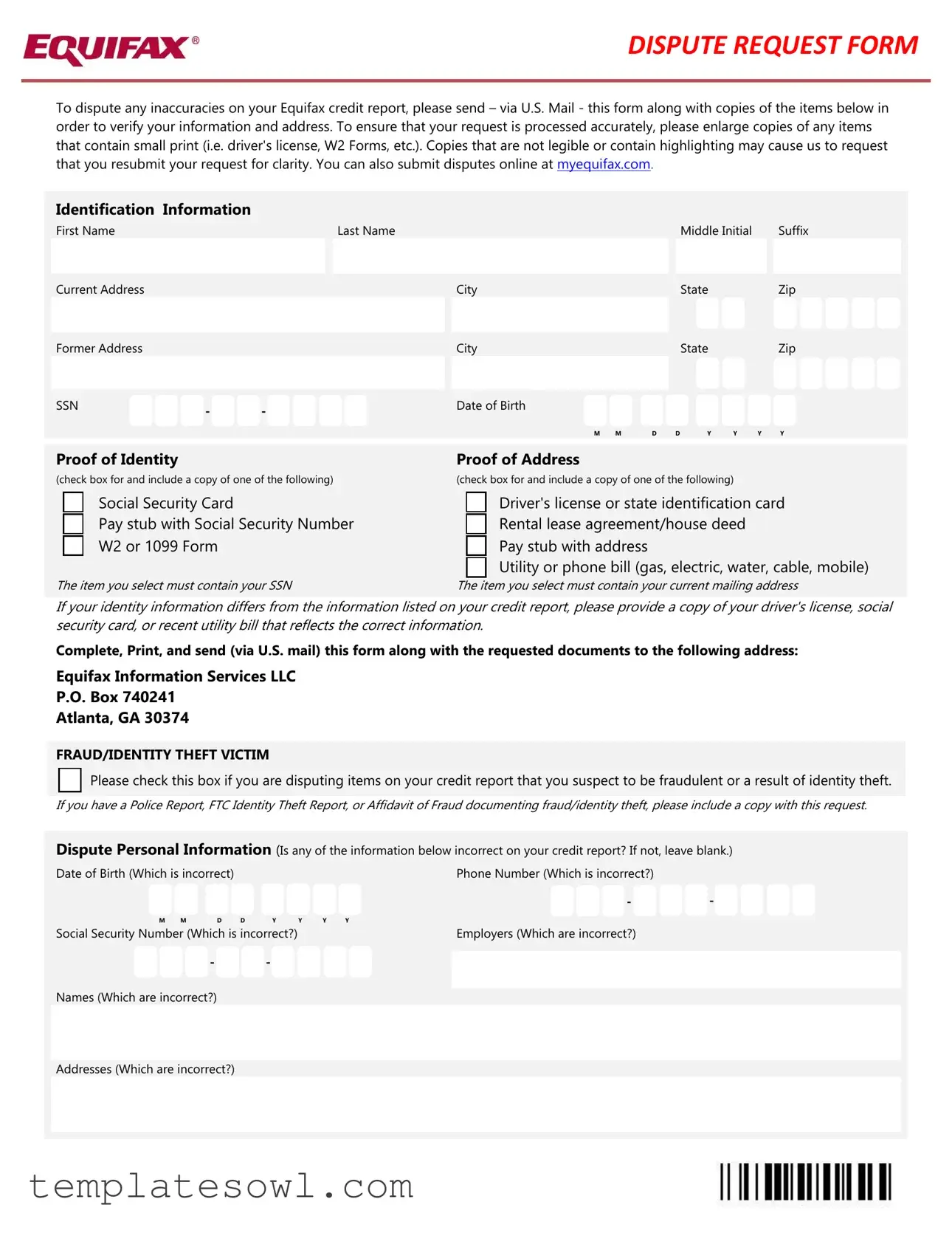

Fill Out Your Equifax Dispute Request Form

When addressing inaccuracies on your Equifax credit report, the Equifax Dispute Request form plays a crucial role in clarifying your credit history. This form requires you to provide personal information, such as your current and former addresses, Social Security number, and date of birth, to help Equifax verify your identity. Additionally, proof of identity and proof of address are vital components. You must include copies of specific documents like your driver's license, Social Security card, or utility bills, which should be clear and legible. This is necessary to avoid potential delays in processing your dispute. If you suspect that fraudulent activities may have occurred, you can indicate that by checking a box on the form. Detailed information on any discrepancies in your personal or credit account details also needs to be provided. You can point out errors in items such as account status, payment records, or even accounts that are unfamiliar to you. For optimal processing, it is recommended to send the completed form and supporting documents via U.S. Mail to Equifax at their designated address. Alternatively, you can dispute inaccuracies online at their website, making the process accessible and streamlined.

