Fill Out Your Csa Damage Form

The CSA Damage form serves as an essential tool for guests and vacation rental agents to document and address property damage that may occur during a rental period. Upon check-in, guests are encouraged to use the form to notify the property management of any pre-existing damage, ensuring that they are not held accountable for issues that were present prior to their arrival. If a guest has purchased CSA Vacation Rental Damage Protection, the form provides a structured way to report any accidental damage that occurs during their stay. It requires detailed descriptions of the incident, including the date and nature of the damage, allowing for clear communication between the guest, property management, and insurance providers. Timeliness is critical; guests must submit written proof of loss within 90 days, and any claims must be finalized within twelve months unless incapacitated. The form is divided into multiple sections, with specific areas for guest information, descriptions of the loss, and potential repair estimates, ensuring that all relevant details are captured. Compliance with local regulations is also addressed, as the form contains warnings against fraudulent claims, underscoring the importance of honest reporting in the claims process.

Csa Damage Example

CSA VACATION RENTAL DAMAGE

COVERAGE DOCUMENTATION

Dear Guest,

Welcome! We are pleased to have you as our guest, and we are committed to providing an outstanding vacation experience.

PLEASE USE THIS FORM TO:

1.Document any damage you discover at the property at the time of

2.If you purchased CSA Vacation Rental Damage Protection coverage, use the attached page to report all accidental damage that occurred during your stay.

The following damage was noted at the property when I checked in:

____________________________________ |

_______________ |

Guest Signature |

Date |

____________________________________ |

|

Print Name |

|

____________________________________ |

_______________ |

Vacation Rental Agent Name |

Date |

Written proof of loss must be sent to us within 90 days after the date the loss occurs. We will not reduce or deny a claim if it was not reasonably possible to give us written proof of loss within the time allowed. In any event, you must give us written proof of loss within twelve (12) months after the date the loss occurs unless you are medically or legally incapacitated.

P.O. Box 939057 | San Diego, CA

VRDP 0915

VACATION RENTAL DAMAGE COVERAGE CLAIM FORM

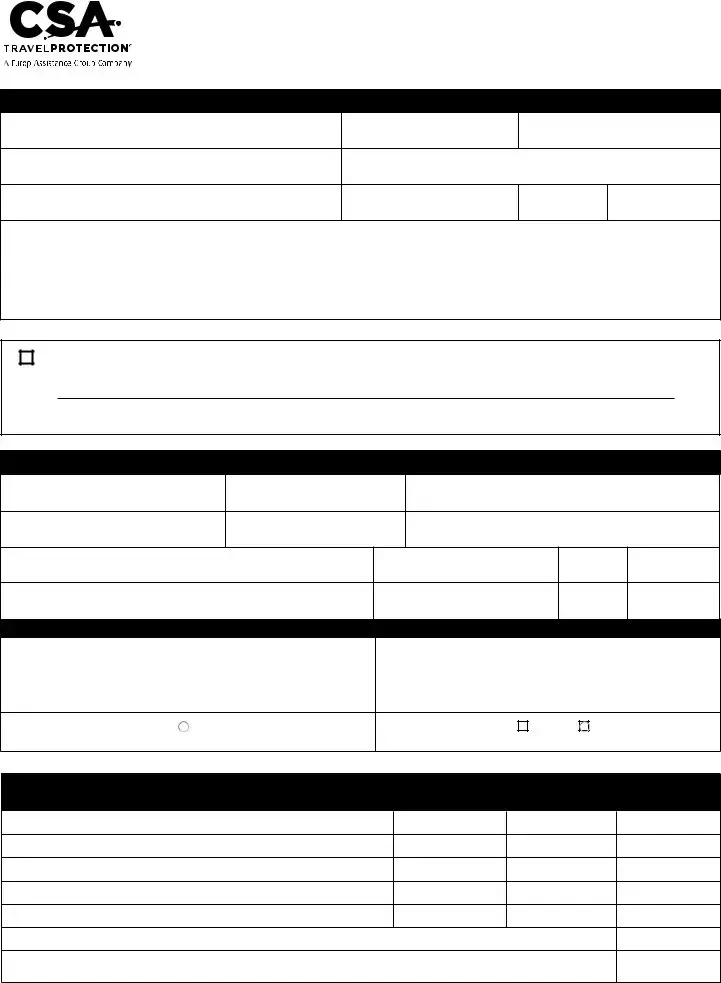

SECTION 1: (To be filled out by the Guest/Tenant)

