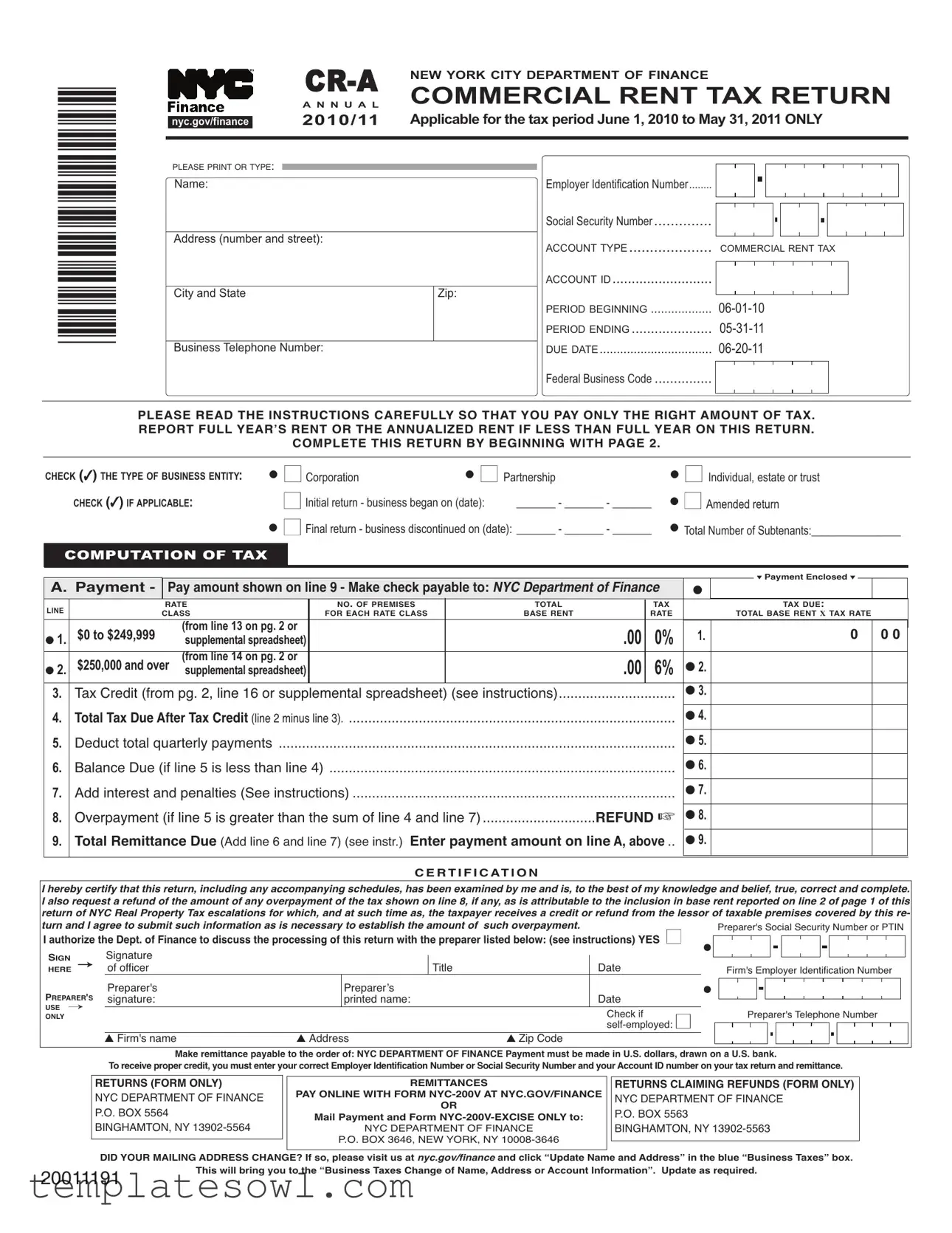

Fill Out Your Cr A Form

The CR-A form, officially titled the Annual Commercial Rent Tax Return, is a vital document for businesses operating in New York City. This form is specifically tailored for the tax period spanning from June 1, 2010, to May 31, 2011. It collects essential information regarding a business's gross rent paid, subtenant details, and rental deductions. The form requires businesses to report their rent accurately, distinguishing between base rent and any amounts set aside for residential use or other deductions. Different rate classes also apply, particularly for rents under or equal to $249,999, which are subjected to a 0% tax, versus a 6% tax for rents exceeding this threshold. Additionally, the CR-A form features spaces for inputting important identifiers such as Employer Identification Numbers (EIN) and Social Security Numbers. Tax credits may be available to businesses meeting specific criteria, highlighting the importance of meticulous record-keeping. Further, the form includes sections for certification to ensure the information provided is accurate and complete. Having a clear understanding of the CR-A form's requirements can significantly impact a business's compliance and financial responsibilities.

