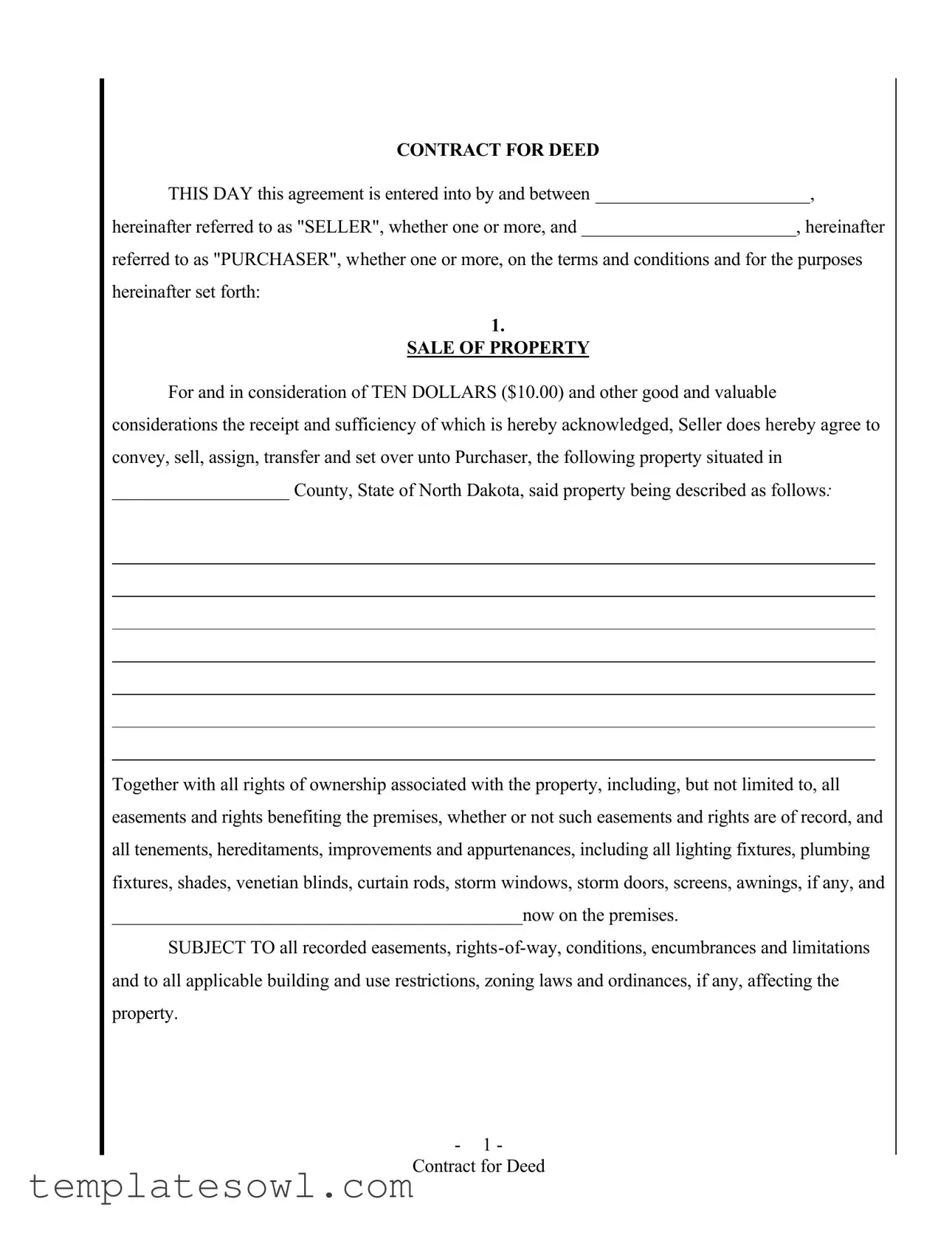

Fill Out Your Contract For Deed Nd Form

The Contract for Deed in North Dakota serves as a crucial legal document that outlines the terms and conditions for real estate transactions where the seller retains legal title until the purchaser fulfills their payment obligations. This agreement details significant aspects such as the sale of the property, including its full description and associated rights. Importantly, it establishes the purchase price along with flexible payment terms that may include monthly installments or interest accrual, giving both parties options to suit their financial contexts. Furthermore, it emphasizes the obligation of the purchaser to maintain the property in satisfactory condition, as the contract stands as collateral for the payments. The agreement also covers provisions regarding possession, insurance responsibilities, and the consequences of any damages or non-compliance with its terms. By elucidating aspects such as maintenance responsibilities, taxes, and insurance, the Contract for Deed prioritizes clarity and ensures that both the seller and purchaser have a solid understanding of their rights and obligations throughout the course of the agreement.

