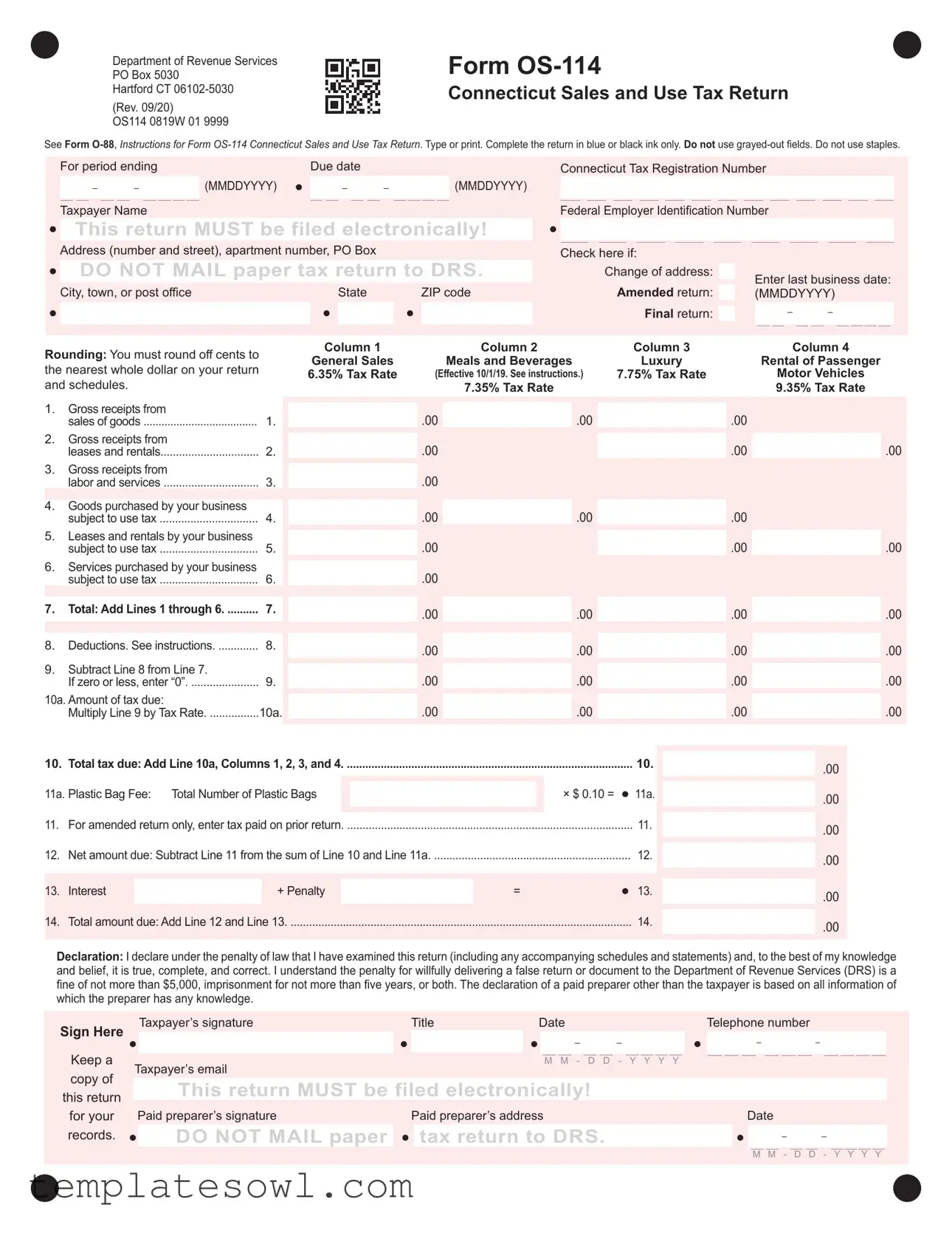

Fill Out Your Ct Os 114 Form

The Ct OS 114 form is an essential tool for businesses operating in Connecticut, serving as the state’s official Sales and Use Tax Return. Designed to simplify tax reporting, this form requires users to diligently track various categories of income, including gross receipts from sales, leases, and services. Each section is structured to capture key information accurately, ensuring that businesses report their total sales, applicable deductions, and tax due. It’s important to note that this form mandates electronic filing, meaning paper submissions are not accepted. By completing the form correctly—using black or blue ink, for example—business owners help themselves avoid penalties. Compliance with regulations, such as rounding amounts to the nearest dollar and adhering to the specific tax rates applicable to different goods and services, is crucial. Furthermore, the Ct OS 114 form allows for amendments in specific situations and serves as a declaration of accuracy. With a host of details to manage, timely filing and a thorough understanding of the form's requirements can lead to a more straightforward tax season.

