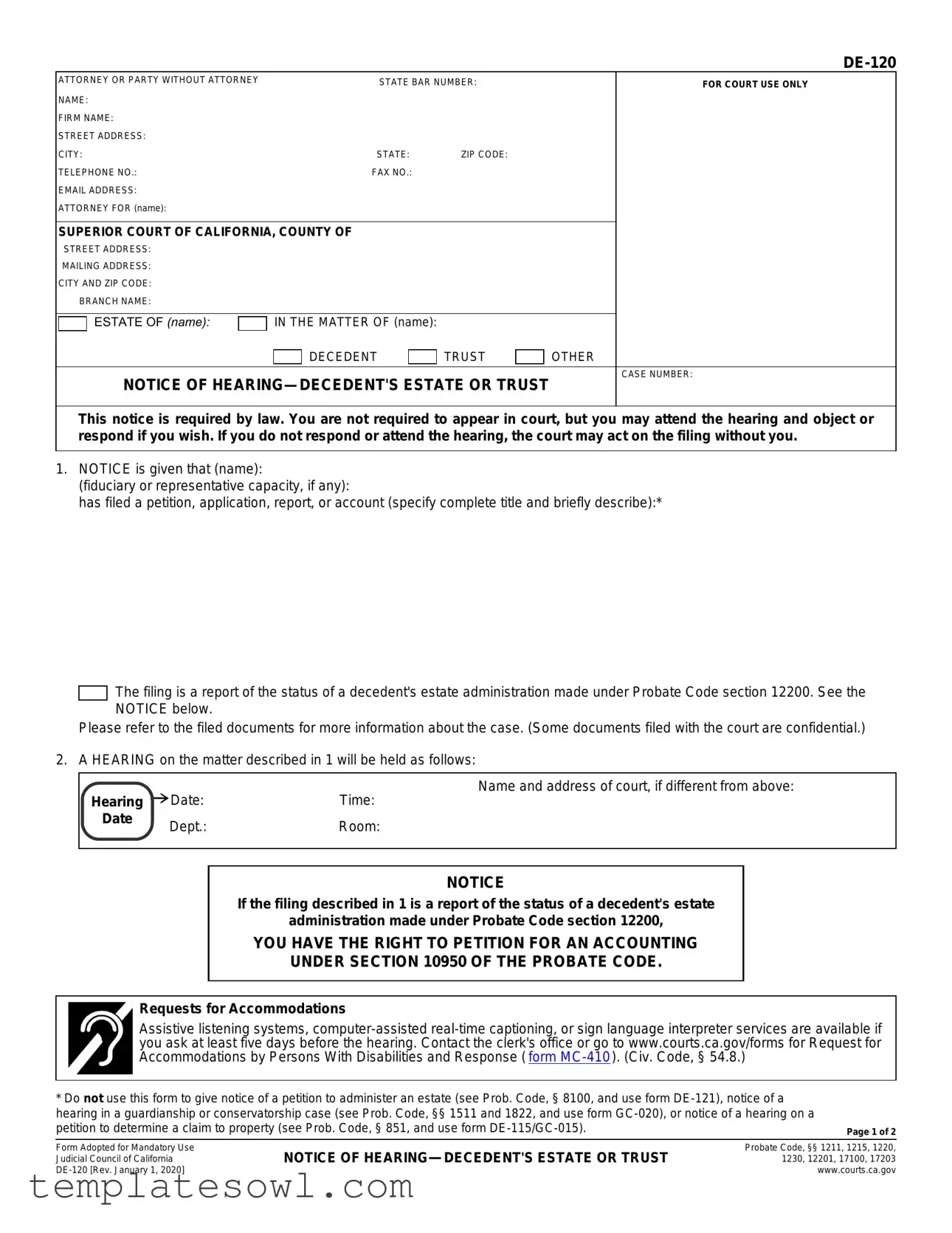

Fill Out Your De 120 Form

The DE-120 form is an important document in the management of a decedent's estate or trust in California. It serves as a formal notice of hearing that informs interested parties about the proceedings related to the estate of a deceased individual. This form contains key details, including the name of the deceased, the case number, and relevant court information. It notifies recipients about a filed petition or report concerning the status of the estate administration under Probate Code section 12200. The DE-120 also outlines essential rights for individuals involved, such as the ability to attend the hearing and the option to object or respond to the filing. Additionally, the form specifies how notifications regarding the hearing should be communicated to all interested parties. Furthermore, it provides space for the certification of posting and proof of service by mail, ensuring compliance with legal requirements. Understanding the DE-120 form is crucial for anyone involved in the estate administration process, as it helps ensure that all parties are informed and can participate effectively in the legal proceedings.