Cr A Example

*20011191*

|

|

|

|

NEW YORK CITY DEPARTMENT OF FINANCE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

A N N U A L |

COMMERCIAL RENT TAX RETURN |

|

||||||||||||||||||||||||||

|

|

2010/11 |

ApplicableforthetaxperiodJune1,2010toMay31,2011ONLY |

|

||||||||||||||||||||||||||||

|

nyc.gov/finance |

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PLEASE PRINT OR TYPE: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name: |

|

|

|

|

Employer Identification Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

Social Security Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Address (number and street): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

ACCOUNT TYPE |

COMMERCIAL RENT TAX |

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ACCOUNT ID |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City and State |

|

|

|

Zip: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

PERIOD BEGINNING |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

PERIOD ENDING |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Business Telephone Number: |

|

|

DUE DATE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Federal Business Code ...............

PLEASE READ THE INSTRUCTIONS CAREFULLY SO THAT YOU PAY ONLY THE RIGHT AMOUNT OF TAX. REPORT FULL YEAR’S RENT OR THE ANNUALIZED RENT IF LESS THAN FULL YEAR ON THIS RETURN.

COMPLETE THIS RETURN BY BEGINNING WITH PAGE 2.

CHECK (✓)THE TYPE OF BUSINESS ENTITY:

CHECK (✓)IF APPLICABLE:

COMPUTATION OF TAX

● ■Corporation |

● ■ Partnership |

|

■Initial return - business began on (date): |

_______ - _______ - _______ |

|

● ■Final return - business discontinued on (date): _______ - _______ - _______

●■ Individual, estate or trust

●■Amended return

●Total Number of Subtenants:________________

|

|

|

|

|

|

|

|

|

|

|

|

|

▼ Payment Enclosed ▼ |

|

|

|

A. Payment - |

Pay amount shown on line 9 - Make check payable to: NYCDepartmentofFinance |

● |

|

|

|

|

||||||||

|

|

|

|

|

|||||||||||

|

LINE |

|

RATE |

|

NO. OF PREMISES |

|

TOTAL |

|

TAX |

|

|

TAX DUE: |

|||

|

|

CLASS |

|

FOR EACH RATE CLASS |

|

BASE RENT |

|

RATE |

|

TOTAL BASE RENT X TAX RATE |

|||||

|

● 1. |

$0 to $249,999 |

|

(from line 13 on pg. 2 or |

|

|

|

|

.00 |

0% |

1. |

0 |

0 0 |

||

|

|

supplemental spreadsheet) |

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$250,000 and over |

(from line 14 on pg. 2 or |

|

|

|

|

.00 |

6% |

● 2. |

|

|

|

|

|

|

● 2. |

supplemental spreadsheet) |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

3. |

Tax Credit (from pg. 2, line 16 or supplemental spreadsheet) (see instructions) |

|

● 3. |

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

4. |

TotalTaxDueAfterTaxCredit(line 2 minus line 3) |

|

|

● 4. |

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. |

Deduct total quarterly payments |

|

|

|

|

● 5. |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6. |

Balance Due (if line 5 is less than line 4) |

......................................................................................... |

|

|

|

|

● 6. |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

7. |

Add interest and penalties (See instructions) |

|

|

● 7. |

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

8. |

Overpayment (if line 5 is greater than the sum of line 4 and line 7) |

............................. |

REFUND ☞ |

● 8. |

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|||||

|

9. |

Total Remittance Due (Add line 6 and line 7) (see instr.) Enter payment amount on lineA,above.. |

● 9. |

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CERTIFICATION

I hereby certify that this return, including any accompanying schedules, has been examined by me and is, to the best of my knowledge and belief, true, correct and complete. I also request a refund of the amount of any overpayment of the tax shown on line 8, if any, as is attributable to the inclusion in base rent reported on line 2 of page 1 of this return of NYC Real Property Tax escalations for which, and at such time as, the taxpayer receives a credit or refund from the lessor of taxable premises covered by this re- turn and I agree to submit such information as is necessary to establish the amount of such overpayment.