Contract For Deed Nd Example

CONTRACT FOR DEED

THIS DAY this agreement is entered into by and between _______________________,

hereinafter referred to as "SELLER", whether one or more, and _______________________, hereinafter

referred to as "PURCHASER", whether one or more, on the terms and conditions and for the purposes hereinafter set forth:

1.

SALE OF PROPERTY

For and in consideration of TEN DOLLARS ($10.00) and other good and valuable considerations the receipt and sufficiency of which is hereby acknowledged, Seller does hereby agree to convey, sell, assign, transfer and set over unto Purchaser, the following property situated in

___________________ County, State of North Dakota, said property being described as follows:

Together with all rights of ownership associated with the property, including, but not limited to, all easements and rights benefiting the premises, whether or not such easements and rights are of record, and all tenements, hereditaments, improvements and appurtenances, including all lighting fixtures, plumbing fixtures, shades, venetian blinds, curtain rods, storm windows, storm doors, screens, awnings, if any, and

____________________________________________now on the premises.

SUBJECT TO all recorded easements,

- 1 -

Contract for Deed

2.

PURCHASE PRICE AND TERMS

The purchase price of the property shall be $____________________. The purchaser does

hereby agree to pay to the order of the Seller the sum of ___________________ Dollars

($_______________) upon execution of this agreement, with the balance of $__________________

being due and payable as follows:(Select one)

(a) Balance payable in __________ (_______) monthly installments of ______________

Dollars ($_________) each, with the first installment being due and payable on the ____ day of

_______________, 20____ and a like payment on the first day of each month thereafter until the

______ day of ________________, 20____, when the final payment shall be due. No interest.

(b) Balance payable, together with interest on the whole sum that shall be from time to time unpaid at the rate of _______ per cent, per annum, payable in the amount of $____________

dollars per month beginning on the _____ day of ____________, 20____ and continuing on the

same day of each month thereafter until fully paid.

(c) Balance payable, together with interest on the whole sum that shall be from time to time unpaid at the rate of _______ per cent, per annum, payable in the amount of

_____________________ dollars per month beginning on the ________ day of

_______________, 20____, and continuing on the same day of each month thereafter until the

______ day of _______________, 20____, when all remaining principal and interest shall be

paid. (Balloon payment)

If interest is charged, interest shall be computed monthly and deducted from payment and the balance of payment shall be applied on principal.

3.

TIME OF THE ESSENCE

Time is of the essence in the performance of each and every term and provision in this agreement by Purchaser.

- 2 -

Contract for Deed

4.

SECURITY

This contract shall stand as security of the payment of the obligations of Purchaser.

5.

MAINTENANCE OF IMPROVEMENTS

All improvements on the property, including, but not limited to, buildings, trees or other improvements now on the premises, or hereafter made or placed thereon, shall be a part of the security for the performance of this contract and shall not be removed there from. Purchaser shall not commit, or suffer any other person to commit, any waste or damage to said premises or the appurtenances and shall keep the premises and all improvements in as good condition as they are now.

6.

CONDITION OF IMPROVEMENTS

Purchaser agrees that the Seller has not made, nor makes any representations or warranties as to the condition of the premises, the condition of the buildings, appurtenances and fixtures locate thereon, and/or the location of the boundaries. Purchaser accepts the property in its

7.

POSSESSION OF PROPERTY

Purchaser shall take possession of the property and all improvements thereon upon execution of this contract and shall continue in the peaceful enjoyment of the property so long as all payments due under the terms of this contract are timely made. Purchaser agrees to keep the property in a good state of repair and in the event of termination of this contract, Purchaser agrees to return the property to Seller in substantially the same condition as it now exists, ordinary wear and tear excepted. Seller reserves the right to inspect the property at any time with or without notice to Purchaser.

8.

TAXES, INSURANCE AND ASSESSMENTS

Taxes and Assessments: During the term of this contract:(Select one)

- 3 -

Contract for Deed

(a) Purchaser shall pay all taxes and assessments levied against the property.

