Fill Out Your Dd 2475 Form

The DD Form 2475 plays a critical role in the Department of Defense's Educational Loan Repayment Program, often referred to as LRP. Designed to assist eligible servicemembers, this form allows for the repayment of a portion of their student loans, which can significantly ease financial burdens associated with higher education. It is categorized into various programs, including those for active duty service members, health professionals, and selected reserve members. When filling out the form, applicants must provide personal information, details about their loans, and authorizations for their lenders to share relevant financial data. Completing the DD Form 2475 entails a collaboration among the servicemember, a designated personnel officer, and the loan servicing agency, ensuring all required information is verified and forwarded correctly. The purposes and protocols outlined in this form underscore the urgency for members to accurately complete and submit their applications timely, as this not only affects loan repayments but can also impact their overall financial health and readiness to serve.

Dd 2475 Example

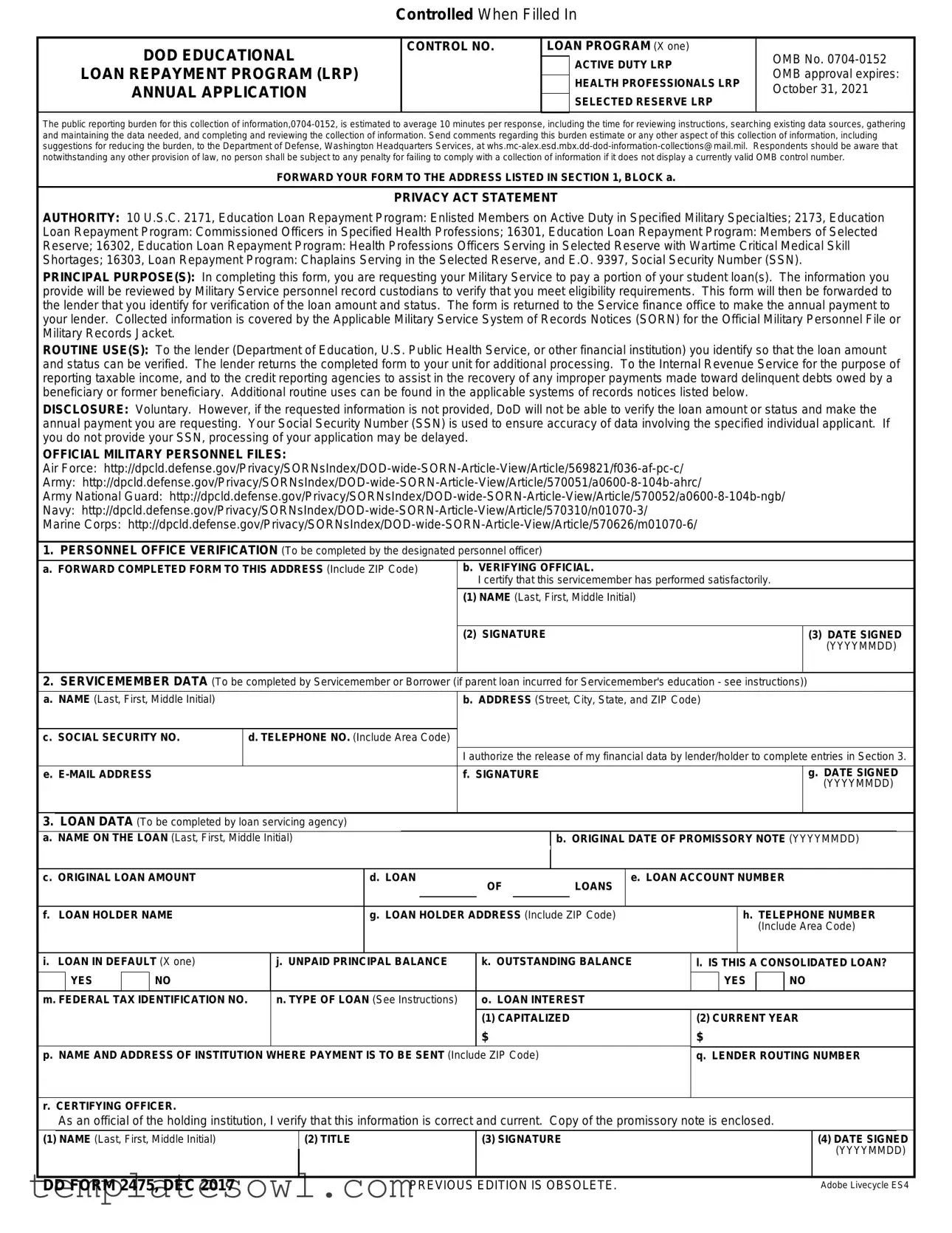

Controlled When Filled In

DOD EDUCATIONAL

LOAN REPAYMENT PROGRAM (LRP)

ANNUAL APPLICATION

CONTROL NO.