Ct Os 114 Example

Department of Revenue Services PO Box 5030

Hartford CT

(Rev. 09/20)

OS114 0819W 01 9999

Form

Connecticut Sales and Use Tax Return

See Form

For period ending |

Due date |

||||||||

|

|

|

|

(MMDDYYYY) |

|

|

|

|

(MMDDYYYY) |

|

|

|

|

|

|||||

Taxpayer Name

This return MUST be filed electronically!

Address (number and street), apartment number, PO Box

DO NOT MAIL paper tax return to DRS.

City, town, or post office |

State |

ZIP code |

|

|

|

Connecticut Tax Registration Number

Federal Employer Identification Number

Check here if: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Change of address: |

|

Enter last business date: |

|||||||||||||||||||

|

|||||||||||||||||||||

Amended return: |

|

||||||||||||||||||||

|

(MMDDYYYY) |

||||||||||||||||||||

Final return: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rounding: You must round off cents to |

Column 1 |

|

Column 2 |

Column 3 |

Column 4 |

||

General Sales |

|

Meals and Beverages |

Luxury |

Rental of Passenger |

|||

the nearest whole dollar on your return |

|

||||||

6.35% Tax Rate |

(Effective 10/1/19. See instructions.) |

7.75% Tax Rate |

Motor Vehicles |

||||

and schedules. |

|

|

7.35% Tax Rate |

|

9.35% Tax Rate |

||

1. |

Gross receipts from |

1. |

.00 |

.00 |

.00 |

|

|

|

sales of goods |

|

|||||

2. |

Gross receipts from |

2. |

.00 |

|

|

.00 |

.00 |

|

|

||||||

|

leases and rentals |

|

|

||||

3. |

Gross receipts from |

3. |

.00 |

|

|

|

|

|

labor and services |

|

|

|

|

||

4. |

Goods purchased by your business |

4. |

.00 |

.00 |

.00 |

|

|

|

subject to use tax |

|

|||||

5. |

Leases and rentals by your business |

5. |

.00 |

|

|

.00 |

.00 |

|

subject to use tax |

|

|

||||

6. |

Services purchased by your business |

6. |

.00 |

|

|

|

|

|

subject to use tax |

|

|

|

|

||

7. |

Total: Add Lines 1 through 6 |

7. |

.00 |

.00 |

.00 |

.00 |

|

|

|

|

|||||

8. |

Deductions. See instructions |

8. |

.00 |

.00 |

.00 |

.00 |

|

|

|

|

|||||

9. |

Subtract Line 8 from Line 7. |

9. |

.00 |

.00 |

.00 |

.00 |

|

|

If zero or less, enter “0” |

||||||

10a. Amount of tax due: |

10a. |

.00 |

.00 |

.00 |

.00 |

||

|

Multiply Line 9 by Tax Rate |

||||||

10. |

Total tax due: Add Line 10a, Columns 1, 2, 3, and 4 |

|

|

10. |

.00 |

||

|

|

|

|

|

|

|

|

11a. |

Plastic Bag Fee: Total Number of Plastic Bags |

|

× $ 0.10 = |

11a. |

.00 |

||

|

|

|

|

|

|

|

|

11. |

For amended return only, enter tax paid on prior return |

|

|

11. |

.00 |

||

|

|

|

|

|

|

|

|

12. |

Net amount due: Subtract Line 11 from the sum of Line 10 and Line 11a |

|

12. |

.00 |

|||

|

|

|

|

|

|

|

|

13. |

Interest |

+ Penalty |

|

= |

|

13. |

.00 |

|

|

|

|

|

|

|

|

14. |

Total amount due: Add Line 12 and Line 13 |

|

|

14. |

.00 |

||

|

|

|

|

|

|

|

|

Declaration: I declare under the penalty of law that I have examined this return (including any accompanying schedules and statements) and, to the best of my knowledge and belief, it is true, complete, and correct. I understand the penalty for willfully delivering a false return or document to the Department of Revenue Services (DRS) is a fine of not more than $5,000, imprisonment for not more than five years, or both. The declaration of a paid preparer other than the taxpayer is based on all information of which the preparer has any knowledge.

