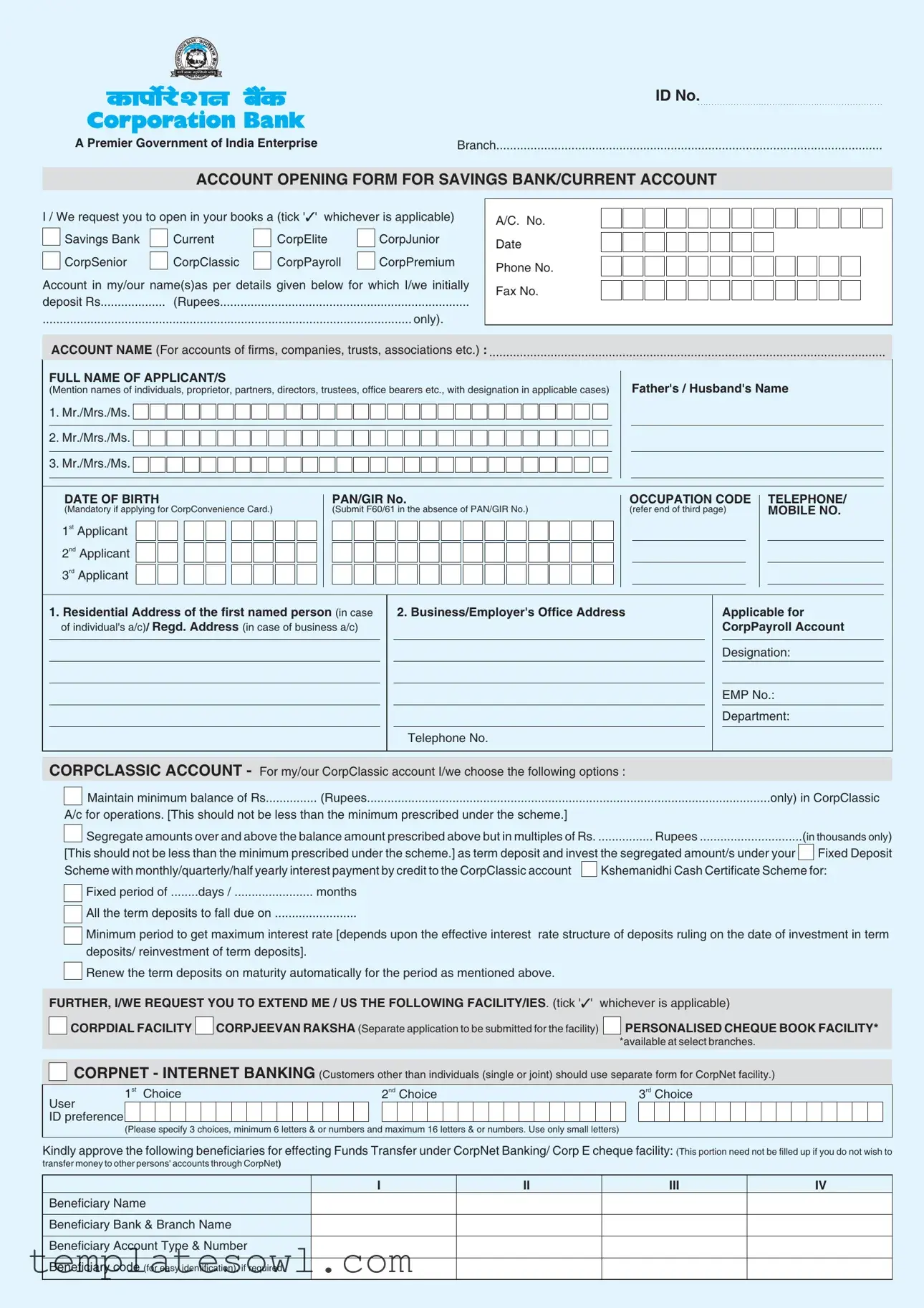

Fill Out Your Corporation Bank Account Opening Form

The Corporation Bank Account Opening form serves as a crucial tool for individuals and entities looking to establish a banking relationship with the bank. It facilitates the opening of various types of accounts, including Savings and Current accounts tailored to meet different customer needs—be it a personal saving initiative, business transactions, or payroll management. The form prompts applicants to select the account type that best fits their requirements and includes essential fields for initial deposits, contact details, and occupation codes. Applicants are asked to provide information about themselves, such as full names and identification numbers, while mandatory sections cover details like the applicant's father's or husband’s name, date of birth, and unique identifiers like PAN numbers. Specific attention is given to address verification for both residential and business locations, while sections for additional services, debit cards, and internet banking highlight the comprehensive nature of modern banking expectations. Furthermore, the form incorporates a nomination feature, forms for insurance benefits, and instructions for linking other accounts, demonstrating a commitment to customer convenience and security. By completing this form, customers take the first step towards not just managing their finances but also enjoying a wide range of banking facilities designed to enhance their financial experience.

Corporation Bank Account Opening Example

ID No.

A Premier Government of India Enterprise |

Branch |

ACCOUNT OPENING FORM FOR SAVINGS BANK/CURRENT ACCOUNT

I / We request you to open in your books a (tick '' whichever is applicable)

Savings Bank |

|

Current |

|

CorpElite |

|

CorpJunior |

|

|

|

|

|

|

|

CorpSenior |

|

CorpClassic |

|

CorpPayroll |

|

CorpPremium |

Account in my/our name(s)as per details given below for which I/we initially

deposit Rs |

(Rupees |

............................................................................................................ |

only). |

A/C. No.

Date

Phone No.

Fax No.

ACCOUNT NAME (For accounts of firms, companies, trusts, associations etc.) : ....................................................................................................................

FULL NAME OF APPLICANT/S

(Mention names of individuals, proprietor, partners, directors, trustees, office bearers etc., with designation in applicable cases)

1.Mr./Mrs./Ms.

2.Mr./Mrs./Ms.

3.Mr./Mrs./Ms.

Father's / Husband's Name

DATE OF BIRTH

(Mandatory if applying for CorpConvenience Card.)

