Fill Out Your Consumer Closing Disclosure Form

The Consumer Closing Disclosure form serves as a crucial document in the real estate transaction process, particularly for home buyers and sellers. Integral to the closing process, this form presents a detailed breakdown of the loan terms, including the interest rate, monthly payments, and total closing costs. It compares the final terms of the mortgage to those initially disclosed in the Loan Estimate, helping buyers understand what they are paying for and providing transparency throughout the transaction. Additionally, the form includes information on taxes, insurance, and other pertinent costs that may arise during homeownership. By thoroughly reviewing this document, buyers can ensure they are well-informed before committing to the closing of their property. Furthermore, the Consumer Closing Disclosure promotes accountability by requiring lenders to adhere to timelines and clarify any fees associated with the loan, ultimately protecting consumers and enhancing their understanding of the financial implications of their purchase.

Consumer Closing Disclosure Example

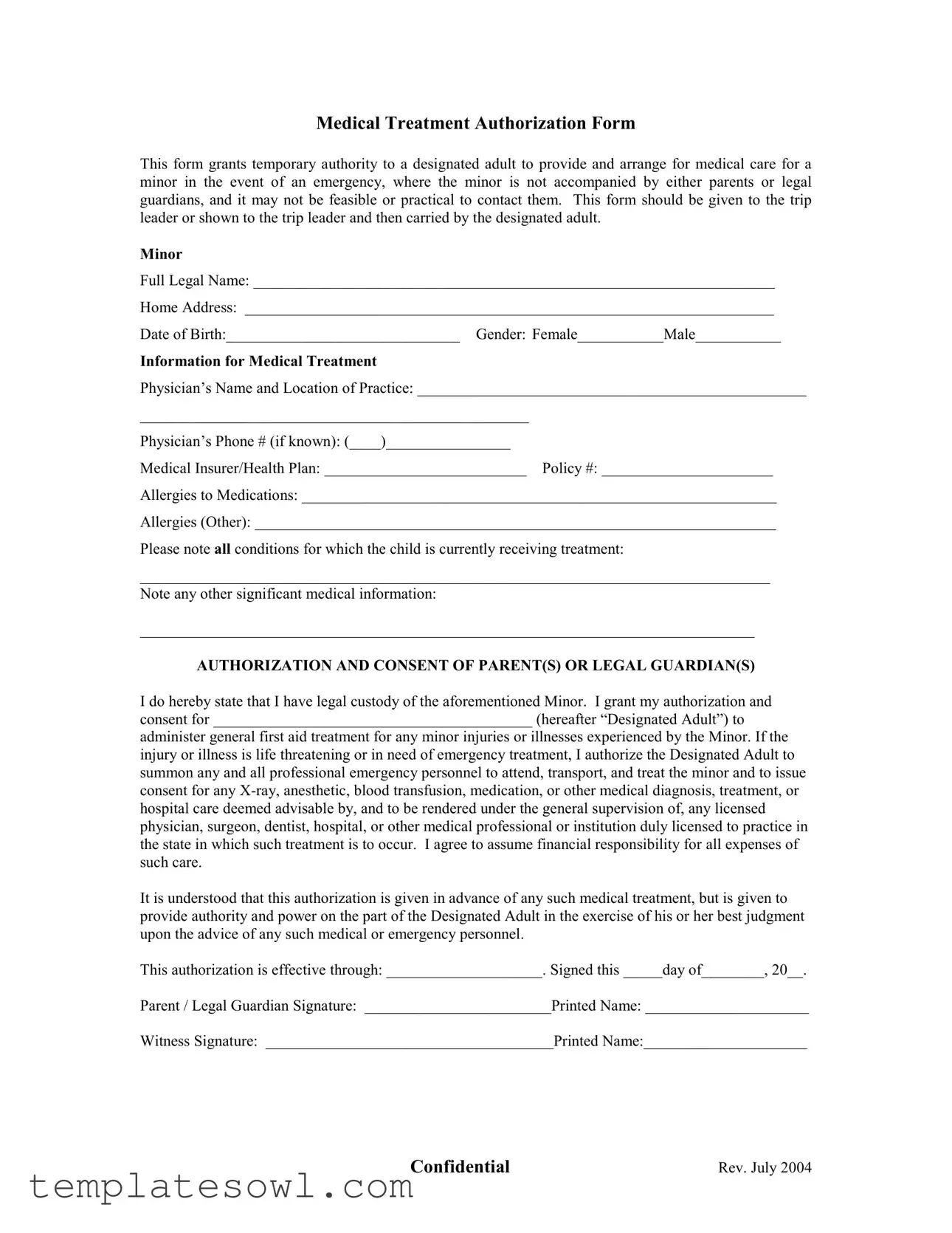

MEDICAL TREATMENT AUTHORIZATION FORM

This form grants temporary authority to a designated adult to provide and arrange for medical care for a minor in the event of an emergency, where the minor is not accompanied by either parents or legal guardians, and it may not be feasible or practical to contact them. This form should be given to the trip leader or shown to the trip leader and then carried by the designated adult.

