Fill Out Your Cs 274W Form

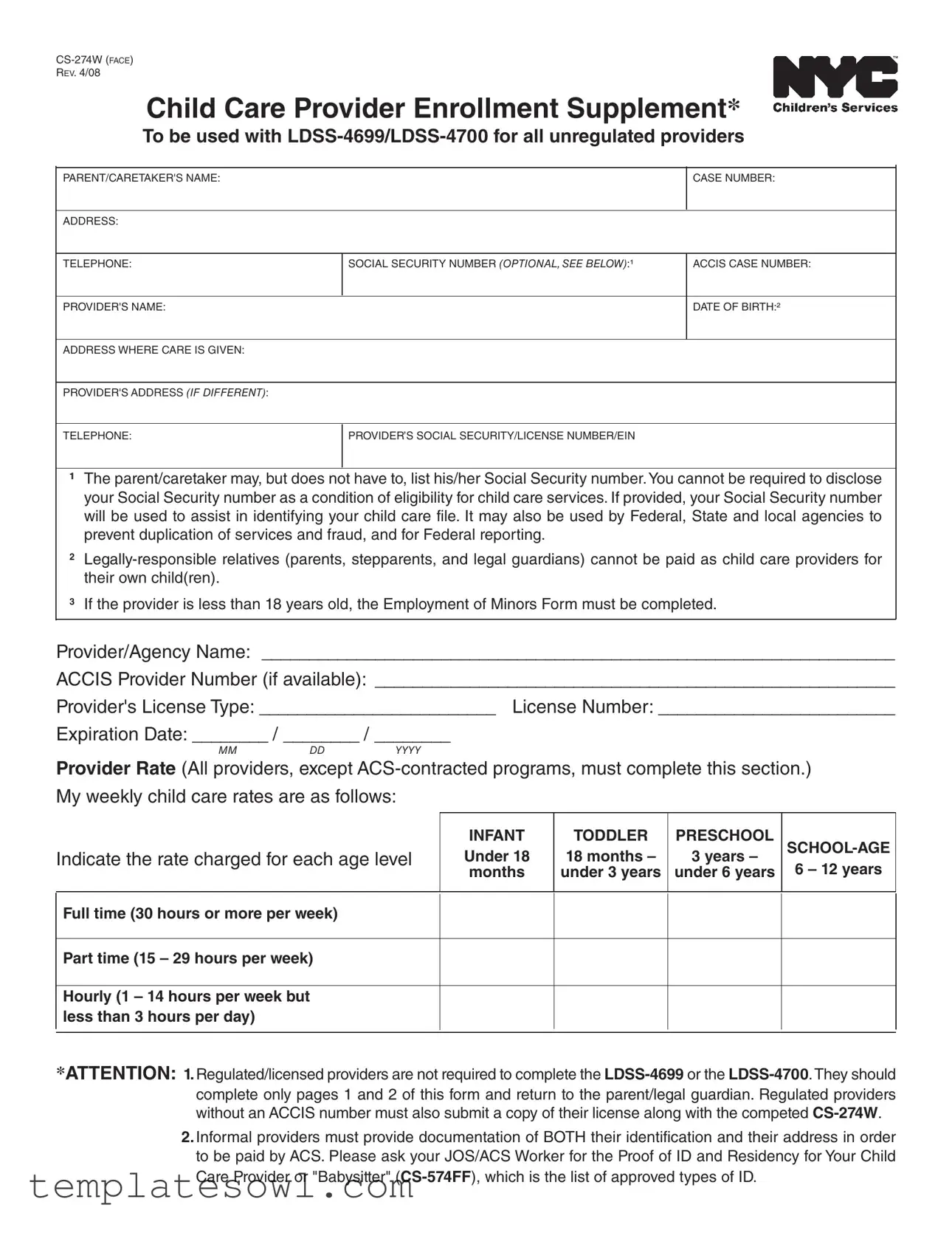

The CS 274W form serves as a vital document for parents and child care providers involved in New York City’s child care services program. This enrollment supplement is specifically designed for unregulated providers, facilitating their registration alongside the primary LDSS-4699/LDSS-4700 forms. Parents or caretakers need to fill out their details, including their name, case number, and optional Social Security number. Crucially, they will also provide information about their child care provider, such as the provider’s name, address, and contact information. The form requests information on the provider's qualifications and rates for different age groups, ensuring transparency in child care costs. Additionally, both the parent and provider must sign to certify the accuracy of the provided information, safeguarding compliance with state regulations. This form not only helps in the enrollment of child care services but also emphasizes the importance of maintaining accurate records to prevent issues such as fraud or duplication of services.

