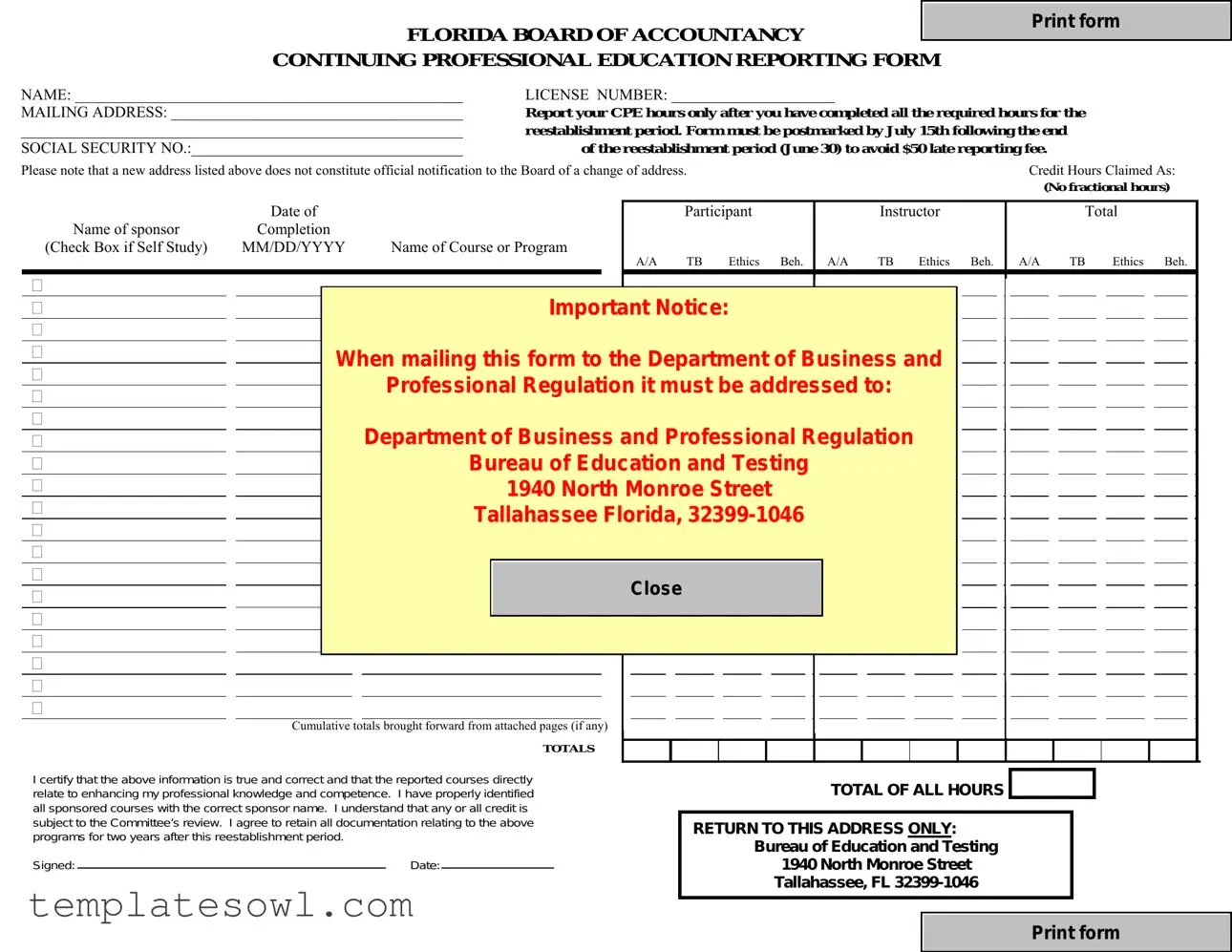

Fill Out Your Cpe Reporting Florida Form

Fulfilling continuing education requirements is a crucial part of maintaining a professional accountancy license in Florida. The CPE Reporting Florida form serves as a key tool for licensees to document their compliance with the state's continuing education mandates. It allows professionals to report the continuing professional education (CPE) hours they’ve earned over a two-year reestablishment period. To avoid any penalties, this form needs to be postmarked by July 15th after the completion of the reestablishment period. It's important to note that simply providing a new mailing address on this form does not officially inform the Board of any address changes. This form requires specific details, including the total hours completed, course names, sponsors, and whether courses were self-study. Each report must be thorough; incomplete forms may be returned without processing. Understanding the minimum requirements is essential: licensees must complete at least 80 total hours, with stipulations on the types and categories of education. Ethical training is particularly emphasized, alongside accounting and behavioral subjects. To ensure the courses count, they must be taken from approved sponsors, and meticulous attention to record-keeping is recommended for compliance. Whether you take self-study courses or attend lectures, accurately logging your hours and maintaining appropriate documentation not only keeps you in good standing but helps enhance your professional capabilities.

