Fill Out Your Ct Resale Certificate Form

The Connecticut Resale Certificate form is a critical document for businesses involved in wholesale and retail transactions. It allows registered buyers to purchase goods without paying sales tax, provided the items are intended for resale or use in production. The certificate details essential information such as the buyer's name, address, and state registration, ensuring clarity and compliance with tax regulations. Sellers gain security, knowing they are making sales to legitimate businesses, while buyers benefit by avoiding upfront tax costs on inventory intended for resale. Included in the form is a declaration that the buyer must sign, confirming their engagement in activities such as wholesaling, retailing, or manufacturing, and outlining the nature of the products they intend to purchase. This document not only streamlines the buying process but also serves as a safeguard against tax liability. The Resale Certificate remains valid until canceled or revoked, making it a lasting part of the seller-buyer relationship as long as compliance is maintained. Understanding how to properly complete and utilize this form is essential for businesses looking to navigate sales tax regulations efficiently and avoid unintended tax consequences.

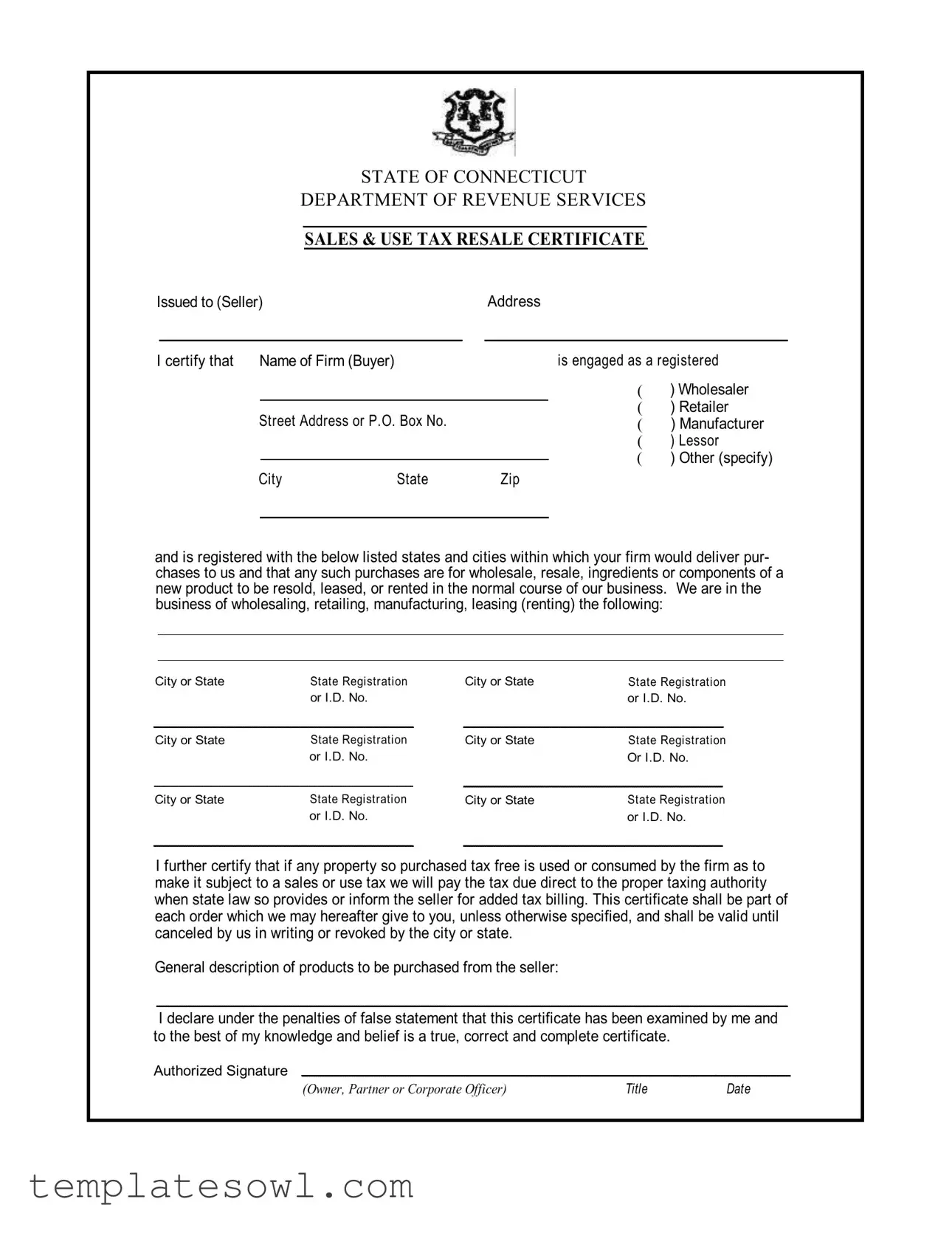

Ct Resale Certificate Example

STATE OF CONNECTICUT

DEPARTMENT OF REVENUE SERVICES

SALES & USE TAX RESALE CERTIFICATE

Issued to (Seller) |

|

|

Address |

|

||||

|

|

|

|

|

|

|

|

|

I certify that |

Name of Firm (Buyer) |

|

|

|

is engaged as a registered |

|||

|

|

|

|

|

|

|

( |

) Wholesaler |

|

|

Street Address or P.O. Box No. |

( |

) Retailer |

||||

|

|

( |

) Manufacturer |

|||||

|

|

|

|

|

|

( |

) Lessor |

|

|

|

|

|

|

|

|

( |

) Other (specify) |

|

|

|

|

State |

|

|||

|

|

City |

Zip |

|

||||

|

|

|

|

|

|

|

|

|

and is registered with the below listed states and cities within which your firm would deliver pur- chases to us and that any such purchases are for wholesale, resale, ingredients or components of a new product to be resold, leased, or rented in the normal course of our business. We are in the business of wholesaling, retailing, manufacturing, leasing (renting) the following:

City or State |

State Registration |

|

or I.D. No. |

City or State |

State Registration |

|

or I.D. No. |

City or State |

State Registration |

|

or I.D. No. |

City or State |