Cs 274W Example

REV. 4/08

Child Care Provider Enrollment Supplement*

To be used with

PARENT/CARETAKER'S NAME:

CASE NUMBER:

ADDRESS:

TELEPHONE:

SOCIAL SECURITY NUMBER (OPTIONAL, SEE BELOW):¹

ACCIS CASE NUMBER:

PROVIDER'S NAME:

DATE OF BIRTH:²

ADDRESS WHERE CARE IS GIVEN:

PROVIDER'S ADDRESS (IF DIFFERENT):

TELEPHONE:

PROVIDER’S SOCIAL SECURITY/LICENSE NUMBER/EIN

¹The parent/caretaker may, but does not have to, list his/her Social Security number.You cannot be required to disclose your Social Security number as a condition of eligibility for child care services. If provided, your Social Security number will be used to assist in identifying your child care file. It may also be used by Federal, State and local agencies to prevent duplication of services and fraud, and for Federal reporting.

2

3If the provider is less than 18 years old, the Employment of Minors Form must be completed.

Provider/Agency Name: ___________________________________________________________________

ACCIS Provider Number (if available): _______________________________________________________

Provider's License Type: _________________________ License Number: _________________________

Expiration Date: ________ / ________ / ________

MM |

DD |

YYYY |

Provider Rate (All providers, except

|

INFANT |

TODDLER |

PRESCHOOL |

||

Indicate the rate charged for each age level |

Under 18 |

18 months – |

3 years – |

||

6 – 12 years |

|||||

|

months |

under 3 years |

under 6 years |

||

|

|

|

|

|

|

Full time (30 hours or more per week) |

|

|

|

|

|

|

|

|

|

|

|

Part time (15 – 29 hours per week) |

|

|

|

|

|

|

|

|

|

|

|

Hourly (1 – 14 hours per week but |

|

|

|

|

|

less than 3 hours per day) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*ATTENTION: 1. Regulated/licensed providers are not required to complete the

2.Informal providers must provide documentation of BOTH their identification and their address in order to be paid by ACS. Please ask your JOS/ACS Worker for the Proof of ID and Residency for Your Child Care Provider or "Babysitter"

REV. 4/08

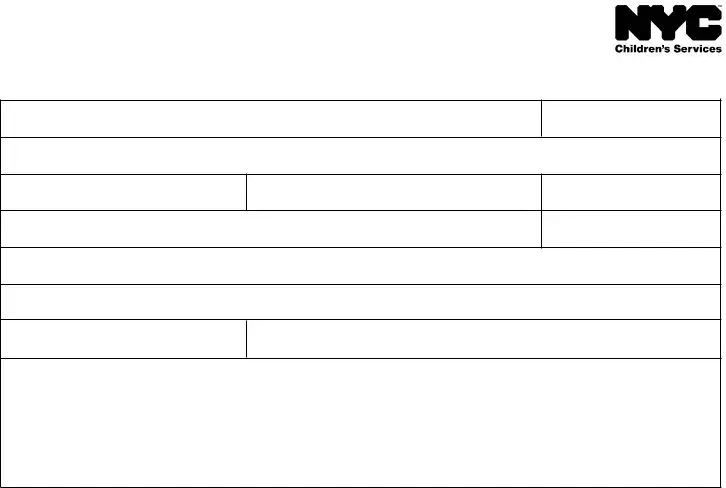

Indicate the weekly schedule(s) of child care services for the child(ren) listed below:

Child’s |

CHILD'S NAME |

|

|

|

CHILD'S NAME |

|

|

|

CHILD'S NAME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MONTH |

DAY |

YEAR |

MONTH |

DAY |

YEAR |

MONTH |

DAY |

YEAR |

|||

Date of Birth |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date Care |

MONTH |

DAY |

YEAR |

MONTH |

DAY |

YEAR |

MONTH |

DAY |

YEAR |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

Began |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weekly |

From |

|

|

To |

From |

|

|

To |

From |

|

|

To |

Schedule |

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Monday |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tuesday |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Wednesday |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Thursday |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Friday |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Saturday |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sunday |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OFFICE |

Total Hours |

|

|

|

Total Hours |

|

|

|

Total Hours |

|

|

|

per Week |

|

|

|

per Week |

|

|

|

per Week |

|

|

|

|

USE |

|

|

|

|

|

|

|

|

|

|||

ACS Child |

|

|

|

ACS Child |

|

|

|

ACS Child |

|

|

|

|

ONLY |

|

|

|

|

|

|

|

|

|

|||

|

Care Rate |

|

|

|

Care Rate |

|

|

|

Care Rate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I acknowledge that receiving payment from the City of New York for child care services provided does not make me an employee of the City of New York. I am an employee of the parent/legal guardian of the child for whom I provide care.