1st Applicant

2nd Applicant

3rd Applicant

PAN/GIR No.

(Submit F60/61 in the absence of PAN/GIR No.)

OCCUPATION CODE

(refer end of third page)

TELEPHONE/ MOBILE NO.

1.Residential Address of the first named person (in case of individual's a/c)/ Regd. Address (in case of business a/c)

2. Business/Employer's Office Address

Telephone No.

Applicable for CorpPayroll Account

Designation:

EMP No.:

Department:

CORPCLASSIC ACCOUNT - For my/our CorpClassic account I/we choose the following options :

|

Maintain minimum balance of Rs |

(Rupees |

only) in CorpClassic |

||||

A/c for operations. [This should not be less than the minimum prescribed under the scheme.] |

|

|

|

||||

|

Segregate amounts over and above the balance amount prescribed above but in multiples of Rs |

................ Rupees |

(in thousands only) |

||||

|

|||||||

[This should not be less than the minimum prescribed under the scheme.] as term deposit and invest the segregated amount/s under your |

|

Fixed Deposit |

|||||

|

|

||||||

Scheme with monthly/quarterly/half yearly interest payment by credit to the CorpClassic account |

|

Kshemanidhi Cash Certificate Scheme for: |

|||||

|

Fixed period of |

days / |

months |

|

|

|

|

|

|

|

|

||||

|

All the term deposits to fall due on |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

Minimum period to get maximum interest rate [depends upon the effective interest rate structure of deposits ruling on the date of investment in term deposits/ reinvestment of term deposits].

Minimum period to get maximum interest rate [depends upon the effective interest rate structure of deposits ruling on the date of investment in term deposits/ reinvestment of term deposits].

Renew the term deposits on maturity automatically for the period as mentioned above.

Renew the term deposits on maturity automatically for the period as mentioned above.

FURTHER, I/WE REQUEST YOU TO EXTEND ME / US THE FOLLOWING FACILITY/IES. (tick '' whichever is applicable)

CORPDIAL FACILITY

CORPDIAL FACILITY

CORPJEEVAN RAKSHA (Separate application to be submitted for the facility)

CORPJEEVAN RAKSHA (Separate application to be submitted for the facility)

PERSONALISED CHEQUE BOOK FACILITY*

PERSONALISED CHEQUE BOOK FACILITY*

*available at select branches.

CORPNET - INTERNET BANKING (Customers other than individuals (single or joint) should use separate form for CorpNet facility.)

1st Choice |

2nd Choice |

3rd Choice |

User

ID preference

(Please specify 3 choices, minimum 6 letters & or numbers and maximum 16 letters & or numbers. Use only small letters)

Kindly approve the following beneficiaries for effecting Funds Transfer under CorpNet Banking/ Corp E cheque facility: (This portion need not be filled up if you do not wish to

transfer money to other persons' accounts through CorpNet)

I |

II |

III |

IV |

Beneficiary Name

Beneficiary Bank & Branch Name

Beneficiary Account Type & Number

Beneficiary code (for easy identification), if required.

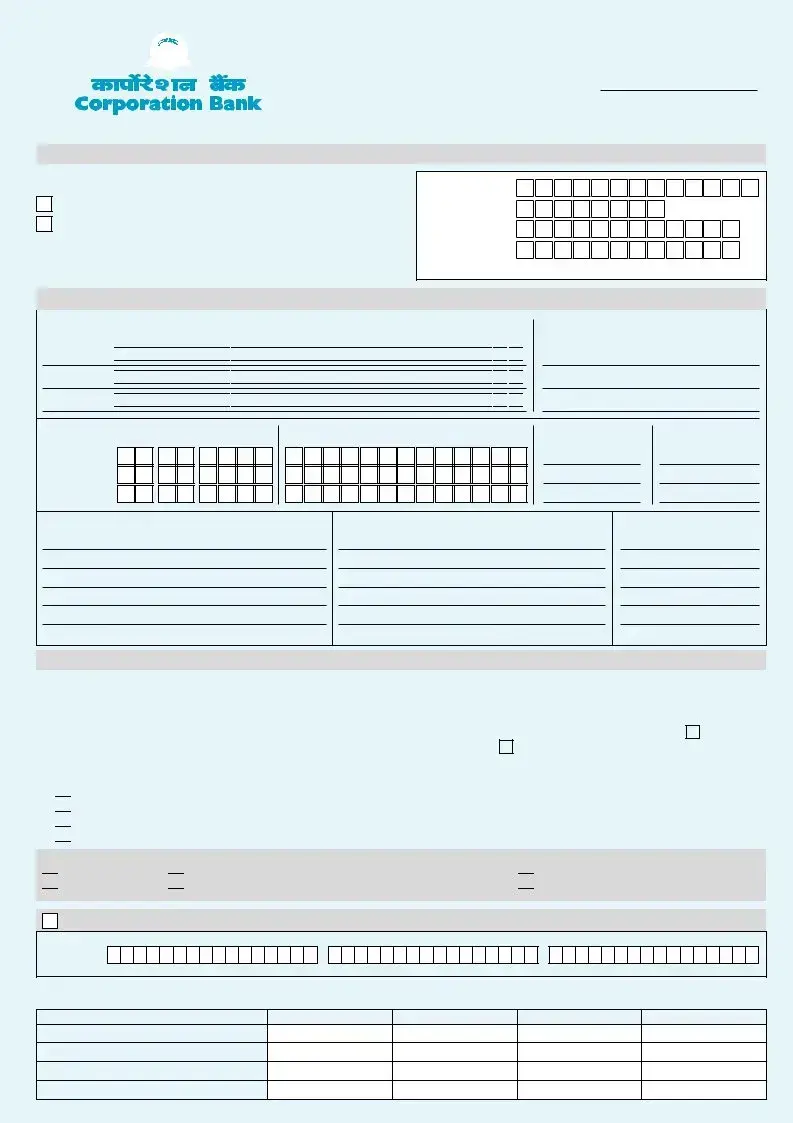

CORP CONVENIENCE DEBIT CARD

Name to be printed on the card (Not to exceed 24 characters, Leave one box blank after every initials/surname/first name/middle name)

Mothers Maiden Name:..................................................

