Fill Out Your Dd 137 3 Form

The DD Form 137-3, also known as the Dependency Statement - Parent form, is a crucial document used by members of the military to declare their dependency status for their parents. This form ensures that the Department of Defense can accurately assess the eligibility of military personnel to receive certain benefits and allowances for their parents. Filling out this form involves providing significant information, including but not limited to the member's relationship with the parent, the parent's financial circumstances, and both present and past support provided by the member. It’s important to provide detailed responses to each item listed, as any omissions can lead to delays in processing. This form collects data necessary to determine dependency claims, such as the parent’s income, living arrangements, and household expenses. Public reporting requirements indicate that it generally takes between 30 to 60 minutes to complete. Submitting the form is voluntary; however, note that failure to comply will temporarily suspend the dependent entitlements until proper documentation is provided. The DD 137-3 form must be signed, dated, and may require notarization, ensuring that all information provided holds true under penalty of law. Understanding the ins and outs of this form is essential for military families seeking support and benefits associated with dependent care.

Dd 137 3 Example

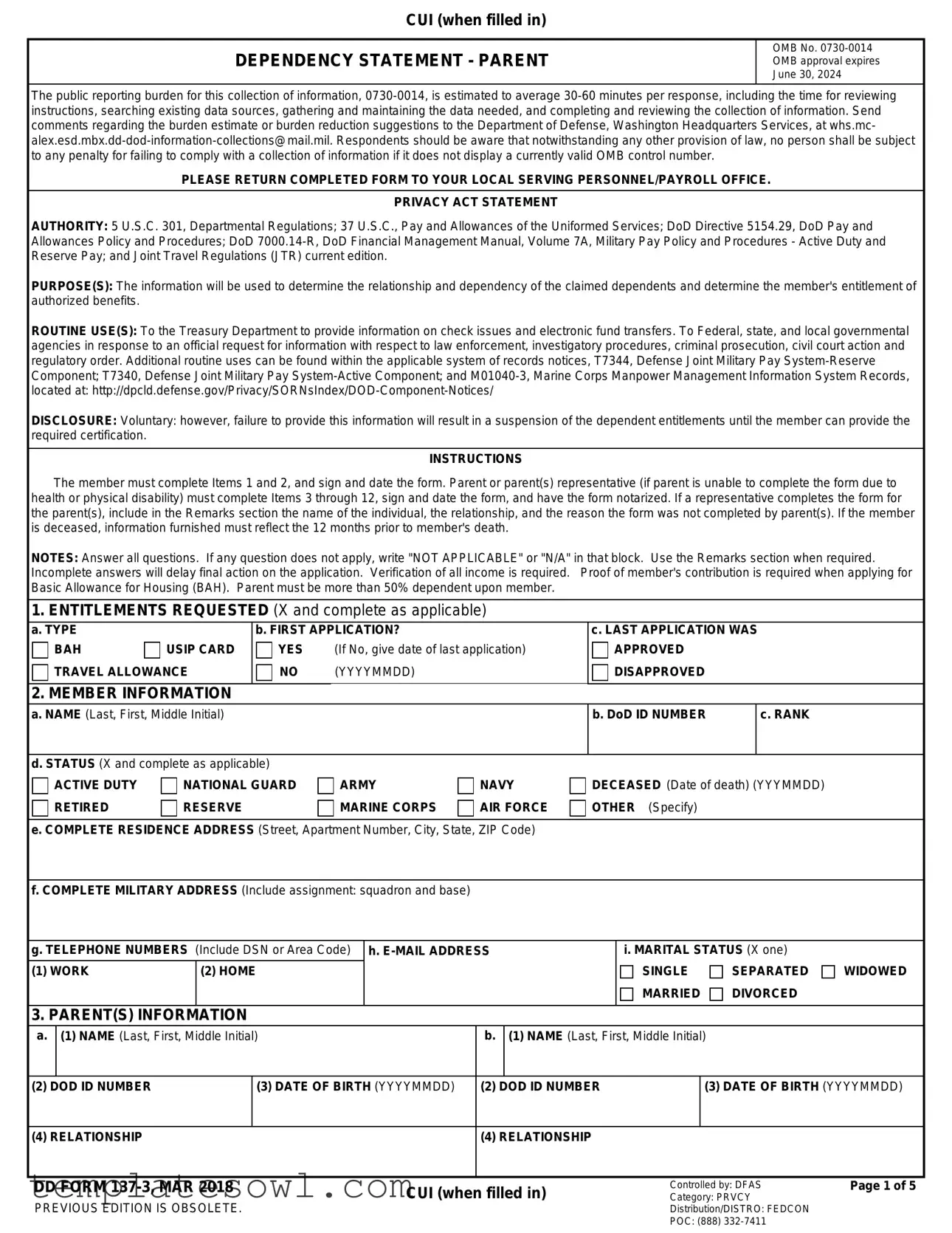

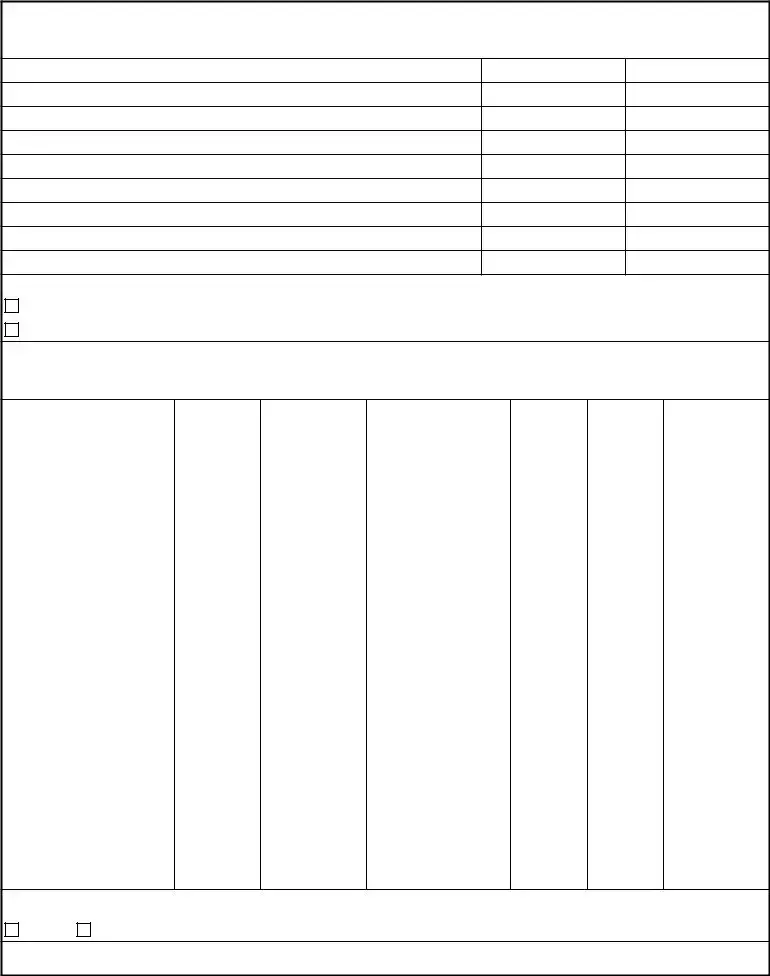

CUI (when filled in)

DEPENDENCY STATEMENT - PARENT

OMB No.

The public reporting burden for this collection of information,

PLEASE RETURN COMPLETED FORM TO YOUR LOCAL SERVING PERSONNEL/PAYROLL OFFICE.

PRIVACY ACT STATEMENT

AUTHORITY: 5 U.S.C. 301, Departmental Regulations; 37 U.S.C., Pay and Allowances of the Uniformed Services; DoD Directive 5154.29, DoD Pay and Allowances Policy and Procedures; DoD

PURPOSE(S): The information will be used to determine the relationship and dependency of the claimed dependents and determine the member's entitlement of authorized benefits.

ROUTINE USE(S): To the Treasury Department to provide information on check issues and electronic fund transfers. To Federal, state, and local governmental agencies in response to an official request for information with respect to law enforcement, investigatory procedures, criminal prosecution, civil court action and regulatory order. Additional routine uses can be found within the applicable system of records notices, T7344, Defense Joint Military Pay

