Fill Out Your Credit Card Application Form

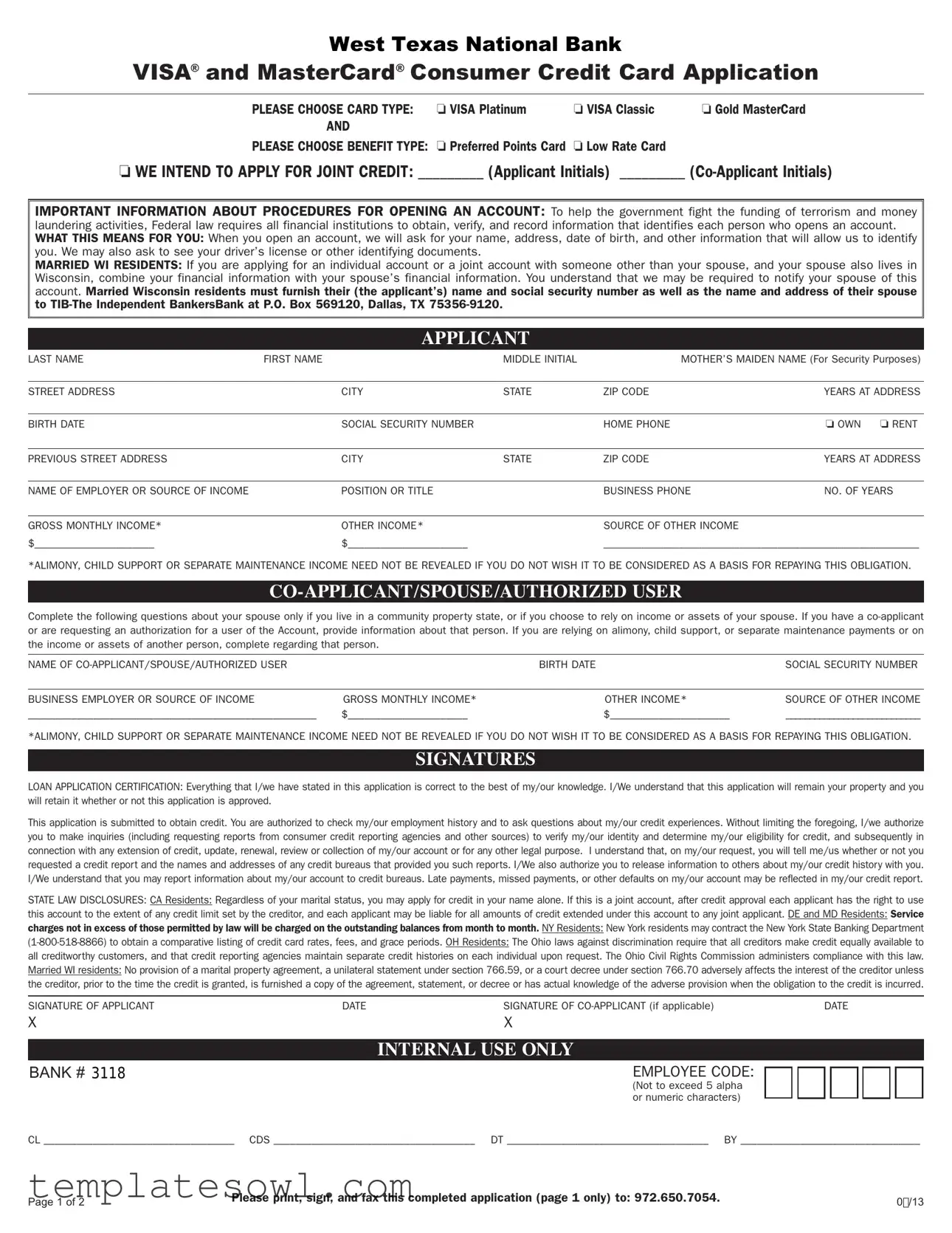

When applying for a credit card, you'll encounter a crucial document known as the Credit Card Application form. This form allows you to specify your preferred card type, whether it's a VISA Platinum, VISA Classic, or Gold MasterCard, and what benefits you want, such as a Preferred Points Card or a Low Rate Card. You'll need to provide important personal details, including your name, address, and Social Security number. The application also asks about your employment and income, helping the financial institution make informed decisions about your creditworthiness. If you're married and reside in certain states, you'll need to disclose your spouse’s information. As part of the process, banks must comply with federal regulations aimed at preventing identity fraud and money laundering, which means they will request documentation to confirm your identity. Additionally, both the applicant and co-applicant—if applicable—must sign the form, certifying that all information is accurate and that they've authorized credit checks. Understanding what goes into this form is essential for a smooth application process, so let's explore each section in detail.