Equifax Dispute Request Example

DISPUTE REQUEST FORM

To dispute any inaccuracies on your Equifax credit report, please send – via U.S. Mail - this form along with copies of the items below in order to verify your information and address. To ensure that your request is processed accurately, please enlarge copies of any items that contain small print (i.e. driver's license, W2 Forms, etc.). Copies that are not legible or contain highlighting may cause us to request that you resubmit your request for clarity. You can also submit disputes online at myequifax.com.

Identification |

Information |

|

|

|

|

|

|

|

|

|

First Name |

|

|

Last Name |

|

|

|

Middle Initial |

|

Suffix |

|

Current Address |

|

|

City |

|

|

|

State |

|

|

Zip |

Former Address |

|

|

City |

|

|

|

State |

|

|

Zip |

SSN |

- |

- |

Date of Birth |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

M |

M |

D |

D |

Y |

Y |

Y |

Y |

|

|

Proof of Identity |

|

|

|

Proof of Address |

|

|

|

|

(check box for and include a copy of one of the following) |

|

|

|

(check box for and include a copy of one of the following) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security Card |

|

|

|

Driver's license or state identification card |

|

|

|

|

Pay stub with Social Security Number |

|

|

|

Rental lease agreement/house deed |

|

|

|

|

W2 or 1099 Form |

|

|

|

Pay stub with address |

|

|

|

|

|

|

|

|

Utility or phone bill (gas, electric, water, cable, mobile) |

|

|

|

|

The item you select must contain your SSN |

|

|

|

The item you select must contain your current mailing address |

|

|

If your identity information differs from the information listed on your credit report, please provide a copy of your driver's license, social security card, or recent utility bill that reflects the correct information.

Complete, Print, and send (via U.S. mail) this form along with the requested documents to the following address:

Equifax Information Services LLC

P.O. Box 740241

Atlanta, GA 30374

FRAUD/IDENTITY THEFT VICTIM

Please check this box if you are disputing items on your credit report that you suspect to be fraudulent or a result of identity theft.

Please check this box if you are disputing items on your credit report that you suspect to be fraudulent or a result of identity theft.

If you have a Police Report, FTC Identity Theft Report, or Affidavit of Fraud documenting fraud/identity theft, please include a copy with this request.

Dispute Personal Information (Is any of the information below incorrect on your credit report? If not, leave blank.)

|

|

Date of Birth (Which is incorrect) |

|

|

|

|

|

|

Phone Number (Which is incorrect?) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

- |

|

|

|

|

|

M M |

D D |

Y |

Y |

Y Y |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|||||

|

|

Social Security Number (Which is incorrect?) |

|

|

|

|

|

Employers (Which are incorrect?) |

|

|

|

||

|

|

|

- |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Names (Which are incorrect?)

Addresses (Which are incorrect?)

