Fill Out Your Credit Investigation Form

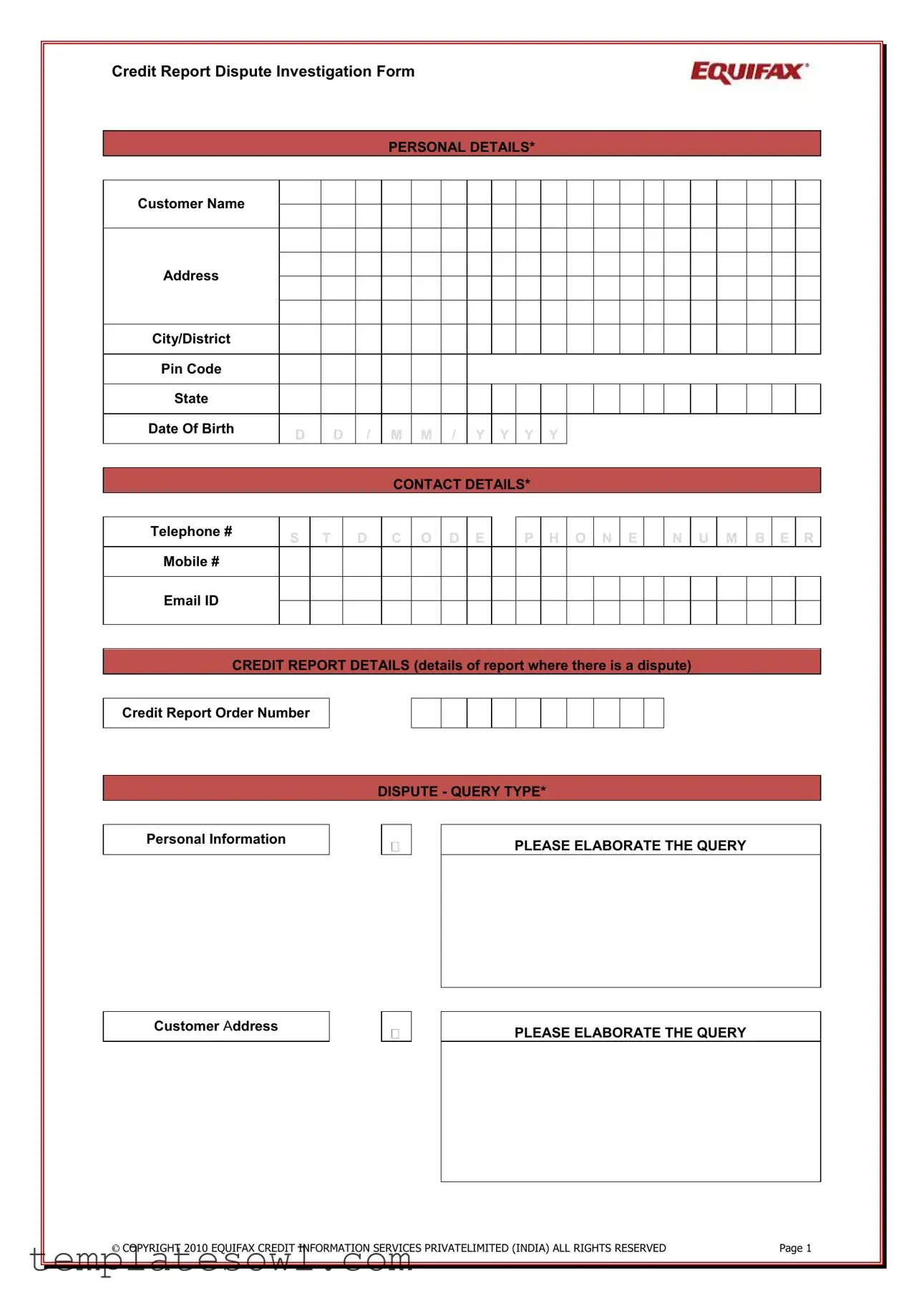

The Credit Investigation form serves as a crucial tool for individuals seeking to address discrepancies in their credit reports, thereby playing an essential role in maintaining accurate credit histories. This form requires several key details, beginning with personal information such as the customer's name, address, and date of birth. Proper input into these fields is vital, as inaccuracies can hinder the investigation process. Additionally, it includes contact information, allowing for efficient communication between the customer and the credit reporting agency. Further along, the form emphasizes the importance of providing specific details regarding the disputed credit report, including the credit report order number and the nature of the discrepancy. Users must clearly articulate their concerns through designated sections for queries related to personal information, account details, or general questions. Notably, a section allows for elaboration on additional concerns not covered in the form, demonstrating the flexibility it offers. Ultimately, after filling out the required fields, customers must acknowledge receipt of the terms and conditions and provide a signature to validate the submission. Such comprehensive requirements ensure that disputes are addressed thoroughly and systematically, empowering consumers to advocate for their financial rights.

Credit Investigation Example

Credit Report Dispute Investigation Form

