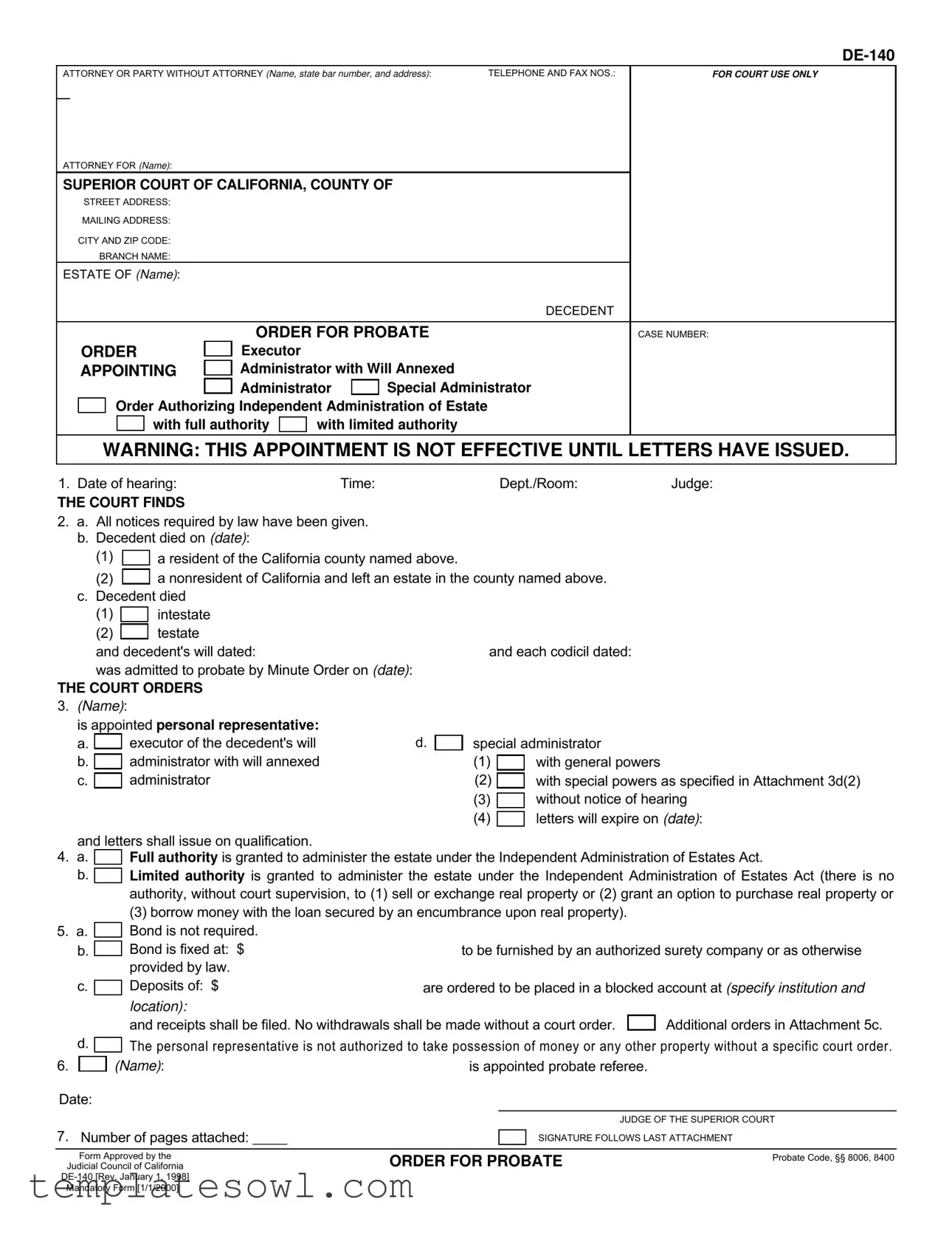

Fill Out Your De 140 Form

When navigating the complexities of estate management in California, one significant document that comes into play is the DE-140 form, commonly referred to as the Order for Probate. This form serves a critical role in the probate process, as it facilitates the official appointment of a personal representative, such as an executor or administrator, to handle the decedent's estate. In the DE-140, the court details various essential elements, including the findings regarding the decedent's residency and the validity of their will, if applicable. The form specifies the authority granted to the appointed representative, which can range from full authority to limited powers, and it outlines any necessary conditions, such as the requirement for a bond or the handling of blocked accounts. A key point to remember is that the appointment expressed within the DE-140 does not take effect until the letters of administration have been issued by the court. Moreover, the document emphasizes the importance of compliance with legal notice requirements, ensuring that all parties involved are adequately informed. Thus, understanding the DE-140 form and its implications is crucial for anyone tasked with administering an estate, offering a clear pathway through the often overwhelming probate process.

