Fill Out Your Ct 200 V Form

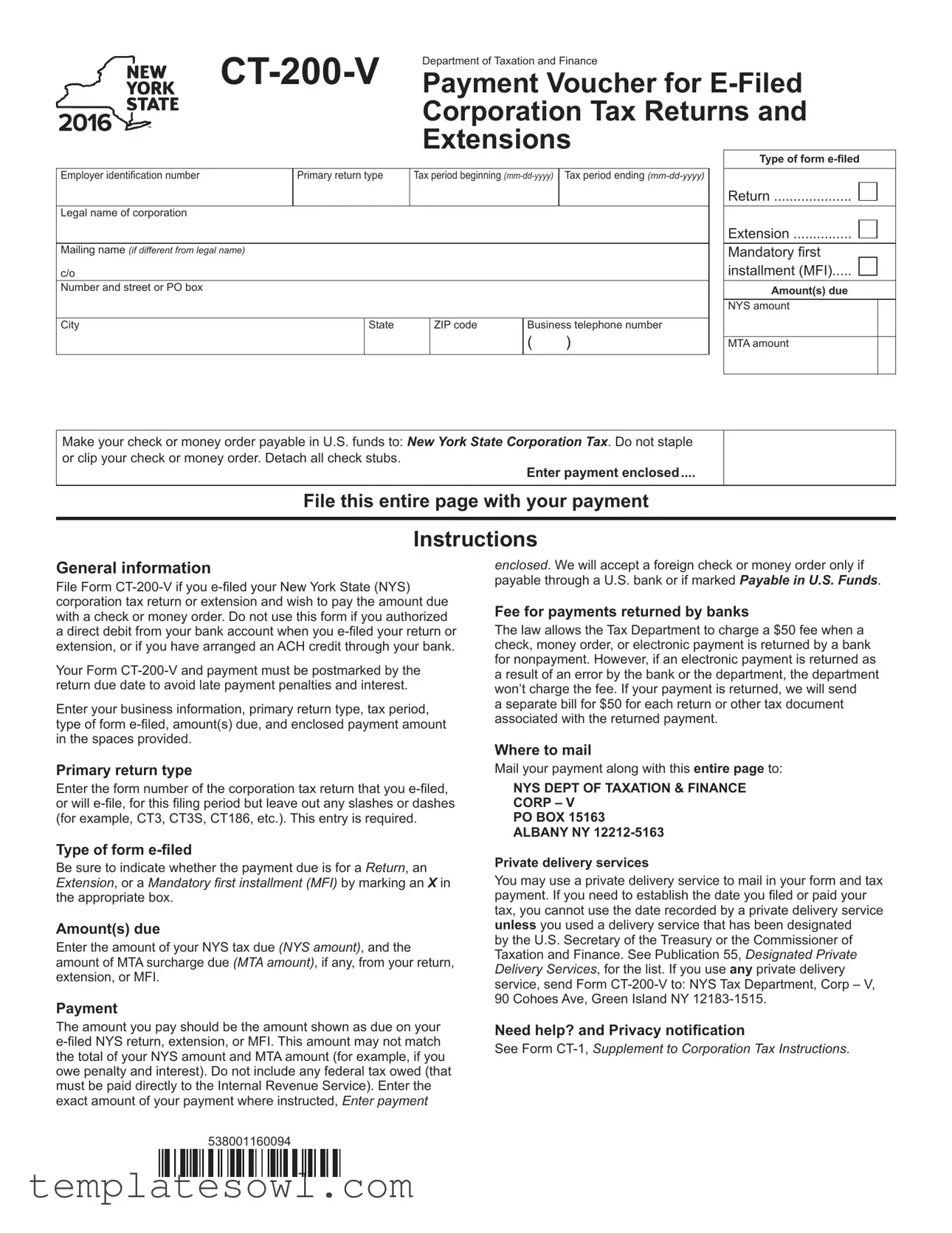

The CT-200-V form plays a crucial role in the process of submitting payments for New York State corporation tax returns and extensions. Designed specifically for the electronic filing (e-filing) system, it is essential for ensuring that businesses can remit their tax payments promptly and accurately. This voucher requires pertinent information, including your employer identification number, legal name of the corporation, and the applicable tax period. It also distinguishes between various types of submissions, whether for a standard return, an extension, or a mandatory first installment. Completing this form correctly is vital; it requires specifying the amounts due for both New York State and the Metropolitan Transportation Authority (MTA). Additionally, clarity is necessary regarding how much payment is enclosed, as inaccuracies could lead to penalties or interest. When it comes to submitting payment, the CT-200-V allows businesses to send checks or money orders, stressing the importance of adhering to strict guidelines, such as where to mail the form and payment, and how to effectively avoid late fees. Understanding this form's requirements is essential for compliance and successful navigation of New York's corporation tax obligations.

Ct 200 V Example

Department of Taxation and Finance |

|

Payment Voucher for |

Corporation Tax Returns and

Extensions

Employer identiication number |

Primary return type |

Tax period beginning |

Tax period ending |

|||

|

|

|

|

|

|

|

Legal name of corporation |

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing name (if different from legal name) |

|

|

|

|

|

|

c/o |

|

|

|

|

|

|

Number and street or PO box |

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

State |

|

ZIP code |

Business telephone number |

|

|

|

|

|

|

( |

) |

Type of form

Return ....................

Extension ...............

Mandatory irst installment (MFI).....

Amount(s) due NYS amount

MTA amount

Make your check or money order payable in U.S. funds to: New York State Corporation Tax. Do not staple or clip your check or money order. Detach all check stubs.

Enter payment enclosed....

File this entire page with your payment

Instructions

General information

File Form

Your Form

Enter your business information, primary return type, tax period, type of form

Primary return type

Enter the form number of the corporation tax return that you

Type of form

Be sure to indicate whether the payment due is for a RETURN, an EXTENSION, or a Mandatory irst installment (MFI) by marking an X in the appropriate box.

Amount(s) due

