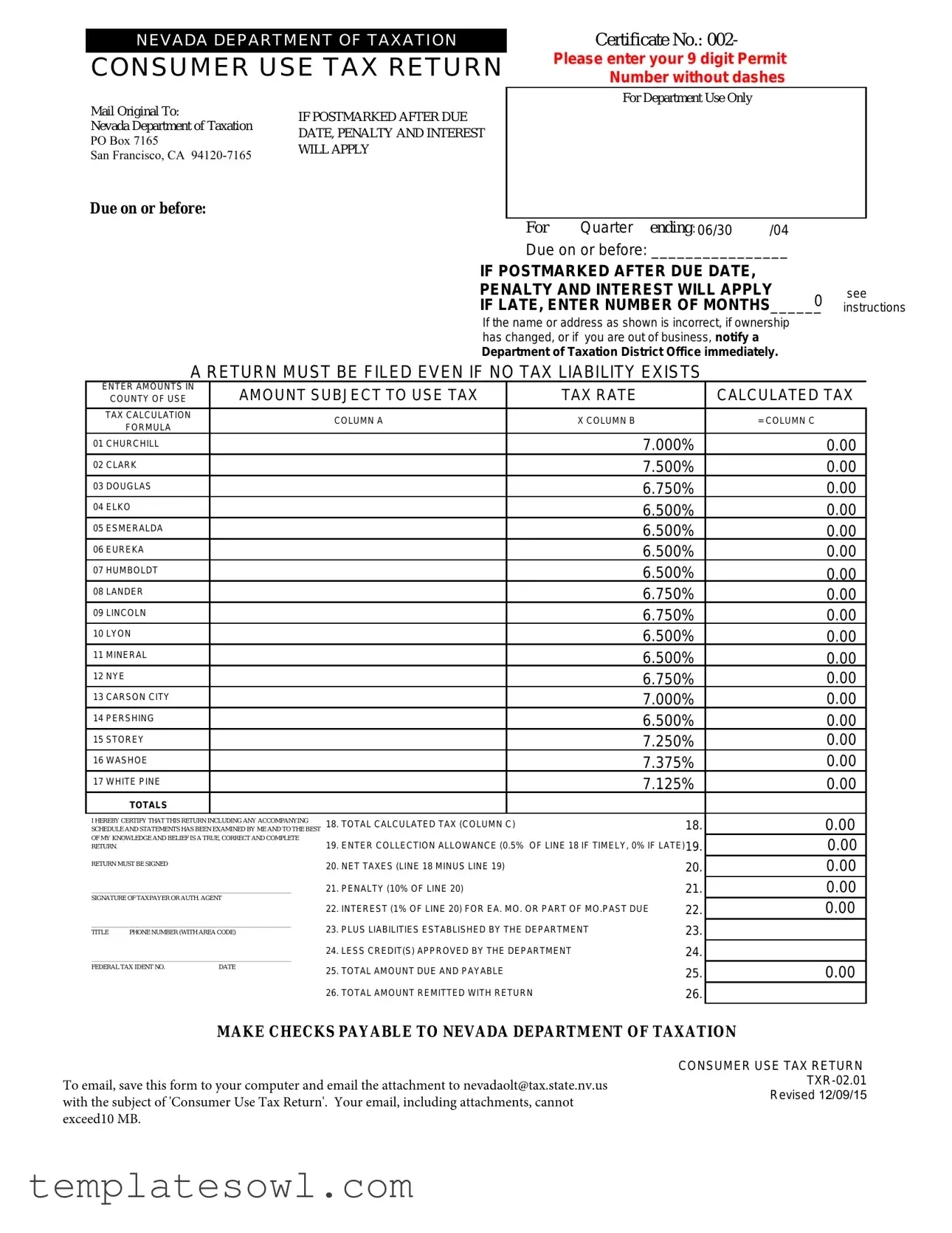

Fill Out Your Consumer Use Tax Return Nevada Form

The Consumer Use Tax Return form in Nevada plays a crucial role in ensuring compliance with state tax regulations for individuals and entities that purchase tangible personal property without paying any Nevada sales tax. This form requires taxpayers to report and remit a tax based on their use of such items within the state. Individuals must fill out key details, including their certificate number, due dates, and the specific county where the use tax applies, as each county has different tax rates. The return not only addresses the amount subject to use tax and the calculated tax, but it also includes essential steps for determining any penalties or interest that may accrue for late payments. Taxpayers must file the return even in the absence of a tax liability, highlighting the necessity of fulfilling reporting obligations. Moreover, the form provides guidelines for accurately calculating taxes owed, along with sections for taxpayers to certify the accuracy of their submissions. With a clear format that guides users through each detail, this return is vital for responsible tax reporting in Nevada.