De 140 Example

ATTORNEY OR PARTY WITHOUT ATTORNEY (Name, state bar number, and address): |

TELEPHONE AND FAX NOS.: |

FOR COURT USE ONLY |

ATTORNEY FOR (Name):

SUPERIOR COURT OF CALIFORNIA, COUNTY OF

|

STREET ADDRESS: |

|

|

|

|

|

|

|

|

|||

|

MAILING ADDRESS: |

|

|

|

|

|

|

|

|

|||

|

CITY AND ZIP CODE: |

|

|

|

|

|

|

|

|

|||

|

BRANCH NAME: |

|

|

|

|

|

|

|

|

|||

ESTATE OF (Name): |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

DECEDENT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ORDER FOR PROBATE |

|

CASE NUMBER: |

||||

|

ORDER |

|

Executor |

|

|

|

|

|

||||

|

|

|

|

|

|

|||||||

|

APPOINTING |

|

Administrator with Will Annexed |

|

|

|||||||

|

|

|

||||||||||

|

|

|

|

|

|

Administrator |

|

Special Administrator |

|

|

||

|

|

Order Authorizing Independent Administration of Estate |

|

|

||||||||

|

|

|

|

|||||||||

|

|

|

|

with full authority |

|

with limited authority |

|

|

||||

|

|

|

|

|

|

|

||||||

WARNING: THIS APPOINTMENT IS NOT EFFECTIVE UNTIL LETTERS HAVE ISSUED.

1. Date of hearing: |

Time: |

Dept./Room: |

Judge: |

THE COURT FINDS

2.a. All notices required by law have been given. b. Decedent died on (date):

(1) |

|

a resident of the California county named above. |

|

(2) |

|

a nonresident of California and left an estate in the county named above. |

|

|

|||

c. Decedent died |

|

||

(1) |

|

intestate |

|

|

|

||

(2) |

|

testate |

|

|

|

||

and decedent's will dated: |

and each codicil dated: |

||

was admitted to probate by Minute Order on (date): |

|

||

THE COURT ORDERS

3.(Name):

is appointed personal representative: |

|

||

a. |

|

executor of the decedent's will |

d. |

b. |

|

administrator with will annexed |

|

|

|

||

|

|

administrator |

|

c. |

|

|

|

special administrator

(1) |

|

with general powers |

(2) |

|

with special powers as specified in Attachment 3d(2) |

|

||

(3) |

|

without notice of hearing |

|

||

(4) |

|

letters will expire on (date): |

|

and letters shall issue on qualification.

4. a. |

|

Full authority is granted to administer the estate under the Independent Administration of Estates Act. |

|

|

|

b. |

|

Limited authority is granted to administer the estate under the Independent Administration of Estates Act (there is no |

5.a.

b.

c.

d.

6.

Date:

authority, without court supervision, to (1) sell or exchange real property or (2) grant an option to purchase real property or

(3) borrow money with the loan secured by an encumbrance upon real property).

Bond is not required. |

|

|

|

Bond is fixed at: $ |

to be furnished by an authorized surety company or as otherwise |

||

provided by law. |

|

|

|

Deposits of: $ |

are ordered to be placed in a blocked account at (specify institution and |

||

location): |

|

|

|

and receipts shall be filed. No withdrawals shall be made without a court order. |

|

Additional orders in Attachment 5c. |

|

The personal representative is not authorized to take possession of money or any other property without a specific court order.

The personal representative is not authorized to take possession of money or any other property without a specific court order.

