Fill Out Your Cpi Crs 13 146 Form

The Cpi Crs 13 146 form facilitates important financial decisions regarding contract exchanges within a 403(b) plan. This form allows participants to transfer assets from one vendor to another, but certain conditions must be met for the transfer to be valid. It's essential that the receiving vendor has an established information-sharing agreement with the participant's employer. Before initiating any transfer, participants must obtain a voucher, as conducting a transfer without one may jeopardize the tax-qualified status of the funds, leading to unforeseen tax liabilities. Participants are also asked to provide detailed personal information and account specifics to ensure the process moves smoothly. This includes verifying if any other contracts with different vendors exist and listing them as necessary. Additionally, the form emphasizes that various vendors may have their own restrictions, which could complicate the transfer process. Participants are urged to carefully complete the information requested in Sections A, B, and C of the form, as this contributes to a seamless transfer experience, but does not guarantee approval. Ultimately, ensuring accuracy and compliance will help preserve the intended tax advantages of the account.

Cpi Crs 13 146 Example

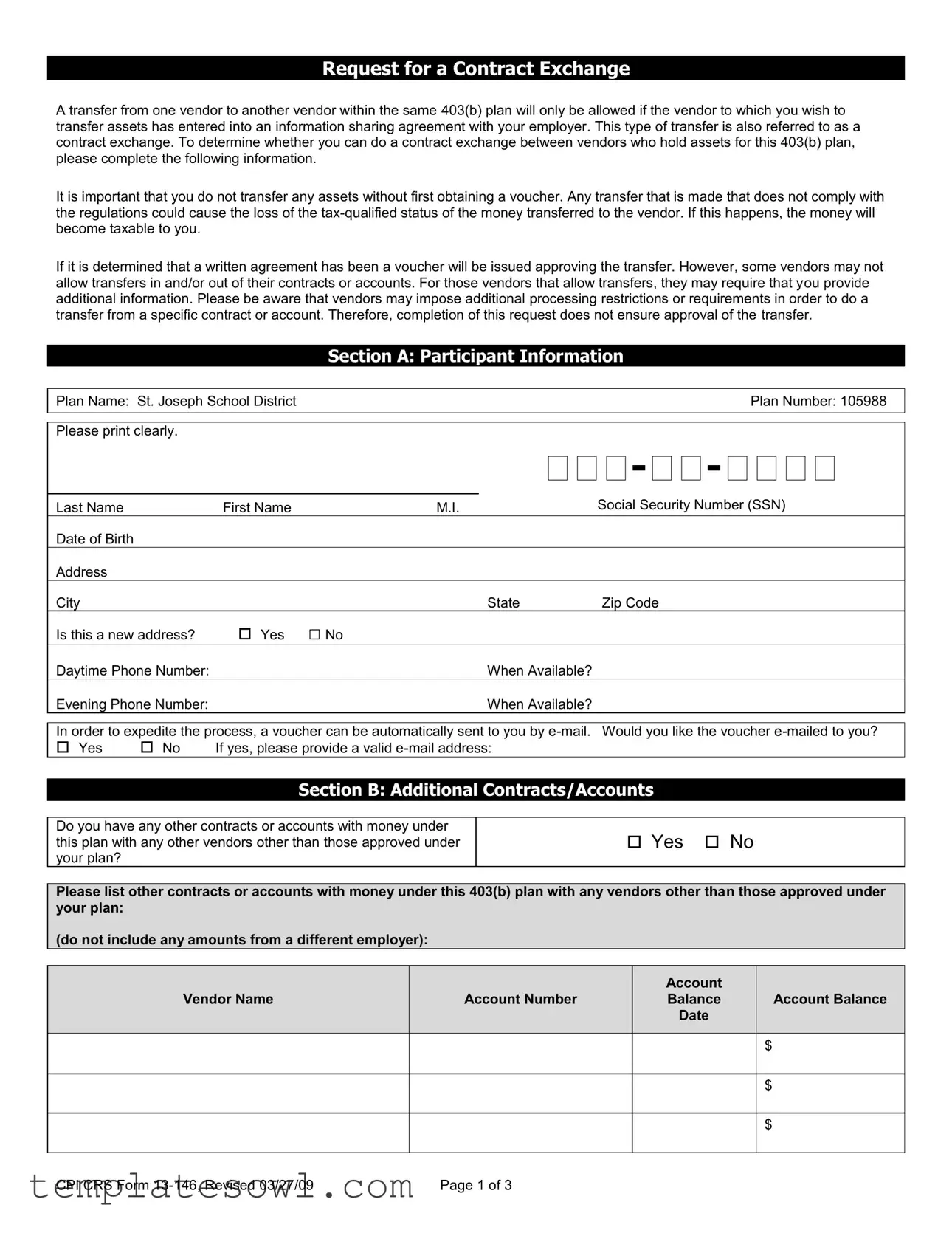

Request for a Contract Exchange

A transfer from one vendor to another vendor within the same 403(b) plan will only be allowed if the vendor to which you wish to transfer assets has entered into an information sharing agreement with your employer. This type of transfer is also referred to as a contract exchange. To determine whether you can do a contract exchange between vendors who hold assets for this 403(b) plan, please complete the following information.

It is important that you do not transfer any assets without first obtaining a voucher. Any transfer that is made that does not comply with the regulations could cause the loss of the

