Fill Out Your Cscl Cd 502 Form

The CSCL CD 502 form is a vital document for anyone looking to establish a Domestic Nonprofit Corporation in Michigan. This form facilitates the legal formation of your organization and ensures compliance with state regulations. When filling out this form, you will provide essential information such as the corporation's name, its purpose, and whether it is set up on a stock or nonstock basis. It also requires details about asset ownership, including real and personal property descriptions, if applicable. You’ll need to appoint a resident agent and provide their address, as well as the registered office address. Additionally, identifying the incorporators involved is a must, as they are responsible for the formation process. There are clear steps outlined for ensuring the document meets legal standards, including necessary signatures and submission guidelines. Even filing fees should be carefully managed to avoid complications. By understanding and accurately completing the CSCL CD 502 form, you take a significant step toward successfully forming your nonprofit organization in Michigan.

Cscl Cd 502 Example

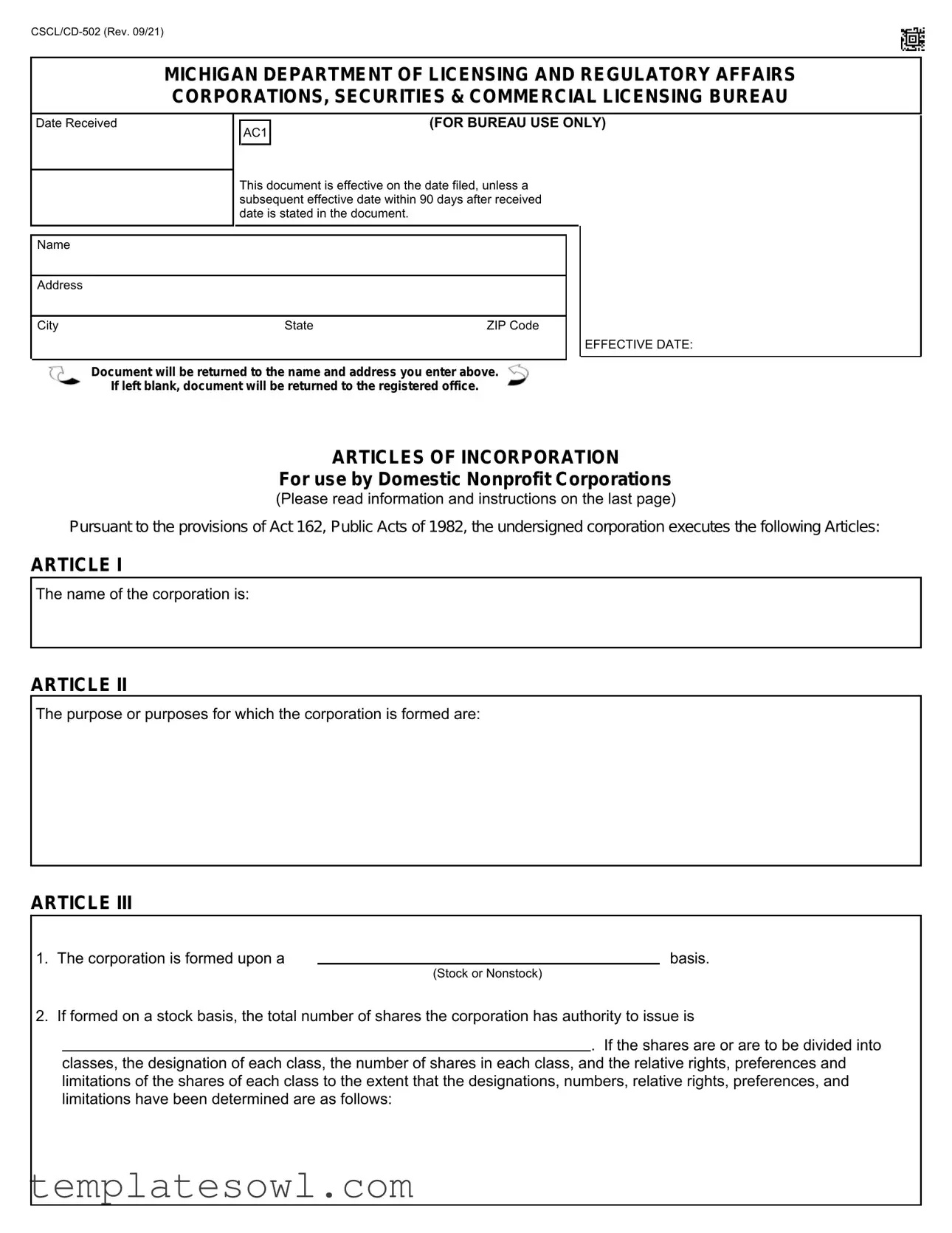

MICHIGAN DEPARTMENT OF LICENSING AND REGULATORY AFFAIRS CORPORATIONS, SECURITIES & COMMERCIAL LICENSING BUREAU

Date Received

|