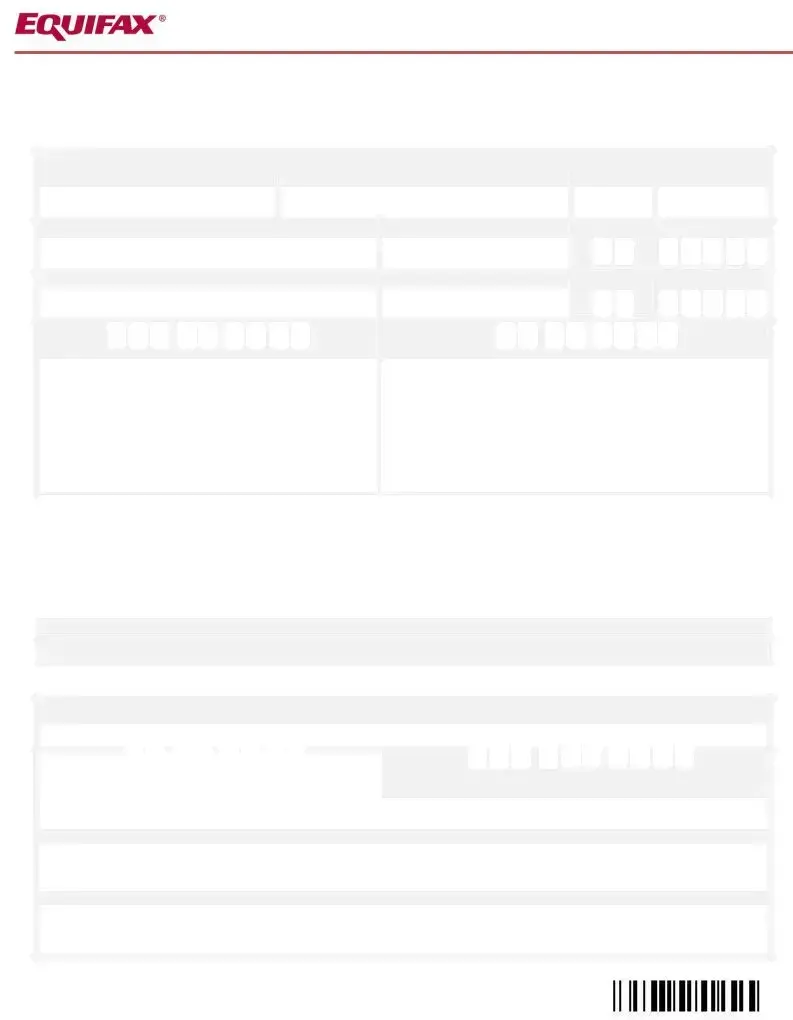

DISPUTE REQUEST FORM

Credit Account Information

Enter the information for accounts or inquiries on your credit report with any inaccuracies. Include correct information (e.g. Balance, payment date) and attach supporting documentation (e.g. account statement, payment confirmation) if applicable. Any documentation provided will be shared with the companies with which the dispute is being made as part of the dispute process.

|

|

|

Company Name |

|

|

|

Account Number/Inquiry Date |

|

|

|

DISPUTE 1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reason for Dispute(select the most appropriate option): |

|

|

|

|

|

|||

|

Account Not Mine |

Account Closed |

Current/Previous Payment Status Incorrect |

Fraud |

|

||||

|

Account Paid in Full |

Inquiry Removal |

Last payment date/Closed Date Incorrect |

|

|

||||

|

Mixed with Another Person |

Not Liable |

Date of Last Activity Incorrect |

|

|

||||

Other (please explain)

Dispute Details

|

|

|

Company Name |

|

|

|

Account Number/Inquiry Date |

|

|

|

DISPUTE 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reason for Dispute(select the most appropriate option): |

|

|

|

|

|

|||

|

Account Not Mine |

Account Closed |

Current/Previous Payment Status Incorrect |

Fraud |

|

||||

|

Account Paid in Full |

Inquiry Removal |

Last payment date/Closed Date Incorrect |

|

|

||||

|

Mixed with Another Person |

Not Liable |

Date of Last Activity Incorrect |

|

|

||||

Other (please explain)

Dispute Details

|

|

|

Company Name |

|

|

|

Account Number/Inquiry Date |

|

|

|

DISPUTE 3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reason for Dispute(select the most appropriate option): |

|

|

|

|

|

|||

|

Account Not Mine |

Account Closed |

Current/Previous Payment Status Incorrect |

Fraud |

|

||||

|

Account Paid in Full |

Inquiry Removal |

Last payment date/Closed Date Incorrect |

|

|

||||

|

Mixed with Another Person |

Not Liable |

Date of Last Activity Incorrect |

|

|

||||

Other (please explain)

