Fill Out Your Dd 2656 6 Form

Understanding the nuances of the DD Form 2656-6, or the Survivor Benefit Plan Election Change Certificate, is essential for retired service members who wish to adapt their survivor benefits in accordance with life changes. This form enables retirees to modify their Survivor Benefit Plan (SBP) elections based on significant events such as marriage, remarriage, acquiring a dependent child, or the death of a spouse. Designed with the principal aim of providing flexibility, it allows members to safeguard their loved ones' financial futures by choosing coverage that best suits their current circumstances. The process begins with members providing their personal information and existing coverage details before identifying the qualifying condition that prompts the change. Proper submission of this form to the appropriate agency, alongside relevant documentation—such as marriage or birth certificates—is vital for ensuring compliance and facilitating timely benefit distribution. It's important to note that while filling out this form is voluntary, not doing so may lead to incorrect elections or delays in payments should the retiree pass away. Therefore, understanding how to effectively utilize the DD Form 2656-6 is crucial for those who have served, highlighting the importance of being proactive in managing their survivor benefit options.

Dd 2656 6 Example

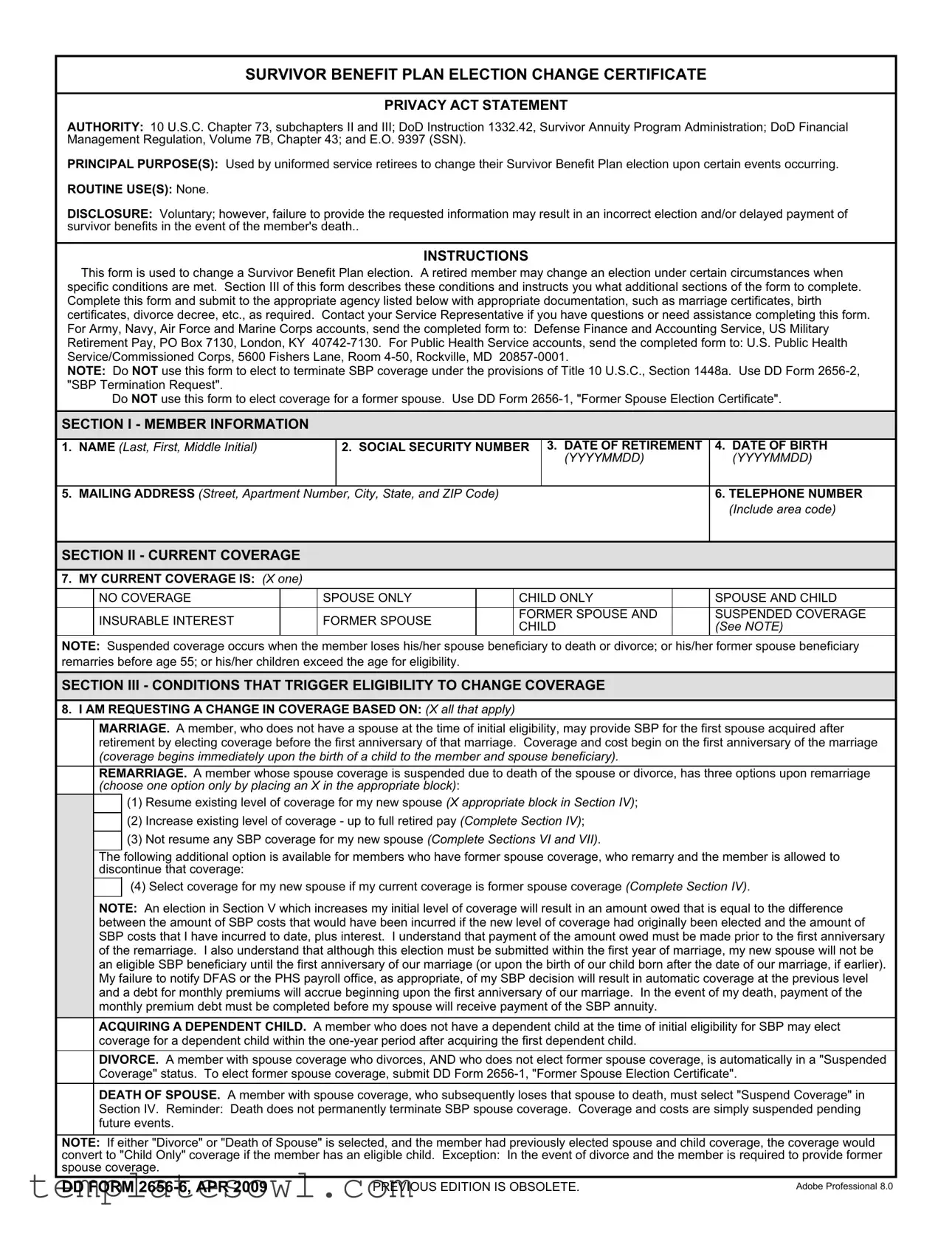

SURVIVOR BENEFIT PLAN ELECTION CHANGE CERTIFICATE

PRIVACY ACT STATEMENT

AUTHORITY: 10 U.S.C. Chapter 73, subchapters II and III; DoD Instruction 1332.42, Survivor Annuity Program Administration; DoD Financial Management Regulation, Volume 7B, Chapter 43; and E.O. 9397 (SSN).

PRINCIPAL PURPOSE(S): Used by uniformed service retirees to change their Survivor Benefit Plan election upon certain events occurring.

ROUTINE USE(S): None.

DISCLOSURE: Voluntary; however, failure to provide the requested information may result in an incorrect election and/or delayed payment of survivor benefits in the event of the member's death..

INSTRUCTIONS

