Fill Out Your De 161 Gc 041 Form

The DE-161 GC-041 form serves a critical role in the management of a deceased person's estate, providing a structured means for documenting and appraising their assets during probate proceedings. This form is specifically designed for use in California and is often required to accompany probate filings. It captures essential information such as the name of the deceased, case number, and details about the inventory and appraised value of each asset. In cases involving community and separate property, adherence to specific Probate Code sections is necessary, ensuring that all parties involved in the estate process can verify the accurate valuation of assets. As one works through this form, attention to detail is paramount; it is organized by item number, allowing for multiple pages if the inventory of items surpasses one page, thus accommodating comprehensive listings. Protecting personal information is also a priority, with options provided to clear the form after printing. In understanding the DE-161 GC-041 form, beneficiaries and legal representatives can navigate the complexities of estate management with greater clarity and confidence.

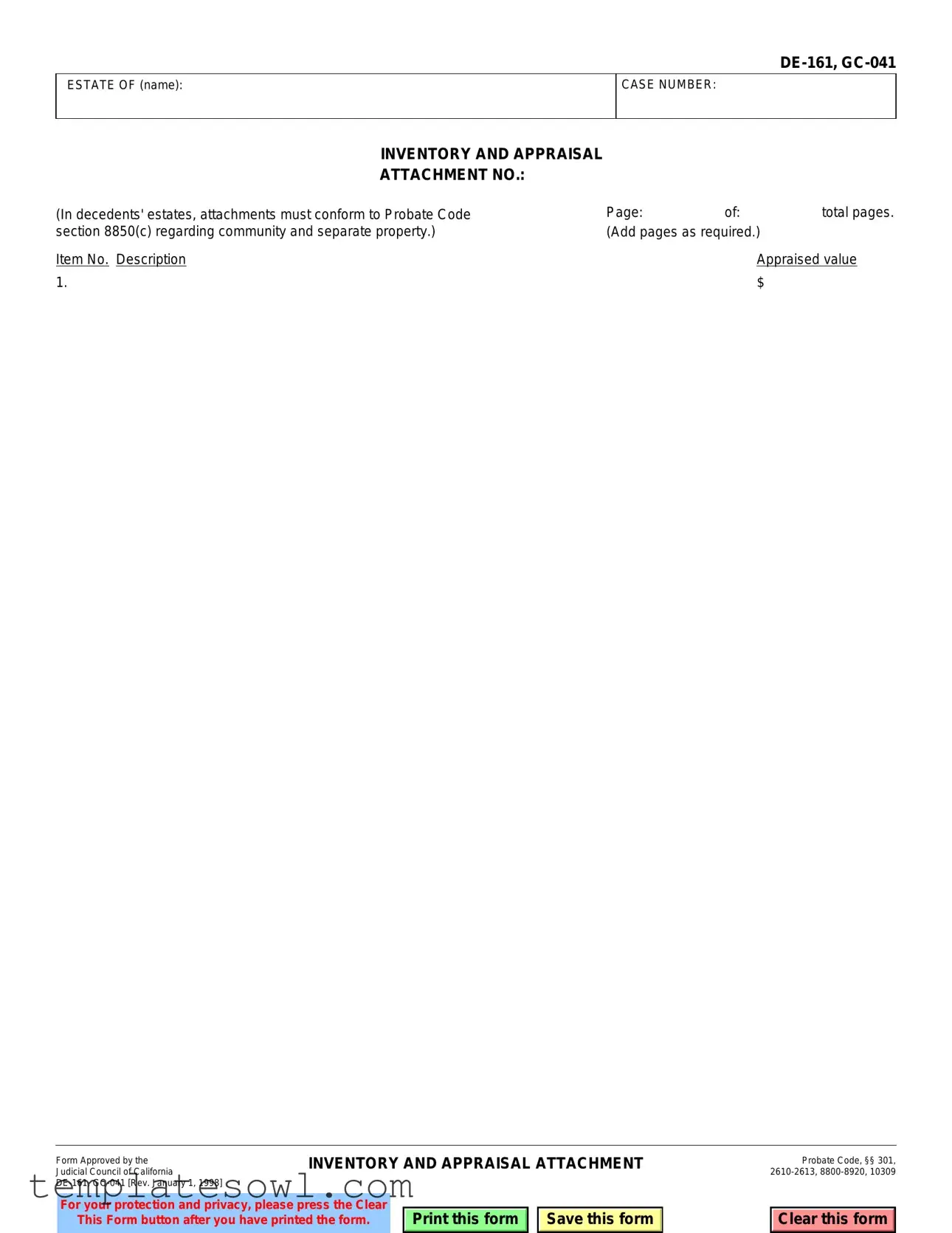

De 161 Gc 041 Example

ESTATE OF (name):

CASE NUMBER:

INVENTORY AND APPRAISAL ATTACHMENT NO.:

(In decedents' estates, attachments must conform to Probate Code section 8850(c) regarding community and separate property.)