Enter the amount of your NYS tax due (NYS amount), and the amount of MTA surcharge due (MTA amount), if any, from your return, extension, or MFI.

Payment

The amount you pay should be the amount shown as due on your

enclosed. We will accept a foreign check or money order only if payable through a U.S. bank or if marked Payable in U.S. Funds.

Fee for payments returned by banks

The law allows the Tax Department to charge a $50 fee when a check, money order, or electronic payment is returned by a bank for nonpayment. However, if an electronic payment is returned as a result of an error by the bank or the department, the department won’t charge the fee. If your payment is returned, we will send

a separate bill for $50 for each return or other tax document associated with the returned payment.

Where to mail

Mail your payment along with this entire page to:

NYS DEPT OF TAXATION & FINANCE

CORP – V

PO BOX 15163

ALBANY NY

Private delivery services

You may use a private delivery service to mail in your form and tax payment. If you need to establish the date you iled or paid your tax, you cannot use the date recorded by a private delivery service unless you used a delivery service that has been designated

by the U.S. Secretary of the Treasury or the Commissioner of Taxation and Finance. See Publication 55, Designated Private Delivery Services, for the list. If you use any private delivery service, send Form

Need help? and Privacy notiication

See Form

538001160094

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The CT-200-V form is a payment voucher for e-filed corporation tax returns and extensions in New York State. |

| Filing Requirement | This form must be filed if you e-filed your New York State corporation tax return or extension and wish to pay by check or money order. |

| Due Date | Both the form and the payment must be postmarked by the return due date to avoid penalties and interest. |

| Payment Guidelines | The payment should be in U.S. funds, and checks or money orders must be made payable to New York State Corporation Tax. |

| Returned Payment Fee | A $50 fee may be charged if a payment is returned by the bank. Exceptions apply for bank errors. |

| Mailing Instructions | Payments should be mailed to NYS Dept of Taxation & Finance, Corp – V, PO Box 15163, Albany NY 12212-5163. |

Guidelines on Utilizing Ct 200 V

Completing the CT-200-V form requires careful attention to the details pertaining to your corporation's tax situation. After filling out the form correctly, you must ensure it is sent with your payment to avoid any penalties or delays in processing. Below are the steps to guide you through this process.