Dispute Details

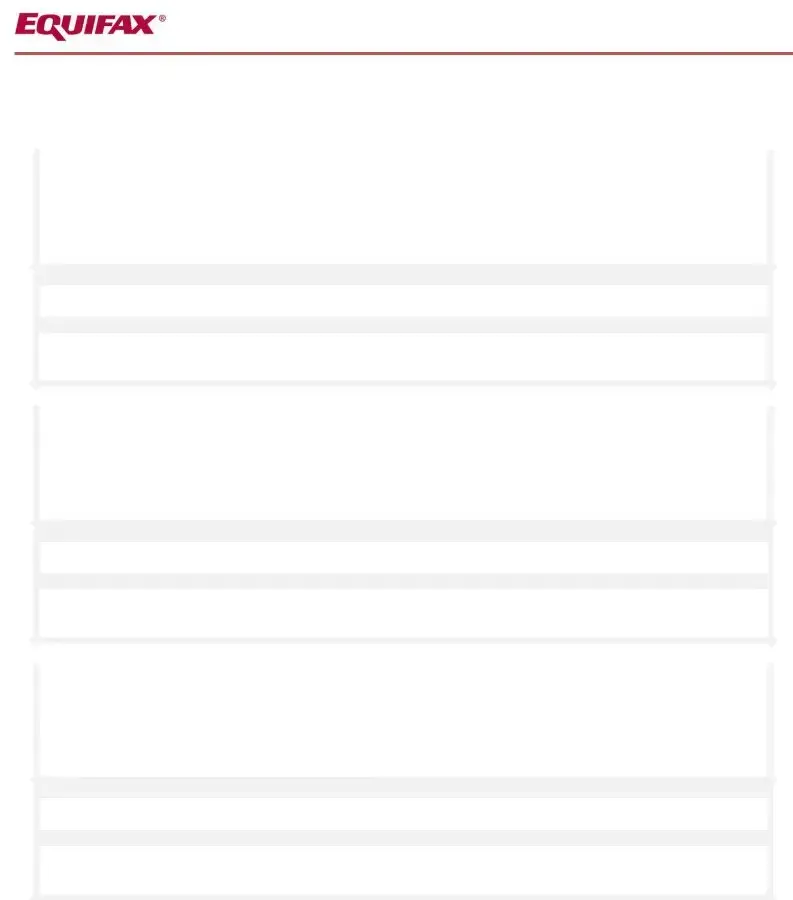

DISPUTE REQUEST FORM

|

|

|

Company Name |

|

|

|

Account Number/Inquiry Date |

|

|

|

DISPUTE 4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reason for Dispute(select the most appropriate option): |

|

|

|

|

|

|||

|

Account Not Mine |

Account Closed |

Current/Previous Payment Status Incorrect |

Fraud |

|

||||

|

Account Paid in Full |

Inquiry Removal |

Last payment date/Closed Date Incorrect |

|

|

||||

|

Mixed with Another Person |

Not Liable |

Date of Last Activity Incorrect |

|

|

||||

Other (please explain)

Dispute Details

|

|

|

Company Name |

|

|

|

Account Number/Inquiry Date |

|

|

|

DISPUTE 5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reason for Dispute(select the most appropriate option): |

|

|

|

|

|

|||

|

Account Not Mine |

Account Closed |

Current/Previous Payment Status Incorrect |

Fraud |

|

||||

|

Account Paid in Full |

Inquiry Removal |

Last payment date/Closed Date Incorrect |

|

|

||||

|

Mixed with Another Person |

Not Liable |

Date of Last Activity Incorrect |

|

|

||||

Other (please explain)

Dispute Details

|

|

|

Company Name |

|

|

|

Account Number/Inquiry Date |

|

|

|

DISPUTE 6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reason for Dispute(select the most appropriate option): |

|

|

|

|

|

|||

|

Account Not Mine |

Account Closed |

Current/Previous Payment Status Incorrect |

Fraud |

|

||||

|

Account Paid in Full |

Inquiry Removal |

Last payment date/Closed Date Incorrect |

|

|

||||

|

Mixed with Another Person |

Not Liable |

Date of Last Activity Incorrect |

|

|

||||

Other (please explain)

Dispute Details

DISPUTE REQUEST FORM

|

|

|

Company Name |

|

|

|

Account Number/Inquiry Date |

|

|

|

DISPUTE 7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reason for Dispute(select the most appropriate option): |

|

|

|

|

|

|||

|

Account Not Mine |

Account Closed |

Current/Previous Payment Status Incorrect |

Fraud |

|

||||

|

Account Paid in Full |

Inquiry Removal |

Last payment date/Closed Date Incorrect |

|

|

||||

|

Mixed with Another Person |

Not Liable |

Date of Last Activity Incorrect |

|

|

||||

Other (please explain)