DISCLOSURE: Voluntary: however, failure to provide this information will result in a suspension of the dependent entitlements until the member can provide the required certification.

INSTRUCTIONS

The member must complete Items 1 and 2, and sign and date the form. Parent or parent(s) representative (if parent is unable to complete the form due to health or physical disability) must complete Items 3 through 12, sign and date the form, and have the form notarized. If a representative completes the form for the parent(s), include in the Remarks section the name of the individual, the relationship, and the reason the form was not completed by parent(s). If the member is deceased, information furnished must reflect the 12 months prior to member's death.

NOTES: Answer all questions. If any question does not apply, write "NOT APPLICABLE" or "N/A" in that block. Use the Remarks section when required. Incomplete answers will delay final action on the application. Verification of all income is required. Proof of member's contribution is required when applying for Basic Allowance for Housing (BAH). Parent must be more than 50% dependent upon member.

1.ENTITLEMENTS REQUESTED (X and complete as applicable)

a. TYPE |

|

BAH |

USIP CARD |

TRAVEL ALLOWANCE

TRAVEL ALLOWANCE

2. MEMBER INFORMATION

b. FIRST APPLICATION?

YES (If No, give date of last application)

YES (If No, give date of last application)

NO (YYYYMMDD)

c. LAST APPLICATION WAS

APPROVED

APPROVED

DISAPPROVED

DISAPPROVED

a. NAME (Last, First, Middle Initial)

b. DoD ID NUMBER

c. RANK

d. STATUS (X and complete as applicable) |

|

|

|

ACTIVE DUTY |

NATIONAL GUARD |

ARMY |

NAVY |

RETIRED |

RESERVE |

MARINE CORPS |

AIR FORCE |

DECEASED (Date of death) (YYYMMDD)

DECEASED (Date of death) (YYYMMDD)

OTHER (Specify)

OTHER (Specify)

e. COMPLETE RESIDENCE ADDRESS (Street, Apartment Number, City, State, ZIP Code)

f. COMPLETE MILITARY ADDRESS (Include assignment: squadron and base)

g. TELEPHONE NUMBERS (Include DSN or Area Code)

(1) WORK |

(2) HOME |

3. PARENT(S) INFORMATION

h.

i. MARITAL STATUS (X one)