FOR ADDITIONAL CARDS: (for joint account holders and where operation clause is "any one of us").

Name in full [Use block letters] as to be embossed on the card (Not to exceed 24 characters, Leave one box blank after every initials/ surname/first name/middle name.)

1. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

..................................................Mothers Maiden Name: |

|

|

||||||

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mothers Maiden Name: |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

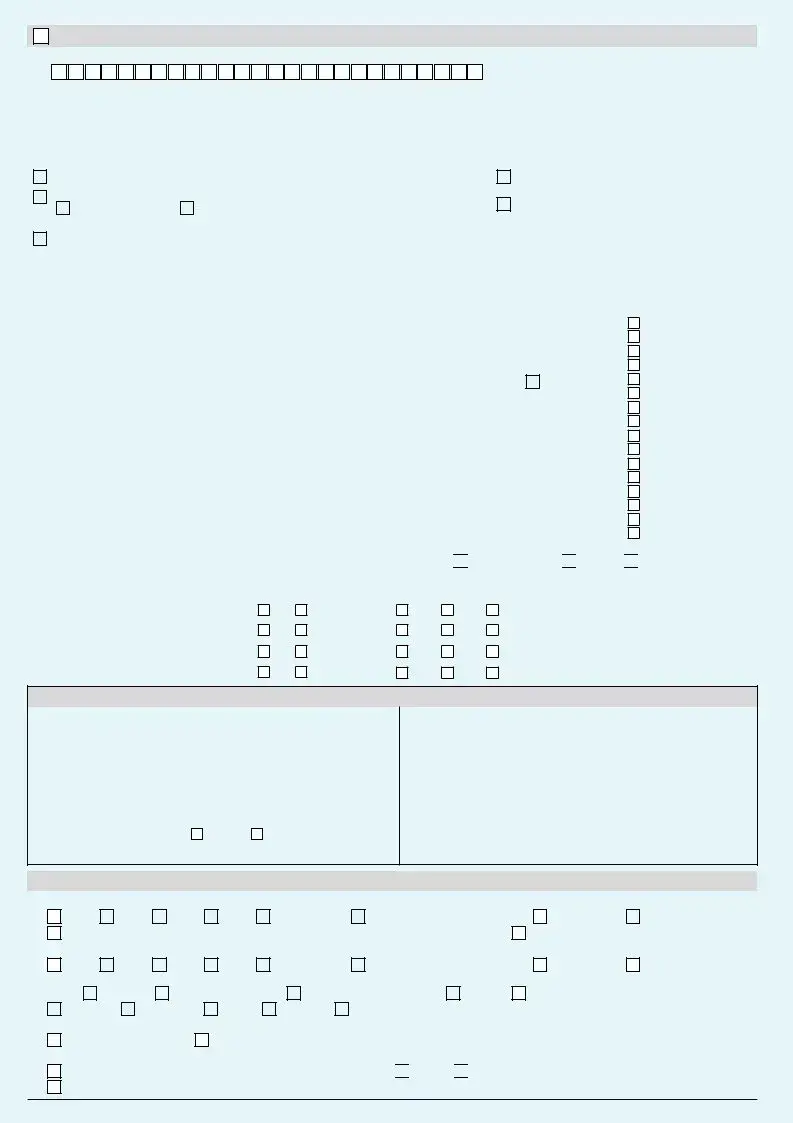

Other Instructions for CorpConvenience Card |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Instructions for CorpNet |

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

The Password Mailer for CorpConvenience card will be collected by me/us in person from you. |

|

|

|

|

The Password Mailer for CorpNet will be collected |

|||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

|

|

|

The Personal Identification No. for CorpConvenience Card may please be mailed to my/our |

|

|

|

|

by me/us in person from you. |

|

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

The Password mailer for CorpNet may please be |

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

Residential Address |

|

|

Business/Office Address provided above at my/ our risk and |

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

|

|

|

responsibility. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

mailed to my/our address No. /provided above at |

|||||||||

|

|

|

For Insurance benefits under the CorpConvenience card to me, I nominate |

|

|

|

|

my/our risk and responsibility. (Applicable only in the |

|||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

case of NRI clients) |

|

|

||||||||||||||||||||||||||||||||||

|

|

|

................................................... |

|

|

|

|

|

|

|

|

|

|

who is |

|

|

|

|

|

(relationship). |

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CORP BILLPAY* (Please attach copy/ies of the previous bill/s for verification and return.) *available at select branches. |

|

|

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

Name of the Biller |

|

Name of the customer/ |

|

Identification Number |

|

|

Reference Number |

|

|

|

|

Other Information |

Auto Pay |

Auto Pay |

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

consumer |

|

|

|

|

|

|

|

|

|

|

|

with Biller |

|

|

|

|

|

|

|

Limit Rs. |

||||||||||

|

Telephone |

|

|

|

|

|

|

|

|

|

|

|

Telephone No. |

|

|

Customer A/c No. |

|

|

|

|

|

|

Yes |

Rs. |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

Electricity. |

|

|

|

|

|

|

|

|

|

|

|

Consumer No. |

|

|

Process Cycle No. |

|

|

|

Billing Unit No. |

Yes |

Rs. |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

Mobile |

|

|

|

|

|

|

|

|

|

|

|

Mobile No. |

|

|

Account No. |

|

|

|

|

|

SMS Pay |

Yes |

Rs. |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

Credit Card |

|

|

|

|

|

|

|

|

|

|

|

Card No. |

|

|

Online Pay ID |

|

|

|

|

|

|

Yes |

Rs. |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Insurance |

|

|

|

|

|

|

|

|

|

|

|

Policy No. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

Rs. |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

Depository |

|

|

|

|

|

|

|

|

|

|

|

DP ID |

|

|

Client ID |

|

|

|

|

|

|

Yes |

Rs. |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

No |

|

|

GAS |

|

|

|

|

|

|

|

|

|

|

|

Consumer No. |

|

|

|

|

|

|

|

|

|

|

|

|

Bill Group |

Yes |

Rs |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

Rs. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LINKING OTHER ACCOUNTS:

Please link my/our following accounts maintained with you/other branches of your Bank for

Corp Convenience

Corp Convenience

CorpNet

CorpNet

CorpBillPay facilities.