I authorize the Dept. of Finance to discuss the processing of this return with the preparer listed below: (see instructions)YES ■ |

|

Preparer's Social Security Number or PTIN |

|||||||||||||||||||||||||||||||||||

● |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

Signature |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HERESIGN → of officer |

|

|

Title |

|

Date |

|

|

Firm's Employer Identification Number |

|||||||||||||||||||||||||||||

|

|

|

Preparer's |

|

Preparer’s |

|

|

● |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

PREPARER'S |

signature: |

|

printed name: |

|

Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

USE → |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

Check if |

|

|

|

|

Preparer's Telephone Number |

||||||||||||||||||||||||||

ONLY |

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

▲ Firm's name |

▲ Address |

▲ Zip Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Make remittance payable to the order of: NYC DEPARTMENT OF FINANCE Payment must be made in U.S. dollars, drawn on a U.S. bank.

Toreceivepropercredit,youmustenteryourcorrectEmployerIdentificationNumberorSocialSecurityNumberandyourAccountIDnumberonyourtaxreturnandremittance.

RETURNS (FORM ONLY)

NYC DEPARTMENT OF FINANCE P.O. BOX 5564 BINGHAMTON, NY

REMITTANCES

PAY ONLINE WITH FORM

OR

Mail Payment and Form

NYC DEPARTMENT OF FINANCE

P.O. BOX 3646, NEW YORK, NY

RETURNS CLAIMING REFUNDS (FORM ONLY)

NYC DEPARTMENT OF FINANCE

P.O. BOX 5563

BINGHAMTON, NY

DID YOUR MAILING ADDRESS CHANGE? If so, please visit us at nyc.gov/finance and click “Update Name and Address” in the blue “Business Taxes” box.

20011191 |

This will bring you to the “Business Taxes Change of Name, Address or Account Information”. Update as required. |

|

Form |

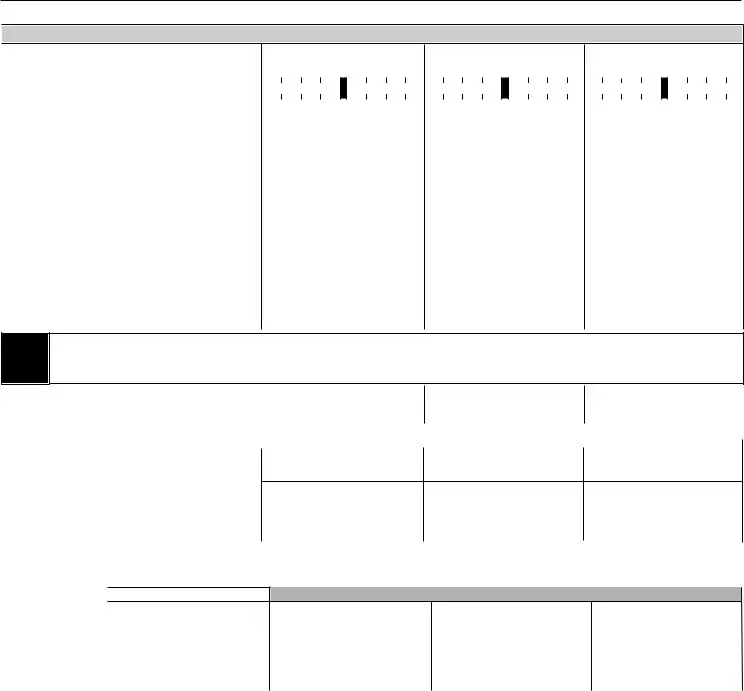

Page 2 |

USETHISPAGEIFYOUHAVETHREEORLESSPREMISES/SUBTENANTSOR,MAKECOPIESOFTHISPAGETOREPORTAD- DITIONAL PREMISES/SUBTENANTS. IF YOU WISH TO REPORT MORE THAN THREE PREMISES/SUBTENANTS, AND CHOOSE TO USE A SPREADSHEET, YOU MUST USE THE FINANCE SUPPLEMENTAL SPREADSHEET, WHICHYOUCAN DOWNLOADFROMOURWEBSITEATWWW.NYC.GOV/CRTINFO.