Item No. Description

1.

Page:of:total pages.

(Add pages as required.)

Appraised value

$

Judicial Council of California |

INVENTORY AND APPRAISAL ATTACHMENT |

||||

Form Approved by the |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For your protection and privacy, please press the Clear |

|

|

|

|

|

This Form button after you have printed the form. |

|

Print this form |

|

Save this form |

|

|

|

|

|

|

|

Probate Code, §§ 301,

Clear this form

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Title | DE-161, GC-041 is officially titled "Inventory and Appraisal Attachment." |

| Purpose | This form is used for detailing the inventory and appraised value of a decedent's estate. |

| Governing Laws | The form complies with California Probate Code sections 301, 2610-2613, and 8800-8920. |

| Attachments | Decedent estates may require attachments that follow Probate Code section 8850(c). |

| Content Structure | The form includes fields for item numbers, descriptions, and appraised values. |

| Printing Instructions | It is recommended to press the "Clear This Form" button after printing. |

| Revision Date | The current version of the form was approved for use on January 1, 1998. |

| Page Requirements | The form is designed to allow additional pages, as necessary, for reporting all items. |

Guidelines on Utilizing De 161 Gc 041

Once you have obtained the DE-161 GC-041 form, taking the next steps will involve carefully completing the required sections to ensure accurate representation of the estate's inventory and appraisal. Following a systematic approach will help maintain clarity and minimize any potential errors in the submission process.

- Obtain the form: Download the DE-161 GC-041 form from a reliable source or acquire a physical copy.

- Fill in the estate information: At the top of the form, write the name of the deceased individual and the corresponding case number assigned to the estate.

- Inventory reference: Note the appropriate attachment number, as this must align with the attachments per Probate Code section 8850(c) concerning community and separate property.

- List items: Start entering the items in the inventory section. For each item, fill in the item number, description, page number, and total page count.

- Appraised values: For each item listed, provide its appraised value in the designated field.

- Additional pages: If necessary, attach additional pages for more items, ensuring they are formatted according to the existing layout.

- Final review: Carefully review all the entries for accuracy and completeness before submission.

- Print and save: Once satisfied, print the completed form. It's wise to save an electronic copy as well for your records.

- Clear the form: For your privacy, press the 'Clear This Form' button to erase all entered information after printing.

Once you have completed all of these steps, you will be ready to submit the DE-161 GC-041 form as part of the estate administration process. This essential documentation will allow the probate court to assist in the proper handling of the estate’s assets.

What You Should Know About This Form

What is the purpose of the DE-161 GC-041 form?

The DE-161 GC-041 form is used to create an inventory and appraisal of a deceased person's estate. It helps to list all significant assets and their appraised values. This form is crucial for providing an accurate overview of the estate during probate proceedings.

Who needs to file the DE-161 GC-041 form?

This form needs to be filed by the executor or administrator of the estate. If a person has passed away and there are assets to administer, the responsible party must gather the necessary details and complete this form for submission to the probate court.

What information is required on the form?

The form requires basic information about the deceased individual, such as their name and the case number. You will also need to provide a list of the estate's assets, including their descriptions and appraised values. It's important to have complete and accurate details to avoid issues later on.

Can additional pages be added to the DE-161 GC-041 form?

Yes, additional pages can be added if necessary. The form includes a section to indicate total pages. Just ensure that any extra pages follow the guidelines outlined in Probate Code section 8850(c), especially concerning community and separate property.

Is there a privacy feature for the DE-161 GC-041 form?

Yes, for your protection and privacy, the form includes a "Clear This Form" button. It is highly recommended to press this button after printing the form to ensure that no personal information remains saved on the device you were using.

Where can I find the DE-161 GC-041 form?

The DE-161 GC-041 form can be obtained from the Judicial Council of California's website or directly from the probate court. Always ensure that you have the most current version of the form to avoid any delays in the process.