Sign Here

Keep a copy of this return for your records.

Taxpayer’s signatureTitleDateTelephone number

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Taxpayer’s email |

|

|

|

|

M |

M |

D |

D |

Y |

Y |

Y |

Y |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

This return MUST be filed electronically! |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

Paid preparer’s signature |

|

Paid preparer’s address |

|

|

|

|

|

|

Date |

|||||||||||||||||||||||||||||||||||||||||||

|

DO NOT MAIL paper |

|

|

tax return to DRS. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

M M - D D - Y Y Y Y

Form

Page 2 of 4 (Rev. 09/20)

OS114 0819W 02 9999

See instructions (Form

Connecticut Tax |

_ _ _ _ _ _ _ _ _ _ _ _ _ |

Registration Number |

All quarterly and monthly filers must file Form

If applicable, provide the following information:

Enter new mailing address:

Enter new physical location (PO Box is not acceptable.):

Enter new trade name: |

First return - Enter business start date: |

|

|

|

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

New owners must obtain a new Connecticut Tax Registration Number. |

M |

|

|

M |

|

D |

D |

|

Y |

Y |

Y |

Y |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Enter new owner name: |

Date sold: |

|

|

|

- |

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

- |

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

M |

M |

D |

D |

|

|

|

Y |

Y |

|

Y |

|

Y |

|||||||||||||||||||

Address:

Deductions (See instructions, Form

15. |

Sales for resale or sales through a registered marketplace facilitator |

|

|

- sales of goods |

15. |

16. |

Sales for resale or sales through a registered marketplace facilitator |

|

|

- leases and rentals |

16. |

17. |

Sales for resale or sales through a registered marketplace facilitator |

|

|

- labor and services |

17. |

18. |

All newspapers and subscription sales of magazines and puzzle |

|

|

magazines |

18. |

19. |

Trucks with GVW rating over 26,000 lbs. or used exclusively for |

|

|

carriage of interstate freight |

19. |

21. |

Food for human consumption, food sold in vending machines, items |

|

|

purchased with food stamps |

21. |

23. |

Sale of fuel for motor vehicles |

23. |

Column 1 |

|

Column 2 |

Column 3 |

|

General Sales |

|

Meals and Beverages |

Luxury |

|

6.35% Tax Rate |

(Effective 10/1/19. See instructions.) |

7.75% Tax Rate |

||

|

|

7.35% Tax Rate |

|

|

|

.00 |

.00 |

.00 |

|

|

.00 |

|

|

.00 |

|

|

|

||

.00

.00

.00

.00.00

.00

24.Sales of electricity, gas, and heating fuel for residential dwellings

25.Sales of electricity - $150 monthly charge per business

26.Sales of electricity, gas, and heating fuel

for manufacturing or agricultural production

For Utility |

24. |

|

and Heating Fuel

Companies 25.

Only

26.

.00

.00

.00

27. |

Aviation fuel |

27. |

29. |

Tangible personal property to persons issued a Farmer Tax |

|

|

Exemption Permit |

29. |

30. |

Machinery, its replacement, repair, component and enhancement |

|

|

parts, materials, tools and fuel for manufacturing |

30. |

31. |

Machinery, materials, tools, and equipment used in commercial |

|

|

printing process or publishing |

31. |

32. |

Vessels, machinery, materials, tools, and fuel for commercial fishing |

32. |

.00

.00

.00

.00

.00

Form

Page 3 of 4 (Rev. 09/20)

