Fill Out Your De 2063 Form

Filling out paperwork is often seen as a tedious task, but it serves important administrative functions in the employment realm. One such critical form is the DE 2063, the Notice of Reduced Earnings. This form plays a pivotal role when an employee experiences a decrease in work hours or income due to various situations, such as layoffs or voluntary quits. Issued for a specific payroll week, it requires precise information, including gross earnings before deductions and the reasons for reduced hours. Additionally, both employers and employees have sections to complete, ensuring that the reasons for reduced earnings—like a lack of available work—are fully documented. Employers must confirm the data provided is accurate, signifying their agreement to the information detailed within the form. Similarly, employees must also certify their understanding of the questions posed and the accuracy of their responses. This collaborative effort helps to maintain transparency and accountability in the unemployment benefits process. It is essential to complete the DE 2063 promptly and accurately, as timely submissions greatly influence eligibility for benefits. Understanding how to navigate this form can alleviate some of the stress associated with managing changes in employment status.

De 2063 Example

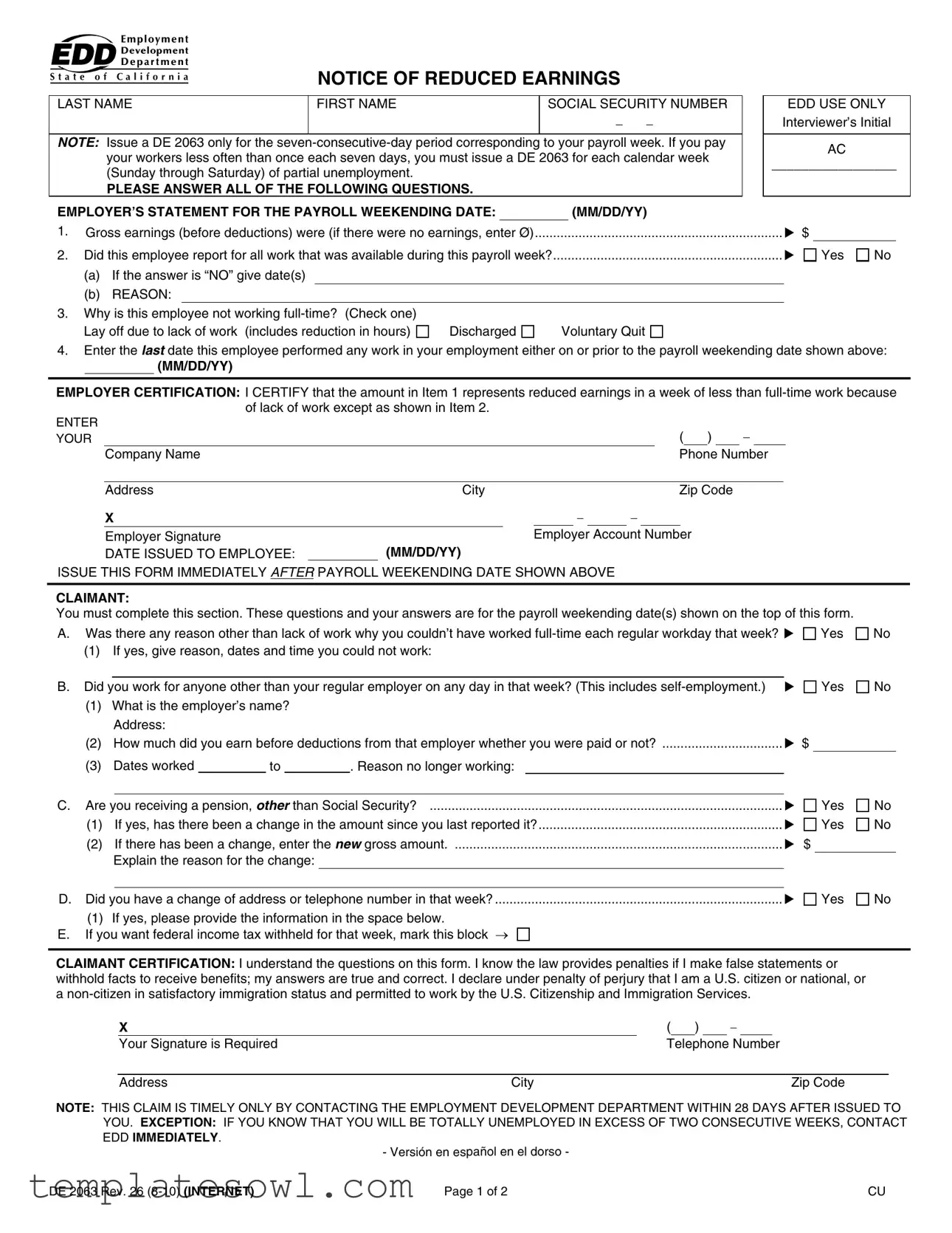

NOTICE OF REDUCED EARNINGS

LAST NAME |

FIRST NAME |

SOCIAL SECURITY NUMBER |

|

|

|

|

|

|

NOTE: Issue a DE 2063 only for the

PLEASE ANSWER ALL OF THE FOLLOWING QUESTIONS.

EMPLOYER’S STATEMENT FOR THE PAYROLL WEEKENDING DATE: |

|

(MM/DD/YY) |

EDD USE ONLY Interviewer’s Initial

AC

_________________

1. |

Gross earnings (before deductions) were (if there were no earnings, enter Ø) |

$ |

|

|

2. |

...............................................................Did this employee report for all work that was available during this payroll week? |

|

Yes |

No |

(a)If the answer is “NO” give date(s)

