Fill Out Your De 24 Form

The DE 24 form serves a crucial role in managing Employee Development Department (EDD) account information for businesses operating in California. This form is utilized to notify the EDD of any changes or corrections that may impact a business's employment tax account. Key aspects highlighted within the DE 24 include changes to addresses, business names (also known as "doing business as"), corporate names, and personal name adjustments due to events such as marriage. It also addresses changes in ownership, whether through partial sales or complete transfers, outlining necessary details like the purchase price and ownership types. Additionally, the form handles changes to partners, officers, or managers, ensuring that all relevant individuals are accurately recorded. Businesses can declare if they had no wages paid in a quarter or if they have discontinued wage payments altogether. Moreover, it includes provisions for indicating a business closing without a successor. By detailing these changes, the DE 24 form helps maintain accurate records for tax assessment purposes while ensuring compliance with state regulations.

De 24 Example

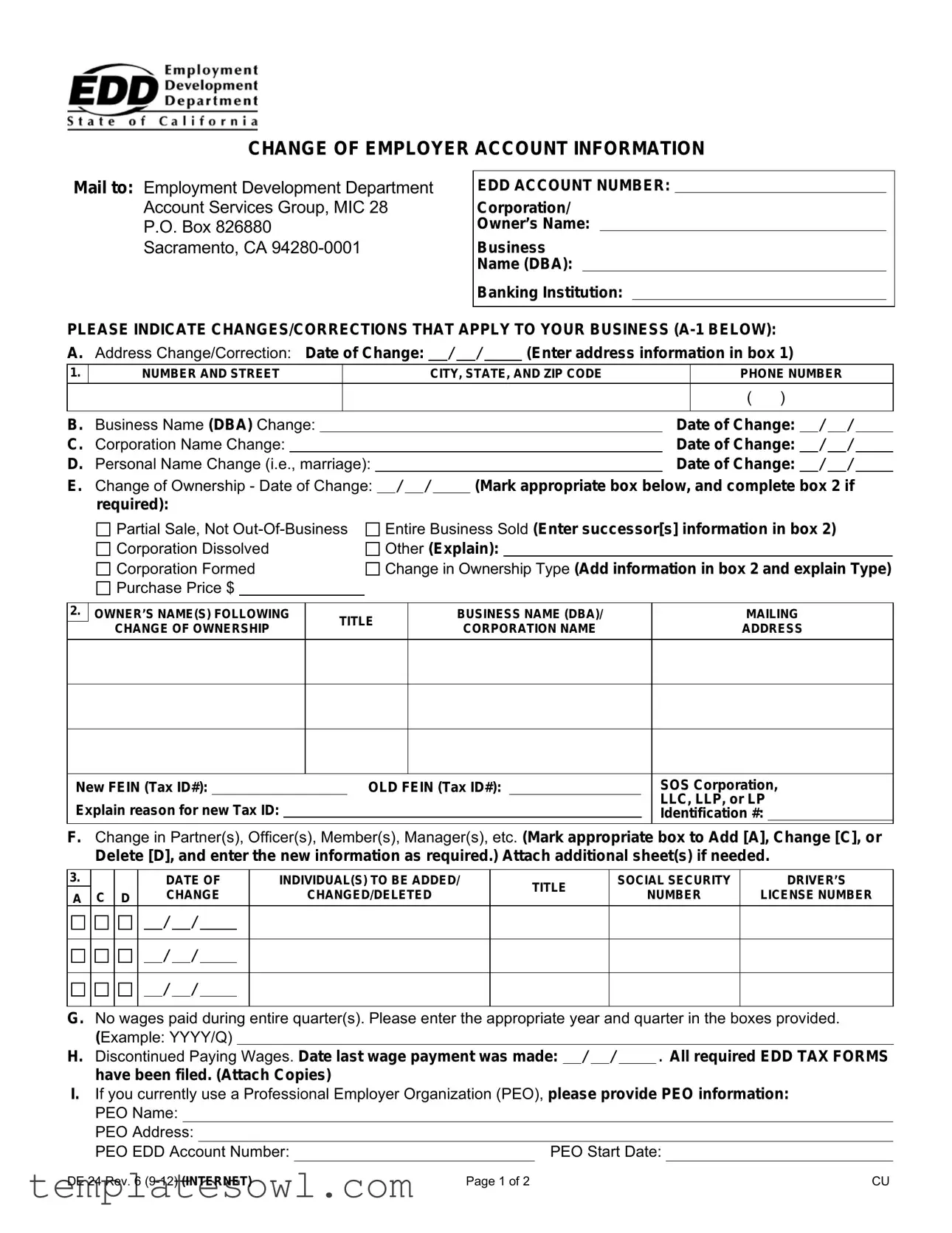

CHANGE OF EMPLOYER ACCOUNT INFORMATION

Mail to: Employment Development Department Account Services Group, MIC 28 P.O. Box 826880

Sacramento, CA

EDD ACCOUNT NUMBER:

Corporation/

Owner’s Name:

Business

Name (DBA):

Banking Institution:

PLEASE INDICATE CHANGES/CORRECTIONS THAT APPLY TO YOUR BUSINESS

A. Address Change/Correction: Date of Change: / / |

|

(Enter address information in box 1) |

1.

