Fill Out Your Cp75A Form

The CP75A form is an important document issued by the Internal Revenue Service (IRS) when the agency initiates an audit regarding a taxpayer's return. This notice specifically addresses tax year 2016 and was issued on January 28, 2019. Receiving this notice indicates that the IRS has questions about certain claims made on your Form 1040, particularly the Earned Income Credit. It is crucial to respond promptly, as you have just 30 days from the notice date to provide the necessary documentation that supports the items the IRS is auditing. Failure to do so may lead to disallowance of the audited items, potentially resulting in additional tax owed. Included with the notice are instructions outlining the types of information required, as well as the means to submit your supporting documentation. You also have resources at your disposal, such as the Taxpayer Advocate Service and Low Income Taxpayer Clinics, should you need assistance during this process. Understanding your responsibilities and the next steps is vital for a smooth audit experience.

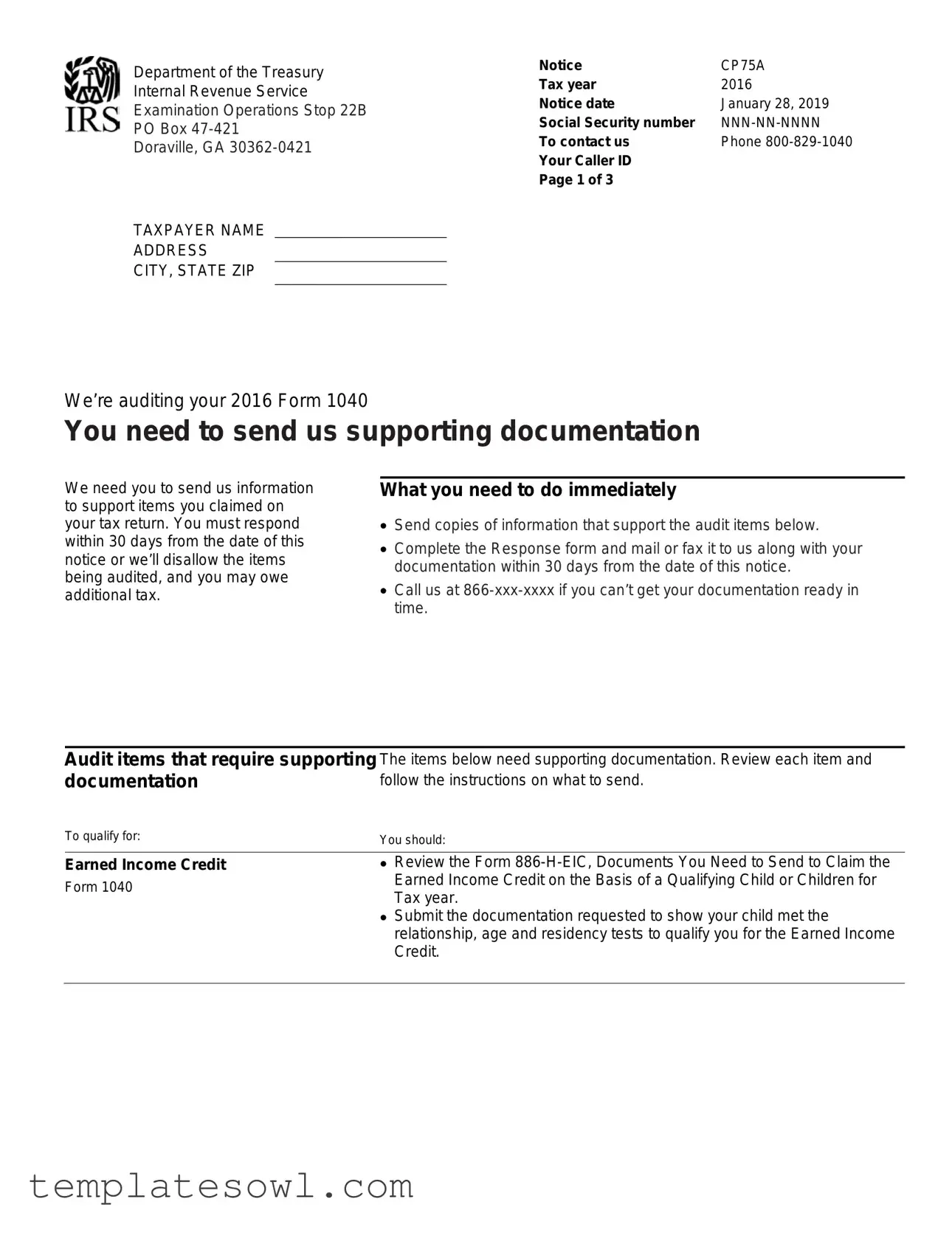

Cp75A Example

Department of the Treasury |

Notice |

CP75A |

||

Tax year |

2016 |

|||

Internal Revenue Service |

||||

Notice date |

January 28, 2019 |

|||

Examination Operations Stop 22B |

||||

Social Security number |

||||

PO Box |

|

|||

|

To contact us |

Phone |

||

Doraville, GA |

||||

Your Caller ID |

|

|||

|

|

|

||

|

|

Page 1 of 3 |

|

|

TAXPAYER NAME ____________________ |

|

|

||

ADDRESS |

____________________ |

|

|

|

CITY, STATE ZIP |

____________________ |

|

|

|

|

|

|

||

We’re auditing your 2016 Form 1040

You need to send us supporting documentation

We need you to send us information to support items you claimed on your tax return. You must respond within 30 days from the date of this notice or we’ll disallow the items being audited, and you may owe additional tax.

What you need to do immediately

•Send copies of information that support the audit items below.

•Complete the Response form and mail or fax it to us along with your documentation within 30 days from the date of this notice.

•Call us at

Audit items that require supporting The items below need supporting documentation. Review each item and

documentation |

follow the instructions on what to send. |

To qualify for: |

You should: |

Earned Income Credit

Form 1040

•Review the Form

•Submit the documentation requested to show your child met the relationship, age and residency tests to qualify you for the Earned Income Credit.

Notice |

CP75A |

Tax year |

2016 |

Notice date |

January 28, 2019 |

Social Security number |

|

Page 2 of 3 |

|

If we don’t hear from you |

If you don’t mail or fax your supporting documentation within 30 days from |

