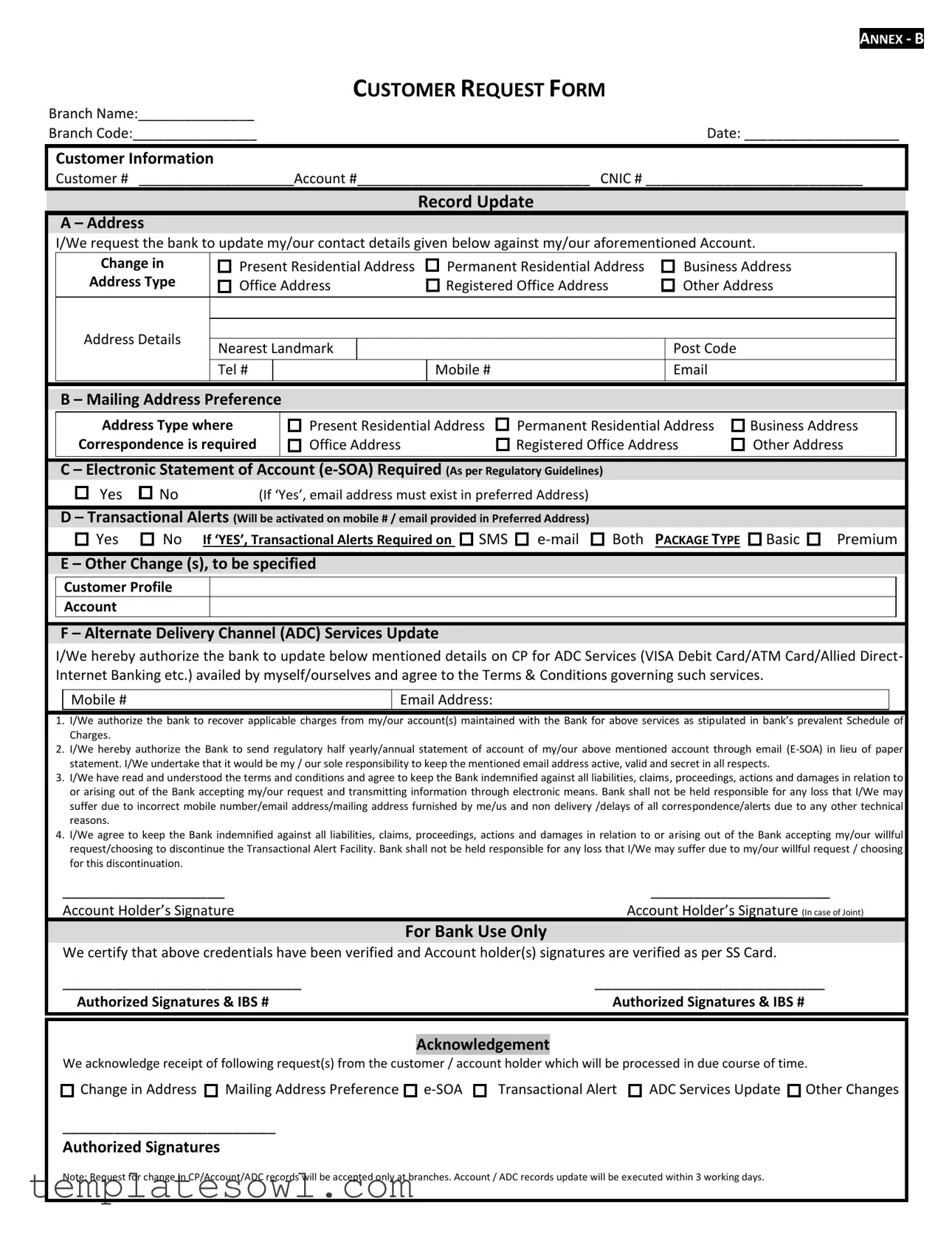

Fill Out Your Customer Request Form

The Customer Request Form serves as a crucial tool for bank customers wishing to update their information and preferences with their financial institution. This form allows users to communicate several types of requests, including changes to personal contact details, mailing address preferences, and updates on electronic statement deliveries. Customers can specify their needs through various sections, such as Record Update, which allows for adjustments to residential or business addresses and contact information, and Transactional Alerts, which enable users to receive essential notifications via SMS or email. The inclusion of an Alternate Delivery Channel Services Update further enhances accessibility by permitting customers to update their details related to digital banking services like debit cards or online banking. Furthermore, the form outlines the responsibilities of customers in maintaining the accuracy of their provided information, emphasizing the bank's limitation of liability concerning any errors. By utilizing this form, customers can streamline their requests, ensuring that their accounts reflect the most current information and preferences, thereby enhancing their overall banking experience.