EACH LINE MUST BEACCURATELYCOMPLETED. YOUR DEDUCTION WILLBE DISALLOWED IF INACCURATE INFORMATION IS SUBMITTED.

LINE |

DESCRIPTION |

PREMISES 1 |

PREMISES 2 |

PREMISES 3 |

||||

● 1a. |

Street Address ......................................................... 1a. |

|

|

|

|

|

|

|

1b. Zip Code ..................................................................1b. |

________________________________________________________________________________________ |

|||||||

1c. |

Block and 1d. Lot Number...................................1c/1d. ________________________________________________________________________________________ |

|||||||

|

|

|

1c. BLOCK |

1d. LOT |

1c. BLOCK |

1d. LOT |

1c. BLOCK |

1d. LOT |

● 2. |

Gross Rent Paid (see instructions) |

2. |

________________________________________________________________________________________ |

3. |

Rent Applied to Residential Use |

3. |

________________________________________________________________________________________ |

4a. SUBTENANT'S NAME |

4a. |

________________________________________________________________________________________ |

|

●4b. Employer Identification Number (EIN) for

|

partnerships or corporations |

4b. |

● 4b. EIN _____________________ ● 4b. EIN_____________________ ● 4b. EIN ____________________ |

4c. Social Security Number for individuals |

4c. |

● 4c. SSN_____________________ ● 4c. SSN ____________________ ● 4c. SSN ____________________ |

|

4d. RENT RECEIVED FROM SUBTENANT |

|

|

|

|

(see instructions if more than one subtenant) |

4d. |

___________________________________________________________________________________________________ |

5a. |

Other Deductions (attach schedule) |

5a. |

________________________________________________________________________________________ |

5b. |

Commercial Revitalization Program |

|

|

|

special reduction (see instructions) |

5b. |

________________________________________________________________________________________ |

6. |

Total Deductions (add lines 3, 4d, 5a and 5b) |

6. |

________________________________________________________________________________________ |

7.Base Rent Before Rent Reduction (line 2 minus line 6) ....7. ________________________________________________________________________________________

4If the line 7 amount represents rent for less than the full year, proceed to line 10a, or

NOTE 4If the line 7 amount plus the line 5b amount is $249,999 or less and represents rent for a full year, transfer line 9 to line 13, or 4If the line 7 amount plus the line 5b amount is $250,000 or more and represents rent for a full year, transfer line 9 to line 14

8. |

35% Rent Reduction (35% X line 7) |

8. |

________________________________________________________________________________________ |

|||||||

9. |

Base Rent Subject to Tax (line 7 minus line 8) |

9. |

________________________________________________________________________________________ |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

COMPLETE LINES 10a, 11 AND 12 ONLY IF YOU RENTED PREMISES FOR LESS THAN THE FULL YEAR |

|||||||||

10a. Number of Months at Premises during the tax period |

|

|

|

|

|

|

|

|

|

|

10a. # of months |

10b. |

From: |

10a. # of months |

10b. From: |

10a. # of months |

10b. From: |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10c. |

To: |

|

10c. To: |

|

|

10c. To: |

|

|

|

|

|

|

|

|

|

|

|

11.Monthly Base Rent before rent reduction

(line 7 plus line 5b divided by line 10a) |

11. ________________________________________________________________________________________ |

12.Annualized Base Rent before rent reduction

(line 11 X 12 months) |

12. ________________________________________________________________________________________ |

■If the line 12 amount is $249,999 or less, transfer the line 9 amount (NOT THE LINE 12AMOUNT) to line 13

■If the line 12 amount is $250,000 or more, transfer the line 9 amount (NOT THE LINE 12AMOUNT) to line 14

*20021191*

RATE CLASS |

TAX RATE |

13.($0 - 249,999)............0%.....13. ______________________________________________________________________________________

14.($250,000 or more)... 6%.....14. ______________________________________________________________________________________

15.Tax Due before credit

(line 14 multiplied by 6%) |

15. |

16.Tax Credit (see worksheet below) .16. ______________________________________________________________________________________

Note: The tax credit only applies if line 7 plus line 5b (or line 12, if applicable) is at least $250,000, but is less than $300,000. All others enter zero.