NAME OF GUEST/TENANT

HOME/CELL PHONE

BUSINESS PHONE

POLICY NUMBER

MAILING ADDRESS

CITY

STATE

ZIP CODE

DESCRIPTION OF LOSS - PROVIDE THE DATE OF THE INCIDENT, DETAILED DESCRIPTION OF THE HOW THE LOSS OCCURRED, & ITEMS DAMAGED

ASSIGNMENT OF BENEFITS

I, ____________________________AUTHORIZE AND REQUEST CSA TRAVEL PROTECTION AND INSURANCE SERVICES (CSA) TO PAY DIRECTLY THE PROPERTY MANAGEMENT

COMPANY, ____________________________, THE AMOUNT DUE TO ME UNDER THE TERMS AND CONDITIONS OF THE VACATION RENTAL DAMAGE PROTECTION PLAN.

INSURED GUEST/TENANT’S SIGNATURE |

PRINT NAME |

SECTION 2: (To be filled out by the Vacation Rental Agent)

VACATION RENTAL AGENCY

CONTACT

BUSINESS TELEPHONE NUMBER

RESERVATION CONFIRMATION NUMBER

EMAIL ADDRESS

COMPANY MAILING ADDRESS

CITY

STATE

ZIP CODE

PROPERTY MAILING ADDRESS

CITY

STATE

ZIP CODE

DETAILS OF LOSS

DATE OF REPORT & TO WHOM WAS THE INCIDENT REPORTED?

DESCRIBE THE INCIDENT THAT CAUSED THE DAMAGE

IS THE LOSS THEFT RELATED? |

|

YES |

|

NO |

If YES, you are required to ill out a police report and submit a copy with this claim.

CAN THE DAMAGE BE REPAIRED? |

YES |

NO |

If YES, please submit a copy of the repair estimate. If NO, please ill out Amounts Claimed below.

SECTION 3: DESCRIPTION OF ITEMS AND AMOUNTS CLAIMED

DESCRIPTION - PLEASE INCLUDE MANUFACTURER, MODEL, AND SERIAL NUMBER

ORIGINAL PURCHASE DATE

ORIGINAL PURCHASE PRICE

REPLACE/REPAIR COST

LESS AMOUNT RECEIVED FROM OTHER SOURCES

Notice: If you have more items, please attach separate sheet |

TOTAL AMOUNT CLAIMED |

|

(including additional items if attached) |

||

|

VACATION RENTAL DAMAGE COVERAGE CLAIM FORM

SECTION 4: (GUEST/TENANT & VACATION RENTAL AGENT: PLEASE READ NOTICE BELOW & SIGN)

FRAUD WARNINGS AND DISCLOSURES

Arizona: For your protection Arizona law requires the following statement to appear on this form: Any person who knowingly presents a false or fraudulent claim for payment of a loss is subject to criminal and civil penalties.

Alaska, Minnesota, New Hampshire: A person who knowingly and with intent to injure, defraud, or deceive an insurance company iles a claim containing false, incomplete, or misleading information may be prosecuted under state law.

Arkansas, Louisiana, New Mexico, Texas, West Virginia: Any person who knowingly presents a false or fraudulent claim for payment of a loss or beneit or knowingly presents false information in an application for insurance is guilty of a crime and may be subject to civil ines and criminal penalties.

California: For your protection California law requires the following to appear on this form: Any person who knowingly presents false or fraudulent claim for the payment of a loss is guilty of a crime and may be subject to ines and coninement in state prison.

Colorado: It is unlawful to knowingly provide false, incomplete, or misleading facts or information to any insurance company for the purpose of defrauding or attempting to defraud the company. Penalties may include imprisonment, ines, denial of insurance and civil damages. Any insurance company or agent of an insurance company who knowingly provides false, incomplete, or misleading facts or information to a policyholder or claimant for the purpose of defrauding or attempting to defraud the policyholder or claimant with regard to a settlement or award payable from insurance proceeds shall be reported to the Colorado Division of Insurance within the Department of Regulatory Agencies.

