Fill Out Your Credit Application Form

The Credit Application form serves as a vital instrument for businesses seeking to establish a line of credit with potential creditors. It typically encompasses a range of essential components, providing creditors with necessary information to assess the creditworthiness of the applicant. At its core, the form requests the name of the business and its contact details, including the phone number, fax number, and mailing address. Applicants are also required to indicate their desired credit line, which defines the maximum amount of credit the business hopes to secure. Importantly, the form delineates the type of business structure—be it a corporation, partnership, or limited liability company—along with asking for pertinent financial details such as annual sales figures and the availability of financial statements. Contact information for company directors or principals is another critical aspect as it helps establish the legitimacy and operational history of the business. Furthermore, banking details and trade references are requested to cross-verify financial stability and reliability. Finally, the agreement includes terms related to payment conditions and dispute resolution, ensuring that both parties understand their obligations and rights throughout the credit relationship. By meticulously completing this form, businesses not only open the door to financial opportunities but also lay the groundwork for a transparent and accountable borrowing experience.

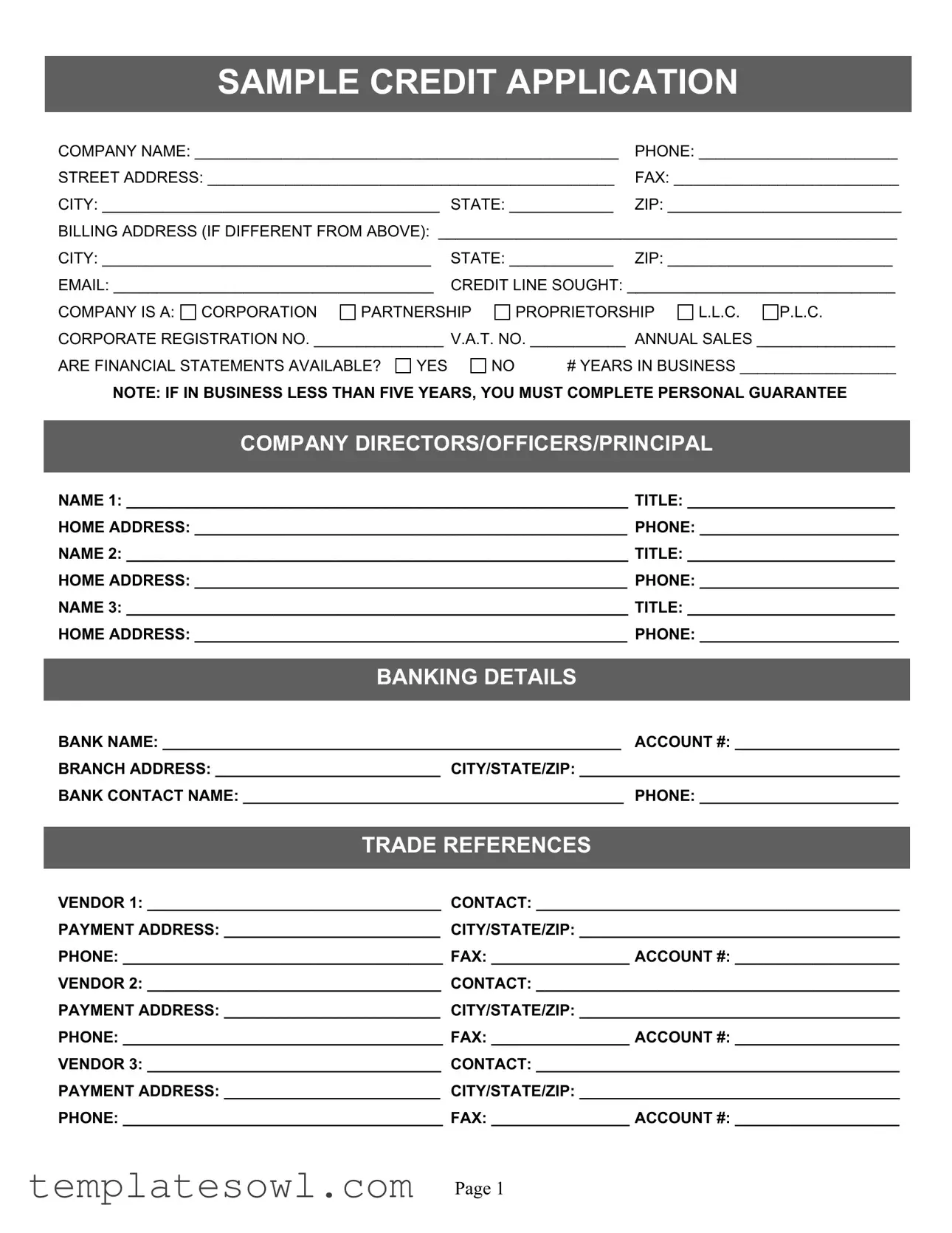

Credit Application Example

SAMPLE CREDIT APPLICATION

COMPANY NAME: _________________________________________________ |

PHONE: _______________________ |

|

STREET ADDRESS: _______________________________________________ |

FAX: __________________________ |

|

CITY: _______________________________________ |

STATE: ____________ |

ZIP: ___________________________ |

BILLING ADDRESS (IF DIFFERENT FROM ABOVE): _____________________________________________________ |

||

CITY: ______________________________________ |

STATE: ____________ |

ZIP: __________________________ |

EMAIL: _____________________________________ |

CREDIT LINE SOUGHT: _______________________________ |

|

COMPANY IS A: CORPORATION |

PARTNERSHIP |

|

PROPRIETORSHIP |

L.L.C. |

P.L.C. |

|

CORPORATE REGISTRATION NO. _______________ V.A.T. NO. ___________ ANNUAL SALES ________________ |

