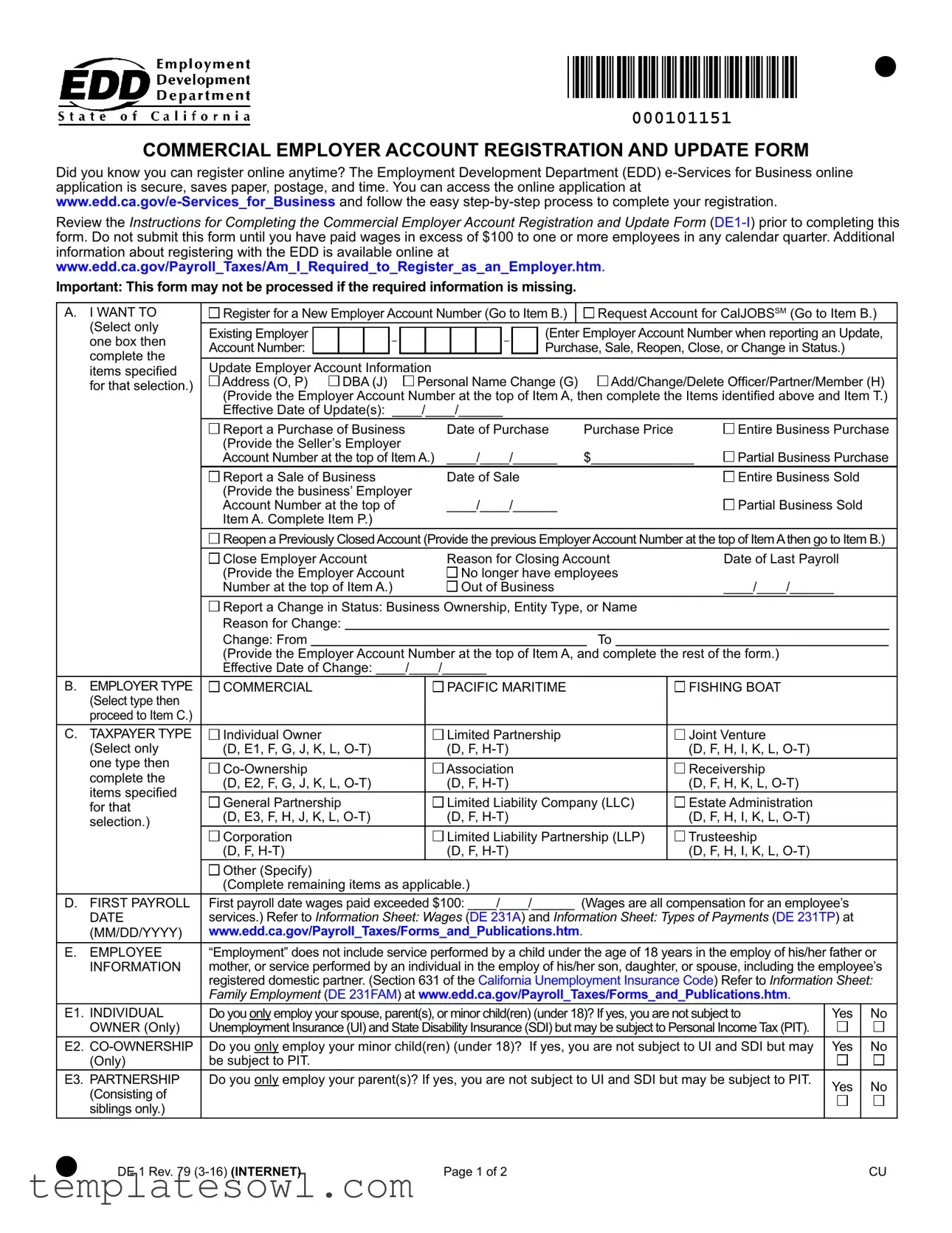

Fill Out Your De 1 Edd Form

The DE 1 EDD form is essential for businesses looking to register their employer accounts with the Employment Development Department (EDD) in California. This commercial employer account registration and update form allows businesses to register for a new employer account number, update their existing information, or request changes associated with employees. Before submitting, it’s crucial to have paid wages exceeding $100 to any employee within a calendar quarter. This ensures that businesses are correctly classified and compliant with state regulations. The form comprises several sections, including the type of business entity, payroll information, and individual owner details. It also accommodates various transitions in business status, such as sales, purchases, or changes in business ownership. Instructions are provided to guide you through the registration process, ensuring that you have all the necessary information before submission. The form can be completed online for convenience, significantly reducing paper waste and expediting the registration process. Remember, missing required information could delay your application, so it’s advisable to pay close attention to all sections.