If it is determined that a written agreement has been a voucher will be issued approving the transfer. However, some vendors may not allow transfers in and/or out of their contracts or accounts. For those vendors that allow transfers, they may require that you provide additional information. Please be aware that vendors may impose additional processing restrictions or requirements in order to do a transfer from a specific contract or account. Therefore, completion of this request does not ensure approval of the transfer.

Section A: Participant Information

Plan Name: St. Joseph School District |

|

|

Plan Number: 105988 |

|

|

|

|

|

|

|

|

|

|

|

Please print clearly. |

|

|

|

|

|

|

|

||

Last Name |

First Name |

M.I. |

Social Security Number (SSN) |

|

Date of Birth |

|

|

|

|

Address |

|

|

|

|

City |

|

|

State |

Zip Code |

Is this a new address? |

Yes |

□ No |

|

|

Daytime Phone Number: |

|

|

When Available? |

|

Evening Phone Number: |

|

|

When Available? |

|

In order to expedite the process, a voucher can be automatically sent to you by

Yes |

No |

If yes, please provide a valid |

Section B: Additional Contracts/Accounts

Do you have any other contracts or accounts with money under this plan with any other vendors other than those approved under your plan?

Yes No

Please list other contracts or accounts with money under this 403(b) plan with any vendors other than those approved under your plan:

(do not include any amounts from a different employer):

|

|

|

|

|

|

|

|

|

|

|

|

|

Account |

|

|

|

|

|

|

|

|

|

|

|

Vendor Name |

|

Account Number |

|

Balance |

|

Account Balance |

|

|

|

|

|

Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

CPI CRS Form |

|

Page 1 of 3 |

|

|

|

|

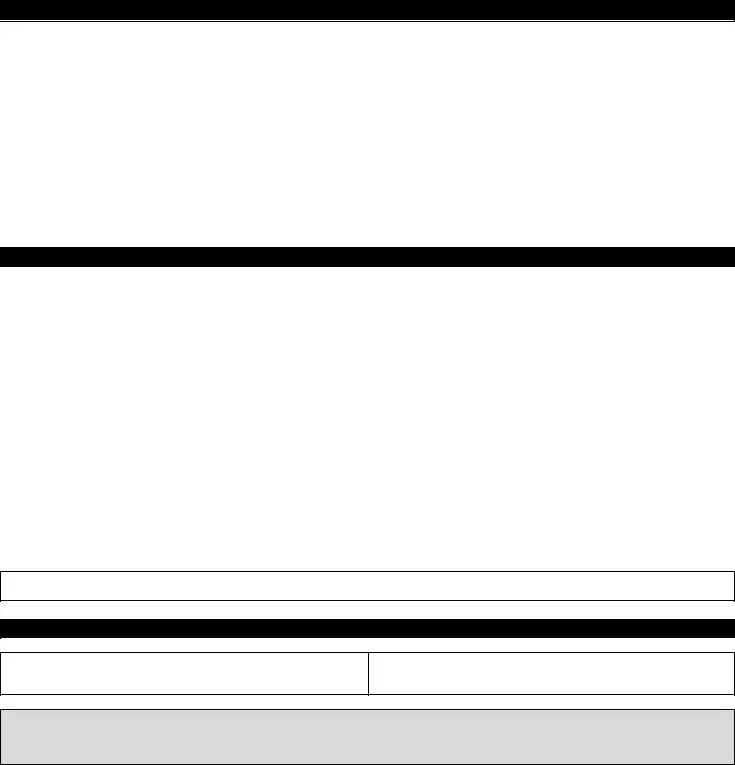

Section C: Choose a Vendor

List the vendor and enter the amount you wish to transfer from one vendor to another vendor on the chart below.