Credit Card Application Example

VISA and MasterCardWest TexasConsumerNationalCreditBankCard Application

®®

|

|

|

|

PLEASE CHOOSE CARD TYPE: |

❏ VISA Platinum |

❏ VISA Classic |

❏ Gold MasterCard |

AND

PLEASE CHOOSE BENEFIT TYPE: ❏ Preferred Points Card ❏ Low Rate Card

❏WE INTEND TO APPLY FOR JOINT CREDIT: _________ (Applicant Initials) _________

IMPORTANT INFORMATION ABOUT PROCEDURES FOR OPENING AN ACCOUNT: To help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account. WHAT THIS MEANS FOR YOU: When you open an account, we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see your driver’s license or other identifying documents.

MARRIED WI RESIDENTS: If you are applying for an individual account or a joint account with someone other than your spouse, and your spouse also lives in Wisconsin, combine your financial information with your spouse’s financial information. You understand that we may be required to notify your spouse of this

account. Married Wisconsin residents must furnish their (the applicant’s) name and social security number as well as the name and address of their spouse to

LAST NAME |

FIRST NAME |

|

MIDDLE INITIAL |

MOTHER’S MAIDEN NAME (For Security Purposes) |

|

|

|

|

|

|

|

STREET ADDRESS |

|

CITY |

STATE |

ZIP CODE |

YEARS AT ADDRESS |

|

|

|

|

|

|

BIRTH DATE |

|

SOCIAL SECURITY NUMBER |

|

HOME PHONE |

❏ OWN ❏ RENT |

|

|

|

|

|

|

PREVIOUS STREET ADDRESS |

|

CITY |

STATE |

ZIP CODE |

YEARS AT ADDRESS |

|

|

|

|

|

|

NAME OF EMPLOYER OR SOURCE OF INCOME |

|

POSITION OR TITLE |

|

BUSINESS PHONE |

NO. OF YEARS |

|

|

|

|

|

|

GROSS MONTHLY INCOME* |

|

OTHER INCOME* |

|

SOURCE OF OTHER INCOME |

|

$______________________ |

|

$______________________ |

|

__________________________________________________________ |

|

*ALIMONY, CHILD SUPPORT OR SEPARATE

Complete the following questions about your spouse only if you live in a community property state, or if you choose to rely on income or assets of your spouse. If you have a

NAME OF |

|

BIRTH DATE |

SOCIAL SECURITY NUMBER |

|

|

|

|

BUSINESS EMPLOYER OR SOURCE OF INCOME |

GROSS MONTHLY INCOME* |

OTHER INCOME* |

SOURCE OF OTHER INCOME |

_____________________________________________________ |

$______________________ |

$______________________ |

____________________________ |

|

SIGNATURES |

|

|

*ALIMONY, CHILD SUPPORT OR SEPARATE MAINTENANCE INCOME NEED NOT BE REVEALED IF YOU DO NOT WISH IT TO BE CONSIDERED AS A BASIS FOR REPAYING THIS OBLIGATION.

LOAN APPLICATION CERTIFICATION: Everything that I/we have stated in this application is correct to the best of my/our knowledge. I/We understand that this application will remain your property and you will retain it whether or not this application is approved.

This application is submitted to obtain credit. You are authorized to check my/our employment history and to ask questions about my/our credit experiences. Without limiting the foregoing, I/we authorize you to make inquiries (including requesting reports from consumer credit reporting agencies and other sources) to verify my/our identity and determine my/our eligibility for credit, and subsequently in connection with any extension of credit, update, renewal, review or collection of my/our account or for any other legal purpose. I understand that, on my/our request, you will tell me/us whether or not you requested a credit report and the names and addresses of any credit bureaus that provided you such reports. I/We also authorize you to release information to others about my/our credit history with you. I/We understand that you may report information about my/our account to credit bureaus. Late payments, missed payments, or other defaults on my/our account may be reflected in my/our credit report.