(b)REASON:

3.Why is this employee not working

Lay off due to lack of work (includes reduction in hours) |

Discharged |

Voluntary Quit |

4.Enter the LAST date this employee performed any work in your employment either on or prior to the payroll weekending date shown above:

(MM/DD/YY)

EMPLOYER CERTIFICATION: I CERTIFY that the amount in Item 1 represents reduced earnings in a week of less than

ENTER |

|

( ) |

|

|

|||||

YOUR |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

Company Name |

|

Phone Number |

||||||

|

|

|

|

|

|

|

|||

|

Address |

City |

Zip Code |

|

|

|

|||

X |

|

|

|

|

|

|

|

|

|

Employer Signature |

|

|

|

Employer Account Number |

|||||

DATE ISSUED TO EMPLOYEE: |

|

(MM/DD/YY) |

|

|

|

|

|||

ISSUE THIS FORM IMMEDIATELY AFTER PAYROLL WEEKENDING DATE SHOWN ABOVE

CLAIMANT:

You must complete this section. These questions and your answers are for the payroll weekending date(s) shown on the top of this form.

A.Was there any reason other than lack of work why you couldn’t have worked

Yes

Yes

No

No

(1)If yes, give reason, dates and time you could not work:

B. Did you work for anyone other than your regular employer on any day in that week? (This includes |

|

||||||

(1) |

What is the employer’s name? |

|

|

|

|||

|

Address: |

|

|

|

|

|

|

(2) |

How much did you earn before deductions from that employer whether you were paid or not? |

$ |

|||||

(3) |

Dates worked |

|

to |

|

. Reason no longer working: |

|

|

Yes

No

C. Are you receiving a pension, OTHER than Social Security? |

|

||

(1) |

If yes, has there been a change in the amount since you last reported it? |

|

|

(2) |

If there has been a change, enter the NEW gross amount |

$ |

|

|

Explain the reason for the change: |

|

|

Yes Yes

No No

D. Did you have a change of address or telephone number in that week? |

|

(1)If yes, please provide the information in the space below.

