Fill Out Your Credit Reference Request Form

The Credit Reference Request form is a crucial document utilized by businesses to gather essential information about a prospective client's creditworthiness. Companies like iGoLogic, Inc. depend on this form to refine their credit assessments and decide on the terms to offer. The form captures a range of data, ensuring that the credit evaluation is thorough and reliable. It includes sections for contact information, sales history, payment performance, and overall credit ratings, allowing the requesting company to gauge the financial behavior of the entity in question. Notably, it prompts the recipient for insights into the sales activity since a specified date, the last sale made, and the average days it takes for payments to be settled. It also addresses any instances of insufficient funds, all of which shed light on the applicant's reliability as a customer. Furthermore, there is space for additional comments, enabling a qualitative assessment of the relationship between the parties involved. Ultimately, this structured approach aims to facilitate informed decision-making concerning credit terms, safeguarding the financial interests of the credit granter while fostering healthy business relationships.

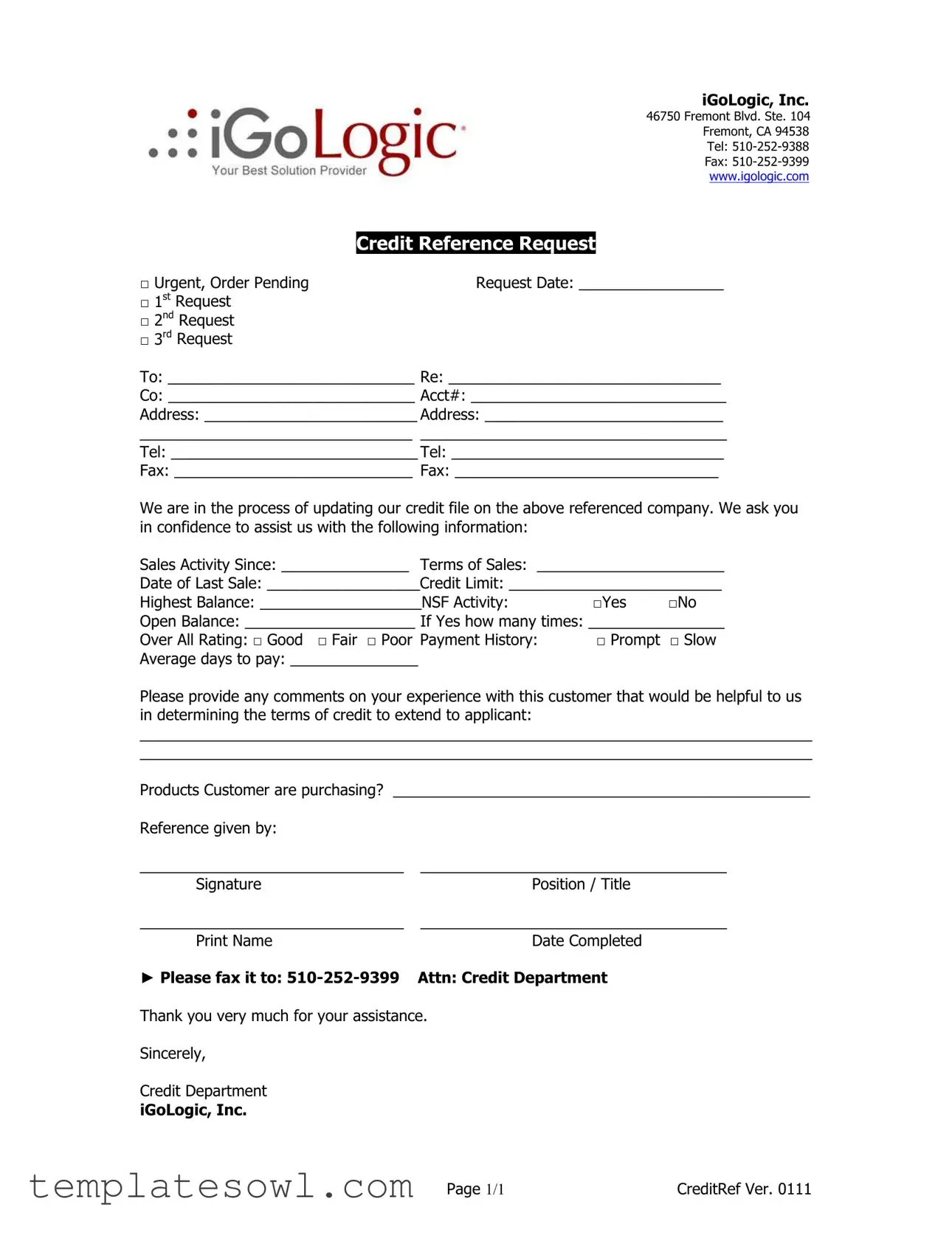

Credit Reference Request Example

iGoLogic, Inc.