This form is used to change a Survivor Benefit Plan election. A retired member may change an election under certain circumstances when specific conditions are met. Section III of this form describes these conditions and instructs you what additional sections of the form to complete. Complete this form and submit to the appropriate agency listed below with appropriate documentation, such as marriage certificates, birth certificates, divorce decree, etc., as required. Contact your Service Representative if you have questions or need assistance completing this form. For Army, Navy, Air Force and Marine Corps accounts, send the completed form to: Defense Finance and Accounting Service, US Military Retirement Pay, PO Box 7130, London, KY

NOTE: Do NOT use this form to elect to terminate SBP coverage under the provisions of Title 10 U.S.C., Section 1448a. Use DD Form

Do NOT use this form to elect coverage for a former spouse. Use DD Form

SECTION I - MEMBER INFORMATION

1. |

NAME (Last, First, Middle Initial) |

2. SOCIAL SECURITY NUMBER |

3. DATE OF RETIREMENT |

4. DATE OF BIRTH |

|

|

|

(YYYYMMDD) |

(YYYYMMDD) |

|

|

|

|

|

5. |

MAILING ADDRESS (Street, Apartment Number, City, State, and ZIP Code) |

6. TELEPHONE NUMBER |

||

|

|

|

|

(Include area code) |

|

|

|

|

|

SECTION II - CURRENT COVERAGE

7. MY CURRENT COVERAGE IS: (X one)

|

NO COVERAGE |

|

SPOUSE ONLY |

|

CHILD ONLY |

|

SPOUSE AND CHILD |

|

|

|

|

|

|

|

|

|

INSURABLE INTEREST |

|

FORMER SPOUSE |

|

FORMER SPOUSE AND |

|

SUSPENDED COVERAGE |

|

|

|

CHILD |

|

(See NOTE) |

||

|

|

|

|

|

|

NOTE: Suspended coverage occurs when the member loses his/her spouse beneficiary to death or divorce; or his/her former spouse beneficiary remarries before age 55; or his/her children exceed the age for eligibility.

SECTION III - CONDITIONS THAT TRIGGER ELIGIBILITY TO CHANGE COVERAGE

8. I AM REQUESTING A CHANGE IN COVERAGE BASED ON: (X all that apply)

MARRIAGE. A member, who does not have a spouse at the time of initial eligibility, may provide SBP for the first spouse acquired after retirement by electing coverage before the first anniversary of that marriage. Coverage and cost begin on the first anniversary of the marriage (coverage begins immediately upon the birth of a child to the member and spouse beneficiary).

REMARRIAGE. A member whose spouse coverage is suspended due to death of the spouse or divorce, has three options upon remarriage (choose one option only by placing an X in the appropriate block):

(1)Resume existing level of coverage for my new spouse (X appropriate block in Section IV);

(2)Increase existing level of coverage - up to full retired pay (Complete Section IV);

(3)Not resume any SBP coverage for my new spouse (Complete Sections VI and VII).