||||||

ARE FINANCIAL STATEMENTS AVAILABLE? |

YES |

NO |

# YEARS IN BUSINESS __________________ |

|||

NOTE: IF IN BUSINESS LESS THAN FIVE YEARS, YOU MUST COMPLETE PERSONAL GUARANTEE

COMPANY DIRECTORS/OFFICERS/PRINCIPAL

NAME 1: __________________________________________________________ TITLE: ________________________

HOME ADDRESS: __________________________________________________ PHONE: _______________________

NAME 2: __________________________________________________________ TITLE: ________________________

HOME ADDRESS: __________________________________________________ PHONE: _______________________

NAME 3: __________________________________________________________ TITLE: ________________________

HOME ADDRESS: __________________________________________________ PHONE: _______________________

BANKING DETAILS

BANK NAME: _____________________________________________________ ACCOUNT #: ___________________

BRANCH ADDRESS: __________________________ CITY/STATE/ZIP: _____________________________________

BANK CONTACT NAME: ____________________________________________ PHONE: _______________________

TRADE REFERENCES

VENDOR 1: __________________________________ CONTACT: __________________________________________

PAYMENT ADDRESS: _________________________ CITY/STATE/ZIP: _____________________________________

PHONE: _____________________________________ FAX: ________________ ACCOUNT #: ___________________

VENDOR 2: __________________________________ CONTACT: __________________________________________

PAYMENT ADDRESS: _________________________ CITY/STATE/ZIP: _____________________________________

PHONE: _____________________________________ FAX: ________________ ACCOUNT #: ___________________

VENDOR 3: __________________________________ CONTACT: __________________________________________

PAYMENT ADDRESS: _________________________ CITY/STATE/ZIP: _____________________________________

PHONE: _____________________________________ FAX: ________________ ACCOUNT #: ___________________

Page 1

CONDITIONS (TERMS ARE NET 30 DAYS UPON CREDIT APPROVAL)

TERMS OF SALE, INCLUDING TERMS OF PAYMENT AND CHARGES, FOR EACH PURCHASE ARE AGREED TO BE THOSE SPECIFIED ON THE FACE OF EACH INVOICE. THE CUSTOMER HEREBY AGREES TO PAY ALL COSTS OF COLLECTION OR LEGAL FEES SHOULD SUCH ACTION BE NECESSARY DUE TO