STATE LAW DISCLOSURES: CA Residents: Regardless of your marital status, you may apply for credit in your name alone. If this is a joint account, after credit approval each applicant has the right to use

this account to the extent of any credit limit set by the creditor, and each applicant may be liable for all amounts of credit extended under this account to any joint applicant. DE and MD Residents: Service

charges not in excess of those permitted by law will be charged on the outstanding balances from month to month. NY Residents: New York residents may contract the New York State Banking Department

SIGNATURE OF APPLICANT |

|

DATE |

|

SIGNATURE OF |

|

|

|

|

DATE |

|||||

X |

|

|

|

X |

|

|

|

|

|

|

|

|

|

|

BANK # 3118 |

|

|

INTERNAL USE ONLY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EMPLOYEE CODE: |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

(Not to exceed 5 alpha |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

or numeric characters) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

CL ___________________________________ |

CDS _____________________________________ |

DT _____________________________________ |

BY _________________________________ |

|||||||||||

Page 1 of 2 |

Please print, sign, and fax this completed application (page 1 only) to: 972.650.7054. |

0/13 |

||||||||||||

|

|

|

|

|||||||||||

VISA® and MasterCard® Consumer Credit Card Application

|

PREFERRED POINTS CARD |

|

LOW RATE CARD |

|

|

|

|

|

|

Interest Rates and Interest Charges |

|

|

||

|

|

|

|

|

|

2.90% introductory APR for six months. |

|

2.90% introductory APR for six months. |

|

Annual Percentage Rate |

After that, your APR will be 15.24%. |

|

After that, your APR will be 10.24%. |

|

(APR) for Purchases |

|

|||

|

This APR will vary with the market based on |

|

This APR will vary with the market based on |

|

|

the Prime Rate.a |

|

the Prime Rate.b |

|

|

2.90% introductory APR for six months. |

|

2.90% introductory APR for six months. |

|

APR for Balance Transfers |

After that, your APR will be 15.24%. |

|

After that, your APR will be 10.24%. |

|

and Cash Advances |

|

|||

This APR will vary with the market based on |

|

This APR will vary with the market based on |

||

|

the Prime Rate.a |

|

the Prime Rate.b |

|

Penalty APR and |

19.24% – This APR will vary with the market based on the Prime Rate.c |

|||

This APR may be applied if you allow your Account to become 60 days past due. |

||||

When It Applies |

How Long Will the Penalty Apply? If your APR is increased for the reason stated above, the |

|||

|

Penalty APR will apply until you make three consecutive minimum payments when due. |

|||

|

|

|

||

How to Avoid Paying Interest |

Your due date is at least 25 days after the close of each billing cycle. We will not charge you |

|||

on Purchases |

any interest on purchases if you pay your entire balance by the due date each month. |

|||

|

|

|

|

|

For Credit Card Tips from |

To learn more about factors to consider when |

applying for or using a credit card, visit the website |

||

the Consumer Financial |

||||

of the Consumer Financial Protection Bureau at |

||||

Protection Bureau |

||||

|

|

|

||

|

|

|

|

|

|

|

|

|

|

Fees |

|

|

|

|

|

|

|

|

|

Annual Fee |

None |

|

None |

|

|

|

|

|

|

Transaction Fees: |

|

|

|

|

Balance Transfer |

Either $10 or 3% of the amount of each balance transfer or each cash advance, whichever |

|||

and Cash Advance |

is greater. |

|

|

|

International Transaction |

2% of each transaction in U.S. dollars. |

|

|

|

|

|

|

|

|

Penalty Fees: |

|

|

|

|

Late Payment |

$25 |

|

|

|

Returned Payment |

$25 |

|

|

|

|

|

|

|

|

Other Fees: |

|

|

|

|

Up to $10 for agent assisted payments. |

|

|

||

|

|

|

|

|

How We Will Calculate Your Balance: We use a method called “average daily balance (including new purchases).” See your account agreement for more details.

