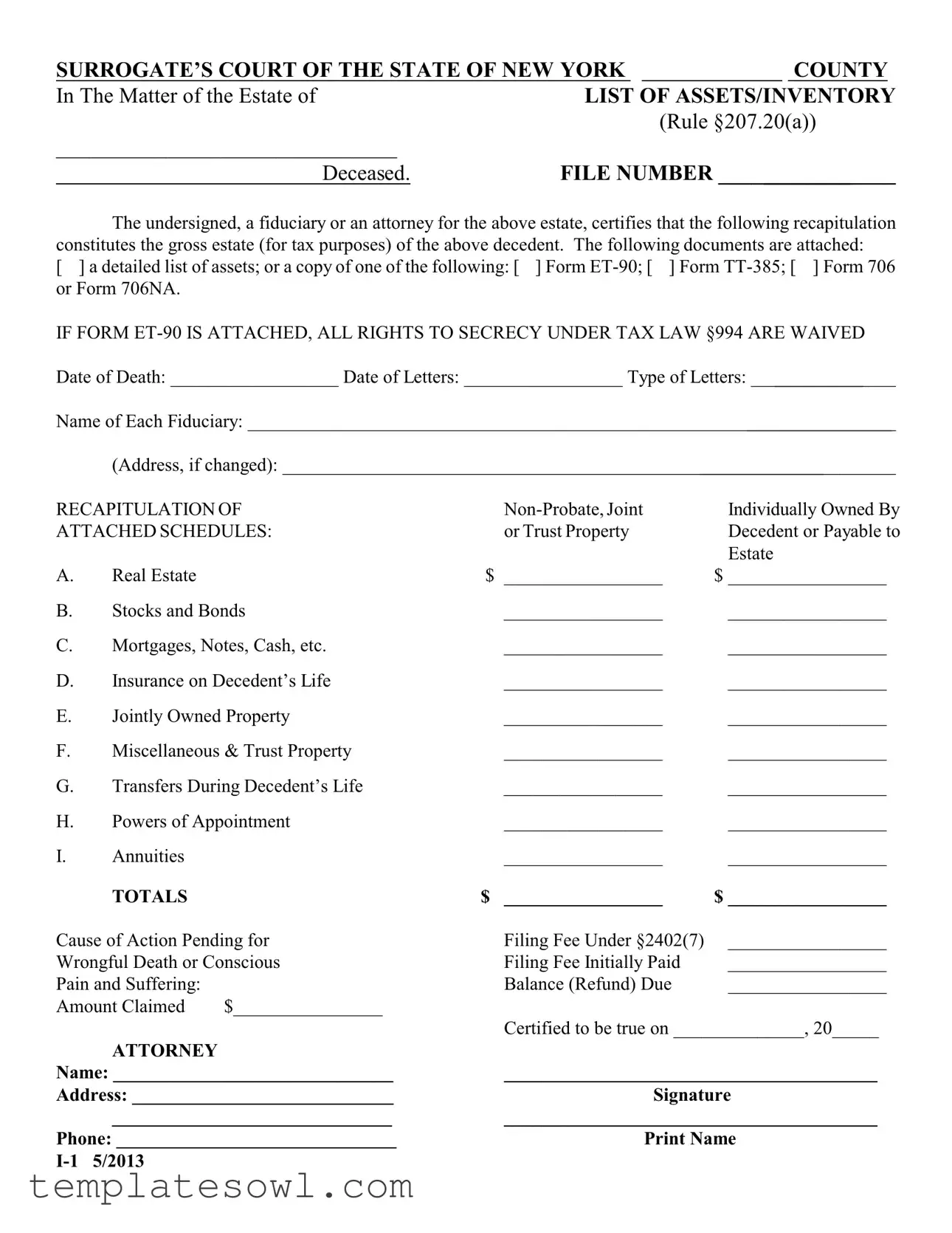

Fill Out Your Court Inventory Form

In the complex landscape of estate management, the Court Inventory form plays a crucial role, particularly within the Surrogate’s Court of New York. This comprehensive document demands attention to the details surrounding the gross estate of a deceased individual. Designed for use by fiduciaries or attorneys representing an estate, the form requires a meticulous recapitulation of various assets, which includes everything from real estate and stocks to insurance policies and jointly owned properties. An essential component of this process involves specifying tax purposes, as the form aids in determining the estate’s valuation for tax responsibilities. With sections dedicated to reporting non-probate assets and transfers made during the decedent’s life, the form ensures that all financial dealings are transparently documented. It not only requires an inventory of assets but also entails a careful compilation of attached schedules that may include detailed lists or various tax forms. By detailing these critical aspects, the Court Inventory form ensures that all legal and fiscal obligations are met, while also facilitating communication among all parties involved in the estate administration process.