The following additional option is available for members who have former spouse coverage, who remarry and the member is allowed to discontinue that coverage:

(4) Select coverage for my new spouse if my current coverage is former spouse coverage (Complete Section IV).

NOTE: An election in Section V which increases my initial level of coverage will result in an amount owed that is equal to the difference between the amount of SBP costs that would have been incurred if the new level of coverage had originally been elected and the amount of SBP costs that I have incurred to date, plus interest. I understand that payment of the amount owed must be made prior to the first anniversary of the remarriage. I also understand that although this election must be submitted within the first year of marriage, my new spouse will not be an eligible SBP beneficiary until the first anniversary of our marriage (or upon the birth of our child born after the date of our marriage, if earlier). My failure to notify DFAS or the PHS payroll office, as appropriate, of my SBP decision will result in automatic coverage at the previous level and a debt for monthly premiums will accrue beginning upon the first anniversary of our marriage. In the event of my death, payment of the monthly premium debt must be completed before my spouse will receive payment of the SBP annuity.

ACQUIRING A DEPENDENT CHILD. A member who does not have a dependent child at the time of initial eligibility for SBP may elect coverage for a dependent child within the

DIVORCE. A member with spouse coverage who divorces, AND who does not elect former spouse coverage, is automatically in a "Suspended Coverage" status. To elect former spouse coverage, submit DD Form

DEATH OF SPOUSE. A member with spouse coverage, who subsequently loses that spouse to death, must select "Suspend Coverage" in Section IV. Reminder: Death does not permanently terminate SBP spouse coverage. Coverage and costs are simply suspended pending future events.

NOTE: If either "Divorce" or "Death of Spouse" is selected, and the member had previously elected spouse and child coverage, the coverage would

convert to "Child Only" coverage if the member has an eligible child. Exception: In the event of divorce and the member is required to provide former spouse coverage.

DD FORM |

PREVIOUS EDITION IS OBSOLETE. |

Adobe Professional 8.0 |

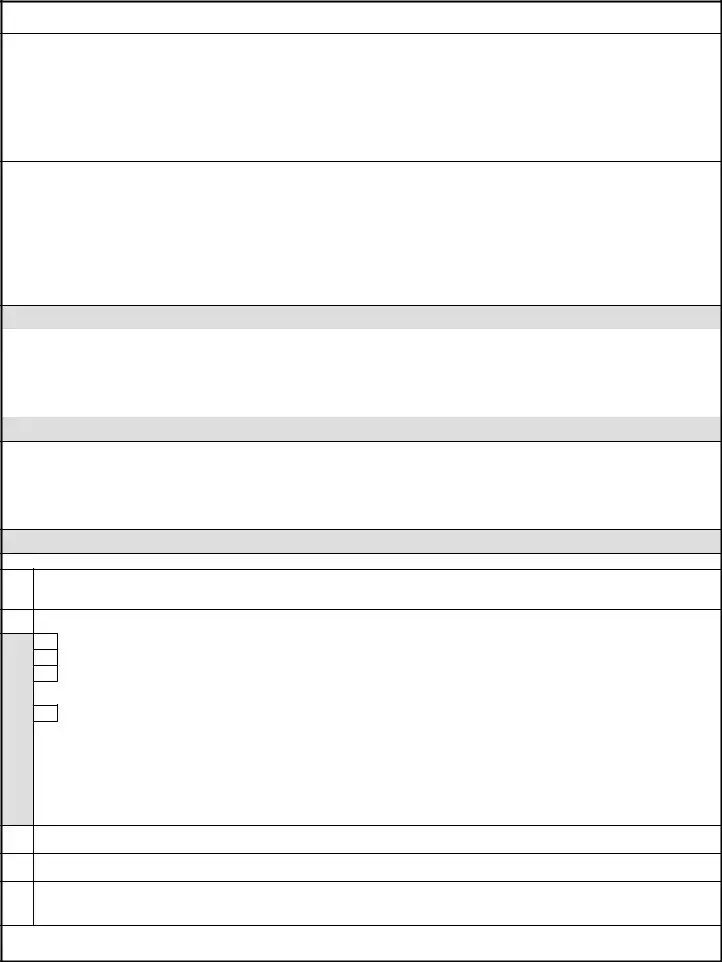

MEMBER NAME (Last, First, Middle Initial)

SSN

SECTION IV - REQUESTED CHANGE TO COVERAGE

9.PLACE AN X IN THE APPROPRIATE BOX TO INDICATE YOUR ELECTION. NOTE: If you are changing to former spouse coverage, disregard this form. Instead, submit DD Form

RESUME EXISTING COVERAGE. (Complete Sections VI and VII below.)