Customer Request Example

|

|

ANNEX - B |

|

CUSTOMER REQUEST FORM |

|||

Branch Name:_______________ |

|

|

|

Branch Code:________________ |

Date: ____________________ |

||

|

|

|

|

Customer Information |

|

|

|

Customer # ____________________Account #______________________________ |

CNIC # ____________________________ |

|

|

Record Update

A – Address

I/We request the bank to update my/our contact details given below against my/our aforementioned Account.

Change in |

|

|

Present Residential Address |

|

|

Permanent Residential Address |

|

|

Business Address |

||

|

|

|

|

|

|

||||||

Address Type |

|

|

|

|

|

|

|||||

|

|

Office Address |

|

|

Registered Office Address |

|

|

Other Address |

|||

|

|

|

|

|

|

||||||

|

|

|

|

|

|

||||||

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

Address Details |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nearest Landmark |

|

|

|

|

|

Post Code |

|||||

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Tel # |

|

|

Mobile # |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

B – Mailing Address Preference

Address Type where

Correspondence is required

|

Present Residential Address |

|

Permanent Residential Address |

|

Business Address |

|

Office Address |

|

Registered Office Address |

|

Other Address |

|

|

|

C – Electronic Statement of Account

Yes |

|

No |

(If Yes , email address must exist in preferred Address) |

|

D – Transactional Alerts (Will be activated on mobile # / email provided in Preferred Address)

Yes

Yes

|

No If YES , T ansactional Ale ts ‘e ui ed on |

|

SMS |

|

|

Both PACKAGE TYPE |

|

Basic |

|

Premium |

|

|

|

|

|

|

|

E – Other Change (s), to be specified

Customer Profile

Account

F – Alternate Delivery Channel (ADC) Services Update

I/We hereby authorize the bank to update below mentioned details on CP for ADC Services (VISA Debit Card/ATM Card/Allied Direct- Internet Banking etc.) availed by myself/ourselves and agree to the Terms & Conditions governing such services.

Mobile #

Email Address:

1. I/We authorize the bank to recover applicable charges from my/our account(s) maintained with the Bank for above services as stipulated in ank s prevalent S hedule of Charges.

2.I/We hereby authorize the Bank to send regulatory half yearly/annual statement of account of my/our above mentioned account through email

3.I/We have read and understood the terms and conditions and agree to keep the Bank indemnified against all liabilities, claims, proceedings, actions and damages in relation to or arising out of the Bank accepting my/our request and transmitting information through electronic means. Bank shall not be held responsible for any loss that I/We may suffer due to incorrect mobile number/email address/mailing address furnished by me/us and non delivery /delays of all correspondence/alerts due to any other technical reasons.

4.I/We agree to keep the Bank indemnified against all liabilities, claims, proceedings, actions and damages in relation to or arising out of the Bank accepting my/our willful request/choosing to discontinue the Transactional Alert Facility. Bank shall not be held responsible for any loss that I/We may suffer due to my/our willful request / choosing for this discontinuation.

___________________ |

_____________________ |

Account Holder s Signature |

Account Holder s Signature (In case of Joint) |

For Bank Use Only

We certify that above credentials have been verified and Account holder(s) signatures are verified as per SS Card.

____________________________ |

___________________________ |

Authorized Signatures & IBS # |

Authorized Signatures & IBS # |

Acknowledgement

We acknowledge receipt of following request(s) from the customer / account holder which will be processed in due course of time.

Change in Address

Change in Address

Mailing Address Preference

Mailing Address Preference

Transactional Alert  ADC Services Update

ADC Services Update

Other Changes

Other Changes

_________________________

Authorized Signatures

Note: Request for change in CP/Account/ADC records will be accepted only at branches. Account / ADC records update will be executed within 3 working days.

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | This form allows customers to request updates to their account and contact information with the bank. |

| Required Information | Customers must provide identification details, including Customer Number, Account Number, and CNIC Number. |

| Address Update Sections | The form includes sections for updating residential, mailing, and business addresses. |

| Electronic Statements | Customers can request electronic statements of account, which requires an active email address. |

| Transactional Alerts | Options for receiving alerts via SMS or email are available, requiring customer consent. |

| Service Charges | Customers authorize the bank to deduct applicable charges from their accounts for requested services. |

| Processing Time | Updates to account and service records will be processed within three working days after submission. |

Guidelines on Utilizing Customer Request

Filling out the Customer Request form is straightforward. It requires specific information to ensure your requests are processed correctly. The following steps will guide you through the process.

- Branch Information: Enter the Branch Name and Branch Code at the top of the form.

- Date: Write the current date in the designated space.

- Customer Information: Fill in your Customer Number and Account Number. Also, provide your CNIC Number.