State Registration |

|

or I.D. No. |

City or State |

State Registration |

|

Or I.D. No. |

City or State |

State Registration |

|

or I.D. No. |

I further certify that if any property so purchased tax free is used or consumed by the firm as to make it subject to a sales or use tax we will pay the tax due direct to the proper taxing authority when state law so provides or inform the seller for added tax billing. This certificate shall be part of each order which we may hereafter give to you, unless otherwise specified, and shall be valid until canceled by us in writing or revoked by the city or state.

General description of products to be purchased from the seller:

I declare under the penalties of false statement that this certificate has been examined by me and to the best of my knowledge and belief is a true, correct and complete certificate.

Authorized Signature

(Owner, Partner or Corporate Officer) |

TITLE |

DATE |

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Connecticut Resale Certificate is used by buyers to purchase goods tax-free, intended for resale or use in business. |

| Eligibility | Only registered wholesalers, retailers, manufacturers, lessors, or other specified businesses can utilize the certificate. |

| Validity | Once issued, this certificate remains valid until it is canceled by the buyer in writing or revoked by the appropriate authority. |

| Compliance Requirement | If the purchased items are used in a manner that incurs sales tax, the buyer is obligated to pay the tax directly to the taxing authority. |

| Governing Law | The Resale Certificate operates under the Sales and Use Tax statutes outlined in Connecticut state law. |

| Signature Requirement | The certificate must be signed by an authorized individual, such as an owner, partner, or corporate officer, to validate the transaction. |

Guidelines on Utilizing Ct Resale Certificate

Once the Ct Resale Certificate form is completed, it is important to ensure that all information is accurate and thoroughly checked. This certificate establishes a record of purchases that are exempt from sales tax. Follow each step carefully to avoid any mistakes that could lead to complications in tax filings.

- Start by filling in the Seller's information. Include the seller's name and address.

- In the section for the Buyer, indicate the Name of Firm. This is your business name.

- Provide your business's Street Address or P.O. Box number, City, State, and Zip code.