(FOR BUREAU USE ONLY) |

|

AC1 |

||

|

||

|

|

This document is effective on the date filed, unless a subsequent effective date within 90 days after received date is stated in the document.

Name

Address

City |

State |

ZIP Code |

EFFECTIVE DATE:

Document will be returned to the name and address you enter above.

If left blank, document will be returned to the registered office.

ARTICLES OF INCORPORATION

For use by Domestic Nonprofit Corporations

(Please read information and instructions on the last page)

Pursuant to the provisions of Act 162, Public Acts of 1982, the undersigned corporation executes the following Articles:

ARTICLE I

The name of the corporation is:

ARTICLE II

The purpose or purposes for which the corporation is formed are:

ARTICLE III

1. The corporation is formed upon a |

|

basis. |

(Stock or Nonstock)

2. If formed on a stock basis, the total number of shares the corporation has authority to issue is

. If the shares are or are to be divided into

classes, the designation of each class, the number of shares in each class, and the relative rights, preferences and limitations of the shares of each class to the extent that the designations, numbers, relative rights, preferences, and limitations have been determined are as follows:

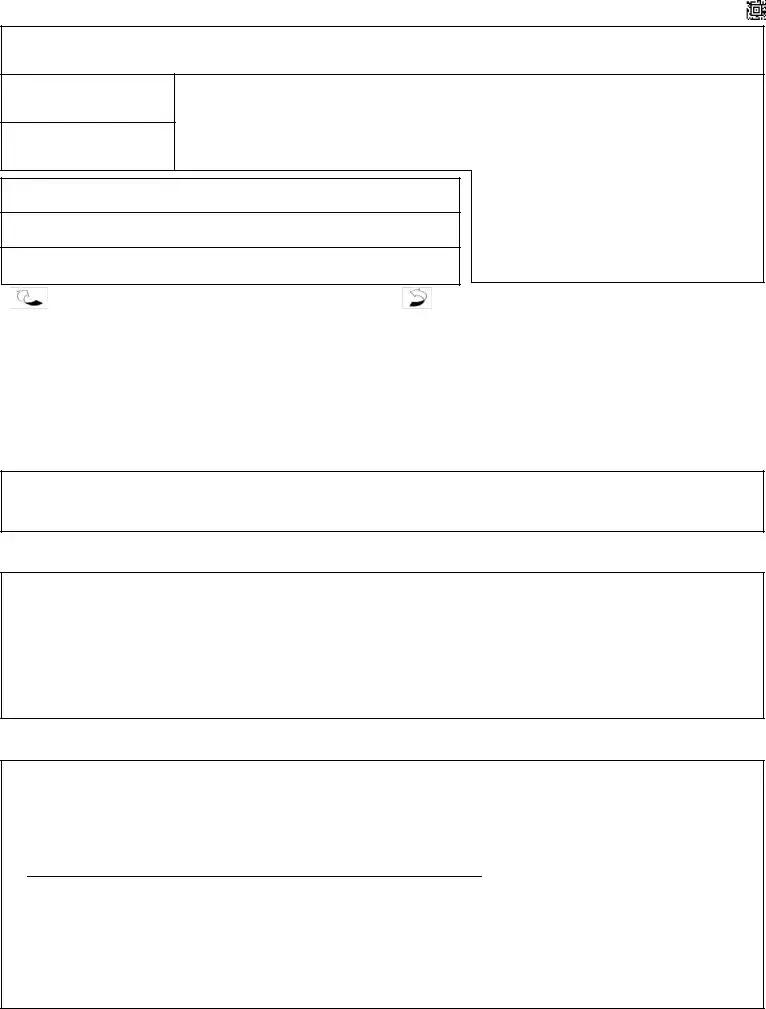

ARTICLE III (cont.)

