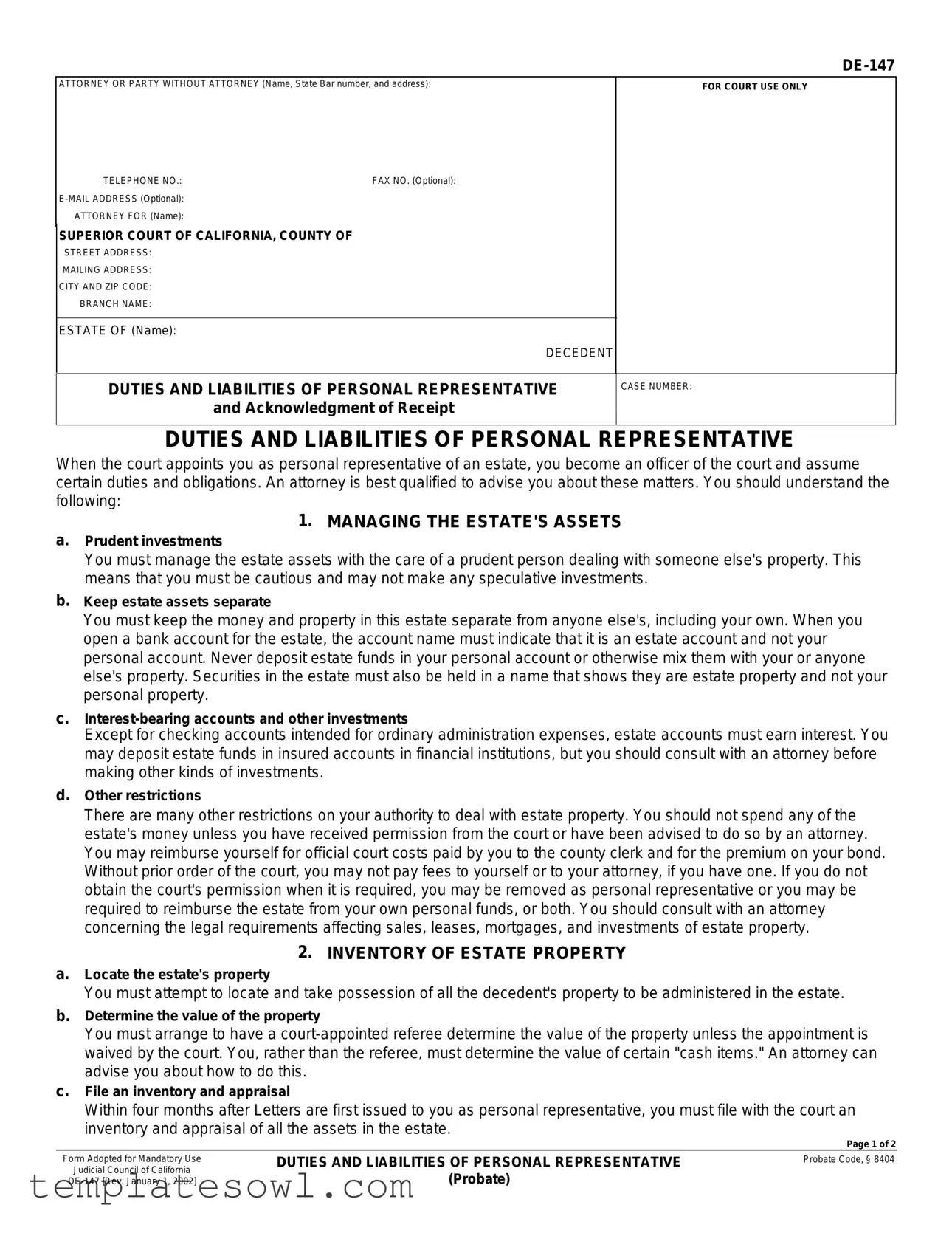

Fill Out Your De 147 Form

The DE-147 form is an important document for anyone stepping into the role of personal representative for an estate in California. This form outlines the responsibilities and liabilities that come with managing the affairs of a deceased individual's estate. As a personal representative, you become an officer of the court and are charged with the vital duty of overseeing the estate’s assets—ensuring they are managed prudently and kept separate from personal funds. This means opening dedicated estate accounts and making informed investment choices with care. Additionally, the form lays out the requirement to inventory all estate property, file the necessary court documents, and notify creditors promptly. From maintaining accurate records of all transactions to consulting with an attorney for legal guidance, each aspect is crucial for successful estate administration. The DE-147 serves as a guiding tool that not only helps clarify these obligations but also protects the interests of all parties involved in the estate process, ensuring that everything is handled lawfully and ethically.