De 1 Edd Example

000101151

COMMERCIAL EMPLOYER ACCOUNT REGISTRATION AND UPDATE FORM

Did you know you can register online anytime? The Employment Development Department (EDD)

Review the Instructions for Completing the Commercial Employer Account Registration and Update Form

www.edd.ca.gov/Payroll_Taxes/Am_I_Required_to_Register_as_an_Employer.htm.

Important: This form may not be processed if the required information is missing.

A. |

I WANT TO |

Register for a New Employer Account Number (Go to Item B.) |

|

|

Request Account for CalJOBSSM (Go to Item B.) |

||||||||||||||||||||||||

|

(Select only |

Existing Employer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Enter Employer Account Number when reporting an Update, |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

one box then |

|

|

|

|

|

– |

|

|

|

|

|

|

– |

|

||||||||||||||

|

Account Number: |

|

|

|

|

|

|

|

|

|

|

|

|

Purchase, Sale, Reopen, Close, or Change in Status.) |

|

|

|||||||||||||

|

complete the |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Update Employer Account Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

items speciied |

|

|

|

|

|

|

|

|

Add/Change/Delete Oficer/Partner/Member (H) |

|||||||||||||||||||

|

for that selection.) |

Address (O, P) |

DBA (J) |

Personal Name Change (G) |

|

||||||||||||||||||||||||

|

|

(Provide the Employer Account Number at the top of Item A, then complete the Items identiied above and Item T.) |

|||||||||||||||||||||||||||

|

|

Effective Date of Update(s): ____/____/______ |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

Report a Purchase of Business |

|

|

Date of Purchase |

Purchase Price |

|

Entire Business Purchase |

|||||||||||||||||||||

|

|

(Provide the Seller’s Employer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

Account Number at the top of Item A.) |

____/____/______ |

|

$______________ |

Partial Business Purchase |

|||||||||||||||||||||||

|

|

Report a Sale of Business |

|

|

Date of Sale |

|

|

|

|

|

|

|

Entire Business Sold |

|

|

||||||||||||||

|

|

(Provide the business’ Employer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

Account Number at the top of |

|

|

____/____/______ |

|

|

|

|

|

|

Partial Business Sold |

|

|

|||||||||||||||

|

|

Item A. Complete Item P.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

Reopen a Previously ClosedAccount (Provide the previous EmployerAccount Number at the top of ItemAthen go to Item B.) |

|||||||||||||||||||||||||||

|

|

Close Employer Account |

|

|

Reason for Closing Account |

|

Date of Last Payroll |

|

|

||||||||||||||||||||

|

|

(Provide the Employer Account |

|

|

|

No longer have employees |

|

|

|

|

|

|

|||||||||||||||||

|

|

Number at the top of Item A.) |

|

|

|

Out of Business |

|

|

|

|

|

____/____/______ |

|

|

|

||||||||||||||

|

|

Report a Change in Status: Business Ownership, Entity Type, or Name |

|

|

|

|

|

|

|||||||||||||||||||||

|

|

Reason for Change: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

Change: From |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

To |

|

|

|

|

|

|

|

|||

|

|

(Provide the Employer Account Number at the top of Item A, and complete the rest of the form.) |

|

|

|

|

|||||||||||||||||||||||

|

|

Effective Date of Change: ____/____/______ |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