Consumer Use Tax Return Nevada Example

NEVADA DEPARTMENT OF TAXATION

CONSUMER USE TAX RETURN

Mail Original To: |

IF POSTMARKED AFTER DUE |

Nevada Department of Taxation |

DATE, PENALTY AND INTEREST |

|

PO Box 7165 |

||

WILL APPLY |

||

San Francisco, CA |

||

|

Due on or before:

Certificate No.: 002-

Please enter your 9 digit Permit Number without dashes

For Department Use Only

For Quarter ending: 06/30 /04

Due on or before: ________________

IF POSTMARKED AFTER DUE DATE, PENALTY AND INTEREST WILL APPLY

IF LATE, ENTER NUMBER OF MONTHS 0

______

If the name or address as shown is incorrect, if ownership has changed, or if you are out of business, notify a

Department of Taxation District Office immediately.

see instructions

A RETURN MUST BE FILED EVEN IF NO TAX LIABILITY EXISTS

ENTER AMOUNTS IN |

AMOUNT SUBJECT TO USE TAX |

|

TAX RATE |

|

|

CALCULATED TAX |

|

COUNTY OF USE |

|

|

|

||||

|

|

|

|

|

|

|

|

TAX CALCULATION |

|

COLUMN A |

|

X COLUMN B |

|

|

= COLUMN C |

FORMULA |

|

|

|

|

|||

|

|

|

|

|

|

|

|

01 CHURCHILL |

|

|

|

|

7.000% |

0.00 |

|

02 CLARK |

|

|

|

|

7.500% |

0.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

03 DOUGLAS |

|

|

|

|

6.750% |

0.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

04 ELKO |

|

|

|

|

6.500% |

0.00 |

|

|

|

|

|

|

|||

05 ESMERALDA |

|

|

|

|

6.500% |

0.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

06 EUREKA |

|

|

|

|

6.500% |

0.00 |

|

|

|

|

|

|

|||

07 HUMBOLDT |

|

|

|

|

6.500% |

0.00 |

|

|

|

|

|

|

|||

08 LANDER |

|

|

|

|

6.750% |

0.00 |

|

|

|

|

|

|

|||

09 LINCOLN |

|

|

|

|

6.750% |

0.00 |

|

|

|

|

|

|

|||

10 LYON |

|

|

|

|

6.500% |

0.00 |

|

|

|

|

|

|

|

|

|

11 MINERAL |

|

|

|

|

6.500% |

0.00 |

|

|

|

|

|

|

|||

12 NYE |

|

|

|

|

6.750% |

0.00 |

|

|

|

|

|

|

|||

13 CARSON CITY |

|

|

|

|

7.000% |

0.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14 PERSHING |

|

|

|

|

6.500% |

0.00 |

|

|

|

|

|

|

|||

15 STOREY |

|

|

|

|

7.250% |

0.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16 WASHOE |

|

|

|

|

7.375% |

0.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17 WHITE PINE |

|

|

|

|

7.125% |

0.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTALS |

|

|

|

|

|

|

|

I HEREBY CERTIFY THAT THIS RETURN INCLUDING ANY ACCOMPANYING |

18. TOTAL CALCULATED TAX (COLUMN C) |

|

|

18. |

0.00 |

||

SCHEDULE AND STATEMENTS HAS BEEN EXAMINED BY ME AND TO THE BEST |

|

|

|||||

OF MY KNOWLEDGE AND BELIEF IS A TRUE, CORRECT AND COMPLETE |

19. ENTER COLLECTION ALLOWANCE (0.5% OF LINE 18 IF TIMELY, 0% IF LATE)19. |

0.00 |

|||||

RETURN. |

|

||||||

RETURN MUST BE SIGNED |

|

20. NET TAXES (LINE 18 MINUS LINE 19) |

|

|

20. |

0.00 |

|

|

|

|

|

||||

_______________________________________________________________ |

21. PENALTY (10% OF LINE 20) |

|

|

21. |

0.00 |

||

SIGNATURE OF TAXPAYER OR AUTH. AGENT |

22. INTEREST (1% OF LINE 20) FOR EA. MO. OR PART OF MO.PAST DUE |

22. |

0.00 |

||||

|

|

||||||

_______________________________________________________________ |

23. PLUS LIABILITIES ESTABLISHED BY THE DEPARTMENT |

|

23. |

|

|||

TITLE PHONE NUMBER (WITH AREA CODE) |

|

|

|||||

_______________________________________________________________ |

24. LESS CREDIT(S) APPROVED BY THE DEPARTMENT |

|

24. |

|

|||

FEDERAL TAX IDENT NO. |

DATE |

25. TOTAL AMOUNT DUE AND PAYABLE |

|

|

25. |

0.00 |

|

|

|

|

|

||||

|

|

26. TOTAL AMOUNT REMITTED WITH RETURN |

|

|

26. |

|

|

MAKE CHECKS PAYABLE TO NEVADA DEPARTMENT OF TAXATION