Court Inventory Example

SURROGATE’S COURT OF THE STATE OF NEW YORK |

|

COUNTY |

|

In The Matter of the Estate of |

LIST OF ASSETS/INVENTORY |

||

|

|

(Rule §207.20(a)) |

|

_______________________________ |

|

|

|

Deceased. |

FILE NUMBER ________________________ |

||

The undersigned, a fiduciary or an attorney for the above estate, certifies that the following recapitulation constitutes the gross estate (for tax purposes) of the above decedent. The following documents are attached:

[ ] a detailed list of assets; or a copy of one of the following: [ ] Form

IF FORM

Date of Death: __________________ Date of Letters: _________________ Type of Letters: _________________________

Name of Each Fiduciary: _____________________________________________________________________________________

(Address, if changed): _______________________________________________________________________________

RECAPITULATION OF |

|

Individually Owned By |

|||

ATTACHED SCHEDULES: |

|

or Trust Property |

Decedent or Payable to |

||

|

|

|

|

|

Estate |

A. |

Real Estate |

|

$ |

_________________ |

$ _________________ |

B. |

Stocks and Bonds |

|

_________________ |

_________________ |

|

C. |

Mortgages, Notes, Cash, etc. |

|

_________________ |

_________________ |

|

D. |

Insurance on Decedent’s Life |

|

_________________ |

_________________ |

|

E. |

Jointly Owned Property |

|

_________________ |

_________________ |

|

F. |

Miscellaneous & Trust Property |

|

_________________ |

_________________ |

|

G. |

Transfers During Decedent’s Life |

|

_________________ |

_________________ |

|

H. |

Powers of Appointment |

|

_________________ |

_________________ |

|

I. |

Annuities |

|

|

_________________ |

_________________ |

|

TOTALS |

|

$ |

_________________ |

$ _________________ |

Cause of Action Pending for |

|

Filing Fee Under §2402(7) |

_________________ |

||

Wrongful Death or Conscious |

|

Filing Fee Initially Paid |

_________________ |

||

Pain and Suffering: |

|

|

Balance (Refund) Due |

_________________ |

|

Amount Claimed |

$________________ |

|

|

|

|

|

|

|

|

Certified to be true on ______________, 20_____ |

|

|

ATTORNEY |

|

|

|

|

Name: ______________________________ |

|

________________________________________ |

|||

Address: ____________________________ |

|

Signature |

|||

|

______________________________ |

|

________________________________________ |

||

Phone: ______________________________ |

|

Print Name |

|||

5/2013 |

|

|

|

|

|

GROSS ASSETS

(Attach Additional Page If Necessary)

A. |

REAL ESTATE (Individually owned property) |

|

|

Description |

Date of Death Value |

____________________________________________ |

_______________________________ |

|

____________________________________________ |

_______________________________ |

|

____________________________________________ |

_______________________________ |

|

B. |

STOCKS AND BONDS (Individually Owned) |

|

|

|

Description, Including Face Amount of Bonds |

|

|

|

and Number of Shares |

|

Date of Death Value |

____________________________________________ |

___________________________________ |

____________________________________________ |

___________________________________ |

____________________________________________ |

___________________________________ |

C. MORTGAGES, NOTES AND CASH (Including Bank Deposits) (Jointly owned property should be reported at E and trust property at F)

Description |

Date of Death Value |

____________________________________________ |

____________________________________ |

____________________________________________ |

____________________________________ |

____________________________________________ |

____________________________________ |

D. INSURANCE ON DECEDENT’S LIFE

(1)Payable to Estate

Description |

Date of Death Value |

|

_________________________________________ |

_________________________________ |

|

_________________________________________ |

_________________________________ |

|

(2) |

Payable to Named Beneficiary |

|

Description |

Date of Death Value |

|

_________________________________________ |

__________________________________ |

|

_________________________________________ |

__________________________________ |

|

E.JOINTLY OWNED PROPERTY (Real and Personal Property)