46750 Fremont Blvd. Ste. 104

Fremont, CA 94538

Tel:

Fax:

www.igologic.com

|

Credit Reference Request |

|

□ Urgent, Order Pending |

Request Date: _________________ |

|

□ 1st Request |

|

|

□ 2nd Request |

|

|

□ 3rd Request |

|

|

To: _____________________________ Re: ________________________________

Co: _____________________________ Acct#: ______________________________

Address: _________________________ Address: ____________________________

________________________________ ____________________________________

Tel: _____________________________Tel: ________________________________

Fax: ____________________________ Fax: _______________________________

We are in the process of updating our credit file on the above referenced company. We ask you in confidence to assist us with the following information:

Sales Activity Since: _______________ Terms of Sales: ______________________

Date of Last Sale: __________________Credit Limit: _________________________

Highest Balance: ___________________NSF Activity: □Yes □No

Open Balance: ____________________ If Yes how many times: ________________

Over All Rating: □ Good □ Fair □ Poor Payment History: |

□ Prompt □ Slow |

Average days to pay: _______________ |

|

Please provide any comments on your experience with this customer that would be helpful to us in determining the terms of credit to extend to applicant:

_______________________________________________________________________________

_______________________________________________________________________________

Products Customer are purchasing? _________________________________________________

Reference given by: |

|

_______________________________ |

____________________________________ |

Signature |

Position / Title |

_______________________________ |

____________________________________ |

Print Name |

Date Completed |

► Please fax it to: |

Attn: Credit Department |

Thank you very much for your assistance.

Sincerely,

Credit Department

iGoLogic, Inc.

Page 1/1 |

CreditRef Ver. 0111 |

Form Characteristics

| Fact Name | Description |

|---|---|

| Company Information | The form is from iGoLogic, Inc., located at 46750 Fremont Blvd. Ste. 104, Fremont, CA 94538. |

| Contact Details | You can reach iGoLogic by phone at 510-252-9388 or by fax at 510-252-9399. |

| Urgency Option | The form offers an option to mark the request as urgent, particularly if an order is pending. |

| Sales Activity | Information regarding sales activity since a specific date is requested to assess the creditworthiness of the referenced company. |

| Payment History | Respondents must indicate the payment history, with options for prompt or slow payments. |

| Over All Rating | The form asks for an overall rating of the company, with responses categorized as good, fair, or poor. |

| Confidentiality | The information provided in the form will be treated as confidential, aiding in credit extension decisions. |

Guidelines on Utilizing Credit Reference Request

Completing the Credit Reference Request form requires attention to detail to ensure all necessary information is accurately provided. Once finished, the form should be faxed to the specified number. Follow these steps to fill out the form correctly:

- Request Date: Enter the date you are submitting the request in the space provided.

- Select Request Type: Check one of the boxes to indicate if this is the first, second, or third request or if it is urgent.

- Add Recipient Information: Fill in the name of the organization you are contacting under "To".

- Reference Information: Write down the reference details in the "Re" and "Co" sections, including account number and addresses as requested.

- Contact Details: Provide the recipient’s telephone and fax numbers in the relevant fields.

- Sales Activity: Input the date of sales activity, terms of sales, and date of the last sale.

- Credit Information: Complete sections related to credit limit, highest balance, NSF activity, and open balance. Indicate if there was NSF activity by checking "Yes" or "No" and note the frequency if applicable.

- Overall Rating: Select one of the rating options: "Good," "Fair," or "Poor".

- Payment History: Note whether the payment history was prompt or slow and provide average days to pay.

- Comments: Write any comments regarding your experience with the customer that could help in determining credit terms.

- Product Information: Describe the types of products the customer is purchasing.

- Reference Given By: Fill in the name of the person providing this reference.

- Signature and Position: Obtain the necessary signature and include the position or title and printed name of the individual completing the form.

- Date Completed: Record the date when the form is completed.

Finally, ensure that the completed form is faxed to the credit department at 510-252-9399. Your cooperation is appreciated, and it contributes to a smoother credit evaluation process.

What You Should Know About This Form

What is the purpose of the Credit Reference Request form?

The Credit Reference Request form is designed to gather information about a company's financial reliability from other businesses. This helps iGoLogic, Inc. assess the creditworthiness of potential customers. By collecting details on a company’s payment history and sales activity, iGoLogic can make informed decisions when extending credit terms. It's a crucial tool in identifying trustworthy clients and minimizing financial risk.

Who should fill out the Credit Reference Request form?