3.a. If formed on a nonstock basis, the description and value of its real property assets are: (if none, insert "none")

b.The description and value of its personal property assets are: (if none, insert "none")

c.The corporation is to be financed under the following general plan:

d. The corporation is formed on a |

|

basis. |

|

(Membership or Directorship) |

|

ARTICLE IV

1.The name of the resident agent at the registered office is:

2.The address of its registered office in Michigan is:

|

|

, Michigan |

|

(Street Address) |

(City) |

|

(ZIP Code) |

3. The mailing address of the registered office in Michigan if different than above:

|

|

, Michigan |

|

(Street Address or PO Box) |

(City) |

|

(ZIP Code) |

ARTICLE V

The name(s) and address(es) of the incorporator(s) is (are) as follows:

Name |

Residence or Business Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Use space below for additional Articles or for continuation of previous Articles. Please identify any Article being continued or added. Attach additional pages if needed.

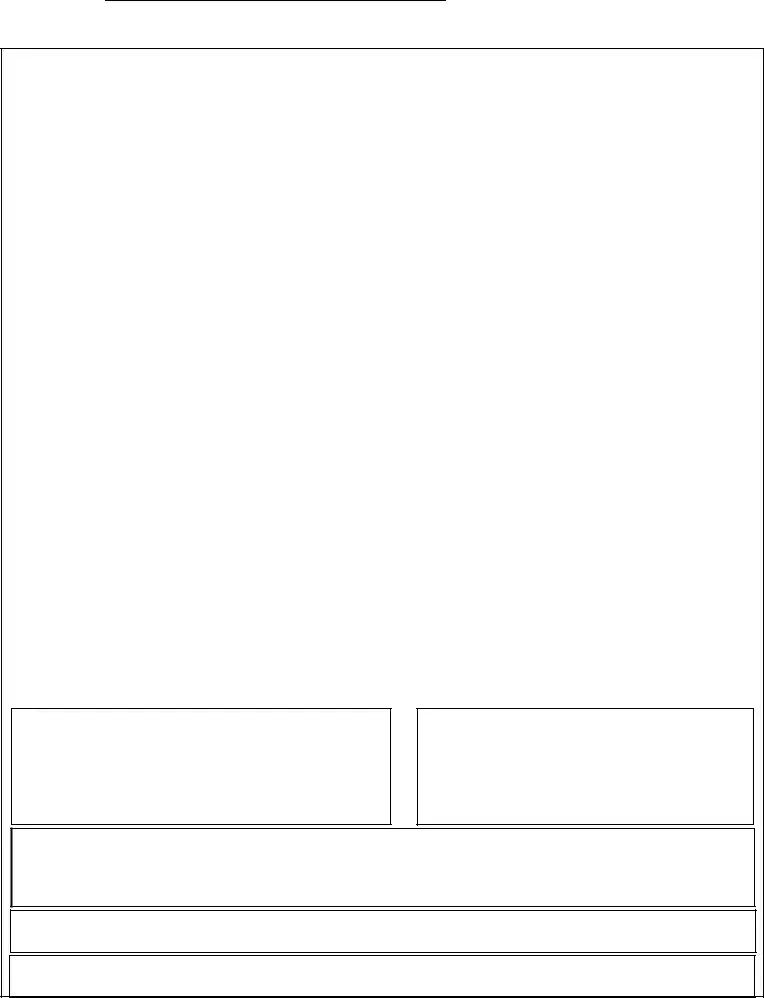

I, (We), the incorporator(s) sign my (our) name(s) this |

|

|

|

day of |

|

, |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preparer's Name

Business Telephone Number ( |

) |

|

|

|

|

INFORMATION AND INSTRUCTIONS

1.This form may be used to draft your Articles of Incorporation. A document required or permitted to be filed under the act cannot be filed unless it contains the minimum information required by the act. The format provided contains only the minimal information required to make the document fileable and may not meet your needs. This is a legal document and agency staff cannot provide legal advice.

2.Submit one original of this document. Upon filing, the document will be added to the records of the Corporations, Securities & Commercial Licensing Bureau. The original will be returned to your registered office address, unless you enter a different address in the box on the front of this document.

Since this document will be maintained on electronic format, it is important that the filing be legible. Documents with poor black and white contrast, or otherwise illegible, will be rejected.

3.This document is to be used pursuant to the provisions of Act 162, P.A. of 1982, by one or more persons for the purpose of

forming a domestic nonprofit corporation.