PERSONAL DETAILS*

Customer Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City/District |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pin Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date Of Birth |

D |

|

D |

/ |

M |

M |

/ |

Y |

Y |

Y |

Y |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

CONTACT DETAILS* |

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Telephone # |

S |

T |

D |

C |

O |

D |

E |

|

P |

H |

O |

N |

E |

|

N |

U |

M |

B |

E |

R |

||||

|

|

|

||||||||||||||||||||||

Mobile # |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Email ID |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

||||||||||||||||||||

CREDIT REPORT DETAILS (details of report where there is a dispute) |

|

|||||||||||||||||||||||

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Credit Report Order Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Personal Information

DISPUTE - QUERY TYPE*

PLEASE ELABORATE THE QUERY

Customer Address

PLEASE ELABORATE THE QUERY

© COPYRIGHT 2010 EQUIFAX CREDIT INFORMATION SERVICES PRIVATELIMITED (INDIA) ALL RIGHTS RESERVED |

PAGE 1 |

||

|

|

|

|

|

|

|

|

Credit Report Dispute Investigation Form

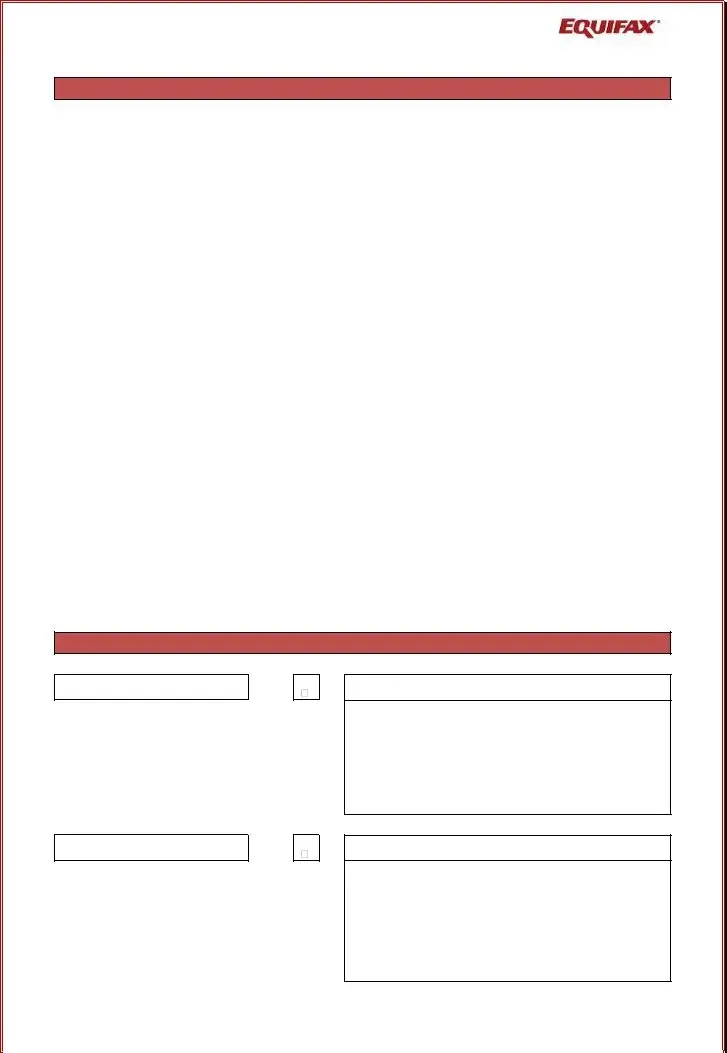

Enquiries

Account Details - 1

Account Details - 2

General Query

PLEASE ELABORATE THE QUERY

PLEASE ELABORATE THE QUERY

PLEASE ELABORATE THE QUERY

PLEASE ELABORATE THE QUERY

In case there are any more queries please elaborate on a piece of paper and attach with the form