DISPUTES: ANY DISPUTE OR CONTROVERSY ARISING FROM THIS AGREEMENT WILL BE RESOLVED BY ARBITRATION BY THE AMERICAN ARBITRATION ASSOCIATION AT ORANGE COUNTY, CALIFORNIA. THE LANGUAGE OF THE ARBITRATION SHALL BE ENGLISH. THE NUMBER OF ARBITRATORS SHALL BE ONE. THE PARTIES AGREE THE AMERICAN ARBITRATION ASSOCIATION’S EXPEDITED RULES SHALL APPLY AND THEY WAIVE ALL RIGHT TO ANY HEARING REQUIRING WITNESS PRODUCTION. THE ARBITRATOR SHALL ISSUE AN AWARD BASED UPON THE WRITTEN DOCUMENTARY EVIDENCE SUPPLIED BY THE PARTIES. THE ARBITRATOR’S AWARD SHALL BE BINDING AND FINAL. THE LOSING PARTY SHALL PAY ALL ARBITRATION EXPENSES, INCLUDING ALL ATTORNEY’S FEES.

I HAVE READ AND UNDERSTAND THE ABOVE TERMS AND CONDITIONS, AND HEREBY AGREE TO THEM:

APPLICANT’S NAME: ______________________________________ TITLE: ________________________________

DATE: ______________________________________ APPLICANT’S SIGNATURE: ___________________________

FOR PROPRIETORS, PARTNERS,

I AUTHORIZE THE SELLER AND THEIR ASSIGNS TO OBTAIN A CONSUMER CREDIT REPORT ON MY CREDIT HISTORY.

DATE: ______________________________________ APPLICANT’S SIGNATURE: ____________________________

PERSONAL GUARANTEE

THE UNDERSIGNED, FOR CONSIDERATION DO HEREBY INDIVIDUALLY AND PERSONALLY GUARANTEE THE FULL AND PROMPT PAYMENT OF ALL INDEBTEDNESS HERETOFORE OR HEREAFTER INCURRED BY THE ABOVE BUSINESS. THIS GUARANTEE SHALL NOT BE AFFECTED BY THE AMOUNT OF CREDIT EXTENDED OR ANY CHANGE IN THE FORM OF SAID INDEBTEDNESS. NOTICE OF THE ACCEPTANCE OF THIS GUARANTEE, EXTENSION OF CREDIT, MODIFICATION IN TERMS OF PAYMENT, AND ANY RIGHT OR DEMAND TO PROCEED AGAINST THE PRINCIPAL DEBTOR IS HEREBY WAIVED. THIS GUARANTEE MAY ONLY BE REVOKED BY WRITTEN NOTICE WHICH SHALL BE SENT TO THE CREDITOR’S CREDIT OFFICE BY CERTIFIED MAIL. ANY REVOCATION DOES NOT REVOKE THE OBLIGATION OF THE GUARANTORS TO PROVIDE PAYMENT FOR INDEBTEDNESS INCURRED PRIOR TO THE REVOCATION. I AUTHORIZE THE SELLER AND THEIR ASSIGNS TO OBTAIN A CONSUMER CREDIT REPORT AND TO CONTACT MY REFERENCES AS NECESSARY. AS GUARANTOR, I AM ALSO BOUND BY THE ABOVE ARBITRATION CLAUSE.