This form is typically filled out by the business requesting credit information. It is addressed to a company that has previously done business with the applicant. The form needs to be sent to selected referees who can provide insight into the applicant's financial behavior and payment history. Providing accurate information helps ensure a reliable assessment.

What kind of information is requested on the form?

The form asks for several details, including sales activity since the date specified, terms of sales, the last sale date, and the credit limit. It also inquires about the highest balance, any instances of non-sufficient funds (NSF) activity, and the customer’s overall payment rating. Collecting these data points gives a clearer picture of how the applicant manages their financial obligations.

How should the completed form be submitted?

Once the form is filled out, it should be faxed to the Credit Department at iGoLogic, Inc. The specific fax number to use is 510-252-9399. It’s advisable to ensure that all fields are completed accurately to avoid delays in processing the credit reference request.

Why is it important to disclose payment history accurately?

Accurate disclosure of payment history is critical because it impacts the decision-making process for credit approval. A reliable account of whether payments were prompt or slow helps iGoLogic assess the risk of extending credit. Misrepresentation of payment history could lead to unwarranted credit terms, which may become problematic for both parties involved.

What happens after the Credit Reference Request form is submitted?

After submission, the iGoLogic Credit Department will review the information provided and may reach out for further clarification or additional details if necessary. Once the assessment is complete, they will determine the credit terms to offer the applicant. Timeliness in providing requested information can expedite this evaluation process.

Common mistakes

Completing a Credit Reference Request form can be straightforward, but various common mistakes can hinder the process. One major error occurs when individuals fail to provide complete information regarding the company referenced. Fields such as “To,” “Re,” and “Co” must be filled out accurately. Omitting this crucial information may delay the request or result in incorrect evaluation.

Another common mistake is neglecting to specify the request date. This detail is important for tracking purposes, especially if more than one request has been made over time. Without a clearly noted date, it becomes challenging for the receiving party to prioritize their responses properly.

Misunderstanding the “NSF Activity” section can also lead to inaccuracies. Respondents may not know whether to check “Yes” or “No.” If there have been occurrences of insufficient funds, that must be indicated correctly. A simple misstep here could skew the overall assessment of creditworthiness.

Another frequent oversight is in providing a complete payment history. Sometimes, individuals will leave out the “Average days to pay” field. This number is vital for assessing how promptly the company pays its bills. An incomplete payment history can mislead the credit evaluator, potentially impacting future credit terms.

Lastly, the comments section often receives insufficient attention. Providing insightful observations about the relationship with the customer can be incredibly helpful. Without thorough input, lenders could miss key details that shape their understanding of the applicant. Ensuring every section is comprehensively answered leads to a clearer picture of credit risk.

Documents used along the form

When applying for credit, several supporting documents complement the Credit Reference Request form. These documents help ensure a comprehensive evaluation of the credit applicant's background and potential risks. Understanding each form and its purpose is crucial for any business or individual seeking to establish sound credit practices.

- Credit Application Form: This document collects essential information from a credit applicant, including their legal name, business structure, tax identification number, and financial information. It serves as the primary request for credit, initiating the evaluation process.

- Financial Statements: These include balance sheets and income statements that provide insight into the applicant's financial health. Lenders use these to assess profitability, liquidity, and overall creditworthiness.

- Business License: A copy of the applicant's business license displays legitimacy and compliance with local regulations. This document assures potential creditors that the business operates legally.

- Bank References: This form presents endorsements from the applicant's banking institution, detailing their banking relationship and account standing. It can signal reliability and effective cash management practices.

- Tax Returns: Recent tax returns enable creditors to evaluate income consistency and tax compliance. They provide a comprehensive overview of the applicant's earnings over the past few years.

- Resumes of Key Individuals: Profiles of owners or partners within the business offer insights into their experience and qualifications. This can influence a creditor’s decision regarding the applicant's capability to manage credit effectively.

- Articles of Incorporation: This document proves the existence of a corporation and outlines its purpose. It is crucial for understanding the legal structure of the business.

- Trade References: A list of suppliers or vendors who have extended credit to the applicant, along with their feedback, helps evaluate the applicant's payment history and reliability.

- Personal Guarantee: Sometimes required from business owners, this document holds them personally accountable for debts if the business defaults. It adds an extra layer of security for creditors.

- Credit Report Authorization: By signing this document, the applicant permits a creditor to access their credit report. This step is vital for assessing the applicant's credit history and score.

Gathering these documents will not only streamline the credit evaluation process but can also enhance the credibility of the applicant. Businesses and individuals alike should prepare these materials in advance, as they play an essential role in obtaining favorable credit terms.

Similar forms

- Loan Application: A loan application requests financial and credit information from individuals or businesses applying for a loan, similar to how the Credit Reference Request seeks information about a company's creditworthiness.