Provider Certification

I am enrolling this child in a child care program. I understand that I will be paid only after the child's attendance data is received by ACS and for so long as the above parent/guardian is engaged in an

I will allow the parent/guardian of the children named on this form unlimited access to his/her children and the premises and will make myself available whenever the children are in my care.

I certify that the statements above are accurate and true to the best of my knowledge. I understand that providing false information may lead to the suspension or termination of payments and the recovery of any payments to which I was not entitled.

Provider's Name (print clearly): ____________________________________ Official Title (if applicable): _________________

Signature: ________________________________________________________________________ Date: _________________

Parent/Guardian Certification

I certify that I have reviewed the above information and that it is correct. I understand I must report any changes to ACS.

Parent/Guardian's Name: ___________________________________________________________________________________

Parent/Guardian's Signature: _________________________________________________________ Date: _______________

For Agency Use Only:

Is child care authorized for this applicant/participant? Yes No

MM DD YYYY

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | This form is designed for enrollment of unregulated child care providers. |

| Associated Forms | CS-274W must be used with LDSS-4699 and LDSS-4700. |

| Optional Social Security Number | Parents/caretakers are not required to provide their Social Security number. |

| Provider Eligibility | Legally responsible relatives cannot be paid as providers for their own children. |

| Age Requirement | If the provider is under 18 years old, an Employment of Minors Form must be completed. |

| Documentation for Informal Providers | Informal providers must present ID and address documentation for payment. |

| Payment Responsibility | The caregiver is considered an employee of the parent/legal guardian rather than an employee of the City of New York. |

| Accuracy of Information | Providing false information may result in the loss of payments and recovery of funds. |

| Governing Law | This form is governed by New York State child care regulations. |

Guidelines on Utilizing Cs 274W

Filling out the CS 274W form is an important step in the process of enrolling a child care provider. Following the correct steps ensures that both the provider and the parent are aligned and that all necessary information is accurately represented. Let’s dive into how to complete this form effectively.

- Begin by entering the PARENT/CARETAKER'S NAME, CASE NUMBER, and ADDRESS in the designated boxes at the top of the form.

- Add the TELEPHONE number and, optionally, the SOCIAL SECURITY NUMBER in the fields provided. Remember, disclosure of the Social Security number is voluntary.

- Fill in the ACCIS CASE NUMBER, PROVIDER'S NAME, and the DATE OF BIRTH of the provider.

- Next, enter the ADDRESS WHERE CARE IS GIVEN and the PROVIDER'S ADDRESS if it differs from the previous address.

- Provide the TELEPHONE number for the provider along with their SOCIAL SECURITY/LICENSE NUMBER/EIN.

- If applicable, fill in the ACCIS Provider Number and indicate the provider's license type and number, including the expiration date.

- List the WEEKLY CHILD CARE RATES for different age levels: INFANT, TODDLER, PRESCHOOL, and SCHOOL-AGE. Specify the rates for full time, part time, and hourly care.

- Indicate the weekly schedule of child care services, ensuring to provide the CHILD'S NAME, DATE OF BIRTH, and the WEEKLY SCHEDULE (Monday to Sunday).

- Complete the PROVIDER CERTIFICATION section by signing and dating the form, confirming all entered information is accurate.

- Finally, the PARENT/GUARDIAN must review, sign, and date the certification section, verifying that the details provided are correct.

Once complete, double-check for accuracy and submit the form as directed. Doing this ensures that you are one step closer to securing quality child care services for your child.

What You Should Know About This Form

What is the purpose of the CS 274W form?

The CS 274W form, also known as the Child Care Provider Enrollment Supplement, serves as a critical tool for enrolling unregulated child care providers who wish to receive payments for their services. This form collects necessary information about the provider and their rates, while also ensuring compliance with regulations pertaining to child care services in New York City. It is often used alongside other forms, specifically the LDSS-4699 and LDSS-4700, to streamline the enrollment process for families seeking child care assistance.

Who needs to fill out the CS 274W form?

This form must be completed by unregulated child care providers who aim to be reimbursed for providing care to children. If a provider is licensed or regulated, they do not need to complete the LDSS forms but should still submit completed pages of the CS 274W. It’s important to note that legally responsible relatives, such as parents and stepparents, cannot be paid for providing care to their own children, as indicated in the form's guidelines.

Can I be required to provide my Social Security number on the CS 274W form?