B. |

EMPLOYER TYPE |

COMMERCIAL |

|

|

|

|

|

|

|

PACIFIC MARITIME |

|

|

|

|

FISHING BOAT |

|

|

|

|

||||||||||

|

(Select type then |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

proceed to Item C.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C. |

TAXPAYER TYPE |

Individual Owner |

|

|

|

|

|

|

|

Limited Partnership |

|

|

|

|

Joint Venture |

|

|

|

|

||||||||||

|

(Select only |

(D, E1, F, G, J, K, L, |

|

|

(D, F, |

|

|

|

|

|

|

(D, F, H, I, K, L, |

|

|

|

|

|||||||||||||

|

one type then |

|

|

|

|

|

|

|

Association |

|

|

|

|

|

|

Receivership |

|

|

|

|

|||||||||

|

complete the |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

(D, E2, F, G, J, K, L, |

|

|

(D, F, |

|

|

|

|

|

|

(D, F, H, K, L, |

|

|

|

|

||||||||||||||

|

items speciied |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

General Partnership |

|

|

|

|

|

|

|

Limited Liability Company (LLC) |

|

Estate Administration |

|

|

|

|

||||||||||||||

|

for that |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

(D, E3, F, H, J, K, L, |

|

|

(D, F, |

|

|

|

|

|

|

(D, F, H, I, K, L, |

|

|

|

|

||||||||||||||

|

selection.) |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

Corporation |

|

|

|

|

|

|

|

Limited Liability Partnership (LLP) |

|

Trusteeship |

|

|

|

|

|||||||||||||

|

|

(D, F, |

|

|

|

|

|

|

|

(D, F, |

|

|

|

|

|

|

(D, F, H, I, K, L, |

|

|

|

|

||||||||

|

|

Other (Specify) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

(Complete remaining items as applicable.) |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

D. |

FIRST PAYROLL |

First payroll date wages paid exceeded $100: ____/____/______ (Wages are all compensation for an employee’s |

|

|

|||||||||||||||||||||||||

|

DATE |

services.) Refer to Information Sheet: Wages (DE 231A) and Information Sheet: Types of Payments (DE 231TP) at |

|

|

|||||||||||||||||||||||||

|

(MM/DD/YYYY) |

www.edd.ca.gov/Payroll_Taxes/Forms_and_Publications.htm. |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

E. |

EMPLOYEE |

“Employment” does not include service performed by a child under the age of 18 years in the employ of his/her father or |

|||||||||||||||||||||||||||

|

INFORMATION |

mother, or service performed by an individual in the employ of his/her son, daughter, or spouse, including the employee’s |

|||||||||||||||||||||||||||

|

|

registered domestic partner. (Section 631 of the California Unemployment Insurance Code) Refer to Information Sheet: |

|||||||||||||||||||||||||||

|

|

Family Employment (DE 231FAM) at www.edd.ca.gov/Payroll_Taxes/Forms_and_Publications.htm. |

|

|

|

|

|||||||||||||||||||||||

E1. |

INDIVIDUAL |

Do you only employ your spouse, parent(s), or minor child(ren) (under 18)? If yes, you are not subject to |

Yes |

|

No |

||||||||||||||||||||||||

|

OWNER (Only) |

Unemployment Insurance (UI) and State Disability Insurance (SDI) but may be subject to Personal Income Tax (PIT). |

|

|

|

|

|||||||||||||||||||||||

E2. |

Do you only employ your minor child(ren) (under 18)? If yes, you are not subject to UI and SDI but may |

Yes |

|

No |

|||||||||||||||||||||||||

|

(Only) |

be subject to PIT. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

E3. |

PARTNERSHIP |

Do you only employ your parent(s)? If yes, you are not subject to UI and SDI but may be subject to PIT. |

Yes |

|

No |

||||||||||||||||||||||||

|

(Consisting of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

siblings only.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DE 1 Rev. 79 |