(b) Seller shall pay all taxes and assessments levied against the property. In the event that Seller pays the taxes and insurance, Purchaser shall reimburse Seller for same upon 30 days notice to purchaser.

Content Insurance: Purchaser shall be solely responsible for obtaining insurance of the contents, insuring contents owned by Purchaser. Seller shall be solely responsible for obtaining insurance on all contents owned by Seller.

Liability and Hazard Insurance: Liability insurance shall be maintained by Purchaser during the term of this contract naming Seller as an additional insured, in the amount of not less than $________________.

Fire, Hazard and Windstorm insurance: Fire, hazard and windstorm insurance shall be maintained as follows: (Select one)

(a) Purchaser shall obtain fire, hazard and windstorm insurance in the amount not less than $_______________, on a policy of insurance naming Seller as additional insured.

(b) Seller shall obtain and pay for hazard, fire and windstorm insurance in an amount not less than $ _________________. In the event Seller elects this option, Purchaser shall repay the

amount so paid by Seller within thirty (30) days of demand for same by Seller.

Should the Purchaser fail to pay any tax or assessment, or installment thereof, when due, or keep said buildings insured, Seller may pay the same and have the buildings insured, and the amounts thus expended shall be a lien on said premises and may be added to the balance then unpaid, or collected by Seller, in the discretion if Seller with interest until paid at the rate of the ______________ per cent per

annum.

In case of any damage as a result of which said insurance proceeds are available, the Purchaser may, within sixty (60) days of said loss or damage, give to the Seller written notice of Purchaser’s election to repair or rebuild the damaged parts of the premises, in which event said insurance proceeds shall be used for such purpose. The balance of said proceeds, if any, which remain after completion of said repairing or rebuilding, or all of said insurance proceeds if the Purchaser elects not to repair or rebuild, shall be applied first toward the satisfaction of any existing defaults under the terms of this contract, and then as a prepayment upon the principal balance owing. No such prepayment shall defer the time for payment of any remaining payments required by said contract. Any surplus of said proceeds

- 4 -

Contract for Deed

in excess of the balance owing hereon shall be paid to the Purchaser.

- 5 -

Contract for Deed

9.

DEFAULT

If the Purchaser shall fail to perform any of the covenants or conditions contained in this contract on or before the date on which the performance is required, the Seller shall give Purchaser notice of default or performance, stating the Purchaser is allowed fourteen (14) days from the date of the Notice to cure the default or performance. In the event the default or failure of performance is not cured within the

14 day time period, then Seller shall have any of the following remedies, in the discretion of Seller:

(a)give the Purchaser a written notice specifying the failure to cure the default and informing the Purchaser that if the default continues for a period of an additional fifteen (15) days after service of the notice of failure to cure, that without further notice, this contract shall stand cancelled and Seller may regain possession of the property as provided herein; or

(b)give the Purchaser a written notice specifying the failure to cure the default and informing the Purchaser that if the default continues for a period of an additional fifteen (15) days after service of the notice of failure to cure, that without further notice, the entire principal balance and unpaid interest shall be immediately due and payable and Seller may take appropriate action against Purchaser for collection of same according to the laws of the State of

____________________.

In the event of default in any of the terms and conditions or installments due and payable under

the terms of this contract and Seller elects 9(a), Seller shall be entitled to immediate possession of the property.

In the event of default and termination of the contract by Seller, Purchaser shall forfeit any and all payments made under the terms of this contract including taxes and assessments as liquidated damages, Seller shall be entitled to recover such other damages as they may be due which are caused by the acts or negligence of Purchaser.

The parties expressly agree that in the event of default not cured by the Purchaser and termination of this agreement, and Purchaser fails to vacate the premises, Seller shall have the right to obtain possession by appropriate court action.

- 6 -

Contract for Deed

10.

DEED AND EVIDENCE OF TITLE

Upon total payment of the purchase price and any and all late charges, and other amounts due Seller, Seller agrees to deliver to Purchaser a Warranty Deed to the subject property, at Seller’s expense, free and clear of any liens or encumbrances other than taxes and assessments for the current year.

11.

NOTICES

All notices required hereunder shall be deemed to have been made when deposited in the U. S. Mail, postage prepaid, certified, return receipt requested, to the Purchaser or Seller at the addresses listed below. All notices required hereunder may he sent to:

Seller:

Purchaser:

and when mailed, postage prepaid, to said address, shall be binding and conclusively presumed to be served upon said parties respectively.

12.