Dispute Details

|

|

|

Company Name |

|

|

|

Account Number/Inquiry Date |

|

|

|

DISPUTE 8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reason for Dispute(select the most appropriate option): |

|

|

|

|

|

|||

|

Account Not Mine |

Account Closed |

Current/Previous Payment Status Incorrect |

Fraud |

|

||||

|

Account Paid in Full |

Inquiry Removal |

Last payment date/Closed Date Incorrect |

|

|

||||

|

Mixed with Another Person |

Not Liable |

Date of Last Activity Incorrect |

|

|

||||

Other (please explain)

Dispute Details

|

|

|

Company Name |

|

|

|

Account Number/Inquiry Date |

|

|

|

DISPUTE 9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reason for Dispute(select the most appropriate option): |

|

|

|

|

|

|||

|

Account Not Mine |

Account Closed |

Current/Previous Payment Status Incorrect |

Fraud |

|

||||

|

Account Paid in Full |

Inquiry Removal |

Last payment date/Closed Date Incorrect |

|

|

||||

|

Mixed with Another Person |

Not Liable |

Date of Last Activity Incorrect |

|

|

||||

Other (please explain)

Dispute Details

DISPUTE REQUEST FORM

|

|

|

Company Name |

|

|

|

Account Number/Inquiry Date |

|

|

|

DISPUTE 10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reason for |

Dispute(select the most appropriate option): |

|

|

|

|

|

||

|

Account Not Mine |

Account Closed |

Current/Previous Payment Status Incorrect |

Fraud |

|

||||

|

Account Paid in Full |

Inquiry Removal |

Last payment date/Closed Date Incorrect |

|

|

||||

|

Mixed with Another Person |

Not Liable |

Date of Last Activity Incorrect |

|

|

||||

Other (please explain)

Dispute Details

|

|

|

Company Name |

|

|

|

Account Number/Inquiry Date |

|

|

|

DISPUTE 11 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reason for Dispute(select the most appropriate option): |

|

|

|

|

|

|||

|

Account Not Mine |

Account Closed |

Current/Previous Payment Status Incorrect |

Fraud |

|

||||

|

Account Paid in Full |

Inquiry Removal |

Last payment date/Closed Date Incorrect |

|

|

||||

|

Mixed with Another Person |

Not Liable |

Date of Last Activity Incorrect |

|

|

||||

Other (please explain)

Dispute Details

|

|

|

Company Name |

|

|

|

Account Number/Inquiry Date |

|

|

|

DISPUTE 12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reason for Dispute(select the most appropriate option): |

|

|

|

|

|

|||

|

Account Not Mine |

Account Closed |

Current/Previous Payment Status Incorrect |

Fraud |

|

||||

|

Account Paid in Full |

Inquiry Removal |

Last payment date/Closed Date Incorrect |

|

|

||||

|

Mixed with Another Person |

Not Liable |

Date of Last Activity Incorrect |

|

|

||||

Other (please explain)

Dispute Details

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose of the Form | The Equifax Dispute Request form allows individuals to contest inaccuracies on their credit reports. |

| Submission Method | Individuals must send the completed form and supporting documents via U.S. Mail to Equifax. |

| Verification Required | Submit copies of identification and proof of address to verify information and identity. |

| Fraud Identification | Users may indicate if they suspect fraud or identity theft by checking a designated box on the form. |

| Online Submission | Disputes can also be submitted online through the Equifax website at myequifax.com. |

| Legibility Caution | Ensure all submitted documents are clear and free of highlighting, as illegible documents may delay processing. |

| Multiple Disputes | The form allows users to document multiple disputes by providing space for up to 12 disputed accounts. |

| State-Specific Governing Law | In California, the Fair Credit Reporting Act (FCRA) regulations apply. Similar laws exist in other states under their own respective consumer protection acts. |

Guidelines on Utilizing Equifax Dispute Request

Completing the Equifax Dispute Request form is an essential step in addressing inaccuracies that may be affecting your credit report. Once you fill out the form, it’s crucial to mail it, along with any required documentation, to ensure your dispute is processed. Below is a detailed guide on how to fill out the form correctly.