SPOUSE ONLY. (Complete Sections V through VII below.)

SPOUSE AND CHILD(REN). (Complete Sections V through VII below.)

CHILD(REN) ONLY. (Complete Sections V through VII below.)

SUSPEND COVERAGE. (Complete Section VII below.)

SECTION V - LEVEL OF COVERAGE

10.If this is an initial election (or if increasing the level of coverage following remarriage), select the monthly amount of retired pay you wish to have the survivor annuity based on. NOTE: You cannot decrease the level of existing coverage. Your covered spouse beneficiary will receive an annuity that will pay 55 percent of the level of coverage you select until their age 62 and will pay between 45 to 50 percent during the

Place an X in the appropriate box to indicate your election.

FULL RETIRED PAY.

REDUCED AMOUNT OF RETIRED PAY (Cannot be less than $300.00) $

SECTION VI - SPOUSE AND CHILD(REN) INFORMATION (If applicable)

11.A. SPOUSE'S NAME (Last, First, Middle Initial)

B. SOCIAL SECURITY NUMBER

C. DATE OF BIRTH

(YYYYMMDD)

12.DATE OF MARRIAGE (YYYYMMDD)

13.DEPENDENT CHILDREN. Complete this section for your unmarried, dependent children who are under age 18; or under age 22 if full time students; or any age if disabled and incapable of

a.CHILD'S NAME (Last, First, Middle Initial)

b. SOCIAL SECURITY NUMBER

c. DATE OF BIRTH

(YYYYMMDD)

d. RELATIONSHIP (Son, daughter, stepson, etc.) (Indicate "FS" if from previous marriage)

e.DISABLED?

(Yes/No)

SECTION VII - MEMBER SIGNATURE

A NOTARY PUBLIC OR SBP COUNSELOR MUST WITNESS THE MEMBER'S SIGNATURE. The witness cannot be the member's spouse, or

beneficiary.

14. SIGNATURE OF MEMBER |

|

15. DATE SIGNED (YYYYMMDD) |

|

|

|

16.A. PRINTED NAME OF WITNESS |

B. SIGNATURE |

C. DATE SIGNED (YYYYMMDD) |

(Last, First, Middle Initial) |

|

|

|

|

|

D. MAILING ADDRESS OF WITNESS (Include ZIP Code)

E. (For Notary Use Only)

MY COMMISSION EXPIRES: (YYYYMMDD)

DD FORM

Form Characteristics

| Fact Name | Fact Details |

|---|---|

| Purpose of the Form | This form is used by U.S. military retirees to change their Survivor Benefit Plan election due to qualifying life events. |

| Applicable Laws | Governed by 10 U.S.C. Chapter 73, subchapters II and III, and various DoD regulations. |

| Voluntary Disclosure | Providing information is voluntary. However, not completing it may lead to incorrect benefit elections. |

| Submission Guidelines | The completed form must be sent to appropriate agencies, along with necessary documentation like marriage or birth certificates. |

Guidelines on Utilizing Dd 2656 6

Completing the DD Form 2656-6 is an important process for military retirees wishing to change their Survivor Benefit Plan election. After filling out the form, ensure you gather any necessary supporting documents before submitting it to the appropriate agency. Below are the steps to guide you through the completion of the form.

- Section I - Member Information:

- Enter your name (Last, First, Middle Initial).

- Provide your Social Security Number.

- Indicate your date of retirement.

- Fill in your date of birth in the format YYYYMMDD.

- Write your mailing address, including street, apartment number, city, state, and ZIP code.

- Include your telephone number with area code.

- Section II - Current Coverage:

- Select your current coverage by marking the appropriate box. Options include: No Coverage, Spouse Only, Child Only, Spouse and Child, Insurable Interest, Former Spouse, Former Spouse and Suspended Coverage Child.

- Section III - Conditions That Trigger Eligibility to Change Coverage:

- Check all applicable conditions for changing your coverage: Marriage, Remarriage, Acquiring a Dependent Child, Divorce, or Death of Spouse.

