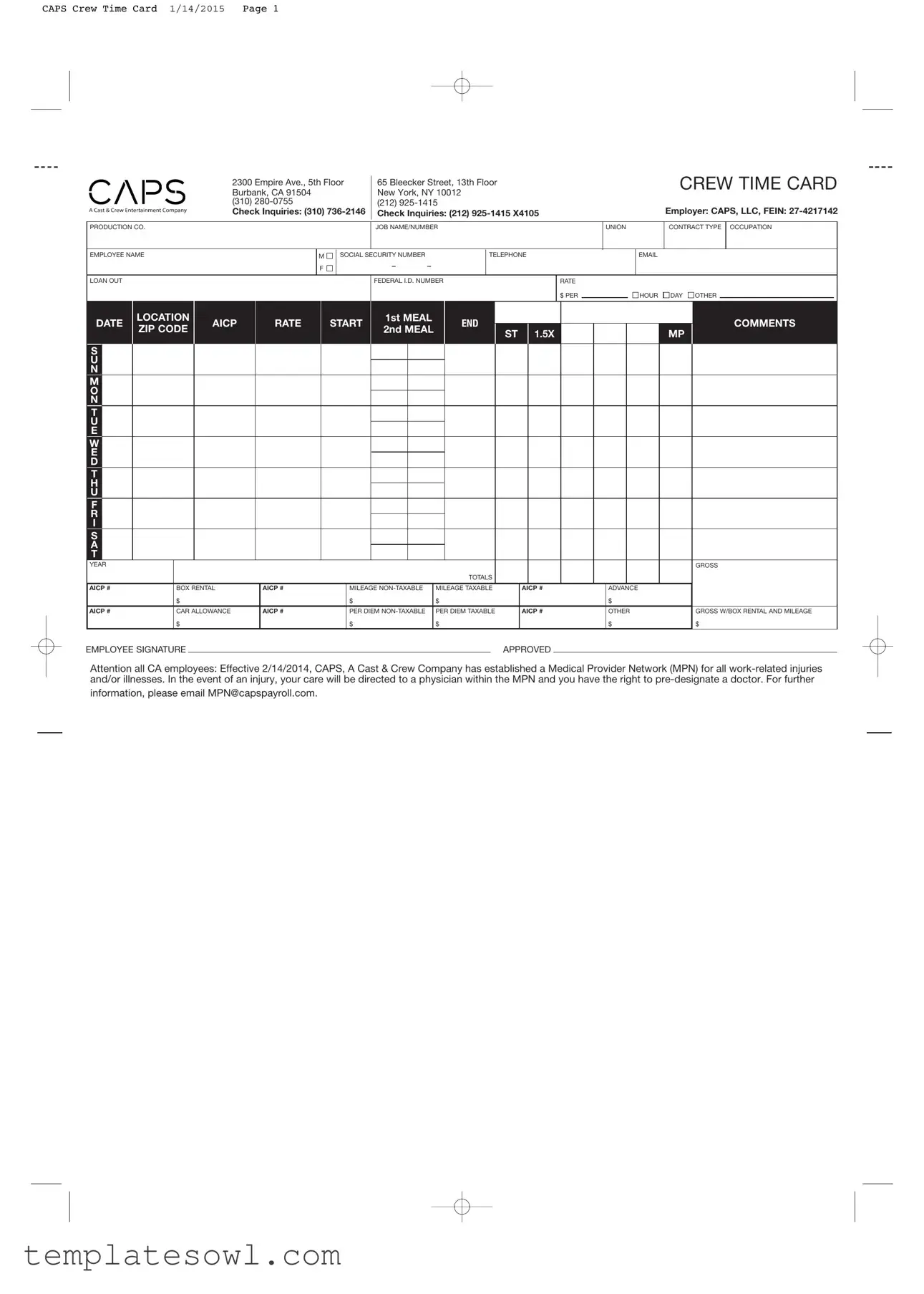

Fill Out Your Crew Time Card Form

The Crew Time Card form serves as a crucial document in the entertainment industry, particularly for employees working on various productions under CAPS, LLC. This form not only facilitates the tracking of hours worked but also details other essential information, including job specifics, employee identification, and payment rates. Essential fields capture the employee's name, social security number, and contact details, while also requiring the production company name and job number for organizational clarity. It includes specific sections for meal breaks and overtime calculations, ensuring accurate compensation based on industry standards. In addition, the form incorporates features for expenses such as mileage, rental, and per diem allowances, presenting a comprehensive view of the employee's earnings and deductions. Noteworthy is the advisory regarding the Medical Provider Network, which instructs employees on the protocol for work-related injuries, emphasizing their rights concerning medical care. Each submission requires an employee signature and approval, underscoring the importance of compliance and accuracy in the record-keeping process.