ASSIGNMENT OR SALE

Purchaser shall not sell, assign, transfer or convey any interest in the subject property or this agreement, without first securing the written consent of the Seller.

- 7 -

Contract for Deed

13.

PREPAYMENT

Purchaser to have the right to prepay, without penalty, the whole or any part of the balance remaining unpaid on this contract at any time before the due date.

14.

ATTORNEY FEES

In the event of default, Purchaser shall pay to Seller, Seller's reasonable and actual attorneys' fees and expenses incurred by Seller in enforcement of any rights of Seller. All attorney fees shall be payable prior to Purchaser's being deemed to have corrected any such default.

15.

LATE PAYMENT CHARGES

If Purchaser shall fail to pay, within fifteen (15) days after due date, any installment due hereunder, Purchaser shall be required to pay an additional charge of five (5%) percent of the late installment. Such charge shall be paid to Seller at the time of payment of the past due installment.

16.

CONVEYANCE OR MORTGAGE BY SELLER

If the Seller's interest is now or hereafter encumbered by mortgage, the Seller covenants that Seller will meet the payments of principal and interest thereon as they mature and produce evidence thereof to the Purchaser upon demand. In the event the Seller shall default upon any such mortgage or land contract, the Purchaser shall have the right to do the acts or make the payments necessary to cure such default and shall be reimbursed for so doing by receiving, automatically, credit to this contract to apply on the payments due or to become due hereon.

The Seller reserves the right to convey, his or her interest in the above described land and such conveyance hereof shall not be a cause for rescission but such conveyance shall be subject to the terms of this agreement.

- 8 -

Contract for Deed

The Seller may, during the lifetime of this contract, place a mortgage on the premises above described, which shall be a lien on the premises, superior to the rights of the Purchaser herein, or may continue and renew any existing mortgage thereon, provided that the aggregate amount due on all outstanding mortgages shall not at any time be greater than the unpaid balance of the contract.

17.

ENTIRE AGREEMENT

This Agreement embodies and constitutes the entire understanding between the parties with respect to the transactions contemplated herein. All prior or contemporaneous agreements, understandings, representations, oral or written, are merged into this Agreement.

18.

AMENDMENT – WAIVERS

This Agreement shall not be modified, or amended except by an instrument in writing signed by all parties.

No delay or failure on the part of any party hereto in exercising any right, power or privilege under this Agreement or under any other documents furnished in connection with or pursuant to this Agreement shall impair any such right, power or privilege or be construed as a waiver of any default or any acquiescence therein. No single or partial exercise of any such right, power or privilege shall preclude the further exercise of such right, power or privilege, or the exercise of any other right, power or privilege. No waiver shall be valid against any party hereto unless made in writing and signed by the party against whom enforcement of such waiver is sought and then only to the extent expressly specified therein.

19.

SEVERABILITY

If any one or more of the provisions contained in this Agreement shall be held illegal or unenforceable by a court, no other provisions shall be affected by this holding. The parties intend that in the event one or more provisions of this agreement are declared invalid or unenforceable, the remaining

- 9 -

Contract for Deed

provisions shall remain enforceable and this agreement shall be interpreted by a Court in favor of survival of all remaining provisions.

20.

HEADINGS

Section headings contained in this Agreement are inserted for convenience of reference only, shall not be deemed to be a part of this Agreement for any purpose, and shall not in any way define or affect the meaning, construction or scope of any of the provisions hereof.

21.

PRONOUNS

All pronouns and any variations thereof shall be deemed to refer to the masculine, feminine, neuter, singular, or plural, as the identity of the person or entity may require. As used in this agreement:

(1)words of the masculine gender shall mean and include corresponding neuter words or words of the feminine gender, (2) words in the singular shall mean and include the plural and vice versa, and (3) the word "may" gives sole discretion without any obligation to take any action.

22.

JOINT AND SEVERAL LIABILITY

All Purchasers, if more than one, covenants and agrees that their obligations and liability shall be joint and several.

23.