Cpe Reporting Florida Example

FLORIDA BOARD OF ACCOUNTANCY |

|

|

Print form |

|

|

|

|

|

|

CONTINUING PROFESSIONAL EDUCATION REPORTING FORM |

|

|

||

NAME: __________________________________________________ |

LICENSE NUMBER: _____________________ |

MAILING ADDRESS: ______________________________________ |

Report your CPE hours only after you have completed all the required hours for the |

_________________________________________________________ |

reestablishment period. Form must be postmarked by July 15th following the end |

SOCIAL SECURITY NO.:___________________________________ |

|

|

of the reestablishment period (June 30) to avoid $50 late reporting fee. |

|||||||||||||||||||||||||||||

Please note that a new address listed above does not constitute official notification to the Board of a change of address. |

|

|

|

|

|

|

Credit Hours Claimed As: |

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(No fractional hours) |

||||||

|

|

Date of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Name of sponsor |

|

|

|

|

|

|

|

|

Participant |

|

|

|

Instructor |

|

|

Total |

||||||||||||||||

Completion |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

(Check Box if Self Study) |

MM/DD/YYYY |

|

Name of Course or Program |

A/A TB Ethics Beh. |

|

A/A |

|

TB Ethics Beh. |

A/A TB Ethics Beh. |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

Important Notice: |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

When mailing this form to the Department of Business and |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

Professional Regulation it must be addressed to: |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

Department of Business and Professional Regulation |

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

Bureau of Education and Testing |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

1940 North Monroe Street |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

Tallahassee Florida, |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Close |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cumulative totals brought forward from attached pages (if any)

|

|

|

|

TOTALS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I certify that the above information is true and correct and that the reported courses directly |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

TOTAL OF ALL HOURS |

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

relate to enhancing my professional knowledge and competence. I have properly identified |

|

|

|

|

|

|

|

|

|

|

||||||||||

all sponsored courses with the correct sponsor name. I understand that any or all credit is |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

subject to the Committee’s review. I agree to retain all documentation relating to the above |

|

|

|

|

RETURN TO THIS ADDRESS ONLY: |

|

|

|

|

|

||||||||||

programs for two years after this reestablishment period. |

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

Bureau of Education and Testing |

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Signed: |

|

Date: |

|

|

|

|

|

|

|

1940 North Monroe Street |

|

|

||||||||

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

Tallahassee, FL |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Print form

INSTRUCTIONS FOR COMPLETING THIS FORM

1.This form must be printed or typed and returned to the Bureau of Education & Testing. All information requested on the form must be completed. Courses must be listed directly on the form to make it complete. Incomplete forms cannot be evaluated and will be returned. (Licensees should retain a copy for their files). Xeroxed copies are acceptable. However, original signatures are required.

2.The minimum requirements for each two year reestablishment period are completion of at least 80 total hours, of which at least 20 hours must be in accounting and auditing (A/A) subjects, 4hours must be in ethics, and no more than 20 hours may be in behavioral subjects. The A/A category includes courses on financial reporting, financial auditing, the related pronouncements, and accounting for specialized industries. The Technical Business category includes courses on taxation, MAS, and general business subjects. The Behavioral category includes courses on oral and written communication, practice administration, management, and marketing. The Ethics category includes only providers and courses approved by the Florida Board of Accountancy. The list of approved courses is available on the board’s website http://www.myflorida.com/dbpr/cpa.

3.Please indicate

4.If the course was presented by an approved sponsor, please enter the sponsor code. If the sponsor was not approved leave this area blank. Note that sponsors do not report for you. You must report all courses which you wish to have recorded.

5.When listing the sponsor code, be certain to complete the blanks with the alpha letter in the first column followed by the numeric digits.