*001063004000000*To email, save this form to your computer and email the attachment to nevadaolt@tax.state.nv.us with the subject of 'Consumer Use Tax Return'. Your email, including attachments, cannot exceed10 MB.

CONSUMER USE TAX RETURN

CONSUMER USE TAX RETURN INSTRUCTIONS

COLUMN A. Amount subject to Use Tax: Enter total purchases subject to use tax on appropriate county line. All purchases of tangible personal property on which no Nevada sales tax has been paid must be entered here.

COLUMN C. Calculated Tax: Multiply taxable amount(s) (Column A) by tax rate(s) (Column B) and enter in Column C.

Note: If you have a contract exemption, give contract exemption number.

TOTALS: Enter total amount of Column A.

LINE 18. Total calculated tax from column C

LINE 19. Collection allowance: Compute 1/2% (or .005) X Line 18 if return and taxes are paid as postmarked on or before the due date as shown on the face of the return. If not postmarked by the due date the collection allowance is not allowed.

LINE 20. Net Taxes Due: Subtract Line 19 from Line 18.

LINE 21. If this return will not be postmarked, and the taxes paid on or before the due date as shown on the face of this

return, a 10% penalty will be assessed. Enter 10% (or .10) times Line 20.

LINE 22. If this return will not be postmarked and the taxes paid on or before the due date as shown on the face of this return, enter 1.5% times line 20 for each month or fraction of a month late, prior to 7/1/99. After 7/1/99, use 1% for each month or fraction of a month late.

LINE 23. Enter any amount due for prior reporting periods for which you have received a Department of Taxation debit notice. Monthly notices received from the Department are not cumulative.

LINE 24. Enter amount due to you for overpayment made in prior reporting periods for which you have received a Department of Taxation credit notice. Monthly notices received from the Department are not cumulative. Do not take the credit if you have applied for a refund.

NOTE: Only credits established by the Department may be used.

LINE 25. Total Taxes Due and Payable: Add Line 20, 21, 22, and 23. Subtract amount on Line 24. Enter total.

LINE 26. Total Amount Remitted: Enter total amount paid with this return.

PLEASE COMPLETE THE SIGNATURE PORTION OF THE RETURN AND RETURN IN THE ENVELOPE PROVIDED.

If you have questions concerning this return, please call one of the Department of Taxation offices listed below.

Carson City (775) |

Las Vegas (702) |

Reno (775) |

CONSUMER USE TAX RETURN INSTRUCTIONS

Revised 12/09/15

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | The Consumer Use Tax Return is used to report and pay the use tax on purchases where no sales tax was paid at the time of purchase. |

| Filing Requirement | A return must be filed even if no tax is owed. This ensures compliance with state tax regulations. |

| Governing Law | The Consumer Use Tax Return falls under the Nevada Revised Statutes (NRS) Chapter 372, which governs sales and use taxes in Nevada. |

| Due Date | Returns are due on or before the last day of the month following the end of the reporting period. |

| Penalties | If the return is postmarked after the due date, penalties and interest will apply, emphasizing timely submission. |

Guidelines on Utilizing Consumer Use Tax Return Nevada

Filling out the Consumer Use Tax Return form in Nevada is essential for individuals and businesses that have made purchases subject to use tax but did not pay Nevada sales tax at the time of purchase. This form helps ensure compliance with tax laws and avoid penalties. Completing the return accurately and submitting it on time will keep you in good standing with the Nevada Department of Taxation.