Crew Time Card Example

2300 Empire Ave., 5th Floor

Burbank, CA 91504 (310)

Check Inquiries: (310)

65 Bleecker Street, 13th Floor |

CREW TIME CARD |

|

|

New York, NY 10012 |

|

(212) |

Employer: CAPS, LLC, FEIN: |

Check Inquiries: (212) |

PRODUCTION CO.

JOB NAME/NUMBER

UNION

CONTRACT TYPE OCCUPATION

EMPLOYEE NAME

M |

SOCIAL SECURITY NUMBER |

- |

F |

- |

TELEPHONE

LOAN OUT

FEDERAL I.D. NUMBER

RATE

$ PER

HOUR

HOUR  DAY

DAY  OTHER

OTHER

DATE |

LOCATION |

AICP |

|

RATE |

START |

1st MEAL |

|

END |

|

|

|

|

|

|

|

|

|

|

|

COMMENTS |

||||||

ZIP CODE |

|

2nd MEAL |

|

|

ST |

|

1.5X |

|

|

|

|

MP |

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

S |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

U |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

N |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

M |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

O |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

N |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

T |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

U |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

W |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

D |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

T |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

H |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

U |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

F |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

R |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

I |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

T |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YEAR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GROSS |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTALS |

|

|

|

|

|

|

|

|

|

|

|

||

AICP # |

|

BOX RENTAL |

|

AICP # |

|

MILEAGE |

MILEAGE TAXABLE |

AICP # |

|

|

ADVANCE |

|

|

|

||||||||||||

|

|

|

$ |

|

|

|

|

|

$ |

|

|

$ |

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

AICP # |

|

CAR ALLOWANCE |

|

AICP # |

|

PER DIEM |

PER DIEM TAXABLE |

AICP # |

|

|

OTHER |

|

GROSS W/BOX RENTAL AND MILEAGE |

|||||||||||||

|

|

|

$ |

|

|

|

|

|

$ |

|

|

$ |

|

|

|

|

|

|

|

|

$ |

|

|

$ |

||

EMPLOYEE SIGNATURE |

|

|

|

|

|

|

|

|

|

|

|

|

APPROVED |

|

|

|

|

|

|

|

|

|||||

Attention all CA employees: Effective 2/14/2014, CAPS, A Cast & Crew Company has established a Medical Provider Network (MPN) for all

information, please email MPN@capspayroll.com.

Form Characteristics

| Fact Name | Details |

|---|---|

| Employer Information | The Crew Time Card form is issued by CAPS, LLC, located in Burbank, CA and New York, NY. |

| Form Purpose | This form is used to track employee hours for payroll and billing purposes in the production industry. |

| State-Specific Regulations (CA) | In California, the use of time cards complies with labor laws requiring accurate hour tracking for payment. |

| Federal Employer Identification Number | The FEIN for CAPS, LLC is 27-4217142, which is used for tax reporting purposes. |

| Medical Provider Network | As of February 14, 2014, CAPS has established a Medical Provider Network for work-related injuries. |

| Employee Rights | Employees have the right to pre-designate a personal physician within the Medical Provider Network. |

| Personal Information Required | Employees must provide their name, Social Security number, contact details, and occupation. |

| Gross Total Calculation | The form includes fields for calculating total hours worked and associated pay rates, including overtime. |

| Signatures Required | Employees need to sign the form to verify the accuracy of the information provided. |

| Contact Information | Inquiries can be directed to specific contact numbers listed on the form for any questions or concerns. |

Guidelines on Utilizing Crew Time Card

Completing the Crew Time Card form is an important step in documenting work hours and related information. Accurate submissions ensure that payroll processes run smoothly and employees receive their due compensation. Follow these steps to fill out the form properly.

- Enter the Job Name/Number in the designated area at the top of the form.

- Specify the Union Contract Type relevant to your position.

- Fill in your Occupation.

- Write your Employee Name.

