Fill Out Your D120 E Form

The D120 E form plays a critical role in customs activities, particularly for businesses operating internationally. This document establishes a bond between the principal and the surety, ensuring compliance with several legislative authorities, including the Customs Brokers Licensing Regulations and the Customs Bonded Warehouse Regulation. It's crucial for businesses to understand that the bond amount is explicitly stated in both numerical and written form, representing their financial commitment. Additionally, the form outlines the period of validity for the bond, either as a continuous bond or one for a specified period, which directly impacts the obligations of the parties involved. If the obligations mandated by the relevant legislative authorities are met, the bond becomes void; otherwise, it remains enforceable. It also specifies that the surety’s liability is limited to the stated amount, and the bond’s terms may be terminated with appropriate notice. The D120 E form encompasses intricate details that require thorough comprehension by all parties involved, to navigate the complexities of customs obligations effectively. Failure to adhere could lead to significant consequences, making it essential for businesses to prioritize understanding and correctly filling out this form.

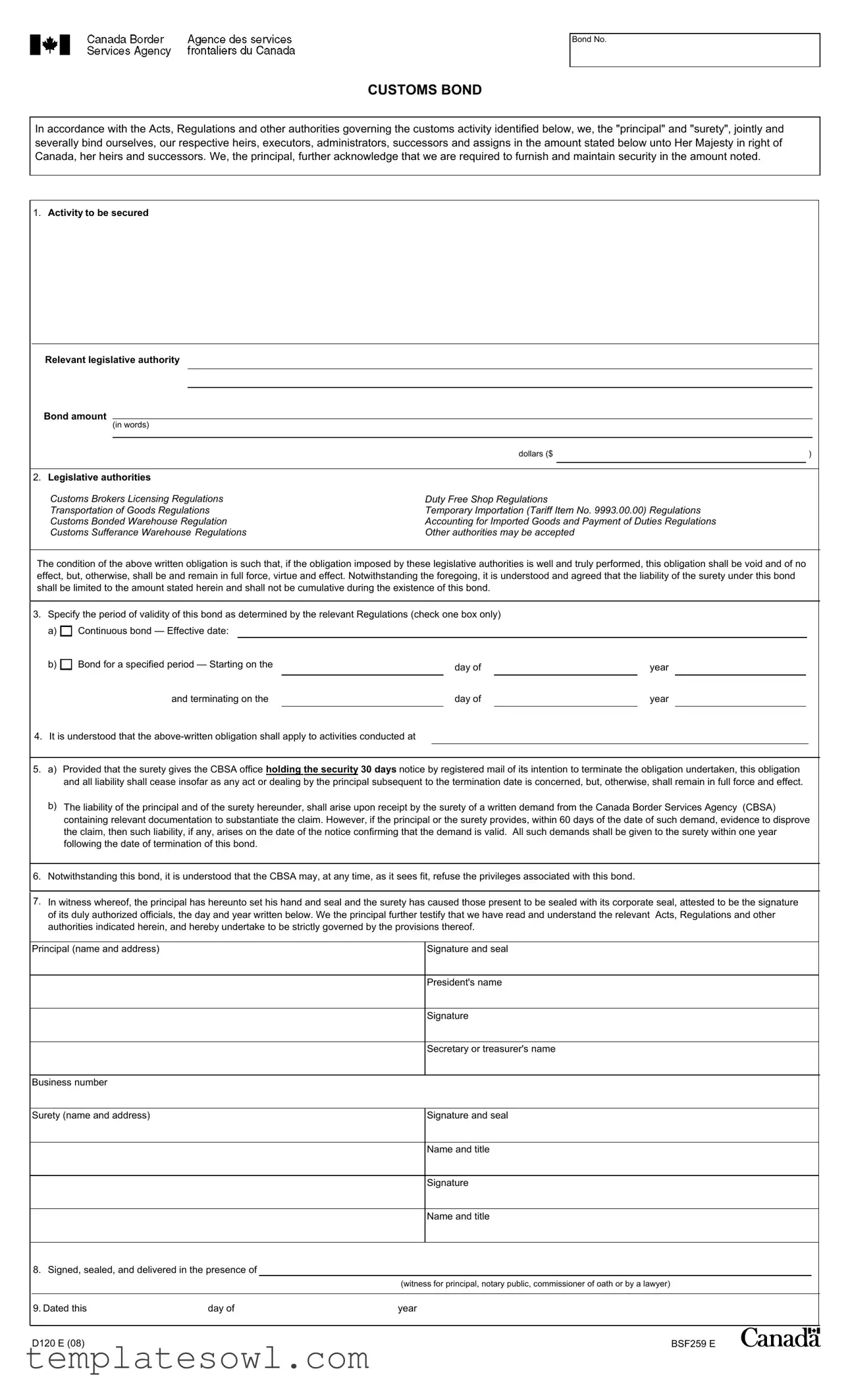

D120 E Example

Bond No.