OS114 0819W 03 9999

See instructions (Form

Connecticut Tax |

_ _ _ _ _ _ _ _ _ _ |

_ _ _ |

|

Registration Number |

|

||

|

|

|

|

Column 1 |

Column 2 |

Column 3 |

|

General Sales |

Meals and Beverages |

Luxury |

|

6.35% Tax Rate |

(Effective 10/1/19. See instructions.) |

7.75% Tax Rate |

|

|

7.35% Tax Rate |

|

|

33. |

33. |

|

34. |

34. |

|

35. |

35. |

|

36. |

Motor vehicles or vessels purchased by nonresidents |

36. |

37. |

Prescription medicines and diabetic equipment |

37. |

38. |

Nonprescription drugs and medicines |

38. |

39. |

Sales to charitable or religious organizations - sales of goods |

39. |

40. |

Sales to charitable or religious organizations - leases and rentals |

40. |

41. |

Sales to charitable or religious organizations - labor and services |

41. |

42. |

Sales to federal, Connecticut, or municipal agencies - sales of goods |

42. |

43.Sales to federal, Connecticut, or municipal agencies - leases and rentals 43.

44.Sales to federal, Connecticut, or municipal agencies - labor and services 44.

45.Items certified for air or water pollution abatement - sales, leases,

|

and rentals of goods |

45. |

47. |

Nontaxable labor and services |

47. |

48. |

Services between |

|

|

(See instructions, Form |

48. |

50. |

50. |

|

52. |

Taxed goods returned within 90 days at the rate listed above in |

|

|

Columns 1 or 3 |

52. |

56. |

Oxygen, blood plasma, prostheses, etc. - sales, leases, rentals, |

|

|

or repair services of goods |

56. |

63. |

Funeral expenses |

63. |

69. |

Certain aircraft and repair services, repair or replacement parts |

|

|

for aircraft |

69. |

71. |

Certain machinery under the Manufacturing Recovery Act of 1992 |

|

|

(See instructions, Form |

71. |

72. |

Machinery, equipment, tools, supplies, and fuel used in the |

|

|

biotechnology industry |

72. |

73. |

Repair and maintenance services and fabrication labor to vessels |

73. |

.00 |

.00 |

.00 |

.00 |

|

.00 |

.00 |

|

|

.00 |

|

.00 |

.00

.00

.00 |

.00 |

.00 |

.00 |

|

.00 |

.00 |

|

|

.00 |

.00 |

.00 |

.00 |

|

.00 |

.00

.00

.00

.00

.00 |

.00 |

.00 |

.00 |

.00

.00

.00

.00

.00

.00

Form

Page 4 of 4 (Rev. 09/20)

OS114 0819W 04 9999

See instructions (Form

Connecticut Tax |

_ _ _ _ _ _ _ _ _ _ |

_ _ _ |

|

Registration Number |

|

||

|

|

|

|

Column 1 |

Column 2 |

Column 3 |

|

General Sales |

Meals and Beverages |

Luxury |

|

6.35% Tax Rate |

(Effective 10/1/19. See instructions.) |

7.75% Tax Rate |

|

|

7.35% Tax Rate |

|

|

74. |

Computer and data processing services at 1% |

|

|

(See instructions, Form |

74. |

75. |

Renovation and repair services to residential real property |

75. |

77. |

Sales of qualifying items to direct payment permit holders |

77. |

78. |

Sales of college textbooks |

78. |

79. |

Sales tax holiday |

79. |

82. |

Motor vehicles sold to active duty nonresident members of the armed |

|

|

forces at 4.5% (See instructions, Form |

82. |

83. |

For cigarette dealers only: Purchases of cigarettes taxed by a |

|

|

stamper or distributor |

83. |

84.Sales of vessels, motors for vessels or trailers used for transporting vessels at 2.99%. Effective October 1, 2019, sales of dyed diesel

|

marine fuel at 2.99%. (See instructions, Form |

84. |

|

A. |

Other Adjustments - sales of goods |

A. |

|

|

(Describe: |

|

) |

B. |

Other Adjustments - leases and rentals |

B. |

|

|

(Describe: |

|

) |

.00

.00

.00 |

.00 |

.00

.00

.00 |

|

.00 |

.00 |

|

|

.00 |

|

|

.00 |

.00 |

.00 |

.00 |

|

.00 |

C. Other Adjustments - labor and services |

C. |

.00 |

|

|

|

|

|

|

|

(Describe: |

) |

|

|

|

Total Deductions: |

|

|

|

|

Enter here and in Column 1, Line 8 on the front of this return |

|

.00 |

|

|

|

|

|

|

|

Enter here and in Column 2, Line 8 on the front of this return |

|

.00 |

|

|

|

|

|

|

|

Enter here and in Column 3, Line 8 on the front of this return |

|

|

.00 |

|

|

|

|

|

|

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Title | This form is known as the Connecticut Sales and Use Tax Return, designated as Form OS-114. |

