Fill Out Your Dayton R 1 Form

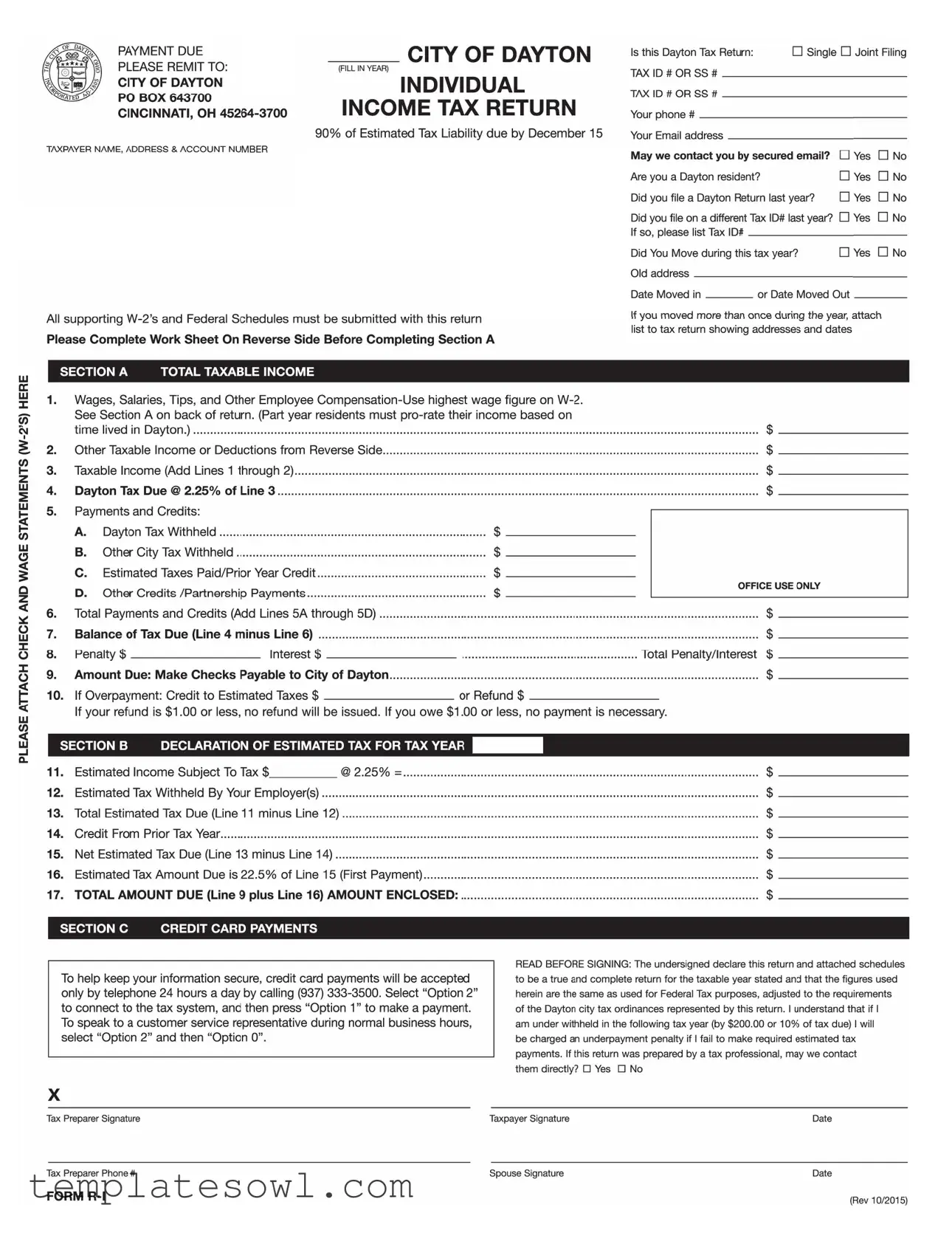

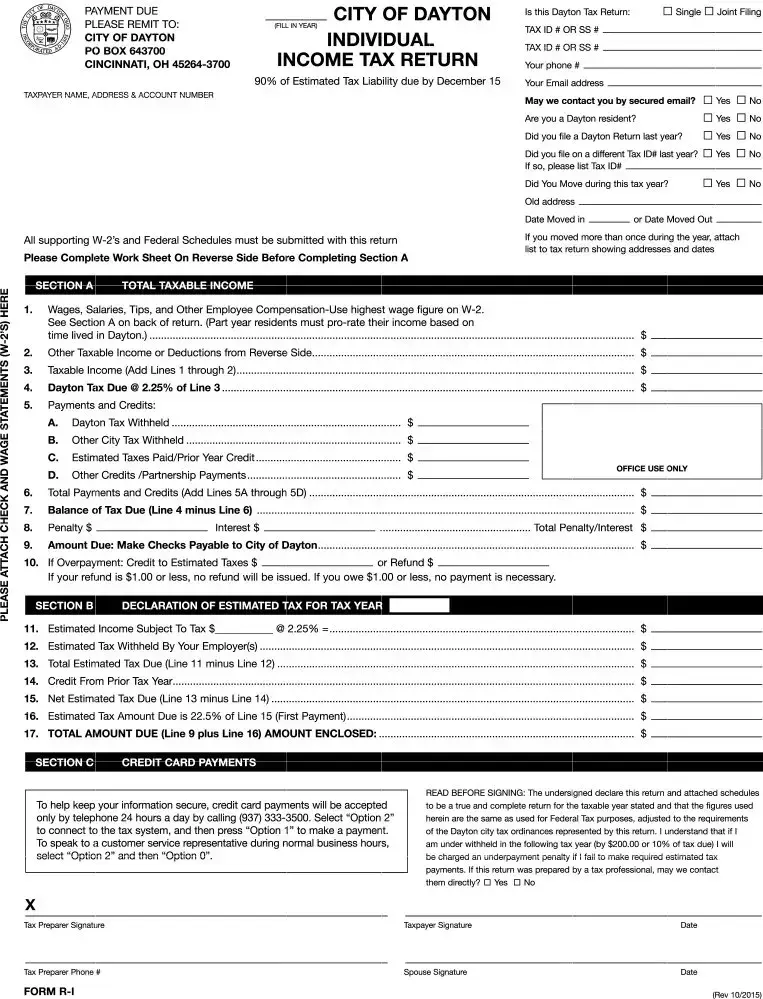

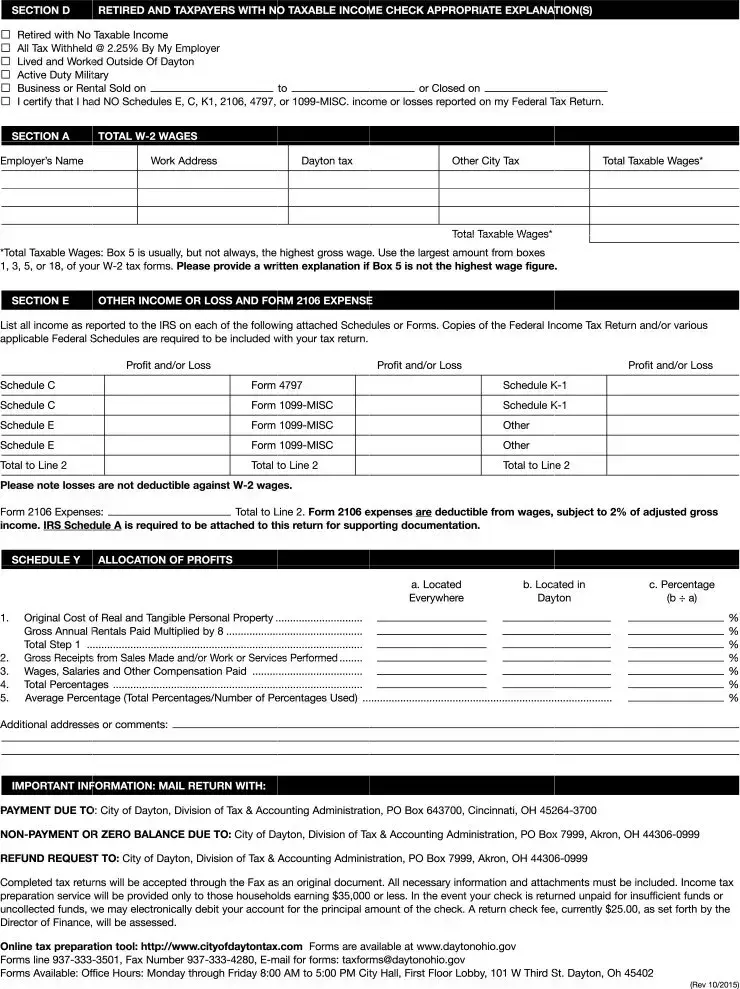

The Dayton R 1 form plays a crucial role in the tax process for residents and workers within the City of Dayton. It serves as the individual income tax return, helping residents accurately report their income and calculate any tax obligations. Essential information required includes the taxpayer’s name, address, tax identification number, and filing status, which can be either single or married filing jointly. Taxpayers must also indicate whether they were residents of Dayton last year and provide income details from W-2 forms, ensuring all taxable wages reflect the highest amount. Furthermore, taxpayers must account for additional taxable income, potential deductions, and estimate their tax liability, with payments due typically by December 15 for estimated assessments. The form also includes sections to declare any credits or payments made toward taxes, as well as others related to specific circumstances like being retired or having no taxable income. Crucially, the process demands a commitment to accuracy, with complete documentation required, such as W-2s and federal schedules, to support claims. Clear guidance is provided on where to send payments, along with instructions on penalties and interest applied for late payments. For many, navigating the nuances of the Dayton R 1 form is not just a compliance task, but an opportunity to ensure financial responsibilities are met efficiently.

Dayton R 1 Example

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The Dayton R 1 form is used to file individual income tax returns for residents of Dayton, Ohio. |

| Filing Requirement | Taxpayers must fill out this form if they have taxable income and owe taxes to the City of Dayton. |

| Tax Rate | The tax rate for the City of Dayton is set at 2.25% of taxable income. |

| Estimated Payment | Taxpayers must remit 90% of their estimated tax liability by December 15 of the tax year. |

| Residency Questions | The form includes questions to determine the residency status of the filer and their previous year's filing status. |