CUSTOMS BOND

In accordance with the Acts, Regulations and other authorities governing the customs activity identified below, we, the "principal" and "surety", jointly and severally bind ourselves, our respective heirs, executors, administrators, successors and assigns in the amount stated below unto Her Majesty in right of Canada, her heirs and successors. We, the principal, further acknowledge that we are required to furnish and maintain security in the amount noted.

1.Activity to be secured

Relevant legislative authority

Bond amount

(in words)

|

|

|

|

|

|

|

|

dollars ($ |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. Legislative authorities |

|

|

|

|

|

Customs Brokers Licensing Regulations |

Duty Free Shop Regulations |

|

|

||

Transportation of Goods Regulations |

Temporary Importation (Tariff Item No. 9993.00.00) Regulations |

|

|

||

Customs Bonded Warehouse Regulation |

Accounting for Imported Goods and Payment of Duties Regulations |

|

|

||

Customs Sufferance Warehouse Regulations |

Other authorities may be accepted |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

The condition of the above written obligation is such that, if the obligation imposed by these legislative authorities is well and truly performed, this obligation shall be void and of no effect, but, otherwise, shall be and remain in full force, virtue and effect. Notwithstanding the foregoing, it is understood and agreed that the liability of the surety under this bond shall be limited to the amount stated herein and shall not be cumulative during the existence of this bond.

3.Specify the period of validity of this bond as determined by the relevant Regulations (check one box only) a)  Continuous bond — Effective date:

Continuous bond — Effective date:

b) |

|

Bond for a specified period — Starting on the |

|

day of |

|

year |

|

|

|

|

|

||

|

|

and terminating on the |

|

day of |

|

year |

|

|

|

|

|||

|

|

|

|

|

|

|

4.It is understood that the

5.a) Provided that the surety gives the CBSA office holding the security 30 days notice by registered mail of its intention to terminate the obligation undertaken, this obligation and all liability shall cease insofar as any act or dealing by the principal subsequent to the termination date is concerned, but, otherwise, shall remain in full force and effect.

b)The liability of the principal and of the surety hereunder, shall arise upon receipt by the surety of a written demand from the Canada Border Services Agency (CBSA) containing relevant documentation to substantiate the claim. However, if the principal or the surety provides, within 60 days of the date of such demand, evidence to disprove the claim, then such liability, if any, arises on the date of the notice confirming that the demand is valid. All such demands shall be given to the surety within one year following the date of termination of this bond.

6.Notwithstanding this bond, it is understood that the CBSA may, at any time, as it sees fit, refuse the privileges associated with this bond.

7.In witness whereof, the principal has hereunto set his hand and seal and the surety has caused those present to be sealed with its corporate seal, attested to be the signature of its duly authorized officials, the day and year written below. We the principal further testify that we have read and understand the relevant Acts, Regulations and other authorities indicated herein, and hereby undertake to be strictly governed by the provisions thereof.

Principal (name and address)

Signature and seal

President's name

Signature

Secretary or treasurer's name

Business number

Surety (name and address)

Signature and seal

Name and title

Signature

Name and title

8. Signed, sealed, and delivered in the presence of

(witness for principal, notary public, commissioner of oath or by a lawyer)

9. Dated this |

day of |

year |

D120 E (08) |

BSF259 E |

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The D120 E form serves as a customs bond for securing customs activities related to imports into Canada. |

| Governing Authority | It is governed by various acts and regulations including the Customs Brokers Licensing Regulations and Temporary Importation Regulations. |

| Principal & Surety | The form is jointly executed by a principal and a surety, both of whom are legally bound by its terms. |

| Bond Amount | The required bond amount must be specified in both numerical and written form on the document. |

| Validity Period | The bond can be set as either a continuous bond or for a specified period, which must be indicated on the form. |

| Liability Limit | The liability of the surety is limited to the bond amount stated and does not accumulate over time. |

| CBSA Notification | The surety must provide a 30-day notice to the CBSA if it intends to terminate the bond. |

| Evidence Requirement | Upon a demand from the CBSA, the principal or surety can present evidence within 60 days to disprove claims against them. |

| Signature Requirements | Must be signed by the principal and surety with witness verification, ensuring legal validation of the bond. |

| Termination Provision | The CBSA has the authority to revoke privileges associated with the bond at their discretion. |

Guidelines on Utilizing D120 E

Filling out the D120 E form is a critical step in securing customs operations. It is important to complete the form accurately to ensure compliance and maintain legal obligations. The following steps outline the necessary actions to fill out the D120 E form properly.