- Gather necessary information. Collect your employer identification number, legal name of the corporation, mailing address, and the tax period dates.

- Fill in your employer identification number. Input your unique employer identification number in the designated space.

- Indicate the primary return type. Enter the form number of the corporation tax return you e-filed (for example, CT3, CT3S) without slashes or dashes.

- Select the type of form e-filed. Mark an X in the appropriate box to indicate whether the payment is for a RETURN, EXTENSION, or Mandatory First Installment (MFI).

- Enter tax period dates. Provide the start and end dates of the tax period in the specified format (mm-dd-yyyy).

- Input the legal name of the corporation. Write the full legal name of your corporation as registered.

- Specify the mailing name. If different from the legal name, fill in the mailing name of your corporation.

- Complete address information. Fill out the street address or P.O. box, city, state, and ZIP code.

- Provide business telephone number. Include your business phone number in the indicated format.

- Enter amounts due. Write in the New York State (NYS) amount and the Metropolitan Transportation Authority (MTA) amount, if applicable.

- Attach payment details. Specify the amount of payment enclosed; make sure the check or money order is payable to New York State Corporation Tax.

- Detach check stubs. Remove all check stubs before mailing your payment.

- Mail your completed form. Send the form along with your payment to the designated address provided in the instructions.

Follow these steps diligently to ensure that your CT-200-V form is accurately completed and submitted punctually. Addressing each part of the form with care helps prevent any errors that could lead to unnecessary penalties. Timely submission is crucial for your corporation’s compliance with tax obligations.

What You Should Know About This Form

What is the CT-200 V form used for?

The CT-200 V form is a payment voucher for New York State corporation tax returns that are filed electronically. If you have e-filed your corporation tax return or an extension and need to pay the amount due by check or money order, this form should be used.

Who needs to file the CT-200 V form?

If you are a corporation that has e-filed your New York State tax return or extension and will not authorize a direct debit from your bank account, you are required to file the CT-200 V form. This form helps ensure that your payment is associated correctly with your tax filing.

What information do I need to provide on the CT-200 V form?

You will need to include several key pieces of information: your Employer Identification Number (EIN), the primary return type, and the tax period dates. Additionally, you should indicate the type of form you e-filed (return, extension, or Mandatory First Installment), as well as the amounts due for state tax and any MTA surcharge.

What payment methods are accepted with the CT-200 V form?

The form accepts payments made by check or money order in U.S. funds. It is important to ensure that your payment does not include any federal tax amounts owed, as those should be paid directly to the IRS. Make sure to write your payment enclosed amount in the designated space on the form.

Where should I submit the CT-200 V form and payment?

Mail your completed CT-200 V form along with your payment to the NYS Department of Taxation and Finance at the specified address:

NYS DEPT OF TAXATION & FINANCE

CORP – V

PO BOX 15163

ALBANY NY 12212-5163.

If using a private delivery service, the address is different; make sure to follow the guidelines provided in the form instructions.

What are the consequences of late payments with the CT-200 V form?

Your CT-200 V form and payment must be postmarked by the due date to avoid late payment penalties and interest. If payments are made after the deadline, penalties will accrue. It is crucial to send your payment on time to avoid extra fees.

What happens if my payment is returned?

If your check, money order, or electronic payment is returned by the bank for nonpayment, the Tax Department may charge a fee of $50. You will receive a separate bill for this fee. However, no fee will apply if the return was due to an error on the part of the bank or the department.

Where can I find additional help or information?

If you have further questions or need assistance, refer to Form CT-1, Supplement to Corporation Tax Instructions. Also, consider consulting Publication 55 for details on designated private delivery services and other related matters.