| Attachments Required | All supporting W-2 forms and federal schedules must be attached to the return for it to be valid. |

| Payment Instructions | Payments should be sent to the City of Dayton at their designated P.O. Box in Cincinnati, Ohio. |

| Governing Laws | This form is governed by the City of Dayton’s tax ordinances and regulations related to income tax. |

Guidelines on Utilizing Dayton R 1

Filling out the Dayton R 1 form is an important step in your tax filing process. It is essential to ensure that all required information is accurately entered to avoid delays or potential penalties. Please follow the steps below carefully to complete the form correctly.

- Begin by filling in the tax year at the top of the form.

- Indicate whether you are filing as Single or Joint.

- Enter your Tax ID # or SS # and your spouse’s information if applicable.

- Provide your phone number and email address.

- Complete the section for your name, address, and account number.

- Answer the questions regarding your residency status, past filings, and any changes in your address during the tax year.

- Attach your check and wage statements (W-2s) to the form.

- Move to SECTION A: Calculate total taxable income:

- List wages, salaries, tips, and any other employee compensation, using the highest wage figure from your W-2.

- Include any other taxable income or deductions from the reverse side.

- Add the two figures to find your total taxable income.

- Calculate your tax due at 2.25% of your taxable income.

- List any payments or credits. If you moved during the year, attach a list of addresses and dates.

- Sum the payments and credits to determine the total and balance of tax due.

- If you have a refund, specify the amount or if it will be credited to estimated taxes.

- Proceed to SECTION B: Complete the estimated tax calculations for the current year.

- In SECTION C, note that credit card payments can only be made by calling the provided telephone number.

- Before signing, ensure you review the declaration, confirming the accuracy of the return.