Page 1 of 2 |

CU |

COMMERCIAL EMPLOYER ACCOUNT

REGISTRATION AND UPDATE FORM

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

000101152 |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

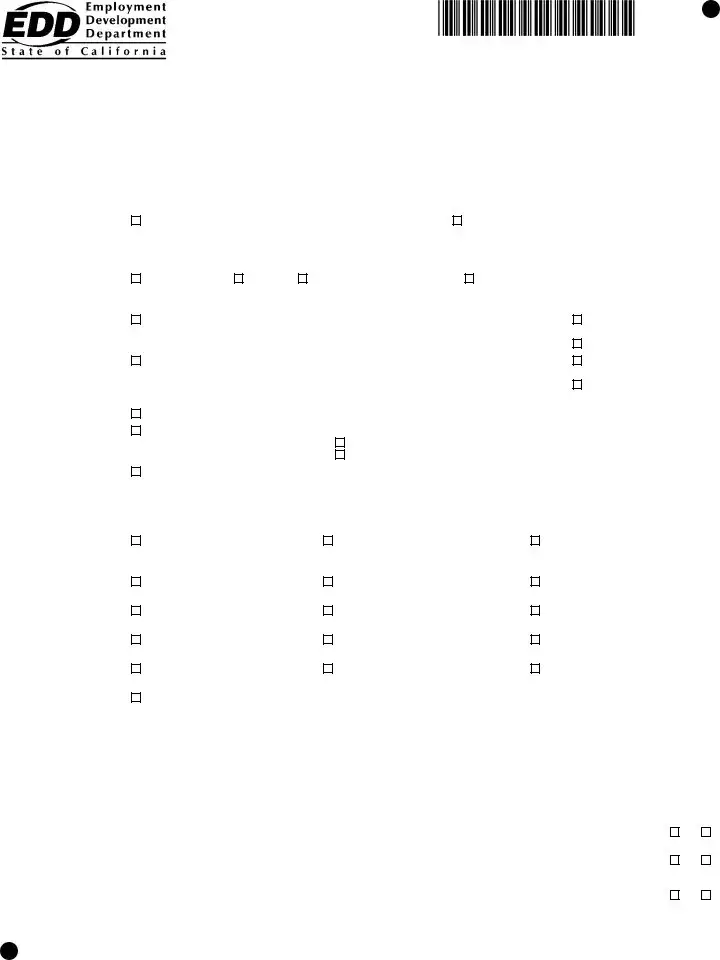

F. |

LOCATION OF |

|

Do you have employees working in California? |

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

No |

|||||

|

EMPLOYEE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SERVICES |

|

Do you have employees residing in California that are working outside of California? |

|

|

|

|

|

Yes |

No |

|||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

G. |

INDIVIDUAL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CA Driver |

|

|

|

|||

|

OWNER/ |

|

|

NAME |

|

|

TITLE |

|

|

|

SSN |

|

License |

Add |

Chg. |

Del. |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number |

|

|

|

||||

|

INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(If applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

H. CORPORATE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CA Driver |

Add |

Chg. |

Del. |

||||

|

OFFICER(S), |

|

|

NAME |

|

|

TITLE |

|

|

|

SSN |

|

License |

||||||||||

|

PARTNERS, OR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number |

|

|

|

|||

|

LLC MEMBER(S), |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MANAGER(S), |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AND/OR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OFFICER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

I. |

LEGAL NAME OF ORGANIZATION (Corporation/LLC/LLP/LP: Enter exactly as it appears on your oficial registration documents.) |

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

J. |

DOING BUSINESS AS (DBA) (If applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

K. |

FEDERAL EMPLOYER IDENTIFICATION NUMBER (FEIN) |

|

L. DATE OWNERSHIP BEGAN (MM/DD/YYYY) |

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

____/____/______ |

|

|

|

|||||

M. STATE OR PROVINCE OF INCORPORATION/ORGANIZATION |

|

N. CALIFORNIA SECRETARY OF STATE ENTITY NUMBER |

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

O. |

PHYSICAL BUSINESS |

Street Number |

|

|

Street Name |

|

|

|

|

|

Unit Number (If applicable) |

||||||||||||

|

LOCATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(PO Box or Private |

|

City |

|

|

State/Province |

|

ZIP Code |

|

|

Country |

|

|

|

|||||||||

|

Mail Box will not be |

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

accepted.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business Phone Number |

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

P. |

MAILING ADDRESS |

|

Street Number |

|

|

Street Name |

|

|

|

|

|

Unit Number (If applicable) |

|||||||||||

|

(PO Box or Private Mail |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Box is acceptable.) |

|

City |

|

|

State/Province |

|

ZIP Code |

|

|

Country |

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

Same as above |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Phone Number |

|

|

|

|

|

|

|

|

|

|

||||||

Q. |

|

Valid |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Check to allow |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

R. |

INDUSTRY ACTIVITY |

Describe in detail your speciic product/services: |

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

Select your business industry |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

Services |

Retail |

Wholesale |

|

Manufacturing |

|

Temporary Services |

|

|

|

||||||||||

|

|

|

|

Leasing Employer |

Professional Employer Organization |

Other (Specify) _____________________ |

|||||||||||||||||

S. |

CONTACT PERSON |

|

Name |

|

|

|

|

|

|

Contact Phone Number |

|

|

|

|

|||||||||

|

(Complete a Power of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Attorney [POA] Declaration |