(1)Real Estate

|

|

Joint |

|

Description |

Tenant |

Date of Death Value |

|

________________________________ |

_________________ |

_______________________ |

|

________________________________ |

_________________ |

_______________________ |

|

(2) |

Stocks and Bonds |

|

|

|

|

Joint |

|

Description |

Tenant |

Date of Death Value |

|

________________________________ |

_________________ |

________________________ |

|

________________________________ |

_________________ |

________________________ |

|

(3)Mortgages, Notes and Cash

|

Joint |

|

Description |

Tenant |

Date of Death Value |

________________________________ |

_________________ |

_________________________ |

________________________________ |

_________________ |

_________________________ |

F.OTHER MISCELLANEOUS PROPERTY

(1)Individually Owned

Description |

|

Date of Death Value |

________________________________ |

__________________ |

_________________________ |

________________________________ |

__________________ |

_________________________ |

(2)Firearms (Check appropriate box)

[ |

] Yes, see attached Firearms Inventory Form |

Date of Death Value |

[ |

] None |

___________________________________ |

(3)Assets Passing to the Estate from Employment

|

Description |

Date of Death Value |

|

____________________________________________ |

___________________________________ |

||

____________________________________________ |

___________________________________ |

||

|

(4) |

Trust Property |

|

|

Description |

Date of Death Value |

|

____________________________________________ |

___________________________________ |

||

____________________________________________ |

___________________________________ |

||

G. |

TRANSFERS DURING DECEDENT’S LIFE |

|

|

|

Description |

Date of Death Value |

|

_____________________________________________ |

___________________________________ |

||

_____________________________________________ |

___________________________________ |

||

H. |

POWERS OF APPOINTMENT |

|

|

|

Description |

Date of Death Value |

|

_____________________________________________ |

___________________________________ |

||

_____________________________________________ |

___________________________________ |

||

I. |

ANNUITIES |

|

|

|

Description |

Date of Death Value |

|

_____________________________________________ |

___________________________________ |

||

_____________________________________________ |

___________________________________ |

||

CAUSE OF ACTION for decedent’s wrongful death and for conscious pain and suffering, as well as any other type of action.

|

Court in which |

Index |

Amount |

Description |

Action Pending |

Number |

Demanded |

__________________ |

____________________ |

_______________ |

_________________ |

__________________ |

____________________ |

_______________ |

_________________ |

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Court Jurisdiction | This form is governed by the Surrogate's Court of New York State. |

| Purpose of the Form | The form serves to provide a detailed inventory of an estate’s assets for tax purposes. |

| Fiduciary Certification | A fiduciary or attorney must certify the accuracy of the information provided in the form. |

| Attachments Required | It requires attachments such as a detailed asset list or specific tax forms like ET-90 or Form 706. |

| Date of Death | The form requires the date of the decedent’s death for accurate record-keeping and tax implications. |

| Sections of Asset Listing | Assets are categorized into real estate, stocks, bonds, insurance, and more for clarity. |

| Legal References | The requirements for the form are found under Rule §207.20(a) of New York Surrogate Court procedures. |

Guidelines on Utilizing Court Inventory

Completing the Court Inventory form is a crucial step in managing an estate. After gathering all necessary information, ensure that every relevant asset is documented correctly. Misreporting can lead to complications in the estate process.

- Start by entering the name of the county where the case is being filed at the top of the form.

- Fill in the decedent's name where it says "In The Matter of the Estate of".

- Write the file number assigned by the court.

- Indicate the decedent's date of death and the date of letters issued.

- Specify the type of letters obtained (e.g., Letters Testamentary, Letters of Administration).

- List the names of each fiduciary responsible for the estate management, along with the address if it has changed.

- In the recapitulation section, accurately enter values for each asset category, ensuring to differentiate between non-probate, jointly owned, and individually owned properties.

- Attach supplementary documents as required, marking the appropriate boxes for detailed lists or tax forms attached.

- Complete the cause of action part, if applicable, specifying if there are any pending cases for wrongful death or conscious pain and suffering.

- Sign the form by providing your name, address, signature, and phone number.

- Finally, certify the document with the date it is being completed, ensuring it is up-to-date when submitted.

What You Should Know About This Form

What is the purpose of the Court Inventory form?

The Court Inventory form is a critical document used in the Surrogate's Court of New York. It outlines the gross estate of a deceased individual for tax purposes. The form requires the fiduciary or attorney managing the estate to accurately list all assets, including real estate, stocks, bonds, and insurance policies, among others. This inventory helps ensure transparency and correct assessment of the estate's value, which is necessary for tax liability and distribution among heirs.

Who is required to file a Court Inventory form?

This form must be filed by the fiduciary or the attorney representing the estate of the deceased person. The fiduciary is the individual appointed to manage the estate, while the attorney is the legal professional assisting in the process. Both parties share the responsibility of providing accurate information regarding the deceased's assets, ensuring compliance with legal requirements.

What information needs to be included in the Court Inventory form?