The above query has been raised by me, on basis of the Credit Report received from Equifax Credit Information Services Pvt Ltd.

I acknowledge and accept the Terms and Conditions applicable as stated in the form

Customer Signature*Date*

___________________________

* Fields marked in asterisk are mandatory requirements for resolving any discrepancy in the Credit Report

© COPYRIGHT 2010 EQUIFAX CREDIT INFORMATION SERVICES PRIVATELIMITED (INDIA) ALL RIGHTS RESERVED |

PAGE 2 |

||

|

|

|

|

|

|

|

|

Form Characteristics

| Fact Name | Fact Detail |

|---|---|

| Purpose | The Credit Investigation form is used to dispute inaccuracies in credit reports. |

| Mandatory Fields | Certain fields, marked with an asterisk (*), are required to process the dispute effectively. |

| Customer Information | Personal details such as name, address, and date of birth need to be provided. |

| Contact Details | It’s essential to include both a telephone number and email for communication purposes. |

| Credit Report Order Number | A specific order number related to the credit report in question is required for processing. |

| Dispute Type | Users must describe the nature of the dispute clearly to aid in resolving the issue. |

| Additional Queries | If there are more questions, they can be documented on a separate piece of paper and attached. |

| Terms and Conditions | Submitters must acknowledge and accept the Terms and Conditions listed on the form. |

| Governing Law | This form is governed by the laws applicable in the jurisdiction where Equifax operates. |

Guidelines on Utilizing Credit Investigation

Completing the Credit Investigation form is an important process that helps resolve discrepancies and ensures that your credit report accurately reflects your financial history. Carefully following the steps below will guide you through filling out the required information, helping you submit your request without any errors.

- Personal Details: Fill in your name, address, city or district, pin code, state, and date of birth (format: DD/MM/YYYY).

- Contact Details: Include your telephone number with the appropriate STD code, mobile number, and email ID.

- Credit Report Details: Locate and input your credit report order number and any relevant personal information as indicated on the report.

- Dispute - Query Type: Select and elaborate on the type of dispute. Be specific about your concerns regarding the report.

- Customer Address: If your address shown in the report requires correction, provide the accurate information.

- Account Details: For any discrepancies related to your accounts, fill in details for up to two account entries as required.

- General Query: If you have any additional questions or need further clarification, please elaborate here.

- Additional Queries: If there are more queries that require explanation, attach a separate piece of paper with the details.

- Acknowledgment: Sign and date the form to confirm that the above queries are raised based on the credit report you received.

Once you complete the form, review all your entries for accuracy. Ensure that fields marked with an asterisk are filled out, as these are mandatory for processing your dispute. Submitting a complete and clear form will help expedite the resolution of your inquiry.

What You Should Know About This Form

What is the purpose of the Credit Investigation form?

The Credit Investigation form is designed for individuals who want to dispute specific items on their credit report. By completing this form, customers can formally raise concerns about inaccuracies or discrepancies found in their reports obtained from credit reporting agencies, such as Equifax. The form assists in documenting the dispute and initiating an investigation process to resolve issues effectively.

What information do I need to provide on the form?

When filling out the Credit Investigation form, it is essential to provide personal details, including your name, address, state, and date of birth. Additionally, you must include your contact details, such as your telephone number and mobile number. The form requires specifics about the credit report in question, such as the credit report order number and details of the dispute. Elaborating on the query will also aid in the investigation process.

How should I elaborate on my query?