CorpBillPay facilities.

Branch Name |

Account Type & No. |

Mode of Operation |

Link for CorpNet (CN) / |

|

Name/s of |

Sign of |

|||

|

|

(e.g.,SB/01/12345) |

|

|

CorpConv(CC) /Corp BillPay (CBP). |

holder for consent |

|||

|

|

|

|

|

|

|

|

|

|

1 |

|

|

Self |

Any one of us |

CN |

CC |

CBP |

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

|

Self |

Any one of us |

CN |

CC |

CBP |

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

Self |

Any one of us |

CN |

CC |

CBP |

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

Self |

Any one of us |

CN |

CC |

CBP |

|

|

|

|

|

|

|

|

|

|

|

|

OCCUPATION/ ACTIVITY PROFILE

If employed

Designation:

Job specifications:

Length of service:

Name and address of the employer (Head Office):

If businessman/professional/self employed |

|

|

Nature of business, vocation or profession: |

|

|

Business activity expected in the a/c : |

|

|

(monthly or annual turnover) |

Monthly |

Annual Rs |

Sources of funds in the business :

Details about income |

|

Annual income. |

Source of Income |

: |

......................... |

Business/Profession |

: |

Rs |

Salary |

: |

Rs |

Investment |

: |

Rs |

Others (Source |

) : |

Rs |

Total |

: |

Rs |

Details of assets owned Movable: Immovable:

Foreign countries visited during last 3 years:

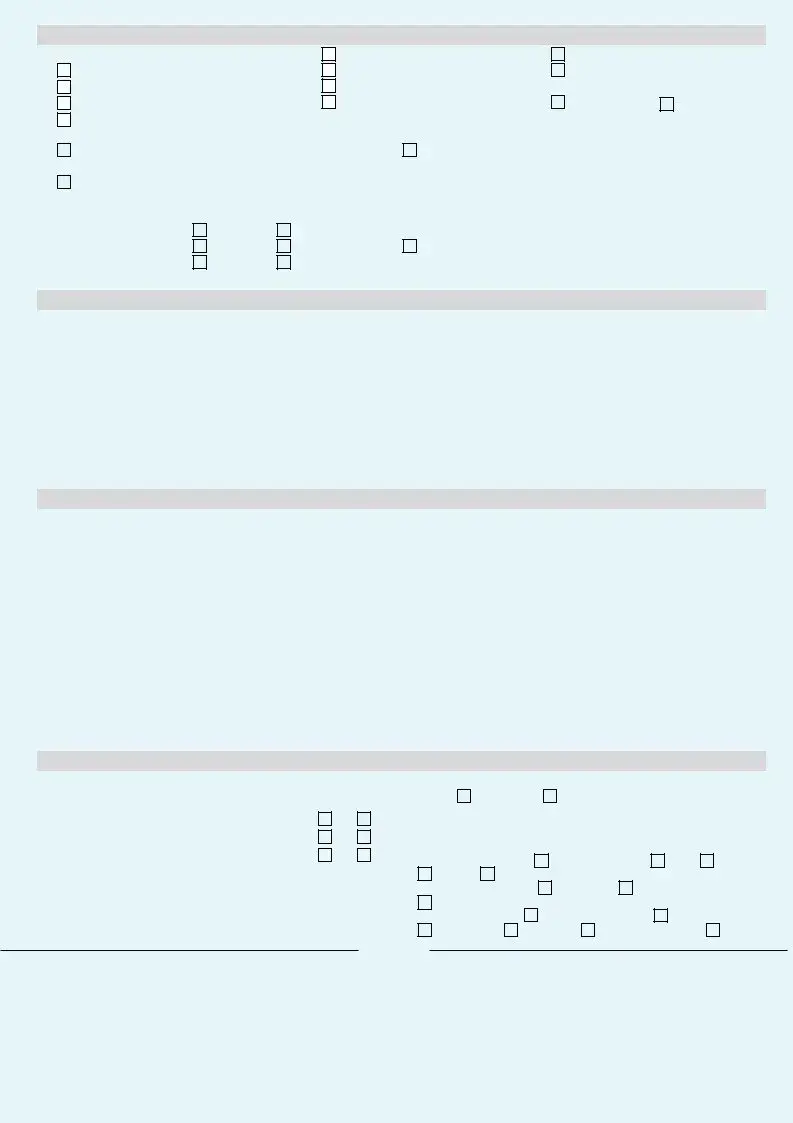

INSTRUCTIONS (Tick '' in the applicable box)

1.Account to be operated by:

Me |

|

No.1 |

|

No.2 |

|

No.3 |

|

Jointly by us |

|

Jointly by |

Mandate Holder (Name) |

|

|

|

(Attach Mandate Letter). |

||||||

2.Balance repayable to:

Any one of us |

|

Either or survivor of us |

Others (specify)....................................................

Me |

|

No.1 |

|

No.2 |

|

No.3 |

|

Jointly to us |

|

......................................Jointly to |

3.Pass book/ Statement of account

Issue |

|

Passbook |

|

Statement of account |

|

|

Send Statement of account |

|

Weekly / |

||||||||

|

Monthly / |

|

Quarterly by |

|

Post / |

|

Courier / |

|

I will collect personally |

|

|||||||

|

|

|

|

|

|

||||||||||||

4. Correspond at |

|

Residential Address |

Business/ Employer's Address |

Any one of us

Fortnightly /

Either or survivor of us

5.Nomination for the Account

Nomination is required by me. Nomination Form is furnished. Please

mention

mention

do not mention nomination details on the account pass book. Nomination facility is not required by me.

do not mention nomination details on the account pass book. Nomination facility is not required by me.