You will need to complete a separate request for each transfer.

Transfer from Account

|

|

|

|

|

|

|

Vendor Name |

|

Account Number |

|

Total Account Balance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transfer to Account |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Approved Vendor Name |

|

Account Number |

|

Total Amount to Transfer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Please Note: Your vendors may impose additional restrictions or requirements in order to receive transfer funds from a specific contract or account. Some vendors may not allow transfers. For those vendors that allow transfers, they may require that you provide additional information. Therefore, completion of this request and receipt of a voucher does not ensure you can transfer the funds as requested.

Participant Certification

I certify that the information provided in this request is true and correct to the best of my knowledge. I understand that the voucher will expire after 30 days from the date it was issued. If the voucher is not used within the 30 days, it will become invalid and it will be necessary to request a new voucher.

Printed Name

Signature

Date

Please send this request to the provided information:

CPI CRS Form |

Page 2 of 3 |

CPI Common Remitter Services

4903 10th Street

P.O. Box 110

Great Bend, KS 67530

Fax (620)

CPI CRS Form |

Page 3 of 3 |

Form Characteristics

| Fact Name | Fact Details |

|---|---|

| Form Purpose | This form is used for requesting a contract exchange between vendors within the same 403(b) plan. |

| Vendor Agreement | A transfer is allowable only if the receiving vendor has an information-sharing agreement with the employer. |

| Tax Implications | Non-compliance with transfer regulations may lead to loss of tax-qualified status, resulting in taxation on transferred money. |

| Approval Requirement | A voucher must be obtained before transferring any assets to ensure compliance and approval. |

| Processing Restrictions | Vendors may impose additional restrictions or requirements for processing transfers from their contracts or accounts. |

| Participant Information | Section A of the form requires detailed participant information, including name, SSN, and contact details. |

| Multiple Transfers | If multiple transfers are desired, a separate request must be completed for each transfer. |

| Return Address | Requests should be sent to CPI Common Remitter Services at the specified address in Great Bend, KS. |

Guidelines on Utilizing Cpi Crs 13 146

Completing the Cpi Crs 13 146 form requires careful attention and accuracy. This form facilitates a contract exchange within your 403(b) plan, allowing you to move assets from one vendor to another under specific conditions. Follow the steps outlined below to ensure your application is filled out correctly.

- Begin with Section A: Participant Information. Write the name of your plan: St. Joseph School District, Plan Number: 105988.

- Print your last name, first name, and middle initial clearly in the designated boxes.

- Enter your Social Security Number (SSN) and date of birth.

- Fill out your full address, including city, state, and zip code.

- Indicate if this is a new address by selecting either Yes or No.

- Provide your daytime and evening phone numbers along with the best times to reach you.

- Decide whether you want the voucher emailed to you. If yes, provide a valid email address.

- Move to Section B: Additional Contracts/Accounts. Answer Yes or No to the question regarding any other accounts under this plan.

- If applicable, list any other contracts or accounts, including the vendor name, account number, balance, and balance date as required.

- Proceed to Section C: Choose a Vendor. Fill in the vendor name and account number for the account you want to transfer from.

- Specify the total account balance and the amount you wish to transfer.

- Then, enter the details of the vendor you wish to transfer to, providing their name, account number, and the total amount to transfer.

- In the Participant Certification section, read the statement and certify that the information provided is true by printing your name, signing, and dating the form.

- Finally, send the completed form to the address provided, which is CPI Common Remitter Services, 4903 10th Street, P.O. Box 110, Great Bend, KS 67530. You may also send it via fax at (620) 792-5622.

After submitting this form, await the issuance of a voucher. Remember, the voucher will expire within 30 days, so keep an eye on the timeline to ensure the successful transfer of your assets.

What You Should Know About This Form

What is the purpose of the CPI CRS 13 146 form?

The CPI CRS 13 146 form is used to request a transfer of assets, commonly known as a contract exchange, from one vendor to another within the same 403(b) plan. This transfer is only permitted if the receiving vendor has an information sharing agreement with your employer. It's crucial to ensure compliance with regulations to avoid potential tax burdens. Completing this form allows for the evaluation of whether a transfer can occur under the specific guidelines of your plan.