E. If you want federal income tax withheld for that week, mark this block

Yes

No

CLAIMANT CERTIFICATION: I understand the questions on this form. I know the law provides penalties if I make false statements or withhold facts to receive benefits; my answers are true and correct. I declare under penalty of perjury that I am a U.S. citizen or national, or a

X |

|

( |

|

) |

|

|

|

|

Your Signature is Required |

|

Telephone Number |

||||||

|

|

|

|

|

|

|

|

|

Address |

City |

|

|

|

|

|

Zip Code |

|

NOTE: THIS CLAIM IS TIMELY ONLY BY CONTACTING THE EMPLOYMENT DEVELOPMENT DEPARTMENT WITHIN 28 DAYS AFTER ISSUED TO YOU. EXCEPTION: IF YOU KNOW THAT YOU WILL BE TOTALLY UNEMPLOYED IN EXCESS OF TWO CONSECUTIVE WEEKS, CONTACT EDD IMMEDIATELY.

- Versión en español en el dorso -

DE 2063 Rev. 26 |

Page 1 of 2 |

CU |

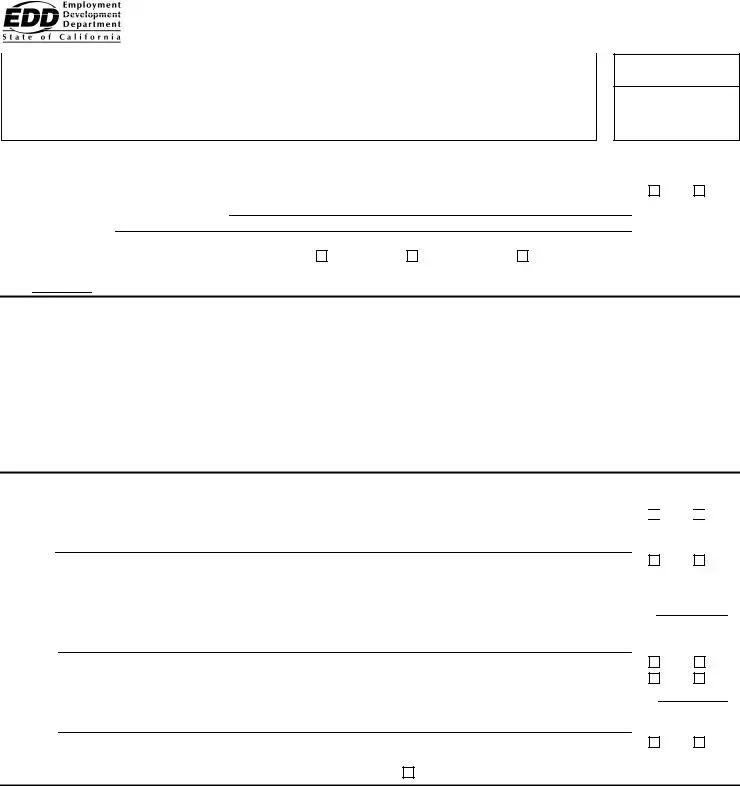

NOTICE OF REDUCED EARNINGS

LAST NAME |

FIRST NAME |

SOCIAL SECURITY NUMBER |

|

|

|

|

|

|

NOTE: Issue a DE 2063 only for the

PLEASE ANSWER ALL OF THE FOLLOWING QUESTIONS.

EMPLOYER’S STATEMENT FOR THE PAYROLL WEEKENDING DATE: |

|

(MM/DD/YY) |

EDD USE ONLY Interviewer’s Initial

AC

_________________

1. |

Gross earnings (before deductions) were (if there were no earnings, enter Ø) |

$ |

2. |

Did this employee report for all work that was available during this payroll week? |

|

(a)If the answer is “NO” give date(s)

(b)REASON:

3.Why is this employee not working

Lay off due to lack of work (includes reduction in hours) |

Discharged |

Voluntary Quit |

Yes

No

4.Enter the LAST date this employee performed any work in your employment either on or prior to the payroll weekending date shown above:

(MM/DD/YY)

EMPLOYER CERTIFICATION: I CERTIFY that the amount in Item 1 represents reduced earnings in a week of less than