Relation |

|

|

Address |

|

|

|

|

|

|

|

|

|

|

||||||||

|

[DE 48], if applicable.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

T. |

DECLARATION |

|

I certify under penalty of perjury that the above information is true, correct, and complete, and that |

||||||||||||||||||||

|

|

|

|

these actions are not being taken to receive a more favorable Unemployment Insurance rate. I further |

|||||||||||||||||||

|

|

|

|

certify that I have the authority to sign on behalf of the above business. |

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

Signature |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

Name |

|

|

|

|

|

Title |

|

|

|

|

|

|

Phone Number |

|

|||||

|

|

|

|

|

|

|

|||||||||||||||||

|

MAIL TO: EDD, Account Services Group, MIC 28, PO Box 826880, Sacramento, CA |

|

|

||||||||||||||||||||

|

DE 1 Rev. 79 |

|

|

Page 2 of 2 |

|

|

|

|

|

|

|

|

|

|

|||||||||

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Form Purpose | The DE 1 EDD form is used for registering and updating commercial employer accounts with the California Employment Development Department. |

| Online Registration | Employers can register online at any time using the EDD e-Services for Business portal, which makes the process convenient and efficient. |

| Submission Requirement | It is essential to wait until you have paid at least $100 in wages during a calendar quarter before submitting the DE 1 form. |

| Governing Law | This form is governed by the California Unemployment Insurance Code, specifically applicable to employer registration and reporting requirements. |

Guidelines on Utilizing De 1 Edd

Filling out the DE 1 EDD form is a straightforward process that allows businesses to register or update their employer account with the Employment Development Department. Before starting, ensure you have all necessary information at hand to avoid delays in processing.

- Visit the EDD website at www.edd.ca.gov/e-Services_for_Business for online registration or access the printed form.

- At the top of the form, indicate whether you are registering for a new account, updating an existing one, or making specific changes like reporting a purchase or sale of a business.

- Complete the "Employer Type" section by selecting the appropriate type for your business. For example, choose "Commercial" or "Pacific Maritime."

- Next, select the "Taxpayer Type," ensuring you check only one option, such as "Individual Owner" or "Corporation."

- Fill in the "First Payroll" date—this is the date when wages exceeded $100.

- Answer the employee information questions. For instance, indicate if you employ only family members or others as outlined in the form.

- Provide the location of employee services, noting if any employees work outside of California.

- List the personal information of all owners, officers, or members, including their names, titles, Social Security Numbers, and California Driver License numbers if applicable.

- Complete the legal name fields, entering your organization’s name exactly as it appears on official documentation.

- Fill in your physical business location and mailing address. Ensure you do not use a PO Box for the physical address.

- Provide a valid email address for correspondence and select the option to allow e-mail contact.

- Describe your business's main industry activity and the services or products offered.

- Designate a contact person for your business, including their name, phone number, and email address.

- Read the declaration at the end of the form. Sign and date it, confirming that the information provided is accurate and that you have the authority to submit it.

- Mail the completed form to EDD, Account Services Group, MIC 28, PO Box 826880, Sacramento, CA 94280-0001.

Once submitted, the EDD will process your form. If any required information is missing, your application might be delayed. You can check your registration status through their website or contact the department for assistance if needed.

What You Should Know About This Form

What is the DE 1 EDD form used for?

The DE 1 EDD form is primarily designed for businesses to register or update their Commercial Employer Account with the Employment Development Department (EDD) in California. This form helps employers establish their identification with the state for tax purposes and provides crucial information about their business operations and employment status.

How do I submit the DE 1 EDD form?

You can submit the DE 1 form either online or by mail. For online registration, visit the EDD's secure e-Services for Business portal at www.edd.ca.gov/e-Services_for_Business. Make sure to follow the step-by-step process provided. If you prefer to submit the form by mail, complete it thoroughly and send it to the EDD Account Services Group at the designated address. Remember, do not submit the form until you have paid wages exceeding $100 to any employee during the calendar quarter.

What if I’m not ready to submit the form?

If you are not ready to submit the DE 1 EDD form but want to ensure compliance, consider gathering all necessary information in advance. This includes your Employer Account Number, business details, and employee payroll information. Reviewing the instructions specified in the DE1-I guide will also help streamline the process when you’re ready to register or update your account.

What happens if I don’t submit the form or have missing information?