- Gather Required Information: Before starting, make sure you have your personal information ready, including your full name, current and former addresses, Social Security Number (SSN), and date of birth.

- Complete Identification Information: Enter your first name, last name, and any middle initials. Include your suffix (e.g., Jr., Sr., III) if applicable. Fill in your current address, city, state, and zip code, along with your former address if relevant.

- Add Proof of Identity: Check the box for and include a copy of one of the accepted identity verification documents, such as your Social Security Card or driver’s license.

- Include Proof of Address: Check the box for and include a copy of a document that verifies your current address, which could be a utility bill or rental lease agreement.

- Indicate Fraud or Identity Theft: If applicable, check the box indicating you suspect items being disputed are fraudulent or due to identity theft. Include any police or FTC reports with your submission.

- List Incorrect Information: If any information on your credit report is incorrect, provide details about what should be corrected, such as your date of birth, phone number, or SSN.

- Detail Credit Account Disputes: For each account or inquiry you wish to dispute (up to 12), enter the company name, account number, and dispute reason. Choose the most appropriate reason from the provided options.

- Attach Supporting Documentation: If you have any documents that support your dispute (e.g., account statements), be sure to attach copies with your submission.

- Print and Sign the Form: After completing the form, print it out. Don’t forget to sign it before sending.

- Mail the Completed Form: Send the completed form and all supporting documents via U.S. Mail to Equifax Information Services LLC at P.O. Box 740241, Atlanta, GA 30374.

After sending your dispute request, Equifax will investigate the information provided. They are required to respond to you within 30 days. Keep an eye on your mail for any correspondence regarding the outcome of your dispute.

What You Should Know About This Form

What is the purpose of the Equifax Dispute Request form?

The Equifax Dispute Request form allows individuals to formally dispute inaccuracies found on their Equifax credit report. This form is necessary for providing clear information about the disputes and supporting documentation, which are essential for a thorough review of the claim.

How can I submit the Equifax Dispute Request form?

You can submit the completed Equifax Dispute Request form via U.S. Mail, along with the required documentation, to Equifax Information Services LLC at P.O. Box 740241, Atlanta, GA 30374. Alternatively, disputes can also be submitted online at myequifax.com.

What documents do I need to include with my dispute?

You must include copies of identification documents and proof of address. Acceptable documents include a social security card, driver’s license, utility bill, pay stub, or W2 form. Ensure that copies are clear and legible, as unreadable documents may delay the processing of your request.

What should I do if my personal information differs from what is on my credit report?

If there is a discrepancy, it is important to provide a copy of your driver's license, social security card, or a recent utility bill that reflects the correct information. This will help verify your identity and ensure that the dispute is processed more swiftly.

How do I indicate fraudulent accounts on the form?

If you suspect that items on your credit report are fraudulent or a result of identity theft, check the designated box on the form. Including any supporting documents such as a police report or affidavit of fraud will help substantiate your claim.

What kind of information can I dispute?

You can dispute inaccuracies related to personal information, such as your date of birth or social security number, as well as information pertaining to specific credit accounts. Fraudulent accounts, incorrect payment statuses, and inquiries can also be disputed using this form.

What is the maximum number of disputes I can file using this form?

The form allows for multiple disputes to be filed simultaneously. You can submit details for up to twelve different disputes, covering various accounts or inaccuracies on your credit report.

Is it necessary to provide supporting documents for each dispute?

Yes, it is essential to attach supporting documentation for each dispute, such as account statements or payment confirmations. Providing this information helps Equifax thoroughly investigate and resolve the disputes more quickly.

How long will it take to resolve my dispute?

The resolution timeline may vary, but after submitting your dispute, Equifax typically has 30 days to investigate. You should receive a response regarding the outcome of your dispute within this timeframe.

What happens after my dispute is resolved?

After Equifax completes its investigation, you will receive the results by mail. If the dispute is resolved in your favor, your credit report will be updated accordingly. If the dispute is not resolved in your favor, you have the option to add a statement explaining your position to your credit report.

Common mistakes

Completing the Equifax Dispute Request form can be a straightforward process, but several common mistakes can lead to delays or rejections. One significant error is failing to provide legible copies of required identification and proof of address. Photocopies that are unclear, small, or highlighted can result in a request for resubmission. Always ensure documents are enlarged and easy to read.