ENTER |

|

( ) |

|

|

|||||

YOUR |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

Company Name |

|

Phone Number |

||||||

|

|

|

|

|

|

|

|||

|

Address |

City |

Zip Code |

|

|

|

|||

X |

|

|

|

|

|

|

|

|

|

Employer Signature |

|

|

|

Employer Account Number |

|||||

DATE ISSUED TO EMPLOYEE: |

|

(MM/DD/YY) |

|

|

|

|

|||

ISSUE THIS FORM IMMEDIATELY AFTER PAYROLL WEEKENDING DATE SHOWN ABOVE

SOLICITANTE:

Usted deberá completar esta sección. Estas preguntas y sus respuestas son para la semana de pago que termina en la fecha indicada en este formulario.

A.¿Había otra razón, además de la falta de trabajo, por la cual Ud. no podría haber trabajado horario completo

cada día normal de trabajo en esa semana? |

|

Sí |

(1)Si contesta que “sí,” proporcione la razón, las fechas y las horas en que no podía trabajar B. ¿Trabajó Ud. para alguien que no es su empleador normal, cualquier día de esa semana?

(Esto incluye trabajos independientes o en su propio negocio) |

|

Sí |

||

(1) ¿Cual es el nombre de ese empleador? |

|

|

|

|

Dirección: |

|

|

|

|

(2) |

¿Cuánto ganó, Ud. antes de deducciones, con ese empleador, aunque todavía no le haya pagado? |

$ |

|||||

(3) |

Fechas en que Ud. trabajó: del |

|

al |

|

. Razón porque Ud. no siguió trabajando |

|

|

|

|

|

|

|

|

|

|

No

No

C. ¿Está Ud. recibiendo una pensión que no sea del Seguro Social? |

|

||

(1) |

Si contesta que “si,” ¿ha habido un cambio en la cantidad que Ud. recibe desde la última vez que la reportó? |

|

|

(2) |

Si la cantidad ha cambiado, favor de escribir la nueva cantidad bruta. |

$ |

|

|

Explique la razón por el cambio: |

|

|

Sí

Sí

No No

D. ¿Cambió Ud. de domicilio o de número de teléfono en esa semana? |

|

Sí |

No |

(1)Si contesta “sí”, favor de proporcionar la información en el espacio a continuación.

E. Si usted desea que se retengan impuestos federales por ésa semana, marque esta casilla

CERTIFICACIÓN DEL SOLICITANTE: Entiendo las preguntas que contiene este formulario. Se que la ley establece sanciones si hago declaraciones falsas o retengo información para recibir beneficios. Mis respuestas son verdaderas y correctas. Declaro bajo pena de perjurio que soy ciudadano o nacional de los Estados Unidos, o soy un(a) extranjero(a) con situación migratoria satisfactoria y con permiso del Servicio de Ciudadanía e Inmigración de los Estados Unidos para trabajar.

X |

( |

) |

|

|

||||

Se Requiere su Firma |

|

Número de Teléfono |

||||||

|

|

|

|

|

|

|

|

|

Dirección |

Ciudad |

|

|

|

|

|

Código Postal |

|

NOTA: ESTA SOLICITUD DE BENEFICIOS SERÁ CONSIDERADA A TIEMPO SOLAMENTE CUANDO USTED SE COMUNICA CON EL DEPARTAMENTO DEL DESARROLLO DEL EMPLEO DENTRO DE 28 DÍAS DESPUÉS DE LA FECHA EN QUE SE LE EMITIÓ A USTED. EXCEPCIÓN: SI UD. TIENE CONOCIMIENTO QUE ESTARÁ TOTALMENTE DESEMPLEADO(A) POR MÁS DE DOS SEMANAS CONSECUTIVAS, COMUNÍQUESE INMEDIATAMENTE EL EDD.