(Name): |

is appointed probate referee. |

|

|

|

|

|

|

JUDGE OF THE SUPERIOR COURT |

7. Number of pages attached: _____ |

|

|

SIGNATURE FOLLOWS LAST ATTACHMENT |

|

|

|

|

|

|

Form Approved by the |

ORDER FOR PROBATE |

Probate Code, §§ 8006, 8400 |

||

Judicial Council of California |

|

|||

Mandatory Form [1/1/2000]

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The DE-140 form is used to request an order for probate in California, allowing the appointment of an executor or administrator for a decedent's estate. |

| Governing Law | This form is governed by the Probate Code, specifically sections 8006 and 8400, of the State of California. |

| Required Information | Details about the decedent, such as their date of death and whether they left a will, must be provided to complete the form. |

| Court Findings | The form allows the court to confirm that all necessary notices have been provided regarding the probate proceedings. |

| Authority Grant | It grants full or limited authority to the appointed personal representative to administer the estate under the Independent Administration of Estates Act. |

| Attachments | Additional pages or documents may be required, and they need to be specified in the form; a section to indicate the number of pages attached is included. |

Guidelines on Utilizing De 140

Filling out the DE-140 form is an essential step in the probate process. This form is used to request the court to appoint a personal representative to manage a decedent's estate. Carefully completing this form helps ensure that the appointment progresses smoothly, leading to the efficient handling of the estate's affairs.

- At the top of the form, provide the name of the attorney or party without an attorney, including their state bar number and address.

- Include the telephone and fax numbers for easy communication.

- Enter the name of the attorney for the estate, if applicable.

- Fill in the details of the Superior Court, including the street address, mailing address, city, and ZIP code.

- State the name of the decedent whose estate is being probated.

- Provide the case number assigned by the court.

- Indicate the order you are requesting by checking the relevant boxes (e.g., appointing an executor, administrator with will annexed, etc.).

- Record the date, time, department/room, and the judge presiding over the hearing.

- Confirm that all required notices have been provided by marking the appropriate box.

- Indicate whether the decedent died as a resident or nonresident of California, and provide the date of death.

- Check whether the decedent died testate or intestate and fill in the relevant details regarding the will and any codicils.

- Specify the name of the person being appointed as personal representative.

- Select the type of appointment (executor, administrator, or special administrator) and detail the powers granted (general or special powers, if any).

- Indicate if the appointment requires court supervision and if any bond is required, detailing the bond amount if applicable.

- Provide information about any blocked accounts for estate funds, including the financial institution and location.

- List the name of the appointed probate referee, if applicable.

- Finally, indicate the number of pages attached and sign where indicated.

What You Should Know About This Form

What is the DE-140 form used for?

The DE-140 form, also known as the Order for Probate, is used in California to initiate the probate process. It formally requests the court to appoint a personal representative to manage the estate of a deceased person, whether they left a will or died intestate (without a will).

Who can file the DE-140 form?

Any interested party, which can include beneficiaries or heirs of the deceased, can file the DE-140 form. If there is an attorney involved, they can also file it on behalf of their client. It’s essential that the person filing has the legal standing to do so, which generally means they have a direct interest in the estate.

What information do I need to provide on the DE-140 form?

Details such as the decedent’s name, date of death, details about their residency, and any will or codicils should be included. You also need to provide information about the proposed personal representative, including their name and relationship to the decedent, as well as any relevant information regarding their authority to act in this role.

What happens after I submit the DE-140 form?

Once the form is submitted, a court hearing will be scheduled. You will receive a notice regarding the date, time, and location of this hearing. It’s vital to ensure that all required notices are given to interested parties prior to the hearing. The court will then decide whether to approve the appointment of the personal representative.

What is meant by "executor" and "administrator" in the context of the DE-140 form?

An executor is someone appointed to carry out the terms of a will. If there’s no will, the appointed person is referred to as an administrator. Both roles involve managing the estate’s assets, settling debts, and distributing property according to the law or the terms of the will.

What is the significance of “letters” mentioned in the DE-140 form?

Letters, referred to in the form, are official documents issued by the court that confer authority to the personal representative to act on behalf of the estate. It’s essential to understand that without the issuance of these letters, the appointment is not effective, meaning the personal representative cannot take any actions related to the estate.

What is independent administration, and how does it affect the personal representative?

Independent administration allows the personal representative to manage the estate without needing court supervision for routine matters. There are two levels of authority: full authority, which permits actions like selling property, and limited authority, which restricts certain actions unless further court approval is obtained. This flexibility can help streamline the management process of the estate.

Are there any fees associated with the DE-140 form?

Yes, there may be filing fees associated with the DE-140 form. In addition to the court's fee for processing the probate application, there could be costs involved in notifying interested parties, attorney fees if you hire legal assistance, and any other related expenses. It's wise to check with the court and consider budgeting for these costs.

Common mistakes

When individuals fill out the DE-140 form, several common mistakes can lead to delays or complications in the probate process. First, it's essential to provide accurate information about the decedent. Misstating the name or leaving out critical details such as the date of death can create confusion. Always double-check the spelling and ensure that all relevant dates are correctly entered.