The Court Inventory form requires detailed financial information regarding the estate. Key components include a recapitulation of both non-probate and joint properties, as well as individually owned assets. Each category—such as real estate, stocks, bonds, and insurance—must include the date of the individual’s death and the corresponding value of the assets. Additionally, any transfers made during the decedent's life, powers of appointment, and annuities must also be documented.

Are there specific attachments required with the Court Inventory form?

Yes, accompanying documentation is essential when submitting the Court Inventory form. This may include a detailed list of assets or copies of specific tax forms, such as Form ET-90, Form TT-385, or Form 706. Each attachment plays a vital role in substantiating the information presented in the inventory, ensuring that all reported assets are acknowledged during the probate process.

What happens if the Court Inventory form is not filed properly?

If the Court Inventory form is not filed correctly or is missing necessary information, it could lead to complications in the probate process. The Surrogate’s Court may require corrections or additional documentation, delaying the administration of the estate. In some cases, inadequate filing could result in legal repercussions or challenges from creditors or heirs. Therefore, it is vital to ensure that the form is complete and accurate before submission.

Common mistakes

Filling out the Court Inventory form can be challenging. Many individuals make common mistakes that can lead to delays or complications in the estate process. One frequent error is incomplete information. Failing to provide all necessary details, such as the date of death or the name of the fiduciary, can result in the court rejecting the document or asking for further clarification. Each section needs careful attention.

Another common mistake is inaccurate valuations of the assets. Providing outdated or incorrect values for real estate, stocks, or any other assets can create significant problems. People often underestimate or overestimate the worth of properties without having proper appraisals. This can lead to issues with taxes and the division of the estate, as well as potential legal repercussions.

Additionally, individuals often forget to attach the required documents. The form clearly states that certain documents need to accompany the inventory, such as a detailed list of assets or specific tax forms. Failing to include these can delay the process or result in additional requests for documentation from the court. Every checkbox should be diligently reviewed and completed.

Lastly, not properly categorizing assets is a mistake that many make. Each asset must be listed in the correct section, whether it is non-probate property or jointly owned assets. Misclassifying an asset can lead to confusion and might affect the distribution of the estate. Understanding where each item belongs is crucial for a complete and accurate inventory.

Documents used along the form

When administering an estate, certain forms and documents support the Court Inventory form. These documents provide additional information about the decedent's assets, tax obligations, and any pending legal matters. Understanding each document's purpose can help streamline the estate settlement process for all involved.

- Form ET-90: This form is used to waive confidentiality rights under New York tax law. It may be attached to the Court Inventory to facilitate tax-related disclosures.

- Form TT-385: This form proves the estate's eligibility for a tax exemption. It can be helpful in establishing the financial status of the estate.

- Form 706: Known as the United States Estate (and Generation-Skipping Transfer) Tax Return, this form is required for estates exceeding a certain value threshold. It reports the decedent's gross estate and calculates the estate tax owed.

- Form 706NA: This form is the non-resident version of Form 706. It is utilized for estates of non-resident aliens and outlines the same tax reporting requirements.

- Proof of Death: A certified copy of the death certificate serves as official documentation for the decedent's passing. It is essential for various estate-related processes.

- Letters Testamentary: This document, issued by the court, grants the executor the authority to administer the estate. It is crucial for validating the executor’s role in the probate process.

- Will: The decedent's last will outlines their wishes regarding the distribution of assets. It is central to the probate process and establishes the legal framework for estate administration.

- Tax Returns: Copies of the decedent's prior tax returns may be necessary to determine any outstanding tax obligations and verify the estate's income for the final tax return.

- Trust Documents: If the decedent had a trust, the trust document outlines the terms for managing the trust's assets. It provides vital information on how the assets are distributed.

- Inventory of Assets: This detailed list itemizes the decedent's possessions, including real estate, financial accounts, and personal items. It provides clarity on what constitutes the estate.

These documents play a significant role in the overall estate management process, ensuring a smooth transition and adherence to legal requirements. When combined with the Court Inventory form, they provide a comprehensive view of the estate's financial landscape and facilitate the timely resolution of any legal or tax-related obligations.

Similar forms

-

Probate Inventory Form: Similar to the Court Inventory form, this document provides a detailed listing of assets owned by the decedent at the time of death. Both documents aim to establish a comprehensive view of the estate for legal and tax purposes.

-

Estate Tax Return (Form 706): This form, like the Court Inventory, is used to report the value of the decedent's estate for tax liabilities. It requires documentation of all assets, mirroring the listing process found in the Court Inventory.