Another common mistake is ignoring the need for complete and accurate personal information. When providing your date of birth, Social Security Number, and employment details, double-check that they match your credit report. Any discrepancies could complicate your dispute, so accuracy is essential.

Many individuals forget to check off the appropriate box regarding fraudulent activities. If items on your report appear to be a result of identity theft, indicate this by checking the designated box. Including a police report or FTC Identity Theft Report adds credibility to your dispute and can expedite the process.

Another frequent error involves the missing signatures. Ensure you sign and date the form before sending it. An unsigned form can lead to delays in processing your request. Timely communication is crucial for resolving discrepancies effectively.

Providing insufficient information about the disputed accounts is a significant issue as well. When listing accounts, include both the correct and incorrect information for clarity. Attach all relevant documentation that supports your claims, such as statements or payment confirmations, to strengthen your case.

Failing to select a reason for the dispute is also common. Each discrepancy should have a clearly marked reason. Providing only vague explanations may result in your dispute being dismissed. Clarity and specificity will aid in the resolution process.

Additionally, some individuals neglect to include a current mailing address. The form necessitates your current address for correspondence purposes. A lack of updated contact information may result in difficulties receiving feedback on your dispute.

It is also essential to remember that each dispute needs to be submitted separately. Many people try to address multiple concerns in a single dispute, which can overwhelm processing staff. Instead, submit each account discrepancy independently to ensure thorough attention to each issue.

Lastly, remember the importance of sending the dispute via U.S. Mail. The form explicitly states that it should not be submitted electronically unless using the online portal. Disregarding this detail may slow down your resolution process significantly.

By avoiding these common pitfalls, individuals can enhance their chances of successfully disputing inaccuracies on their Equifax credit reports. Careful attention to detail is key.

Documents used along the form

When individuals find inaccuracies in their Equifax credit reports, the process of disputing these errors often requires additional documentation. Each of these documents serves a specific role in verifying identity, supporting claims, or providing evidence necessary for the dispute. Below is a list of forms and documents commonly used alongside the Equifax Dispute Request form.

- Proof of Identity: This can include a driver’s license, state ID, or social security card. It helps establish who you are and confirms your identity as the individual making the dispute.

- Proof of Address: Documents such as utility bills, rental agreements, or bank statements that display your current address are essential. They help validate that your correct residence is on file.

- Police Report: If you suspect fraudulent activity, a police report detailing the identity theft can provide crucial evidence to support your claim.

- FTC Identity Theft Report: This report can be obtained from the Federal Trade Commission and serves as an official document that outlines the nature of the identity theft. It adds weight to your dispute.

- Account Statements: For disputing specific entries, providing statements or confirmations from creditors can clarify discrepancies in account balances or payment histories.

Each of these documents plays a vital role in ensuring that disputes are handled appropriately and efficiently. By carefully preparing and submitting the necessary paperwork, disputing inaccuracies can lead to the resolution of issues that could otherwise affect a person's creditworthiness.

Similar forms

- Credit Bureau Dispute Form: Similar to the Equifax Dispute Request form, other credit bureaus like Experian and TransUnion offer their own dispute forms. These are also used to contest inaccuracies on credit reports and require personal identification information and supporting documents.

- Identity Theft Report: If you believe your credit information may have been compromised, you can file an Identity Theft Report with the Federal Trade Commission (FTC). This report is used to dispute fraudulent items on your credit report, similar to how the Equifax form facilitates disputes based on identity theft.

- Police Report: A police report serves as official documentation of identity theft. Much like the Equifax form, it provides critical evidence when disputing fraudulent accounts that may appear on your credit report.

- FTC Identity Theft Affidavit: This affidavit allows you to report identity theft. It parallels the Equifax dispute process by enabling you to challenge fraudulent charges on your credit report, using the information in the affidavit as a basis for your dispute.

- Request for Fraud Alerts: You can request a fraud alert on your credit report. This action notifies creditors to take extra steps to verify your identity before extending credit. It complements the Equifax Dispute Request form by providing an additional layer of security against identity theft.

- Collection Account Dispute Form: If there are inaccuracies related to collection accounts, a specific dispute form can be used to address these issues. It is akin to the Equifax form in its purpose to rectify inaccuracies in your credit history.