What happens if I complete the form but do not obtain a voucher?

If you do not obtain a voucher before initiating a transfer, you risk jeopardizing the tax-qualified status of the funds being transferred. This situation could lead to these funds becoming taxable to you, which can result in unexpected financial consequences. Therefore, it is essential to first secure the voucher to confirm that all conditions for the transfer are met.

Can my request for a contract exchange be denied?

Yes, your request for a contract exchange can be denied. Several factors influence this outcome, such as whether the vendor allows transfers and if additional requirements or restrictions are imposed. Each vendor has unique policies, and simply completing the request form does not guarantee that a transfer will be approved. It’s always best to check with the vendor directly for their specific guidelines.

How long is the voucher I receive valid for?

The voucher issued after your request is only valid for 30 days. If it remains unused within that period, it will expire, necessitating a new request for a voucher. Timeliness is key when dealing with transfers, so be proactive in ensuring that you utilize the voucher before the 30-day window closes.

What information do I need to provide when completing the form?

When completing the CPI CRS 13 146 form, you will need to provide detailed participant information, including your name, Social Security number, contact details, and a summary of any other contracts or accounts related to your 403(b) plan. Additionally, you will select the vendor you wish to transfer from and the vendor to which you want to transfer your assets. Ensure that all information is accurate to avoid delays in processing your request.

Common mistakes

Filling out the Cpi Crs 13 146 form accurately is crucial for a smooth contract exchange. One common mistake occurs in the Participant Information section. Users frequently skip or misinterpret the requirement to print clearly. Handwriting that is illegible can lead to misunderstandings and processing delays, which may hinder the transfer process.

Another error often seen is related to the Social Security Number (SSN) entry. Many individuals overlook the importance of providing the SSN without any duplications or omissions. Errors in this crucial identification number can result in significant complications, including the possibility of losing the tax-qualified status of the transferred funds.

Additionally, applicants sometimes neglect to answer the vendor restrictions question accurately. The form asks if there are any other contracts or accounts with vendors not approved under the plan. Failing to disclose this information may lead to problems down the line. It is essential to provide complete details about all relevant accounts to ensure compliance with transfer regulations.

Lastly, some individuals do not pay attention to the voucher expiration information stated in the Participant Certification section. The voucher expires after 30 days. Ignoring this detail can result in unnecessary delays or the need to re-submit a request if the voucher becomes invalid. It is vital to be aware of these time constraints to maintain the progress of the transfer smoothly.

Documents used along the form

The Cpi Crs 13 146 form is a crucial document for requesting a contract exchange within a 403(b) plan. However, it is often accompanied by various other forms and documents to ensure that the transaction is executed smoothly and in compliance with regulatory requirements. Below is a list of six commonly used forms and documents related to the contract exchange process.

- Information Sharing Agreement: This document is essential for facilitating communication and data exchange between your employer and the vendor receiving the transfer. Without this agreement, vendor-to-vendor transfers may not be approved.

- Transfer Voucher: The transfer voucher is a specific authorization issued by your current vendor that permits the transfer of funds to another vendor. This document is crucial for ensuring that the transfer complies with the required regulations.

- Participant Authorization Form: This form allows you to provide explicit consent for the transaction to take place. It typically includes your personal information and the details of the accounts involved in the transfer.

- Account Statement: This statement provides a detailed overview of your current account balances and investments. It may be requested by the receiving vendor to confirm the funds available for transfer.

- Vendor Transfer Request Form: This form is often required by the receiving vendor to initiate the transfer process. It generally includes sections for detailing the amount to be transferred and the accounts involved.

- Tax Withholding Notice: This notice outlines any tax implications associated with your transfer. It is important to review this document to understand how the transfer may impact your tax liabilities.

Always ensure that you have completed all relevant forms and documents before initiating a contract exchange. Proper documentation can help prevent potential issues and ensure that your transfer aligns with regulatory compliance and vendor requirements.

Similar forms

- 403(b) Plan Transfer Request Form: Similar to the Cpi Crs 13 146, this document facilitates the transfer of funds among accounts within 403(b) plans, ensuring compliance with specific vendor requirements.

- Retirement Account Transfer Form: This form allows individuals to move funds between different retirement accounts, highlighting necessary information and certifications from all parties involved.