Tax Credit Computation Worksheet

■If the line 7 amount represents rent for the full 12 month period, your credit is calculated as follows:

Amount on line 15 X ($300,000 minus the sum of lines 7 and 5b) = _____________ = your credit

$50,000

■If the line 7 amount represents rent for less than the full 12 month period, your credit is calculated as follows:

Amount on line 15 X ($300,000$50,000minus line 12) = _____________ = your credit

TRANSFER THE AMOUNTS FROM LINES 13 THROUGH 16 TO THE CORRESPONDING LINES ON PAGE 1

20021191 |

|

|

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Title | The form is titled "CR-A Annual Commercial Rent Tax Return" for New York City. |

| Tax Period | This specific form is applicable for the tax period from June 1, 2010, to May 31, 2011. |

| Governing Law | The Commercial Rent Tax is governed by New York City Administrative Code § 11-702. |

| Purpose | The main purpose is to report and pay the commercial rent tax owed based on the rent collected. |

| Account Type | Business entities must check the appropriate account type: Corporation, Partnership, or Individual. |

| Tax Rates | The tax rate is 0% on base rent up to $249,999 and 6% on rent of $250,000 or more. |

| Payment Information | Payments must be made in U.S. dollars, drawn on a U.S. bank, and can be submitted online or by mail. |

| Submission Address | Returns should be mailed to NYC Department of Finance, P.O. Box 5564, Binghamton, NY 13902-5564. |

| Certification | Filers must certify that the return is true, correct, and complete, and they must include their signatures. |

| Amended Returns | If necessary, filers can submit an amended return to correct any previous information provided. |

Guidelines on Utilizing Cr A

Filling out the CR-A form is an essential step for eligible property owners and businesses in New York City who need to report their commercial rent activity for the specified tax period. Following the steps outlined below will help ensure that your submission is both accurate and complete.

- Gather Necessary Information: Assemble all required information, including your name, Employer Identification Number (EIN) or Social Security Number (SSN), and business address.

- Account Type: Check the appropriate boxes that indicate your type of business entity and any applicable status, such as initial or final return.

- Fill Out Company Details: Complete the sections for applicable business details, including Business Telephone Number and Account ID.

- Enter Rent Information: Report the total gross rent paid for all premises over the tax period, making sure to note any rent applied to residential use.

- Deductions and Credits: Calculate any applicable deductions or credits. Include gross rent, subtenant information, and any deductions for commercial revitalization program applicability.

- Total Tax Calculation: Sum up the tax amounts following the provided rates based on the gross rent information. Ensure the correct calculations for total tax due, considering any deductions and credits.

- Payment Details: If applicable, complete the payment section and indicate the total amount due. Make sure to make your check payable to NYC Department of Finance.

- Certification: Sign and date the certification area, confirming that the information provided is accurate to the best of your knowledge.

- Prepare for Submission: Decide whether to mail the completed form or submit payment online. Follow the mailing instructions as indicated for either returns or remittances.

Once you have filled out the form, it is important to review it for accuracy. Submit it according to the guidelines provided, making sure to keep a copy for your records. Proper compliance with this process can eliminate potential issues and ensure transparency in your business dealings.

What You Should Know About This Form

What is the Cr A form?

The Cr A form is the Annual Commercial Rent Tax Return for the tax period from June 1, 2010, to May 31, 2011. The form is required by the New York City Department of Finance to report and pay the commercial rent tax. It is essential for businesses that meet specific rent thresholds to file this return accurately and on time to avoid penalties.

Who needs to file the Cr A form?

What information is required on the Cr A form?

The form requires basic business information, including the name, address, Employer Identification Number (EIN), and the total rent paid for the tax period. Additionally, you will need to provide details about any subtenants and calculate the total tax due based on the applicable tax rates. Accurate reporting is necessary to ensure you pay the correct amount of tax.

How is the commercial rent tax calculated?

The commercial rent tax is determined based on the rent amount. If your annual rent is $249,999 or less, you are not required to pay tax. If your rent is $250,000 or more, a 6% tax rate applies. You must calculate the total tax due by reporting your base rent and applying any available credits. Proper deductions for any residential use of the rented space can also affect the final tax amount.

When is the Cr A form due?

The Cr A form has a specific due date. For the tax period from June 1, 2010, to May 31, 2011, the return was due on June 20, 2011. It is essential to submit the form on time to avoid late fees and penalties. Always check the New York City Department of Finance website for the most current deadlines and requirements.

What happens if you do not file the Cr A form?