Prime Rate: After the introductory rate, the APR will vary based on changes in the Index, the Prime Rate (the base rate on corporate loans posted by at least 70% of the ten largest U.S. banks) published in the Wall Street Journal. The Index will be adjusted on the 25th day of each month or the business day preceding the 25th day if that day falls on a weekend or a holiday recognized by the Board of Governors of the Federal Reserve System. Changes in the Index will take effect beginning with the first billing cycle in the month following a change in the Index. Increases or decreases in the Index will cause the APR and periodic rate to fluctuate, resulting in increased or decreased Interest Charges on the Account. As of December 24, 2012, the Index was 3.25%.

aWe add 11.99% to the Prime Rate to determine the APR for Purchases, Balance Transfers, and Cash Advances. The Account will never have an APR over 21%.

bWe add 6.99% to the Prime Rate to determine the APR for Purchases, Balance Transfers, and Cash Advances. The Account will never have an APR over 21%.

cWe add 15.99% to the Prime Rate to determine the Penalty APR. The Account will never have an APR over 21.00%.

If at least one box at the top of the application is not checked, or, if too many boxes are inadvertently checked, you will be deemed to have selected the VISA Platinum card with the Low Rate option.

If you do not qualify for a VISA Platinum Card and you qualify for a VISA Classic Card, you will automatically be offered a VISA Classic Card.

The issuer and administrator of the credit card program is

The information about the Cost described in this table is accurate as of January 1, 2013.

This information may change after that date. To find out what may have changed, call us at

or write

Page 2 of 2 |

Please print and save this page for your records. |

01/13 |

|

|

Form Characteristics

| Fact Name | Details |

|---|---|

| Card Type Options | The application allows applicants to choose between VISA Platinum, VISA Classic, and Gold MasterCard. |

| Benefit Type Selection | Applicants can select from Preferred Points Card or Low Rate Card options based on their needs. |

| Joint Credit Application | Joint credit can be applied for, requiring initials from both the applicant and co-applicant to indicate intent. |

| Identification Requirements | Federal law mandates that financial institutions collect and verify identifying information, including name, address, and date of birth. |

| Married Wisconsin Residents | In Wisconsin, married residents may need to combine financial information with their spouse's and notify them about the account. |

| State-Specific Laws | Different states have specific laws impacting credit applications, including California, Ohio, Maryland, Delaware, and New York. |

| Reporting to Credit Bureaus | The credit issuer will report account information to credit bureaus, reflecting payment history and account status. |

Guidelines on Utilizing Credit Card Application

Once the Credit Card Application form is completed, it can be submitted for processing. Make sure all information is accurate and clearly written to avoid delays in approval.

- Read the instructions carefully.

- Select the type of card you want by checking one of the options: VISA Platinum, VISA Classic, or Gold MasterCard.

- Choose your preferred benefit type by checking one of the options: Preferred Points Card or Low Rate Card.

- If applying for joint credit, both the applicant and co-applicant should initial in the designated area.

- Fill out the applicant's personal information, including:

- Last name

- First name

- Middle initial

- Mother’s maiden name (for security purposes)

- Street address

- City

- State

- Zip code

- Years at address

- Birth date

- Social security number

- Home phone number

- Housing status (own or rent)

- If applicable, provide the previous street address and the number of years at that address.

- Complete the employment or income section, including:

- Name of employer or source of income

- Position or title

- Business phone number

- Number of years at the job

- Gross monthly income

- Other income (if any)

- Source of other income

- Fill out the co-applicant's or authorized user's information if applicable, including their personal and income details.

- Review the certification statement and confirm that all information provided is correct.

- Sign and date the application in the designated areas for both the applicant and co-applicant (if applicable).

- Submit the completed application by printing, signing, and faxing the first page to the provided number: 972.650.7054.

What You Should Know About This Form

1. What types of credit cards can I apply for?

You can choose between a VISA Platinum, VISA Classic, or a Gold MasterCard. Depending on your needs, options include the Preferred Points Card or the Low Rate Card for benefits.

2. What personal information do I need to provide on the application?

During the application process, you will be asked for your name, address, date of birth, social security number, and other identifying information. You may also need to provide documents such as a driver's license.

3. What if I am married and live in Wisconsin?

If you're married and live in Wisconsin, you need to provide your spouse’s information along with your own, including their name and social security number. Your financial information may be combined with your spouse's for the application.