PURCHASER’S RIGHT TO REINSTATE AFTER ACCELERATION

If Purchaser defaults and the loan is accelerated, then Purchaser shall have the right of reinstatement as allowed under the laws of the State of North Dakota, provided that Purchaser: (a) pays Lender all sums which then would be due under this agreement as if no acceleration had occurred; (b) cures any default of any other covenants or agreements; and (c) pays all expenses incurred in enforcing this agreement, including, but not limited to, reasonable attorneys' fees, and other fees incurred for the purpose of protecting Seller's interest in the Property and rights under this agreement. Seller may require that Purchaser pay such reinstatement sums and expenses in one or more of the following forms, as

- 10 -

Contract for Deed

Form Characteristics

| Fact Name | Details |

|---|---|

| Governing Laws | This Contract for Deed is governed by North Dakota state laws. |

| Purpose | The contract facilitates the sale of property directly from Seller to Purchaser without a traditional mortgage. |

| Purchase Price | The specific purchase price is negotiated between Seller and Purchaser and is documented in the contract. |

| Payment Terms | The agreement allows for different payment structures: no interest, monthly installments, or a balloon payment. |

| Condition of Property | The Purchaser accepts the property in "as-is" condition, without any warranties from the Seller. |

| Responsibilities | Purchaser is responsible for property maintenance, payment of taxes, and obtaining insurance during the contract term. |

Guidelines on Utilizing Contract For Deed Nd

Completing the Contract For Deed ND form requires careful attention to each section to ensure accuracy. This agreement is designed to govern the sale of property between the Seller and the Purchaser. Following these steps is essential for a smooth transaction.

- Identify the Seller and Purchaser: Write the full names of the Seller(s) and Purchaser(s) in the designated spaces at the beginning of the contract.

- Property Description: Fill in the county and provide a detailed description of the property being sold in the specified section.

- Purchase Price: State the total purchase price of the property where indicated, followed by the initial payment amount.

- Select Payment Terms: Choose one of the three options for payment terms and fill in the corresponding amounts, dates, and any other required information.

- Terms of Performance: Acknowledge that time is of the essence in the performance of the contract terms by checking the appropriate statement.

- Security Agreement: Recognize that the contract serves as security for payments due from the Purchaser.

- Maintenance Responsibilities: Confirm that the Purchaser is responsible for maintaining the property and improvements during the contract term.

- Property Condition: Accept the property "as-is" by acknowledging the absence of warranties from the Seller regarding the property's condition.

- Possession Clause: Note that possession of the property will commence upon signing the agreement and highlight any conditions pertaining to its return if the contract is terminated.

- Taxes and Insurance: Choose who will be responsible for paying taxes and obtaining insurance, and fill in the required details.

Once the form is completed, both parties should sign and date the document to make the agreement official. It’s recommended to keep copies for future reference. This step is crucial for securing the rights and obligations set forth in the contract.

What You Should Know About This Form

What is a Contract for Deed?

A Contract for Deed is an agreement wherein the seller retains the title to the property while the buyer makes payments. The buyer obtains equitable title, allowing them to occupy and utilize the property during the payment period. Once all terms are met, the title transfers to the buyer, ensuring a clear path to ownership.

How does the purchase price work in a Contract for Deed?

The purchase price is negotiated between the seller and buyer and is specified in the contract. The buyer typically pays a portion upfront at the agreement's execution, followed by monthly installments, either with or without interest. The payment structure can vary based on the agreed-upon terms, allowing flexibility for both parties.

What are the responsibilities for maintenance and improvements?

The buyer is responsible for maintaining the property and keeping it in good condition throughout the term of the contract. This includes any buildings, trees, or other improvements, ensuring the property is not wasted or damaged. At contract termination, the property should be returned in substantially the same condition, aside from normal wear and tear.

What happens if the buyer fails to make payments?

If the buyer does not make timely payments as specified in the contract, the seller has the right to reclaim the property. This process may include forfeiting any payments made, and the buyer can lose their equity in the home. It is crucial for buyers to understand their payment obligations and the risks they face if they fall behind.

Who is responsible for taxes and insurance?

The contract outlines whether the buyer or seller will pay taxes and insurance. Typically, the buyer bears responsibility for property taxes and content insurance. In some cases, if the seller pays these costs, the buyer may need to reimburse the seller within a designated period, such as 30 days. Liability and hazard insurance often also fall to the buyer.

Is the property sold "as-is"? What does that mean?

Yes, properties sold via a Contract for Deed are often taken "as-is." This means that the seller makes no warranties or representations about the property’s condition. Buyers accept the property in its current state without expecting repairs or improvements from the seller, so it's essential for buyers to conduct their due diligence prior to signing.

Can the seller inspect the property?

Yes, the seller reserves the right to inspect the property whenever necessary, with or without prior notice to the buyer. Regular inspections can help ensure that the property is being maintained to the agreed-upon standards. Buyers should be prepared for potential inspections throughout the contract duration.