De 120 Example

ATTORNEY OR PARTY WITHOUT ATTORNEY |

STATE BAR NUMBER: |

FOR COURT USE ONLY |

|

NAME: |

|

|

|

FIRM NAME: |

|

|

|

STREET ADDRESS: |

|

|

|

CITY: |

STATE: |

ZIP CODE: |

|

TELEPHONE NO.: |

FAX NO.: |

|

|

EMAIL ADDRESS: |

|

|

|

ATTORNEY FOR (name): |

|

|

|

|

SUPERIOR COURT OF CALIFORNIA, COUNTY OF |

|

|

|

|

|

||||||

|

STREET ADDRESS: |

|

|

|

|

|

|

|

|

|

|

|

|

MAILING ADDRESS: |

|

|

|

|

|

|

|

|

|

|

|

|

CITY AND ZIP CODE: |

|

|

|

|

|

|

|

|

|

|

|

|

BRANCH NAME: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ESTATE OF (name): |

|

|

IN THE MATTER OF (name): |

|

|

|

|

|

||

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

DECEDENT |

|

TRUST |

|

|

OTHER |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NOTICE OF |

|

CASE NUMBER: |

||||||||

|

|

|

|

|||||||||

This notice is required by law. You are not required to appear in court, but you may attend the hearing and object or respond if you wish. If you do not respond or attend the hearing, the court may act on the filing without you.

1.NOTICE is given that (name):

(fiduciary or representative capacity, if any):

has filed a petition, application, report, or account (specify complete title and briefly describe):*

The filing is a report of the status of a decedent's estate administration made under Probate Code section 12200. See the NOTICE below.

Please refer to the filed documents for more information about the case. (Some documents filed with the court are confidential.)

2. A HEARING on the matter described in 1 will be held as follows:

Hearing Date: |

Name and address of court, if different from above: |

|

Time: |

||

Date |

Dept.: |

Room: |

|

||

|

|

|

NOTICE

If the filing described in 1 is a report of the status of a decedent's estate

administration made under Probate Code section 12200,

YOU HAVE THE RIGHT TO PETITION FOR AN ACCOUNTING

UNDER SECTION 10950 OF THE PROBATE CODE.

Requests for Accommodations

Assistive listening systems,

*Do not use this form to give notice of a petition to administer an estate (see Prob. Code, § 8100, and use form

Page 1 of 2

Form Adopted for Mandatory Use Judicial Council of California

NOTICE OF

Probate Code, §§ 1211, 1215, 1220, 1230, 12201, 17100, 17203

www.courts.ca.gov

|

|

ESTATE OF (name): |

|

IN THE MATTER OF (name): |

CASE NUMBER: |

DECEDENT TRUST OTHER

CLERK'S CERTIFICATE OF POSTING

1.I certify that I am not a party to this cause.

2.A copy of the foregoing Notice of

a.was posted at (address):

b.was posted on (date):

Date: |

Clerk, by |

|

, Deputy |

|

|

|

|

|

|

|

|

PROOF OF SERVICE BY MAIL*

1.I am over the age of 18 and not a party to this cause. I am a resident of or employed in the county where the mailing occurred.

2.My residence or business address is (specify):

3.I served the foregoing Notice of

a. depositing the sealed envelope on the date and at the place shown in item 4 with the U.S. Postal Service with the postage fully prepaid.

depositing the sealed envelope on the date and at the place shown in item 4 with the U.S. Postal Service with the postage fully prepaid.

b. placing the envelope for collection and mailing on the date and at the place shown in item 4 following our ordinary business practices. I am readily familiar with this business's practice for collecting and processing correspondence for mailing. On the same day that correspondence is placed for collection and mailing, it is deposited in the ordinary course of business with the U.S. Postal Service in a sealed envelope with postage fully prepaid.

placing the envelope for collection and mailing on the date and at the place shown in item 4 following our ordinary business practices. I am readily familiar with this business's practice for collecting and processing correspondence for mailing. On the same day that correspondence is placed for collection and mailing, it is deposited in the ordinary course of business with the U.S. Postal Service in a sealed envelope with postage fully prepaid.

