal income tax, Social Security, and Medicare.

- For any other earnings or deductions, refer to the appropriate boxes and fill in the necessary details.

- Finally, review all entries for accuracy. Look for any missing information or typos before submission.

After completing the form, ensure to keep a copy for your records. Submit the original to the appropriate authority as directed.

What You Should Know About This Form

What is the Conduent W2 form?

The Conduent W2 form is a tax document that employers use to report an employee's annual wages and the amount of taxes withheld from their paycheck. This form is essential for employees to file their federal and state income tax returns accurately.

How do I obtain my Conduent W2 form?

Employees typically receive their Conduent W2 form by mail at the beginning of the year, usually by January 31st. If you do not receive it by this date, you should contact your payroll department or Conduent directly to request a copy.

What should I do if my W2 form has incorrect information?

If you notice any discrepancies on your W2 form, it’s important to address them right away. Contact your employer or the payroll department to notify them of the inaccuracies. They will issue a corrected W2 form known as a W2c.

Can I access my W2 form online?

Yes, many employers provide access to W2 forms through employee portals. You may need to log in with your employee credentials to view and download your W2 form. Check with your organization’s human resources department for specific instructions.

What do I do if I can't find my W2 form?

If your W2 form is missing, first double-check with your mail or online account. If you still cannot locate it, contact your employer for a reissue. You can also call the IRS for guidance on how to proceed in case of a missing form.

When is the deadline to file my taxes with the W2 form?

The deadline for filing your taxes is typically April 15th each year, unless it falls on a weekend or holiday. It is crucial to file your taxes on time to avoid penalties, so make sure to have your W2 ready well ahead of this date.

What if I worked for more than one employer in a year?

If you worked for multiple employers during the year, you will receive a separate W2 form from each employer. You must report all your earnings from each W2 on your tax return. This ensures an accurate account of your total income.

Why is my W2 form important for my taxes?

The W2 form is vital for your tax return as it provides crucial details about your earnings and tax withholdings. This information is necessary for determining whether you owe additional taxes or will receive a refund. Make sure your W2 is accurate to avoid any complications with your filings.

Common mistakes

Many people look forward to receiving their W-2 forms at the start of the year, but filling them out can lead to several pitfalls. Common mistakes can delay processing and cause issues with tax filings. Awareness of these errors can help individuals ensure they complete their forms correctly and efficiently.

One frequent mistake occurs with personal information. Individuals sometimes provide incorrect names or Social Security numbers. These tiny errors can cause big problems. If the information does not match what the IRS has on file, it can lead to delays in receiving refunds or, worse, audits.

Another area where errors often occur is in the reporting of wages. People sometimes forget to include all income sources, or they misreport the amount of wages earned. Comprehensive accuracy is critical for tax compliance. Even if it seems insignificant, missing even a small amount can complicate your tax return.

Some individuals neglect to check the withholding amounts listed on their W-2 forms. It is essential to verify whether the correct federal and state tax amounts have been withheld. Mistakes can lead to either a larger tax bill than expected or receiving a smaller refund than anticipated.

Pitfalls can also arise when they overlook state and local taxes. Not every state requires this information, but if you live in a locality that does, failing to report it properly can result in fines. Always research local tax obligations to understand what needs to be included.

Many people also fail to account for benefits and deductions that may affect their taxes. Forms can sometimes include pre-tax contributions—like those for health insurance or retirement plans—yet individuals do not understand how these affect their gross income. Being aware of all financial aspects can lead to a more favorable tax situation.

Completing the optional personalization fields improperly can also be an issue. Some forms may ask for additional options, but if individuals do not correctly fill them out, their requests may be overlooked or misinterpreted. Make sure to read the instructions carefully.

Another mistake relates to using the wrong form. Some people may receive multiple versions of the W-2, depending on their employer's arrangements. Using an obsolete version can confuse tax calculations and lead to processing issues.

Lastly, many forget to check the submission deadlines. The deadline to submit forms may vary, and missing it can lead to penalties. Insisting on timely completion can save time and stress later in the tax season. It’s crucial to be proactive and aware of all dates relevant to tax filings.

Documents used along the form

When it comes to tax season, many individuals need to gather multiple forms to ensure they accurately file their taxes. The Conduent W2 form is a critical document that summarizes an employee's annual earnings from their employer. However, other documents often complement the W2 to provide a complete financial picture. Below is a list of these essential forms and documents, along with brief explanations of each.

- Form 1099-MISC: This form reports various types of income received by individuals who are not considered employees. It includes compensation for freelance work, rental income, and other miscellaneous earnings.

- Form 1099-NEC: Used specifically for reporting nonemployee compensation, this form highlights payments made to independent contractors or freelancers. It is crucial for reporting income when an individual receives more than $600 in a year from a single source.

- Form 1040: This is the main tax form used by individuals to report their annual income to the IRS. It allows taxpayers to calculate their tax liability, report their income, and claim deductions and credits.

- Form 1040-SR: Designed specifically for senior taxpayers, this is similar to Form 1040 but features larger print and an easier-to-read format. It provides older taxpayers with a user-friendly option for reporting their income.

- Form 8889: If an individual has a Health Savings Account (HSA), this form is necessary. It reports contributions, distributions, and the tax implications of those funds.

- Form 8862: This form is needed to claim the Earned Income Tax Credit (EITC) after it has been disallowed in a prior year. It allows taxpayers to provide information proving their eligibility.

- Schedule A: For individuals who want to itemize deductions, this form is essential. It lists deductions such as mortgage interest, property taxes, and medical expenses that can reduce taxable income.