GUARANTOR’S NAME: _____________________________________ |

SIGNATURE: __________________________ |

HOME ADDRESS: _____________________________ CITY/STATE/ZIP: ____________________________________ |

|

DATE: _______________________________________ TAX I.D. OR S.S. NO: _________________________________ |

|

GUARANTOR’S NAME: _____________________________________ |

SIGNATURE: __________________________ |

HOME ADDRESS: _____________________________ CITY/STATE/ZIP: ____________________________________

DATE: _______________________________________ TAX I.D. OR S.S. NO: _________________________________

Page 2

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Purpose | The credit application form is used to assess a business's creditworthiness before extending credit terms. |

| Information Required | It collects essential details such as company name, address, phone number, and banking details. |

| Types of Entities | The form accommodates various business entity types, including corporations, partnerships, and proprietorships. |

| Credit Line Sought | Applicants specify the amount of credit they are seeking on the form. |

| Financial Statements | Businesses must indicate whether financial statements are available, an important indicator of financial health. |

| Duration in Business | Applicants must disclose how long they have been in business; less than five years may require a personal guarantee. |

| Bank Verification | The creditor may contact the listed bank to verify the banking details provided by the applicant. |

| Trade References | The form requires the listing of trade references, which help evaluate the applicant’s payment history. |

| Governing Law | For disputes, arbitration is handled by the American Arbitration Association in Orange County, California. |

| Collection Costs | Should non-payment occur, the applicant agrees to pay any collection costs, including legal fees. |

Guidelines on Utilizing Credit Application

Completing the Credit Application form is essential for establishing a credit relationship with a supplier or lender. It requires input from the applicant regarding their business information, financial details, and personal guarantees if necessary. Follow these steps carefully to ensure that the application is correctly filled out.

- Begin by entering the Company Name at the top of the form.

- Fill in the Phone number, along with the Fax number, if applicable.

- Provide the Street Address, City, State, and ZIP code for your main business location.

- If the billing address is different, fill in the Billing Address information as well.

- Enter the Email address and the Credit Line Sought.

- Select the type of business structure by checking the appropriate box: Corporation, Partnership, Proprietorship, L.L.C., or P.L.C.

- Fill in the Corporate Registration No. and V.A.T. No. if applicable.

- Enter the Annual Sales figure.

- Indicate whether Financial Statements are available by marking YES or NO.

- Provide the number of Years in Business.

- If your business has been operating for less than five years, complete the personal guarantee section as required.

- List each company director, officer, or principal in the provided sections, including their Name, Title, Home Address, and Phone Number.

- For Banking Details, enter the Bank Name, Account #, Branch Address, and the City/State/ZIP.

- Include the Bank Contact Name and their Phone Number.

- Complete the Trade References section by filling in details for three vendors, including Vendor Name, Contact, Payment Address, City/State/ZIP, Phone, Fax, and Account #.

- Review the terms and conditions carefully before signing.

- Sign and date the application where indicated as the Applicant and provide your title.

- If you are applying as a proprietor, partner, or with an S-Corporation, sign the authorization for a credit report.

- Complete the Personal Guarantee section with the name, signature, home address, date, and tax ID or social security number of the guarantor.

What You Should Know About This Form

What is the purpose of the Credit Application form?

The Credit Application form is used to collect essential information about your business. This information helps in determining your creditworthiness for extending credit lines. It ensures that your business can meet its financial obligations and outlines the terms for repayment.

What information is required to complete the form?

You will need to provide various details, including your company name, address, phone number, and email. Information about your business structure, annual sales, number of years in business, and banking details is also necessary. Furthermore, you must submit references from vendors and company directors or officers.

How will my personal information be used?

Your personal information will only be used to evaluate your creditworthiness. The creditor is authorized to contact your bank and trade references. If you are a sole proprietor, your personal credit report may be obtained to assess your financial responsibility.

What happens if I have been in business for less than five years?

If your business has been operating for less than five years, you must complete a personal guarantee. This means that you will be personally responsible for any debts incurred by the business, strengthening the creditor's assurance of repayment.

How long does it take to get a decision on my credit application?

The review process duration varies depending on the complexity of your application and the responsiveness of the references provided. Typically, you can expect a decision within a few business days, but it may take longer in some cases.

What are the terms of payment if my application is approved?

If your application is approved, payment terms are generally net 30 days. This means that the total amount due must be paid within 30 days from the invoice date. If you fail to make timely payments, additional charges may apply.

Can I revoke my personal guarantee?