4.a. Date mailed:

5.

b.Place mailed (city, state):

I served with the Notice of

I declare under penalty of perjury under the laws of the State of California that the foregoing is true and correct. Date:

(TYPE OR PRINT NAME) |

(SIGNATURE) |

1.

2.

3.

4.

5.

|

NAME AND ADDRESS OF EACH PERSON TO WHOM NOTICE WAS MAILED |

||

Name |

|

|

Address (street & number, city, state, zip code) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Continued on an attachment. (You may use Attachment to Notice of Hearing Proof of Service by Mail, form

* Do not use this form for proof of personal service. You may use form

NOTICE OF

For your protection and privacy, please press the Clear |

Print this form |

Save this form |

This Form button after you have printed the form. |

Page 2 of 2

Clear this form

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | The DE-120 form serves as a notice of hearing for decedent's estate or trust matters in California. |

| Governing Law | The form is governed by California Probate Code Sections 1211, 1215, 1220, 1230, 12201, 17100, and 17203. |

| Filing Requirements | This form must be completed and filed when a petition, application, report, or account regarding a decedent's estate is submitted. |

| Public Notice | The notice must be posted to inform interested parties about the upcoming hearing related to the estate. |

| Responding to Notice | Individuals have the right to respond or attend the hearing. If they do not, the court may proceed without their input. |

| Hearing Details | Hearing information, including date, time, and court address, must be clearly provided on the form. |

| Confidential Documents | Some documents filed with the court might be confidential, and the form advises checking filed documents for details. |

| Service by Mail | The form includes instructions for serving the notice by mail to relevant parties, ensuring they are informed. |

Guidelines on Utilizing De 120

Before you begin filling out the DE-120 form, ensure you have all the necessary information at hand. Use a pen to fill out the form clearly. Gather details about your case, including the name of the decedent, court information, and hearing details.

- At the top of the form, fill in the details for Attorney or Party Without Attorney. Provide your state bar number, name, firm name, street address, city, state, ZIP code, telephone number, fax number, and email address.

- Under the section for Attorney for (name), specify whose interests you are representing.

- Next, indicate details about the Superior Court of California. Fill in the street address, mailing address, city, and ZIP code. Also, specify the branch name.

- In the section titled Estate of (name), write the name of the decedent.

- In the In the Matter of (name) section, provide any related names.

- Fill in the Case Number assigned to your case.

- In Notice, state the name of the fiduciary or representative along with their capacity, if applicable.

- Briefly describe the type of petition or application filed. Mention it as a report under the appropriate section of the Probate Code.

- Specify the details for the Hearing. Include the hearing date, time, department, and room number if this information is available.

- Complete the Clerk's Certificate of Posting section, indicating the address where the notice was posted and the date of posting.

- Fill in the Proof of Service by Mail section, including your address, the date of mailing, and the place of mailing.

- Finally, list the names and addresses of each person to whom you mailed the notice. Use additional pages if needed.

Make sure to review the completed form for any errors before submitting it. Once done, you can file it with the court as required. Keep a copy for your own records too.

What You Should Know About This Form

What is the purpose of the DE-120 form?

The DE-120 form is used as a Notice of Hearing regarding a decedent's estate or trust in California. This document informs interested parties about a scheduled hearing involving the administration of a decedent's estate. It outlines the necessary details, such as the date, time, and location of the hearing, as well as what has been filed with the court. The filing can be a petition, application, report, or account related to the estate. The form ensures that those involved are aware of their rights to object or respond during the hearing.

Who needs to receive the DE-120 Notice?

What should I do if I want to attend the hearing mentioned in the DE-120?

If you wish to attend the hearing indicated in the DE-120 form, you are encouraged to do so. Your presence allows you to voice any objections or responses you may have regarding the proceedings. Although attendance is not mandatory, you should be aware that if you do not respond or attend, the court might proceed with the filing without considering your views.

Are there accommodations available for individuals with disabilities?

Yes, accommodations are available for individuals with disabilities who wish to attend the hearing. Services like assistive listening systems, computer-assisted real-time captioning, and sign language interpreting can be requested. It’s important to ask for these services at least five days before the scheduled hearing. You can contact the clerk’s office or visit the official court website for more details on how to request these accommodations.