LOAN PROGRAM (X one)

ACTIVE DUTY LRP

HEALTH PROFESSIONALS LRP SELECTED RESERVE LRP

OMB No.

The public reporting burden for this collection of

FORWARD YOUR FORM TO THE ADDRESS LISTED IN SECTION 1, BLOCK a.

PRIVACY ACT STATEMENT

AUTHORITY: 10 U.S.C. 2171, Education Loan Repayment Program: Enlisted Members on Active Duty in Specified Military Specialties; 2173, Education

Loan Repayment Program: Commissioned Officers in Specified Health Professions; 16301, Education Loan Repayment Program: Members of Selected

Reserve; 16302, Education Loan Repayment Program: Health Professions Officers Serving in Selected Reserve with Wartime Critical Medical Skill

Shortages; 16303, Loan Repayment Program: Chaplains Serving in the Selected Reserve, and E.O. 9397, Social Security Number (SSN).

PRINCIPAL PURPOSE(S): In completing this form, you are requesting your Military Service to pay a portion of your student loan(s). The information you provide will be reviewed by Military Service personnel record custodians to verify that you meet eligibility requirements. This form will then be forwarded to the lender that you identify for verification of the loan amount and status. The form is returned to the Service finance office to make the annual payment to your lender. Collected information is covered by the Applicable Military Service System of Records Notices (SORN) for the Official Military Personnel File or Military Records Jacket.

ROUTINE USE(S): To the lender (Department of Education, U.S. Public Health Service, or other financial institution) you identify so that the loan amount and status can be verified. The lender returns the completed form to your unit for additional processing. To the Internal Revenue Service for the purpose of reporting taxable income, and to the credit reporting agencies to assist in the recovery of any improper payments made toward delinquent debts owed by a beneficiary or former beneficiary. Additional routine uses can be found in the applicable systems of records notices listed below.

DISCLOSURE: Voluntary. However, if the requested information is not provided, DoD will not be able to verify the loan amount or status and make the annual payment you are requesting. Your Social Security Number (SSN) is used to ensure accuracy of data involving the specified individual applicant. If you do not provide your SSN, processing of your application may be delayed.

OFFICIAL MILITARY PERSONNEL FILES:

Air Force:

Army:

Army National Guard:

Navy:

Marine Corps:

1.PERSONNEL OFFICE VERIFICATION (To be completed by the designated personnel officer)

a. FORWARD COMPLETED FORM TO THIS ADDRESS (Include ZIP Code) |

b. VERIFYING OFFICIAL. |

|

|

I certify that this servicemember has performed satisfactorily. |

|

|

(1) NAME (Last, First, Middle Initial) |

|

|

|

|

|

(2) SIGNATURE |

(3) DATE SIGNED |

|

|

(YYYYMMDD) |

2.SERVICEMEMBER DATA (To be completed by Servicemember or Borrower (if parent loan incurred for Servicemember's education - see instructions))

a. NAME (Last, First, Middle Initial) |

|

b. ADDRESS (Street, City, State, and ZIP Code) |

|

|

|

|

|

|

|

|

|

c. SOCIAL SECURITY NO. |

d. TELEPHONE NO. (Include Area Code) |

|

|

|

|

|

|

|

|

I authorize the release of my financial data by lender/holder to complete entries in Section 3. |

|

|

|

|

|

e. |

|

f. SIGNATURE |

g. DATE SIGNED |

|

|

|

(YYYYMMDD) |

|

|

|

|

3.LOAN DATA (To be completed by loan servicing agency)