- Vendor Change Request Form: This document enables participants to officially request a change of vendor for their retirement savings, requiring approval and compliance with vendor policies.

- Account Rollover Request Form: The rollover form is used when participants wish to transfer retirement account funds to another qualified account, with a focus on tax implications and eligibility criteria.

- Distribution Request Form: This form may be necessary when requesting distributions from retirement accounts, detailing personal information and distribution amounts.

- Investment Change Request Form: Similar in purpose, this document is utilized for modifying investment selections within a retirement plan, ensuring changes meet plan guidelines.

- Account Update Form: This form is used to update personal information related to accounts, which can impact the management and transfer of retirement funds.

Dos and Don'ts

When filling out the CPI CRS 13 146 form, it is important to follow specific guidelines to ensure a smooth process. Here are five things to do and avoid:

- Do print clearly and provide accurate information. This helps prevent processing delays.

- Do confirm that your receiving vendor has an information sharing agreement with your employer before initiating a transfer.

- Do request a voucher before transferring any assets. This protects your tax-qualified status.

- Do provide a valid email address if you would like the voucher sent electronically for faster communication.

- Do check for additional vendor requirements or restrictions that may apply to your transfer request.

- Don't forget to include all necessary personal and account information. Incomplete forms may delay processing.

- Don't transfer assets without obtaining the required voucher first. It could lead to financial consequences.

- Don't assume that completing the form guarantees that your transfer will be approved. Each vendor has different rules.

- Don't ignore the expiration date of your voucher. Act within 30 days to ensure its validity.

- Don't submit multiple transfer requests on the same form. Each transfer needs its own request.

Misconceptions

Misconceptions about the CPI CRS 13 146 form can lead to confusion, especially when it comes to transferring funds within a 403(b) plan. Here are nine common misunderstandings:

-

All transfers are allowed.

Many believe that they can freely transfer funds between vendors, but that’s not the case. Each vendor must have entered into an information-sharing agreement with your employer for a transfer to take place.

-

Assets can be transferred without a voucher.

Some people think they can move assets without any prior authorization. It is crucial to obtain a voucher before proceeding with any transfer, as failing to do so could jeopardize the tax-qualified status of the funds.

-

All vendors allow fund transfers.

Not every vendor permits transfers in or out of their accounts. Some might entirely restrict such transactions, so it’s important to check each vendor’s policy.

-

Completion of the form guarantees a transfer.

Filling out the form does not ensure that your transfer request will be approved. Each vendor can impose their own additional requirements or restrictions.

-

A voucher is valid indefinitely.

Many people think that once they have a voucher, it remains valid forever. However, vouchers expire after 30 days. If the transfer isn’t completed within that time frame, a new voucher will be needed.

-

All information is optional on the form.

Individuals might assume that supplying information is optional. In reality, providing complete and accurate information is essential for processing the request.

-

I can consolidate all accounts in one transfer.

A common belief is that one form can consolidate multiple accounts into a single transaction. In fact, a separate request form is required for each transfer to ensure clarity and compliance.

-

The Social Security Number is not important.

Some individuals may underestimate the importance of including their Social Security Number on the form. This information is vital for accurately identifying and processing the account.

-

Emailing the voucher is automatic.

Recipients might assume that they will automatically receive their voucher via email. It is necessary to indicate your preference and provide a valid email address if you wish to receive it electronically.

Understanding these misconceptions can help you navigate the process more effectively and avoid pitfalls during your fund transfer requests.

Key takeaways

Understanding the Cpi Crs 13 146 form is crucial for a smooth contract exchange process within your 403(b) plan. Here are some key takeaways:

- Transfer Requirements: A transfer between vendors can only occur if both vendors have an information-sharing agreement with your employer. Verify this before initiating the process.

- Obtain a Voucher: Before transferring any assets, it's essential to obtain a voucher. Proceeding without it may jeopardize the tax-qualified status of your funds.

- Additional Vendor Limitations: Some vendors impose restrictions that could affect whether your transfer is approved. Always check for any additional requirements they might have.

- Time Limits: Be aware that vouchers expire 30 days from the issue date. If you don’t use it within this timeframe, a new request will be necessary.

Browse Other Templates

Chabot College Transcript - Rush service is available for $10 per copy of the transcript.

E-1 Visa Usa Requirements - Fingerprint submission is mandatory if the registrant cannot sign the form.