4. Will my credit history be checked?

Yes, as part of the application process, the lender is authorized to check your credit history. This may include obtaining reports from consumer credit reporting agencies. You have the right to know if a report was requested.

5. Can I apply for a credit card if I have no credit history?

Yes, it’s possible to apply for a credit card with no credit history. However, the approval may depend on other factors such as income and employment history.

6. Are there any fees associated with the credit card?

There are potential fees, including a balance transfer fee which could be either $10 or 3% of the transfer amount. Additionally, late payment and returned payment fees may apply, typically around $25.

7. What happens if I miss a payment?

If you miss a payment, you may incur a late payment fee. Your account could also be subject to a penalty annual percentage rate (APR), which is higher than your regular rate until you make three consecutive minimum payments on time.

8. How do I know my personal information will be kept safe?

Your personal information is protected through various security measures. The application process is designed to comply with federal laws aimed at preventing identity theft and fraud.

9. How can I get more information if I have questions?

If you have additional questions, feel free to contact the customer service line at 800-367-7576. Alternatively, you can write to TIB-The Independent BankersBank, P.O. Box 569120, Dallas, Texas 75356-9120 for more detailed inquiries.

Common mistakes

Filling out a credit card application can feel like a daunting task, and mistakes can lead to delays or even rejections. One common mistake is not double-checking the chosen card type. When multiple options exist, like the VISA Platinum or Gold MasterCard, it is vital to mark only one choice. If more than one box is checked, the applicant may automatically be assigned a card they did not intend to choose, potentially leading to dissatisfaction.

Another frequent error involves incomplete personal information. It's essential to provide your last name, first name, middle initial, and other identifying details, such as your social security number and date of birth. Skipping any of these crucial pieces of information can result in an incomplete application, which the institution may not process. Ensure every required field is filled out completely.

Additionally, some applicants mistakenly underestimate the importance of providing accurate income information. Applicants should report their gross monthly income and sources of other income, even if they prefer not to disclose alimony or child support. Providing misleading or inaccurate information can not only result in application denial but may also affect future credit opportunities.

Moreover, neglecting to check the residency requirements based on marital status can create complications. For instance, married residents of Wisconsin are required to combine financial information with their spouse’s. If this step is overlooked, it can lead to additional paperwork or require notification to the spouse, creating unnecessary complications.

Failing to sign the application is another common oversight. The application includes a certification section that requires signatures from both the applicant and, if applicable, the co-applicant. Without these signatures, the application lacks validity and cannot be processed, leading to delays that can be easily avoided.

Lastly, applicants often overlook verifying their contact information. Providing an accurate phone number and email address is crucial for the financial institution to reach the applicant if additional information is needed or to convey the status of the application. An incorrectly entered phone number may lead to missed communication and, ultimately, a rejected application.

Taking care to avoid these mistakes makes the application process smoother. By paying attention to detail and ensuring all sections are correctly completed, applicants can improve their chances of receiving the credit card that best fits their needs.

Documents used along the form

When applying for a credit card, several important documents often accompany the Credit Card Application form. These forms play various roles in facilitating the application process. Below is a list of common documents that may be required or helpful during this procedure.

- Credit Report Authorization Form: This document grants the lender permission to access the applicant’s credit report. It helps the lender evaluate creditworthiness and assess any potential risks associated with the applicant.

- Income Verification Document: Applicants may need to provide proof of income, such as pay stubs or tax returns. This information is critical for determining the applicant's ability to repay borrowed funds.

- Identification Verification: A government-issued identification, like a driver’s license or passport, is often required to verify the identity of the applicant and prevent fraudulent applications.

- Employment Verification Form: This form may be used to confirm employment status and salary details. Lenders often want to ensure a steady income before extending credit.

- Joint Account Application: If applying for a joint credit card account, a separate form for the co-applicant or spouse is typically necessary. Additional information about the co-applicant’s financial history is also required.

- Financial Statement: Some applicants may be asked to provide a detailed summary of their assets and liabilities. This document helps lenders understand the applicant's overall financial situation.

Each of these documents serves a vital purpose in the credit application process, helping lenders make informed decisions. Comprehensive information supports a smoother application journey for the applicant, ultimately contributing to a positive credit experience.

