Fill Out Your Credit Agreement Employee Form

The Credit Agreement Employee form outlines essential guidelines for employees who are granted the privilege of using a Church credit card. This form emphasizes the balance between convenience and responsibility, as the card remains Church property, even though it is issued in the employee's name. By signing this document, employees agree to specific terms related to the use and management of the card. They accept personal responsibility for its safekeeping, ensuring that only they can make charges. The agreement also sets clear expectations for submitting monthly Expense Reports, complete with receipts, and explains the repercussions of failing to repay any disallowed charges. Unauthorized use and non-Church-related expenses are strictly prohibited, and employees must report any loss or theft of the card immediately. Compliance with these terms is crucial, as violations may lead to consequences ranging from suspension of card privileges to disciplinary actions. Employees must understand that all purchases will be documented for review, guaranteeing adherence to the established guidelines.

Credit Agreement Employee Example

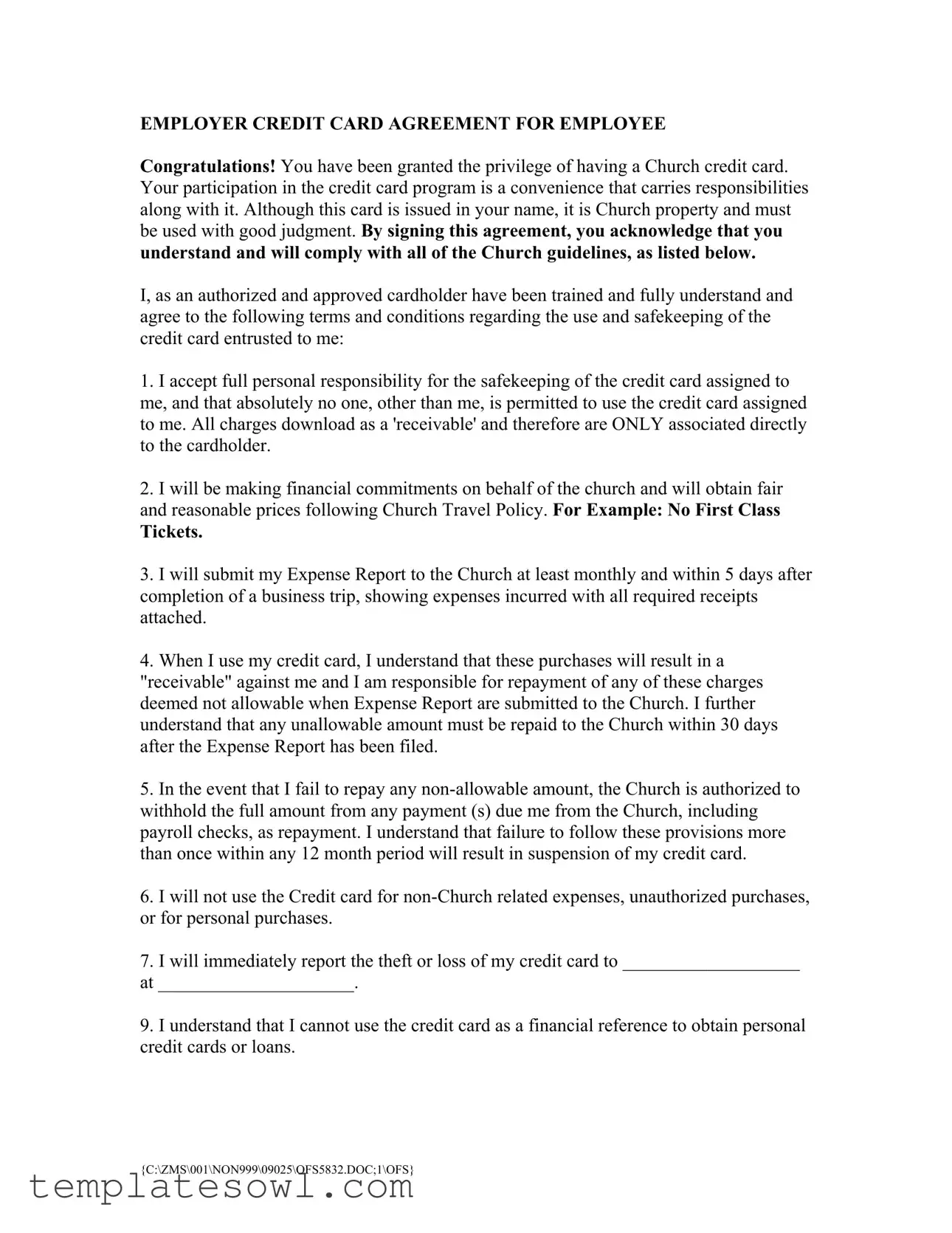

EMPLOYER CREDIT CARD AGREEMENT FOR EMPLOYEE

Congratulations! You have been granted the privilege of having a Church credit card. Your participation in the credit card program is a convenience that carries responsibilities along with it. Although this card is issued in your name, it is Church property and must be used with good judgment. By signing this agreement, you acknowledge that you understand and will comply with all of the Church guidelines, as listed below.