- Obtain the form: Download the Consumer Use Tax Return form from the Nevada Department of Taxation website or get a physical copy.

- Begin with your information: Fill in your Permit Number without dashes and the Certificate Number in the appropriate spaces at the top of the form.

- Indicate the quarter: Write the quarter ending date for which you are filing the return.

- Address changes: If your name or address has changed, correct it on the form and notify the Nevada Department of Taxation District Office immediately.

- Fill in Column A: Enter the total amount subject to use tax in the appropriate county line. This should include all tangible personal property purchases on which no Nevada sales tax has been paid.

- Calculate tax: In Column C, calculate the tax by multiplying the amount in Column A by the tax rate from Column B. Enter this amount in the designated space.

- Total the amounts: Add up all entries in Column A and enter the total in the provided field.

- Line 18: Transfer the total calculated tax from Column C onto Line 18.

- Collection allowance: If the return is timely filed, calculate the collection allowance (0.5% of Line 18) and enter it on Line 19. If late, do not enter anything.

- Calculate net taxes: Subtract Line 19 from Line 18 and write the result on Line 20.

- Penalties and interest: Calculate any penalties (10% of Line 20 for late payments) and interest (1% for each month late prior to 7/1/99 or 1.5% after) and enter these amounts on Lines 21 and 22 respectively.

- Prior liabilities: Enter any prior liabilities received from the Department on Line 23.

- Credits: If applicable, enter any approved credits on Line 24.

- Total Amount Due: Add Line 20, 21, 22, and 23, then subtract any credits from Line 24; enter the total on Line 25.

- Amount Remitted: Write the amount you are sending with the return on Line 26.

- Sign and date: Be sure to sign, date, and provide your title and contact information in the signature section.

- Submit the return: Mail the original form to the Nevada Department of Taxation, ensuring it is postmarked by the due date to avoid penalties.

What You Should Know About This Form

What is the Consumer Use Tax Return form in Nevada?

The Consumer Use Tax Return in Nevada is a form used by individuals and businesses to report and pay use tax on tangible personal property purchased outside the state when no Nevada sales tax was paid. This tax is imposed on items used, stored, or consumed in Nevada. Even if no tax liability exists, a return must still be filed. The form allows taxpayers to calculate the amount owed based on their total purchases, given the applicable tax rate for their county.

When is the Consumer Use Tax Return due?

The form is typically due on or before the last day of the month following the end of the quarter being reported. For example, if you are reporting for the quarter ending June 30, your return must be postmarked by July 31. It is crucial to pay attention to this deadline, as any late submissions will incur penalties and interest.

How do I complete the Consumer Use Tax Return form?

To complete the form, you will first enter your total purchases subject to use tax in Column A. Then, find the tax rate for your county listed in Column B and multiply the two to get your calculated tax (Column C). Make sure to include any exemptions, if applicable. Additionally, factor in collection allowances for timely payments to lower your total amount due. Always remember to sign the form before sending it.

What happens if I miss the deadline?

If your return is postmarked after the due date, you will automatically incur a penalty of 10% of the amount owed. Additionally, interest will be charged at a rate of 1% for each month or partial month that the tax remains unpaid. These costs can accumulate quickly, so it’s important to file and pay on time to avoid any extra charges.

What if I have no tax liability?

Even if you have no tax liability, you are required to file a return. When completing the form, simply note that there is no taxable amount. It’s better to file a nil return than to skip it altogether, as failing to submit the form may lead to penalties and further complications with the tax department.

Where can I get assistance if I have questions about the form?

If you have questions about the Consumer Use Tax Return form or need assistance, you can contact one of the Nevada Department of Taxation offices. The Carson City office can be reached at (775) 684-2000, the Las Vegas office at (702) 486-2300, and the Reno office at (775) 688-1295. They are there to help clarify any concerns you may have about the form or your tax obligations.

Common mistakes

Filling out the Consumer Use Tax Return in Nevada can be a tricky process. Many people encounter common pitfalls that could lead to penalties or unnecessary delays. Here are seven key mistakes to avoid when completing this form.