- Provide your Social Security Number.

- List your Telephone number.

- Input your Email address.

- Indicate whether this is a Loan Out situation.

- Fill in your Federal I.D. Number (if applicable).

- Enter your Rate per hour, day, or other relevant categories.

- Record the Date of service.

- Specify the Location where the work was performed.

- Provide the appropriate AICP Rate if applicable.

- List the Start Time, 1st Meal duration, End Time, and 2nd Meal duration.

- Complete the weekly time slots for each day worked, marking hours as needed.

- Calculate the Gross Totals for the week, including any additional rates.

- Detail any relevant AICP # in areas specifying box rental, mileage, advances, car allowance, per diem, and other categories.

- Sign the form under your Employee Signature.

- Seek approval as needed by designated personnel.

What You Should Know About This Form

What is the purpose of the Crew Time Card form?

The Crew Time Card form serves as an essential document for recording hours worked by employees in the production industry. It allows employees to track their work hours, meal breaks, and any additional compensation, ensuring accurate payroll processing. This form must be filled out correctly to avoid discrepancies in payments and to comply with labor regulations.

How do I fill out the Crew Time Card form?

To fill out the Crew Time Card form, begin by entering your personal information, including your name, Social Security number, and contact details. Next, indicate the production company and job name/number. Record your hours worked each day of the week, detailing start times and meal breaks. Be sure to calculate your total gross earnings, including any additional payments such as mileage and per diem. Sign the form at the end to confirm the information is accurate and complete.

What should I do if I have an error on my Crew Time Card?

If you notice an error on your Crew Time Card after submission, address it promptly. Contact your supervisor or payroll department to report the mistake and provide the correct information. It is advisable to do this as soon as possible to ensure that the payroll reflects accurate hours and compensation during the next pay cycle.

How do I inquire about payment issues related to the Crew Time Card?

If you have any questions or concerns about your payment related to the Crew Time Card, reach out to the appropriate check inquiry number listed on the form. For California employees, this would be (310) 736-2146, while New York employees can call (212) 925-1415 X4105. Be prepared to provide your employee details and any relevant information to facilitate a swift resolution.

Common mistakes

Filling out a Crew Time Card form is a crucial task that can significantly affect payroll processes and compliance with labor laws. However, many individuals make common mistakes that can lead to delays or even disputes. One frequent error occurs when individuals neglect to include their Social Security Number. This number is vital for identification purposes and ensures that earnings are accurately tracked for tax reporting. Without this number, payroll could face unnecessary complications.

Another mistake that often arises is the failure to accurately report the hours worked. Employees sometimes miscalculate their start and end times or forget to account for meals and breaks. This inaccuracy can lead to underpayment or overpayment, which complicates payroll reconciliation. It is essential for employees to double-check their time entries to ensure that they are both accurate and complete—especially when it comes to overtime or multiple rate types.

Additionally, individuals frequently overlook the comments section, which can provide crucial context for specific entries or adjustments. Any irregularities, such as changes in job duties or reason for overtime, should be documented clearly. This omission can lead to confusion or questions during the payroll process, ultimately resulting in delays and frustration for all parties involved.

People also tend to misunderstand the importance of signing the time card. Failing to provide a signature can signal that the information is unverified and may result in the form being rejected. It serves as an acknowledgment that the employee has reviewed and agrees with the documented hours and rates. A lack of this signature can initiate a back-and-forth between the employee and payroll, further complicating the payment process.

Lastly, there are often errors related to the rate of pay sections of the form. Employees may forget to indicate whether they are earning on a per-hour or per-day basis or mistakenly write in the wrong rate. These inaccuracies can cause discrepancies during payroll processing and impact an employee's overall earnings. It warrants careful attention to detail to ensure the pay rate aligns with the employment agreement.

Documents used along the form

The Crew Time Card form is an essential document for tracking hours worked by employees in the production industry. However, it is not the only form involved in the process. Below are a number of related documents and forms that are often used in conjunction with the Crew Time Card, ensuring a smooth workflow and accurate record-keeping.

- W-4 Form: This document allows employees to indicate their tax withholding preferences. It informs the employer how much federal income tax to withhold from each paycheck.

- I-9 Form: Required for all new hires, this form verifies the employee's identity and eligibility to work in the United States. It must be completed within three days of employment.