SINGLE

SEPARATED

SEPARATED

MARRIED  DIVORCED

DIVORCED

WIDOWED

a. |

(1) NAME (Last, First, Middle Initial) |

|

b. |

(1) NAME (Last, First, Middle Initial) |

|

|||

|

|

|

|

|

|

|

||

(2) DOD ID NUMBER |

(3) DATE OF BIRTH (YYYYMMDD) |

(2) DOD ID NUMBER |

|

(3) DATE OF BIRTH (YYYYMMDD) |

||||

|

|

|

|

|

|

|

|

|

(4) RELATIONSHIP |

|

|

(4) RELATIONSHIP |

|

|

|

||

|

|

|

|

|

|

|||

DD FORM |

|

CUI (when |

filled in) |

Category: PRVCY |

Page 1 of 5 |

|||

|

|

|

|

|

|

Controlled by: DFAS |

|

|

PREVIOUS EDITION IS OBSOLETE. |

|

|

|

|

Distribution/DISTRO: FEDCON |

|

||

|

|

|

|

|

|

POC: (888) |

|

|

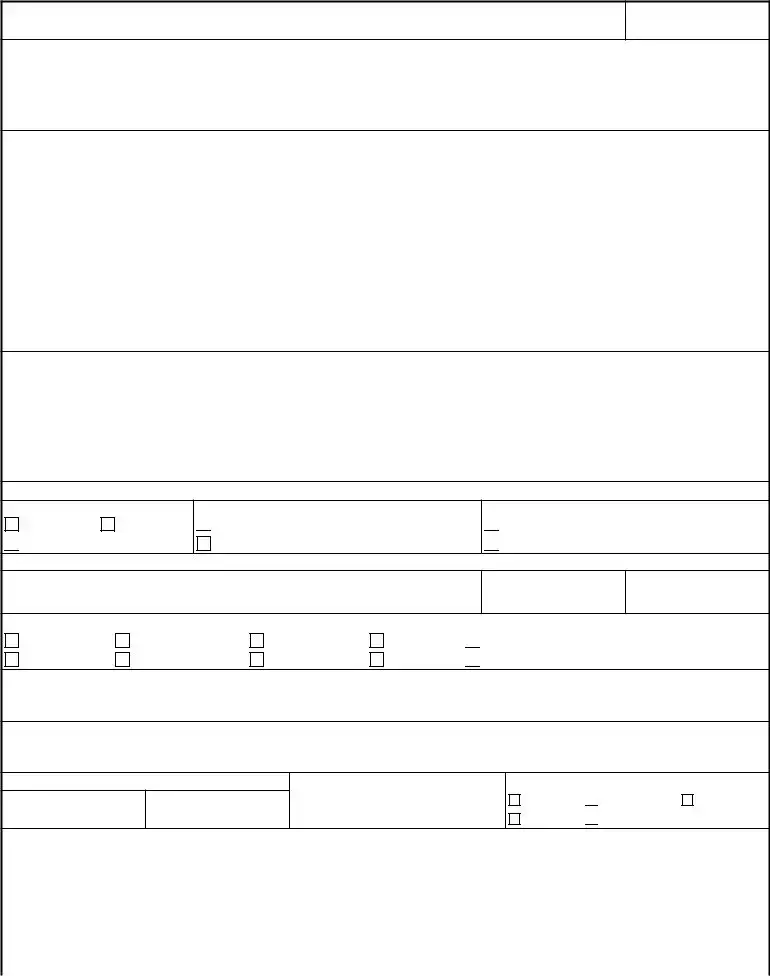

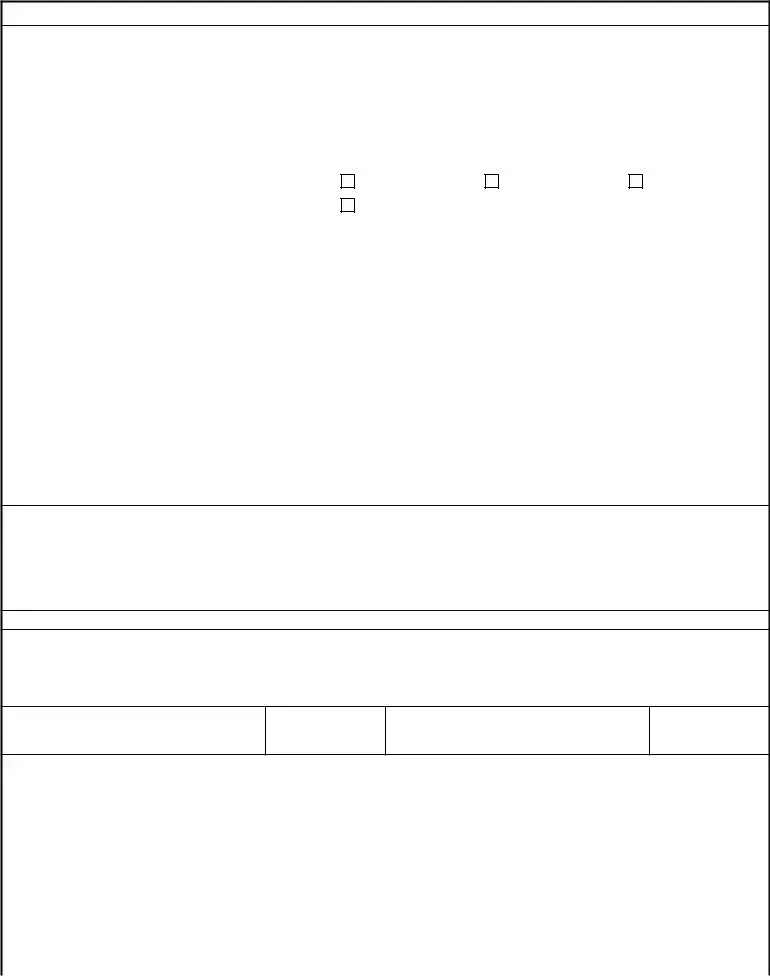

CUI (when filled in)

3. PARENT(S) INFORMATION (Continued)

a. |

(5) COMPLETE ADDRESS (Street, Apartment Number, City, State, ZIP Code) |

b. |

(5) COMPLETE ADDRESS (Street, Apartment Number, City, State, ZIP Code) |

|

|

||

(6) TELEPHONE NUMBER (Include Area Code) |

(6) TELEPHONE NUMBER (Include Area Code) |

||

|

|

||

(7) PRESENT OCCUPATION OR BUSINESS |

(7) PRESENT OCCUPATION OR BUSINESS |

||

(8)NAME AND ADDRESS OF EMPLOYER (If unemployed, state reason, date (8) NAME AND ADDRESS OF EMPLOYER (If unemployed, state reason, date

unemployment began, and date unemployment is expected to resume.) |

unemployment began, and date unemployment is expected to resume.) |

c. MARITAL STATUS (X one) |

|

d. IF SPOUSE IS DECEASED OR LEGALLY SEPARATED FROM PARENT, |

MARRIED |

DIVORCED |

GIVE DATE OF DEATH, DIVORCE OR SEPARATION (YYYYMMDD) |

|

||

SINGLE |

LIVING APART UNTIL LEGAL |

|

WIDOWED |

SEPARATION |

|

e. IF PARENT AND SPOUSE LIVE APART OR SPOUSE DOES NOT SUPPORT PARENT, GIVE REASON:

f. CHILDREN (List all parent's living children regardless of age. Show the average monthly contribution to parent from each child. Continue in Remarks section if more space is needed.)

(1) NAME

(Last, First, Middle Initial)

(2)DOD ID NUMBER (Service Members Only)

(3)BRANCH OF SERVICE (If on Active Duty)

(4)MONTHLY CONTRIBUTION TO PARENT

g. DOES ANY OTHER CHILD CLAIM PARENT FOR BAH, TRAVEL ALLOWANCE, OR USIP CARD? (If Yes, give child's name, DoD ID Number, and branch of service.)