If you fail to file the Cr A form, you may face penalties, interest on unpaid tax, and other enforcement actions from the city. Not filing can also lead to the loss of any potential credits or deductions that you may have qualified for. Therefore, timely and accurate filing is crucial for any business affected by the commercial rent tax.

How can payments be made for the Cr A form?

Payments for the commercial rent tax can be made by check or through online payment options provided by the New York City Department of Finance. If paying by check, make it payable to the NYC Department of Finance. Additionally, businesses can use the NYC-200V form to pay online. Following the correct procedures ensures that payments are credited to the right account.

Common mistakes

When filling out the Cr A form for the Commercial Rent Tax, it’s easy to make mistakes that could lead to penalties or overcharges. One common mistake is failing to read the instructions carefully. Each section contains specific guidelines that help ensure accurate reporting of your tax obligations. Many people skip this crucial step, leading to unintended errors.

Another frequent issue is not providing complete information on the form, particularly in the business identification section. Missing details such as the Employer Identification Number (EIN) or Social Security Number can cause delays in processing your return. It's important to double-check that all required identification numbers are entered correctly before submission.

A third mistake involves overlooking the base rent calculation. The form requires you to accurately report the full year's rent or the annualized amount. Sometimes, individuals miscalculate and report an incorrect figure, which can significantly affect the tax amount owed. Be sure to follow the provided guidelines for determining your base rent.

People also often misinterpret or neglect to complete the deductions section. Totals for deductions must be calculated by adding up all applicable amounts. If a taxpayer fails to include deductions, they may end up paying more tax than necessary. Remember that precise calculations can make a tangible difference in your overall tax liability.

Additionally, some individuals mistakenly do not account for all their subtenants. The form asks for details about each subtenant, including their respective EINs or Social Security Numbers. Leaving out any subtenant details or incorrectly reporting them could result in inaccuracies that lead to issues with the tax authority.

Filling in the dates correctly is another common oversight. The Cr A form specifies tax periods, and it is essential to use correct dates when indicating your business start and end dates. Mistakes in these areas can prompt an inquiry from the tax department, leading to further complications.

Moreover, individuals sometimes forget to sign the form or fail to have the necessary authorizations. Failing to provide a signature can render the entire return invalid. Before sending in the form, it's wise to review whether you've completed all certification aspects.

Another area where mistakes often occur is with the tax computation. Calculating the tax based on the provided rate classes can be tricky. Errors in computation may arise from transposing numbers or misreading the tax rate. Paying attention to detail here is crucial.

Finally, sending the form to an incorrect address or using the wrong payment method can lead to frustrations and delays. It’s vital to ensure that you send your payment to the correct location and in the appropriate format. Online payments usually provide immediate confirmation and can help avoid these common pitfalls.

Documents used along the form

The CR-A form, designed for the Annual Commercial Rent Tax Return in New York City, often accompanies several other important documents in the tax filing process. Each of these forms plays a crucial role in providing clarity and supporting the information reported on the CR-A. Below is a list of commonly used forms and documents that may be necessary when submitting the CR-A form.

- NYC-200V: This form is used for making payments associated with various NYC taxes. It allows taxpayers to remit payment for excise taxes quickly.

- CR-A Supplemental Spreadsheet: In cases with more than three premises or subtenants, this spreadsheet should be filed to report details accurately. It complements the information required on the CR-A form.

- Form NYC-200V-EXCISE ONLY: This is specifically for submitting payments when filing for certain excise taxes. If additional filings are required alongside the CR-A, this form may be necessary.

- Payment Confirmation Receipts: It’s advisable to maintain a record of any payment confirmations for tax payments made. These documents serve as proof in case of discrepancies or audits.

- Amended Tax Returns: In situations where there is a need to correct previously submitted information, this document serves to revise the original return and is key for compliance.

- Records of Rent Transactions: Keeping a thorough record of all rent payments, deductions, and any related financial transactions is essential. This document will support various claims made on the tax return.

- Business Lease Agreement: The lease itself may need to be provided for clarity on the terms negotiated, as it defines the obligations regarding rent payments and related terms.

Filing the CR-A form accurately is vital for compliance with tax regulations in New York City. Utilizing these additional documents will enhance accuracy, provide necessary support for reported information, and help ensure successful navigation of the tax filing process.

Similar forms

-

IRS Form 1040: This form is used by individuals to file their annual income tax return. Like the CR A form, it requires detailed reporting of financial information, including income and deductions over a specific tax period.