MINOR

Full Legal Name: ___________________________________________________________________

Home Address: ____________________________________________________________________

Date of Birth:______________________________ Gender: Female___________Male___________

INFORMATION FOR MEDICAL TREATMENT

Physician’s Name and Location of Practice: __________________________________________________

__________________________________________________

Physician’s Phone # (if known): (____)________________

Medical Insurer/Health Plan: __________________________ Policy #: ______________________

Allergies to Medications: _____________________________________________________________

Allergies (Other): ___________________________________________________________________

Please note ALL conditions for which the child is currently receiving treatment:

_________________________________________________________________________________

Note any other significant medical information:

_______________________________________________________________________________

AUTHORIZATION AND CONSENT OF PARENT(S) OR LEGAL GUARDIAN(S)

I do hereby state that I have legal custody of the aforementioned Minor. I grant my authorization and consent for _________________________________________ (hereafter “Designated Adult”) to

administer general first aid treatment for any minor injuries or illnesses experienced by the Minor. If the injury or illness is life threatening or in need of emergency treatment, I authorize the Designated Adult to summon any and all professional emergency personnel to attend, transport, and treat the minor and to issue consent for any

It is understood that this authorization is given in advance of any such medical treatment, but is given to provide authority and power on the part of the Designated Adult in the exercise of his or her best judgment upon the advice of any such medical or emergency personnel.

This authorization is effective through: ____________________. Signed this _____day of________, 20__.

Parent / Legal Guardian Signature: ________________________Printed Name: _____________________

Witness Signature: _____________________________________Printed Name:_____________________

CONFIDENTIAL |

Rev. July 2004 |

Form Characteristics

| Fact Name | Detail |

|---|---|

| Purpose | The Consumer Closing Disclosure form provides clear information about the final terms of a mortgage loan. |

| Required Use | Lenders must use the form for most residential mortgage transactions under federal law. |

| Disclosure Timing | Consumers must receive the Closing Disclosure at least three business days before closing on the loan. |

| Content Overview | The form includes key information such as loan terms, closing costs, and cash to close. |

| Regulatory Body | The Consumer Financial Protection Bureau (CFPB) oversees the use and regulation of the form. |

| Effect on Consumers | Consumers can compare the Closing Disclosure with the Loan Estimate to check for discrepancies. |

| Signature Requirement | While consumers do not need to sign the Closing Disclosure, lenders must keep evidence of its delivery. |

| State-Specific Laws | Additional state requirements may apply. For example, in California, Civil Code § 2948.5 mandates further disclosures. |

| Loan Types | The form is applicable to various loan types, including fixed-rate and adjustable-rate mortgages. |

| Amendments | If any significant changes occur before closing, a revised Closing Disclosure must be provided. |

Guidelines on Utilizing Consumer Closing Disclosure

Filling out the Consumer Closing Disclosure form is a straightforward process. Follow these steps to ensure all the necessary information is provided accurately. Once completed, this form will guide you through the details of your closing costs and loan terms.

- Start with the borrower's information: Enter the full legal name of all borrowers involved in the transaction.

- Fill in the property address: Provide the complete address of the property being purchased.

- Loan information: Record the loan amount and loan term. This will generally include the length of time for which the loan will be active.

- Calculate the monthly payment: This will include estimates for principal, interest, taxes, insurance, and any homeowners association fees.

- List all closing costs: Document all fees and costs associated with the closing. This may include lender fees, title insurance, and government fees.

- Detail the loan features: Specify whether the loan has any special features, such as a balloon payment or prepayment penalty.

- Review the summary: Ensure all figures add up correctly and make sense based on your understanding of the transaction.

- Sign and date: The borrower(s) must sign the form acknowledging the information provided is accurate and understood.

What You Should Know About This Form

What is the purpose of the Consumer Closing Disclosure form?

The Consumer Closing Disclosure form is designed to help homebuyers and homeowners understand their mortgage loan terms and closing costs. It is a detailed document that provides information about the loan, including the loan amount, interest rate, monthly payments, and closing costs. By reviewing this form, you can ensure that you are aware of all financial aspects before finalizing your purchase or refinance.

When will I receive the Consumer Closing Disclosure form?

You should receive the Consumer Closing Disclosure form at least three business days before your closing date. This allows you time to carefully review the document and ask any questions you may have. Receiving the form early is essential because it helps you understand your obligations and financial commitments associated with the loan.