- Address Update: Choose the address type you want to update and fill in the corresponding address details, including nearest landmark, post code, telephone number, mobile number, and email address.

- Mailing Address Preference: Indicate which address type you prefer for correspondence.

- Electronic Statement of Account: Specify whether you want an electronic statement of account. If yes, ensure an email address is provided.

- Transactional Alerts: Select if you want the alerts sent to your mobile number or email. Choose between SMS, email, or both.

- Package Type: Indicate whether you want Basic or Premium package services.

- Other Changes: Provide details for any additional changes you need to request.

- Alternate Delivery Channel Services Update: Authorize the bank to update the details for services like VISA Debit Card, ATM card, or Internet Banking. Provide your mobile number and email address.

- Signatures: Both account holders must sign the form, if applicable. Ensure to include your printed names under each signature.

Once you have completed the form, it will be processed in due course by the bank. Remember to provide accurate information to avoid delays in your requests.

What You Should Know About This Form

What is the Customer Request Form used for?

The Customer Request Form is designed for customers to submit requests related to their bank accounts. This includes updating personal information, changing mailing addresses, requesting electronic statements, and managing transactional alerts. It ensures that all the information the bank has is accurate and up to date.

How can I fill out the Customer Request Form?

To fill out the form, provide the required details such as your branch name, branch code, customer number, and account number. Then, specify the changes you wish to make, including any updates to your address or preferences for communication. Be sure to double-check the information to avoid any errors.

What should I do if I need to update my address?

If you need to update your address, complete the relevant section of the Customer Request Form by indicating your old and new addresses. Specify whether the change is for your permanent, business, or mailing address. This will help the bank keep accurate records and ensure you receive important correspondence.

Are electronic statements mandatory?

No, electronic statements (e-SOA) are not mandatory. However, as per regulatory guidelines, you must indicate whether you wish to receive them. If you choose to receive e-SOAs, ensure that you provide a valid email address where these statements can be sent.

What are transactional alerts and how do I sign up for them?

Transactional alerts are notifications sent to your mobile phone or email about account activities. You can opt for these alerts on the Customer Request Form by marking "Yes" for transactional alerts. Choose your preferred method of receiving these alerts—SMS, email, or both—and provide the required details.

Can I request multiple changes at once?

Yes, the form allows you to request multiple changes at once. You can update your address, mailing preferences, electronic statements, transactional alerts, and other service options all in the same request. Just ensure that all required sections are completed accurately.

How long does it take to process my request?

Typically, requests for changes will be executed within three working days. Keep in mind that this timeframe can vary based on the nature of the request or any specific banking policies that may apply.

What happens if I provide incorrect information on the form?

If incorrect information is provided, the bank will not be responsible for any issues that arise, including missed communications or delays. It's crucial to review all details carefully before submitting the form to prevent any complications.

Common mistakes

Filling out the Customer Request form can seem straightforward, but many individuals make mistakes that can delay their requests or even lead to complications. One common error is not providing complete customer information. Missing details such as customer numbers, account numbers, or CNIC numbers can hinder the bank's ability to process the request efficiently. It's essential to double-check these fields before submitting the form.

Another frequent mistake occurs in the address update section. People often fail to select the correct type of address they want to update. For example, whether it is a business address, residential address, or an office address, the distinction is crucial. If someone mistakenly marks the wrong type, it can result in adjustments not being applied to the intended address.

In the electronic statement section, respondents sometimes answer ‘Yes’ without checking whether their email address is already listed in the preferred address section. If the email address isn't provided in the preferred address section or isn't valid, this can cause issues in receiving important statements. This oversight can have further repercussions, as individuals may miss crucial account information.

Additionally, when authorizing delivery channels for alerts, individuals may not realize that they have to specify both mobile and email preferences. Selecting only one option and neglecting the other could lead to missed notifications regarding account transactions. Ensuring that both channels are designated helps keep customers informed and protects against unauthorized transactions.

Another mistake involves the section regarding transactional alerts. Sometimes, individuals select ‘No’ without fully understanding the benefits of receiving such alerts. These alerts serve as an excellent way to monitor account activity and can alert account holders to potential fraud. Ignoring this feature might compromise security or result in missed opportunities for timely action.

Finally, a significant number of people neglect to read the terms and conditions associated with the requested changes. Failing to understand these can lead to unintended consequences. By overlooking this critical step, individuals may inadvertently agree to terms that do not align with their needs. It is always advisable to take the time to understand these stipulations fully before signing the form.

Documents used along the form

The Customer Request form serves as an essential tool for clients to communicate their needs to their bank. Alongside this form, several other documents may be utilized to enhance the process of updating personal information, managing accounts, or subscribing to various bank services. Below is a brief overview of four commonly associated forms.