6.Credit can be claimed for two types of activity: (1) hours earned as a participant and (2) hours earned as an instructor or lecturer. If you are reporting hours of instruction, you may claim double credit for the first presentation of the course, single credit for the second presentation of the same course, and no credit thereafter except for new content (See Rule

7.List the hours claimed in the appropriate column. Report whole hours only, no fractions. Fractional hours must be rounded down to the nearest whole hour. Any fractional hour reported will be removed. Total all columns and indicate the total of all hours from all categories in the box at the bottom.

8.The form must be signed and dated. Be sure to indicate your employer or firm name.

9.You are required to notify the Board office in writing of address changes (Rule 61H126.005). A change of address on this reporting form will not constitute official notification and will not result in an address change.

10.If there are any questions regarding the use of this form, contact:

Bureau of Education & Testing

1940 N. Monroe Street

Tallahassee, Florida

Or by Phone: 850.487.1395

*Under the Federal Privacy Act, disclosure of Social Security numbers is voluntary unless specifically required by Federal statute. In this instance, social security numbers are mandatory pursuant to Title 42 United States Code, Sections 653 and 654; and sections 455.203(9), 409.2577, and 409.2598, Florida Statutes. Social Security numbers are used to allow efficient screening of applicants and licensees by a Title

DBPR FORM CPA41

Form Characteristics

| Fact Name | Description |

|---|---|

| Submission Deadline | The CPE Reporting Form must be postmarked by July 15th following the end of the reestablishment period (June 30) to avoid a $50 late reporting fee. |

| Minimum Hour Requirements | Licensees must complete a minimum of 80 total hours within each two-year reestablishment period, with specific hour allocations for different categories. |

| Required Ethics Hours | Among the total, at least 4 hours must be in ethics from courses approved by the Florida Board of Accountancy. |

| Course Reporting | All courses must be listed directly on the form. Incomplete forms will be returned and cannot be evaluated. |

| Address Change Notification | A new address on this form does not constitute official notification to the Board about an address change, as per Rule 61H126.005. |

| Social Security Number Requirement | Social security numbers are required for license applications under specific federal and state laws, primarily to screen for compliance with child support obligations. |

| Self-Study Courses | Self-study courses must come from sponsors approved by NASBA's Quality Assurance Service and must be marked clearly on the form. |

Guidelines on Utilizing Cpe Reporting Florida

After completing the required continuing professional education (CPE) hours, it's time to accurately fill out the CPE Reporting Form for Florida. Ensure that all sections are completed thoroughly to avoid setbacks in processing your report.

- Print or type the form. Ensure all fields are filled in completely. Incomplete submissions will be returned.

- Provide your name, license number, and mailing address in the designated areas.

- Report your Social Security number in the appropriate field.

- Enter the total hours for the reestablishment period in the designated box.

- List each course you attended along with:

- The date of completion (MM/DD/YYYY)

- The name of the sponsor

- The name of the course or program

- The total hours earned

- Check the box if the course was self-study

- Ensure to classify the courses under the appropriate categories: Accounting and Auditing (A/A), Technical Business (TB), Behavioral (Beh), or Ethics.

- For self-study or correspondence courses, write the sponsor's name and mark the box beside it.

- If the course was presented by an approved sponsor, include their sponsor code. Leave blank if not approved.

- Calculate and list the total hours claimed for each category.

- Round down any fractional hours. Total all columns and place the overall total in the designated box.

- Sign and date the form, including your employer or firm name.

- Mail the completed form to:

- Department of Business and Professional Regulation

- Bureau of Education and Testing

- 1940 North Monroe Street

- Tallahassee, Florida, 32399-1046

After submitting the form, keep a copy for your records. If you have any questions during the process, reaching out to the Bureau of Education & Testing will provide the necessary assistance.

What You Should Know About This Form

What is the CPE Reporting Florida form used for?

The CPE Reporting Florida form is used by licensed accountants in Florida to report their Continuing Professional Education (CPE) hours. This report must reflect the completion of CPE hours that enhance professional knowledge and competence during a specified reestablishment period.

When is the deadline for submitting the CPE Reporting form?

The form must be postmarked by July 15th, following the end of the reestablishment period, which concludes on June 30. Late submissions may incur a $50 fee.

What are the minimum requirements for CPE hours?