I, as an authorized and approved cardholder have been trained and fully understand and agree to the following terms and conditions regarding the use and safekeeping of the credit card entrusted to me:

1.I accept full personal responsibility for the safekeeping of the credit card assigned to me, and that absolutely no one, other than me, is permitted to use the credit card assigned to me. All charges download as a 'receivable' and therefore are ONLY associated directly to the cardholder.

2.I will be making financial commitments on behalf of the church and will obtain fair and reasonable prices following Church Travel Policy. For Example: No First Class

Tickets.

3.I will submit my Expense Report to the Church at least monthly and within 5 days after completion of a business trip, showing expenses incurred with all required receipts attached.

4.When I use my credit card, I understand that these purchases will result in a "receivable" against me and I am responsible for repayment of any of these charges deemed not allowable when Expense Report are submitted to the Church. I further understand that any unallowable amount must be repaid to the Church within 30 days after the Expense Report has been filed.

5.In the event that I fail to repay any

6.I will not use the Credit card for

7.I will immediately report the theft or loss of my credit card to ___________________

at _____________________.

9.I understand that I cannot use the credit card as a financial reference to obtain personal credit cards or loans.

{C:\ZMS\001\NON999\09025\OFS5832.DOC;1\OFS}

10.I understand that I am personally responsible for obtaining ALL original detailed receipts (purchase and credit documents) and submitting them in accordance with Church credit card procedures, for those purchases where a receipt is required.

11.I understand that any purchases made by me will be recorded and reviewed in management reports, to insure compliance with credit card guidelines.

12.I understand that failure to follow any of the above listed terms & conditions or if found to have misused the credit card in any manner may result in:

o Revocation of the privilege to use the credit card o Disciplinary action

o Termination of employment, and/or criminal charges being filed with the appropriate authority.

13.I agree to surrender the credit card immediately upon request or upon termination of employment for any reason.

I, _________________________________ hereby accept the above terms and conditions

and acknowledge receipt of the Credit card.

_____________ _________________________________________

DateEmployee Signature

_____________________________________________________

Employee email address

{C:\ZMS\001\NON999\09025\OFS5832.DOC;1\OFS}

Form Characteristics

| Fact Name | Description |

|---|---|

| Ownership of Card | The credit card is issued in the employee's name, but it remains the property of the Church and must be used responsibly. |

| Personal Responsibility | Employees are fully responsible for the safekeeping of their assigned credit card. No one else is allowed to use it. |

| Expense Reports | Monthly expense reports must be submitted, featuring all relevant receipts, particularly within five days after a business trip. |

| Repayment Terms | Any charges deemed not allowable must be repaid to the Church within 30 days after the expense report is submitted. |

| Consequences of Misuse | Improper usage or failure to comply may lead to disciplinary actions, including termination of employment and possible criminal charges. |

| Signature Requirement | By signing the agreement, the employee acknowledges understanding and accepting all the terms provided above. |

Guidelines on Utilizing Credit Agreement Employee

Filling out the Credit Agreement Employee form is an essential step for those who have been granted the privilege of using a Church credit card. This form sets forth terms and conditions that ensure responsible usage and accountability associated with the use of the card. Completing this form accurately is important for maintaining compliance with Church policies and protecting both the cardholder and the Church.

- Begin by carefully reading through the entire form to ensure a complete understanding of the terms and conditions.

- In the designated space, clearly print your name as the authorized cardholder.

- Sign and date the form where indicated to acknowledge acceptance of the terms.

- Provide your email address in the required field for communication purposes.

- Report the name and contact information of the person to whom you will report a stolen or lost card in the specified blanks.

- Review the form one final time to ensure all information is accurate and complete.

- Submit the form to the designated authority within the Church, as per the instructions provided by your supervisor or HR department.

What You Should Know About This Form

What is the Credit Agreement Employee form, and why is it important?

The Credit Agreement Employee form is a document that outlines the terms and responsibilities associated with the use of a Church credit card assigned to an employee. By signing this agreement, employees acknowledge that the credit card is church property and must be used wisely. It is crucial because it sets clear expectations regarding usage, accountability, and compliance with Church policies. Understanding these responsibilities helps prevent misuse and ensures that Church funds are used appropriately.

What are the key responsibilities of an employee with a Church credit card?