|

the date of this notice, we’ll disallow the items being audited and send you |

|

an audit report showing the proposed changes to your tax return. |

|

|

Next steps |

• We’ll review the information you provide (please allow us at least 30 |

|

days). |

|

• If the information supports your tax return, we’ll send your refund and a |

|

letter letting you know your audit is closed. |

|

• If the information doesn’t fully support your tax return, we’ll send you an |

|

audit report that explains the proposed changes, including any additional |

|

tax you may owe plus any penalties and interest that may apply. |

Additional information

•Visit www.irs.gov/cp75a

•Review the enclosed documents and The Examination Process (Publication

•For tax forms, instructions, and publications, visit

•Review the enclosed Publication 1, Your Rights as a Taxpayer.

•Keep this notice for your records.

If you need assistance, please don’t hesitate to contact us.

Taxpayer Advocate Service

The Taxpayer Advocate Service (TAS) is an independent organization within the IRS that can help protect your taxpayer rights. TAS can offer you help if your tax problem is causing a hardship, or you've tried but haven't been able to resolve your problem with the IRS. If you qualify for TAS assistance, which is always free, TAS will do everything possible to help you. Visit www.taxpayeradvocate.irs.gov or call

Low Income Taxpayer Clinics (LITC)

Assistance can be obtained from individuals and organizations that are independent from the IRS. The Directory of Federal Tax Return Preparers with credentials recognized by the IRS can be found at http://irs.treasury.gov/rpo/rpo.jsf. IRS Publication 4134 provides a listing of Low Income Taxpayer Clinics (LITCs) and is available at www.irs.gov. Also, see the LITC page at www.taxpayeradvocate.irs.gov/litcmap. Assistance may also be available from a referral system operated by a state bar association, a state or local society of accountants or enrolled agents or another nonprofit tax professional organization. The decision to obtain assistance from any of these individuals and organizations will not result in the IRS giving preferential treatment in the handling of the issue, dispute or problem. You don’t need to seek assistance to contact us. We will be pleased to deal with you directly and help you resolve your situation.

Department of the Treasury

Internal Revenue Service

Examination Operations Stop 22B

PO Box

Doraville, GA

INTERNAL REVENUE SERVICE

Examination Operations Stop 22B

PO Box

Doraville, GA

Response form

Complete this form, and mail or fax it to us within 30 days from the date of this notice. If you use the enclosed envelope, be sure our address shows through the window.