Elaboration of your query is vital for clarity. In the form, you will find sections designated for detailing your concerns about personal information, account details, or general queries. Be precise about what information you believe is incorrect or needs clarification. If the space provided is insufficient, you can write additional details on a separate piece of paper and attach it to the form. Clear and thorough information will help expedite the investigation.

Are there any mandatory fields on the form?

Yes, certain fields are marked with an asterisk (*) and are mandatory for effectively addressing discrepancies in your credit report. Providing your customer name, address, date of birth, contact details, and specific dispute information are all required. Omitting any of these essential details might delay the processing of your dispute.

What should I do after submitting the form?

After you have completed and submitted the Credit Investigation form, the credit reporting agency will review the information you provided. They will conduct an investigation into the disputed items and typically respond within a reasonable timeframe. Be sure to keep a copy of the submitted form and any additional documentation for your records. If you do not receive a response or need further assistance, you can follow up with the agency regarding the status of your dispute.

Common mistakes

Filling out the Credit Investigation form accurately is crucial for processing disputes effectively. However, mistakes can occur. One common error is not providing all the personal details requested. Missing even one mandatory field, such as the customer name or address, could lead to delays or complications in the investigation. It is important to double-check that all required fields marked with an asterisk are completed.

Another mistake often seen is insufficient detail in the dispute query section. When individuals do not elaborate on the nature of their dispute, it can result in confusion. A vague description may not provide enough context for the review team, making it harder to resolve the issue. Clearly explaining the problem helps expedite the resolution process.

Failing to include accurate contact information is also a frequent oversight. If the phone number or email is incorrect, the credit investigation team may struggle to reach the person. This can prolong the investigation and lead to missed opportunities for communication. Always verify that the contact details listed are correct and up to date.

Many individuals forget to check their credit report order number before submitting the form. This number is essential for tracking the dispute. If it is missing or incorrect, it may cause confusion and leave the investigation in a backlog. Ensuring that this information is correct streamlines the process.

Another common error involves the submission of additional queries on separate paper without clear instructions. While it is acceptable to attach further information, individuals should ensure that these documents are clearly labeled and directly related to the form's original content. Otherwise, they may be overlooked during processing.

Signing and dating the form can also lead to mistakes. Some people might forget to sign the form or may not include the correct date. Without a signature, the form can be considered invalid. It is critical to ensure that both of these elements are properly completed before submission.

Lastly, neglecting to review the terms and conditions can result in misunderstandings later on. It is important to acknowledge understanding of the policies linked to the credit report dispute process. Ignoring these terms may lead to unforeseen issues down the road. Taking the time to read and accept the terms ensures clarity regarding the process.

Documents used along the form

The Credit Investigation form is an essential document for addressing discrepancies in a credit report. Along with this form, several other documents can facilitate the investigation process. Here is a list of other forms and documents commonly used in conjunction with the Credit Investigation form.

- Credit Report: This is the primary document containing detailed information about an individual's credit history. A consumer can request their own report to review for accuracy or discrepancies.

- Dispute Letter: A written communication that accompanies the Credit Investigation form, detailing the specific discrepancies found in the Credit Report.

- Proof of Identity: Documents like a government-issued ID or utility bills may be required to verify the identity of the person raising the dispute.

- Bank Statements: Recent bank statements can be helpful in providing evidence for claims made in the dispute, demonstrating payments or transactions relevant to the investigation.

- Correspondence from Creditors: Any correspondence related to the accounts in question can support the dispute by providing context or confirming inaccuracies.

- Payment Receipts: Copies of receipts for payments made can be used to validate claims, especially if there are record discrepancies regarding outstanding balances.

- Identity Theft Report: In cases of fraud, a report filed with law enforcement can be a critical document to support claims in the dispute process.

Gathering these documents can significantly ease the process of investigating credit report discrepancies. It is vital to ensure all information provided is accurate and comprehensive to achieve the best outcome.

Similar forms

- Credit Report – This is a detailed report that includes information about an individual's credit history. Like the Credit Investigation form, it is crucial for assessing creditworthiness.

- Loan Application Form – Similar in that personal and financial information is required, this document is used to apply for loans and often includes acknowledgments related to credit responsibilities.