- Select the appropriate status for your business by checking one of the boxes: Wholesaler, Retailer, Manufacturer, Lessor, or Other (specify).

- List the cities or states where your business operates. Include the State and corresponding State Registration or I.D. Number for each location.

- In the next section, describe the general types of products you intend to purchase from the seller.

- Sign the form with the Authorized Signature, which should be the Owner, Partner, or Corporate Officer of the business.

- Fill in the Title of the person signing the form and the Date of signing.

Ensure that all details are correct and legible before submitting the form to the intended seller. This will prevent any unnecessary delays in processing your orders and tax exemptions.

What You Should Know About This Form

What is a Connecticut Resale Certificate?

A Connecticut Resale Certificate is a document that allows businesses to purchase goods or services without paying sales tax at the time of the transaction. The form is intended for businesses that will resell or lease the purchased items in the ordinary course of their operations. By presenting this certificate to the seller, the buyer certifies that the items being acquired are for resale and not for personal use.

Who can use the Connecticut Resale Certificate?

This certificate can be utilized by wholesalers, retailers, manufacturers, lessors, and other types of businesses engaged in selling goods. To qualify, your business must be legally registered with the appropriate state and city authorities. This registration validates your claim that the purchases made under this certificate are intended for resale, rental, or lease.

How do I fill out the Connecticut Resale Certificate?

To complete the certificate, begin by entering the seller's name and address at the top of the form. Next, provide your firm's name and address. Check the box that corresponds to your type of business—whether you are a wholesaler, retailer, manufacturer, lessor, or another specified category. Then, list the states and cities where your business is registered, along with the relevant identification numbers. In the final section, describe the types of products you plan to purchase from the seller.

Do I need to provide a CT Resale Certificate for every purchase?

Generally, the Connecticut Resale Certificate should accompany each order you place with a seller, unless you specify otherwise. The certificate remains valid until you cancel it in writing or if it is revoked by the state or city authorities. This ongoing validity simplifies the purchasing process for businesses that frequently buy from the same supplier.

What happens if I use the purchased items for personal use instead of resale?

If you utilize items acquired with a resale certificate for personal use, your business becomes liable for the sales or use tax applicable to those items. The law requires that you pay this tax directly to the proper taxing authority. You should also inform the seller of the situation so that they can issue an additional tax bill if necessary.

Is it possible to cancel a Resale Certificate?

Yes, a Connecticut Resale Certificate can be canceled at any time by providing written notice to the seller. This cancellation ensures that you are no longer able to purchase tax-free items under that certificate. If your business status changes or if you cease operations, it is advisable to formally cancel the certificate.

Can I use a Resale Certificate issued in another state?

While Connecticut recognizes resale certificates from other states, it is crucial to be aware of any specific requirements that may differ. Sellers may require that you obtain a Connecticut-specific Resale Certificate when making purchases within the state, especially if the items are being delivered there. Therefore, it is wise to discuss this with your seller before proceeding.

What are the penalties for submitting a false Resale Certificate?

Submitting a false certificate can lead to serious implications, including penalties for tax evasion. If a tax authority discovers that the certificate was used to avoid tax liability fraudulently, your business may face fines or additional taxes owed. Therefore, it is essential to ensure that the information provided in the resale certificate is accurate and truthful.

Where can I obtain a Connecticut Resale Certificate?

The Connecticut Resale Certificate form is accessible through the Connecticut Department of Revenue Services (DRS) website. Alternatively, you can contact your tax advisor or accountant to obtain a copy or assistance filling it out correctly. Familiarizing yourself with the document will aid in a smoother purchasing experience.

Common mistakes

Filling out the Connecticut Resale Certificate form can be straightforward, but mistakes may lead to issues with tax compliance. One common mistake occurs when individuals forget to include the full details of the seller. Providing the seller's name and address is essential for the form to be valid. Omitting this information can result in the seller being unable to substantiate the tax-exempt status of the transaction.

Another frequent error is related to the classification of the buyer's business. Buyers often fail to accurately select their business type from the options provided, such as wholesaler, retailer, manufacturer, or other. Selecting the wrong classification can lead to complications in the auditing process and potential penalties, as it creates ambiguity regarding the purpose of the purchase.