Notice |

CP75A |

Tax year |

2016 |

Notice date |

January 28, 2019 |

Social Security number |

|

Page 3 of 3 |

|

Provide your contact information

If your address has changed, please call

TAXPAYER NAME

ADDRESS

CITY, STATE ZIP

|

a.m. |

|

a.m. |

|

p.m. |

|

p.m. |

Primary phone |

Best time to call |

Secondary phone |

Best time to call |

1.Indicate which items you’re addressing with supporting documents

The enclosed documentation supports my 2016 tax return (check all that apply):

Earned Income Credit, Form 1040

2.Send this Response form to us

Mail or fax your Response form to us along with any documentation within 30 days from the date of this notice. If you’re using your own envelope, mail your package to the address on this form or, fax it to

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The CP75A form is a notice from the IRS regarding the audit of your 2016 Form 1040 tax return. |

| Response Timeframe | You must provide supporting documents within 30 days from the notice date to prevent disallowance of claimed items. |

| Documentation Required | Support for the Earned Income Credit needs documentation showing your child meets the relevant tests. |

| Contact Information | For questions or delays in documentation, you can reach the IRS at 800-829-1040. |

| Additional Resources | Visit www.irs.gov/cp75a for more information and guidance. |

Guidelines on Utilizing Cp75A

When you receive the CP75A form, it indicates that the IRS is auditing your 2016 tax return. Prompt action is necessary to ensure that you address the audit items effectively. Follow these steps to fill out the form and submit the required documentation.

- Gather your documentation: Collect all necessary supporting documents related to the items being audited, specifically for the Earned Income Credit.

- Review the form: Locate the Notice CP75A form and familiarize yourself with its sections.

- Provide your contact information: Enter your name, address, and contact numbers where indicated. Make sure this information is accurate.

- Check applicable items: Indicate which audit items you’re addressing by checking the appropriate box, such as the Earned Income Credit.

- Complete the Response form: Fill out the Response form completely, ensuring all required fields are addressed.

- Mail or fax: Send the completed Response form along with your supporting documentation within 30 days of receiving the notice. If you’re using your own envelope, mail it to the address provided on the form. Otherwise, use the enclosed envelope.

- Keep copies: Before sending your submission, make copies of everything for your records.

- Follow up: If additional time is needed to secure your documents, call the contact number provided on the notice.

By adhering to these steps, you’ll position yourself to address the audit process effectively. Make sure you meet deadlines and stay organized to facilitate smoother communication with the IRS.

What You Should Know About This Form

What is the CP75A form?

The CP75A form is a notice issued by the IRS regarding an audit of your tax return. It specifically indicates that the IRS is reviewing your 2016 Form 1040 and requires supporting documentation for certain claims made on that return.

When will I receive a CP75A notice?

You will receive a CP75A notice if the IRS decides to audit your tax return. This can happen anytime after you file your taxes, but in this case, it pertains to the 2016 tax year and was dated January 28, 2019.

What should I do when I receive the CP75A notice?

Act quickly. You have 30 days from the date of the notice to submit the requested documentation to support your claimed items. Review the notice carefully, gather your documentation, and complete the accompanying response form. Send both to the IRS via mail or fax.

What type of documentation do I need to provide?

The documentation will depend on the specific items under review. For example, if you claimed the Earned Income Credit, you must provide evidence that supports your eligibility, such as relationship, age, and residency documents for qualifying children.

What happens if I don't respond to the CP75A notice?

If you fail to provide the necessary documentation within the 30-day deadline, the IRS will disallow the items being audited. This could result in owing additional taxes, as well as possible penalties and interest.

How will the IRS handle my submitted documentation?

Once you submit your documentation, the IRS will review it. You should allow at least 30 days for them to process this information. If everything supports your tax return, the IRS will send a refund along with a notice that the audit is closed.

What if my documentation doesn't fully support my tax return?

If the IRS finds that your submitted documents do not fully support your claims, they will issue an audit report. This report will explain the proposed changes, which may include additional taxes owed as well as interest and penalties.

Can I seek help with the CP75A process?

Yes. You can get assistance from the Taxpayer Advocate Service (TAS), which can help protect your rights. If your situation causes a hardship or if you’re having difficulty resolving the issue with the IRS, TAS provides free help. Low Income Taxpayer Clinics (LITCs) are also available for additional support.