Licensees must complete a minimum of 80 total hours during each two-year reestablishment period. This includes 20 hours in accounting and auditing subjects, 4 hours in ethics, and no more than 20 hours in behavioral subjects.

What happens if the form is incomplete?

Incomplete forms cannot be evaluated and will be returned. It is essential to complete all requested information and list all courses to ensure the form is accepted. Keeping a copy for personal records is recommended.

How should self-study courses be reported?

Self-study or correspondence courses must be clearly indicated on the form. Licensees need to write the sponsor's name and check the appropriate box. Only courses from sponsors approved by NASBA's Quality Assurance Service can be claimed for CPE credit.

Can I report hours as an instructor?

Yes, credit can be claimed for hours earned as both a participant and an instructor. Instructors may claim double credit for the first presentation of a course and single credit for any subsequent presentations.

What should I do if my mailing address changes?

Changes of address must be reported to the Board office in writing. Simply listing a new address on the CPE Reporting form does not officially notify the Board of the change.

What is the purpose of providing my Social Security number on the form?

The Social Security number is required for identification purposes and to ensure compliance with child support obligations. This requirement is in accordance with federal and state laws. Disclosure of Social Security numbers is voluntary in other contexts.

Common mistakes

Many individuals make common mistakes when completing the CPE Reporting Florida form, which can lead to delays or complications in processing. One frequent error is failing to report all required continuing professional education (CPE) hours. The form requires a minimum of 80 hours, with specific allocations for accounting and auditing, ethics, and behavioral subjects. If hours are not reported fully or are miscategorized, this can result in an incomplete submission.

Another mistake often observed is the completion and submission of incomplete forms. The instructions clearly state that all information must be filled out and that incomplete forms will be returned. Some individuals might overlook portions of the form or forget to provide essential details, such as the instructor’s name or the course completion date. Missing these elements can lead to a rejection of the application.

Additionally, participants sometimes forget to round their claimed hours correctly. The instructions specify that only whole hours should be reported. Any fractional hours must be rounded down. Reporting a fractional hour, even by mistake, will result in its removal from the total claimed hours, potentially jeopardizing meeting the necessary requirements.

Lastly, individuals often provide incorrect or incomplete sponsor information. It is crucial to list the correct sponsor code and acknowledge any self-study courses taken. Errors in this section can lead to confusion and an inability for the board to verify course eligibility. Accurate and thorough information is essential to ensure the successful processing of the CPE hours claimed on the form.

Documents used along the form

When completing the Continuing Professional Education (CPE) Reporting Form for Florida, additional forms and documents may be required to ensure that all educational credits are properly recorded and verified. Understanding these accompanying documents can streamline the completion of your CPE requirements. Here’s a brief overview of six commonly used forms along with the CPE Reporting Form:

- Course Completion Certificates: After completing any CPE course, you typically receive a certificate indicating the hours earned and the course details. This document serves as tangible proof of your participation and must be retained for your records.

- Documentation of Self-Study: If you claim credit for self-study courses, it's essential to keep any materials such as workbooks or completion letters provided by the sponsor. This documentation supports the hours requested on the CPE Reporting Form.

- Sponsor Approval Letters: Some courses may require verification that the sponsor is approved by NASBA's Quality Assurance Service. Keep any letters or communications from sponsors that confirm their approved status, as this may be necessary if questions arise during your reporting.

- Previous CPE Reports: Saving copies of your CPE reports from previous years can be beneficial for reference. It can also help ensure continuity and completeness when reporting your educational hours over multiple reestablishment periods.

- Employer or Firm Verification: If your CPE credits were sponsored by your employer, obtaining a letter of verification from them may be advantageous. This document can affirm your participation and the number of hours completed while reinforcing the connection to your professional development.

- Forms for Special Circumstances: Should any unique situations arise, such as needing to report credits for a non-traditional course or an appeal for late reporting, additional forms may be required. Make sure to check with the Bureau of Education and Testing for any specific formats necessary in such instances.

Being aware of these documents and forms can make the process of completing your CPE Reporting Form smoother and more efficient. Proper record-keeping ensures that you meet your educational requirements without any delays or issues with the Florida Board of Accountancy.

Similar forms

- Professional Development Hours Reporting Form: Similar to the CPE Reporting Florida form, this document serves to track and report hours of professional development activities completed by an individual, ensuring compliance with industry requirements.