a. |

NAME ON THE LOAN (Last, First, Middle Initial) |

|

|

|

b. ORIGINAL DATE OF PROMISSORY NOTE (YYYYMMDD) |

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

c. ORIGINAL LOAN AMOUNT |

|

d. LOAN |

OF |

|

LOANS |

e. LOAN ACCOUNT NUMBER |

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

f. LOAN HOLDER NAME |

|

g. LOAN HOLDER ADDRESS (Include ZIP Code) |

|

|

|

h. TELEPHONE NUMBER |

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Include Area Code) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

i. LOAN IN DEFAULT (X one) |

j. UNPAID PRINCIPAL BALANCE |

k. OUTSTANDING BALANCE |

l. IS THIS A CONSOLIDATED LOAN? |

|

||||||||||||||

|

|

YES |

|

NO |

|

|

|

|

|

|

|

|

|

YES |

|

NO |

|

|

m. FEDERAL TAX IDENTIFICATION NO. |

n. TYPE OF LOAN (See Instructions) |

o. LOAN INTEREST |

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

(1) CAPITALIZED |

|

(2) CURRENT YEAR |

|

|||||||

|

|

|

|

|

|

|

|

$ |

|

|

|

|

$ |

|

|

|

|

|

p. NAME AND ADDRESS OF INSTITUTION WHERE PAYMENT IS TO BE SENT (Include ZIP Code) |

|

|

|

q. LENDER ROUTING NUMBER |

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

r. CERTIFYING OFFICER.

As an official of the holding institution, I verify that this information is correct and current. Copy of the promissory note is enclosed.

(1)NAME (Last, First, Middle Initial)

DD FORM 2475, DEC 2017

(2) TITLE |

(3) SIGNATURE |

|

|

PREVIOUS EDITION IS OBSOLETE.

(4)DATE SIGNED (YYYYMMDD)

Adobe Livecycle ES4

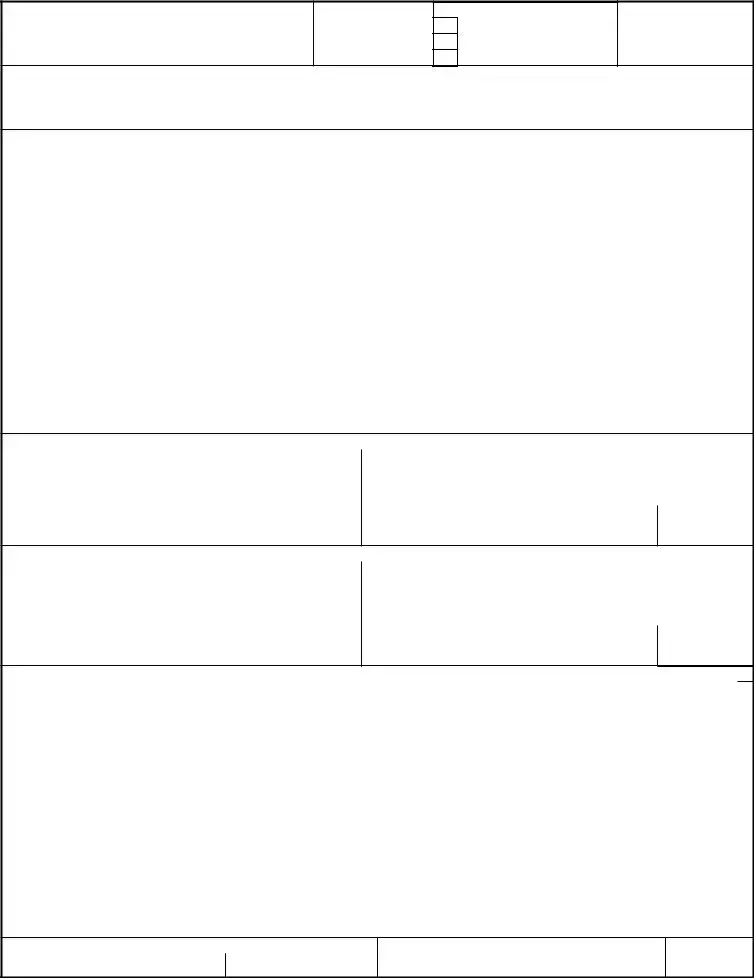

Controlled When Filled In

4.a. ORIGINAL LOAN AMOUNT

b. CANCELLED AMOUNT

c. DISBURSED AMOUNT

d. DATE OF DISBURSEMENT (YYYYMMDD)

5. REMARKS

DDFORM 2475, "DOD EDUCATIONAL LOAN REPAYMENT PROGRAM (LRP) ANNUAL APPLICATION" INSTRUCTIONS

SECTION 1. PERSONNEL OFFICE VERIFICATION (To be completed by the designated personnel officer.)