| Filing Requirement | Taxpayers are required to file this return electronically, and paper returns should not be sent to the Department of Revenue Services (DRS). |

| Due Date | The form must be filed and taxes paid by the last day of the month following the end of the tax period. |

| Tax Rates | Several tax rates apply, including 6.35% for general sales, 7.75% for meals and beverages, and 9.35% for luxury goods. |

| Gross Receipts | Taxpayers report gross receipts from sales of goods, leases, rentals, and services directly on this form. |

| Amended Returns | If you need to correct a prior submission, indicate it by checking the amended return option on the form. |

| Plastic Bag Fee | An additional fee of $0.10 per plastic bag is calculated and reported on this form. |

| Governing Laws | Form OS-114 is governed by the Connecticut General Statutes, Section 12-408 through Section 12-416 regarding sales and use taxes. |

| Record Keeping | Taxpayers must keep a copy of the filed return for their records after submission. |

Guidelines on Utilizing Ct Os 114

After completing the Ct Os 114 form, you will need to file it electronically. It is crucial to ensure that all sections are filled accurately to avoid any potential issues. Make sure to keep a copy of the completed form for your records.

- Obtain the Ct Os 114 form from the official source or your tax preparation software.

- Type or print your information in blue or black ink. Avoid using grayed-out fields.

- Enter the period ending date and the due date in MMDDYYYY format.

- Provide your Taxpayer Name, and fill in your address, including apartment number or PO Box.

- Complete the City, Town, or Post Office, state, and ZIP code.

- Fill in your Connecticut Tax Registration Number and Federal Employer Identification Number.

- If applicable, check the boxes for Change of Address, Amended Return, Final Return, indicate the last business date in MMDDYYYY format.

- Input the sales data in the appropriate columns for General Sales, Meals and Beverages, and Luxury using the specified tax rates.

- Complete part four regarding Goods Purchased and any Leases and Rentals subject to use tax.

- Add totals from Lines 1 through 6 to calculate the Total.

- List any Deductions in the provided fields. Refer to instructions for details on allowable deductions.

- Subtract total deductions from total receipts to find the taxable amount.

- Calculate the Amount of Tax Due by multiplying the taxable amount by the appropriate tax rate.

- Complete the Plastic Bag Fee calculation if applicable.

- Determine the Net Amount Due by subtracting any tax paid on prior returns and any penalties or interest.

- Sign and date the form where indicated. Include contact details such as telephone number and email, if required.

- Ensure the form is filed electronically. Do not attempt to mail the physical copy to the Department of Revenue Services.

What You Should Know About This Form

What is the Ct OS-114 form?

The Ct OS-114 form is the Connecticut Sales and Use Tax Return. It is used by businesses to report and pay sales and use taxes to the Department of Revenue Services (DRS) in Connecticut. The form must be completed accurately to ensure compliance with state tax laws.

Who is required to file Form OS-114?

All businesses that collect sales tax or are subject to use tax in Connecticut must file Form OS-114. This includes retailers, service providers, and businesses involved in leasing or renting tangible goods. Failure to file may result in penalties and interest on unpaid taxes.

How often must the OS-114 be filed?

Businesses must file Form OS-114 either monthly or quarterly, depending on their sales volume. The form and any associated tax payments are due by the last day of the month following the end of the reporting period. Always check if your filing frequency has changed based on your taxable sales.

What are the penalties for filing late or not at all?

Late filing of Form OS-114 may lead to penalties and interest. The state assesses fines for both late submissions and any unpaid taxes. Penalties can accumulate over time, so timely filing is essential to avoid escalating amounts owed.

Can I file the OS-114 form on paper?

No, businesses must file Form OS-114 electronically. The DRS has mandated electronic filing to streamline the process and improve efficiency. Paper returns are not accepted, and submitting electronically ensures faster processing.

What information is required when completing the OS-114?