Common mistakes

Filling out the CT-200 V form accurately is crucial for avoiding delays and penalties in your tax payments. However, many individuals encounter common pitfalls when completing this payment voucher. One significant mistake people make is neglecting to provide their Employer Identification Number (EIN). This number is essential for identifying your corporation. Without it, processing your payment becomes complicated, and it may lead to unnecessary follow-up from the tax authorities.

Another frequent error involves misclassifying the type of return. Taxpayers must carefully indicate whether the payment corresponds to a RETURN, an EXTENSION, or a Mandatory First Installment (MFI). By failing to mark the appropriate box, individuals risk processing their payment under the wrong category, which could delay filing or lead to penalties.

Additionally, inaccuracies in the amount due can lead to serious ramifications. Individuals often miscalculate the NYS tax amount or forget to include the MTA surcharge if applicable. To ensure accuracy, it's vital to cross-check the figures from the e-filed return. Entering a payment amount that doesn't align with the designated totals can trigger penalties or lead to a delay in processing.

Lastly, a common but simple mistake is not submitting the entire voucher page along with the check or money order. Some people detach the check stubs or assume that only the payment itself is necessary. This oversight can create confusion and complicate the processing of payments. It's important to remember that the CT-200 V form is designed to be submitted in its entirety with your payment.

Documents used along the form

When filing a corporation tax return or an extension in New York State, the CT-200-V form is essential for making a corresponding payment. However, several other forms and documents may also be utilized alongside the CT-200-V. These documents generally help clarify your tax situation or fulfill additional obligations. Below is a list of some common forms that often accompany the CT-200-V.

- CT-3: General Business Corporation Franchise Tax Return - This is the primary return form for corporations doing business in New York. It reports income, expenses, and tax liability.

- CT-3-S: New York S Corporation Franchise Tax Return - Specifically for S corporations, this form allows them to report income and calculate their franchise tax.

- CT-5: Application for Extension of Time to File - Corporations use this form to request an extension for filing their tax return. This does not extend the time to pay any tax due.

- CT-186: New York State Partnership Return - This form is used by partnerships to report income and taxes, and can be important for partners who are also filing corporate returns.

- CT-250: New York State Corporation Tax Return for the 50% Renewable Energy Credit - Corporations that qualify for renewable energy credits must complete this form to claim their credit.

- Form 1100: New York State Tax Return for Publicly Traded Corporations - This return is specifically for publicly traded corporations and includes information related to their operations and tax obligations.

- Form CT-15: New York State Corporation Tax Credit Claimed - This document allows corporations to claim various credits against their owed tax, making it essential for tax planning.

By being aware of these forms and their purposes, you can ensure a smoother tax-filing process. This knowledge not only helps in meeting deadlines but also minimizes the risk of errors that could lead to penalties or interest.

Similar forms

- Form CT-3: This is the main Corporation Franchise Tax Return in New York. The CT-200 V form accompanies this return when a payment is due after e-filing.

- Form CT-3-S: This is the S Corporation Franchise Tax Return. Similar to the CT-200 V, it requires payment information when an S Corporation e-files and owes taxes.

- Form CT-186: This form is for New York State Corporations that elect different tax treatments. Like the CT-200 V, it involves submitting payment after an e-filed return.

- Form CT-5: This form is an Extension of Time to File for Corporations. A CT-200 V is submitted if payment is required for an extension following e-filing.

- Form CT-606: This is the New York State Unincorporated Business Tax Form. It is similar because it also establishes payment details related to e-filed returns.

- Form IT-204: This is the New York State Partnership Return form. The CT-200 V is similar in that both require payment for e-filed tax obligations.

- Form CT-275: This form is used for certain nonprofit organizations in New York. Like the CT-200 V, it can also require payment submission after e-filing.

Dos and Don'ts

When filling out the CT-200-V form, it is important to ensure accuracy and compliance to avoid any penalties or delays. Here are four things to remember, including what to do and what to avoid.