- Sign and date the form. Ensure your tax preparer, if any, provides their signature and information.

- Mail the completed form along with any required payments to the specified address.

Once you have completed these steps, review the form for accuracy and submit it by the deadline. This will help ensure compliance and avoid any unnecessary complications.

What You Should Know About This Form

What is the Dayton R 1 form?

The Dayton R 1 form is the Individual Income Tax Return for residents and non-residents of Dayton, Ohio. This form is required for individuals to report their income and calculate their tax liability to the City of Dayton. It is crucial that all income, wage statements, and required documentation are submitted with this form.

Who needs to file the Dayton R 1 form?

Everyone who earns income while residing or working in Dayton, whether as a resident or non-resident, must file this form. If you are engaged in business activities or have rental income, you may need to file in addition to reporting other sources of income.

What information is required on the Dayton R 1 form?

Essential details include taxpayer name, address, contact information, and Social Security or Tax Identification number. You will also need to provide your income details from W-2 forms, other income statements, and any credits or payments already made. Finally, ensure you mention if you've moved during the tax year and include the pertinent dates.

How do I calculate my taxable income for the Dayton R 1 form?

To calculate your taxable income, start with your total wages, salaries, and other employee compensation as reported on your W-2. If you have other taxable income, include that as well. The total taxable income will be multiplied by the Dayton tax rate of 2.25% to determine your tax due.

What if I owe taxes or have an overpayment?

If you owe taxes, the form will indicate the total due after credits have been applied. You can pay via check or by phone with a credit card. For overpayments, you may choose to apply the amount to future estimated taxes or request a refund. Be mindful that refunds of $1.00 or less are not issued.

How can I make a payment for taxes owed?