DECLARATIONS

1. Following documents are submitted by me/us:

Letter of Proprietorship (ID891)

Certificate of incorporation

Certificate of ROC for commencement of business

My/our/authorised signatories specimen signature/s

2. *Declaration about other accounts and credit facilities:

HUF Letter (ID303) |

|

Letter of Mandate (ID304) |

||

Partnership Letter (ID892) |

|

Partnership Deed |

|

|

|

|

|

||

Copies of Memorandum & Articles of Association |

|

|

||

Certified copy of Board Resolution |

|

Trust deed |

|

Bye Laws |

|

|

|||

|

|

|||

|

|

|

|

|

|

|

I/We are operating/not operating account with any other bank. |

|

I/We am/are not enjoying credit facilities with any other bank/branch of |

your bank and undertake to inform you as and when credit facilities are availed by me/us with other banks/branches of your bank. |

||||

|

|

I/We am/are enjoying credit facilities with |

(bank & branch name) |

|

|

|

|||

3. * Declaration in case of Minor's Account:

Guardian's Name |

|

|

|

|

|

|

Nature of guardianship |

|

Natural |

|

By Court order |

|

|

|

|

|

|

|||

Relationship with minor |

|

Son |

|

Daughter |

|

Others (specify) |

|

|

|

||||

Source of funds |

|

Self funds |

|

Minor's funds |

|

|

|

|

|

|

|||

I shall indemnify the Bank against the claim of above minor for any transaction/withdrawal made by me in his/her account

NOMINATION FORM

|

DETAILS OF NOMINEE |

DETAILS OF APPOINTEE FOR MINOR |

|

WITNESS/ES |

|||

|

|

|

|

|

|

|

|

Name: |

Name: |

1. Name: |

|||||

Address: |

Age |

Address: |

|||||

................................................................................ |

Address: |

....................................................................... |

|

||||

................................................................................ |

............................................................................... |

Signature: |

|||||

City |

Pin Code |

............................................................................... |

|

|

|

||

2. Name: |

|||||||

|

|

|

|

||||

Phone No |

............................................................................... |

Address: |

|||||

|

|

|

|

||||

Date of Birth (If Minor): |

City |

Pin Code |

....................................................................... |

|

|||

|

|

|

|

|

|||

Relationship with Depositor |

|

|

Signature: |

||||

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FORM NO. 60

1. |

Full name of the declarant. |

|

|

|

|

2. |

Particulars of transactions: New |

................ Account No |

|

|

|

3. |

Amount of transaction: |

Rs |

|

|

|

4. |

Are you assessed to Tax? |

|

Yes / No |

Yes / No |

Yes / No |

5. |

If Yes, |

|

|||

|

|

|

|

||

|

i) Details of Ward/Circle/Range where the last return of income was filed? |

|

.................................. |

.................................. |

|

|

ii) Reasons for not having Permanent Account No./ General Index |

...................................... |

|||

|

|

|

|

||

|

Register No.? |

|

|

.................................. |

.................................. |

6. |

Details of document* being produced in support of the address in |

...................................... |

|||

|

|

|

|||

|

Column no.1. |

|

|

.................................. |

.................................. |

|

|

|

...................................... |

||

Verification: I/We |

do hereby declare that what is |

|

|

|

|

|

stated above is true to the best of my knowledge & belief. |

|

|

|

|

|

Verified today, the |

day of |

|

|

|

|

Date: |

|

|

.................................. |

.................................. |

|

Place: |

Signature/s |

...................................... |

||

|

|

|

|

||

|

|

|

|

|

|

|

*Documents which can be produced in support of the address are:- 1.Passport. 2. Driving Licence. 3. Identity Card issued by the institution. |

4. Copy of the electricity bill/telephone bill showing residential address. |

|||

|

5. Any document or communication issued by any authority of Central or State Govt. or local bodies showing residential address. 6. Any other documentary evidence (Copies should be verified with originals and held as records.) |

||||

|

|

|

|

|

|

RELATIONSHIP INFORMATION

1. Family Details |

|

|

|

|

|

|

|

3. |

Asset Details |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Name |

Vocation |

D O B |

|

Earning |

|

|

Vehicle |

|

Four Wheeler |

|

|

|

|

Brand |

|

|

|

|

|

Reg. No |

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

Spouse |

........................ ........................ |

|

Yes |

|

|

No |

|

Credit Card Issued by |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Children |

........................ ........................ |

|

Yes |

|

|

No |

|

........................................................................Owned House : Owned by |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Parents |

........................ ........................ |

|

Yes |

|

|

No |

|

..................................................................................................... |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

4. |

Income details: Sources |

|

|

|

|

Business/Profession |

|

|

|

Salary |

|

|

Rent on |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

2. Business / Profession / Employment Details |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

Property |

|

Investment |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

..................................................................................................................... |

|

Level of investment (Rs.) |

|

|

|

Below 2.0 lac |

|

2.0 lac to 5.0 lac |

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

Above 5.0 lac |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred Investments |

|

Term Deposits in Banks |

|

|

Insurance Policies |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

Mutual Funds |

|

Relief Bonds |

|

Government Securities |

|

|

Shares |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PERFORATION

OCCUPATION CODES: 01 SERVICE. 02 BUSINESS. 03 HOUSE WIFE. 04 DOCTOR. 05 ENGINEER. 06 ADVOCATE. 07 TEACHER. 08 AGRICULTURIST. 09 LANDLORD. 10 LABOURER. 11 DRIVER. 12 INDUSTRIALIST. 13 INSURANCE AGENT. 14 HOTELIER. 15 SHARE BROKER. 16 PHOTOGRAPHER. 17 JEWELLER. 18 MERCHANTS. 19 PRINTERS & PUBLISHERS. 20 TRANSPORT OPERATORS. 21 BUILDING CONTRACTORS/CONSTRUCTION. 22 ELECTRICAL CONTRACTORS/ELECTRICIAN. 23 STUDENT.