YES

YES

NO

NO

4. PARENT'S RESIDENCE

a. TYPE OF RESIDENCE (X and complete as applicable)

|

|

HOME OR APARTMENT OF PARENT |

|

|

HOME OR APARTMENT OF FRIEND OR RELATIVE (State relationship) |

|||

|

|

HOME OR APARTMENT OF MEMBER |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

(Date began residing with member) |

|

|

HOSPITAL OR INSTITUTION |

|

|

|

|

|

|

|

|

|

OTHER (Explain) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b. OWNER OF RESIDENCE |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

(1) NAME (Last, First, Middle Initial) |

(2) ADDRESS (Street, Apartment Number, City, State, ZIP Code) |

|

|

|||||

|

|

|

|

|

|

|

|

|

c. IS RESIDENCE |

d. DATE PARENT STARTED |

LIVING AT |

e. IS CURRENT ADDRESS PARENT'S PERMANENT ADDRESS? |

|

|

|||

|

|

SUBSIDIZED HOUSING? |

CURRENT ADDRESS (YYYYMMDD) |

YES |

(If No, explain where else parent lives and number of months there each year.) |

|

||

|

|

|

||||||

|

|

YES |

|

|

|

|||

|

|

|

|

NO |

|

|

|

|

|

|

NO |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

DD FORM |

2018 |

CUI (when filled in) |

Page 2 of 5 |

||||

PREVIOUS EDITION IS OBSOLETE.

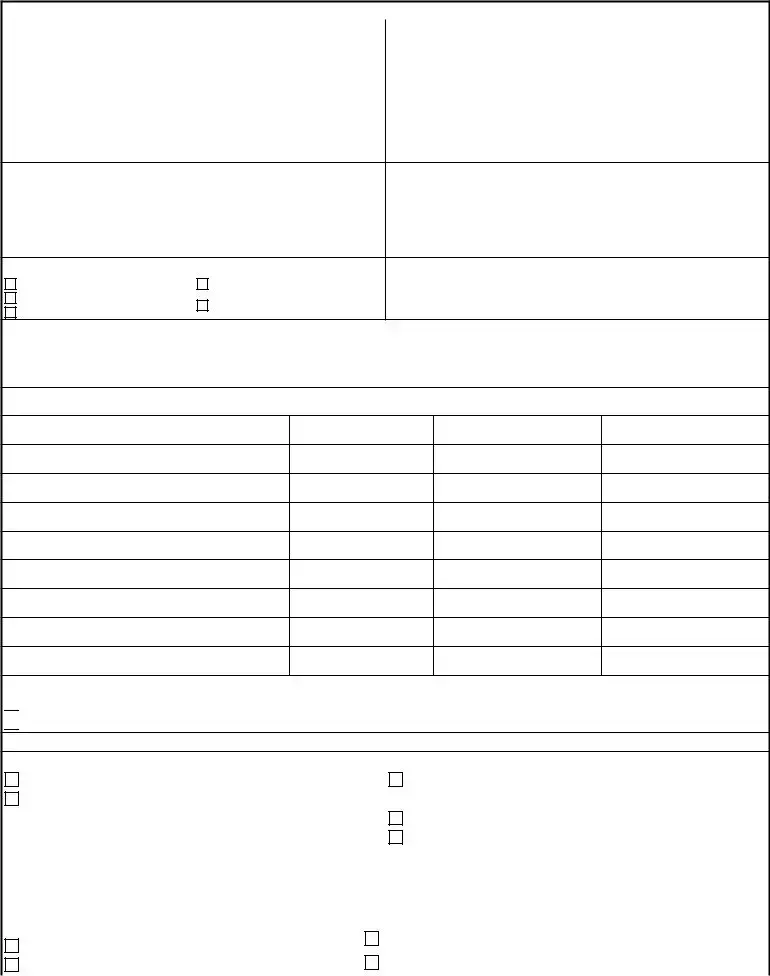

CUI (when filled in)

5. PERSONS LIVING IN HOUSEHOLD WITH PARENT

List all persons who live in the household, including claimed parent. If employed, show hours per week worked. Continue in Remarks if more space is needed.

a. NAME (Last, First, Middle Initial)

b.RELATIONSHIP TO PARENT

c. AGE

d. MARRIED (X) |

e. EMPLOYED |

||||||||

|

|

|

|

|

|

|

|

|

|

|

YES |

|

|

NO |

HOURS PER WEEK |

NO (X) |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

f.MONTHLY CONTRIBUTION TO PARENT

6. HOUSEHOLD EXPENSES

List the household expenses for all persons living in the home. If expense was

FAIR RENTAL VALUE (FRV): FRV is a single monthly sum for the entire dwelling where the parent lives. This sum is an amount the owner can reasonably expect to receive from a stranger to rent the dwelling. FRV will not include food, utilities, furniture, and home repairs, which are listed separately.

|

(1) |

(2) |

|

|

(1) |

(2) |

|

ITEM |

|

PRESENT MONTHLY |

TOTAL EXPENSE FOR |

ITEM |

PRESENT MONTHLY |

TOTAL EXPENSE FOR |

|

|

|

EXPENSE |

PAST 12 MONTHS |

|

EXPENSE |

PAST 12 MONTHS |

|

|

|

|

|

|

|

|

|

a. (X one) |

|

|

|

|

d. FURNITURE AND |

|

|

RENT |

FRV |

|

|

|

|

||

|

|

APPLIANCES |

|

|

|||

MORTGAGE (Specify |

|

|

|

|

|||

|

|

|

|

|

|||

amount of tax and |

|

|

|

|

|

||

|

|

|

|

|

|||

insurance if applicable) |

|

|

|

|

|

||

TAX |

|

|

|

|

e. REPAIRS ON HOME |

|

|

INSURANCE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b. FOOD |

|

|

|

|

f. OTHER (Itemize in Remarks |

|

|

|

|

|

|

|

|

|

|

c. UTILITIES (Heat, power, |

|

|

section) |

|

|

||

water, and telephone) |

|

|

|

|

|

||

7. PARENT'S PERSONAL EXPENSES

List personal expenses for parent, parent's spouse, and their unmarried minor children who are not fully employed and who live in the same household. Do not list personal expenses for the member, his or her immediate family, or any other person. List all of the parent's personal expenses regardless of who is paying for them.