No, disclosing your Social Security number is entirely optional when filling out the CS 274W form. Although providing this information can help identify your child care file and prevent issues related to overlapping services and fraud, you cannot be compelled to provide it as a requirement for obtaining child care services. However, if you choose to include it, the information will be safeguarded and used judiciously by federal, state, and local agencies.

What documentation is required for informal providers?

Informal child care providers, those who are not regulated or licensed, must present documentation verifying both their identity and their residential address to qualify for payment from the ACS. To ensure compliance and to find out which types of identification are accepted, providers should consult their Job Opportunity Specialist (JOS) or ACS worker for guidance, often referring to the form known as "Babysitter ID" (CS-574FF) for a comprehensive list of acceptable documentation.

What happens if the parent or guardian fails to meet requirements for child care payment?

If the parent or guardian engaged in activities approved by the FIA (Family Independence Administration) does not maintain eligibility—either due to a change in employment or failure to participate in required activities—the child care provider will receive a notification informing them that payments for child care will cease. It is essential for both caregivers and parents to stay informed and report any changes in circumstances that might affect eligibility.

Why is accurate information so important on the CS 274W form?

Providing accurate and truthful information on the CS 274W form is crucial for several reasons. For one, incorrect details can lead to delays or denial of payment, as authorities rely on this information for processing claims. Moreover, giving false information may result in severe consequences, including the potential suspension of payments and the recovery of funds if overpayments are discovered. Thus, integrity is key to ensuring smooth operations within the child care assistance system.

Common mistakes

When filling out the CS-274W form, many people make common mistakes that can delay the processing of their application. One frequent error is the omission of important details related to the parent or caretaker's information. Not including the case number or contact information can result in confusion or extra paperwork later on.

Another mistake is not providing accurate information about the childcare provider. It's essential to include the full name, date of birth, and address where care is given. Missing or incorrect data here can lead to verification issues.

People often forget to include their social security number, even though it is marked as optional. Providing it can help in identifying records more easily. However, if listed, accuracy is vital. An error can cause funding delays.

In some cases, individuals may neglect to indicate the correct childcare rates. Fields for infants, toddlers, preschool, and school-age children must be filled out completely. Failure to provide all rates could prevent payment.

Additionally, individuals might not specify the weekly schedule for childcare services. It’s important to outline the days and hours clearly. Missing this information may result in extended processing times.

Another common error is forgetting to include documentation of identification and address for informal providers. This documentation is necessary for payment and without it, providers might not receive compensation.

Signature discrepancies can also cause issues. It's essential for both the provider and the parent/guardian to sign the form. Without proper signatures, ACS may not process the form at all.

People sometimes overlook the importance of reviewing the entire form. It is advisable to double-check all entries for accuracy. Inaccurate information can lead to complications or a denial of services.

Lastly, failing to report any changes to ACS after submitting the form can pose challenges. Changes in employment, rates, or childcare arrangements should be promptly communicated to avoid payment interruptions. Keeping the lines of communication open is crucial in these situations.

Documents used along the form

The CS-274W form is a crucial document for enrolling unregulated child care providers. To complete the process efficiently, several additional forms and documents are typically required. Below is a list of up to ten commonly used documents that can facilitate this enrollment and support your request for child care services.

- LDSS-4699: This form is used to apply for child care services in New York City. It collects necessary personal and family information to determine eligibility.

- LDSS-4700: This document serves a similar purpose as the LDSS-4699 and is used for child care subsidy requests. Both forms must be submitted for comprehensive assessment.

- Proof of ID and Residency (CS-574FF): Required for informal providers, this checklist outlines acceptable types of identification and proof of residence necessary for compliance.

- Employment of Minors Form: If a child care provider is under 18 years old, this form must be completed to ensure compliance with labor laws regarding minor employment.

- Provider Registration Form: This form registers the child care provider with the agency for payment purposes. It contains essential information about the provider's services.

- Tax Identification Form: Child care providers may need to submit a tax identification form such as an EIN or SSN which is required for processing payments and taxes.

- Background Check Authorization: Providers may need to authorize a background check to ensure they meet the safety and regulatory standards for child care services.

- Caregiver Agreement: A contractual agreement between the parent and the caregiver, outlining responsibilities and the terms of care, including payment rates and schedules.

- Health and Safety Requirement Checklist: This checklist ensures that the child care setting meets health and safety regulations. Providers must comply with local health codes.

- Child's Immunization Records: Documentation of the child's immunizations is often required to ensure they are up-to-date and to avoid the spread of illness in care settings.

Completing these forms thoroughly and accurately can expedite the enrollment process and ensure compliance with necessary regulations. Always keep copies of submitted documents for your records and follow up with the relevant agency for any updates on your application status.