- Account Update Form: This document allows customers to formally request changes to their account details, such as name changes or modifications to account types. Clients provide necessary identification and account numbers to ensure all changes are documented and processed accurately.

- Change of Address Notification: Specifically designed for notifying the bank of changes to a customer’s residential or mailing address, this form ensures that all correspondence is sent to the correct location. Providing up-to-date contact information is vital for maintaining communication regarding account activities.

- Electronic Consent Form: This document is crucial for customers who wish to receive electronic communications from the bank, including electronic statements or alerts. By signing this form, clients consent to receive important account information through email or SMS, enhancing the convenience and speed of communication.

- Service Agreement Form: This form outlines the terms and conditions associated with specific banking services, such as online banking or ATM services. Customers review and accept the policies detailed within the agreement, ensuring clarity on service usage and potential fees.

Each of these documents plays an integral role in facilitating seamless banking operations and improving customer satisfaction. By being aware of these forms and their purposes, clients can better navigate the processes associated with their banking needs.

Similar forms

- Request for Information Form: Similar to the Customer Request form, this document solicits customer details and preferences without requiring extensive transactional data.

- Change of Address Form: This form specifically focuses on updating a customer's address in the bank's records, much like the Customer Request form's address update section.

- Account Update Form: Used to update any account-related information, this document parallels the Customer Request form by containing sections for various changes.

- Statement Delivery Preference Form: This document allows customers to choose how they receive their account statements, similar to the electronic statement preferences in the Customer Request form.

- Service Enrollment Form: This form captures customer consent to enroll in bank services, akin to how the Customer Request form seeks authorization for specific services.

- Customer Feedback Form: Both forms gather input from customers, although the feedback form focuses on customer experience, while the Customer Request form focuses on specific changes.

- Transaction Alert Enrollment Form: This document allows customers to sign up for alerts, paralleling the transactional alerts section within the Customer Request form.

- Product Change Request Form: Used when a customer wants to change their banking products, this form resembles the Customer Request form in its structure and the type of requests it handles.

Dos and Don'ts

When filling out the Customer Request form, here are some important dos and don'ts. Follow these guidelines to ensure your request is processed smoothly.

- Do provide accurate personal information, including your account and contact details.

- Do clearly specify any changes you are requesting.

- Do check that your email address and phone number are correct for alerts and statements.

- Do keep your signature consistent across relevant documents.

- Do review your submission for any errors before handing it in.

- Don't leave blank fields that are mandatory.

- Don't provide outdated or incorrect residential addresses.

- Don't forget to read the terms and conditions before signing.

- Don't submit the form without ensuring you understand the implications of requested changes.

Misconceptions

Here are eight common misconceptions about the Customer Request Form, clarifying each to enhance understanding.

- All changes can be made online. Many people believe that they can submit any request through an online portal. In reality, requests affecting personal account details must be submitted in person at a branch.

- The request is processed immediately. It may seem that action on your request is instantaneous. However, updates may take up to three working days to process.

- All forms must be filled out completely. While it is advantageous to provide detailed information, not every section is mandatory. Only complete the sections relevant to your request.

- Email and mobile notifications are optional. Some users think they can opt out of transactional alerts altogether, but for many accounts, these alerts are a standard requirement to ensure communication.

- Changes are reversible. A common myth is that customers can easily rewind changes made to their accounts. Once a request is finalized, reversing such alterations may not be possible without additional action.

- Signature verification is not necessary. Some individuals underestimate the importance of signature matching. The bank verifies signatures to ensure security and prevent unauthorized changes.

- There is no risk of loss from incorrect information. Neglecting to provide accurate details can be harmful. If a mobile number or email is incorrect, customers may miss important notifications or alerts.

- Any employee at the bank can process requests. It may seem that all bank staff can handle any request. However, only authorized personnel are permitted to process changes to accounts, ensuring compliance with regulations.

Understanding these misconceptions can help customers navigate the Customer Request Form process more effectively.

Key takeaways

When using the Customer Request form, there are several important aspects to keep in mind:

- Accurate Information: Ensure that all personal and account details are filled out accurately to prevent delays in processing.

- Preferred Contact Method: Clearly specify your mailing address preference to ensure you receive important correspondence.

- Electronic Statement of Account: If you choose to receive e-SOAs, make sure that your provided email address is active and correct.

- Transactional Alerts: Decide whether you want alerts through SMS, email, or both, and confirm that the provided contact numbers are correct.

These steps help in avoiding potential issues with account updates and ensure that you receive timely notifications.

Browse Other Templates

Biochem - Polar molecules interact well with water, facilitating various biochemical reactions.

How to Get Power of Attorney Over a Parent in Michigan - Transactions initiated by the agent are subject to risks, and you remain liable for them.

Hud 9832 - Failure to sign may lead to denial or termination of benefits.