Payments can be made by check, payable to the City of Dayton, and sent to the address listed on the form. Additionally, credit card payments can be made over the phone at the designated number provided on the form. Simply follow the prompts to process your payment securely.

What should I do if I have moved during the tax year?

If you have moved, list all addresses where you lived during the year, including the dates of your moves. This information is vital to accurately calculate your taxable income, especially if you lived in Dayton for only part of the year.

What happens if my check for payment bounces?

If a payment check is returned for insufficient funds, the city may electronically debit your account for the original amount. Additionally, a return check fee of $25 may be assessed. It’s essential to ensure that funds are available before submitting your payment.

Can I file my tax return electronically?

While the form states that original documents can be submitted by fax, the City of Dayton encourages filing and submitting required documentation through the mail to ensure proper processing. Keep in mind that all forms and attachments must be included for successful submission.

How can I get help with completing the Dayton R 1 form?

If you have questions while filling out the form, you might consider reaching out to a tax professional or the customer service representatives at the City of Dayton. They can provide guidance and any necessary clarifications regarding your specific situation.

Common mistakes

When completing the Dayton R-1 form, many individuals unknowingly make common mistakes that can lead to complications in their tax filing process. One frequent error pertains to the submission of wage statements. It’s crucial to attach all W-2 forms to the return. Without these documents, your tax return may be considered incomplete. This can result in delays or even penalties.

Another mistake often made is neglecting to properly calculate taxable income. Taxpayers sometimes misinterpret which wages to include. Make sure you are using the highest wage figure from your W-2 forms. If you are a part-year resident, it’s important to remember that your taxable income should be prorated based on the time you lived in Dayton. Failing to do this can lead to an inaccurate tax assessment.

Many people also overlook the importance of answering all questions on the form. For instance, questions regarding whether you were a Dayton resident or if you filed a Dayton return last year must be addressed. These answers help the city assess your tax liability correctly. Leaving any question unanswered could raise red flags or prompt further inquiry.

The accuracy of the calculations in Section A of the form is essential. Mistakes in adding or subtracting the numbers could lead to an incorrect balance due or an erroneous refund claim. Double-checking your math is a simple yet effective way to avoid this pitfall.

Lastly, ensure that you are aware of payment submission procedures. Many first-time filers mistakenly send their payment to the wrong address. Always route your tax payments to the specified address—City of Dayton, PO Box 643700, Cincinnati, OH 45264-3700. A minor oversight here can result in payment processing delays, which may affect your tax standing with the city.

Documents used along the form

The Dayton R 1 form serves as a critical document for individuals filing their income taxes in Dayton, Ohio. Alongside this form, there are various other documents that taxpayers may require to ensure a complete and accurate filing. Below is a list of these supporting forms and documents commonly used with the Dayton R 1.

- W-2 Form: This form reports an employee's annual wages and the taxes withheld from their paycheck. It is essential for calculating taxable income and supports the taxpayer's declarations in the Dayton R 1 form.

- Federal Tax Return (1040): Taxpayers are often required to attach a copy of their federal tax return, which provides a comprehensive account of their overall financial situation, including income, deductions, and credits.

- Schedule C: This form is used by sole proprietors to report income or loss from their business. It is vital for taxpayers who have self-employment income, applicable when filling out the Dayton R 1 form.

- Schedule E: This is utilized to report income from rental properties or partnerships. Taxpayers should include this schedule if they have income from these sources, as it impacts their overall taxable income.

- Form 2106: This form allows employees to report unreimbursed business expenses, which can be deducted from their income. Including this form helps taxpayers accurately report their net taxable income.

- Simplified Tax Worksheet: Many taxpayers use this worksheet to summarize various deductions and credits. It aids in compiling necessary data before transferring figures to the Dayton R 1 form.

These documents collectively help taxpayers prepare for filing their income taxes accurately and comprehensively. Proper documentation can help prevent delays in processing returns and ensure that any eligible refunds are issued promptly. Each document supports the information provided in the Dayton R 1 and can simplify the tax filing process.

Similar forms

The Dayton R 1 form is an essential document used for filing individual income tax returns in the City of Dayton, Ohio. It helps residents report their income and calculate their tax liabilities. Several other forms share similarities with the Dayton R 1 form, serving various tax-related purposes. Here are nine documents akin to the Dayton R 1 form, each with its unique focus:

- 1040 Form: This is the standard individual income tax return form used in the United States. Like the Dayton R 1 form, the 1040 form is designed to report income, claim tax deductions, and calculate tax liability for federal taxes.