- Section IV - Requested Change to Coverage:

- Select your election by marking the appropriate box. Options include: Resume Existing Coverage, Spouse Only, Spouse and Child(ren), Child(ren) Only, or Suspend Coverage.

- Section V - Level of Coverage:

- If this is your initial election or if you are increasing coverage, choose the monthly amount of retired pay you wish to base the survivor annuity on. Remember, you cannot decrease the existing coverage level.

- Section VI - Spouse and Child(ren) Information (If applicable):

- Provide your spouse's name, Social Security Number, and date of birth.

- Indicate the date of marriage.

- List information for dependent children including name, Social Security number, date of birth, relationship, and whether they are disabled.

- Section VII - Member Signature:

- Sign and date the form. A witness, who cannot be your spouse or beneficiary, must also sign.

- Ensure the witness fills out their printed name, signature, and date signed. Include their mailing address.

- If applicable, have a notary public complete their portion.

Following these steps will help ensure your form is filled out correctly. Once you complete the form, send it along with any necessary documentation to the appropriate agency to avoid delays in processing your change. If you have any questions, reach out to your Service Representative for assistance.

What You Should Know About This Form

What is DD Form 2656-6 used for?

The DD Form 2656-6, also known as the Survivor Benefit Plan (SBP) Election Change Certificate, is utilized by retired members of the uniformed services to modify their existing SBP election. This form is particularly relevant following specific life events such as marriage, remarriage, or the birth of a dependent child. By filing this form, retirees can ensure that their survivor benefits are accurately aligned with their current situation.

Who needs to fill out DD Form 2656-6?

Retired members of the uniformed services who wish to change their Survivor Benefit Plan elections are required to fill out this form. This includes retirees who experience life changes such as marriage, the death of a spouse, acquiring a dependent child, or divorce. Each of these events triggers specific conditions under which an election can be modified.

How do I submit DD Form 2656-6?

Once you have completed the form, it must be submitted to the appropriate agency based on your affiliation. For Army, Navy, Air Force, and Marine Corps retirees, the form should be sent to the Defense Finance and Accounting Service, US Military Retirement Pay. For those connected to the Public Health Service, it should be sent to the U.S. Public Health Service/Commissioned Corps. It is essential to include any required documentation such as marriage certificates or divorce decrees when submitting the form.

What happens if I do not submit this form after a qualifying event?

If you fail to submit the DD Form 2656-6 following a qualifying event, such as a marriage or divorce, your SBP coverage may remain at its previous level. This could potentially result in insufficient coverage, leading to complications and delays in survivor benefits for your beneficiaries in the event of your death. Timely submission is crucial to ensure that your benefits are aligned correctly with your current circumstances.

Can this form be used to terminate SBP coverage?

No, DD Form 2656-6 cannot be used to terminate SBP coverage. For that purpose, you will need to use DD Form 2656-2, the SBP Termination Request. If your situation involves electing coverage for a former spouse, you would need to complete DD Form 2656-1, the Former Spouse Election Certificate, instead.

What should I do if I have questions about completing the form?

If you encounter any uncertainties while completing the DD Form 2656-6, it is advisable to contact your Service Representative. They can provide guidance tailored to your specific situation and assist you with the form’s requirements.

What are the eligibility conditions for making changes in coverage?

Eligibility to change coverage using DD Form 2656-6 is contingent upon specific conditions. These include events like marriage, remarriage, or the birth of a dependent child. In the case of divorce or the death of a spouse, other actions may be needed, such as selecting "suspend coverage." Each condition warrants a careful review to determine the proper action and form completion.

What documentation do I need to provide with the form?

When submitting DD Form 2656-6, you will need to include supporting documentation relevant to your situation. This may consist of marriage certificates, birth certificates for dependent children, or divorce decrees. Including accurate documentation helps ensure a smoother processing of your form and adjustments to your coverage.

Common mistakes

When completing the DD Form 2656-6, there are common mistakes that individuals often make, which can lead to issues in the election process for the Survivor Benefit Plan. One of the most frequent errors is providing incorrect personal information.

Members must ensure that their name, social security number, and other personal details are accurately recorded. Inaccuracies can cause significant delays in processing the form, leading to complications in benefits eligibility. It is essential to double-check these facts before submission.