De 147 Example

ATTORNEY OR PARTY WITHOUT ATTORNEY (Name, State Bar number, and address):

TELEPHONE NO.: |

FAX NO. (Optional): |

|

|

ATTORNEY FOR (Name): |

|

SUPERIOR COURT OF CALIFORNIA, COUNTY OF

STREET ADDRESS:

MAILING ADDRESS:

CITY AND ZIP CODE:

BRANCH NAME:

ESTATE OF (Name):

DECEDENT

FOR COURT USE ONLY

DUTIES AND LIABILITIES OF PERSONAL REPRESENTATIVE |

CASE NUMBER: |

and Acknowledgment of Receipt |

|

DUTIES AND LIABILITIES OF PERSONAL REPRESENTATIVE

When the court appoints you as personal representative of an estate, you become an officer of the court and assume certain duties and obligations. An attorney is best qualified to advise you about these matters. You should understand the following:

1. MANAGING THE ESTATE'S ASSETS

a.Prudent investments

You must manage the estate assets with the care of a prudent person dealing with someone else's property. This means that you must be cautious and may not make any speculative investments.

b.Keep estate assets separate

You must keep the money and property in this estate separate from anyone else's, including your own. When you open a bank account for the estate, the account name must indicate that it is an estate account and not your personal account. Never deposit estate funds in your personal account or otherwise mix them with your or anyone else's property. Securities in the estate must also be held in a name that shows they are estate property and not your personal property.

c.

Except for checking accounts intended for ordinary administration expenses, estate accounts must earn interest. You may deposit estate funds in insured accounts in financial institutions, but you should consult with an attorney before making other kinds of investments.

d.Other restrictions

There are many other restrictions on your authority to deal with estate property. You should not spend any of the estate's money unless you have received permission from the court or have been advised to do so by an attorney. You may reimburse yourself for official court costs paid by you to the county clerk and for the premium on your bond. Without prior order of the court, you may not pay fees to yourself or to your attorney, if you have one. If you do not obtain the court's permission when it is required, you may be removed as personal representative or you may be required to reimburse the estate from your own personal funds, or both. You should consult with an attorney concerning the legal requirements affecting sales, leases, mortgages, and investments of estate property.

2. INVENTORY OF ESTATE PROPERTY

a.Locate the estate's property

You must attempt to locate and take possession of all the decedent's property to be administered in the estate.

b.Determine the value of the property

You must arrange to have a

c.File an inventory and appraisal

Within four months after Letters are first issued to you as personal representative, you must file with the court an inventory and appraisal of all the assets in the estate.

|

|

Page 1 of 2 |

Form Adopted for Mandatory Use |

DUTIES AND LIABILITIES OF PERSONAL REPRESENTATIVE |

Probate Code, § 8404 |

Judicial Council of California |

(Probate) |

|

|

ESTATE OF (Name):

DECEDENT

CASE NUMBER:

d.File a change of ownership

At the time you file the inventory and appraisal, you must also file a change of ownership statement with the county recorder or assessor in each county where the decedent owned real property at the time of death, as provided in section 480 of the California Revenue and Taxation Code.

3. NOTICE TO CREDITORS

You must mail a notice of administration to each known creditor of the decedent within four months after your appointment as personal representative. If the decedent received

4. INSURANCE

You should determine that there is appropriate and adequate insurance covering the assets and risks of the estate. Maintain the insurance in force during the entire period of the administration.

5. RECORD KEEPING

a.Keep accounts

You must keep complete and accurate records of each financial transaction affecting the estate. You will have to prepare an account of all money and property you have received, what you have spent, and the date of each transaction. You must describe in detail what you have left after the payment of expenses.

b.Court review

Your account will be reviewed by the court. Save your receipts because the court may ask to review them. If you do not file your accounts as required, the court will order you to do so. You may be removed as personal representative if you fail to comply.

6. CONSULTING AN ATTORNEY

If you have an attorney, you should cooperate with the attorney at all times. You and your attorney are responsible for completing the estate administration as promptly as possible. When in doubt, contact your attorney.

NOTICE: 1. This statement of duties and liabilities is a summary and is not a complete statement of the law. Your conduct as a personal representative is governed by the law itself and not by this summary.