|

(1) |

(2) |

|

|

(1) |

(2) |

ITEM |

PRESENT MONTHLY |

TOTAL EXPENSE FOR |

ITEM |

PRESENT MONTHLY |

TOTAL EXPENSE FOR |

|

|

EXPENSE |

PAST 12 MONTHS |

|

EXPENSE |

PAST 12 MONTHS |

|

a. CLOTHING |

|

|

|

g. PRIVATE AUTO PAYMENTS |

|

|

|

|

|

(If auto is registered in |

|

|

|

|

|

|

|

|

|

|

b. LAUNDRY AND DRY |

|

|

|

parent's name) |

|

|

CLEANING |

|

|

|

h. MONTHLY TRANSPORTA- |

|

|

|

|

|

|

TION PAYMENTS (Include |

|

|

c. MEDICAL (Do not include |

|

|

|

|

|

|

|

|

|

gas, oil, insurance, repairs, |

|

|

|

expenses paid by insurance, |

|

|

|

|

|

|

|

|

|

and public transportation) |

|

|

|

welfare, or Medicare) |

|

|

|

|

|

|

|

|

|

i. SCHOOL EXPENSES (Itemize) |

|

|

|

|

|

|

|

|

|

|

d. VALUE OF USIP CARD |

|

|

|

|

|

|

|

|

|

|

|

|

|

(Verification of amount is |

|

|

|

|

|

|

required) |

|

|

|

|

|

|

e. PERSONAL INSURANCE |

|

|

|

|

|

|

(Specify) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

j. OTHER EXPENSES (Itemize) |

|

|

|

|

|

|

|

|

|

f. PERSONAL TAXES (Specify) |

|

|

|

|

|

|

DD FORM |

CUI (when filled in) |

|

Page 3 of 5

PREVIOUS EDITION IS OBSOLETE.

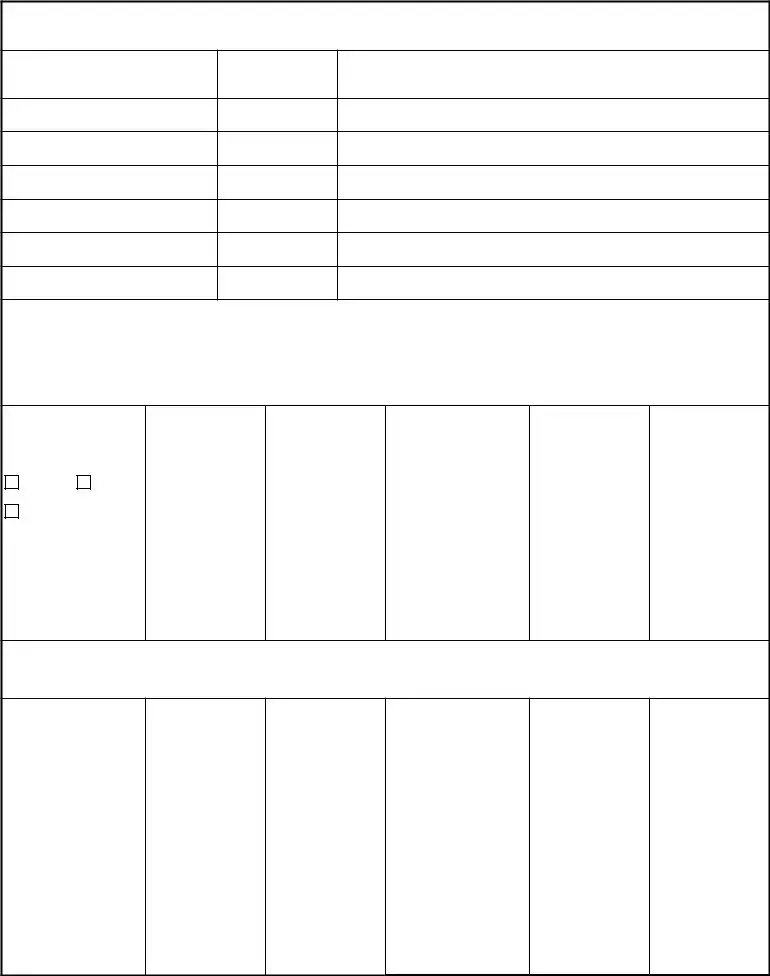

CUI (when filled in)

8. PARENT'S ASSETS

List all assets such as real estate (including home), personal property, farm and/or business equipment, automobiles, trucks, cash, savings of any type, stocks, bonds, etc., whether owned separately by parent, jointly with spouse, or jointly by parent or spouse with another person. Assets must be listed even though parent may not be using the income earned by these assets, but is allowing the interest of dividends to accrue.

a. DESCRIPTION

b. PRESENT VALUE

c. PARENT'S EQUITY

d. IS PARENT LIQUIDATING ASSETS? (For example, is parent withdrawing money from savings, or selling stocks and bonds?)

YES |

IF YES, HOW MUCH OF PARENT'S CAPITAL IS USED MONTHLY? |

$ |

NO |

EXPLAIN: |

|

9. PARENT'S INCOME

All gross income received by parent and parent's spouse, whether taxable or nontaxable, and whether received monthly, quarterly, or yearly, must be listed. If any income received includes funds for children, be sure to show the amount received for them. List income for parents and children separately. If any income received during the past 12 months was a