24RETD,/ PENSIONERS. 25 EDUCATIONAL INSTITUTION. 26 FINANCIERS/ FINANCE COMPANIES. 27 BOAT/SHIP BUILDING. 28 MARKETING /ADVERTISING. 29 EXPORT BUSINESS. 30 DISTRIBUTORS. 31 ENGINEERS - REPAIRS & MAINTENANCE. 32 TIMBER MERCHANTS . 33 FILM EXHIBITORS. 34 COMMISSION AGENTS. 35 FABRICATORS.

36 DEALERS IN PETROLEUM PRODUCTS. 37

I/We have understood the Bank's rules for .....................................................(the type of account) and agree to comply with and be bound by them as they are

in force now and from time to time in force for such accounts. I/we undertake to advise the Bank in writing of any change in my/ our constitution/ partners/ directors/ articles of Association.

I/We have read the terms and conditions for providing the aforesaid facilities and I/We agree to abide by and be bound by them as they are in force now and from time to time in force for such facilities. I/We request you to provide me/us the Card, the initial Password / PIN (Personal Identification number) which I/we shall change periodically for maintaining secrecy of my/our account level information. I/We undertake to keep my Password / PIN with myself/ourselves without giving any room for disclosure of the same to any third party. Further, I/We shall be responsible for any disclosure of my/our Password / PIN or Account Level Information to any third party and the Bank shall not be held responsible for any loss/damage caused to me/us on account of such disclosure. I/We shall be availing this facility at my/our request without any liability, either expressed or implied, to the Bank.

INTRODUCTION

I/We certify that I/We have known |

............................................................................................................for the past |

months/years and confirm |

|

his/her/their occupation and address as stated in this application. My Association/Relationship with applicant/s is |

|

||

Name: |

Account No.: |

|

|

Address |

|

|

|

|

|

|

|

.................................................................................................................... |

Phone No |

|

Signature of introducer |

Yours Faithfully

1.

2.

3.

Signature/s of depositor/s

(Affix property seal, if applicable)

1. |

|

2. |

3. |

|

Paste a recent |

|

Paste a recent |

|

Paste a recent |

passport photograph |

|

passport photograph |

|

passport photograph |

of each of the account |

|

of each of the account |

|

of each of the account |

holder and obtain |

|

holder and obtain |

|

holder and obtain |

his/her signature on |

|

his/her signature on |

|

his/her signature on |

the bust portion |

|

the bust portion |

|

the bust portion |

thereof. |

|

thereof. |

|

thereof. |

|

|

|

|

|

FOR BRANCH USE |

FOR BRANCH USE |

Signed before me. Introducer's signature tallied. Introduction is found in order. Document verified for name and address.

Permitted to open account.

(i)Issue/Do not issue Ordinary /Personalised cheque book

(ii)Send Letter of Thanks to the account holder/s.

(iii)Send Letter of Confirmation of Introduction to the Introducer.

The account is classified as

Low Risk |

|

Medium Risk |

|

High Risk |

|

|

|

|

|

Threshold limit for monitoring transactions is (for medium /high Risk a/c):

Single Transaction Rs |

Annual Transaction Rs |

|

|

|

|

Date: |

Signature of authorised official |

|

Name |

E. No |

|

Party Code No |

Account mobilised by |

|

|

||

Cheque book issued - |

|

|

Yes |

|

No |

Letter of Thanks sent to the a/c holder - |

|

|

Yes |

|

No |

|

|

|

|||

Letter of Confirmation of Introduction sent |

|

|

|

|

|

|

|

|

|

||

to the Introducer - |

|

|

Yes |

|

No |

Whether Nomination Registered? : |

|

|

Yes |

|

No |

|

|

|

|||

If yes, Nomination registration No.: |

|

|

|

|

|

|

|

|

|

||

If No, reason for non registration: |

|

|

|

|

|

Specimen Signature scanned and tagged by |

|

|

|||

Date: |

|

|

|

|

|

Party Master Number: |

|

|

|

|

|

Party Master Entered by : Name |

Sign |

|

|

||

Party Master Checked by : Name |

Sign |

|

|

||

AT WEB CENTRE

Registration Form No |

Serial No |

/200_ |

Received from the Base Branch (Name) |

|

|

|

CorpNet Password/ Mailer sent on |

Date: |

|

|

|

Seal of Web Centre |

|

|

Signature of Authorised Officer |

FOR CORPNET / CORPCONVENIENCE / CORPBILLPAY

Secondary Branch Name

CERTIFIED THAT

|

Party Code is |

|

|

Account |

|

|

Mode of |

|

Signature is |

||

|

|

|

|

Number is |

|

Operation |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Correct |

|

|

Correct |

|

|

Correct |

|

|

Correct |

|

|

Incorrect |

|

|

Incorrect |

|

|

Incorrect |

|

|

Incorrect |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Correct |

|

|

Correct |

|

|

Correct |

|

|

Correct |

|

|

|

|

|

|

|

|

||||

|

|

Incorrect |

|

|

Incorrect |

|

|

Incorrect |

|

|

Incorrect |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Correct |

|

|

Correct |

|

|

Correct |

|

|

Correct |

|

|

Incorrect |

|

|

Incorrect |

|

|

Incorrect |

|

|

Incorrect |

|

|

|

|

|

|

|

|

|

|

|

|

|

CorpNet, Corpconvenience, |

|

Name & Sign |

Signature |

|

|

|

and Corpbillpay facility is |

|

code of |

with seal |

|

|

|

|

official |

|

|

|

|

|

|

|

|

|

Recommended |

|

|

|

|

|

Rejected (Reason |

) |

|

|

|

|

|

|

|

|

|

|

Recommended |

|

|

|

|

|

|

|

|

|

|

|

Rejected (Reason |

) |

|

|

|

|

|

|

|

|

|

|

Recommended |

|

|

|

|

|

Rejected (Reason |

) |

|

|

|

|

|

|

|

|

ACKNOWLEDGEMENT BY CORPORATION BANK

To____________________________________________________________Branch:______________________

____________________________________________________________

We acknowledge your Nomination instruction relating to________________Account No. ______________ held with us. |

Branch Round Seal |

|

|

Please quote the Nomination Registration No.___________________ in all your future correspondence with us. |

|

Date: |

Signature |

Form Characteristics

| Fact Name | Details |

|---|---|

| Types of Accounts Offered | The form allows for the opening of various account types, including Savings Bank, Current Account, and specialized options like CorpElite, CorpJunior, and CorpClassic. |

| Minimum Deposit Requirement | Applicants must make an initial deposit, the amount of which must be filled in as per the specific account type requirements. |

| Mandatory Documents | Furnishing documents such as ID proofs, address proof, and occupation details is compulsory for the application to be processed. |

| Governing Laws in Different States | State-specific laws will govern the operations of the account, influenced by local banking regulations and practices. |

Guidelines on Utilizing Corporation Bank Account Opening

Completing the Corporation Bank Account Opening form is a crucial step in initiating your banking relationship. This form gathers essential information to ensure that the bank has accurate details for account management and services. Following the steps outlined below will guide you through the process of filling out the form correctly.