Maine, Virginia, Tennessee, Washington: It is a crime to knowingly provide false, incomplete or misleading information to an insurance company for the purpose of defrauding the company or any other person. Penalties include imprisonment and/or ines. In addition, an insurer may deny insurance beneits if false information materially related to a claim was provided by the applicant.

Delaware, Idaho, Indiana: Any person who knowingly, and with intent to injure, defraud or deceive any insurer iles a statement of claim containing any false or misleading information is guilty of a felony.

Florida: Any person who knowingly and with intent to injure, defraud, or deceive any employer or employee, insurance company, or self insured program iles a statement of claim or an application containing any false or misleading information is guilty of a felony of the third degree.

Hawaii: For your protection, Hawaii law requires you to be informed that presenting a fraudulent claim for payment of a loss or beneit is a crime punishable by ines or imprisonment, or both.

District of Columbia: WARNING: It is a crime to provide false or misleading information to an insurer for the purpose of defrauding the insurer or any other person. Penalties include imprisonment and/or ines. In addition, an insurer may deny insurance beneits, if false information materially related to a claim was provided by the applicant.

Oklahoma: Warning: Any person who knowingly, and with intent to injure, defraud or deceive any insurer, makes any claim for the proceeds of an insurance policy containing any false, incomplete or misleading information is guilty of a felony.

Kentucky, Pennsylvania: Any person who knowingly and with intent to defraud any insurance company or other person, iles an application for insurance or statement of claim containing any materially false information or conceals for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance act, which is a crime and subjects such person to criminal and civil penalties.

Kansas: Any person who knowingly and with intent to defraud any insurance company or other person iles an application for insurance or statement of claim containing any materially false information or conceals for the purpose of misleading, information concerning any fact material thereto may be guilty of insurance fraud as determined by a court of law.

Maryland: Any person who knowingly or willfully presents a false or fraudulent claim for payment of a loss or beneit or knowingly or willfully presents false information in an application for insurance is guilty of a crime and may be subject to civil ines and criminal penalties.

New Jersey: Any person who knowingly iles a statement of claim containing any false or misleading information is subject to criminal and civil penalties.

New York: Any person who knowingly and with intent to defraud any insurance company or other person iles an application for insurance or statement of claim containing any materially false information, or conceals for the purpose of misleading, information concerning any fact material thereto, commits a fraudulent insurance act, which is a crime, and shall also be subject to a civil penalty not to exceed ive thousand dollars and the stated value of the claim for each violation.

Ohio: Any person who, with intent to defraud or knowing that he is facilitating a fraud against an insurer, submits an application or iles a claim containing a false or deceptive statement is guilty of insurance fraud.

Oregon: Any person who knowingly and with intent to defraud, iles a claim for beneits may be guilty of insurance fraud and may be subject to prosecution.

By checking this box, I/we, the insured(s) and the Agent(s), agree that my/our electronic signature(s) shall be the legal equivalent of my/our manual signature(s) on the document. I/we, the insured(s) and the Agent(s), attest that all the statements in this document are true and complete to the best of my/our knowledge. I/we authorize CSA Travel Protection to contact me/us or anyone else involved in this matter, to verify whether or not this loss occurred. I/we further authorize CSA Travel Protection to release and share claim information including that which may be used in the identiication and prevention of potential fraudulent activity to Generali U.S. Branch, Generali Assicurazioni Generali S.p.A. (U.S. Branch), Assicurazioni Generali – U.S. Branch, Generali U.S. Branch DBA The General Insurance Company of Trieste & Venice, The General Insurance Company of Trieste and Venice – U.S. Branch, Stonebridge Casualty Insurance Company, Transamerica Casualty Insurance Company, insurance support organizations, fraud information clearinghouses, designated service providers and business associates assisting in the processing of the claim.