- Begin with the Bond No. section at the top of the form. Write the appropriate bond number.

- Under CUSTOMS BOND, identify the customs activity that requires security. Write a brief description of this activity.

- In the Bond amount (in words) section, state the amount of money required, first in words, followed by the numerical figure in dollars ($).

- Indicate the Legislative authorities related to your bond. Check all applicable boxes according to the regulations mentioned.

- Specify the period of validity of the bond. Choose either a) Continuous bond or b) Bond for a specified period, and fill in the effective or termination dates as required.

- In section 4, enter the location where activities related to the bond will be conducted.

- Sign the form where indicated, ensuring that the principal's name, address, and corporate seal are included.

- The Surety section must be completed next. Enter the name and address of the surety, including necessary signatures and titles.

- Provide a signature from an authorized witness such as a notary public or lawyer in the final section.

- Finally, ensure the date is filled in at the bottom of the form.

After completing these steps, double-check the information for accuracy and completeness. Submitting the D120 E form to the relevant customs authority will finalize your compliance with the necessary regulations.

What You Should Know About This Form

What is the purpose of the D120 E form?

The D120 E form is a Customs Bond used to secure the obligations of principals and sureties in accordance with various legislative authorities related to customs activities. This form ensures that the financial obligations described in the bond are fulfilled, which may include duties and regulations pertaining to imported goods, temporary importation, or customs warehouses.

Who typically needs to submit the D120 E form?

The D120 E form is generally required by individuals or businesses engaged in customs activities that require a bond, such as importers, customs brokers, or operators of duty-free shops. Those seeking to temporarily import goods or use bonded warehouses may also need to complete and submit this form to ensure compliance with customs regulations.

What information must be included on the D120 E form?

The D120 E form requires specific details, including the bond amount, the relevant legislative authorities under which the bond is issued, the period for which the bond is valid, and the name and address of both the principal and the surety. Additionally, the signatures and seals of the parties involved must be affixed, along with witnessing signatures as necessary.

How long is the D120 E bond valid?

The D120 E form allows for two options regarding validity. It can be a continuous bond with no specific end date, or it can be for a specified period with defined start and end dates. It is essential to check the relevant regulations to determine the appropriate option for your situation.

What happens if the conditions of the bond are not met?

If the obligations outlined in the D120 E bond are not fulfilled, the bond remains in full force until a claim is validated by the Canada Border Services Agency (CBSA). The surety may be required to respond to demands from the CBSA regarding non-compliance. However, the surety can limit liability to the specified bond amount as outlined in the form.

Can the privileges associated with the bond be revoked?

Yes, the CBSA reserves the right to revoke the privileges associated with the bond at any time. This action may occur regardless of the bond’s current validity status or obligations, and it is important for all parties involved to remain aware of potential changes in their customs status.

Common mistakes

Filling out the D120 E form can seem straightforward, but many make errors that can complicate the process. One common mistake is failing to specify the correct bond amount. Clarity is essential when citing the amount in words and numbers. If there is a discrepancy between these two representations, it can lead to confusion and potential rejection of the form.

Another frequent error is incorrectly checking the validity period. Whether opting for a continuous bond or a specified period, applicants must double-check that only one box is selected. Failure to adhere to this guideline can result in processing delays, as officials may need to contact you for clarification.

Many people neglect to provide complete and accurate information about the principal and surety. Ensure all names, addresses, and signatures are filled out correctly. Incomplete details can undermine the authority of the document. This not only affects your current application but could also result in complications for future dealings.

Additionally, some applicants overlook the requirement for a witness when signing the form. It is critical that a witness, such as a notary public or lawyer, is present to validate the signatures. Omitting this step can render the entire bond ineffective.

Finally, not reading the relevant Acts and Regulations thoroughly before completion can be a costly mistake. The applicant must ensure they are familiar with the obligations set forth in the document. This understanding is paramount not only for proper completion but also for legal compliance and avoidance of future disputes or penalties.

Documents used along the form

The D120 E form, used for securing customs bonds related to various customs activities, is often accompanied by additional forms and documents that facilitate legal compliance and provide necessary information. Below is a list of several common forms and documents used in conjunction with the D120 E form.

- CBSA Bond Application (BSF259E): This application form is submitted to the Canada Border Services Agency (CBSA) to formally request a customs bond. It provides essential details about the principal and ensures that all necessary information is included for processing.

- Power of Attorney: This document authorizes an agent or broker to act on behalf of the principal in dealing with customs matters. It is crucial for allowing representation in customs activities without the principal's direct involvement.