Another common mistake involves the selection of the current coverage type. Members may choose an incorrect option, such as selecting "Child Only" instead of "Spouse and Child." This error can result in inadequate coverage or failure to meet eligibility requirements for a desired benefits level. Properly reviewing the options available in Section II is crucial for accurate completion.

An oversight in understanding triggers for changes in coverage often occurs as well. For example, failing to select all relevant triggering events in Section III can leave out critical changes in circumstances that need to be communicated. Members should carefully read these conditions to avoid missing important selections.

In Section IV, individuals might not accurately indicate the requested change to their coverage. Specifically, neglecting to check the appropriate box or omitting additional required sections can invalidate the election process. Proper completion of this section is vital, especially in cases where a change to former spouse coverage applies.

Including documentation is another area where mistakes are prevalent. Members may forget to attach necessary paperwork such as marriage or divorce certificates, which are required to support their election changes. The absence of this documentation can delay approval or result in an incorrect election.

Lastly, some members do not follow the signature requirements outlined in Section VII. It is important that the member's signature is properly witnessed by the designated individuals as specified. Missing signatures or failing to have the form properly notarized can lead to further complications in processing the form.

Documents used along the form

The DD Form 2656-6 is significant for retirees who need to make adjustments to their Survivor Benefit Plan elections. Several other forms and documents may accompany this form to ensure that the information provided is complete and accurate. Below is a list of documents that are commonly used in conjunction with the DD Form 2656-6, along with brief descriptions of each.

- DD Form 2656-1: This form is used when a member wants to elect Survivor Benefit Plan coverage for a former spouse. It outlines the options available for coverage post-divorce.

- DD Form 2656-2: This form allows members to formally request the termination of their Survivor Benefit Plan coverage. It is essential for those who wish to stop their participation in the program.

- Marriage Certificate: A document that verifies the legal marriage of the retiree to a spouse. It is often needed to establish eligibility for changes in the Survivor Benefit Plan.

- Divorce Decree: A legal document that finalizes a divorce. This is crucial for members who are transitioning from spouse coverage to former spouse coverage.

- Birth Certificate: This document verifies the birth of children and is often required to establish dependent eligibility for Survivor Benefit Plan coverage.

- Letter of Instruction: Sometimes, retirees may provide a letter to clarify their intentions regarding the Survivor Benefit Plan changes, especially during complex changes involving multiple beneficiaries.

- Proof of Dependency: This may include documents proving that a child is still a dependent if they are over 18. It ensures that there is eligibility for continued coverage.

- Identification Documents: Various forms of ID, such as driver's licenses or passports, may be required to confirm identity when submitting forms for changes in beneficiary status.

- Income Verification: For certain options in the Survivor Benefit Plan, proof of income may be necessary to establish financial need or eligibility for specific benefits.

These accompanying documents play a crucial role in ensuring that changes to the Survivor Benefit Plan are processed smoothly and accurately. It is advisable for retirees to gather all pertinent documents before submitting the DD Form 2656-6 to facilitate the process and avoid any potential complications.

Similar forms

The DD Form 2656-6 is used by retirees to modify their Survivor Benefit Plan election. It parallels several other forms, each serving a distinct function within the broader framework of military retirement benefits. Here is a list of six forms that resemble the DD Form 2656-6:

- DD Form 2656-2: This form is specifically utilized for SBP termination requests. Unlike the DD Form 2656-6, which focuses on changing elections, Form 2656-2 addresses the process for terminating coverage under the Survivor Benefit Plan.

- DD Form 2656-1: Known as the Former Spouse Election Certificate, this form is essential when a member wishes to elect coverage for a former spouse. Unlike the DD Form 2656-6, which pertains to current spouses and beneficiaries, this form provides specific instructions for former spouse coverage.

- DD Form 214: The Certificate of Release or Discharge from Active Duty form provides essential details about a service member’s military history. While it does not directly relate to the Survivor Benefit Plan, it is a critical document for understanding eligibility and benefits upon retirement.

- SF 2809: This form is used for health benefits enrollment and changes. Although its primary purpose is different, it also requires personal information and beneficiary elections, similar to the DD Form 2656-6.

- DD Form 1172: The Application for Uniformed Services Identification Card/DEERS Enrollment form identifies family members and dependents. This document, like the DD Form 2656-6, serves to ensure that proper beneficiary information is recorded and updated.