Failure to submit the DE 1 form, or submitting it with incomplete information may result in delays or processing issues. The EDD may not process your form if they find essential information to be missing. It’s crucial to double-check that all required fields are completed accurately to avoid complications.

Is there a fee associated with registering through the DE 1 EDD form?

No, there is no fee for submitting the DE 1 form to register or update your employer account with the EDD. However, it’s important to note that you must have already paid wages over $100 to employees in a calendar quarter before submitting the form. This ensures that your registration aligns with wage payment obligations.

Common mistakes

Filling out the DE 1 EDD form correctly is crucial for employers. However, many individuals make mistakes that can delay their registration and create obstacles. Here are six common missteps to avoid.

One significant mistake is omitting required information. This form demands complete and accurate details. If crucial sections are left blank or incorrectly filled, the form may not be processed. Take the time to review all necessary fields before submission.

Another frequent error involves incorrectly identifying the employer type. Employers are required to select only one type from the options provided. This section is essential for determining the appropriate tax treatment. Double-check your choice to ensure correctness.

A third mistake involves failing to report the first payroll date accurately. This date is vital as it signifies when your business started paying wages exceeding $100. Entering an incorrect date can affect your registration timeline and tax obligations.

Some individuals also overlook the importance of their Employer Account Number. This number should be referenced correctly throughout the form, especially if reporting updates or changes. Missing or incorrect references can lead to processing delays.

Another common error is not providing a valid email address. This step is vital for communication from the EDD. Ensure that your email is accurate and check the box that allows for email contact. Failing to do this can lead to missed notifications regarding your account.

Lastly, many applicants forget to sign the declaration section of the form. A signature is required to certify that the information provided is true and correct. Without this signature, the form remains invalid, and processing cannot occur.

By being aware of these common mistakes and taking care to avoid them, you can ensure a smoother registration process with the EDD.

Documents used along the form

The following is a list of documents and forms often utilized in conjunction with the Commercial Employer Account Registration and Update Form (DE 1 EDD). Each document serves a specific purpose in the context of employer registration and compliance with state regulations.

- DE 231A - Information Sheet: Wages: This document provides guidelines on what constitutes wages for employees and outlines the various forms of compensation that qualify as wages.

- DE 231TP - Information Sheet: Types of Payments: This sheet details the types of payments that may need to be reported as part of employee compensation, helping employers understand their obligations.

- DE 231FAM - Information Sheet: Family Employment: This document clarifies the rules regarding family employment, specifically the exemptions applicable to certain family members under the Unemployment Insurance Code.

- DE 48 - Power of Attorney (POA) Declaration: This form is used to authorize an individual or entity to act on behalf of the employer, especially for legal and tax matters, ensuring proper representation.

- EDD e-Services for Business Account Registration: An online platform that simplifies the registration process for employers. It allows users to set up and manage their employer accounts conveniently.

- California Secretary of State Entity Registration Documents: These documents provide evidence of the business's legal formation and are necessary for various administrative processes, including tax registrations.

Each of these documents plays a vital role in the successful registration and operation of an employer's account with the Employment Development Department. Completing and submitting them accurately ensures compliance with California’s labor laws and regulations.

Similar forms

The DE 1 EDD (Commercial Employer Account Registration and Update Form) shares similarities with several other important documents related to employer registration and updates. Here are five such documents:

- DE 2 – Employer of Household Workers Registration Form: This form is designed for individuals who employ household workers. Similar to the DE 1, it collects essential information about the employer and their workforce, ensuring compliance with tax regulations.

- DE 3 – Payroll Tax Registration Form: Used for payroll tax registration, this document functions similarly by gathering detailed information about employees and the employer’s status. Both forms help ensure that the necessary data is in place to meet state tax obligations.

- DE 1870 – Employer Registration Form: Like the DE 1, this form is intended for businesses registering with the Employment Development Department. It requires similar foundational details that enable the EDD to manage employer accounts effectively.

- DE 231 – California Payroll Tax Record: This record keeps track of the payroll taxes an employer must pay. It operates in conjunction with the DE 1, providing a comprehensive view of employer obligations and employment activity.

- Form W-2 – Wage and Tax Statement: Although its primary purpose is different, the W-2 form and the DE 1 are interconnected. Both documents capture critical information about employees and payroll, playing a key role in ensuring compliance with federal and state tax laws.