- Debt Verification Letter – Much like the Credit Investigation form, this letter is used to dispute debt records. It requests validation of the debt and details for review.

- Identity Theft Report – This document assists in reporting identity theft. It often requires personal details and specifics of fraudulent activities, similar to the information requested in the Credit Investigation form.

- Credit Monitoring Request – Used to track credit changes, it collects personal data and identifies inquiries or changes, paralleling the data-gathering process of the Credit Investigation form.

- Credit Repair Agreement – Often requires similar personal information and outlines issues to be addressed, which aligns with the dispute aspect of the Credit Investigation form.

- Financial Counseling Intake Form – This form gathers personal and financial data to guide clients in financial matters, reflecting the credit-related inquiries in the Credit Investigation form.

- Bank Account Dispute Form – Used to contest unauthorized transactions. Similarities lie in the provision of account details and personal information before resolution.

- Loan Dispute Resolution Form – This form is designed to address disputes related to loans. It collects details related to the account and relevant personal information, much like the Credit Investigation form does.

- Fraud Alert Request – This document requests a fraud alert on a credit report. It collects personal information similar to that required in the Credit Investigation form to help protect against identity theft.

Dos and Don'ts

Things to Do:

- Provide accurate and complete personal details, including your name, address, and date of birth.

- Fill in contact details carefully, ensuring your phone number and email are correct.

- Clearly specify the dispute type in the designated section.

- Include any relevant information about the credit report you are disputing.

- Use clear and concise language when elaborating on the query.

- Sign and date the form to confirm your application.

- Attach any additional documents if there are more queries.

Things Not to Do:

- Do not leave any mandatory fields blank.

- Avoid providing incomplete or vague information about the dispute.

- Do not submit the form without reviewing it for errors.

- Don’t forget to double-check your contact details.

- Never include personal information that is not relevant to the dispute.

- Do not forget to read the Terms and Conditions before signing.

- Refrain from using illegible handwriting, as it may lead to miscommunication.

Misconceptions

Here are some common misconceptions about the Credit Investigation form:

- Only negative information can be disputed. Many believe they can only challenge inaccuracies that reflect poorly on their credit. In reality, you can dispute any incorrect information, whether it's positive or negative.

- Filling out the form is unnecessary if I contact a credit bureau directly. While you may reach out to the bureau by phone or email, submitting the form is a more formal way to document your dispute and ensures it gets the necessary attention.

- All disputes are resolved quickly. Some people expect a resolution right after submitting the form. However, investigations can take time, as the credit agency must verify the information provided.

- Providing extensive details is not important. It's crucial to elaborate on your query clearly. The more information you provide, the better the chances of a swift and accurate investigation.

- Once I submit the form, there's nothing more to do. After submitting, keep track of your reports and follow up if you haven't received updates within the expected timeframe to ensure your concerns are addressed.

- Submitting a dispute can lower my credit score. This is a common fear, but disputing inaccurate information does not affect your score. It's actually a positive step toward ensuring your credit report reflects your true financial history.

- All types of discrepancies can be resolved through this form. Not every issue can be settled via the Credit Investigation form. Some situations may require more extensive documentation or even assistance from a financial advising service.

Understanding these misconceptions can help you navigate the Credit Investigation process more effectively.

Key takeaways

When using the Credit Investigation form, it’s essential to understand the following key points:

- Complete All Mandatory Fields: Ensure that all fields marked with an asterisk (*) are filled out. This includes personal details like your name, address, and date of birth.

- Provide Accurate Contact Information: Your telephone number and email address should be correct. This allows for swift communication regarding your dispute.

- Clearly Specify the Dispute: In the credit report details section, describe your dispute in detail. Make sure to elaborate on each query to avoid any confusion.

- Attach Additional Information: If your disputes require more explanation, write them on a separate sheet and attach it to the form.

- Sign and Date the Form: Don't forget to include your signature and the date. This is crucial for acknowledging the terms and conditions of the process.

Adhering to these points will help expedite the review of your credit report dispute.

Browse Other Templates

Neisd Transcript - Picture identification is mandatory when submitting a transcript request.

Pa Hire - Include the employee's social security number for identification.