2.If you fail to perform your duties or to meet the deadlines, the court may reduce your compensation, remove you from office, and impose other sanctions.

ACKNOWLEDGMENT OF RECEIPT

1.I have petitioned the court to be appointed as a personal representative.

2.My address and telephone number are (specify):

3.I acknowledge that I have received a copy of this statement of the duties and liabilities of the office of personal representative.

Date:

(TYPE OR PRINT NAME) |

(SIGNATURE OF PETITIONER) |

Date:

(TYPE OR PRINT NAME) |

(SIGNATURE OF PETITIONER) |

CONFIDENTIAL INFORMATION: If required to do so by local court rule, you must provide your date of birth and driver's license number on supplemental Form

DUTIES AND LIABILITIES OF PERSONAL REPRESENTATIVE |

||||||

|

|

|

(Probate) |

|||

For your protection and privacy, please press the Clear |

|

|

|

|

|

|

This Form button after you have printed the form. |

|

Print this form |

|

Save this form |

|

|

Page 2 of 2

Clear this form

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Title | The form is officially titled DE-147, which pertains to the duties and liabilities of a personal representative in an estate. |

| Governing Law | This form is governed by the Probate Code, specifically § 8404, of the State of California. |

| Purpose | DE-147 serves to inform personal representatives about their responsibilities when administering an estate. |

| Filing Requirements | Personal representatives must file an inventory and appraisal of the estate's assets within four months of their appointment. |

| Notice to Creditors | A notice of administration must be mailed to known creditors within four months of the appointment of the personal representative. |

Guidelines on Utilizing De 147

After receiving the DE-147 form, it's important to fill it out accurately and completely. This form is essential in the administration of an estate, and it details your duties and liabilities as a personal representative. Completing it correctly ensures that you are aware of your responsibilities and helps facilitate the estate administration process.

- Begin by writing the name of the attorney or party without an attorney at the top of the form. Include the State Bar number, address, telephone number, and optional fax and email information.

- Next, specify the name of the attorney for whom you are filling out the form.

- Provide the street address, mailing address, city, zip code, and branch name of the Superior Court of California, County of.

- Fill in the name of the estate and the decedent.

- Leave the "Duties and Liabilities of Personal Representative" section untouched, as it contains general guidelines.

- In the "Acknowledgment of Receipt" section, confirm your petition to be appointed as personal representative.

- Clearly print your address and telephone number in the designated area.

- Indicate the date on which you are completing the form.

- Sign the form where indicated, using your typewritten or printed name under the signature line. If there are additional petitioners, provide their details and signatures as well.

- If applicable, complete supplemental Form DE-147S to provide confidential information such as your date of birth and driver’s license number, as required by local court rules.

Make sure to review the form for any missed information and ensure all details are correct. It might be beneficial to consult with an attorney to clarify any questions regarding the form before submission. After completing, keep a copy for your records and submit it to the court as needed.

What You Should Know About This Form

What is the purpose of the DE-147 form?

The DE-147 form is used in California probate proceedings. It outlines the duties and responsibilities of a personal representative appointed by the court to manage an estate. This document helps ensure that the personal representative understands their obligations and acts in accordance with the law during the estate administration process.

Who should fill out the DE-147 form?

The DE-147 form is typically filled out by an individual who has petitioned the court to serve as a personal representative of a decedent's estate. This can be an attorney or a party without an attorney. The form serves to inform them of their responsibilities and liabilities that arise once they are appointed.

What are the key duties listed in the DE-147 form?

Key duties include managing the estate's assets prudently, keeping estate property separate from personal property, filing an inventory and appraisal of the estate within a specified time, notifying creditors, maintaining adequate insurance, and keeping thorough records of all transactions related to the estate. The form specifically emphasizes the importance of seeking legal advice when needed.

What happens if a personal representative fails to comply with their duties?

If the personal representative does not perform their duties or meet deadlines, the court may impose sanctions. This can include reducing their compensation, removing them from their role, or requiring them to cover any costs incurred due to their non-compliance from their own personal funds. Thus, it is crucial to adhere to the responsibilities outlined in the DE-147 form.

How long does a personal representative have to file an inventory and appraisal?

A personal representative must file an inventory and appraisal of the estate's assets within four months of being issued Letters of Administration. This is a critical step in the probate process, as it establishes the value of the estate.