|

(1) PRESENT |

(2) TOTAL INCOME |

|

PARENT/ |

(1) PRESENT |

(2) TOTAL INCOME |

|

SOURCE |

MONTHLY |

FOR PAST 12 |

SOURCE |

MONTHLY |

FOR PAST 12 |

||

CHILDREN |

|||||||

|

INCOME |

MONTHS |

|

INCOME |

MONTHS |

||

|

|

|

|||||

|

|

|

|

|

|

|

|

a. WAGES, SALARIES, TIPS, OR |

|

|

|

Parent |

|

|

|

OTHER CASH GRATUITIES |

|

|

i. SCHOLARSHIPS OR |

|

|

||

|

|

|

|

|

|||

b. INTEREST ON INVESTMENTS, |

|

|

|

|

|

||

|

|

EDUCATIONAL GRANTS |

|

|

|

||

BONDS, SAVINGS, TRUST |

|

|

|

Child |

|

|

|

FUNDS, ETC. |

|

|

|

|

|

|

|

c. INSURANCE OR PUBLIC/ |

|

|

j. SOCIAL SECURITY |

|

|

|

|

GOVERNMENT PENSION |

|

|

PAYMENTS, DISABILITY |

Parent |

|

|

|

PAYMENTS, UNEMPLOYMENT OR |

|

|

OR REGULAR |

|

|

|

|

DISABILITY COMPENSATION |

|

|

(Specify type) |

|

|

|

|

|

|

|

|

|

|||

(Specify type) |

|

|

|

|

|

||

|

|

|

Child |

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

d. NET INCOME FROM RENTAL |

|

|

|

Parent |

|

|

|

PROPERTY, BUSINESS AND |

|

|

k. SUPPLEMENTAL |

|

|

||

|

|

|

|

|

|||

FARMING (Specify type and |

|

|

SECURITY INCOME (SSI) |

Child |

|

|

|

explain in Remarks section) |

|

|

|

|

|

|

|

e. FOREIGN PENSION PAYMENTS |

|

|

l. VETERANS |

Parent |

|

|

|

(Specify type and if received |

|

|

ADMINISTRATION |

|

|

||

based on previous employment, |

|

|

PAYMENTS (Specify type) |

|

|

|

|

|

|

|

|

|

|||

parent's need, age, military |

|

|

|

Child |

|

|

|

service, etc., in Remarks section) |

|

|

|

|

|

|

|

f. CONTRIBUTIONS FROM |

|

|

m. STATE OR LOCAL |

|

|

|

|

PERSONS OTHER THAN |

|

|

Parent |

|

|

||

|

|

WELFARE AID, |

|

|

|||

MEMBER |

|

|

|

|

|

||

|

|

INCLUDING AID TO |

|

|

|

||

|

|

|

|

|

|

||

g. TAX REFUNDS (Specify) |

|

|

DEPENDENT CHILDREN |

|

|

|

|

|

|

|

|

|

|||

|

|

|

(Include agency in |

Child |

|

|

|

|

|

|

Remarks section) |

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

h. OTHER (Specify) |

|

|

n. PAYMENT OR ALIMONY |

Parent |

|

|

|

|

|

|

|

|

|||

|

|

|

FROM SEPARATED OR |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

DIVORCED SPOUSE |

Child |

|

|

o. HAS PARENT OR SPOUSE APPLIED FOR ANY TYPE OF PENSION, SOCIAL SECURITY, VA, DISABILITY, UNEMPLOYMENT, OR RETIREMENT PAYMENTS NOT YET RECEIVED? (If Yes, explain.)

YES |

NO |

IF PARENT OR SPOUSE HAS REACHED THE ELIGIBILITY AGE FOR SOCIAL SECURITY BENEFITS (Unremarried widow or widower, 60 or older, retired, 62 or older), BUT DOES NOT RECEIVE THEM, FURNISH DISALLOWANCE LETTER FROM THE SOCIAL SECURITY ADMINISTRATION.

DD FORM |

CUI (when filled in) |

|

Page 4 of 5

PREVIOUS EDITION IS OBSOLETE.

CUI (when filled in)

10. MEMBER'S CONTRIBUTION

a. SHOW THE TOTAL AMOUNT THE MEMBER GAVE PARENT, OR PAID IN PARENT'S BEHALF FOR EACH OF THE PAST 12 MONTHS.

(1) MONTH AND YEAR |

(2) AMOUNT |

(1) MONTH AND YEAR |

(2) AMOUNT |

(1) MONTH AND YEAR |

(2) AMOUNT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b. MEMBER PROVIDES SUPPORT BY (X one) |

ALLOTMENT |

PERSONAL CHECK |

MONEY ORDER |

|

|

|

|

(Verification documentation is required for BAH claims) |

OTHER (Explain) |

|

|

|

|

|

|

|

|

|

|

11. REMARKS (Use back if necessary) |

|

|

|

READ THE PENALTY PROVISIONS, SIGN AND DATE THE FORM, AND HAVE IT NOTARIZED.

NOTE: Whoever, in any matter within the jurisdiction of any department or agency of the United States, knowingly and willfully falsifies, conceals, or covers up by any trick, scheme, or device, a material fact, or makes any false, fictitious, or fraudulent statements or representations, or makes or uses any false writing or document knowing the same to contain any false, fictitious, or fraudulent statement or entry, shall be fined as provided in Title 18, or imprisoned not more than 5 years, or both (U.S. Code, title 18, section 1001). The information provided in this form may be referred to the appropriate Military Service investigative agency.

I make the foregoing claim with full knowledge of the penalties involved for willfully making a false claim. (U.S. Code, title 18, section 287, formerly section 80 provides a penalty as follows: Imprisonment for not more than five years and subject to a fine in the amount provided in this title.)

12.SIGNATURES a. PARENT(S)

I, |

|

(print name) and |

|

(print name) |

|

|

|

|

|

will immediately notify the service concerned of any changes in residency, financial circumstances, or dependency upon the member.

(1) PARENT'S SIGNATURE

(2)DATE SIGNED (YYYYMMDD)

(3) PARENT'S SIGNATURE

(4)DATE SIGNED (YYYYMMDD)

b. NOTARY PUBLIC

Subscribed and duly sworn (or affirmed) to before me according to law by the above named affiant(s). |

|

|

|

|

|

||||||||

This |

day of |

, |

|

, at city (or town) of |

|

|

, county of |

|

, |

||||

and state (or territory) of |

|

|

|

, |

|

|

|

|

|

, |

|||

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

(Notary) |

|

|

|

|

(Official Seal) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Official Title) |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

||

c. MEMBER |

|

|

|

|

|

|

|

|

|

|

|

||

(1) SIGNATURE |

|

|

|

|

|

|

|

|

(2) DATE SIGNED (YYYYMMDD) |

||||

|

|

|

|

|

|

|

|

|

|

|

|||

DD FORM |

|

|

CUI (when filled in) |

|

|

|

Page 5 of 5 |

||||||

PREVIOUS EDITION IS OBSOLETE.

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Title | The official title of the form is Dependency Statement - Parent. |

| OMB Control Number | The form is associated with OMB No. 0730-0014. |

| Reporting Burden | It is estimated to take 30-60 minutes to complete this form. |

| Submission Instruction | Completed forms should be returned to the local personnel or payroll office. |

| Privacy Act Statement | The form collects personal information under the authority of multiple U.S. regulations, including 5 U.S.C. 301. |

| Purpose of the Form | The information gathered is used to establish the dependency status of claimed dependents for benefits entitlement. |

| Disclosure | Submission of information is voluntary, but failure to provide it may suspend dependent entitlements. |

| Notarization Requirement | The form must be signed by the parent or representative, and notarization is required if a representative completes the form. |

| Eligibility Dependence | For claims, the parent must be more than 50% dependent on the service member. |

| Governing Laws | The form is governed by laws including 37 U.S.C., Defense Joint Travel Regulations, and DoD Financial Management Manual. |

Guidelines on Utilizing Dd 137 3

To proceed with submitting the DD Form 137-3, it is essential to accurately complete each required section. Failing to provide all necessary information could delay the processing of your application. Proper adherence to the outlined instructions aids in ensuring a smoother process and prevents complications associated with incomplete applications.