GUEST/TENANT’S SIGNATURE |

PRINT NAME |

DATE |

|

|

|

VACATION RENTAL AGENT’S SIGNATURE |

PRINT NAME |

DATE |

VACATION RENTAL AGENTS: REMEMBER TO SUBMIT THE

FOLLOWING WITH THIS CLAIM FORM:

•FOR THEFT CLAIMS, A COPY OF THE POLICE REPORT

•PHOTOGRAPHS OF THE PROPERTY DAMAGE

• REPAIR ESTIMATES |

You may also submit your completed form to CSA by fax: (877) |

|

|

• ORIGINAL PURCHASE RECEIPTS OR ESTIMATES |

CSA Travel Protection |

|

|

• REPLACEMENT RECEIPTS |

P.O. Box 939057 |

• A COPY OF THE PROPERTY/LEASE AGREEMENT |

San Diego, CA 92193 |

QUESTIONS? CALL CSA AT (800)

VRD With Assignment_15677_0414

Form Characteristics

| Fact | Details |

|---|---|

| Purpose | This form documents existing damage at check-in and accidental damage during the guest's stay. |

| Documentation Requirement | Guests must provide written proof of loss within 90 days of the incident. |

| Time Limit for Claims | Claims must be submitted within 12 months unless the claimant is incapacitated. |

| Evidence for Theft | If theft is involved, a police report must be submitted with the claim form. |

| Repair Documentation | If damage can be repaired, a copy of the repair estimate is required. |

| State-Specific Laws | California law indicates that presenting a false claim is a crime, subject to fines and imprisonment. |

| Contact Information | For assistance, guests can call CSA at (800) 541-3522 or email claims@CSATravelProtection.com. |

Guidelines on Utilizing Csa Damage

Completing the CSA Damage Form is a straightforward process but requires careful attention to detail. This form ensures that you properly document any damage you encounter during your stay or any accidental damage you may accidentally cause. By following the steps outlined below, you will help protect yourself and ensure a smoother claims process.

- Read the entire form carefully before you start filling it out.

- In Section 1, provide the necessary personal information. Include your name, home/cell phone number, business phone number, email address, and mailing address. Fill in the policy number if applicable.

- Detail any damage you noticed upon check-in. Be specific about what was damaged and when it occurred. Use a separate sheet if necessary.

- Sign and date the form where it asks for your signature in Section 1. This confirms that the information is accurate.

- In Section 2, the vacation rental agent will provide their contact details, including the business phone number and the reservation confirmation number.

- The agent should describe the incident that caused the damage, specifying whether it is theft-related. If it was theft-related, a police report must be filed and attached.

- Indicate whether the damage can be repaired, and if so, submit a copy of the repair estimate.

- In Section 3, list each damaged item, including details such as manufacturer, model, and serial number. State the original purchase date and price, and the replacement/repair cost.

- If there are multiple items, attach a separate sheet detailing each item.

- Calculate and enter the total amount claimed at the bottom of Section 3.

- In Section 4, both the guest and vacation rental agent must read the fraud warnings and disclosures, then sign and print their names.

- Finally, gather any supporting documentation, such as photos of the damage and receipts, and submit the completed form and documents by fax or mail.

By thoroughly completing each step, you will aid in the efficient processing of your claim. Be sure to keep a copy of this form and any attached documents for your records as you navigate this process.

What You Should Know About This Form

What is the purpose of the CSA Damage Form?

The CSA Damage Form serves two main purposes. First, it lets guests report any damage they notice when they check into a rental property. Notifying us right away helps ensure you won't be held responsible for any pre-existing issues. Second, if you have purchased CSA Vacation Rental Damage Protection, you can use the form to report any accidental damage that occurs during your stay.

How quickly should I report damage I discover?

It's essential to report any damage as soon as you find it. Prompt notification allows us to document the issue properly, ensuring you are not charged for something that existed prior to your arrival. Timely communication is key to avoiding misunderstandings.

What information do I need to provide on the form?

You will need to include several details. This includes your name, contact information, reservation details, and a description of the damage. Be specific about how the damage occurred and list any items affected. If you have the CSA Vacation Rental Damage Protection, fill out the required sections concerning your policy and sign the document.

Is there a deadline for submitting claims?

Yes, there are specific deadlines for submitting claims. You must provide written proof of loss within 90 days from the date of the incident. However, the absolute deadline is one year from the date the loss occurred, unless you have a legal or medical reason that prevents you from submitting it sooner.

What if I can't provide proof of loss within 90 days?

If it's not reasonably possible to submit proof within those 90 days, you will not automatically be denied. It’s important to communicate your situation clearly. Regardless, all claims must be submitted within twelve months from the date of loss.