- Direct Deposit Authorization Form: This form authorizes the employer to deposit wages directly into the employee's bank account, improving payment convenience and security.

- Payroll Deduction Authorization Form: Employees use this document to authorize various deductions from their paychecks, such as health insurance or retirement contributions.

- Expense Report: This form is used to request reimbursement for out-of-pocket expenses incurred during work-related activities, such as travel or supplies.

- Time-Off Request Form: Employees submit this form to formally request leave from work, detailing the dates and reasons for their absence.

- Contractor Agreement: This document outlines the terms and conditions of employment between the production company and any independent contractors, including rates and responsibilities.

- Accident Report Form: In the event of an on-the-job accident, this form is completed to document details of the incident, ensuring proper protocols are followed and insurance claims can be processed.

Each of these documents plays a critical role in the management and administration of employee information and payroll processes. Using them alongside the Crew Time Card helps maintain clarity and compliance within the workplace.

Similar forms

- Time Sheet: Like the Crew Time Card, a time sheet records hours worked by an employee. Both documents track hours and often include a section for overtime, meal breaks, and comments.

- Payroll Voucher: Similar to the Crew Time Card, a payroll voucher outlines earnings for a pay period. It details the employee’s name, hours worked, and any deductions, reinforcing accuracy for payroll processes.

- Work Order: A work order initiates a task and provides specifics about a job, akin to the Crew Time Card's job name/number section. Both documents ensure clarity regarding assignments and expectations.

- Expense Report: The expense report tracks expenditures related to work, just as the Crew Time Card documents additional payments like per diem and mileage. Both facilitate reimbursement processes.

- Employee Attendance Record: This document monitors attendance, reflecting patterns similar to how the Crew Time Card logs daily hours. Both ensure compliance with workforce regulations.

- Time and Attendance Policy: This policy outlines the expectations for work hours and attendance. It aligns with the Crew Time Card's purpose, reinforcing guidelines for employees' time tracking and reporting duties.

Dos and Don'ts

When filling out the Crew Time Card form, it is crucial to follow specific guidelines to ensure accuracy and compliance. Here are seven important dos and don'ts:

- Do enter your information clearly and legibly.

- Do use the correct job name and number.

- Do indicate your rate of pay accurately.

- Don't forget to include your social security number.

- Don't omit any meal break times.

- Don't submit the form without reviewing for errors.

- Don't forget to sign the form before submission.

Misconceptions

There are several misconceptions regarding the Crew Time Card form that may lead to confusion. Below are four common misunderstandings and explanations for each.

- The Crew Time Card is only for hourly employees. In fact, the form can be used for various types of compensation, including daily rates and other payment structures. This means both hourly and contract workers may need to complete the form.

- Filling out the Crew Time Card is optional. This is not the case. Employees are typically required to complete the form accurately to ensure proper payment. Submitting the form is crucial for tracking work hours and payment details.

- The information on the Crew Time Card is not important. This misconception overlooks the significance of the data. Accurate entries are essential for compliance with labor regulations and to ensure employees receive correct compensation for their work.

- Once submitted, the Crew Time Card cannot be changed. While it is best to submit accurate information initially, corrections can often be made if discrepancies arise. It is advisable to notify the employer of any errors as soon as possible to rectify them.

Understanding these misconceptions can help employees complete the Crew Time Card correctly and maintain accurate records of their work and compensation.

Key takeaways

The Crew Time Card form serves as a critical tool for documenting hours worked and ensuring proper compensation for employees in the entertainment industry. Understanding its layout and requirements can facilitate accurate record-keeping and timely payments.

- Completeness is essential. Ensure that all sections of the form are filled out completely. Missing information can delay payment and create confusion regarding work hours.

- Documentation of job details matters. Clearly specify the job name and number, union contract type, and employee occupation. This information aids in the correct allocation of hours and compliance with applicable labor agreements.

- Accurate time tracking is crucial. Record meal breaks and start and end times precisely. This accuracy helps in calculating total hours worked and avoids potential disputes over compensation.

- Know your rights. Employees should be aware of the Medical Provider Network (MPN) established for work-related injuries and illnesses. Familiarity with this system ensures that you can access necessary medical care promptly if required.

Browse Other Templates

B13a Export Declaration Form - The form collects data on the gross weight of the shipment.

Khsaa Middle School Physical Form - The detailed medical history must be filled out to ensure student safety during activities.