What happens if I do not respond to the DE-120 Notice?

If you do not respond to the DE-120 Notice or attend the scheduled hearing, the court may proceed with making decisions based on the filing. This means that the court might take action regarding the decedent’s estate without considering your input or concerns. Therefore, if you have any objections or interests in the estate, it is advisable to respond or attend the hearing.

Common mistakes

Filling out the DE-120 form can be straightforward, but many people make common mistakes that can lead to confusion or delays. One significant error is failing to provide complete contact information for the attorney or party without an attorney. Omitting the telephone number or email address can hinder communication and affect the processing of the case.

Another frequent mistake is neglecting to specify the correct case number. This information is crucial, as it helps the court track the filing. Without it, your document may not be properly associated with your case. Double-checking that you have entered the right case number can save valuable time.

Inaccurate information about the decedent or the estate is also a common issue. It’s vital to ensure that the names and titles provided match the legal documents associated with the estate. Errors here can raise questions and may even result in the rejection of your form.

People often forget to indicate the appropriate hearing date and time. This detail is not just a formality; it ensures that all parties are aware of when the hearing is scheduled and can plan accordingly. Failing to fill this out can lead to significant miscommunication.

Another mistake is related to the proof of service aspect. Many forget to complete all sections relevant to proof of service by mail. The section asking for the name and address of each person notified needs to be clear and complete; otherwise, it may lead to claims that parties were not properly informed.

Some individuals make the error of not signing the form. A signature indicates that the information provided is true and correct, and leaving this blank can invalidate the submission.

Another crucial element is the certificate of posting. Omitting the details regarding where and when the notice was posted can create issues down the line. Clarity in this section helps maintain transparency with the court.

Pay attention to the choice of hearing type indicated on the form. Submitting a notice of hearing without specifying if it concerns a decedent’s estate or a trust can cause legal complications. Knowing the difference is imperative for ensuring the correct legal procedures are followed.

Filling out the form for the wrong process is also a mistake that can lead to major headaches. For example, using the DE-120 for guardianship matters instead of a proper form only tailored for decedent’s estates can derail the filing process entirely.

Lastly, individuals sometimes fail to keep a copy of the completed form for their records after submission. It's crucial to keep proof of what was submitted, just in case there are follow-up questions or disputes. Retaining a copy ensures you have a reference point for future proceedings.

Documents used along the form

The DE-120 form is commonly used in probate proceedings to notify interested parties about a hearing concerning a decedent's estate or trust. Several other documents may accompany this form in the probate process. Below is a list of these forms, along with brief descriptions of their purposes.

- DE-121 Notice of Petition to Administer Estate: This form is used to notify interested parties about a petition to administer a decedent's estate. It provides details on the impending hearing and enables beneficiaries to respond or object.

- GC-020 Notice of Hearing: This document is utilized in guardianship or conservatorship cases to inform parties of a scheduled hearing. It ensures that all interested individuals are aware of the legal proceedings affecting a person's rights or affairs.

- DE-115 Notice of Hearing on Petition to Determine Succession to Real Property: This form gives notice of a hearing regarding a petition that seeks to establish the rightful heir's claim to real estate. It plays a critical role in resolving property ownership disputes.

- MC-410 Request for Accommodations: Individuals requiring assistance for disabilities can use this form to request accommodations at court hearings. It ensures that everyone can participate in legal proceedings on an equal basis.

- DE-120(P) Proof of Personal Service: This document is used to verify that the Notice of Hearing was personally served to interested parties. It is important for confirming that all relevant individuals were officially informed of the proceedings.

These forms are essential in the probate process to ensure that all parties receive proper notification and have the opportunity to participate. Understanding their functions can help individuals navigate the complexities of estate administration more effectively.

Similar forms

- DE-121: Notice of Petition to Administer Estate - This document notifies interested parties about the pending petition to administer a decedent's estate. Like the DE-120, it serves to inform parties about upcoming hearings and their rights, particularly regarding the administration of estates.

- GC-020: Notice of Hearing - This form is used in guardianship and conservatorship cases to notify interested parties of a hearing. Similar to the DE-120, it provides essential details about the hearing date, time, and location, ensuring transparency in legal proceedings.