Similar forms

- LDSS-4699: This form is also used for child care services. It gathers similar information regarding the parent/caretaker, the child, and the provider, ensuring that eligibility is properly assessed.

- LDSS-4700: Like the CS-274W, this form is used to collect information about unregulated childcare providers. It helps verify the provider's qualifications and the services they offer.

- CS-574FF: This form is a proof of identification and residency for child care providers, akin to the documentation needed for the CS-274W. It ensures that providers can be verified and compensated appropriately.

- Employment of Minors Form: This document must be completed if the provider is under 18 years old. It shares the CS-274W's objective of ensuring compliance with regulations regarding child care providers.

- Provider Agreement: This agreement outlines the terms and responsibilities of child care providers. It serves a similar purpose as the CS-274W in confirming the provider's understanding of their obligations and the payment structure.

Dos and Don'ts

When filling out the CS-274W form, consider the following guidelines to ensure a smooth process:

- Do: Write legibly. Clear handwriting will help prevent mistakes during processing.

- Do: Double-check all entered information for accuracy. Incorrect details can lead to delays.

- Do: Provide documentation of identification and address if you’re an informal provider. This is essential for processing payments.

- Do: Ensure all sections of the form are completed. Missing information may cause issues with your application.

- Don't: Leave sections blank unless they are truly not applicable. Incomplete forms may be rejected.

- Don't: Submit the form without a signature. An unsigned document is not valid.

Misconceptions

Here are ten misconceptions about the CS-274W form, which is essential for child care provider enrollment.

- The Social Security number is mandatory. Many believe that providing a Social Security number is required, but it is optional. Individuals cannot be denied eligibility for services if they choose not to disclose it.

- Relatives can receive payment for child care. Some think that family members can be paid as care providers; however, legally-responsible relatives, like parents and stepparents, cannot be compensated for caring for their own children.

- Only licensed providers need to fill out the form. Unregulated providers also must complete the CS-274W. It's crucial for all types of providers working with families receiving child care services.

- Minors cannot be providers at all. This is inaccurate. Providers under 18 can work as caregivers, but an Employment of Minors Form must be submitted to comply with labor laws.

- Providers cannot set their own rates. In fact, providers can establish their own rates. The form requires them to disclose pricing, but it does not restrict what they can charge.

- Payments are made regardless of parent eligibility. This is a misconception. Payments depend on the parent’s involvement in an approved activity or employment. If the parent does not meet the criteria, payments will cease.

- The form does not need to be updated. Families need to report any changes to ACS. Accurate and current information is vital to avoid interruptions in payment.

- Filling out the form guarantees payment. Just submitting the CS-274W doesn't ensure compensation. Payment is contingent on the ACS receiving and processing the child's attendance data.

- All information provided is kept private. While confidentiality is important, some information may be shared with federal, state, and local agencies to prevent fraud and ensure accurate reporting.

- Filling out the form is a one-time task. This is not true. Providers must update their information and potentially re-apply as situations change, such as changes in rates or the child’s status.

Understanding these misconceptions can help in effectively navigating the child care provider enrollment process.

Key takeaways

Understanding the CS-274W form is essential for effectively navigating child care provider enrollment. Below are some key takeaways regarding its use and completion.

- Purpose of the form: The CS-274W is designed for unregulated child care providers and must be used in conjunction with the LDSS-4699 or LDSS-4700 forms to ensure eligibility for child care services.

- Provider information: Providers should include detailed personal information, such as name, address, and contact numbers, to ensure accurate processing of applications.

- Social Security Number (SSN): Listing a provider's SSN is optional. It helps agencies track child care files but cannot be used as a condition for receiving services.

- Child care regulations: Legally-responsible relatives cannot be paid as providers for their own children, which is crucial for compliance with child care regulations.

- Identification requirements: Informal providers need to provide documentation proving both their identity and residency to qualify for payment from ACS. A list of accepted forms of ID is available via the ACS worker.

- Weekly rate structure: Providers must specify their rates for different age groups and settings. All rates must be clearly listed to facilitate payment.

- Provider and parental certifications: Both the provider and the parent/guardian must certify the accuracy of the information provided on the form. False statements can lead to financial penalties and loss of eligibility for payments.

Browse Other Templates

Sc-100a - The clear presentation of all plaintiff and defendant details avoids unnecessary complications.

Do You Need a Front License Plate in Missouri - The form indicates that perjury penalties apply if information is falsified.

What Is the Easiest Sba Loan to Get - The application requests the use of funds to be clearly stated, aiding in loan review.