Completing the registration details is also critical. People sometimes neglect to enter their state registration or ID numbers, which are necessary for the resale certificate's legitimacy. Leaving these sections blank compromises the integrity of the document and can lead to tax authorities questioning the validity of tax-exempt purchases.

Additionally, individuals might overlook the description of the products being purchased. A vague or incomplete description can raise red flags during inspections or audits. It's important to provide a clear and specific general description of the products to prevent misunderstandings about the intended use of the purchases.

Lastly, not providing a valid signature is a common yet serious oversight. The authorized signature of an owner, partner, or corporate officer is required. Without this signature, the form is incomplete and cannot serve its purpose of certifying tax-exempt status. Ensuring each section is accurately completed and thoroughly checked will help mitigate these common mistakes.

Documents used along the form

The Connecticut Resale Certificate form serves as a crucial document for businesses engaged in the resale of goods. When utilizing this form, several additional documents often accompany it to ensure compliance with tax regulations and to clarify the terms of business transactions. Below are some of these commonly used documents.

- Vendor Agreement: This document outlines the terms and conditions agreed upon between the buyer and the seller, including details about delivery, pricing, and the quality of goods. It formalizes the relationship and protects both parties in the transaction.

- Sales Tax Exemption Certificate: Used primarily by nonprofit organizations or government entities, this certificate proves that the organization is exempt from paying sales tax on purchases. It is important when purchasing goods that will not be resold.

- Bill of Sale: A bill of sale provides official documentation of a transaction between a buyer and a seller. It details the items sold, the sale price, and the date of the transaction, serving as a receipt for the buyer.

- Purchase Order: A purchase order is a document issued by the buyer to the seller specifying types, quantities, and agreed prices for products or services. It helps manage purchases and serves as a record of the order.

- Delivery Receipt: This document confirms that the buyer has received the goods ordered. It typically includes details about the items, the date of delivery, and may require a signature from the receiving party to validate the transaction.

Understanding these documents can simplify the process of managing business transactions and ensure all parties meet their legal obligations. Being knowledgeable about these forms will ultimately lead to smoother operations and foster better business relationships.

Similar forms

The Connecticut Resale Certificate is a crucial document for businesses engaged in transactions where sales tax is a consideration. Several other documents serve similar purposes in different contexts, ensuring that tax obligations are properly managed. Here are eight documents that share similarities with the Connecticut Resale Certificate:

- Sales Tax Exemption Certificate: This document allows eligible purchasers to buy goods without paying sales tax. It differs slightly from the resale certificate in that it may apply to charitable organizations, government entities, or certain nonprofits.

- Wholesale License: This license permits a business to buy products at wholesale prices. Unlike a resale certificate, which asserts intention for resale, a wholesale license is a regulatory requirement for conducting wholesale transactions.

- Direct Pay Permit: This permit allows businesses to make purchases without paying sales tax upfront, later remitting the tax directly to the state. Similar to the resale certificate, it serves to streamline the purchasing process for tax-exempt transactions.

- Sales Tax Resale Certificate (various states): Similar to the Connecticut form, these certificates exist in many states, allowing businesses to purchase items tax-free for resale. Each state's version may vary slightly in format and rules.

- Customs Bond: Companies importing goods into the U.S. may need a customs bond, guaranteeing that duties and taxes will be paid. Like the resale certificate, it is a tool for tax management concerning business transactions.

- Uniform Sales and Use Tax Certificate – Multijurisdictional: This certificate facilitates sales tax exemption in multiple jurisdictions. It allows businesses engaged in cross-state sales to declare their resale intentions without needing a specific certificate for each state.

- Certificate of Exemption for Agricultural Sales: This certificate applies to agricultural producers purchasing supplies tax-free for farming. It mirrors the resale certificate in its aim to exempt specific transactions from sales tax.

- Certificate of Compliance: Often required in contract work, this certificate demonstrates adherence to tax obligations. It serves to verify that contractors are compliant, paralleling the way a resale certificate affirms a business's taxable status.