- Schedule C: This form is used by sole proprietors to report income and expenses from their business. It assists in calculating net profit or loss from a self-owned business.

- Schedule SE: This is used to calculate self-employment tax for individuals who earn money through self-employment. It ensures that those without a traditional employer still properly contribute to Social Security and Medicare.

Gathering these documents in tandem with the Conduent W2 form can provide a clearer financial overview for tax filing purposes. Being well-prepared makes the filing process easier and helps ensure compliance with IRS regulations.

Similar forms

The Conduent W2 form, which reports wages and taxes withheld from an employee's paycheck, has several similarities with other important tax documents. Below is a list of seven documents that share features in reporting income and tax withholding information:

- 1099-MISC: This form is used by independent contractors and freelancers to report income earned. Like the W2, it provides detailed information on income but is typically issued to non-employees.

- 1099-NEC: Similar to the 1099-MISC, this form specifically reports non-employee compensation. It summarizes what a business paid to independent contractors, resembling the W2 in its reporting function.

- 1040 Tax Form: The individual income tax return form, 1040 integrates data from W2s, 1099s, and other income sources. It summarizes an individual’s tax obligations based on total income reported, including that on the W2.

- W3 Form: This form is a summary of all W2 forms submitted by an employer. It is filed with the Social Security Administration and provides a comprehensive account of wages and taxes, akin to the information contained in individual W2s.

- Payroll Summary Report: Employers use this internal report to monitor the total wages paid and taxes withheld during a pay period. It shares the purpose of documenting compensation and withholding, like the W2.

- State Wage and Tax Statement: Several states require similar forms to the W2, which report state income tax withheld and wage totals. These documents parallel the W2 format but cater to state taxes.

- K-1 Form: Used to report income from partnerships, S corporations, or estates, the K-1 shares characteristics with W2 forms in that it details earnings received by individuals from entities, though it serves different types of income earners.

Dos and Don'ts

When filling out the Conduent W2 form, follow these guidelines to ensure correct completion:

- Do enter your full legal name as it appears on your Social Security card.

- Do include your correct Social Security number.

- Do ensure your address is up to date and matches your tax records.

- Do double-check your filing status and exemptions before submission.

- Do keep a copy of the completed form for your records.

- Don’t leave any required fields blank; this can delay processing.

- Don’t use nicknames or initials; provide your name as it is legally recognized.

- Don’t forget to submit the form by the deadline to ensure timely processing.

- Don’t ignore discrepancies or errors; correct them immediately.

By following these steps, you can facilitate a smoother experience with your W2 form submission.

Misconceptions

Understanding the Conduent W2 form can be confusing. Many people hold misconceptions that can lead to misunderstandings about their tax situation. Here are some common myths, along with clarifications to help you navigate this important tax document.

- The W2 form is only for employees. Many believe that only employees receive a W2 form. While it's true that W2s are primarily for employees, certain service providers or contractors may also receive a similar form under specific conditions.

- I only need my W2 form to file my taxes. Some assume that the W2 is the only thing needed for tax filing. In reality, you may also need other documents, such as 1099s, to report all your income accurately.

- All employers provide W2 forms by January 31. It is commonly thought that employers must deliver W2 forms by this date. While this is the deadline, some employers may issue them earlier or later due to administrative delays.

- If I don’t receive my W2, I can’t file my taxes. There is a misconception that not receiving a W2 form means you cannot file your taxes. You can still file using your last pay stub or by estimating your income, but it's important to contact your employer for a replacement W2 as soon as possible.

- I can claim all of my expenses on my W2 form. Some people believe they can list all expenses on their W2. However, this form is meant only to report income, not expenses. To claim business expenses, you would generally need to use a different form.

- The information on the W2 is always accurate. Many think that all information on their W2 is error-free. Unfortunately, errors can occur. It is crucial to double-check the details and request corrections from your employer if you find discrepancies.

- W2 forms are the same for everyone. Some users assume that W2 forms look the same for all employees. In fact, while there is a standard format, the information varies based on an employee's wages, tax withheld, and other factors.

- Once I receive my W2, I’m finished with taxes for the year. It is a common belief that receiving a W2 concludes your tax responsibilities. However, after receiving it, you must carefully prepare your tax return, which may include additional forms and calculations.

By dispelling these misconceptions, you can approach the tax season with greater confidence and understanding. Remember to keep accurate records and consult with a tax professional if you have any questions.

Key takeaways

- Understand the Purpose: The Conduent W2 form is essential for reporting your annual earnings to the IRS. It helps ensure you're accurately taxed.

- Check Your Information: Always verify that your name, Social Security number, and address are correct on the form to avoid processing issues.

- Review Earnings and Deductions: Carefully examine reported wages and any deductions to confirm they align with your records.

- Filing Deadlines: Be aware of the deadlines for submitting the W2 form. Typically, employers must provide this to you by January 31st.

- Use Reliable Tax Software: Many people find tax software helpful for filling out the W2. Ensure it's up-to-date to capture any changes to tax laws.

- Keep a Copy: Always retain a copy of your completed W2 for your records. A copy will be useful if there are any discrepancies later.

- Know Where to Send It: Understand where to send your W2 form when filing your tax return. It typically goes to the IRS and your state tax agency if applicable.

- Optional Personalization: If included in your form, decide whether you want optional personalization, as this may affect your total cost.

- Contact Information: Ensure all necessary contact details, such as your name and phone number, are clearly stated on the form.

- Follow Up: If you have not received your W2 by early February, proactively reach out to your employer or the issuing company.

Browse Other Templates

Fms Score - Active straight-leg raise measures hamstring flexibility and hip mobility.

Informed Refusal Form - It serves as both a notification and a record of your health decision.