Similar forms

- Loan Application: A credit card application is similar to a loan application as both documents gather personal and financial information from the applicant. They typically require details such as income, employment history, and creditworthiness to assess eligibility for credit. Each form often includes a section for consent to check credit history.

- Lease Agreement: Much like a credit card application, a lease agreement requires the lessee's personal information, including name, address, and income. Both documents highlight the obligation of the signer, whether it is to repay credit or pay rent. The lease often includes terms regarding responsibility for payments and consequences for non-compliance.

- Mortgage Application: A mortgage application resembles a credit card application in that it requests comprehensive financial details and personal information to evaluate the applicant's ability to meet payment obligations. Both documents must also adhere to regulations that protect financial institutions from risk, requiring applicants to provide proof of identity and income.

- Bank Account Application: The bank account application shares similarities with a credit card application through the requirement of personal identification and financial background. Both applications seek to ensure that the applicant can be verified and assessed, often including a request for joint account information and necessary disclosures related to financial responsibility.

Dos and Don'ts

When filling out a Credit Card Application form, consider these important guidelines:

- Ensure all information is accurate and complete. Double-check for spelling errors, especially in your name, address, and Social Security Number. Inaccuracies can delay your application or cause rejection.

- Choose the correct card type and benefit option. Make sure to mark only one option in each section to avoid confusion or misinterpretation.

- Provide all required documentation. This may include identification like a driver’s license or another form of ID for verification.

- Read the terms and conditions thoroughly. Familiarize yourself with the interest rates, fees, and overall account policies to make informed decisions.

Also, avoid these common mistakes:

- Do not leave any sections blank. Incomplete applications can lead to delays or disqualification.

- Avoid guessing or estimating income and other financial data. Provide precise figures to maintain credibility.

- Refrain from submitting multiple applications at once. This can negatively impact your credit score.

- Do not ignore the fine print. Overlooking critical information may result in unexpected fees or terms later on.

Misconceptions

Credit card application forms often come with a range of misconceptions. Understanding these myths can help you navigate the process more effectively.

- You must apply for a joint account with a spouse. Many people believe that applying with a spouse is necessary. However, individuals can apply for credit independently, depending on state laws.

- Your income must be disclosed in full. Applicants sometimes think they have to reveal all sources of income. If you prefer to keep certain income sources confidential, such as alimony or child support, that’s acceptable.

- Your creditworthiness solely depends on your income. A common misconception is that income determines creditworthiness. While it is one factor, lenders also consider your credit history, debt-to-income ratio, and other aspects.

- Only residents of community property states need to involve a spouse in the application. This is not true. The application may require spouse information based on income reliance, not merely the state you live in.

- All applications must be approved if the form is filled out correctly. Many assume that a correctly completed application guarantees approval. However, the lender will evaluate various factors before deciding.

- Your credit report will always stay the same. Some believe that once a credit report is established, it remains unchanged. In reality, your credit report continuously evolves based on financial activity.

- All credit card types have the same terms and conditions. Misunderstanding exists around the belief that all credit card offers are similar. Different cards may feature various interest rates, fees, and benefits, which are crucial to examine.

Being informed about these misconceptions can empower you when filling out a credit card application. Each point highlights the importance of understanding your rights and responsibilities as a borrower.

Key takeaways

Choose the right card type and benefit carefully. Selecting between options like VISA Platinum or VISA Classic can impact your credit experience and offers.

Complete all personal information accurately. The application requires details such as your name, address, and social security number, which verify your identity and creditworthiness.

Be aware of the legal requirements. Federal law mandates that financial institutions confirm your identity to combat terrorism and money laundering.

Consider joint credit implications. If applying with a co-applicant, each party's financial situation may be assessed, and both may be liable for card usage.

Understand state-specific requirements. For instance, married Wisconsin residents must include their spouse's info, even if they are not applying jointly.

Review the terms carefully. Pay attention to interest rates, fees, and penalties to avoid surprises, ensuring you are fully informed about your credit obligations.

Browse Other Templates

World Omni Financial Corp Payoff - Confirm all contact information on the form is correct to receive updates on your request.

21-530 - It includes instructions on reporting burial expenses incurred post-veteran's death.