One frequent error is failing to report all taxable purchases. It’s essential to list every acquisition of tangible personal property for which sales tax was not previously paid. Even small purchases can add up, and leaving them off can result in incorrect tax calculations or future audits.

Another common mistake involves miscalculating the tax. Each county in Nevada has its own tax rate. Ensure that you know your county's rate and apply it correctly to the total taxable amount. Inaccuracies in this calculation could lead to underpayment or overpayment of taxes, which can complicate future filings.

Additionally, many filers make the mistake of overlooking the importance of postmark dates. Those who fail to mail their return by the due date will incur penalties and interest. Always allow enough time for postal delivery, especially if you are mailing close to the deadline. It’s better to be overly cautious than to face unwelcome fees.

Many also neglect to complete the signature portion of the return. You might think your calculations are all that matter, but the signature certifies that the information provided is accurate. Without this, your return could be considered incomplete, leading to further complications with the Nevada Department of Taxation.

Furthermore, failing to adjust for any collection allowance can cause issues. If your return is timely filed and the corresponding taxes are paid on time, you are eligible for a collection allowance of 0.5% of the total tax due. Ignoring this can mean missing out on a small but valuable deduction.

Another misstep can be forgetting to include any previous liabilities or credits. If you’ve received notices from the Department regarding credits or debits for prior reporting periods, be sure to account for them. Each reporting period stands on its own, and failing to consider past notices may lead to a misunderstanding of your current liabilities.

Lastly, some individuals misinterpret the requirement to file even if there’s no tax liability. A return must be submitted regardless of whether taxes are owed. This oversight can result in fines or penalties, so it’s crucial to meet the obligation to file annually, even if you believe no payment is due.

By being aware of these common mistakes, you can navigate the Consumer Use Tax Return process more confidently and accurately. Taking the time to review your information and ensuring compliance will save you from potential headaches down the line.

Documents used along the form

The Consumer Use Tax Return form in Nevada is an essential document for reporting and paying the consumer use tax on purchases made without paying the applicable sales tax. However, there are several other forms and documents that may accompany this return. Understanding these related documents can help ensure compliance and accurately convey the necessary financial information to the Nevada Department of Taxation.

- Business License Application: This form registers a business with the state. It's fundamental for any new business to ensure that they are legally allowed to operate within Nevada.

- Sales Tax Permit: Also known as a seller's permit, this document allows a business to collect sales tax from customers. It is typically required for businesses selling tangible goods or taxable services.

- Resale Certificate: A resale certificate allows a purchaser to buy goods tax-free if they intend to resell those items. This certificate must be presented during the transaction to avoid sales tax payment.

- Exemption Certificate: This document allows certain purchases to be made without paying sales tax, often applicable to specific types of entities or for specific usages, such as government or non-profit organizations.

- Tax Calculation Worksheet: This worksheet assists in calculating the total tax due based on taxable purchases. It may include formulas for tax rates by county to ensure accuracy in the Consumer Use Tax Return form.

- Detailed Purchase Records: Businesses should keep detailed records of all purchases subject to use tax. These records are necessary for verification if the Department of Taxation requests them during an audit.

- Tax Payment Receipt: If taxes are paid online or through other means, keeping this receipt ensures that proof of payment is readily available for future reference.

- Penalty and Interest Waiver Request: If a taxpayer believes they have substantial grounds to request a waiver for penalties or interest accrued, this form can be submitted to the Nevada Department of Taxation.

- Certificate of Good Standing: If a business is incorporated, this certificate may be required to affirm that the business is compliant with state regulations and is in good standing before submitting various tax documents.

- Franchise Tax Return: If applicable, this form reports income and payables for the franchise tax, which some businesses may also need to submit depending on their structure and revenue.

In summary, various documents work in conjunction with the Consumer Use Tax Return form in Nevada. Each serves a distinct purpose and contributes to the overall compliance landscape for businesses operating within the state. Having access to and understanding these forms can streamline tax reporting and ensure the timely and accurate payment of taxes owed.

Similar forms

- Sales Tax Return: This document, similar to the Consumer Use Tax Return, is filed by businesses to report sales tax collected on sales to customers. Both forms calculate tax based on taxable sales but from different perspectives—one from the seller and the other from the consumer.