What happens if the damage is related to theft?

If the damage involves theft, you are required to file a police report and include a copy with your claim submission. This documentation is necessary for us to assess the situation fully and process your claim appropriately.

Can my rental agent assist me with the claims process?

Absolutely! Your vacation rental agent can help you complete the form and make sure it is submitted correctly. They also play a crucial role in gathering necessary documentation, such as repair estimates, to support your claim.

How can I submit my completed CSA Damage Form?

You can submit the form either by faxing it to (877) 300-8670 or mailing it to the provided address. Be sure to include any required attachments, like photos of the damage and receipts, to help support your claim.

Common mistakes

Filling out the CSA Damage form is crucial for properly documenting any damage that occurs during your vacation rental. However, there are common mistakes that can lead to delays or issues in processing claims. Here are ten mistakes to avoid:

One significant mistake is failing to report pre-existing damage upon check-in. If you notice any damage when you arrive at the property, document it immediately on the form. This helps ensure you are not held responsible for damages that were already present before your stay.

Another frequent error occurs when guests don’t include complete details in the description of loss section. Provide a thorough account of how the damage occurred, the date of the incident, and any items that were affected. Incomplete information can hinder the claims process.

Some individuals skip signing the form, thinking that it is unnecessary. However, your signature is a confirmation of the accuracy of the information presented, and failure to sign can lead to the rejection of your claim.

Using incorrect or outdated contact information can cause confusion. Ensure that your home/cell phone number, email address, and mailing address are current and accurately listed on the form. This way, claims representatives can reach you without delay.

Many forget to check the appropriate boxes regarding the nature of the incident, such as whether the loss was related to theft. If theft is involved, you are required to submit a police report, and omitting this detail complicates the claim process.

Another pitfall is neglecting to provide proof of loss within 90 days after the incident. Submitting written proof in this timeframe is essential for your claim to be processed. Remember, one year is the maximum time frame allowed for submission unless you are incapacitated.

Individuals often underestimate the importance of including repair estimates or police reports when applicable. When you check "yes" under whether the damage can be repaired, include any estimates from repair services to support your claim. This documentation is vital.

When listing items and their details, some forget to provide essential information like the manufacturer, model, and serial number of the damaged goods. Inaccurate or missing specifics can cause delays or denials of claims.

Failing to include total amounts claimed can lead to confusion. Double-check that all calculations are accurate and comprehensive, ensuring you include any extra items or documentation that supports your claim.

Lastly, some guests do not keep copies of their submitted forms and supporting documents. Retaining copies of everything submitted can serve as a reference should any questions arise later in the process.

By being aware of these common mistakes and taking steps to avoid them, you can ensure a smoother claims process and help protect yourself during your vacation rental experience.

Documents used along the form

When managing vacation rental damage claims, several forms and documents may accompany the CSA Damage Form. Each of these documents plays a crucial role in facilitating the claims process effectively and efficiently.

- Inspection Report: This document details the property's condition at check-in and check-out, noting any pre-existing damages and helping to substantiate the claim.

- Repair Estimates: A breakdown of anticipated repair costs prepared by a licensed contractor. This document is crucial for assessing the financial impact of any damage.

- Photographs: Visual documentation showing the extent of the damage. These images serve as proof of conditions that may not be easily conveyed in writing.

- Police Report (if applicable): Required for theft-related claims, this report assesses the circumstances surrounding the loss and helps validate the claim.

- Proof of Purchase Receipts: Original receipts for damaged items or repairs demonstrate ownership and establish the value of the items claimed.

- Lease Agreement: A copy of the rental agreement outlines the terms of the rental, including responsibilities related to damages and coverage.

- Claim Submission Form: A form detailing the specifics of the claim. This provides structured information to support the request and helps the processing organization understand the situation clearly.

- Assignment of Benefits Form: This document authorizes the insurance company to pay the damages directly to the repair company, streamlining the financial exchange.

Having these forms and documents prepared can significantly enhance the speed and success of processing a damage claim. Ensure that all necessary paperwork is completed accurately before submission to facilitate a smoother claims experience.