How can I verify the information provided in the Consumer Closing Disclosure form?

To verify the information in the Consumer Closing Disclosure form, carefully compare the details with your loan estimate and any prior agreements made with your lender. Ensure that the numbers for your loan amount, interest rate, and monthly payments match. If you notice any discrepancies or have questions, reach out to your lender immediately for clarification. It’s important to feel confident and informed before proceeding with the closing process.

What should I do if I find errors in the Consumer Closing Disclosure form?

If you find errors in the Consumer Closing Disclosure form, it is crucial to address them as soon as possible. Contact your lender or closing agent directly to discuss the inaccuracies. Provide them with any supporting documentation and clearly explain the issues you found. Corrections can often be made before the closing occurs, ensuring that you have accurate information about your loan.

Common mistakes

When filling out the Consumer Closing Disclosure form, several common mistakes can occur. Each error can lead to confusion or delays in the closing process. It's essential to be aware of these pitfalls to ensure a smooth transaction.

One prevalent mistake is leaving out crucial personal information. Omitting details such as your full legal name or the property address can result in significant issues. The form should reflect accurate identifiers to avoid any discrepancies. Before submitting, double-check for completeness.

Another frequent error involves misreporting the loan terms. Many homeowners fail to accurately document the interest rate or loan amount. It's critical to verify that these figures match your loan estimate. Incorrect information can lead to misunderstandings about your financial obligations.

People also often skip reviewing the estimated closing costs. Closing costs can vary widely, and overlooking them can leave you unprepared. Take the time to examine line items closely, ensuring that you understand what you are being charged. This will help you manage your budget effectively.

Failing to compare the Consumer Closing Disclosure with the Loan Estimate is a common oversight. These documents should align closely. If you notice discrepancies, bring them up with your lender immediately to clear up any confusion. Timely communication can prevent last-minute issues.

Additionally, some individuals mistakenly overlook the significance of the "cash to close" section. This area details the final amount you need to bring to the closing table. Forgetting to prepare this sum can lead to delays in finalizing the transaction. Always aim to clarify this figure well in advance.

Another error is not confirming the contact information of your lender. Staying in contact is essential throughout the closing process. Individuals often write down incorrect numbers or emails, making it challenging to reach their lender when questions arise. Accuracy in this section is vital for smooth communication.

It's also important to note that not everyone pays attention to the "Loan Features" section. Here, essential information, including potential prepayment penalties, is disclosed. Ignoring these details can have future financial implications. Be sure to read through this section to understand what you are agreeing to.

Finally, neglecting to have documents reviewed by a professional can lead to errors being missed. Before signing, involving a real estate attorney or a qualified professional can provide guidance. These experts can help identify mistakes you might overlook, ensuring everything is in order.

Documents used along the form

The Consumer Closing Disclosure form is a vital document in any real estate transaction, providing detailed information about the mortgage loan and closing costs. However, several other forms and documents often accompany it, enhancing transparency and ensuring all parties understand their financial commitments and rights. Below is a list of these important documents.

- Loan Estimate: This document provides a breakdown of the estimated monthly mortgage payments, interest rates, and closing costs. Issued by the lender within three days of receiving a loan application, it allows consumers to compare loan offers from different lenders.

- Purchase Agreement: Often referred to as a sales contract, this document outlines the terms of the property sale, including the purchase price, closing date, and other conditions that both the buyer and seller must agree upon.

- Title Report: This report provides information about the property's legal status, including ownership history and any liens or claims against it. It ensures that the buyer is acquiring clear and marketable title.

- Closing Statement: Also known as the HUD-1 Settlement Statement for certain transactions, this document itemizes the final costs to both the buyer and seller in the property transfer process. It is typically prepared by the closing agent.

- Affidavit of Title: A sworn statement by the seller confirming their ownership of the property and that there are no undisclosed liens or judgments. It is intended to protect the buyer from title defects.

- Homeowners Insurance Policy: Proof of coverage that protects the property from damage or theft. Lenders often require buyers to obtain this insurance before closing on a mortgage.

- Property Disclosure Statement: This form, completed by the seller, outlines known issues or defects related to the property. It informs the buyer of any potential problems before the sale is finalized.

- Identity Verification Documents: Buyers often need to provide personal identification, such as a driver's license or passport, to verify their identity during the closing process.

Each of these documents plays a crucial role in ensuring a transparent and fair closing process. By understanding these key forms, all parties involved can be more confident in their decisions and the overall transaction.

Similar forms

- Loan Estimate: Similar to the Consumer Closing Disclosure, the Loan Estimate provides borrowers with a detailed summary of the loan terms, including interest rates, monthly payments, and estimated closing costs. This document is crucial for comparing loan offers from different lenders.