-

Form W-2: This document reports an employee's annual wages and the taxes withheld from their paycheck. Similar to the CR A form, it provides a summary of earnings and tax obligations for a given year.

-

Form 1065: Partnerships use this form to report their income, deductions, gains, and losses. Like CR A, it provides a comprehensive picture of tax liability based on business operations within a defined period.

-

Form 1120: Corporations use this form to report their income and calculate their corporate tax. Similar to the CR A form, it focuses on a specific financial year and includes calculations that determine tax owed.

-

Schedule C: Sole proprietors use this schedule to report income and expenses from their business. Like the CR A form, it is tied to a specific tax period and details financial data relevant for tax purposes.

-

Form 990: Nonprofit organizations use this form to report their financial information. Similar in nature to the CR A form, it includes detailed financial disclosures that help determine tax-exempt status and compliance with regulations.

-

Form 941: Employers use this form to report income taxes, social security tax, and Medicare tax withheld from employees' paychecks. Similar to the CR A form, it provides a snapshot of tax responsibilities associated with a specific time frame.

Dos and Don'ts

When filling out the CR-A form, keeping a clear perspective on what to do and what to avoid can greatly reduce complications. Here are six key points for successful completion:

- Do: Ensure all information is complete and accurate. Double-check names, numbers, and addresses.

- Do: Use clear, legible print or type your information. This will help prevent any misunderstandings or processing delays.

- Do: Calculate your tax liability accurately. Use the specified tax rates and deductibles carefully.

- Don’t: Leave any required fields blank. Every section of the form needs your attention.

- Don’t: Wait until the deadline to submit your form. Early submission allows time for any potential corrections.

- Don’t: Forget to include a payment if applicable. Any overdue payments could result in penalties.

By following these guidelines, you can ensure a smoother process and minimize potential issues with your submission.

Misconceptions

Here are seven common misconceptions about the CR A form that individuals often have:

- Anyone can fill out the form without understanding it. It is essential to read the instructions thoroughly to ensure accurate completion and to avoid mistakes.

- The form is only for large businesses. In fact, all commercial entities, regardless of size, may be required to submit this form if they meet specific criteria.

- One can submit the form late without consequences. Late submissions may incur penalties and interest fees, impacting the overall amount due.

- The CR A form can be filled out without accurate records. Accurate records of rental payments and premises details are crucial to ensure the information reported aligns with what is owed.

- Tax credits will automatically apply. Tax credits require specific calculations and conditions that must be met for eligibility on the form.

- All commercial rents are taxed at the same rate. The tax rate varies based on the total base rent, clearly outlined on the form.

- Only the business owner can submit the form. An authorized tax preparer can also file the form on behalf of the business as long as they are properly mentioned in the certification section.

Key takeaways

The CR-A form is essential for reporting the Annual Commercial Rent Tax in New York City. Here are key takeaways to consider when filling it out and using it:

- Provide Accurate Information: Ensure that all fields, including business name and account details, are filled out correctly to avoid processing delays.

- Report Full-Year Rent: If your business rented premises for less than a full year, report annualized rent on the form.

- Check the Right Boxes: Indicate if your return is an initial, final, or amended submission by marking the appropriate options.

- Calculate Tax Correctly: Use the correct tax rates based on your rent amounts. There's a 0% rate for rents up to $249,999 and a 6% rate for rents of $250,000 or more.

- Include Deductions: List and sum all applicable deductions accurately. Missing or incorrect deductions can lead to disallowed claims.

- Payment Details: Make payments in U.S. dollars and ensure they are drawn from a U.S. bank. Attach checks to the return as indicated.

- Understanding Refunds: If you are eligible for a refund, complete the specified section and provide the necessary information to facilitate processing.

- File on Time: Be aware of the due date for your tax submission to avoid penalties and interest for late payments.

Handling the CR-A form with care will help ensure compliance and potentially minimize tax liabilities.

Browse Other Templates

Active Duty Family Dental Enrollment Form,FMDP Enrollment Application,Tricare Family Member Dental Plan Election,Dental Insurance Enrollment for Family Members,Supplemental Dental Coverage Selection,Dependent Dental Coverage Application,Dental Plan E - It’s essential to be mindful of the fact that changes in family status require updates to this enrollment.

How to Get a Firearm License - For transport permits, the transporter’s name and details must be accurately filled in.