- Credit Report Request Form: You can request your credit report for free annually from each credit bureau. This report may facilitate disputes similar to how the Equifax form does, enabling you to review and correct any inaccuracies observed.

- Consumer Statement Form: After disputing inaccuracies, you can add a consumer statement to your credit report. This statement explains your side of the story, much like how the Equifax form allows you to detail inaccuracies during the dispute process.

Dos and Don'ts

When filling out the Equifax Dispute Request form, paying attention to the details is essential. Here’s a list of what to do and what to avoid:

- Do: Ensure all personal information is accurate. Any discrepancies can delay your request.

- Do: Include clear copies of required identification and proof of address. Legibility is crucial.

- Do: Use the appropriate reasons for each dispute. Selecting the correct reason expedites the resolution process.

- Do: Mail your dispute through U.S. Postal Service, following the address guidelines closely.

- Don't: Submit documents that are blurred or highlighted. Illegible documents may require you to resubmit your request.

- Don't: Leave any sections incomplete unless they are not applicable. Incomplete forms can cause delays.

- Don't: Forget to check the box if you're disputing fraudulent activity. It triggers special handling of your case.

- Don't: Send original documents. Always provide copies to keep your records intact.

Misconceptions

- Misconception 1: You can submit your dispute request electronically only.

- Misconception 2: It is not necessary to include proof of identity.

- Misconception 3: You can include any document you want as proof.

- Misconception 4: All disputed items will automatically be corrected.

- Misconception 5: You do not need to explain your reason for dispute.

Many people believe that the Equifax Dispute Request form can only be submitted online. In fact, you have the option to send the form via U.S. Mail along with the necessary documents for verification.

Some may think that proof of identity is optional when disputing inaccuracies. However, it is essential to provide proof of identity and address to ensure that your request is processed accurately.

There is a specific list of acceptable documents that must be included for evidence. Selecting documents that contain your Social Security number and current address is crucial for successful processing.

Some individuals believe that submitting a dispute guarantees the errors will be corrected. The process requires a thorough review, and not every dispute results in changes to your credit report.

Many assume that simply indicating they have a dispute is enough. Providing a clear reason for the dispute is important, as it contributes to a better understanding of your case and aids in the resolution process.

Key takeaways

Filing a dispute with Equifax regarding inaccuracies in your credit report can be a critical step towards maintaining your financial health. Below are some key takeaways to help guide you through the process of filling out and using the Equifax Dispute Request form.

- Use Legible Copies: When submitting copies of documents, ensure they are enlarged and clear. Illegible documents may cause delays in processing your dispute.

- Proof of Identity: Include proof of your identity and current address. This may consist of documents like your driver's license or utility bills.

- Check for Fraud: If you suspect fraudulent activities, check the appropriate box indicating this on the form. Include any relevant police reports or fraud affidavits.

- Fill Out Personal Information: Carefully note any incorrect information in the personal details section. This ensures clarity and improves the chances of a swift correction.

- Document Inaccuracies: Clearly state the inaccuracies related to your credit accounts. Specificity about the nature of disputes helps the investigation process.

- Provide Supporting Documentation: Attach relevant documents, such as account statements or payment confirmations, to support your dispute. This can expedite the review process.

- Submit by Mail: Send your completed form and all attachments via U.S. Mail to the address provided. This remains one of the most secure ways to submit sensitive information.

- Consider Online Submission: Alternatively, you have the option to submit your dispute online at myequifax.com, which may serve you better depending on your situation.

- Follow Up: After submission, keep track of your dispute status. Equifax is required to investigate disputes and respond within a reasonable timeframe, typically 30 days.

Being thorough and organized can greatly enhance your experience while disputing inaccuracies with Equifax. Taking these steps ensures that your rights are preserved and that your credit report reflects accurate information.

Browse Other Templates

Audit List - Provides insights into patients' living arrangements and lifestyle choices.

Hole-in-One Insurance Application,Golf Event Coverage Form,Tournament Prize Insurance Request,Hole-in-One Coverage Quote,Golf Tournament Insurance Application,Prize Insurance Application for Golf Tournaments,Event Hole-in-One Insurance Request,Golf H - Applicants can easily fill out this form online for convenience.

Nwacc Transcript - Completion of the form is necessary to confirm your enrollment status with potential employers or educational institutions.