1.a. - b.

SECTION 2. SERVICEMEMBER DATA

(To be completed by Servicemember or Borrower.)

2.a. - g. Servicemember or Borrower must complete. If the Borrower is the parent and has a Parent Loan for Undergraduate Students incurred for the Servicemember's education, please ensure the Servicemember's full name and last 4 digits of their SSN are provided in Section 5, Remarks.

SECTION 3. LOAN DATA

(To be completed by loan servicing agency.)

3.a. Name as it appears on the promissory note. 3.b. - c.

3.d. Loan ___ of ___ Loans. A separate DD Form 2475 must be completed for each loan if Borrower has more than one (1) loan. For example, loan 1 of 3 loans, loan 2 of 3 loans, and loan 3 of 3 loans.

3.e. Loan Account Number to be used to ensure payments are applied to the correct amount.

3.f. - h. Identify the name, address, and telephone number of the institution that currently services the loan. Please list any additional contact information in Section 5, Remarks.

3.i. Mark X in the appropriate box. 3.j.

3.k.

3.l. If multiple loans have been consolidated, mark (X) "Yes"

or "No" indicating consolidating action.

3.m. Provide Federal tax identification number for tax withholding.

DD FORM 2475 (BACK), DEC 2017

3.n. Type of Loan. Select from list below: The loan must qualify under the Higher Education Act of 1965, Title 4, Parts B, D, and E; the Health Education Assistance Loan under Part C, Title VII, Public Health Service Act; under Part B, Title VIII; Health Professional Loans that the SECDEF determines to be critical to meet wartime medical skill shortages; William D. Ford Federal Direct Loan; or any loan incurred for educational purposes made by a lender that is: (1) an agency or instrumentality of a State; (2) a financial or credit institution (including an insurance company) that is subject to examination and supervision by an agency or the United States or any State; or (3) from a pension fund or a

Office of the Undersecretary of Defense for Personnel and Readiness (Military Personnel Policy) (Accession Policy) through each Service's Education Representatives).

NOTE: For eligible LRP participants - Parent Loans for Undergraduate Students (PLUS) and Consolidated Loans are also eligible for repayment under the LRP, as long as the loans were incurred for the Servicemember's education. Since the loans may be in someone else's name and could include loans incurred for individual's education other than the Servicemember (such as a sibling or loans incurred for their own education), it would be necessary to have the borrower complete Section 2 and include information regarding the education for which the loans were incurred.

3.o.

3.p. Complete this block only if different than the one listed in 3.f. and 3.g. 3.q. Lender may not use a routing number as the payment address.

3.r.

SECTION 4. LOAN DATA (To be completed by loan servicing agency.)

4.a.

4.b. Amount cancelled after Origination Date of Loan. 4.c.

4.d. Date of each individual disbursement.

SECTION 5. REMARKS.

Use this section to enter additional information that will assist in processing this application.

After completion and signature, please return form to the address listed in Section 1.a.

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | The DD Form 2475 is used for the Department of Defense Educational Loan Repayment Program, allowing servicemembers to request partial repayment of their student loans. |

| Eligibility | Active duty enlisted members, commissioned officers in specified health professions, and members of the Selected Reserve can apply for loan repayment through this form. |

| Privacy Act Compliance | This form is governed by the Privacy Act of 1974, which means that the information provided is protected and used solely for verification purposes within the Department of Defense. |

| OMB Approval | The form has an OMB approval number (0704-0152) and was set to expire on October 31, 2021. However, this does not mean the form is invalid; it simply indicates a review period. |

| Collection Burden | Participants can expect to spend approximately 10 minutes completing the form. This estimate includes time for gathering information and reviewing instructions. |

| Loan Types | The program includes eligibility for various loan types, such as the William D. Ford Federal Direct Loan and certain health professional loans deemed critical during wartime. |

| Disclosure Information | While providing the requested information is voluntary, not submitting certain key details could hinder the Department of Defense’s ability to process loan repayments. |

| Submission Process | After completing the form, servicemembers must forward it to the designated address noted in Section 1, facilitating timely processing by the appropriate personnel. |

Guidelines on Utilizing Dd 2475

After completing the DD 2475 form, you will need to submit it to the designated address specified in the form. Make sure all required sections are filled out accurately to avoid any delays in processing your application.