- Do include your business information accurately. Make sure to fill in the employer identification number, legal name of the corporation, mailing address, and contact number correctly.

- Do specify the primary return type clearly. Indicate the appropriate form number by omitting any slashes or dashes, as per the instructions.

- Do ensure that your payment is exactly as stated on your e-filed return. Double-check to make certain that you distinguish between any state and MTA amounts and include them accurately in the designated areas.

- Do mail the entire completed form along with your payment to the provided address, ensuring it is postmarked by the requisite due date. This is crucial to avoid late fees.

- Don't neglect to mark the type of form you are filing. Be sure to indicate whether it is for a return, extension, or mandatory first installment.

- Don't include any federal taxes owed on this form. Ensure that the payment is strictly for New York State taxes only.

- Don't use a form if you already authorized a direct debit from your bank when you e-filed your return. In such cases, the CT-200-V is not necessary.

- Don't forget to detach any check stubs and avoid stapling or clipping them to your payment, as this could complicate the processing of your application.

Misconceptions

Misconception 1: The CT-200-V form is only for late payments.

In reality, the CT-200-V form is used to make payments for e-filed New York State corporation tax returns and extensions, regardless of whether they are submitted on time or late.

Misconception 2: This form can be used for federal tax payments.

The CT-200-V form is specifically for New York State corporation tax obligations. Federal taxes must be paid directly to the Internal Revenue Service, and cannot be included on this form.

Misconception 3: Payments can be made without sending the entire form.

It is essential to submit the entire CT-200-V form along with the payment. Failure to do so may lead to delays or penalties.

Misconception 4: Only checks and money orders can be used for payments.

While checks and money orders are acceptable, it is important to ensure they are payable in U.S. funds or drawn from a U.S. bank if they are foreign. Electronic payments are also an option, provided they are not via a direct debit from a bank account.

Misconception 5: You can skip entering the primary return type.

The form requires the entry of the primary return type to process the payment correctly. Omitting this information could hinder the processing of the payment.

Misconception 6: The MTA surcharge amount may be ignored.

Taxpayers should include any applicable MTA surcharge amount alongside the New York State tax due. This ensures accurate payment and prevents potential issues with tax calculations.

Misconception 7: Any delivery method for the payment is acceptable.

While payments can be sent through private delivery services, only those designated by the U.S. Secretary of the Treasury or the Commissioner of Taxation and Finance will be recognized for timely payment. Using a non-designated service may result in delayed acknowledgment of payment.

Misconception 8: There are no consequences for incorrectly filled payment information.

Incorrect or incomplete information can lead to penalties, interest, or misapplied payments. It is imperative to double-check all entries to ensure compliance and avoid complications.

Key takeaways

Filling out and using the CT-200-V form can seem daunting, but with these key takeaways, it should be easier:

- The CT-200-V form is necessary if you've e-filed your New York State corporation tax return or an extension and want to pay by check or money order.

- Do not use this form if you set up a direct debit or ACH credit for payment when you filed electronically.

- Your Form CT-200-V and payment must be postmarked on or before the return due date. This helps you avoid late fees and interest.

- Clearly put your business information, primary return type, tax period, and the exact amounts due in the spaces provided on the form.

- Mark your payment type accurately: RETURN, EXTENSION, or Mandatory First Installment (MFI) by checking the correct box.

- Be cautious about your payment amount. It should match what you owe on your e-filed return, extension, or MFI, not including federal taxes.

- Mail your completed form and payment to the specified address to ensure it reaches the Department of Taxation and Finance without delays.

Following these steps will help ensure your payment process goes smoothly and on time.

Browse Other Templates

Virginia Vehicle Title - The form is applicable for any vehicle requiring a title transfer or lien addition.

Cms-10114 - It is recommended to review the form and instructions fully prior to submission.

Ncui 101 Form - Employers report seasonal wages subject to specific state determinations.