- DD Form 149: This form is utilized for applying for a correction of military records. It is not directly related to the Survivor Benefit Plan but can be essential for ensuring that a retiree’s records accurately reflect elections made, including those updates specified in the DD Form 2656-6.

Dos and Don'ts

When filling out the DD Form 2656-6, there are certain best practices to follow, as well as common pitfalls to avoid. This will help ensure that the form is completed accurately and efficiently.

- Do provide accurate personal information. Double-check your name, social security number, and contact details to avoid delays.

- Do follow the specific instructions. The form includes particular sections that must be filled out depending on your circumstances, such as marriage or acquiring dependents.

- Do submit supporting documents. Ensure you include necessary documentation like marriage certificates or divorce decrees, as these are often required to process your request.

- Do ask for help if needed. Don’t hesitate to reach out to your Service Representative if you find parts of the form confusing or require assistance.

- Do check for submission addresses. Make sure to send your completed form to the correct address depending on your military branch or agency.

- Don’t use this form for terminating coverage. If you intend to terminate SBP coverage, you must use DD Form 2656-2 instead.

- Don’t assume prior information is still valid. If you have had changes in your marital status or dependents, be sure to update all relevant sections.

- Don’t forget to date and sign the form. This is crucial; incomplete signatures may delay your request.

- Don’t overlook the witness requirement. Make sure a notary public or SBP counselor witnesses your signature, and remember they cannot be your spouse or beneficiary.

- Don’t ignore deadlines. Pay attention to any time-sensitive information regarding elections that may affect your survivor benefits.

Misconceptions

Understanding the DD Form 2656-6 is crucial for those utilizing the Survivor Benefit Plan (SBP). Here are seven common misconceptions about this form:

- This form is only for new applicants.—Many believe the DD Form 2656-6 is strictly for those initial enrollees. In reality, it allows retirees to update existing agreements following significant life events, such as marriage or divorce.

- Submission of the form guarantees immediate coverage changes.—Some think that once submitted, coverage changes take effect immediately. However, these changes typically commence on the first anniversary of the marriage or upon the birth of a child, not from the date of submission.

- All changes can be made using this form.—It's a common error to assume this form can handle all SBP-related requests. For example, former spouse coverage cannot be elected using DD Form 2656-6; instead, one must use DD Form 2656-1.

- My previous coverage automatically transfers to my new spouse.—This is misleading. If a retiree’s spouse passes away or they divorce, the coverage is suspended. A new election must be made to reinstate or change coverage for a new spouse.

- I cannot change my mind after submitting the form.—While some might think sending the form is final, there are opportunities to adjust post-submission. It’s essential to consult the guidelines and conditions carefully to understand when modifications can occur.

- Proof of life changes is not necessary.—It’s a misconception that retirees can simply declare changes without documentation. Depending on the situation, documentation such as marriage certificates or divorce decrees may need to be submitted with the form.

- The benefits will be paid instantly upon my passing.—Many retirees overlook the fact that survivor benefits are not distributed immediately. If there is an outstanding premium debt, benefits may not be released until all debts are settled.

Key takeaways

Key Takeaways for Filling Out and Using the DD Form 2656-6:

- This form allows service retirees to change their Survivor Benefit Plan (SBP) election due to specific life events.

- Common qualifying events include marriage, remarriage, acquiring a dependent child, and divorce.

- Documentation such as marriage certificates or divorce decrees must be submitted with the form.

- Ensure to send the completed form to the appropriate agency based on your military branch.

- Do not use this form for terminating SBP coverage; a separate form, DD 2656-2, is required for that purpose.

- For former spouse coverage, use DD Form 2656-1; DD Form 2656-6 is not applicable.

- Understand the implications of suspended coverage when losing a spouse due to death or divorce.

- Changes in coverage can affect future premiums. Be aware of potential debts incurred when increasing coverage levels.

- Fill out all applicable sections accurately, as errors can lead to delays in benefits for survivors.

Browse Other Templates

Messenger Service Request,Delivery Service Order,Legal Document Submission Form,Attorney Messenger Request,Court Filing Request,Document Delivery Order,Legal Messenger Instruction Sheet,Filing Assistance Request,Attorney Service Request Form,Court Do - Specify the district if the request involves the Supreme Court.

Ecers Score Sheet Example - Information about the recipient’s address is mandatory for tracking purposes.