Common mistakes

When filling out the DE-161, GC-041 form, individuals often encounter several common mistakes that can lead to complications in the probate process. One significant error is the failure to accurately specify the name of the deceased and the correct case number. It is crucial that these details match the information filed with the court. Any discrepancies might not only delay the process but could also lead to legal challenges.

Another frequent oversight happens in the inventory section. People sometimes neglect to provide a complete description of the items. Each item must be clearly identified, including its condition and any relevant details, to ensure accurate appraisal. If items are described vaguely, it can create confusion later on, especially during valuation.

The appraised value is a critical component of the DE-161, GC-041 form. Some individuals mistakenly input incorrect values or leave this section blank. It is essential to conduct a thorough appraisal of each item to ensure that the values are both accurate and justifiable. This helps to avoid potential disputes among heirs or beneficiaries.

A further common mistake is failing to adhere to formatting requirements for the total number of pages. When submitting multiple attachment pages, it is vital to indicate the current page number along with the total number of pages. This oversight can lead to confusion regarding the completeness of the submission and may result in the form being considered invalid.

Moreover, some filers do not pay attention to the necessary signatures. Every person listed in the form must provide their signature where required. Omitting a signature might result in denial of the application or additional requests for documentation, prolonging the administrative process.

Additionally, there is a tendency to overlook the instructions provided on the form itself. Each section of the DE-161, GC-041 has specific guidelines that must be followed. Ignoring these can lead to completion errors or misinterpretation of what information is required for the inventory and appraisal.

Lastly, individuals sometimes fail to safeguard their privacy after filling out the form. It is imperative to press the “Clear This Form” button once the document has been printed. This action prevents sensitive information from being stored on the device used for form completion, thus protecting the privacy and integrity of the estate involved.

Documents used along the form

The DE-161 GC-041 form is used in the context of probate procedures to document the inventory and appraised value of a deceased person's estate. This document is essential for ensuring proper asset management and distribution according to the law. Several other forms and documents are often utilized in conjunction with the DE-161 GC-041 to facilitate various aspects of estate administration. Below is a list of these commonly used forms.

- DE-160: This is the Inventory and Appraisal form, which outlines all the assets of the estate. It serves as a comprehensive listing, helping to establish the total value of the assets for probate purposes.

- DE-111: This Petition for Probate form is used to begin the probate process. It notifies the court of the need to settle the estate and outlines the essential details for the judge's review.

- GC-350: This is the Order for Final Distribution form. It is filed with the court to request the distribution of the estate’s assets, following the completion of all necessary inventories and appraisals.

- GC-020: This is a form for the Notice of Hearing. It informs interested parties about the upcoming probate hearing, ensuring they have the opportunity to be involved in the process.

- DE-295: This Consent to Probate form is used when all heirs agree to the terms of the probate. It simplifies the process by showing support from all parties involved.

- GC-040: This request for special notice is essential for those who wish to receive notifications about proceedings regarding the estate, beyond the standard notices typically provided.

- DE-140: The Petition for Final Distribution of Estate Assets form is needed when the executor wants to finalize the estate by distributing the remaining assets among the beneficiaries.

- DE-212: This form is for the Report of Sale of Real Property. It is used to document and seek court approval for the sale of real estate as part of the probate process.

- GC-155: This is the Waiver of Notice form, which allows interested parties to waive their rights to receive specific notices about the estate, streamlining the process.

Understanding these forms and their purposes can significantly help in navigating the probate process effectively. Each document plays a critical role in ensuring compliance with legal requirements and facilitating a smooth administration of the estate.

Similar forms

The DE-161 GC-041 form is commonly used in the context of estate planning and probate. It serves a specific purpose in detailing the inventory and appraised value of an estate's assets. Several other documents share similarities with this form in terms of purpose, content, or function. Here is a list of ten documents that are akin to the DE-161 GC-041 form:

- DE-160: This form is also for inventory purposes, capturing essential details about assets within an estate, but it does not have the appraisal component.

- GC-040: Similar in function, this document can be used to report an estate’s inventory to the court without appraisals included.

- DE-22: This form is intended for a detailed list of a decedent's assets and debts, focusing on liabilities alongside inventory.

- DE-11: Known as the petition for letters of administration, it may include property details, but its primary function is different as it seeks court permission to manage an estate.