What happens if the property is damaged?

In the event of damage, the buyer should notify the seller of any losses within 60 days. Buyers can then elect to repair or rebuild using insurance proceeds. If repairs are made, any remaining balance from insurance proceeds can first address defaults on the contract before being applied toward the principal balance, ensuring both parties' interests are protected.

How is a Contract for Deed different from a traditional mortgage?

A key difference lies in ownership and title. With a traditional mortgage, the buyer gets the title upfront and pays off a loan to the lender, while a Contract for Deed allows the seller to retain the title until the full purchase price is paid. This structure can offer more leniency in qualifications for buyers who may not fit conventional lending criteria.

Common mistakes

When filling out the Contract For Deed Nd form, one common mistake is leaving out essential information. The property description field must be completed with precise details. If you don’t include the county and specific location, it could create confusion later. The buyer and seller need to know exactly what property is being sold to avoid any disputes.

Another frequent error occurs in the section regarding the purchase price and payment terms. People often skip selecting the most appropriate payment method or leave the amounts blank. This section is critical for ensuring both parties agree on how and when payments will occur. Failing to fill this properly can lead to misunderstandings and complicate the financial arrangements.

Additionally, neglecting to specify who is responsible for taxes and insurance can lead to unexpected costs. If this part of the form is not addressed, one party may assume the other is taking care of these obligations, resulting in disagreements and financial loss. Clear communication about these responsibilities is essential to maintaining a smooth transaction.

Lastly, many overlook the significance of the maintenance and condition clauses. Buyers often assume that or believe warranties are implied, which is not the case here. Not acknowledging that the Seller doesn’t make any representations regarding the property can result in disappointment or disputes after the sale is finalized. Understanding that the property is taken in "as-is" condition is vital for both parties.

Documents used along the form

When engaging in a Contract for Deed transaction, there are several other forms and documents that often accompany it. These documents help clarify different aspects of the agreement, ensuring that both the seller and purchaser fully understand their rights and obligations. Below are five key documents that are frequently utilized alongside the Contract for Deed.

- Disclosure Statement: This document outlines important information about the property, including any known defects, necessary repairs, or existing liens. It is designed to inform the purchaser about the property’s condition before finalizing the deal.

- Promissory Note: This is a written promise from the purchaser to pay a specified amount to the seller. It includes details such as the loan amount, payment schedule, and interest rate, making it a critical component of financing the purchase.

- Deed of Trust: Used to secure the loan, this document gives the seller a lien on the property until the purchaser fully repays the contract. It establishes the seller's rights in case of default on payment.

- Title Insurance Policy: This protects the purchaser against any title defects, disputes, or encumbrances that may arise after the sale. It ensures that the purchaser has clear ownership of the property without unexpected legal complications.

- Amendment Agreement: Should any terms of the initial contract require changes, this document is used to officially update those terms. It’s essential for maintaining clear communication between the seller and purchaser regarding any modifications.

Utilizing these forms and documents alongside the Contract for Deed not only clarifies the agreement but also helps to protect both parties involved. Understanding each component is essential for a smooth transaction. Always ensure that all paperwork is carefully reviewed and understood before proceeding.

Similar forms

-

Lease Agreement: A lease agreement allows a tenant to occupy property owned by a landlord for a specific period. Similar to a contract for deed, it sets terms for payment and responsibilities for maintenance. However, the tenant does not gain ownership rights during the lease term, unlike in a contract for deed, where equity builds over time.

-

Installment Sale Agreement: This document outlines terms for purchasing a property over time through installments. Like the contract for deed, it allows the seller to retain legal title until full payment is made. Both documents serve as security for the seller while providing a means for the buyer to pay gradually.

-

Mortgage Agreement: A mortgage is used when a buyer borrows money from a lender to purchase property. The property serves as collateral until the loan is paid off. Similar to a contract for deed, it gives the buyer possession while the lender retains a security interest in the property until the debt is fully satisfied.

-

Land Contract: Often used in rural or undeveloped areas, a land contract allows the buyer to pay for property in installments while living on it. Like a contract for deed, the seller retains the title until the contract terms are fulfilled, offering a similar pathway to property ownership.

-

Lease Purchase Agreement: This arrangement combines elements of leasing and buying. A tenant can occupy the property while part of the rent goes toward the purchase price. It shares similarities with a contract for deed by allowing eventual ownership but typically includes an option to purchase rather than the obligation to complete the sale.