- W-2 Form: The W-2 form is issued by employers to report wages, tips, and other compensation paid to employees, and the taxes withheld from these earnings. This is similar to the information required on the Dayton R 1 form, where wage statements are needed for accurate tax return filing.

- Schedule C: This form is used by sole proprietors to report income and expenses from their business. While the Dayton R 1 form focuses on overall individual income, the Schedule C is specifically aimed at reporting business income within the broader tax context.

- Schedule E: This document is used to report supplemental income such as rental income, royalties, and income from partnerships. Like the Dayton R 1 form, it helps taxpayers report various income sources but emphasizes specific forms of earnings.

- Form 2106: Taxpayers use this form to deduct unreimbursed employee expenses. The Dayton R 1 form also considers deductions, making both documents crucial for a thorough understanding of income and tax liability.

- 1040-SR: This version of the 1040 form is designed for seniors, providing a simpler layout. Similar to the Dayton R 1 form, it assists taxpayers in reporting income and calculating taxes but is tailored for a specific demographic.

- State Income Tax Return: Each state has its own income tax return form. Like the Dayton R 1 form, these documents capture information on wages, deductions, and tax credits specific to state tax laws.

- Estimated Tax Form (1040-Es): This form is used to pay estimated taxes on income that isn’t subject to withholding. The Dayton R 1 form includes a section on estimated taxes, making them related in their function of tax assessment and payment.

- Form 8862: This form is used to claim the Earned Income Tax Credit after reaching certain disqualified statuses. It shares similarities with the Dayton R 1 form in that both require comprehensive information about income to determine eligibility for credits and refunds.

Each of these documents plays a significant role in the tax filing process, helping individuals meet their obligations while ensuring they take advantage of their rights and benefits as taxpayers.

Dos and Don'ts

When filling out the Dayton R 1 form, attention to detail is crucial. Here’s a list of things to keep in mind:

- Do: Ensure that all check and W-2 statements are attached as indicated at the top of the form.

- Do: Use the highest wage figure from your W-2 for reporting total taxable income.

- Do: Pro-rate your income if you were a part-year resident in Dayton.

- Do: Double-check your math calculations, particularly in the balance due section.

- Don’t: Forget to enter your tax ID number or Social Security number. Omitting this can delay processing.

- Don’t: Leave any section blank. Each question must be answered, even if it is not applicable.

By following these guidelines, you can help ensure that your tax return is complete and accurate, which can lead to a smoother processing experience. Happy filing!

Misconceptions

Misperception 1: The Dayton R 1 form is only for full-time residents of Dayton.

This is not correct. Even part-time residents who earned income while living in Dayton must file this form. Taxable income is prorated based on the time spent as a resident.

Misperception 2: Everyone has to pay estimated taxes to the City of Dayton.

This is misleading. Only those who expect to owe $200 or more in tax by year-end typically need to make estimated tax payments. Many taxpayers might not fall into this category.

Misperception 3: I can submit the Dayton R 1 form without including supporting documents.

This is incorrect. The form requires submission of all pertinent W-2s and supporting schedules. Failing to include these can delay processing or result in penalties.

Misperception 4: Penalties and interest will not apply for a small tax balance due.

This is false. Even if you owe $1.00 or less, penalties can still apply for failure to pay on time. It’s essential to address all dues, regardless of the amount.

Key takeaways

1. Importance of Accuracy: Ensure that all figures entered on the Dayton R 1 form are accurate and reflect your financial situation correctly. This includes reporting your wages and any other taxable income. Any discrepancies or inaccuracies can lead to penalties or unnecessary delays in processing your return.

2. Supporting Documentation: Always attach your W-2 forms and any other necessary schedules, such as the Federal Tax Return, to your submission. These documents provide crucial evidence of your income and tax payments, and they are essential for the review process.

3. Filing Options: Be aware of the different filing options, such as single or joint filing. Your choice may affect your tax liabilities and deductions. If you have moved during the tax year, clearly indicate your old and new addresses to avoid confusion and to ensure you receive any due refunds or notifications promptly.

4. Deadlines and Payments: Keep track of important deadlines, such as the 90% estimated tax liability due by December 15. If you owe taxes, follow the instructions for making payments, whether via check, credit card, or electronic transfer. Making timely payments can help you avoid penalties and interest.

Browse Other Templates

Nebraska Worker Injury Report,First Occupational Injury Form,Nebraska Work-Related Injury Notification,Workers' Compensation Incident Report,Employer Injury Reporting Form,Employee Injury Incident Submission,Occupational Illness Notification Form,Cla - Claim administrators use the information to assess cases and determine appropriate compensation.

What Is Delivery Receipt - Provides clarity on what has been received, alleviating confusion for both sender and receiver.