- DE-121: This form involves the petition for final distribution, summarizing the estate’s inventory and appraisals for final disbursement.

- GC-350: Used for a financial transaction report, it emphasizes asset movement, indirectly linking it back to inventory tracking in estate management.

- DE-940: While used to report an estate’s income tax matters, it often requires similar asset identification and monetary assessment like the DE-161.

- DE-142: This is for the notice of proposed action regarding sale of property, discussing inventory items intended for sale, which relates to their appraised value.

- DE-250: This substitute form for fiduciaries also requires inventory detailing, helping provide a broader picture of the estate under management.

- GC-0401: This form is designed for a court’s inventory report, aligning with DE-161 in summarizing assets but focuses more on liquid assets.

Each document complements the DE-161 GC-041 form in various ways, whether by covering different aspects of estate management or providing complementary information regarding the inventory and appraised values. Understanding these similarities helps in navigating the estate planning and probate processes more effectively.

Dos and Don'ts

When completing the DE-161 GC-041 form, there are specific guidelines to follow. Below is a list of important do's and don'ts:

- Do ensure all fields are filled out completely to prevent delays in processing.

- Do use clear and legible handwriting or type the information to enhance readability.

- Do review the form for accuracy before submitting, as errors can complicate the administrative process.

- Do keep a signed copy of the completed form for your records.

- Don't leave any required sections blank, as this may lead to rejection of the form.

- Don't submit the form without confirming that you have included any necessary attachments.

- Don't forget to clear the form if you are filling it out electronically, to protect your personal information.

- Don't use corrections fluid on the form; instead, draw a line through the error and write the correct information above it.

Misconceptions

Understanding the DE-161 GC-041 form is essential for anyone involved in the probate process. However, there are several common misconceptions that could lead to confusion. Here’s a list of ten misconceptions and clarifications regarding this form.

- Misconception 1: The DE-161 GC-041 form is only for wealthy estates.

- Misconception 2: Completing the form is optional.

- Misconception 3: The form only needs to be completed once.

- Misconception 4: I can estimate values without appraisals.

- Misconception 5: There are no penalties for inaccuracies.

- Misconception 6: The form is only for real estate assets.

- Misconception 7: It's a quick and easy form to fill out.

- Misconception 8: My attorney will fill it out for me without my input.

- Misconception 9: The form does not require any attachments.

- Misconception 10: Once it’s submitted, I do not need to think about it again.

Many people believe this form is reserved for high-value estates, but it is applicable to all probate cases, regardless of the estate's size.

In fact, submitting the DE-161 GC-041 form is often required by the court during the probate process to ensure proper valuation of estate assets.

The inventory may require updates if new assets are discovered or if there are changes in valuation, which means you might need to submit additional forms.

While personal estimates might be tempting, a professional appraisal is often necessary to provide an accurate and legally recognized value for the estate's assets.

Providing inaccurate information can have legal consequences, including penalties or scrutiny from the court, illustrating the importance of careful and truthful reporting.

The DE-161 GC-041 form is designed to cover all types of assets, including personal property, bank accounts, and investments, among others.

While the form has a straightforward layout, gathering accurate information for it can take time, especially when dealing with multiple assets.

While your attorney can guide you, you will need to provide the necessary information and documentation to ensure the form is accurate and complete.

In many cases, if the estate involves complex assets, you may need to attach additional documentation, including detailed appraisals or valuations.

Upon submission, the court may request further information or amendments, so it’s important to stay engaged with this part of the probate process.

Understanding these misconceptions can help you navigate the complexities of estate management more effectively. Always consider seeking personalized guidance tailored to your specific situation.

Key takeaways

When filling out the DE-161 GC-041 form, here are some important points to keep in mind:

- Purpose: This form is used for providing an inventory and appraisal of a decedent's estate, which includes listing assets and their appraised values.

- Required Attachments: In cases involving decedents' estates, additional documents must comply with Probate Code section 8850(c), especially regarding community and separate property.

- Appraisal Details: Each item listed should include a description and its appraised value. Ensure accuracy, as this will inform the estate’s worth.

- Pagination: The form allows you to add pages as necessary. Clearly indicate the total number of pages at the top.

- Form Submission: After completing the form, it is vital to press the "Clear This Form" button for your privacy before printing or saving.

Browse Other Templates

Medicaid North Carolina - Clarify relationships between household members when filling out the form.

C&c Management Application - Income documentation must reflect the expected income for the next 12 months.