Understanding these documents can simplify transactions and ensure compliance with tax laws, allowing businesses to operate more efficiently within their respective industries.

Dos and Don'ts

When filling out the Connecticut Resale Certificate form, attention to detail is essential. Here’s a helpful list of things to do and avoid to ensure the form is completed correctly.

- Do clearly write the name of the buyer's firm at the top of the form.

- Do provide accurate addresses, including street, city, and zip codes.

- Do check the correct classification of the buyer’s business, such as wholesaler, retailer, or manufacturer.

- Do include all relevant state registration or identification numbers for jurisdictions where you operate.

- Don't leave any section blank. Each field should be filled out as completely as possible.

- Don't provide incorrect or outdated business information. Use current data to avoid complications.

- Don't sign the certificate if you are unsure about the accuracy of the information provided.

- Don't forget to date the certificate, as this will confirm when the certification was completed.

Following these guidelines can help streamline the process and ensure compliance with tax regulations. Always keep a copy of the completed form for your records.

Misconceptions

Understanding the Connecticut Resale Certificate can be challenging, and various misconceptions can lead to confusion for both buyers and sellers. Here are nine common misconceptions along with clarifications:

- Misconception 1: The Resale Certificate exempts all purchases from sales tax.

- Misconception 2: Only wholesalers can use the Resale Certificate.

- Misconception 3: The Resale Certificate is a one-time use form.

- Misconception 4: You don't need to mention the type of purchases on the form.

- Misconception 5: The form is only valid in Connecticut.

- Misconception 6: Filling out the form incorrectly is not a big deal.

- Misconception 7: You can use the form if you don't have a tax registration number.

- Misconception 8: The seller has to keep the Resale Certificate for their records.

- Misconception 9: Once the certificate is issued, the buyer cannot change the information.

This is incorrect. The Resale Certificate only applies to purchases meant for resale or use in production. If items are used or consumed personally, sales tax must be paid.

This is a misunderstanding. Retailers, manufacturers, and lessors can also use the form, provided the purchases are for items they intend to sell or rent.

In fact, the certificate can be used multiple times. It stays valid until the buyer cancels it in writing or it is revoked by the state.

Actually, the form requires a description of the products being purchased. This clarifies the purpose and ensures proper use of the certificate.

While the certificate is primarily for Connecticut, it can be applicable in other states that recognize it, depending on local laws.

This can lead to significant issues. False statements or incomplete information can result in penalties or tax assessments for both parties.

This is not true. A valid tax registration number is required to use the Resale Certificate legally.

While it is good practice for sellers to retain it, they are not legally required to keep the certificate. It is primarily the buyer's responsibility.

This is a misconception. Buyers can update or modify the certificate information at any time, but they must ensure accuracy when doing so.

Clearing up these misconceptions helps ensure compliance and a smooth transaction process. Always keep accurate records and consult with a tax professional if unsure about the certificate's usage.

Key takeaways

Filling out and utilizing the Connecticut Resale Certificate form is essential for businesses engaged in wholesale, retail, or manufacturing. Here are some key takeaways:

- The certificate is issued to the seller, indicating the buyer's status.

- Buyers must identify their business type, such as wholesaler, retailer, or manufacturer.

- Clearly list the business's address and registration or I.D. numbers for each relevant state or city.

- The purchases made under this certificate should be for resale, leasing, or incorporation into new products.

- If any property is used in a way that incurs tax, the buyer is responsible for paying that tax directly to the taxing authority.

- The certificate remains valid until canceled in writing or revoked by a state or local authority.

- Including a general description of the products to be purchased aids in clarity and compliance.

- The buyer must sign and provide their title along with the date on the certificate.

- This form is crucial for avoiding unnecessary sales taxes on eligible purchases.

- False statements made on the certificate can lead to penalties; accuracy is vital.

Browse Other Templates

Va Fiduciary Form - The fiduciary's duties include safeguarding the beneficiary's financial assets and reporting them accurately.

Metro Pcs Rebate - Check the terms carefully to ensure your purchase meets all requirements.

Ohio Bmv Forms - False statements may lead to significant legal consequences, including fines and imprisonment.