- Section 1: Personnel Office Verification - This step is for the designated personnel officer.

a. Forward the completed form to the specified address (include ZIP code).

b. Verify the servicemember’s satisfactory performance by completing the necessary details, including the name, signature, and date signed. - Section 2: Servicemember Data - This section must be filled out by the servicemember or the borrower if a parent loan was incurred.

a. Provide your name (Last, First, Middle Initial).

b. Fill in your address (Street, City, State, and ZIP Code).

c. Enter your Social Security number.

d. Include your telephone number (include area code).

e. Provide your email address.

f. Sign the form.

g. Include the date signed (YYYYMMDD). - Section 3: Loan Data - This section should be completed by the loan servicing agency.

a. Fill in the name as it appears on the promissory note.

b. Include the original date of the promissory note (YYYYMMDD).

c. Enter the original loan amount.

d. Indicate the total number of loans (e.g., Loan 1 of 3).

e. Fill in the loan account number.

f. Include the name of the loan holder.

g. Provide the loan holder’s address (include ZIP code).

h. Enter the loan holder's telephone number (include area code).

i. Mark "X" if the loan is in default.

j. Fill in the unpaid principal balance.

k. Enter the outstanding balance.

l. Indicate if this is a consolidated loan (mark "Yes" or "No").

m. Provide the Federal tax identification number.

n. Select the type of loan from the provided options.

o. Fill in the loan interest amounts: capitalized and current year.

p. If the payment address differs, enter the name and address of the institution where the payment is to be sent (include ZIP code).

q. Provide the lender routing number.

r. The certifying officer should complete their information, including name, title, signature, and date signed (YYYYMMDD). - Section 4: Loan Data - To be completed by the loan servicing agency.

a. Include the original loan amount.

b. Write the cancelled amount.

c. State the disbursed amount.

d. Enter the date of each disbursement (YYYYMMDD). - Section 5: Remarks - Use this section for any additional information that will assist in processing the application.

Once everything is complete and signed, remember to submit the form as directed. Ensure that you keep a copy for your records.

What You Should Know About This Form

What is the DD 2475 form?

The DD 2475 form is an application used by servicemembers to request payment for a portion of their student loans through the Department of Defense's Educational Loan Repayment Program (LRP). This form serves to verify eligibility and details of the loans to facilitate the repayment process.

Who is eligible to use the DD 2475 form?

The form is intended for active duty servicemembers, health professionals, and members of the Selected Reserve. Each eligibility category may have specific criteria, so it's important for applicants to review the program guidelines to determine their eligibility before submitting the form.

How do I complete the DD 2475 form?

The form consists of several sections. The servicemember or borrower must fill out personal data and loan details in Section 2. A designated personnel officer will verify the servicemember's information in Section 1. The loan servicing agency completes Section 3, which includes important information such as the loan account number and loan holder information. Ensure that all sections are completed accurately to avoid delays.

What information is required on the form?

Applicants need to provide personal information including their name, address, Social Security number, and contact details. Additionally, they must include information about the loan, such as the loan account number, outstanding balance, and the name of the loan holder. Accurate information is crucial as it helps ensure the timely processing of the application.

Where do I send the completed DD 2475 form?

After completing the form, it should be forwarded to the address indicated in Section 1, Block a. This is usually the finance office associated with the servicemember's unit. It is essential to ensure that the form reaches the correct office to avoid any processing delays.

Is submitting the DD 2475 form mandatory?

While submission of the DD 2475 form is voluntary, not providing the requested information means the Department of Defense cannot verify the loan amount or status. Consequently, the DoD will be unable to make the annual payment that the servicemember is requesting. Thus, completing and submitting the form is important for those seeking loan repayment assistance.

How long does it take to process the DD 2475 form?