What is the significance of consulting an attorney when serving as a personal representative?

Consulting with an attorney is essential as they can provide guidance on various legal matters related to estate administration. An attorney can help navigate the complexities of the law, ensure compliance with all legal requirements, and assist with any questions that may arise during the process. Their expertise is particularly valuable in avoiding potential pitfalls that could lead to legal troubles.

Are there any financial responsibilities of a personal representative?

Yes, a personal representative is responsible for managing estate assets, which includes keeping accurate financial records of all incoming and outgoing funds. They must track all transactions meticulously and may need to present these accounts for court review. Failure to maintain proper records can lead to complications, including removal from their position.

What should a personal representative do with estate funds?

Estate funds should be kept separate from personal finances. A personal representative must open a bank account specifically for the estate, ensuring that it is clearly labeled as an estate account. They must handle these funds judiciously, avoiding speculative investments, and should only spend them with court approval or upon the advice of an attorney.

When should a personal representative notify creditors?

A personal representative is required to mail a notice of administration to each known creditor of the decedent within four months of their appointment. If the decedent received Medi-Cal assistance, they must also notify the State Director of Health Services within 90 days of their appointment.

Common mistakes

When filling out the DE-147 form, there are several common mistakes that can lead to significant issues. One major error is neglecting to provide complete contact information. This includes not only the name and address but also the telephone number and optional email address. Incomplete information may hinder communication with the court and delay the process.

Another frequent oversight occurs in the duties and liabilities acknowledgment section. Individuals may fail to read and understand the responsibilities expected of them as personal representatives. Skipping this step can result in misunderstandings, potentially leading to legal consequences. The court takes these duties seriously, and acknowledgment is not merely a formality.

Many people also forget to file the inventory and appraisal within the required time frame. The form mandates that this document be filed within four months after receiving the Letters of Administration. Missing this deadline can prompt unwanted legal complications, including removal as the personal representative.

Providing inaccurate information about the estate's assets is yet another common mistake. All items must be accounted for, including their values. If there are discrepancies or omissions, the court may view this as a lack of diligence. This can also affect the disbursement of assets and lead to disputes among beneficiaries.

Lastly, failing to maintain organized records can have serious ramifications. Detailed documentation of every financial transaction is necessary. Without proper records, individuals risk losing their authority or facing penalties. Keeping receipts and detailed accounts ensures transparency and accountability in the management of the estate.

Documents used along the form

When dealing with estate administration, it’s crucial to have the right documents in order. Below is a list of common forms and documents that are often used alongside the DE-147 form. Each plays a significant role in ensuring that the estate is handled properly and in accordance with the law.

- DE-150: Petition for Letters of Administration - This form is used to request formal appointment as the personal representative of the estate. It includes details about the decedent and the petitioner.

- DE-160: Letters of Administration - Once the court approves the petition, this document serves as proof of the personal representative's authority to act on behalf of the estate.

- DE-161: Notice of Petition to Administer Estate - This notice informs interested parties about the upcoming petition hearing and allows them to contest the appointment if they choose.

- DE-164: Inventory and Appraisal - This important document provides a detailed list of the decedent’s assets. It must be filed within four months of being appointed as personal representative.

- DE-165: Notice of Proposed Action - If the personal representative intends to take significant actions regarding the estate, such as selling property, this notice must be given to heirs and beneficiaries.

- DE-172: Final Account and Report - This is the final accounting document that summarizes all transactions conducted during the estate administration process. It must be submitted before the estate is closed.

- DE-173: Petition for Final Distribution - After settling all debts and expenses, this form requests approval to distribute the remaining assets to the beneficiaries.

- Accountings - Detailed accountings of all income and expenses related to the estate must be created during the administration period and can be reviewed by the court if necessary.

- Change of Ownership Statement - This form is filed with the county whenever real property changes hands in order to update ownership records, ensuring that property tax assessments are accurate.

Having these documents at your fingertips can facilitate a smoother estate administration process. It’s always a good idea to consult with an attorney to ensure that everything is handled correctly and to avoid any potential issues down the road.

Similar forms

- DE-160 Inventory and Appraisal: This document requires a detailed inventory of the decedent's property and its appraisal, similar to the DE-147's inventory section, ensuring all assets are accounted for and valued.

- DE-161 Account: The account form is used to report the financial transactions related to the estate, akin to the DE-147's record-keeping requirements, where thorough documentation of all dealings is crucial.