- Continuing Education Report for Nurses: This report outlines the continuing education hours nurses must complete to retain their licensure, similar in format and function to collect documentation of training completed during a renewal period.

- License Renewal Application for Teachers: This application requires educators to submit proof of completed professional learning hours, mirroring the CPE Reporting form in its requirement for thorough record-keeping and submission before deadlines.

- Real Estate Continuing Education Reporting Form: Just like the CPE Reporting Florida form, this document helps real estate agents track their continuing education credits to maintain their licenses, detailing the number of hours completed and courses attended.

- CPR Certification Renewal Application: This application captures training hours and courses completed by healthcare professionals to renew their CPR certification, paralleling the CPE Reporting Florida form in the collection of educational records.

- Continuing Legal Education Compliance Form: Attorneys must complete a specific number of hours in continuing legal education; this form similarly requires documentation of completed courses, akin to the CPE Reporting Florida form's requirements.

- Insurance Continuing Education Transcript: This transcript outlines the training that insurance agents have undertaken. It maintains a format that focuses on reporting hours similar to the CPE Reporting Florida form.

- Aviation Training Record: Pilots and aviation professionals use this document to log hours of flight training and education, echoing the CPE Reporting form's recording of educational hours and completion of courses.

- Social Work Continuing Education Verification Form: This document requires social workers to report their continuing education hours to maintain licensure, functioning like the CPE Reporting Florida form in terms of necessary documentation.

- Chiropractic Continuing Education Tracking Form: This form allows chiropractors to track their continuing education credits over a reporting period, reflecting a similar structure and purpose to the CPE Reporting Florida form.

Dos and Don'ts

When filling out the CPE Reporting Florida form, it’s important to keep a few key points in mind. Here’s a concise guide on what to do and what to avoid:

- Do ensure that all required information is completed on the form. Missing details can lead to delays or rejection.

- Do report your CPE hours only after completing the necessary hours for the reestablishment period.

- Don't submit fractional hours. Round down to the nearest whole hour to ensure compliance.

- Don't rely on the form to update your address. Notify the Board in writing separately for any changes.

Misconceptions

Misconception 1: The CPE Reporting Form can be submitted at any time after completing the required hours.

This is incorrect. The form must be postmarked by July 15th following the end of the reestablishment period, which ends on June 30. Failing to submit on time results in a $50 late reporting fee.

Misconception 2: Any change of address written on the CPE Reporting Form will automatically update my information with the Board.

This is not true. A new address included on the CPE form does not officially notify the Board of any changes. Licensees must submit a written notification separately to update their official address.

Misconception 3: I can report fractional hours for my CPE credits.

Fractional hours are not allowed. All claimed hours must be whole numbers. Any reported fractions will be rounded down to the nearest whole hour, and values less than one hour will be removed entirely.

Misconception 4: The CPE courses do not need to be approved by any governing body.

This is misleading. Courses must be from providers approved by the Florida Board of Accountancy. Additionally, self-study courses must be taken from sponsors approved by NASBA's Quality Assurance Service to qualify for accounting and/or auditing credits.

Misconception 5: I do not have to keep documentation of my completed courses.

In reality, licensees must retain all documentation related to the reported programs for two years after the reestablishment period. This ensures compliance and provides support for any claims during the review process.

Key takeaways

- Complete All Information: Ensure that every section of the CPE Reporting Form is filled out completely. Incomplete forms will be returned.

- Understand the Requirements: You must complete at least 80 hours of continuing education, which includes 20 hours in accounting and auditing, 4 hours in ethics, and a maximum of 20 hours in behavioral subjects.

- Self-Study Courses: Identify self-study or correspondence courses by marking the appropriate box next to the sponsor's name. Only courses approved by NASBA's Quality Assurance Service qualify.

- Credit Hours: Report only whole hours. Any fractional hours will be rounded down and eliminated from your total.

- Sign and Date: Your form must be signed and dated. Include your employer or firm name as well.

- Address Changes: Notify the Board separately in writing if your address changes. Address changes on the reporting form are not official.

Browse Other Templates

Ogden Standard Obituaries - Using concise language can help maximize the space available within the line count limitations.

Sf-50 Form - The SF 50 also includes specifics about organizational information related to the employee's position.

Doh 4359 Form - Emergency preparedness regarding the patient's ability to call for help is crucial.