|

- English version on other side - |

|

DE 2063 Rev. 26 |

Page 2 of 2 |

CU/MIC 38 |

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | The DE 2063 form serves as a Notice of Reduced Earnings for employees experiencing partial unemployment. |

| Eligibility Period | This form is issued for a seven-consecutive-day payroll week. If paid less frequently, issue it for each calendar week of partial unemployment. |

| Employer's Certification | The employer certifies that the reported earnings reflect reduced hours due to lack of work. |

| Claimant's Responsibility | Claimants must answer questions regarding their employment status and earnings accurately to avoid penalties. |

| Timeliness of Claim | Claims are timely if the claimant contacts the Employment Development Department within 28 days after the form is issued. |

| Legal Reference | Governed by California Employment Development Department regulations, which outline the proper use of the form. |

Guidelines on Utilizing De 2063

Completing the DE 2063 form accurately is essential for ensuring that all parties involved have the necessary information for processing claims related to reduced earnings. This form must be filled out with care, as it captures vital details about an employee’s work status during a specific payroll week. Follow the steps outlined below to complete the form correctly.

- Start with the employee's personal details. Fill in the last name and first name in the designated fields.

- Enter the Social Security Number.

- Provide the payroll week ending date formatted as MM/DD/YY.

- For item 1, report the gross earnings for the week before any deductions. If no earnings were made, write Ø.

- Move to item 2 and indicate whether the employee reported for all available work by selecting Yes or No. If "No," specify the date(s) and provide the reason in the space provided.

- In Item 3, identify the reason for the employee not working full-time by checking one of the options: Lay off due to lack of work, Discharged, or Voluntary Quit.

- In Item 4, enter the last date the employee performed work (in the same MM/DD/YY format).

- Complete the employer certification section. Ensure that all fields such as Company Name, Phone Number, Address, City, and Zip Code are accurately filled in.

- The employer must sign and date the form, including their Employer Account Number.

- Provide the date issued to the employee in the MM/DD/YY format.

Next, the employee must fill out their section, which includes additional questions regarding their work status during the week. Accuracy in answering these questions is crucial to avoid any delays or complications with the claim.

- The employee should identify any reasons, other than lack of work, preventing full-time work by responding to question A with Yes or No. If "Yes," they need to detail the reason, dates, and times.

- In question B, the employee must disclose if they worked for anyone else that week. If "Yes," provide the employer’s name and address, along with earnings before deductions and the dates worked.

- For question C, the employee should indicate if they are receiving a pension other than Social Security. If the answer is "Yes," they must specify any changes in the amount and explain the reason for the change.

- Question D asks if there was a change of address or phone number during the week. If “Yes,” the employee should provide the new information.

- Finally, the employee must indicate if they want federal income tax withheld by checking the respective box.

The employee must sign the form, include their telephone number, and provide their address, city, and zip code. Filling out the DE 2063 accurately and promptly allows for a smoother process moving forward.

What You Should Know About This Form

What is the DE 2063 form used for?

The DE 2063 form is a "Notice of Reduced Earnings" that employers issue for employees who have experienced a reduction in their work hours or earnings over a specific payroll week. It covers a seven-day period and is used to report less than full-time work due to lack of available work.

Who needs to complete the DE 2063 form?

Both the employer and the employee need to participate. Employers fill out the form to report reduced earnings for their employees. Employees must complete their section to provide additional information about their work status, earnings from other employers, and any changes to their information.

How should an employer fill out the DE 2063 form?

The employer should start by entering the employee's information, including their last name, first name, and Social Security number. Next, they will fill in gross earnings for the week and indicate if the employee reported for available work. It is also essential to check the reason for reduced hours, such as layoff or voluntary quit. Finally, the employer certifies the information with their signature and company details.

What happens if an employee is unemployed for more than two consecutive weeks?

If an employee knows they will be completely unemployed for more than two weeks, they must contact the Employment Development Department (EDD) immediately. This is crucial to ensure that their unemployment benefits are processed correctly and in a timely manner.

Is it important to submit the DE 2063 form quickly?

Yes, it is essential to submit the DE 2063 form immediately after the payroll week ends. The employee's claim for reduced earnings is only timely if the form is submitted within 28 days. Prompt submission helps avoid delays or issues with unemployment benefits.