4 . Article II - The purpose for which the corporation is formed must be included. It is not sufficient to state that the corporation may engage in any activity within the purpose for which corporations may be formed under the Act.

5.Article III - The corporation must be formed on a stock or nonstock basis. Complete Article III(2) or III(3) as appropriate, but not both. Real property assets are items such as land and buildings. Personal property assets are items such as cash, equipment, fixtures, etc. The dollar value and description must be included. If there is no real and/or personal property, write in "none".

6.A domestic nonprofit corporation may be formed on either a membership or directorship basis. A membership corporation entitles the members to vote in determining corporate action. If formed on a directorship basis, the corporation may have members but they may not vote and corporate action is determined by the Board of Directors.

7.Article IV - A post office box may not be designated as the address of the registered office.

8.Article V - The Act requires one or more incorporators. Educational corporations are required to have at least three (3) incorporators. The address(es) should include a street number and name (or other designation), city and state.

9.This document is effective on the date endorsed "filed" by the Bureau. A later effective date, no more than 90 days after

the date of delivery, may be stated as an additional article.

10.The Articles must be signed in ink by each incorporator listed in Article V. However, if there are 3 or more incorporators,

they may, by resolution adopted at the organizational meeting by a written instrument, designate one of them to sign the Articles of Incorporation on behalf of all of them. In such event, these Articles of Incorporation must be accompanied by a copy of the resolution duly certified by the acting secretary at the organizational meeting and a statement must be placed in the articles incorporating that resolution into them.

11.FEES: Make remittance payable to the State of Michigan. Include corporation name on check or money order.

FILING AND FRANCHISE FEE |

$20.00 |

Veterans: Pursuant to MCL 450.3060(5), if a majority of the initial members of a membership corporation, initial directors of a directorship corporation, or initial shareholders of a stock corporation, as applicable, are, or if applicable the initial members, initial directors, or initial shareholders will be, individuals who served in the armed forces and were separated from that service with an honorable character of service or under honorable conditions (general) character of service, you may contact the Corporations Division regarding a fee waiver.

Submit with check or money order by mail:

Michigan Department of Licensing and Regulatory Affairs Corporations, Securities & Commercial Licensing Bureau Corporations Division

P.O. Box 30054 Lansing, MI 48909

To submit in person:

2407 N Grand River Ave

Lansing, MI 48906

Telephone: (517)

Fees may be paid by check, money order, VISA, MasterCard, American Express or Discover when delivered in person to our office.

COFS (Corporations Online Filings System):

This document may be completed and submitted online at www.michigan.gov/corpfileonline. Fees may be paid by VISA, MasterCard, American Express or Discover.

Documents that are endorsed filed are available at www.michigan.gov/corpentitysearch. If the submitted document is not fileable, the notice of refusal to file and document will be available at the Rejected Filings Search website at www.michigan.gov/corprejectedsearch.

LARA is an equal opportunity employer/program. Auxiliary aids, services and other reasonable accommodations are available upon request to individuals with disabilities.

Optional expedited service.

Expedited review and filing, if fileable, is available for all documents for profit corporations, limited liability companies, limited partnerships and nonprofit corporations.

The nonrefundable expedited service fee is in addition to the regular fees applicable to the specific document.

Please complete a separate

Same day service

Same day - $100 for formation documents and applications for certificate of authority.

Same day - $200 for any document concerning an existing entity.

Review completed on day of receipt. Document and request for same day expedited service must be received by 1 p.m. EST OR EDT.

Two hour - $500

Review completed within two hours on day of receipt. Document and request for two hour expedited service must be received by 3 p.m. EST OR EDT.

One hour - $1000

Review completed within one hour on day of receipt. Document and request for 1 hour expedited service must be received by 4 p.m. EST OR EDT.

Documents submitted by mail are delivered to a remote location for receipts processing and are then forwarded to the Corporations Division for review. Day of receipt for mailed expedited service requests is the day the Corporations Division receives the request.