You can revoke your personal guarantee, but this requires written notice sent to the creditor’s credit office by certified mail. It's important to note that revocation does not eliminate your responsibility for any debts incurred prior to the revocation date.

What should I do if I have disputes regarding the credit application?

If you have any disputes arising from the credit application or related transactions, these will be resolved by arbitration. The American Arbitration Association will handle this in Orange County, California, applying expedited rules. You agree to the arbitration terms when you submit the credit application.

Common mistakes

When applying for credit, thoroughness and accuracy are crucial. However, completing a Credit Application can be tricky, and many applicants make common mistakes that can delay their approval or even lead to denial. Here are seven of the frequent pitfalls to avoid.

First, many individuals fail to provide complete information. Fields such as company name, contact details, and banking information must be filled out accurately. Incomplete applications can raise red flags for lenders, who may interpret missing information as a lack of transparency or organization.

The second mistake is neglecting to double-check the spelling and numbers. A simple typo in your annual sales figure or credit line sought might inaccurately reflect your business's financial health. Always verify that all entered data is correct before submitting the application.

Next, some applicants overlook the importance of listing all trade references. Providing detailed references allows creditors to gain a clearer view of your creditworthiness. Without sufficient references, your application may be viewed as less credible, which could impact your approval chances.

Additionally, many fail to address the years in business appropriately. This information is vital for creditors assessing stability. If your business is less than five years old, be sure to complete a personal guarantee as required. Ignoring this step can lead to an incomplete or rejected application.

Another common mistake involves ignoring conditions and terms outlined in the application. Applicants should read and comprehend what they are signing. Understanding that terms are set for net 30 days upon credit approval can prevent future misunderstandings regarding repayment obligations.

Furthermore, some people forget to include their personal guarantee when necessary. For sole proprietors and partners, this section is essential. Excluding it may result in immediate disqualification from receiving the desired credit line.

Finally, not including a valid email address can hinder communication. Creditors often send updates and requests for further information via email. An incorrect or missing email can cause delays in processing the application.

By being mindful of these common mistakes when filling out a Credit Application, applicants can significantly improve their chances of a smooth approval process. Accuracy, thoroughness, and attention to detail are key elements that help build trust with lenders.

Documents used along the form

The Credit Application form is a key document when requesting a credit line. To facilitate this process, several additional forms may often be needed. Here are four commonly used documents that accompany the Credit Application.

- Personal Guarantee: This document confirms that an individual will personally guarantee the debts of the business. It requires signatures from individuals who are willing to be held accountable for repayment, should the business fail to meet its obligations.

- Financial Statements: These documents provide a snapshot of the company’s financial health. They typically include income statements, balance sheets, and cash flow statements. Lenders review these to assess creditworthiness.

- Tax Returns: Recent tax returns demonstrate the company's income and overall financial stability. Lenders often require this information to verify reported income and assess risk.

- Trade Reference List: This document includes contact information for companies that extend credit to the applicant. It serves as a resource for the creditor to evaluate the applicant's credit history and reliability.

Each of these documents plays a significant role in the credit approval process, ensuring that lenders have a comprehensive understanding of the applicant’s financial situation. Properly completed forms contribute to a smoother application and evaluation process.

Similar forms

-

Loan Application Form: Similar to a Credit Application form, a Loan Application gathers essential financial and personal information to assess an applicant's creditworthiness. It incorporates income details, existing debts, and purpose of the loan, thereby aiding lenders in making informed decisions.

-

Lease Agreement: A Lease Agreement outlines the terms and conditions under which a tenant rents property from a landlord. Like the Credit Application, it requires personal and financial information to determine eligibility and credit terms associated with renting the property.

-

Vendor Application Form: This form enables a business to apply for accounts or terms with a vendor. It similarly collects business details, credit references, and necessary financial information to evaluate whether to extend credit to the applicant.

-

Business Credit Application: Designed for businesses seeking credit from suppliers, this application is akin to the Credit Application as it requires comprehensive financial disclosures, company structure, and trade references for thorough credit evaluation.