Employees holding a Church credit card must adhere to several key responsibilities. First, they accept full responsibility for the safekeeping of the card, meaning it should only be used by the assigned employee. They are required to make expenditures that align with the Church's Travel Policy, ensuring that purchases are reasonable and necessary. Additionally, employees must submit expense reports monthly, attaching all necessary receipts, and repaying any charges deemed non-allowable within 30 days. Failure to meet these obligations can lead to disciplinary actions including suspension of credit card privileges.

What happens if an employee misuses the Church credit card?

If an employee misuses their Church credit card or fails to comply with the agreement, several consequences may arise. The Church reserves the right to revoke the privilege of using the card, impose disciplinary actions, or terminate employment. In serious cases, criminal charges may be pursued. Employees must understand that repeated violations can lead to more severe outcomes, including revocation of the credit card privilege.

What should an employee do if their Church credit card is lost or stolen?

In the event that a Church credit card is lost or stolen, it is imperative that the employee reports this occurrence immediately to the designated authority within the organization. Prompt notification helps mitigate potential unauthorized charges and safeguards the interests of both the employee and the Church. Taking swift action can prevent further complications and ensure that the card is deactivated to protect Church assets.

Common mistakes

When filling out the Credit Agreement Employee form, many individuals inadvertently make mistakes that could lead to misunderstandings or even financial repercussions. Recognizing these common errors can help ensure a smoother process. Here are ten pitfalls to watch out for.

First, a frequent mistake is not reading the entire agreement thoroughly. This document is packed with important information about responsibilities and restrictions associated with the credit card. Failing to understand these terms can result in using the card improperly.

Second, incomplete or incorrect personal information is often provided. Accuracy is paramount. If the name, email address, or other details are incorrect, it could delay communication or lead to misdirected correspondence regarding card usage.

Another common error is neglecting to list the appropriate contact person for reporting a lost or stolen card. It’s essential to fill in this section; knowing who to contact in case of a theft can save time and stress.

People also sometimes overlook the importance of keeping receipts. Not collecting and submitting all required receipts can lead to complications during the reimbursement process. Keep in mind that original detailed receipts are a requirement, and not adhering to this could result in personal responsibility for unapproved charges.

Additionally, failing to submit expense reports on time is a critical mistake. The form specifies the need for monthly submissions and timely responses following business trips. Missing deadlines could affect personal finances if funds are withheld due to improper reporting.

Misunderstanding the term "non-allowable amounts" can also trip up cardholders. It’s important to be clear about which expenses are deemed non-allowable. Ignoring this can lead to unanticipated charges that must be repaid within a short time frame.

Using the credit card for personal expenses, despite the clear prohibition, remains a common violation. Misusing the card in this manner not only contravenes the agreement but could also have serious repercussions, including disciplinary action.

People may also neglect the requirement to report any misuse of the card or failure to follow the guidelines. Transparency is critical. Not acknowledging violations could lead to further complications if the matter is discovered later.

Furthermore, some individuals mistakenly believe they can use this credit card as a financial reference for obtaining personal loans or credit cards. The guidelines explicitly state that this is not acceptable and doing so could lead to disciplinary measures.

Lastly, many do not prepare to surrender the card promptly upon termination of employment or upon request. Being unprepared or reluctant to do so can escalate the situation, potentially leading to legal consequences. Awareness and compliance with these terms are crucial for all cardholders.

In summary, awareness of these common mistakes can help individuals navigate the Credit Agreement Employee form with confidence. Careful attention to detail and adherence to guidelines will ensure a responsible and successful experience with the church credit card.

Documents used along the form

The Credit Agreement Employee form is an important document that sets the guidelines for the responsible use of a Church-issued credit card. Along with this form, several other documents may be utilized to ensure a comprehensive understanding and management of financial responsibilities. Here are some commonly associated forms:

- Expense Report Form: This form is used by employees to detail all business-related expenses incurred while using the Church credit card. It includes sections for the date, description of each expense, amount spent, and requires original receipts to be attached. Submission of this form is essential for the proper documentation of expenditures.

- Cardholder Acknowledgment Form: This document is often signed by employees to formally acknowledge their understanding of the credit card policies and the responsibilities that come with being a cardholder. It provides a clear record that the employee has received this information and agrees to adhere to it, further safeguarding the Church's interests.

- Credit Card Misuse Policy: This policy outlines specific actions that are considered misuse of the credit card and the consequences associated with these actions. By outlining what behaviors could lead to disciplinary action, it serves both as a deterrent and as a clear guideline for cardholders.

- Training Completion Certificate: After receiving training on credit card usage and related policies, employees may be given a certificate that verifies their participation and understanding of the program. This certificate can serve as evidence of the employee's commitment to responsible use of the credit card.