- Begin by selecting the type of account you wish to open: Savings Bank, Current, CorpElite, CorpJunior, CorpSenior, CorpClassic, CorpPayroll, or CorpPremium. Mark the appropriate box.

- Enter your initial deposit amount in the space provided.

- Fill in your account number and the date of application.

- Provide your phone and fax numbers.

- For accounts associated with firms, companies, trusts, or associations, correctly enter the account name in the designated section.

- List the full names of all applicants, including their titles (Mr./Mrs./Ms.) and any relevant designations.

- Indicate the father’s or husband’s name for signatories if applicable.

- Include the date of birth for each applicant; this is mandatory for CorpConvenience Card applications.

- Provide the PAN or GIR number, and submit Form 60 or 61 if you do not possess one.

- Choose the designation code that corresponds to your occupation, referring to the list at the end of the form.

- Fill in your residential address, and if applicable, the business or employer’s office address and its phone number.

- For CorpPayroll accounts, provide your employee number and department.

- Select your preferences for the CorpClassic account, including minimum balance options and terms for fixed deposit investments.

- Mark any other facility you wish to request, such as CorpDial facility or CorpNet – Internet banking, and list your desired user ID preferences.

- Complete the necessary details for any beneficiaries if you plan to transfer funds via CorpNet Banking.

- Fill in the requested information for a CorpConvenience Debit Card and provide mothers' maiden names where indicated.

- Address the sections on BillPay and linking other accounts to your new account, ensuring all necessary details are provided.

- Review the section regarding account operation and select how you prefer it to be managed (individual, jointly, etc.).

- State your choice regarding the issuance of a passbook or statements and how you would like to receive them.

- Sign and date the declaration section, ensuring all required documents, such as IDs and proof of address, are attached.

- Make sure to include witnesses if necessary and affix photographs where indicated.

Taking time to carefully fill out each section will facilitate a smoother account opening process and help ensure that your specific banking needs are met. Once completed, submit the form as instructed by your chosen branch. Your commitment to providing accurate information is greatly appreciated.

What You Should Know About This Form

What types of accounts can I open using the Corporation Bank Account Opening form?

You can open various types of accounts using this form, including Savings Bank accounts and Current accounts. Specific options are available such as CorpElite, CorpJunior, CorpSenior, CorpClassic, CorpPayroll, and CorpPremium accounts. You can choose one based on your needs by simply ticking the appropriate box on the form.

What information do I need to provide on the form?

The form requires several details. You will need to provide your full name and contact details, including your phone and fax numbers. Other important information includes your occupation, PAN/GIR No., and your residential or registered address. You must also include the names and details of any joint applicants if applicable. Ensure all information is accurate for smooth processing.

Is it necessary to maintain a minimum balance in my account?

Yes, if you choose to open a CorpClassic account, you must maintain a minimum balance as prescribed under the scheme. The form allows you to specify how much you will maintain in the account. Not adhering to the minimum balance requirement may lead to additional charges.

What facilities can I request while opening the account?

You can request several services, including the CorpDial facility and CorpNet Internet banking. There's also an option for a personalized cheque book, but this is available at select branches. Be sure to tick the desired options on the form, so it's clear what services you want linked to your new account.

How do I submit additional documentation with my application?

The form includes a section where you must list and submit any additional documents required for account approval, such as proof of identity or business registration. Each document must be clearly labeled. Ensure that you collect copies of these documents to keep for your records, as the bank may require them for verification.

Common mistakes

Filling out the Corporation Bank Account Opening form can seem straightforward, but many applicants make common mistakes that can delay account setup. One prevalent error is related to accurately providing personal information. Often, individuals neglect to verify the correctness of their full name or misspell it entirely. This inaccuracy can lead to complications in processing the application.

Another frequent mistake involves the omission of the mandatory fields. Applicants sometimes overlook sections marked as mandatory, such as the Date of Birth or PAN/GIR Number. Missing these essential details can result in the rejection of the application, requiring individuals to start over, which can be both time-consuming and frustrating.

Many also fail to submit necessary documentation along with the form. Applicants might assume that submitting the form alone suffices, but specific documents such as proof of identity or address may be required. Not including these documents will lead to delays or even a denial of the account opening request.

Incorrectly selecting the account type is another misstep that can create issues. Some applicants may inadvertently tick the wrong box, opting for a different type of account than they intended. This error necessitates a redo of paperwork and can cause confusion during the account management process.

Lastly, applicants often neglect to double-check their contact details, particularly phone numbers and email addresses. A simple typo can make it difficult for the bank to communicate crucial information or updates related to the account. Ensuring all details are accurate is fundamental to a smooth banking experience.

Documents used along the form

When opening a corporation bank account, certain forms and documents are essential to complete the process efficiently. Here’s a list of important documents often used in conjunction with the Corporation Bank Account Opening Form. Each of these documents serves a specific purpose and may be required to satisfy bank regulations or account setup requirements.

- Proof of Identity: A government-issued ID, such as a passport or driver's license, is commonly required to verify the identity of the account holders.

- Proof of Address: Documents like a utility bill or rental agreement can establish the residential address of the applicants.

- PAN Card: The Permanent Account Number (PAN) is essential for taxation purposes. If an applicant does not have one, a declaration (Form 60 or Form 61) should be submitted instead.