- Begin by marking the entitlements requested in Item 1. Select the type you are applying for by checking the appropriate box.

- In Item 2, provide the member's information, including their name, DoD ID number, rank, status, complete address, and relevant telephone numbers. If applicable, state if this is the first application or a subsequent one.

- Complete Item 3, providing details for the parent(s) including names, DoD ID numbers, dates of birth, and relationships. Ensure you fill out this information for both parents, if applicable.

- Input the parent’s residence details in Item 4. Specify whether the residence is owned, subsidized, or in another form. Indicate the date the parent started living at their current address.

- List all individuals residing with the parent in Item 5 and provide details about their relationship to the parent, age, employment status, and monthly contributions.

- In Item 6, provide an overview of all household expenses. Categorize these expenses appropriately by months or year totals.

- Detail the parent’s personal expenses in Item 7. Document each item and its associated costs.

- Outline the parent’s assets in Item 8. Include descriptions and valuations such as real estate or cash holdings.

- In Item 9, summarize the parent’s income sources. Include monthly income and total income for the past year, ensuring to differentiate between parent and child income where applicable.

- Input the total amount the member contributed to the parent in Item 10. Record the amount given monthly over the past year and the method of support.

- Use the Remarks section to add any necessary additional information that does not fit in the required fields.

- Sign and date the form in Item 12. If applicable, have the signatures notarized, and ensure proper execution according to legal requirements.

What You Should Know About This Form

What is the DD Form 137-3?

The DD Form 137-3, also known as the Dependency Statement – Parent, is used to establish the relationship and financial dependency of a parent on a member of the Uniformed Services. This form is necessary for military personnel to claim benefits for their parents, such as Basic Allowance for Housing (BAH) or other allowances. It is crucial for active duty members and their dependents to fill it out accurately to avoid any disruption in benefits.

Who needs to complete the DD Form 137-3?

The service member must complete the first part of the form. If a parent is unable to fill it out due to health or physical disability, a representative can do so on their behalf. In this case, the representative must provide adequate information about their relationship with the parent and the reason for their assistance. All required items must be filled out, with proper signatures and notary verification when necessary.

What information is required on the form?

The form collects a range of information including details about the member, the parent(s), their living situation, household income, and monthly expenses. It requires specifics such as contact information, the number of individuals living in the household, and any contributions the member makes toward their parent’s support. Accurate and complete details are necessary to prevent delays in processing.

What happens if the form is incomplete or inaccurate?

Failure to complete the DD Form 137-3 properly may lead to delays in processing claims for dependent benefits. If any section of the form does not apply, the applicant should write "N/A". Missing or unclear information can result in automatic disapproval of benefits until the discrepancies are resolved.

Is submitting the DD Form 137-3 voluntary?

While the form is technically filled out voluntarily, it is important to note that without submitting the necessary information, a service member may experience a suspension of their dependent allowances. Therefore, providing accurate details on this form is essential for maintaining benefits.

What is meant by 'Fair Rental Value' (FRV) in the context of the form?

Fair Rental Value (FRV) is defined as a reasonable amount that one would expect to pay to rent a dwelling similar to the one where the parent resides. This value is crucial for those parents living in the member's home or in a residence owned by the member and helps define the support provided for benefits such as BAH. The purpose is to assess appropriate housing costs in relation to eligibility for benefits.

Where should the completed form be sent?

Once completed, the DD Form 137-3 should be returned to the local serving personnel or payroll office of the member. This is where it will be processed to evaluate dependency status and eligibility for benefits based on the information provided.

Common mistakes

Completing the DD Form 137-3 is a critical process for determining dependency status. Unfortunately, mistakes can happen. One common error is failing to answer all questions. Each section is designed to gather essential information. Leaving questions blank can lead to delays in processing your application. If a question does not apply, simply write "NOT APPLICABLE" or "N/A." This small step can save time and avoid complications.

Another frequent issue involves incomplete or inaccurate contact information. It is vital to provide a complete address and accurate telephone numbers for both the member and the parent. Omitting any details, like apartment numbers, can hinder communication. Additionally, not including a current email address may restrict any electronic correspondence regarding your application.

Verification of income is essential. Many individuals overlook the requirement to submit proof of income, which can significantly delay the processing of the application. All sources of income must be documented clearly. For parents, this includes wages, pensions, and any government assistance. If a source of income is applicable, but not documented, it will be seen as an incomplete submission.

Many also fail to provide the necessary notarization. If a representative fills out the form for the parent, the form must be notarized. Neglecting to do so can invalidate the application. Make sure that proper signatures are obtained, and ensure the date is correctly filled out. This can trip up even the most diligent applicants.

Additionally, applicants often forget to explain any special circumstances in the Remarks section. This section is not only for extra details but also for clarifying anything unusual about the dependency claim. Whether it’s a unique relationship detail or an explanation of living arrangements, transparency is essential.

Not listing all dependents is another error. Failure to list every child and their contributions will complicate the assessment of dependency. The form requires detailed information on each child, including their monthly financial contributions. This helps to calculate the degree of dependency, ensuring accurate benefit determination.

Another mistake involves misunderstandings regarding “Fair Rental Value” (FRV). If the parent lives in a member’s home, the FRV must be estimated and explained in detail. Many applicants either miscalculate or neglect to include this information entirely. The FRV should reflect what a landlord would charge in rent.

Lastly, not adhering to the submission deadlines can lead to missed opportunities. Ensure that the completed form is returned to the appropriate personnel or payroll office promptly. Late submissions can result in denied benefits. Being proactive in this regard is beneficial for all parties involved.

Documents used along the form

The DD Form 137-3, known as the Dependency Statement - Parent, is a crucial document used to establish the dependency relationship for benefit entitlements within military families. Aside from this form, there are several other important documents commonly utilized in conjunction with the DD Form 137-3. These documents help streamline the process of verifying dependencies and facilitating associated benefits.

- DD Form 1172-2: This form is used to apply for a Uniformed Services Identification Card. It captures vital information about dependents, which is necessary for access to military facilities and healthcare services.

- DD Form 2656: The Application for a Uniformed Services Annuity form allows military members to designate beneficiaries for their retirement benefits. This ensures dependents receive appropriate benefits upon the member's passing.