The processing time can vary, but on average, it might take several weeks. Factors such as the accuracy of the submitted information, verification processes, and the volume of applications received can influence the time frame. To help expedite processing, ensure that all sections are filled out completely and accurately before submission.

What happens after I submit the DD 2475 form?

Once submitted, the form will be reviewed by military personnel who will verify eligibility. The lender will also confirm loan details and status. After all information is validated, the completed form is sent back to the finance office to initiate the annual payment to the lender. It’s advisable to keep track of the submitted form and follow up if there are any delays.

Common mistakes

Completing the DD Form 2475 is essential for those seeking assistance under the Department of Defense Educational Loan Repayment Program. However, applicants often make mistakes during this process that can lead to delays or denials. Understanding common errors can help ensure a smoother submission.

One common mistake is not providing accurate personal information. Often, applicants misenter their name, address, or Social Security Number. It's vital to ensure that the name matches the one on the promissory note, as discrepancies can cause verification issues. Double-check your information before submitting the form to avoid this pitfall.

In Section 2, some applicants forget to include their telephone number and email address. Providing this contact information can facilitate communication, particularly if there are questions or issues related to your application. Lack of contact details may result in processing delays, so ensure these fields are filled out completely.

Another frequent mistake is failing to complete the Loan Data section accurately. Applicants may skip fields or provide incomplete information about their loans, such as the loan account number or the original loan amount. Each loan must be addressed individually, and any missing information can hinder timely processing of the repayment request.

Some individuals mistakenly believe that a single form can apply to multiple loans. Every loan requires a separate DD Form 2475. Therefore, it is crucial to follow the instructions carefully to list each loan individually, identifying it as “Loan ___ of ___ Loans.” Neglecting this detail could lead to misunderstandings with the lender and a lack of payments.

Omitting the necessary signatures can also be problematic. Both the servicemember or borrower and the verifying official must sign the form for it to be valid. Not providing these signatures will result in automatic rejection of the form, so ensure you have signed in all required sections.

Some applicants fail to check the box indicating whether their loan is in default. This information is crucial for lenders, as it affects payment options and eligibility. A simple oversight in this area can lead to complications later, so it's essential to carefully mark your response.

Finally, some people do not provide additional remarks when necessary. Section 5 allows you to include notes that may help clarify any unique aspects of your situation. Omitting this information can result in misunderstandings or missed details essential for processing your application.

Avoiding these common mistakes when completing the DD Form 2475 is critical. A careful review of the form and its instructions can lead to smoother processing of your loan repayment application and help ensure that you receive the assistance you need.

Documents used along the form

The DD Form 2475 serves as the application for the Department of Defense Educational Loan Repayment Program. Individuals frequently submit other forms and documents in conjunction with this form. The following is a list of related documents that may be relevant during this process.

- DD Form 214: This is the Certificate of Release or Discharge from Active Duty. It provides evidence of military service and is often required to establish eligibility for various benefits, including loan repayment programs.

- Loan Promissory Note: This document outlines the terms and conditions of the loan, including the borrower's commitment to repay. It is important for verifying the loan information needed on the DD Form 2475.

- VA Form 22-1990: This form is used to apply for educational assistance from the Department of Veterans Affairs. It may be submitted by servicemembers or veterans seeking alternative funding for education-related expenses.

- Financial Eligibility Documents: Various documents such as tax returns, pay stubs, or loan statements may be needed to assess financial eligibility and verify the loan status. These documents support the information provided in the DD Form 2475.

These documents complement the DD Form 2475 in ensuring accurate processing of educational loan repayment requests. Ensuring all requested forms and supplementary documentation are complete can help facilitate a smooth application process.

Similar forms

Form W-4: This Internal Revenue Service form is used by employees to indicate their tax situation to their employers. Like the DD 2475, it requires personal data and needs verification by authorized personnel for accurate processing of benefits.

FAFSA (Free Application for Federal Student Aid): This form collects financial information from students seeking aid for college. Similar to the DD 2475, it assesses eligibility based on submitted details and requires a verified signature.

Form 1040: The standard individual income tax return form used by the IRS. Like the DD 2475, it necessitates the reporting of financial information to ensure accuracy when calculating benefits or taxes owed.

DD Form 214: This form is issued upon a service member's retirement or discharge from active duty. Both forms require verification of service and personal data, linking back to benefits the individual may receive.