- Business Registration Documents: For business accounts, you'll need to provide a certificate of incorporation or a business license to confirm the legitimacy of the operation.

- Partnership Deed: If the account is for a partnership, the original partnership deed must be submitted, detailing the agreements and terms between partners.

- Certificate of Commencement of Business: This document is required for companies to show that business activities have officially begun.

- Nomination Form: A form for designating a nominee is often necessary to ensure that funds can be transferred to the intended beneficiary upon the account holder's passing.

- Specimen Signature Cards: This is needed to provide the bank with a reference of each account holder’s signature for verification during transactions.

- Corporate Resolution: If the account is for a corporation, a resolution authorizing the opening of the account and designating who can operate it must be included.

Gathering these documents will help streamline your account opening process at the bank. It’s important to ensure all forms are accurately filled out and that all necessary supporting documents are provided to avoid any delays. Prompt action can lead to a more efficient banking experience.

Similar forms

- Account Opening Application: This document also requests the bank to open an account for an individual or entity. It requires similar details, such as the applicant's name, contact information, and type of account, just like the Corporation Bank Account Opening form.

- Loan Application Form: Much like the bank account form, this document requires personal information about the applicant, including employment status and financial background. Both documents aim to evaluate the applicant's capability to manage banking services.

- Business Registration Form: This form requires details about the business owners, similar to how the bank account form asks for personal details of account holders. Both require proof of identity and the nature of business activities.

- KYC (Know Your Customer) Document: This document verifies the identity of clients. It mirrors the Corporation form’s requirement for identification, such as PAN or similar documentation, to ensure compliance with regulations.

- Fixed Deposit Application: Like the bank account opening form, this document collects information about the applicant and requires them to specify their preferences regarding the deposit. Both documents serve to establish a financial relationship with the bank.

- Nomination Form: This document allows account holders to nominate a beneficiary, akin to the nomination aspects included within the Corporation Bank Form. It ensures that such preferences are recorded to facilitate easier future transactions.

- Debit Card Application: This application requests the issuance of a debit card and requires similar personal information as the account opening form. Both documents focus on establishing the identity of the individual while enabling banking functionalities.

Dos and Don'ts

When filling out the Corporation Bank Account Opening form, it's essential to approach the process thoughtfully. Here are some important do’s and don’ts to keep in mind:

- Do double-check all personal information for accuracy, including names, addresses, and identification numbers.

- Do include all required documents and supporting materials to avoid delays in account processing.

- Do ensure that signatures match those on identification documents. This verification helps streamline the approval process.

- Do read all instructions carefully before starting. Understanding requirements is key to completing the form correctly.

- Do keep a copy of the completed form and any related correspondence for your records.

- Don't leave any mandatory fields unanswered. Every section needs attention to avoid processing delays.

- Don't submit the form without checking for spelling errors. Mistakes can lead to complications.

- Don't provide outdated contact information. Ensure that phone and address details are up to date.

- Don't rush the completion process. Take the time to read and understand before signing.

- Don't forget to follow up if you do not receive confirmation of your account opening within a reasonable time.

Misconceptions

Understanding the Corporation Bank Account Opening form is essential to navigate the account opening process smoothly. However, several misconceptions can create confusion. Here are six common misconceptions, along with clarifications:

- Misconception 1: Any form of ID is acceptable.

- Misconception 2: Only individual applicants can open an account.

- Misconception 3: The initial deposit amount is flexible.

- Misconception 4: Nomination is optional for all accounts.

- Misconception 5: Providing PAN/GIR number is not essential for non-residents.

- Misconception 6: You can apply for multiple accounts without additional documentation.

It's important to submit specific valid identification documents such as a passport, driver's license, or government-issued ID. Ensure you have the documents that the bank requires for verification.

The form accommodates various entity types, including businesses, trusts, and partnerships. It's not limited to individual account holders.

Each account type has a minimum required deposit. Make sure to check the specifics for the account you're interested in to avoid issues.

While some may choose to skip this step, nomination is mandatory for certain accounts. Make sure to complete this part to ensure a smooth transition in case of unforeseen events.

Even if you are a non-resident, a PAN (Permanent Account Number) is often required. If you lack this, you may need to provide additional documentation to fulfill the tax requirements.

Each account application generally requires distinct documentation and may have particular requirements. Be prepared to provide all relevant information for each application.

Key takeaways

Filling out the Corporation Bank Account Opening form is an important step to establish your banking relationship. Here are key takeaways to consider when completing and using this form:

- Ensure you choose the right type of account, such as Savings Bank or Current Account, by ticking the appropriate option on the form.

- Provide the required initial deposit amount in the designated section and make sure it meets the minimum balance requirements for your chosen account type.

- List all applicants' full names and details accurately, including fathers' or husbands' names, to avoid any future complications.

- Remember to include the date of birth for each applicant, especially if applying for a CorpConvenience Card.

- Provide residential and business addresses clearly. This information is crucial for communication and account verification.

- If requesting additional services, such as CorpNet or CorpBillPay, ensure separate application forms are filled out where necessary.

- Double-check that you have signed and dated the form where required. Incomplete signatures can delay the account opening process.

- All supporting documents, such as proof of identity and address, must be submitted with the form. Keep copies for your records.

- Review the terms and conditions related to your chosen services and accounts; understanding your obligations is essential for maintaining a good banking relationship.

By following these takeaways, you can facilitate a smoother account opening experience with Corporation Bank.

Browse Other Templates

Eicr Stand for - With this report, clients can take proactive steps to maintain electrical safety at their properties.

Wisconsin Tax Simplified Form,WI 2017 Income Adjustment Form,Wisconsin Amended Tax Return,WI-Z Income Tax Return,Wisconsin Tax Reporting Form,WI Joint Filing Form,Wisconsin Easy Tax Return,WI-Z Simple Tax Submission,Wisconsin 2017 Tax Revision Form,W - Consult the tax district information for geographical accuracy in reporting.

Nycha Careers - Supporting medical documentation should clearly outline the need for requested accommodations.