When filling out the OS-114, businesses must provide the Connecticut Tax Registration Number, Federal Employer Identification Number, gross receipts from sales, deductions, and tax amounts due. Accurate record keeping will assist in filling out this information correctly.

What should I do if I need to amend my OS-114 form?

If you discover an error after submitting your OS-114, you can file an amended return. Indicate that your return is amended on the form and provide the corrected information. Remember to do so promptly to reduce potential penalties.

Is there a plastic bag fee included in the OS-114?

Yes, if applicable, businesses must calculate a plastic bag fee and report it on the OS-114 form. This fee is calculated by multiplying the total number of plastic bags provided by the fee rate. It must be included in the overall tax calculation.

How can I ensure my OS-114 is processed correctly?

To ensure correct processing of your OS-114, complete the form accurately and review it for errors before submission. Use blue or black ink if submitting any paper documentation (not applicable for the OS-114, which must be filed electronically). Additionally, follow all instructions provided in Form O-88, which accompanies the OS-114.

Common mistakes

Filling out the Connecticut Sales and Use Tax Return, known as Form OS-114, can be a daunting task. Many taxpayers make common mistakes that can lead to delays or penalties. Awareness of these common pitfalls is essential for ensuring a smooth filing process.

One frequent mistake is neglecting to file the form electronically. The instructions clearly state that this return must be filed electronically. Some individuals may attempt to submit a paper return, thinking it will be acceptable. This can result in significant fines and issues with the Department of Revenue Services.

Another common error involves the completion of grayed-out fields. Taxpayers often find it tempting to enter information in these sections, but it is crucial to adhere strictly to the guidelines. Grayed-out fields are not intended for entry; entering data here will lead to complications and may require amending the return.

Additionally, rounding mistakes occur frequently. Taxpayers might forget to round figures to the nearest whole dollar, as instructed. This small oversight can lead to discrepancies that may not be immediately evident but could have larger implications down the line.

Inaccurate information regarding deductions also creates numerous complications. Deductions must be well-supported and in compliance with the provided guidelines. Misinterpretation or inattention to detail can result in excess taxes being claimed, which could prompt investigations or audits.

Failing to double-check the taxpayer’s name and identification numbers is yet another error that can lead to significant burdens. Even a minor typo can create a cascade of paperwork and may necessitate corrections that delay the processing of the return.

Lastly, taxpayers commonly overlook the requirement for signatures. A return without a signature cannot be processed and may be returned, forcing the individual to start over. This oversight can often be attributed to rushing through the form rather than carefully reviewing it.

Careful attention to the details in the OS-114 form not only fosters compliance but also contributes to a smoother experience for taxpayers. Avoiding these pitfalls is crucial for ensuring the process is as efficient and straightforward as possible.

Documents used along the form

The CT OS-114 form is an essential document for businesses in Connecticut to report sales and use tax. Often, other forms and documents accompany it, providing additional information or serving related purposes. Below is a list of nine important forms that frequently complement the CT OS-114, along with a brief description of each.

- Form O-88: This form provides detailed instructions for completing the OS-114. It outlines necessary information, filing procedures, and any calculations required for accurate tax reporting.

- Form OS-115: This is used to report and pay the sales tax that businesses have collected during the month. It is crucial for companies that operate on a monthly filing schedule.

- Form OS-114-EXT: This extension request form allows businesses to apply for more time to file their sales and use tax return. It's important for those needing additional time beyond the original due date.

- Form CT-941: This form is the Employer’s Quarterly Reconciliation of Withholding, which businesses use to report income tax withheld from employee wages. It's integral for tax compliance in employment scenarios.

- Form W-2: Often required for reporting the annual wages paid to employees, this form documents income, tips, and other compensation, along with the amount of taxes withheld. It is essential for year-end tax reporting.

- Form 1099-MISC: This form is utilized to report payments made to non-employees, such as independent contractors. It ensures that all recipients report their income accurately for tax purposes.

- Form CT-810: This is a Business Entity Tax Return form which applies to certain business entities, allowing them to report and pay their annual tax obligations in Connecticut.

- Documentation of Sales: Businesses must maintain supporting documentation for all sales, including invoices and receipts. These records are critical if the Connecticut Department of Revenue Services requests verification of tax reports.