- Use Tax Return: Like the Consumer Use Tax Return, a Use Tax Return is filed by individuals or businesses for items purchased without paying sales tax. The intent is the same: to report and pay tax on purchases made for use in Nevada.

- Property Tax Return: This form may appear different, yet both are designed to report taxes owed on property that is not directly purchased in-state. They both aim to ensure tax compliance for non-resident purchases.

- Business License Renewal Application: Both documents require information about the taxpayer's identity and tax obligations. They help ensure that all business activities within Nevada are appropriately taxed or licensed.

- Excise Tax Return: This form is similar because it applies to certain goods and services where taxes are calculated based on the amount sold. Both returns require detailed calculations to report tax liabilities accurately.

- Form 941 (Employer’s QUARTERLY Federal Tax Return): While focused on federal taxes, it's similar in that both forms calculate liabilities on a quarterly basis and require prompt submission to avoid penalties.

- Annual Business Tax Return: This form, unlike others, is filed annually but shares common elements of tax reporting, calculations, and the necessity for penalties if filed late. It ensures that business tax obligations are continually monitored.

Dos and Don'ts

When completing the Consumer Use Tax Return for Nevada, consider the following guidelines:

- Do ensure you accurately enter your 9-digit Permit Number.

- Don’t forget to include all purchases of tangible personal property where no Nevada sales tax was paid.

- Do calculate your tax by multiplying the amount subject to use tax by the applicable tax rate for your county.

- Don’t leave any sections blank, even if there’s no tax liability; a return must be filed regardless.

- Do check that your name and address are correct; notify the Department if there are any changes.

- Don’t wait until the last minute to send in your form; postmark it by the due date to avoid penalties.

- Do sign the return. An unsigned return may not be processed.

- Don’t forget to add any collection allowance if your return is timely submitted.

- Do calculate and include penalties and interest if applicable.

- Don’t forget to include a payment with your return if there are taxes owed.

Misconceptions

When it comes to the Consumer Use Tax Return in Nevada, there are several common misconceptions that can lead to confusion. Here are seven of them:

- Filing is Optional: Many believe that if they have no taxes due, they do not need to file. This is incorrect. A return must be filed even if there is no tax liability.

- Only Businesses Need to File: Some think this form is only for businesses. In reality, individuals who purchase items without paying Nevada sales tax also need to file.

- Penalties are Rarely Enforced: There is a belief that penalties and interest are rarely applied. However, if your return is postmarked late, you will incur penalties and interest based on the amount owed.

- All Purchases are Exempt: People often assume that all purchases made outside of Nevada are exempt from use tax. This is not true. If no Nevada sales tax was paid, the use tax may apply.

- Use Tax Does Not Apply to Services: There’s a misconception that use tax only applies to physical goods. In fact, it can also apply to certain services where no sales tax was paid.

- Filing Can Be Done Anytime: Some think they can file the return whenever it's convenient. The form has specific due dates, and missing them will incur penalties.

- Collection Allowance is Always Granted: Many believe they will automatically receive a collection allowance. However, this allowance only applies if the return is submitted on time.

Understanding these misconceptions can help ensure compliance with Nevada tax laws and avoid unnecessary fees. Always double-check your obligations and deadlines regarding the Consumer Use Tax Return.

Key takeaways

Filing the Consumer Use Tax Return form in Nevada is essential for individuals and businesses that have made purchases without paying state sales tax. Here are four key points to consider:

- Filing Requirement: A return must be filed even if no tax liability exists. This ensures compliance with state regulations and avoids potential penalties.

- Calculation Method: The form requires entering the total purchases subject to use tax and calculating the tax based on applicable county rates. It's critical to multiply the taxable amount by the appropriate tax rate to determine the amount owed accurately.

- Deadlines Matter: The form must be mailed by the due date to avoid penalties and interest. If late, a 10% penalty and additional interest charges will apply, underscoring the importance of adhering to deadlines.

- Signature Requirement: The return must be signed by the taxpayer or an authorized agent. This validates the accuracy of the information provided and is a necessary step before submitting the form.

Browse Other Templates

Mychoice Win Loss Statement - A signature at the back of the form verifies the request.

Midlands College Online Application for 2024 Undergraduate - Consider the range of courses available to find your ideal fit.