Rev. 09/21

Form Characteristics

| Fact Name | Detail |

|---|---|

| Purpose | The CSCL/CD-502 form is used to draft Articles of Incorporation for domestic nonprofit corporations in Michigan. |

| Governing Law | This form is governed by Act 162, Public Acts of 1982. |

| Filing Requirements | It must include minimum information as required by the Act to be filed properly. |

| Effective Date | The document becomes effective on the date it is filed, unless a different date is specified (within 90 days). |

| Incorporator Details | At least one incorporator is needed to complete this form, and educational corporations require at least three. |

| Asset Requirement | A description and value of both real and personal property assets must be included if applicable. |

| Membership vs. Directorship | The corporation may be formed on either a membership or directorship basis, affecting voting rights. |

| Submission Fee | A filing fee of $20.00 is required to submit this document. |

| Expedited Services | Expedited review services are available for an additional fee, including options for same-day and two-hour service. |

| Legibility Importance | Filing documents must be legible; otherwise, they may be rejected due to poor contrast or illegibility. |

Guidelines on Utilizing Cscl Cd 502

After completing the CSCL CD-502 form, it is essential to submit it correctly to ensure your corporation is registered properly. Be aware of the filing fees associated with the document, as well as the options available for expedited service if needed.

- Date Received: Leave this section blank, as it will be filled out by the Bureau.

- Name: Enter the name of your corporation in the designated space.

- Address: Provide the street address, city, state, and ZIP code for the corporation.

- Effective Date: Fill in the effective date if you wish it to be different from the date filed. Otherwise, leave it blank.

- Article I: Write the name of your corporation again in the space provided.

- Article II: Describe the purpose or purposes for forming the corporation.

- Article III:

- Choose whether the corporation will be stock or non-stock.

- If stock, provide the total number of shares authorized and their classification details.

- If non-stock, outline the description and value of real property assets and personal property assets (include "none" if applicable).

- Detail the corporation's financing plan.

- Indicate whether the corporation will be based on membership or directorship.

- Article IV:

- Input the name of the resident agent for the registered office.

- Write the address of the registered office in Michigan (must be a physical address, not a P.O. Box).

- Note the mailing address if it's different from the registered office.

- Article V: List the name(s) and address(es) of the incorporator(s), ensuring to include a street number and name, city, and state.

- Continuation: If necessary, use additional space for further Articles or to continue previous entries.

- Signature: Each incorporator must sign and date the document.

- Preparer’s Information: Include the preparer’s name and business telephone number.

Ensure all sections are completed accurately before submission. Remember to send your form along with the appropriate fees to the Michigan Department of Licensing and Regulatory Affairs for processing.

What You Should Know About This Form

What is the CSCL CD 502 form?

The CSCL CD 502 form is the Articles of Incorporation document required for establishing a domestic nonprofit corporation in Michigan. It collects essential information about the corporation, such as its name, purpose, and structure.

Who needs to file the CSCL CD 502 form?

Individuals or groups planning to create a nonprofit corporation in Michigan must file this form. This includes educational entities, charities, and other organizations intending to operate without profit motives.

What information is required on the CSCL CD 502 form?

Key information includes the corporation's name, purpose, whether it is stock or nonstock, details of real and personal property assets, and addresses for the registered office and resident agent. Incorporators' names and addresses must also be provided.

How do I designate a resident agent?

A resident agent acts on behalf of the corporation for legal matters. You must provide the name and address of the designated resident agent in Article IV of the CSCL CD 502 form. This address cannot be a post office box.

What is the fee for filing the CSCL CD 502 form?

The standard filing fee for submitting the CSCL CD 502 form is $20. This may vary if the organization qualifies for a fee waiver, particularly if the majority of incorporators are veterans.

Can the CSCL CD 502 form be filed online?

Yes, the CSCL CD 502 form can be completed and submitted online through the Michigan Corporations Online Filings System at www.michigan.gov/corpfileonline. Fees can also be paid electronically via various credit cards.

What happens after I submit the CSCL CD 502 form?

Once submitted, the form will be reviewed by the Michigan Department of Licensing and Regulatory Affairs. If the form is approved, it will be filed, and you will receive a confirmation. If rejected, you will receive a notice detailing the reasons for the refusal.

What is an effective date for the form?

The effective date for the Articles of Incorporation is typically the date the Bureau endorses the document as "filed". Alternatively, a future effective date can be indicated, as long as it is within 90 days of filing.

Do all incorporators need to sign the form?

Yes, each incorporator listed in Article V must sign the CSCL CD 502 form in ink. If there are three or more incorporators, one person may sign on behalf of all, provided a certified resolution is included with the form.

Is there a way to expedite the filing process?

Yes, expedited review services are available. Depending on your chosen level of service, you can receive a review within one hour, two hours, same day, or in 24 hours, for an additional fee. Ensure to submit your request within the specified timeframes for expedited services.