- Truth in Lending Disclosure: This document outlines the costs of borrowing, such as the annual percentage rate (APR) and total loan costs over time. Like the Consumer Closing Disclosure, it ensures that borrowers are well informed of their financial commitments before closing.

- Settlement Statement (HUD-1): This form details the financial aspects of the transaction, including all costs and credits associated with the sale. The Settlement Statement serves a similar purpose to the Consumer Closing Disclosure by itemizing the final costs at closing.

- Promissory Note: This legal document establishes the borrower's obligation to repay the loan. It contains terms like interest rates and repayment schedule, paralleling the Consumer Closing Disclosure's goal of transparency regarding financial obligations.

- Mortgage Agreement: This document outlines the terms of the mortgage loan and the borrower's responsibilities. It includes important details about the property, just as the Consumer Closing Disclosure summarizes key loan information and terms.

Dos and Don'ts

When filling out the Consumer Closing Disclosure form, attention to detail is crucial. Here is a guide that outlines what you should and shouldn’t do to ensure the process goes smoothly.

- Review all information carefully. Double-check names, addresses, and financial details to ensure accuracy.

- Ask questions if something is unclear. Don’t hesitate to seek clarification from your lender or real estate agent.

- Keep copies of the signed document. Having a record of the completed form can be beneficial for future reference.

- Be mindful of deadlines. Ensure that you submit the form in a timely manner as required by your lender.

- Read the fine print. Take the time to understand all fees associated with the transaction and any terms laid out in the document.

- Do not rush through the form. Taking your time can help prevent errors that could cause delays.

- Do not omit any required information. Leaving sections blank can lead to complications later in the process.

- Do not feel intimidated. If the language seems complex, remember that asking for help is both acceptable and encouraged.

- Do not ignore discrepancies. If you notice any inconsistencies with prior documents, address them before signing.

- Do not overlook your rights. Familiarize yourself with your rights as a borrower to ensure you are treated fairly throughout the transaction.

Misconceptions

Misconceptions about the Consumer Closing Disclosure form can lead to confusion and delays during the closing process of a mortgage. Addressing these misconceptions is crucial for ensuring a smooth and informed transaction.

- The form is optional. Many believe that the Consumer Closing Disclosure is optional. In reality, it is a mandatory document that lenders must provide to borrowers at least three days before closing on a mortgage.

- It only outlines loan costs. Some think the form solely lists loan costs. However, it also includes important details about the loan terms, monthly payments, and other closing costs that impact the total price of the home.

- It is the same as the Loan Estimate. There is a common misconception that the Closing Disclosure and Loan Estimate are identical. While related, the Closing Disclosure is a final statement that reflects actual loan terms and costs, whereas the Loan Estimate is a projection provided earlier in the process.

- The lender can change terms after issuance. Many consumers assume that after receiving the Closing Disclosure, terms can be freely changed by the lender. This is not the case; any changes must be disclosed, and borrowers should be informed of them.

- All fees are negotiable. Some think that all fees listed on the Closing Disclosure are negotiable. While certain fees might be negotiable, others, such as taxes and government fees, are typically non-negotiable.

- It only affects the borrower. A misconception exists that the Closing Disclosure only impacts the borrower. In truth, it also informs real estate agents and other parties involved in the transaction about the terms of the loan.

- If everything is accurate, there’s no need to read. Borrowers often assume they don’t need to read the form thoroughly. However, even if the information appears correct, it is vital to review it carefully to catch any errors that could affect the loan or costs.

- The form is only required in some states. Some believe that the Consumer Closing Disclosure is only necessary in certain states. In reality, it is a federal requirement under the Truth in Lending Act, applicable throughout the United States.

- It can be signed digitally at any time. There is a misunderstanding that the Closing Disclosure can be signed at any time, even after the three-day review period. In fact, borrowers must receive the document three days before closing, and signing afterward can delay the closing process.

Understanding these misconceptions is essential for anyone involved in a home purchasing process. Proper awareness can not only prevent potential issues but also ensure that all parties are adequately prepared for closing.

Key takeaways

Here are some important points to keep in mind when filling out and using the Consumer Closing Disclosure form:

- Ensure accuracy in all information provided. Review the details for any errors in spelling, amounts, or personal information.

- Understand your loan terms clearly. Review the interest rate, monthly payment, and total payment amount thoroughly before signing.

- Keep a copy of the form for your records. This will help you refer to the terms of your loan in the future if needed.

- Reach out with any questions. If something isn’t clear, don’t hesitate to ask your lender for clarification before closing.

Browse Other Templates

Af Form 4380 - The AF 4380 is part of the larger framework of military benefits for families facing challenges.

Cancel Centurylink - The form assists in preventing disputes by providing documented proof of agreement.

Avon Order Forms - Include your email address for digital receipts and notifications.