- DE-115/GC-015: Notice of Hearing on Petition to Determine Claim to Property - This document informs parties about hearings concerning property claims. Like the DE-120, it allows individuals to understand the nature of the petition and respond accordingly, fostering jurisdictional awareness.

- DE-140: Order for Probate - This form initiates the probate process, similar to the DE-120, which provides a notice related to estate administration. Both forms are part of the legal proceedings following a decedent's passing, ensuring proper handling of estate matters.

- DE-145: Notice of Hearing for Confirmation of Sale of Real Property - This document announces hearings related to the sale of real property in probate cases. As with the DE-120, the focus is on preserving the rights of interested parties by allowing them to attend and respond to proceedings.

- MC-410: Request for Accommodations - While not a direct notice form, this document ensures that individuals with disabilities can participate in hearings. It includes similar procedural information to facilitate public access, paralleling the notice functionality of the DE-120.

- DE-7: Notice of Motion to Compel Production of Documents - This form is used to notify parties about motions related to document production in probate cases. Like the DE-120, it ensures that involved parties are aware of crucial dates and can respond appropriately.

- Form DE-900: Petition for Final Distribution - This petition marks the conclusion of the probate process. While the DE-120 involves notices for ongoing processes, both forms play critical roles in managing estate matters, emphasizing the importance of communication during the probate process.

Dos and Don'ts

When filling out the DE-120 form, certain best practices can help ensure that the process is completed correctly. Here are eight things you should and shouldn’t do:

- Do ensure that all names and addresses are accurate to prevent delays.

- Do include your contact information clearly so the court can reach you if needed.

- Do use the correct version of the form to avoid complications.

- Do follow the instructions for proof of service to ensure proper notification.

- Don't leave any sections blank; missing information can lead to rejection.

- Don't use this form for purposes other than those specified, such as guardianship notices.

- Don't forget to check for any local court rules or additional requirements.

- Don't rush the process. Take time to review your entries before submission.

Misconceptions

Understanding the DE-120 form is essential, yet there are some common misconceptions surrounding it. Here are six of those misconceptions, along with clarifications to help you navigate the process more easily.

- Misconception 1: The DE-120 form must be filed for every court case.

- Misconception 2: You are required to appear in court when this notice is filed.

- Misconception 3: If you do not respond to the notice, the court cannot take action.

- Misconception 4: The DE-120 form is used to give notice of a petition to administer an estate.

- Misconception 5: All information in the filed documents is available to the public.

- Misconception 6: You can ignore the notice if it's not addressed to you directly.

This form is specific to notices regarding a decedent's estate or trust. It is not necessary for other types of cases.

The notice indicates that attendance is not mandatory. You may choose to attend to object or respond, but it is not compulsory.

In fact, if you do not respond or attend the hearing, the court can still make decisions based on the petition.

This form should not be used for that purpose. You must use form DE-121 for that specific notification.

Some documents related to the case are confidential and may not be accessible to everyone.

Even if the notice doesn't mention your name, it might impact your interests in the estate. Always take them seriously.

Key takeaways

The DE-120 form, known as the Notice of Hearing for a Decedent's Estate or Trust, is an important document within the probate process. Here are some key takeaways regarding its use:

- Purpose of the Form: The DE-120 serves to notify interested parties about a hearing concerning the administration of a decedent’s estate or trust. This notification includes details of the filing, such as the type of document submitted and the relevant hearing information.

- Filing Requirements: When filling out the DE-120, it is crucial to provide accurate information regarding the decedent, the executor or representative, and the filing details. Inaccuracies may lead to complications in the probate process.

- Hearing Attendance: While attending the hearing is not mandatory, interested parties have the right to object or respond. Failing to attend may result in the court making decisions without one’s input, potentially affecting one's interests.

- Confidential Information: It's important to recognize that some documents filed with the court may be confidential. Interested parties should be aware of this as they prepare to engage in the hearing process.

- Accommodations: The form provides information about accessibility options available for individuals with disabilities. Such services, including sign language interpreters, must be requested in advance to ensure proper accommodations.

Understanding these key elements of the DE-120 form can aid individuals in effectively navigating the probate process and ensuring their rights are recognized in legal proceedings surrounding a decedent's estate or trust.

Browse Other Templates

Airline Job Application Form - Holding a full clean UK driving license may be necessary for certain positions within the company.

Where to Report Executor Fees on 1040 - The form is part of the compliance process for estate tax matters.