Each of these documents serves a vital role in the employer registration and taxation process, promoting transparency and adherence to regulations.

Dos and Don'ts

When filling out the DE 1 EDD form, follow these important guidelines to ensure a smooth registration process:

- Do review the Instructions for Completing the Commercial Employer Account Registration and Update Form (DE1-I) before starting.

- Do ensure you have paid wages over $100 to employees within a calendar quarter before submitting the form.

- Do provide all required information accurately to avoid processing delays.

- Do list your business’s legal name exactly as it appears in official registration documents.

- Don't submit the form without an Employer Account Number if you are requesting an update.

- Don't use a PO Box for the physical business location; it must be a valid street address.

- Don't forget to sign and date the declaration section of the form.

- Don't leave any required fields blank; incomplete forms may be rejected.

By following these tips, you can help ensure that your DE 1 EDD form is processed without issues.

Misconceptions

Understanding the De 1 Edd form—California's Commercial Employer Account Registration and Update Form—can be complicated. Several misconceptions often arise regarding its usage and requirements. Here are eight common misunderstandings, along with clarifications for each.

- Anyone can submit the form at any time. Many people believe they can fill out and submit the De 1 Edd form whenever they wish. In reality, submission is only appropriate after paying wages exceeding $100 to employees in one calendar quarter.

- Email submission is allowed. Some assume they can submit this form electronically via email. However, the only accepted method of submission is through physical mailing to the designated address provided on the form.

- Only new employers need to fill out this form. A significant number of individuals think that the De 1 Edd form is solely for new businesses. This is incorrect; existing employers must also use it for updates, such as changes in business structure or ownership.

- Completing the form guarantees account approval. Many believe that filling out and submitting the form ensures immediate approval of their employer account. However, the form may not be processed if required information is missing, which can lead to delays.

- Wages refer only to hourly payments. Some mistakenly think that “wages” solely mean hourly earnings. In fact, wages encompass all forms of compensation for an employee’s services, regardless of how they are calculated.

- Registration can be done without prior research. A common misconception is that individuals can effectively complete the registration form without consulting the accompanying instructions. In reality, reviewing the Instructions for Completing the Commercial Employer Account Registration and Update Form is crucial for accurate submission.

- Filing is the same for all employer types. Individuals often believe that the registration process is uniform across all types of employers. However, specific sections of the form cater to different types of employers, requiring unique information depending on their classification.

- All businesses are required to register with the EDD. Some business owners mistakenly think that every employer must register with the EDD. This is not the case. Only those who meet certain criteria, such as paying wages beyond a specified threshold, are obligated to register.

Understanding these misconceptions can help individuals navigate the complexities of the De 1 Edd form more effectively, ensuring compliance with California's employment regulations.

Key takeaways

Understanding how to fill out and use the DE 1 EDD form is essential for business owners in California. Here are some key takeaways that can help streamline the process:

- Online Registration: You can register for a new employer account online at any time. The secure online application saves paper, postage, and time.

- Completion Instructions: Prior to filling out the form, review the accompanying instructions for detailed guidance.

- Wage Requirement: Do not submit the DE 1 EDD form until you’ve paid more than $100 in wages to one or more employees within a calendar quarter.

- Incomplete Submissions: If required information is missing, your form may not be processed. Ensure all details are completed before submission.

- Multiple Changes: The form allows for various updates, including changes in employer account information or reporting a business sale or purchase.

- Eligibility for Exemptions: Certain employment situations, such as hiring family members, may exempt you from Unemployment Insurance and State Disability Insurance obligations.

- Accurate Information: Provide the legal name of your business as it appears on official documents. Inaccuracies can delay processing.

- Mailing Instructions: Send your completed form to the designated address: EDD, Account Services Group, MIC 28, PO Box 826880, Sacramento, CA 94280-0001, ensuring to include all required documentation.

Staying informed and organized can significantly ease the process of managing your employer account with the EDD.

Browse Other Templates

Permit Designation Form,Contractor Authorization Form,Permit Delegate Document,Authorized Agent Submission,Project Permit Application,Contractor Permit Authorization,Permit Retrieval Authorization,Authorized Permit Submission,Permit Acquisition Form, - Each project must be distinctly identified to avoid any potential confusion in the permitting process.

Sf-50 Form - It serves as an official record of employment actions taken by federal agencies.