Where can I find additional information about the CP75A notice?

For more details, visit the IRS website dedicated to the CP75A form or consult IRS Publication 3498-A, which explains your appeal rights and other relevant information regarding the audit process.

Common mistakes

Completing the CP75A form can be a daunting task, especially when dealing with an audit notice. Mistakes can lead to delays or even unfavorable outcomes with the IRS. Here are eight common errors that individuals often make when filling out this important form.

One frequent mistake is neglecting to provide complete contact information. Many people forget to update their address or miss entering their phone numbers. Accurate contact details are crucial; without them, the IRS may struggle to reach you for clarification or further communication.

Another common error involves failing to respond within the designated 30-day timeframe. It’s easy to push this task aside, but if you miss this window, the IRS may disallow the items being audited. This can result in additional tax liabilities that could have been avoided with a timely response.

Some individuals also make the mistake of submitting inadequate documentation. It's essential to provide all requested supporting documents that validate the items under audit. If the IRS needs information about your Earned Income Credit, for instance, the necessary forms and evidence must accompany your response.

People sometimes underestimate the importance of checking all applicable boxes on the Response form. When indicating which items you’re addressing, it’s vital to mark every relevant category. Failing to do so can create confusion and may lead to delays in processing your information.

Additionally, inaccuracies in filling out personal information can be a significant issue. Simple errors, such as misspellings of your name or incorrect Social Security numbers, can lead to complications. It’s wise to verify all details for accuracy before submitting the form.

Some individuals forget to keep copies of their submitted documents. Retaining a record of what has been sent provides a backup in case the IRS claims they did not receive the information. This can serve as proof of compliance with their requests.

Relying solely on verbal communication without following up in writing is another error. While it might be tempting to call the IRS for clarification, it’s crucial to confirm any agreements or information discussed over the phone with documentation. This helps maintain a clear record of all interactions.

Lastly, it’s important to avoid procrastination. Waiting too long to gather your documents or to fill out the form can lead to unnecessary stress and increased risks of missing deadlines. Staying organized and proactive can help ensure a smoother process in addressing your audit.

By avoiding these common mistakes, you can better navigate the complexities of the CP75A form and improve your chances of a favorable outcome with the IRS.

Documents used along the form

When navigating the complexities of an IRS audit, the CP75A form is important, but it’s not the only document you may need. Several accompanying forms and documents can help you respond effectively and support your claims. Here's a look at some essential forms often used alongside the CP75A notices.

- Form 1040: This is the standard individual income tax return form. It summarizes your income, deductions, and ultimately determines your tax liability for the year being audited. You'll need this to provide context for the items the IRS is questioning.

- Form 886-H-EIC: Specifically related to the Earned Income Tax Credit (EITC), this form provides guidance on the documentation needed to prove eligibility based on qualifying children. If you claimed this credit, submit the requested evidence to support your claim.

- Publication 3498-A: This IRS publication details your rights and the examination process. It can provide clarity on what to expect during an audit and outline your options, including the appeal process if disagreements arise.

- Publication 1: Titled "Your Rights as a Taxpayer," this publication explains taxpayer rights when dealing with the IRS. It's essential for understanding the protections available to you throughout the audit process.

- Response Form: Enclosed with the CP75A notice, this form must be completed and returned to the IRS, indicating which items you're addressing. You’ll need to specify the documents being submitted in support of your tax return.

- Taxpayer Advocate Service (TAS) Information: While not a form, guidelines and contact information for TAS can be crucial if you experience hardship. TAS can help navigate unresolved issues, offering a pathway to additional support.

Being prepared with these forms and documents can significantly enhance your ability to respond to the IRS effectively. Keeping organized records not only aids in your current audit but also simplifies future tax submissions.

Similar forms

The CP75A form is similar to several other notices and forms issued by the IRS, primarily in their purpose of communication and requirement for action or documentation from taxpayers. Below are five documents that share similarities with the CP75A form:

- Form 1040 - This is the individual income tax return form used to report personal income. Like the CP75A, it requires supporting documentation for various claims, such as deductions or credits.

- Notice CP2000 - This notice informs taxpayers of proposed changes to tax returns due to discrepancies in information. Both CP2000 and CP75A requests documentation to substantiate claims made on the tax return.