Similar forms

-

Insurance Claim Form: Similar to the CSA Damage Form, an insurance claim form allows policyholders to report damages and request compensation. Both forms require detailed descriptions of the incidents and associated costs.

-

Property Inspection Report: Conducted before or after renting a property, this document records the condition of the premises. Like the CSA Damage Form, it serves as a preventive measure to track any existing damages to avoid misunderstandings later.

-

Lease Agreement Addendum: This document is used to document any existing damage before lease signing. Both forms focus on protecting parties by noting the pre-existing condition of the property, ensuring accountability.

-

Accident Report Form: Often used in various scenarios, this form documents specific incidents where damage occurred. Like the CSA form, it collects details on how the damage happened to support future claims or disputes.

-

Damage Waiver Agreement: This agreement allows renters to avoid charges for small damages. Similar to the CSA form, it defines what is covered and helps both parties clarify their responsibilities regarding potential damages.

-

Repair Estimate Document: Required alongside damage claims, this document outlines the costs to repair damages. It parallels the CSA Damage Form by providing essential details about how much compensation is sought for repairs.

Dos and Don'ts

When filling out the CSA Damage Form, keep in mind the following do's and don'ts:

- Do: Document any damage you find immediately upon check-in to ensure it is not attributed to you later.

- Do: Include detailed descriptions of the damage, including how it occurred and the items affected.

- Do: Make sure to sign and date the form to validate your report.

- Do: Submit written proof of loss within 90 days, even if circumstances prevented you from doing so sooner.

- Do: Keep copies of all receipts and supporting documents related to the claim.

- Don't: Wait too long to report any damage; the sooner you notify, the better.

- Don't: Provide incomplete or misleading information, as this could jeopardize your claim.

- Don't: Forget to attach any necessary documentation, such as police reports for theft claims or repair estimates.

- Don't: Assume that verbal notifications will suffice; always document in writing.

- Don't: Ignore the fraud warnings; providing false information can lead to serious legal consequences.

Misconceptions

Understanding the CSA Damage Form is critical for ensuring a smooth claim process. Here are six common misconceptions that often arise:

- Misconception 1: The form is only for damage caused by guests.

- Misconception 2: You can submit the claim anytime after the damage occurs.

- Misconception 3: Only serious damage needs to be reported.

- Misconception 4: Claims will always be approved, regardless of circumstances.

- Misconception 5: A signature on the form releases you from all liability.

- Misconception 6: The claim process is automatic once the form is submitted.

This is not true. The form is also used to document pre-existing damage at the property. This allows guests to avoid responsibility for damages that were not caused during their stay.

While there is a deadline, guests must provide written proof of loss within 90 days after the damage occurs. Additionally, claims must be completed within twelve months unless under special circumstances.

It is advised to report any and all damage, regardless of how minor it may seem. Documenting everything helps to avoid confusion and ensures complete transparency.

Claims can be denied or reduced if they do not meet specific documentation or information requirements outlined in the form and related policy documents.

Signing the form does not absolve one of responsibility for any incidents reported. It is simply a method to document situations as they occur.

The claim process requires further steps, including the need for evidence such as photographs and repair estimates. Also, follow-up may be necessary to facilitate processing.

Key takeaways

- Report Damage Promptly: Document any damage found at the property during check-in. Prompt reporting is essential to avoid liability for pre-existing issues.

- Accidental Damage Coverage: If you have CSA Vacation Rental Damage Protection, use the appropriate section to report accidental damages incurred during your stay.

- Written Proof of Loss: Submit written proof of loss within 90 days of the incident. If this is not possible, proof must still be provided within twelve months unless you are incapacitated.

- Complete All Information: Fill in all required fields on the claim form accurately to avoid delays in processing your claim.

- Include Detailed Descriptions: Describe the incident that caused the damage thoroughly. Include dates and specifics on the items affected.

- Theft Claims: If the damage is theft-related, a police report must be completed and attached to the claim.

- Repair Estimates: For damages that can be repaired, submit a copy of the repair estimate alongside your claim.

- Submit Required Documentation: Along with the claim form, include any requested photographs of the damage and original purchase receipts, as applicable.

Browse Other Templates

Pca Northeast - Electronic timesheets can streamline the billing process.

Horse Training Contract Template - The Owner must supply proof of veterinary care for the horse as needed.