- Vendor Application: A vendor application collects information about a business seeking to become a supplier. It evaluates the business's background, much like the Credit Reference Request assesses a company's credit history.

- Credit Report Authorization Form: This form allows a lender to obtain a credit report about a consumer's or business's credit history, similar to how the Credit Reference Request gathers information from references regarding credit history.

- Financial Statement: A financial statement provides an overview of a business's financial status, similar to how the Credit Reference Request looks for sales activity and payment history as indicators of creditworthiness.

- Trade Reference Form: This form is used to collect feedback from other businesses regarding payment history. It resembles the Credit Reference Request in seeking insights on a company's payment behavior.

- Account Verification Form: This document confirms the details of a business’s account with a supplier or lender. Like the Credit Reference Request, it helps verify financial and credit information.

- Background Check Authorization: This form allows a company to conduct a background check on a potential client. It similarly seeks to gather relevant information before extending credit or services.

- Application for Credit: This application is used by businesses seeking credit lines. It requests various financial details and references, similar to the Credit Reference Request's inquiry for customer feedback.

- Service Provider Reference Form: This form collects information on a service provider’s history and reliability. It shares similarities with the Credit Reference Request, which seeks references to assess a customer’s payment habits.

Dos and Don'ts

When filling out the Credit Reference Request form, it is essential to ensure accuracy and clarity. Follow these guidelines to avoid common mistakes.

Things You Should Do:

- Complete all required fields thoroughly.

- Use clear and legible handwriting or type the information.

- Double-check the information for accuracy.

- Specify any urgent requests clearly, marking the appropriate box.

- Provide detailed comments about your experience with the customer.

- Include a valid fax number for the response.

- Sign the form to authenticate the request.

Things You Shouldn't Do:

- Leave any required fields blank.

- Use informal language or abbreviations.

- Submit the form without proofreading it first.

- Forget to specify the date when you last sold to the customer.

- Provide vague descriptions of the customer's purchasing habits.

- Send the request without the appropriate signature.

- Neglect to include the date of completion on the form.

By adhering to these dos and don’ts, you will contribute to a smoother and more efficient credit reference process.

Misconceptions

When dealing with the Credit Reference Request form, people often have misconceptions that can lead to confusion. Below is a list of these common misunderstandings, along with clarifications to provide guidance.

- It serves as a credit application. The Credit Reference Request form is not an application for credit. Instead, it gathers information about an applicant's previous credit relationships.

- All companies will respond to the request. Some organizations may choose not to respond. Participation in this process is voluntary, and responses can vary based on company policies.

- The information provided is confidential. While the form indicates that this request is made in confidence, the recipient must handle any information shared with discretion.

- Requests are always processed quickly. The urgency of a request does not guarantee fast responses. Processing times depend on the responsiveness of the contacted entities.

- A credit reference request guarantees future credit. While a favorable review can support credit decisions, it does not guarantee that credit will be extended to the applicant.

- All references have the same weight. Responses from different companies can vary considerably based on their individual experiences with the applicant. This difference must be taken into account when evaluating the creditworthiness.

- The company being referenced will have access to the responses. Responses are confidential and typically not shared with the company under review unless disclosed by the reference provider.

- Negative comments will end the credit application process. While negative feedback may raise concerns, it should be viewed as part of the broader context of the applicant's credit history.

- Only the account holder can provide references. Anyone familiar with the applicant's credit behavior may comment on their payment history, including suppliers and trade partners.

- The form can be modified for personal use. Changes to the form can affect its legality and validity. It is advisable to use the form as-is to ensure compliance with established practices.

Understanding these misconceptions can aid individuals in navigating the Credit Reference Request process more effectively. Always approaching this with care and caution is wise.

Key takeaways

Filling out and using the Credit Reference Request form is an important step in assessing potential credit relationships. Here are some key takeaways to remember:

- Complete All Sections: Ensure that every section of the form is filled out accurately. Missing information can delay your request or lead to misunderstandings.

- Specify the Urgency: If your request is urgent, indicate this at the top of the form. Clearly marking it as "Urgent" can help prioritize your request.

- Provide Clear Context: In the "Re" and "Co" sections, give clear details about the company you're inquiring about. This helps the recipient understand which account or company is being referenced.

- Follow Up: After sending the form by fax, it’s wise to follow up with a phone call. Confirm that your request was received and inquire about the timeframe for receiving the credit reference.

Remember, thoroughness and clarity can make all the difference in obtaining a useful credit reference.

Browse Other Templates

Va Application 10-2850c - The form includes an authorization for the release of information necessary for VA to verify qualifications.

Is Basic Life Support the Same as Cpr - Through this roster, the focus remains on the importance of BLS training in society.