Common mistakes

Filling out the DE 2063 form can be straightforward, yet many people overlook critical details that can lead to delays or denials of benefits. One common mistake is failing to provide accurate gross earnings. It's essential to enter the correct dollar amount before any deductions. If an individual had no earnings during the week, it should be marked as Ø. An oversight here could result in complications for both employees and employers.

Another frequent error involves the employment status of the individual. Some people mistakenly mark "Yes" or "No" without supporting details or clarifications. If the employee did not report for all available work, it is crucial to include the specific dates and reasons. Omitting this information can leave the form incomplete, causing delays.

Misidentifying the reason for not working full-time is also a significant mistake. It is vital to accurately check the box that applies, whether it’s a layoff, discharge, or voluntary quit. Each option carries different implications for the claim. Failure to accurately represent this situation can complicate the claims process.

Completing the employer certification section is often overlooked. Employers must sign and certify the information given on the form. Without a signature or correct company information, the form may not be accepted, further delaying the processing of benefits. It cannot be stressed enough how critical this certification is.

The date of the last work performed should be clearly entered. Some individuals forget or inaccurately fill in the date, leading to confusion. This date is necessary for determining eligibility for benefits. An incorrect date can result in an employee missing out on needed assistance.

Claimants often fail to disclose other work performed during the week. This includes any self-employment or work done for different employers. It is important to provide details about side jobs, including employer names and earnings. Missing this information could be viewed as withholding facts and can impact the claim negatively.

Changes in address or phone number during the week are frequently left unchecked. If there was a change, providing the new details is not just a formality—it's necessary for communication and verification. Ignoring this detail could result in missed notifications and important updates.

Lastly, individuals sometimes forget to check the box regarding federal income tax withholding. This decision can affect personal finances significantly. It’s essential to make this choice clear on the form to avoid unexpected tax liabilities later on. Taking the time to verify this can help in avoiding potential tax issues.

Documents used along the form

The DE 2063 form is used to report reduced earnings for employees during a specified payroll week. However, there are several other documents that often accompany it to ensure a complete understanding of the employment situation. Here is a list of relevant forms and documents typically used alongside the DE 2063, along with a brief explanation of each.

- DE 2501: This form is utilized for claims related to Disability Insurance. Employees may need to file it if they cannot work due to non-work-related injuries or illnesses.

- DE 4581: The Notice of Employee Rights outlines the rights of employees regarding unemployment insurance benefits and claims. This is essential for understanding available resources.

- UI Claim Forms: These forms allow employees to apply for unemployment benefits. They capture necessary information such as work history and reasons for unemployment.

- W-2 Form: Employees receive this tax form from their employer at the end of the year. It details their earnings and taxes withheld, which may impact eligibility for certain benefits.

- EDD Verification of Employment: This document is used to verify an individual’s employment status with the Employment Development Department. It can help support claims for reduced earnings.

- Payroll Records: Employers maintain these records to document employee hours and wages. They serve as evidence of reduced earnings or employment changes during the specified period.

- Claimant’s Employment History: A detailed account of an employee's work history may be requested to establish a pattern of employment and assess eligibility for benefits.

- Written Notices from Employers: Any formal communication regarding layoffs, reduced hours, or employment changes can provide important context and help clarify the reasons behind reduced earnings.

By having these documents available, employees and employers can ensure that all necessary information is included when filing claims. A comprehensive understanding of the situation can support claims for unemployment benefits and provide clarity on employment status.

Similar forms

DE 2062: Notice of Unemployment Insurance Claim Filed - This document is issued when a claim for unemployment insurance is submitted. Like the DE 2063 form, it helps track reduced earnings and needs to be filed after a specific pay period.

DE 4581: Weekly Certification for Benefits - This form is used to certify eligibility for unemployment benefits on a weekly basis. It requires information about earnings, work availability, and unemployment reasons, similar to the DE 2063.

UI-507: Employee's Claim for Benefits - This document gathers information from the employee regarding their work status, earnings, and reasons for reduced work. Both forms are critical for assessing unemployment benefits.