-

Form ET-90: This form is also focused on the gross estate and provides details on assets, similar to the Court Inventory. Attaching it involves waiving certain rights under tax law, reflecting the dual purpose of reporting and compliance.

-

Form TT-385: This form serves to report certain transfers made during the decedent's life. It is related to the Court Inventory since both documents aim to identify assets that may affect the overall value of the estate.

-

Asset Declaration Form: This document may be utilized in various legal contexts to declare ownership of assets. It shares the purpose of itemizing significant assets, akin to the Court Inventory's role in estate identification.

-

Financial Disclosure Statement: Often used in divorce proceedings or bankruptcy cases, this form provides a thorough overview of an individual’s financial situation. It parallels the Court Inventory's objective to disclose assets.

-

Life Insurance Beneficiary Designation: This document specifies beneficiaries on life insurance policies. It complements the Court Inventory's listing process by addressing how such policies are designated post-death.

-

Trust Inventory Report: Similar to the Court Inventory form, this document outlines the assets held within a trust, aiming to ensure transparency and compliance with legal requirements.

Dos and Don'ts

When filling out the Court Inventory form, certain practices can significantly ease the process. Here is a list of things you should and shouldn’t do:

- Do read the entire form carefully before starting. Understanding the requirements is essential.

- Do gather all necessary documents and supporting information before you begin filling out the form.

- Do write legibly. Clear handwriting will help prevent errors and confusion.

- Do double-check all figures and calculations for accuracy before submission.

- Do sign and date the form in the appropriate areas, as this validates the submission.

- Don't leave any required fields blank. Every section must be addressed.

- Don't provide vague descriptions of assets. Be as specific as possible.

- Don't use abbreviations that may not be universally understood.

- Don't ignore deadlines. Timely submission is crucial to avoid complications.

Misconceptions

Understanding the Court Inventory form can seem daunting, particularly when misinformation circulates. Here are nine common misconceptions that people often have about this form, along with clarifications:

- It’s only for large estates. Many believe this form is relevant only for sizable estates. In reality, it applies to estates of all sizes, as everyone must identify and document their assets upon a person's passing.

- Only lawyers can fill it out. While attorneys often assist with completing the form, fiduciaries or personal representatives can also fill it out. You don’t have to hire an attorney, although legal guidance can be beneficial.

- All assets must go through probate. Some people assume every asset requires a probate process. However, non-probate assets, such as trusts or jointly owned properties, should also be included on the form, but don't necessarily require probate.

- You can submit it any time after death. A misconception exists that the form can be submitted at leisure. It should be submitted in a timely manner, often along with other required documents, to comply with estate settlement timelines.

- The form is solely for tax purposes. Many think this inventory is only for taxation. While tax considerations are crucial, the form also provides a comprehensive overview of the estate's assets for the court.

- Filling it out correctly is not that important. Some may feel that minor mistakes or omissions won’t matter. However, inaccuracies can lead to delays or even legal challenges, making attention to detail critical.

- Only liquid assets need to be listed. It's a common myth that only cash or easily liquidated assets should be reported. In truth, every type of asset, from real estate to personal items, should be documented.

- Once filed, the information is permanent and unchangeable. People may think that submitting the form locks in the information forever. However, updates or amendments can be made if new information comes to light.

- Life insurance proceeds don’t need to be included. A prevalent misunderstanding is that insurance payouts don't count as part of the estate. If they benefit the estate, they must be reported on the form, especially if they're part of a wrongful death claim.

Dispelling these misconceptions helps clarify the importance of the Court Inventory form and encourages accurate and timely submissions for estate matters. Being informed can reduce frustration and lead to smoother probate processes.

Key takeaways

When filling out and using the Court Inventory form, it's essential to keep a clear understanding of the process. Here are four key takeaways that can help guide you:

- Accurate Documentation: Ensure you attach all necessary documents, such as a detailed list of assets or specific tax forms like ET-90, TT-385, or Form 706. This completeness aids in avoiding delays.

- Reporting Assets: List each asset in its appropriate category, including real estate, stocks, and insurance policies. Ensure values are accurate as of the date of death to maintain compliance with legal requirements.

- Date and Signature: Don't forget to include critical dates—date of death and date of letters issued. The form must also be signed by the fiduciary or attorney, certifying that the information is true to the best of their knowledge.

- Review Regularly: Assets and financial circumstances can change. Regularly reviewing and updating the estate inventory can prevent oversights and ensure all relevant information is current.

Browse Other Templates

Leatherman Warranty - Understand that warranty service handling may take some time.

Ao78 Form - The form assists in maintaining standards for federal employment eligibility.