These documents not only support the Credit Agreement Employee form but also help enhance financial accountability, protect the Church's assets, and promote transparency in financial practices. Understanding and completing each of these forms accurately can foster a positive financial environment for everyone involved.

Similar forms

- Employment Agreement: This document outlines the responsibilities and rights of the employee and employer. Just like the Credit Agreement Employee form, it requires the employee's acknowledgment of these terms and adherence to specific guidelines related to their role.

- Expense Reimbursement Policy: Similar to the Credit Agreement, this policy details the procedures for submitting business-related expenses. Both documents emphasize the importance of submitting receipts and adhering to timeframes for reimbursement.

- Code of Conduct: Like the Credit Agreement, the Code of Conduct sets expectations regarding acceptable behavior in the workplace. Both documents highlight responsibility and adherence to rules laid out by the organization.

- Company Travel Policy: This document governs travel-related expenses. It shares similarities with the Credit Agreement in that it defines what expenses are allowable and outlines the process for travel purchases.

- Credit Card Use Agreement: This is often a more general document for multiple employees describing the use of company credit cards. Similar to the Credit Agreement, it also emphasizes personal responsibility for charges made and adherence to company guidelines.

- Confidentiality Agreement: This agreement requires employees to protect sensitive information. Both it and the Credit Agreement foster a sense of responsibility, ensuring employees understand the importance of maintaining integrity in their roles.

- Withdrawal Agreement: This type of document requires acknowledgment of obligations upon leaving the company. The language around surrendering privileges in the Credit Agreement parallels provisions that outline the return of company property upon termination.

Dos and Don'ts

When filling out the Credit Agreement Employee form, attention to detail is essential. Mistakes can lead to complications that affect both the employee and the Church. Here are four key actions to consider:

- Do ensure accurate personal information. Double-check that your name, contact information, and any other personal details are entered correctly. Errors can lead to delays or misunderstandings.

- Do familiarize yourself with the guidelines. Understand the Church's credit card policies and ensure you can operate within those rules. This knowledge will help you make informed decisions while using the card.

- Don't forget to read the terms thoroughly. Ensure that you know your responsibilities and the potential consequences of misusing the card. Ignorance of these terms can lead to serious repercussions.

- Don't allow others to use your card. The card is issued exclusively to you, and sharing it can result in issues both for you and the Church. Your personal responsibility cannot be transferred.

These attentions will not only ensure compliance with Church policies but also facilitate a smooth and responsible experience while utilizing the credit card privileges afforded to you.

Misconceptions

The Employer Credit Card Agreement for Employees is a document that governs the use of a church-issued credit card. Several misconceptions commonly arise regarding this agreement, which can lead to confusion and misunderstanding among employees. Below are five prevalent misconceptions about the Credit Agreement Employee form, along with clarifications.

- The card is a personal credit card. This form of credit card is not a personal asset. It remains the property of the church, and employees must use it strictly for church-related expenses.

- Only the church is responsible for any charges. Employees hold full personal responsibility for all charges made on the card. Any unallowable charges must be repaid by the employee within 30 days after submitting their Expense Report.

- Using the card is a right rather than a privilege. Holding the credit card is a privilege that can be revoked. Misuse or failure to follow the stipulated terms can lead to disciplinary actions, including termination of employment.

- Expense Reports can be submitted at any time. In fact, employees must submit their Expense Reports at least monthly and within five days after completing a business trip, ensuring timely and accurate financial oversight.

- There are no consequences for improper use. The agreement clearly states that violations can result in severe consequences, including revocation of card privileges, disciplinary actions, or even criminal charges.

Understanding these misconceptions is vital for responsible card use. Employees must remain vigilant and compliant with the agreement to maintain their privileges and avoid potential complications.

Key takeaways

When filling out and using the Credit Agreement Employee form, there are several key points to keep in mind. Understanding these takeaways can help ensure that you use the Church credit card responsibly and in accordance with the guidelines.

- Personal Responsibility: As the cardholder, you are fully responsible for the safekeeping and use of the credit card. No one else is allowed to use it, and you must ensure all charges are legitimate and compliant with Church policies.

- Expense Reporting: It is important to submit your Expense Report monthly or within five days after completing a business trip. This report must include all expenses along with the necessary receipts.

- Repayment of Non-Allowable Charges: If any charges are deemed non-allowable, you must repay those amounts to the Church within 30 days after filing your Expense Report.

- Consequences of Misuse: Failing to adhere to these guidelines may lead to significant repercussions, including suspension of credit card privileges, disciplinary action, or even termination of employment.

Browse Other Templates

Delta Usa Dental - Failure to fill out the form accurately can delay care and payments.

Chase Dreamaker - Any additional information regarding outstanding liens must also be disclosed.

Carl's Jr Application Pdf - Incomplete applications will not be evaluated.