EDD-542: Employer's Report of Wages - This report provides the employer’s perspective on employee earnings during a certain period, including any reductions, echoing the certification purpose of the DE 2063.

DE 2501: Claim for Disability Insurance Benefits - When an employee can’t work due to medical reasons, this form is completed. It shares similarities with the DE 2063 in tracking earnings while away from work.

EDD-1000: Employer's Participation Agreement - This form is used for laying out conditions for employers regarding unemployment benefits. It is similar to the DE 2063 as it relies on employer input regarding employee work status.

DE 8920: Self-Employment Assistance Program Application - This is used by individuals seeking assistance while starting a business. It relates to the DE 2063 through the assessment of work and earnings.

EDD-886: Report Job Separation - This form is important for reporting the reason for an employee’s job loss. Like the DE 2063, it helps clarify unemployment situations and assists in benefits determination.

Dos and Don'ts

When filling out the DE 2063 form, there are several important guidelines to keep in mind. Below are items you should do and avoid.

- Ensure you issue the DE 2063 only for the correct seven-day payroll week.

- Provide accurate gross earnings before any deductions.

- Check the box for whether the employee reported for available work.

- Certify the information in your employer statement to confirm its accuracy.

- Do not skip any questions on the form; all must be answered.

- Avoid providing inaccurate or misleading information, as this can lead to penalties.

- Do not delay in issuing the form immediately after the payroll week ends.

- Never forget to have the employee complete their section of the form.

Following these guidelines will help ensure a smooth process when completing the DE 2063 form.

Misconceptions

- Only full-time employees need to use the DE 2063 form. This is a common misunderstanding. The DE 2063 is required for any employee experiencing reduced earnings, regardless of their usual full-time status.

- Submitting the form is optional. In reality, it is mandatory to submit the DE 2063 for any week where an employee has not worked full-time due to reduced hours or a lack of available work. Failing to do so could affect unemployment benefit eligibility.

- All earnings must be reported for the entire week. This is not accurate. Employees only need to report earnings received during the actual payroll week indicated on the form. If no earnings were made, it is permissible to enter 'Ø' to represent that there were no earnings.

- Employers can delay issuing the DE 2063. This is a misconception. Employers are required to issue the form immediately after the payroll week-ending date to ensure timely processing of benefits claims.

- Answers on the DE 2063 do not impact eligibility for benefits. This belief is incorrect. Each answer provided on the form is critical in determining eligibility and can lead to penalties if false statements are made. Accuracy is essential for compliance with the law.

Key takeaways

Filling out and using the DE 2063 form, known as the Notice of Reduced Earnings, is essential for employees experiencing partial unemployment. Here are key points to keep in mind:

- Seven-Day Period: This form must only cover a seven-day period associated with your payroll week. Employers should issue a new form for each calendar week of reduced work.

- Gross Earnings Reporting: Employers must accurately report the gross earnings before deductions. If an employee has no earnings, it is crucial to note that appropriately as Ø.

- Work Availability: It is necessary to confirm whether the employee reported for all available work during the payroll week. Provide reasons and dates if the answer is "No."

- Employee Status: The employer must choose the reason for reduced work hours, selecting from options such as layoff, discharge, or voluntary quit.

- Employer Certification: Employers need to certify that the reported earnings represent reduced earnings due to lack of work. This section is critical to validate the claim.

- Claimant Responsibilities: Employees should answer questions thoughtfully, explaining any other reasons for not working full-time and providing information on any additional employment.

- Filing Timeliness: Claims are only considered timely if submitted within 28 days after being issued. Immediate contact with the Employment Development Department is necessary if total unemployment exceeds two weeks.

Browse Other Templates

Alabama Short Term Disability - The number of dependents must be noted on the form.

Houston Burglar Alarm Permits - Contact details for the alarm company must be current and accurate.

London, Ky 40742-7656 - Each signer must be the person identified on the form and must not share their PIN.