Common mistakes

Filling out the CSCL/CD-502 form can be a straightforward process, but many people run into common mistakes. Being aware of these pitfalls can save you time and frustration. First, neglecting to provide a name for the corporation is a frequent oversight. A corporation must have a unique name that complies with state regulations. Without it, the form will not be processed.

Another common mistake is failing to include the purpose of the corporation. It's not enough to say that the corporation can engage in any lawful activity. You need to specify the particular purpose for which your nonprofit is formed. Vagueness can lead to delays or rejections.

Some individuals skip over Article III entirely or fill it out incorrectly. It is crucial to indicate whether the corporation is stock or nonstock. If you choose the stock option, you must declare the total number of shares your corporation will issue. On the other hand, if it’s nonstock, a description and value of real and personal assets must be included in detail. Ignoring these requirements can put your filing at risk.

Individuals often write in a Post Office Box as the registered office address. This is a no-go because the form specifically states that a physical street address is necessary. Not following this guideline can lead to automatic rejection of your application.

Similarly, when it comes to the names and addresses of the incorporators in Article V, it’s important to provide complete details. Failing to include all necessary contact information, such as a street number and city, can cause issues down the line. It's critical that this section is filled out accurately, as it’s a legal requirement.

Some also overlook the requirement for signatures. Each incorporator must sign the form in ink. If there are three or more incorporators, a resolution must be attached. This resolution should authorize one person to sign on behalf of all, and it must be certified properly.

Writing “none” in the sections for assets when there are truly assets can create confusion. Clarifying each asset type is essential, even if it feels like extra work. You would rather be thorough now than deal with snags during the review process.

Another mistake involves omitting the filing fee entirely or providing the wrong amount. The fee should be clearly noted on your submission and payable to the State of Michigan. Leaving this section blank may result in delays or an outright rejection of the application.

Additionally, not keeping a copy of your submission can lead to headaches later. Keeping a personal copy can be invaluable, should questions arise about your application status or if you need to reference it in the future.

Finally, many people miss out on the option for expedited services. If you need your document processed quickly, be sure to check the applicable fees and processes. Ignoring this can extend the time it takes to receive your results.

By avoiding these ten mistakes, you can significantly streamline the process and ensure that your filing meets all necessary requirements. Filling out the CSCL/CD-502 form doesn’t have to be daunting! With careful attention, you can navigate it successfully.

Documents used along the form

When filing the CSCL/CD-502 form to establish a nonprofit corporation in Michigan, several other documents might be required to ensure smooth processing and compliance with state regulations. Here’s a list of commonly associated forms and documents that may be helpful to you during this process.

- CSCL/CD-501 (Application for Certificate of Authority) - This document is necessary if a foreign nonprofit corporation wishes to operate in Michigan. It verifies that the corporation has the legal standing to do business within the state.

- CSCL/CD-700 (Annual Report) - Every nonprofit corporation must submit this report annually to maintain its good standing. It updates the state on the corporation’s status, financials, and governance structure.

- CSCL/CD-511 (Registered Office Change) - If there is a change in the address of the registered office, this form must be completed and submitted to keep the state informed of the corporation's official location.

- CSCL/CD-710 (Statement of Change) - Use this form to report changes to the corporation's structure or its board members, ensuring that the state has the most current information about the organization.

- CSCL/CD-573 (Bylaws) - While not filed with the state, bylaws outline the rules and regulations governing the internal management of the nonprofit. They are essential for operational clarity and accountability.

- IRS Form 1023 (Application for Recognition of Exemption) - If your nonprofit seeks federal tax-exempt status, this form is required by the IRS. It provides detailed information about your organization’s structure and purpose.

- Michigan Charitable Solicitation Act Registration - If your nonprofit intends to solicit donations, it must register under this act. This ensures compliance with state regulations regarding fundraising.

- CSCL/CD-100 (Merger or Consolidation) - Should two or more nonprofits wish to merge, this form captures the necessary details and approvals needed for the process.

- CSCL/CD-508 (Dissolution) - If at any point the corporation needs to dissolve, this form must be submitted to formally end the nonprofit's existence in the eyes of the law.

Each of these documents plays a vital role in the ongoing compliance and operation of your nonprofit corporation. By ensuring that you have these forms completed and submitted as required, you can help safeguard your organization's status and streamline your administrative responsibilities.