- DD Form 214: This document serves as a record of military service. A member's DD Form 214 can provide context about their service and contribute to establishing eligibility for certain benefits.

- VA Form 21-526EZ: This is used to apply for veterans' benefits, including disability compensation. Dependents may need to be listed to determine eligibility for additional support.

- DD Form 724: The Application for Dependency and Indemnity Compensation (DIC) is a claim form for survivors of deceased military members. It establishes dependency status necessary for compensation claims.

- DA Form 5960: This form is for requesting a Basic Allowance for Housing (BAH) and includes information on dependents. Proper completion is essential for determining housing allowances.

- SF 1199A: The form of Authorization for Direct Deposit of Federal Benefits is used to set up direct deposits for benefits. It may require dependent information for specific payment considerations.

- Form W-2: This form shows an individual's annual wages and the amount of taxes withheld, helping verify income for financial assessments related to dependent claims.

Each of these documents plays a vital role in supporting the benefits and allowances related to military dependents. Proper documentation facilitates the evaluation process and ensures that eligible families receive their entitled support without unnecessary delays.

Similar forms

The DD 137-3 form serves as a critical document for establishing dependency status for parents of military members. Similar in purpose and function, several other forms and documents address related issues of dependency and service entitlements. Below is a list of eight documents that share similarities with the DD 137-3:

- DD Form 1172-2: This form is used for applying for a dependent ID card and benefits for family members of military personnel. Like the DD 137-3, it requires verification of the relationship and any other necessary supporting documents to establish dependency.

- DA Form 3975: Known as the “Military Police Report,” this document can establish the status of dependents when investigations involve issues like domestic incidents. It contains details that may affect eligibility for various military benefits, similar to the DD 137-3.

- DD Form 214: While primarily a discharge document for military personnel, it often includes information about the service member’s dependents. This form assists in verifying eligibility for benefits for a member’s family, akin to the dependency verification purpose of the DD 137-3.

- VA Form 21-686c: This application for Dependency Claim for Veterans Affairs focuses on establishing the status of dependents for VA benefits. It parallels the DD 137-3 in its emphasis on verifying dependent status and the associated entitlements.

- SF 86: The Standard Form 86 is used for security clearance applications but mandates the reporting of dependents. It is similar in that it requires detailed information about family connections, especially those that might impact security risks.

- DD Form 1300: This is the Report of Casualty and is used to inform families about service members who are missing or who have died. It can provide insight into dependency claims and rights of survivors, aligning with the goal of verifying dependent relationships.

- DD Form 1351-2: This form pertains to travel reimbursements for military members, including provisions for travel authorized for family members. It often requires information similar to that found on the DD 137-3 to confirm eligibility for reimbursements or allowances based on dependents.

- Form W-4: Although primarily a tax withholding document, claiming dependents affects tax benefits. Proper documentation of dependent status is crucial for tax benefits, similar to claims made in the DD 137-3 for military benefits.

Understanding the similarities among these forms can help navigate the complexities of verifying dependent status and accessing necessary benefits. Each document plays a distinct role in ensuring that both service members and their families receive the support they need.

Dos and Don'ts

When filling out the DD Form 137-3, it is important to approach the process with care and attention to detail. Below are some guiding principles regarding what to do and what to avoid during this process.

- Do: Read all instructions thoroughly before starting the form.

- Do: Answer all questions completely. Include "N/A" for questions that do not apply.

- Do: Ensure all required signatures are obtained before submission, especially notarization if applicable.

- Do: Verify all income information and keep supporting documents ready for review.

- Do: Use the Remarks section to clarify any complex situations or additional information.

- Don't: Leave any sections blank. Incomplete forms will cause delays.

- Don't: Misrepresent any information. This could lead to serious consequences.

- Don't: Forget to return the completed form to the local serving personnel or payroll office.

- Don't: Overlook the deadline for submission. Timely submission is crucial for benefits.

- Don't: Ignore the need for proof of dependency. The parent must show over 50% financial dependency on the member.

By adhering to these dos and don'ts, you can navigate the filling of the DD Form 137-3 more smoothly, ensuring clarity and accuracy in your application for benefits.

Misconceptions

- Misconception 1: The DD Form 137-3 is only for military members.

- Misconception 2: Completing the DD Form 137-3 is optional.

- Misconception 3: The form can be submitted without any verification of income or support.

- Misconception 4: Notarization is not necessary if the form is filled out by a representative.

- Misconception 5: The form only needs to be filled out once.

- Misconception 6: Only financial status is considered for dependency.

- Misconception 7: The DD Form 137-3 is universally accepted across all branches of the military.

This form is specifically designed to assess parental dependency for benefits related to military service, but it applies to eligible dependents of both active duty and retired service members.

While filling out this form is voluntary, not submitting it will result in a suspension of dependent benefits. Therefore, timely completion is critical to maintaining entitlement to benefits.

Verification of all income is necessary. This includes a detailed record of the member's contributions to the parent and any other financial-supporting documents.

It is crucial that if a representative completes the form on behalf of a parent, notarization is required to validate the submission. This ensures accountability and accuracy in claims.

Submitting the DD Form 137-3 is often ongoing. If the member's status changes, or if the dependency status fluctuates, a new form may need to be completed.

The assessment of dependency is comprehensive and includes examining living conditions, household composition, and any other factors influencing the parent's need for support.

While the DD Form 137-3 is a common form used, each military branch may have slight variations in their processes or requirements for submission. Always consult specific branch regulations for clarity.

Key takeaways

Understanding the Dd 137 3 Form: This form is used to declare dependency for a parent of a member of the armed forces. Filling it accurately is crucial for benefit eligibility.

- Time Requirement: Expect to spend 30-60 minutes filling out this form.

- Complete All Sections: Every question must be answered. Responses like “N/A” are needed if a question does not apply.

- Notarization: If a representative fills out the form for a parent, notarization is mandatory.

- Financial Verification: Proof of income and contributions is required. This includes verification documents for all claimed income.

- Dependency Criteria: A parent must rely on the member for over 50% of their support to qualify for benefits.

- Return Location: Submit the completed form to your local personnel or payroll office.

- Review Before Submission: Incomplete or inaccurate information will delay processing and could suspend dependent entitlements.

Browse Other Templates

Megger Test Sheet - Allows for quick reference to specific projects and tests.

Childcare License Application - The child’s date of birth is also required in the service schedule section.