Loan Application Form: This document is used when applying for personal loans, requiring various financial disclosures, similar to the financial data collected on the DD 2475 for loan repayment verification.

Social Security Application (Form SS-5): This form is used to apply for a Social Security number and requires personal identification. Like the DD 2475, it involves personal information and federal processing protocols.

Form 1099: This IRS form is used for reporting income received other than wages, salaries, or tips. Both the 1099 and the DD 2475 are crucial for accurately tracking financial transactions and reporting data to relevant authorities.

IRS Form 8862: This form is used for claiming the Earned Income Tax Credit after a prior denial. Similar to the DD 2475, it involves detailed financial and verification requirements to determine eligibility.

Application for Health Benefits (VA Form 10-10EZ): This form is used by veterans to apply for health benefits. Like the DD 2475, it requires detailed personal and financial information, along with verification from appropriate authorities.

U.S. Citizenship Application (Form N-400): This form is used by foreign nationals to apply for U.S. citizenship. It shares similarities with the DD 2475 in that both require personal information and are subject to scrutiny for eligibility verification.

Dos and Don'ts

Do's and Don'ts for Filling Out the DD 2475 Form

- Do read all instructions carefully before starting.

- Do ensure all sections are filled out completely and accurately.

- Do use your full legal name as it appears on official documents.

- Do provide a current and valid Social Security Number (SSN).

- Do send the completed form to the correct address as specified.

- Don't leave any required fields blank.

- Don't use a routing number as your payment address.

- Don't forget to sign and date the form.

- Don't submit the form without confirming all information is correct.

- Don't disregard the additional remarks section; use it for important notes.

Misconceptions

Understanding the DD 2475 form, which is vital for those participating in the Department of Defense Educational Loan Repayment Program, comes with its own set of misconceptions. Addressing these can aid in better utilization and compliance with the process. Below are eight common misconceptions about the DD 2475 form:

- This form is only for active duty members. In fact, it also covers members of the Selected Reserve and Health Professionals, ensuring that all eligible individuals can benefit from loan repayment assistance.

- You can submit the form any time during the year. The DD 2475 form has specific annual submission windows. Always check the deadlines relevant to your service branch to ensure timely processing.

- The form guarantees loan repayment. Completing the DD 2475 does not automatically guarantee that your loans will be repaid. Eligibility and compliance with specific program requirements are also needed.

- Any type of loan qualifies. Only certain loans are eligible under this program. These include federal loans and others that meet specific criteria, ensuring that only qualifying educational debts are addressed.

- You don't need to include your Social Security Number (SSN). Providing your SSN is essential for accurately processing your application and verifying your identity.

- Once submitted, there is no need for follow-up. It is recommended to maintain communication with your military service personnel to confirm that the form has been processed and to address any issues that may arise.

- Your loan servicer is responsible for contacting you. While they may communicate information, you as the borrower must keep track of the status of your application and any repayment updates.

- Privacy concerns are negligible. Privacy protections are in place. However, understanding how your information will be used is crucial when submitting any form related to your loans.

By recognizing and overcoming these misconceptions, servicemembers can navigate the DDS 2475 process more effectively and ensure they are making the most of the benefits available to them.

Key takeaways

Understand that the DD 2475 form is an essential application for the Department of Defense's Educational Loan Repayment Program (LRP). Filling it out correctly is crucial for receiving loan repayment benefits.

This form must be forwarded to the appropriate address provided in Section 1, Block a. Ensuring it reaches the correct office is vital for processing.

Provide accurate personal information in Section 2. This includes your name, address, Social Security Number, and contact details, ensuring that the information aligns with official records.

Each loan requires its own DD 2475 form. If you have multiple loans, complete a separate form for each one, labeling them accordingly in Section 3.

In the loan data portion, ensure the loan holder's information is complete. This includes name, address, and any required details about the loan account to avoid delays.

It is essential to keep communication open. If your lender contacts you for verification, respond promptly to help with the processing of your application.

Remember, providing your Social Security Number (SSN) is optional but recommended for accuracy. Not providing it could lead to processing delays or complications.

Browse Other Templates

U.S. Taxpayer Foreign Account Declaration - Financial accounts reported might include bank, securities, or other types.

South African Vat - The applicant is required to explain their nature of business or organization type.