- Notice of Deficiency (90-Day Letter) - This notice alerts taxpayers of the IRS’s intent to assess additional tax due to inaccuracies in their returns. It requires a response within a specific timeframe, similar to the 30-day response window of the CP75A.

- Form 886-H-EIC - Used specifically to verify eligibility for the Earned Income Credit. This form is referenced in the CP75A and both are critical for supporting evidence regarding tax credits.

- Publication 3498-A - This publication outlines taxpayer rights during the examination process. Similar to the CP75A, it aims to inform taxpayers about their responsibilities and rights when the IRS is auditing their returns.

Dos and Don'ts

When filling out the CP75A form, adherence to proper procedures is crucial for a smooth audit process. Below are some recommended actions and common pitfalls to avoid.

- Ensure accuracy in your personal information. Double-check your name, address, and Social Security number to avoid discrepancies.

- Submit documentation within the specified 30 days. Timely submission is essential to prevent disallowance of audit items.

- Review requirements carefully. Each item being audited has specific documentation needed; make sure you provide what's necessary.

- Keep copies of all documents you send. Having your own records will help you track what has been submitted.

- Contact the IRS if you need more time. Call the provided number if you can't gather your documents in the required timeframe.

- Do not ignore the notice. Failing to respond can lead to unfavorable tax adjustments.

- Avoid sending original documents. Always send copies instead, as original documents may not be returned.

- Don’t hesitate to seek assistance if you're unsure. Utilize resources like the Taxpayer Advocate Service or Low Income Taxpayer Clinics for help.

By following these guidelines, you can navigate the audit process with greater confidence and clarity.

Misconceptions

- Misconception 1: The CP75A form is a notice of tax fraud.

- Misconception 2: Responding to the CP75A notice is optional.

- Misconception 3: You can ignore the CP75A notice if you already filed an appeal.

- Misconception 4: The IRS will automatically close the audit if no response is provided.

Many taxpayers mistakenly believe that receiving a CP75A form indicates they are being accused of tax fraud. In reality, this notice is simply a part of the audit process. The IRS uses this form to request supporting documentation for specific items claimed on your tax return, allowing you to verify your information and resolve any discrepancies without implying wrongdoing.

This is not true. It's critical to respond to the CP75A notice within the specified 30-day period. Failing to provide the requested documentation could lead to the IRS disallowing the items under audit. This might result in owing additional taxes or facing penalties, so timely response is vital.

Some taxpayers think that filing an appeal means they can disregard the CP75A request. However, it's important to understand that you still need to provide the requested documentation relevant to the audit. Not addressing the specific items can hinder your appeal process and may result in unfavorable outcomes.

This is a common misunderstanding. If you do not respond to the CP75A notice, the IRS will not close the audit on your behalf. Instead, they will likely disallow the audit items and issue an audit report that includes proposed changes to your tax return, potentially increasing your tax liability. Proactive engagement is key to a smoother resolution.

Key takeaways

When managing your CP75A form, it’s essential to understand its purpose and requirements. Here are some key takeaways:

- Timely Response is Crucial: You have 30 days from the date of the notice to provide the requested documentation. Missing this deadline may result in the disallowance of the items under audit.

- Documentation is Required: The IRS specifically asks for supporting documentation related to items claimed on your tax return. Ensure you submit relevant papers as outlined in the notice.

- Earned Income Credit (EIC): If you’re claiming EIC, review Form 886-H-EIC. You need to prove that your child met relationship, age, and residency tests.

- Keep Records: Save a copy of the notice and all documentation sent. Maintaining organized records can help in future correspondences.

- Communication with the IRS: If you can’t gather the documentation in time, reach out at the provided number. They may allow extensions or offer guidance.

- Review Process: After submission, allow at least 30 days for the IRS to review your information. They will notify you of the outcome.

- Possible Outcomes: Your audit might conclude with either a refund or an audit report detailing proposed changes. Understand what the implications of these outcomes are.

- Seek Help if Needed: Resources like the Taxpayer Advocate Service exist to assist you. If you're experiencing hardship, do not hesitate to reach out.

Browse Other Templates

Af Form 174 - The evaluation process is critical for career development and employee motivation.

California Promise - Input your IRS address for 1099 tax documents and related correspondence.

Aud Credit Reporting - Disputes filed via this form can result in corrections that enhance creditworthiness.