Another mistake occurs when determining the residency of the decedent. The form requires you to indicate if the decedent was a resident of California or a non-resident leaving an estate in California. Failing to classify this correctly can affect jurisdiction and the estate's management. Take a moment to verify residency status before proceeding.

Completing the section detailing the appointment of the personal representative can also lead to errors. Many people mistakenly select the wrong type of representative, whether it’s an executor or administrator. This choice is crucial as it outlines who will manage the estate. If unsure about the correct designation, seek clarification before making a selection.

It's important to avoid neglecting the required attachments. The DE-140 form may require additional pages to be submitted alongside it. If these attachments are missing, the application may be considered incomplete. A thorough review of the checklists provided by the court can help ensure everything required is included.

Another frequent error is related to the bond section. In some situations, a bond may not be required, but if it is, providing an incorrect amount or failing to complete this section can lead to processing issues. It's imperative to understand the bond requirements applicable to your situation, as this is determined by state law.

Lastly, do not overlook the importance of signatures and dates. The form requires a signature and the date when the application is submitted. Forgetting to sign or misdating the document can result in delays or the return of the paperwork. Taking a final moment to ensure that all signatures are present and dated will save time in the long run.

Documents used along the form

When dealing with the DE-140 form, which is used for establishing a personal representative to manage a decedent's estate, there are several other important forms and documents you will likely encounter. Each of these documents serves a specific purpose in the probate process, ensuring compliance with legal requirements and facilitating the orderly management of the estate.

- DE-111: Petition for Probate - This form initiates the probate process. It provides the court with necessary information about the decedent, the beneficiaries, and the overall estate, helping to establish the grounds for appointing a personal representative.

- DE-154: Letters of Administration - Once the court approves the request for probate, this document is issued to the personal representative. It grants the representative the legal authority to administer the estate, which includes managing the decedent’s assets and fulfilling their debts and obligations.

- DE-255: Notice of Hearing on Petition for Probate - This form is used to notify interested parties of the upcoming court hearing regarding the petition for probate. Proper notification ensures that all potential heirs and beneficiaries have a chance to express their concerns or objections.

- DE-295: Notice of Petition to Administer Estate - Similar to the Notice of Hearing, this document is sent to interested parties to inform them about the ongoing probate process and any hearings that may be scheduled. It protects the rights of heirs and creditors by keeping them informed.

- DE-160: Inventory and Appraisal - After the personal representative is appointed, they must conduct an inventory of the decedent’s assets. This form records all property and its value, offering transparency and accountability in estate management.

- DE-201: Final Distribution Account - This document summarizes the estate's transactions, including income and expenses. It is presented to the court at the end of the probate process to seek approval for final distributions to beneficiaries.

- DE-220: Notice of Proposed Action - When a personal representative wants to take specific actions regarding the estate, this notice informs interested parties. It allows for potential objections before the action is carried out.

- DE-255-INFO: Information on Completing the Petition for Probate - This informational document provides guidance on how to fill out the Petition for Probate, assisting individuals in understanding the requirements and necessary information needed in the form.

Being familiar with these forms and documents will help streamline the probate process, ensuring that all necessary steps are taken in a timely manner. Thorough preparation and understanding can alleviate potential complications and delays during this sensitive time.

Similar forms

- DE-111: Petition for Probate - This document initiates the probate process in court. Like DE-140, it requires details about the deceased, their estate, and the petitioner’s relationship with the decedent. Both forms aim to appoint a representative for managing the estate.

- DE-121: Notice of Petition to Administer Estate - Similar to DE-140, this form provides notice to interested parties about the petition for probate. Both documents serve to inform heirs and beneficiaries, ensuring transparency in the administration process.

- DE-147: Letters of Administration - This document grants legal authority to the personal representative appointed in DE-140. Both forms emphasize the necessity of official authorization in managing the estate of the deceased.

- DE-154: Inventory and Appraisal - Like DE-140, this document is concerned with estate management. It details the assets of the estate and provides a formal appraisal, reflecting the responsibilities assigned to the executor or administrator.

- DE-205: Order for Final Distribution - This form marks the conclusion of the probate process, similar to DE-140 which initiates it. Both documents highlight the final steps in administering an estate and can determine the distribution of assets among beneficiaries.

- DE-295: Petition for Letters of Special Administration - This document allows for the appointment of a temporary administrator. Like DE-140, it focuses on the need for specialized management of the estate during urgent circumstances.