- DE-117 Notice of Petition to Administer Estate: This notice informs interested parties about the estate administration, paralleling DE-147's obligation to notify known creditors about the estate’s administration.

- DE-120 Preliminary Spousal Property Petition: It serves to determine spousal rights to the estate, echoing DE-147's focus on the duties and interests of those managing the estate.

- DE-150 Petition for Final Distribution: This petition facilitates the final distribution of estate assets, similar to the DE-147’s focus on the responsibilities of the personal representative in managing estate distributions.

- DE-140 Duties of Personal Representative: This document outlines the personal representative's responsibilities in detail, much like the DE-147's summary of duties and liabilities, providing guidance for compliance.

- DE-147S Confidential Information Form: In some cases, this form collects sensitive personal information about the petitioner, reflecting the need for privacy in the estate administration outlined in DE-147.

Dos and Don'ts

When filling out the DE-147 form, there are important things to keep in mind. Here is a list of dos and don'ts to help guide you through the process.

- Do fill in your name, address, and contact information clearly at the top of the form.

- Do make sure to specify whether you are an attorney or a party without an attorney.

- Do keep estate assets separate from your personal assets.

- Do maintain detailed records of all transactions related to the estate.

- Do consult with an attorney if you have questions.

- Don't mix estate funds with your personal funds in any accounts.

- Don't spend estate money without court permission.

- Don't ignore deadlines for filing information with the court.

- Don't underestimate the importance of notifying creditors timely.

- Don't forget to keep copies of all receipts and documents related to the estate.

Misconceptions

Misconception 1: The DE-147 form is only for attorneys.

This form can be used by both attorneys and individuals acting as personal representatives. While many may choose to work with an attorney, it is not a requirement.

Misconception 2: The responsibilities outlined in the DE-147 are optional.

All the duties listed in this form are mandatory and must be fulfilled to avoid legal repercussions. Ignoring these responsibilities can lead to removal from office or other penalties.

Misconception 3: Personal representatives can freely access estate funds for personal use.

Personal representatives must keep estate funds separate and cannot use them for personal expenses without court approval.

Misconception 4: Filing the inventory and appraisal can be done at any time.

The law requires that the inventory and appraisal be filed within four months of being appointed as a personal representative. Delays can lead to complications.

Misconception 5: Insurance for the estate is not necessary.

It is essential to maintain adequate insurance covering the estate's assets throughout the period of administration to protect against potential risks.

Misconception 6: The DE-147 form doesn’t require consultation with an attorney.

While individuals can handle it on their own, consulting with an attorney is highly recommended to navigate the complexities of estate management.

Misconception 7: All transactions made by the personal representative are automatically approved.

Any financial transactions involving estate assets usually require court approval, especially if they may impact the estate’s value or obligations.

Misconception 8: Personal representatives can mix estate funds with their own.

This is incorrect. Estate funds must be kept completely separate to prevent any legal issues or accusations of mismanagement.

Misconception 9: Creditors do not need to be notified about the estate administration.

It is required to notify all known creditors within four months of appointment, and failing to do so may lead to complications in settling the estate.

Misconception 10: The DE-147 form is a comprehensive legal guide.

This form merely provides a summary of duties. It is crucial for personal representatives to familiarize themselves with the full legal obligations governing estate management.

Key takeaways

Filling out the DE-147 form is an important step in the estate administration process. Here are some key takeaways to keep in mind:

- Understand Your Responsibilities: As a personal representative, you take on significant duties, including managing the estate's assets and maintaining accurate records. This role puts you under the court's oversight.

- Keep Estate Assets Separate: It's crucial to keep estate funds and property distinct from your personal assets. Open a dedicated estate account to avoid any mix-ups.

- Notify Creditors Promptly: You must inform known creditors of the decedent within four months of your appointment. This helps ensure that all debts are settled appropriately.

- File Necessary Documents: Within four months, submit an inventory and appraisal of the estate’s assets to the court. Ensure this is done timely to avoid penalties.

- Consult an Attorney: Having legal guidance can clarify many of the duties you'll face. When unsure, reaching out to an attorney can help you navigate complex situations.

Following these guidelines can help ease the process of estate administration and ensure that you fulfill your responsibilities effectively.

Browse Other Templates

Access Transit Los Angeles - Access-A-Ride offers door-to-door transportation for eligible individuals with disabilities.

Cair2 - The form reinforces the importance of community health through vaccinations.