-

Quitclaim Deed: Although primarily used to transfer property ownership without warranties, a quitclaim deed can be executed after a contract for deed is fulfilled. Once the buyer completes payment, a quitclaim deed can provide legal record of transfer, emphasizing the transition of ownership rights.

-

Deed of Trust: This document secures a loan by placing property in trust. The borrower retains possession and equitable title while the lender holds a security interest in the property. This resembles a contract for deed because both structures allow use of property while the debt is outstanding.

Dos and Don'ts

When filling out the Contract For Deed Nd form, it is essential to follow specific guidelines to ensure accuracy and compliance. Below is a list of actions to take and avoid.

- Do: Clearly print or type all information to ensure legibility.

- Do: Confirm all purchase price details are accurate before submission.

- Do: Review the terms of maintenance and insurance requirements thoroughly.

- Do: Obtain signatures from all parties involved to validate the agreement.

- Don't: Leave any sections blank; all fields must be completed.

- Don't: Use unapproved shorthand or abbreviations that may lead to misunderstandings.

- Don't: Forget to specify payment terms, including interest rates and due dates.

- Don't: Ignore local regulations and legal requirements concerning real estate transactions.

Misconceptions

Understanding the Contract for Deed in North Dakota can be challenging due to a variety of misconceptions that often arise. Here are seven common misconceptions, along with explanations to clarify each one:

- Misconception 1: The seller retains total ownership of the property until the purchase price is fully paid.

In a Contract for Deed, the seller does retain a security interest in the property until the buyer completes all payments. However, the buyer can occupy and use the property during this time, which differs from a traditional lease or rental agreement. - Misconception 2: A Contract for Deed guarantees homeownership for the buyer.

This is not always true. If a buyer fails to make payments, the seller has the right to cancel the contract and take back the property, often without lengthy legal proceedings. - Misconception 3: The seller is responsible for maintaining the property.

Typically, the buyer is responsible for property maintenance and repairs, much like a traditional home purchase. The seller often includes language in the contract that states the buyer assumes responsibility for maintaining the property. - Misconception 4: There are no taxes or insurance obligations until the property is paid in full.

False. Buyers are usually responsible for paying property taxes and obtaining insurance from the outset. If they fail to do so, the seller may intervene to cover these costs and recoup the expenses later, adding them to the balance owed. - Misconception 5: The seller must provide warranties on the property.

In most Contracts for Deed, sellers sell the property "as-is." This means that sellers generally do not make any guarantees about the property's condition. Buyers take on the risk associated with any repairs or issues. - Misconception 6: The terms of payment are always the same regardless of the individual circumstances.

Payment terms are flexible. Buyers and sellers can negotiate terms, including payment amounts and schedules. Options may include a balloon payment or different interest rates. - Misconception 7: If a buyer defaults, the seller cannot reclaim the property quickly.

While the process can vary, sellers typically have the right to reclaim the property through a relatively swift process if the buyer defaults. This is often much faster than a traditional foreclosure, depending on the terms outlined in the contract.

Being aware of these misconceptions can help both buyers and sellers approach a Contract for Deed with a clearer understanding of their rights and responsibilities. Accurate knowledge is key to ensuring a successful transaction.

Key takeaways

- Agreement Parties: The Contract for Deed includes two primary parties: the Seller and the Purchaser. Both parties must be identified clearly at the beginning of the document.

- Sale of Property: The agreement must state the property being sold, along with its legal description and any rights and easements associated with it. Understanding these details is crucial for both parties.

- Purchase Price: The form allows for flexibility in payment terms. The total purchase price needs to be specified, along with the amount and timing of payments, which can vary widely based on the parties' agreement.

- Time of Performance: Time is regarded as essential in this contract, meaning all terms must be executed promptly. Delays could impact the agreement's validity.

- Condition and Maintenance: The Purchaser must keep the property in good condition and assumes responsibility for any improvements. The form includes a stipulation regarding waste or damage to the property.

- Insurance and Taxes: The agreement specifies responsibilities for taxes and insurance. The Purchaser may be required to secure and maintain certain insurances, which protects the interests of both parties.

Browse Other Templates

How to Fill Gratuity Form - Witnesses hold an important role, ensuring the integrity of the nomination process.

Njtr1 - The form emphasizes safety protocols in vehicles, including various safety restraints and devices.