Similar forms

- Articles of Organization (LLC): This document serves a similar purpose as the CSCL CD 502 form but is specifically designed for Limited Liability Companies (LLCs) in Michigan. Both documents establish the organization but differ in their structure and regulatory requirements due to the nature of the business entity formed.

- Bylaws: While the CSCL CD 502 form lays out the foundational aspects of a corporation, bylaws detail the operational guidelines and procedures. Both are essential for governance but focus on different areas of a corporation's structure.

- Certificate of Good Standing: This document proves that a corporation is authorized to do business in Michigan. Similar to the CSCL CD 502, it provides validation of a corporation's existence but does so after incorporation has occurred.

- Annual Report: Corporations must file this document to provide updates on their status, such as current officers and address changes. It maintains the corporation’s active status, similar to the CSCL CD 502 form, which initiates the entity.

- Foreign Corporation Registration: This form is needed by corporations based outside of Michigan that wish to operate in the state. Like the CSCL CD 502, it formalizes the corporation's standing with the state but caters specifically to non-Michigan entities.

- Application for Certificate of Authority: This document is filed by foreign corporations seeking permission to do business in Michigan. It is analogous to the CSCL CD 502 as both establish a legal presence in the state, though they serve different entities.

- Withdrawal Document: If a corporation decides to cease its operations in Michigan, it must file a withdrawal document. This process is comparable to the CSCL CD 502 form as it represents a formal action regarding a corporation’s legal status within the state.

Dos and Don'ts

When filling out the CSCL CD 502 form, there are essential guidelines to follow to ensure accuracy and compliance. Here’s what you should and shouldn't do:

- Do read all instructions carefully before beginning to complete the form.

- Do provide accurate and complete information for each section, particularly the corporation name and address.

- Do specify the purpose of the corporation in Article II; general statements are not sufficient.

- Do ensure that the registered office address is not a PO Box as required.

- Don't leave any required fields blank; every section must be filled out appropriately.

- Don't forget to sign the document in ink; unsigned documents may be returned.

- Don't use illegible handwriting or poor contrast as it may lead to rejection of the form.

Misconceptions

Misconceptions about the CSCL CD 502 form can lead to confusion and errors in the incorporation process for nonprofit organizations. Below are some common misconceptions with explanations.

- This form is only for for-profit corporations. In fact, the CSCL CD 502 form is specifically designed for domestic nonprofit corporations in Michigan.

- The form can be submitted without a specified effective date. The document is effective on the date filed, unless a specific effective date within 90 days is provided.

- All incorporators need to be residents of Michigan. While incorporators can be from outside Michigan, the registered office must be in the state.

- Using a post office box as the registered office address is acceptable. The form explicitly states that a street address must be provided and a post office box is not allowed.

- The purpose of the corporation can be vague. The form requires a clear and specific statement of the purpose for which the corporation is formed. General statements are insufficient.

- A single incorporator can complete the form without additional input. While one person can sign, if there are three or more incorporators, they must designate one to act on behalf of all, through a resolution.

- The form can be submitted with poor quality print or formatting. Poor legibility can lead to rejection; submissions must be clear and maintain good black and white contrast.

- Incorporators do not need to provide personal information. The form requires the names and addresses of all incorporators, ensuring accountability and transparency.

Understanding these misconceptions can help individuals accurately navigate the incorporation process, ensuring the proper completion and submission of the CSCL CD 502 form.

Key takeaways

When completing the CSCL/CD-502 form, it is essential to follow specific guidelines.

- The form is used to create Articles of Incorporation for Domestic Nonprofit Corporations in Michigan.

- Include the corporation's name and clear purpose in Article II.

- Specify whether the corporation is stock or nonstock in Article III.

- If claiming stock status, provide the total number of shares in Article III (2).

- If the corporation is nonstock, provide a description and value of real and personal property in Article III (3).

- The corporation must have a registered agent; ensure the address is correct in Article IV.

- Each incorporator must sign the form; if there are three or more, one can sign on behalf of the group with proper documentation.

- Retain a clear and legible format to prevent rejection of the document.

- Submit the original document; if an alternate address is not provided, it will return to the registered office.

- Check the total fees applicable for filing, as outlined, ensuring payment is included with submission.

Properly filling out this form helps set the foundation for your nonprofit corporation. Attention to detail will aid in a smooth filing process.

Browse Other Templates

Pregnancy Note From Doctor - It emphasizes the collaboration between medical professionals and adoption services.

Becu Fraud Alert - Each owner or authorized signer must complete a specific section for their information.