- Business Registration Certificate: This document certifies that a business is registered and allowed to operate in Connecticut. It may be required when filing various tax forms to verify the business’s legitimacy.

Understanding these forms and documents is crucial for a business's tax compliance in Connecticut. Each plays a significant role in ensuring all sales and use tax obligations are met accurately and timely.

Similar forms

- Form CT-1065: This is the pass-through entity tax return for business entities like partnerships and LLCs. Similar to Form OS-114, it requires accurate reporting of receipts, deductions, and tax amounts due.

- Form CT-1120: This is the corporate income tax return for C corporations in Connecticut. Like OS-114, this form entails reporting income, deductions, and calculating tax liability, ensuring compliance with state tax regulations.

- Form CT-1040: This is the personal income tax return. It parallels OS-114 in that both forms demand clear calculations and honest disclosures related to income and tax savings for each reporting period.

- Form OS-114-E: This is an electronic version of the sales and use tax return. It functions like OS-114 but is optimized for online filing, promoting efficiency and reducing paper usage.

- Form W-2: This form is used for reporting wages and taxes withheld by employers. Although it serves a different purpose than OS-114, both documents emphasize accuracy and transparency in financial reporting.

- Form 1099: This is issued to report various income types besides wages, such as rents or dividends. Similar to OS-114, it necessitates precise reporting to ensure that all income is accurately accounted for in tax filings.

- Form I-9: This is used for verifying employee eligibility to work in the U.S. While OS-114 centers on sales tax, both require thorough attention to detail and accurate completion to avoid penalties.

Dos and Don'ts

- Do fill out the form using blue or black ink only.

- Do file the return electronically to comply with regulations.

- Do keep a copy of the completed form for your records.

- Do round off cents to the nearest whole dollar on the return.

- Don't mail a paper tax return to the Department of Revenue Services (DRS).

- Don't use any grayed-out fields while completing the form.

- Don't staple the form or any attached documents together.

Misconceptions

- Myth: Paper submissions are accepted. The OS-114 form is required to be filed electronically. Attempting to mail a paper return will lead to penalties or delays. Always file online to ensure compliance.

- Myth: All tax filers can use the same tax rate. Different tax rates apply based on the type of sales or services. For instance, sales of general goods are taxed at 6.35% while meals and beverages have a higher rate. It's essential to consult the instructions to determine the correct rate for your business.

- Myth: You don’t need to keep a copy of your submission. It's crucial to retain a copy of your filed return for your records. This helps in case of audits or discrepancies and serves as proof that you fulfilled your filing obligations.

- Myth: The form can be submitted anytime during the month following the reporting period. The OS-114 must be filed and paid by the last day of the month following the end of the reporting period. Missing this deadline may result in penalties or interest charges.

- Myth: All businesses are exempt from sales tax filing. This is not true. Most businesses must file the OS-114, even if they have no tax to report. Understanding your obligations ensures you remain compliant with tax regulations.

Key takeaways

1. Electronic Filing Requirement: The Ct OS 114 form must be filed electronically. Paper returns will not be accepted by the Department of Revenue Services (DRS).

2. Due Dates: The form must be filed and the associated taxes paid by the last day of the month following the end of the reporting period. This deadline is crucial to avoid penalties.

3. Use of Ink: Always complete the form using blue or black ink. Grayed-out fields should not be filled in, and staples must not be used.

4. Rounding Off: Any amounts entered on the form must be rounded to the nearest whole dollar. This includes gross receipts, tax amounts, and fees.

5. Updating Information: If there are any changes to your business, such as a new address or ownership, this information must be updated on the form. New owners need to obtain a new Connecticut Tax Registration Number.

6. Keep a Copy: A copy of the completed Ct OS 114 form should be kept for your records. This may be beneficial for future reference or in case of audits.

Browse Other Templates

Employment Application,Job Opportunity Request,Workplace Application Form,Candidate Information Sheet,Staff Recruitment Form,Position Application Document,Employment Inquiry Form,Job Candidate Profile,Application for Job Consideration,Hobbytown Caree - Explain the reason for leaving your last job succinctly.

Illinois State Llc Filing Fee - An incomplete application could lead to delays or rejection from the Secretary of State.