- Customs Declaration Form (B3): Used for declaring goods being imported into Canada, this form contains specifics about the items, their value, and applicable duties or taxes. It ensures compliance with customs laws during the import process.

- Import Control List (ICL) Supplement: Certain goods are subject to import controls, and this document provides a list of those items. It is helpful for understanding restrictions or requirements that might impact the customs bond.

- Bill of Lading: This shipping document details the type, quantity, and destination of the goods being transported. It serves as a receipt and a contract between the shipper and carrier and is often required for customs processing.

- Commercial Invoice: A vital document in international trade, it outlines the transaction details between the seller and buyer, including prices and payment terms. It is essential for customs clearance and calculating duties owed.

- Manifest: A manifest lists all the cargo being transported on a vessel or vehicle. It is required for customs enforcement to verify the accuracy of goods entering the country.

These forms and documents are designed to ensure compliance with customs regulations and facilitate the customs process when engaging with the Canada Border Services Agency. Proper use and completion of these materials are essential for a smooth customs experience.

Similar forms

The D120 E form is a Customs Bond used in Canada, primarily to ensure compliance with customs regulations. Several other documents share similarities with the D120 E form, usually serving as guarantees or applications related to financial obligations and compliance. Here are five such documents:

- Customs Bond (CBP Form 301): This document serves a similar purpose in the United States, providing a financial guarantee for duties and taxes owed on imported goods. Like the D120 E, it involves a principal and a surety, binding them to cover any potential financial liabilities arising from customs activities.

- Letter of Credit: This is a financial document from a bank guaranteeing that a buyer's payment to a seller will be received on time and for the correct amount. Similar to the D120 E, it is a form of assurance for fulfilling a financial obligation, often used in international trade transactions.

- Carnet: This is an international customs document that allows the temporary importation of goods without the need to pay duties. Like the D120 E, it helps facilitate cross-border transactions while ensuring compliance with customs regulations.

- Performance Bond: This document ensures the completion of a project or contract. It shares the principle of financial security with the D120 E, providing protection to the entity requiring the bond in case the principal fails to fulfill their obligations.

- Insurance Policy: Specifically, a surety bond insurance policy can be likened to the D120 E, as it serves to protect against financial losses resulting from non-compliance or failure to perform contractual obligations, establishing a similar safety net for creditors.

Each of these documents plays a crucial role in ensuring financial compliance and mitigating risks in various transactions and activities, much like the D120 E form serves within the customs framework.

Dos and Don'ts

When filling out the D120 E form, adhering to specific guidelines can greatly enhance the accuracy and efficiency of your submission. Below are important dos and don’ts to keep in mind.

- Do carefully read the entire form before starting to fill it out.

- Do provide accurate bond amounts and ensure they are mentioned in both words and figures.

- Do select the appropriate period of validity for the bond, ensuring to check only one box.

- Do sign and seal the document appropriately, confirming the names and titles of all involved parties.

- Don’t leave any required sections blank; incomplete forms can lead to delays.

- Don’t use unclear or ambiguous terms when describing activities that need to be secured.

- Don’t forget to attach any necessary supporting documents that may be requested by the Canada Border Services Agency (CBSA).

By following these guidelines, you can ensure that your D120 E form is completed correctly and efficiently.

Misconceptions

-

Misconception 1: The D120 E form is only needed for imports into Canada.

This form is actually required when securing bonds for various customs activities, not just for imports. It can also apply to activities like temporary importation and customs bonded warehousing.

-

Misconception 2: Only large companies need to file a D120 E form.

This is not true. Any individual or business engaging in customs activities, regardless of size, may need to file this form to meet legal obligations.

-

Misconception 3: Completing the D120 E form guarantees automatic approval.

Submitting the form does not guarantee approval. The Canada Border Services Agency (CBSA) has the discretion to refuse privileges associated with the bond at any time.

-

Misconception 4: The bond amount on the D120 E form can be changed after it is filed.

Once the bond amount is set and the form is submitted, it cannot be altered arbitrarily. You should review the terms carefully and ensure that the amount is adequate at the time of filing.

Key takeaways

When filling out and using the D120 E form, consider these key takeaways:

- The form outlines the obligation of both the principal and the surety regarding customs activities and bond amounts.

- It is essential to specify the purpose of the bond and the relevant legislative authority under which it operates.

- The validity period of the bond must be clearly marked, either as continuous or for a specified duration.

- All parties must understand their rights and responsibilities, especially regarding claims and termination of the bond.

Browse Other Templates

Form 8850 Wotc - Form 8850 may help in reducing barriers faced by individuals seeking employment.

Employee Announcement Examples - Encourage new hires to reach out and ask for assistance.