- DE-140S: Appointment of Probate Referee - This form functions in conjunction with the DE-140 by appointing a referee to evaluate the estate assets. Both documents underscore the importance of accurate assessment in the probate process.

- DE-262: Petition for Assigning Real Property - Similar to DE-140, this form requests court approval for the management of specific real estate within the estate. Both documents are crucial during the administration phase to ensure compliance with legal requirements.

- DE-355: Order to Transfer Assets - This document transfers assets from the estate to the beneficiaries, echoing aspects of DE-140 concerning the orderly distribution of assets after probate proceedings have concluded.

Dos and Don'ts

When completing the DE-140 form, there are essential guidelines to follow for a successful submission. Below is a list of do's and don’ts.

- Do ensure all required fields are filled out completely.

- Do double-check the names and dates for accuracy.

- Do provide the correct court address and branch information.

- Do clearly indicate the type of personal representative being appointed.

- Do read the form instructions thoroughly.

- Don’t leave any sections blank unless instructed.

- Don’t sign the form before it is fully completed.

- Don’t use correction fluid or tape on the form; any mistakes should be neatly crossed out and initialed.

- Don’t submit the form without the accompanying documents required for the specific case.

Misconceptions

Misconceptions about the DE-140 form can create confusion for individuals navigating the probate process. Addressing these misconceptions can lead to a clearer understanding of its purpose and requirements.

- The DE-140 form is only for attorneys. This form can be filed by both attorneys and parties representing themselves in court. It is designed to facilitate the appointment of a personal representative, regardless of legal representation.

- Completing the DE-140 form guarantees the appointment of a personal representative. While the form initiates the process, the actual appointment depends on the court's approval. The court must find that all legal notices have been given and that the requirements for appointment are met.

- Once the DE-140 is filed, the personal representative can act immediately. This is not the case. The form states that "this appointment is not effective until letters have issued." Only after the court grants the necessary letters can the personal representative take action.

- Limited authority means no actions can be taken without court approval. Limited authority does mean that certain actions, like selling real property, cannot be done without supervision. However, the personal representative may have specific powers outlined in the form that can be exercised without additional court approval, depending on the circumstances.

- The DE-140 form does not require any additional documentation. This is misleading. While the form serves a primary purpose, it is often accompanied by additional documents, such as the decedent's will or affidavits to establish residency, as instructed in the probate process.

Understanding these misconceptions can help individuals approach the probate process with greater confidence. Ensuring accuracy in filing the DE-140 and seeking guidance when needed will foster a smoother experience in what can be an emotionally taxing time.

Key takeaways

When filling out and using the DE-140 form, there are several important points to keep in mind. This form is essential for the probate process in California, and understanding its requirements can help ensure a smoother experience.

- Complete Information: Ensure that all sections of the form are filled out accurately. Include details such as names, addresses, telephone numbers, and the specific case number as this information is crucial for processing.

- Understanding Appointments: The form allows the court to appoint different types of personal representatives. Clarify whether you need an executor, administrator with will annexed, or a special administrator as each role has different responsibilities.

- Authority Levels: Recognize the distinction between full authority and limited authority under the Independent Administration of Estates Act. This will determine what actions the personal representative can take without court approval.

- Attachments Are Important: If there are additional orders or attachments referenced in the form, make sure to include them. These can provide further specificity regarding the estate's management or any special instructions.

- Check for Bond Requirements: Determine if a bond is required. The bond acts as a safeguard and the amount must be specified; make sure it aligns with the legal requirements to avoid delays.

- Filing Timeline: Remember, the appointment is not effective until letters have issued. Be aware of any timelines related to hearings or other legal requirements to ensure compliance.

By paying close attention to these key elements, you can navigate the completion and submission of the DE-140 form with greater confidence. Each detail counts, and taking the time to understand the requirements will facilitate the probate process for you and your loved ones.

Browse Other Templates

5106 Form Fedex - Prepare to provide specific business-related details when filling out the 5106 form.

Direct Pension Deposit Form,SERS Pension Payment Authorization,Pension Direct Deposit Request,SERS Member Payment Transfer,Retirement Payment Direct Deposit,SERS Monthly Pension Deposit Form,State Pension Direct Deposit Agreement,Direct Deposit Enrol - All prior payment arrangements with SERS are revoked upon submission of the form.

Dphs Chennai - Training programs or additional ceremonies may be organized following the Convocation.