-

Personal Guarantee Form: A Personal Guarantee Form obligates an individual to repay the debts of a business. This form directly aligns with the Credit Application by often being required if a business's creditworthiness is unknown, necessitating a personal assurance of repayment.

-

Credit Card Application: When applying for a credit card, individuals must provide personal and financial details similar to those required in a Credit Application. Both forms are utilized by creditors to gauge the risk associated with extending credit.

-

Line of Credit Application: This application serves to request a credit limit for ongoing borrowing. Like the Credit Application, it necessitates detailed financial history and current business status to establish credit viability.

-

Partnership Agreement: While mainly a legal document outlining the responsibilities of partners in a business, a Partnership Agreement may include credit terms. Both documents necessitate personal information and may involve financial evaluations to establish liability.

-

Account Application Form: Businesses or individuals seeking to open an account with a bank or service provider would complete an Account Application Form. Like the Credit Application, the document demands financial information and references to assess legitimacy and credit risk.

Dos and Don'ts

When filling out the Credit Application form, there are some important dos and don'ts to keep in mind. Follow these simple guidelines to make the process smoother.

- Do provide accurate and complete information.

- Do double-check all entries for spelling and numerical errors.

- Do read the terms and conditions carefully before signing.

- Do include valid contact information for references.

- Do ensure the application is signed and dated correctly.

- Don't rush through the form. Take your time.

- Don't leave any sections blank unless instructed.

- Don't provide misleading information.

- Don't forget to check the eligibility requirements.

- Don't overlook the importance of your personal guarantee if required.

Misconceptions

Misconceptions about the Credit Application form can lead to confusion. Here are some common ones:

- My credit history won't be checked if my business is new. Many believe that if their business is in its early stages, no credit check will occur. However, lenders may still review personal credit histories for proprietors or partners, so it's essential to be prepared.

- Submitting the application guarantees credit approval. Some applicants may think that filling out the form ensures they will receive credit. Approval depends on various factors, including the company's financial health and creditworthiness.

- It's okay to provide inaccurate information. Some people may think it's harmless to adjust numbers or provide incorrect details to appear more favorable. Inaccurate information can lead to denial of credit or even legal issues.

- All companies must complete a personal guarantee. It's a misconception that everyone needs to provide a personal guarantee. Only businesses that have been operating for less than five years are required to include this section.

- Filling out the application is just a formality. Many view the credit application as a simple formality that doesn't require attention. In reality, the details you provide are crucial in determining your creditworthiness and can impact the future of your business.

Understanding these misconceptions can help ensure a smoother application process and lead to better outcomes for your business.

Key takeaways

Filling out a Credit Application form is a crucial step for any business seeking credit. Here are some key takeaways to help you navigate the process:

- Accuracy is Key: Ensure all information provided is accurate and up-to-date. This includes business name, phone number, and address.

- Complete All Sections: Fill out every section of the form. Incomplete applications can delay the approval process.

- Company Structure: Specify the type of business entity accurately, whether it's a corporation, partnership, or LLC.

- Financial Statements: Be prepared to submit financial statements, particularly if your business is under five years old. This is often a requirement.

- Personal Guarantee: If your business is a proprietorship or partnership, a personal guarantee may be necessary to secure credit.

- Trade References: Provide reliable trade references. Make sure to include accurate contact information for ease of verification.

- Read Terms Carefully: Understand the terms and conditions outlined, especially concerning payment and collection responsibilities.

- Review Before Submission: Double-check all details before sending the application. Errors can lead to rejection.

- Follow Up: After submission, consider following up with the creditor to confirm receipt and inquire if any further information is needed.

By following these guidelines, you can improve your chances of a smooth application process and establish a beneficial credit relationship.

Browse Other Templates

Registered Retail Merchant Certificate - Owners who change their business structure must carefully review the requirements for submitting the BT-1.

Workers Comp New Mexico - Any communication or correspondence with the Taxation and Revenue Department should reference the form.