NUMBER AND STREET |

CITY, STATE, AND ZIP CODE |

PHONE NUMBER |

|

|

|

( |

) |

|

|

|

|

B. |

Business Name (DBA) Change: |

|

|

|

|

Date of Change: |

/ |

/ |

||

C. |

Corporation Name Change: |

|

|

|

|

Date of Change: |

/ |

/ |

||

D. |

Personal Name Change (i.e., marriage): |

|

|

|

|

Date of Change: |

/ |

/ |

||

E. |

Change of Ownership - Date of Change: / / |

|

(Mark appropriate box below, and complete box 2 if |

|||||||

|

required): |

|

|

|

|

|

|

|||

Partial Sale, Not

Partial Sale, Not

Corporation Dissolved

Corporation Dissolved

Corporation Formed

Corporation Formed

Purchase Price $

Purchase Price $

Entire Business Sold (Enter successor[s] information in box 2)

Entire Business Sold (Enter successor[s] information in box 2)

Other (Explain):

Other (Explain):

Change in Ownership Type (Add information in box 2 and explain Type)

Change in Ownership Type (Add information in box 2 and explain Type)

2. |

OWNER’S NAME(S) FOLLOWING |

TITLE |

BUSINESS NAME (DBA)/ |

MAILING |

|

CHANGE OF OWNERSHIP |

CORPORATION NAME |

ADDRESS |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New FEIN (Tax ID#): |

|

OLD FEIN (Tax ID#): |

|

|

SOS Corporation, |

|

Explain reason for new Tax ID: |

|

|

|

|

LLC, LLP, or LP |

|

|

|

|

|

Identification #: |

||

|

|

|

|

|||

F. Change in Partner(s), Officer(s), Member(s), Manager(s), etc. (Mark appropriate box to Add [A], Change [C], or

Delete [D], and enter the new information as required.) Attach additional sheet(s) if needed.

3. |

|

|

DATE OF |

|

INDIVIDUAL(S) TO BE ADDED/ |

TITLE |

SOCIAL SECURITY |

DRIVER’S |

||

A |

C |

D |

CHANGE |

|

CHANGED/DELETED |

NUMBER |

LICENSE NUMBER |

|||

|

|

|||||||||

|

|

|

/ |

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/ |

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/ |

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

G.No wages paid during entire quarter(s). Please enter the appropriate year and quarter in the boxes provided. (Example: YYYY/Q)

|

|

|

|

H. Discontinued Paying Wages. Date last wage payment was made: / / |

. All required EDD TAX FORMS |

||

have been filed. (Attach Copies) |

|

|

|

I.If you currently use a Professional Employer Organization (PEO), please provide PEO information: PEO Name:

PEO Address:

|

|

|

|

|

PEO EDD Account Number: |

|

PEO Start Date: |

||

DE 24 Rev. 6 |

Page 1 of 2 |

|

CU |

|

J. Out of Business (Without a Successor) on: / / |

|

. (Provide forwarding address in box |

Note: If business corporation/owner is represented by an authorized agent for employment tax purposes, the agent may sign below. A signed and properly executed power of attorney must be attached or on file. THE SIGNATURE OF ANY OTHER PERSON/THIRD PARTY WILL NOT BE ACCEPTED.

“I certify under penalty of perjury that the above information is true and correct, and that these actions are not being taken to receive a more favorable Unemployment Insurance rate. I further certify that I have the authority to sign on behalf of the above business.”

|

|

( |

) |

/ / |

|

|

Signature |

|

Phone Number |

Date |

|

||

|

|

|

|

|||

Print Name |

|

Title (Officer, Owner, Member, GP, or Authorized Agent) |

|

|||

Manage your payroll tax account online!

File reports, make deposits, update addresses, and much more.

Enroll now for

DE 24 Rev. 6 |

Page 2 of 2 |

CU |

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose of Form | The DE 24 form is used to change employer account information with the Employment Development Department (EDD) in California. |

| Submitting Authority | This form should be mailed to the Account Services Group at the EDD in Sacramento, California. |

| EDD Account Number | The form requires the employer's EDD account number for reference during the account update process. |

| Changes Allowed | Employers can report various changes, including address, business name, and ownership changes. |

| Ownership Change Details | Sections allow for detailed reporting of ownership changes, with indications for partial sales, dissolutions, or complete sales. |

| Required Dates | For each change, the date of change must be documented, ensuring accurate record-keeping. |

| Professional Employer Organizations (PEO) | If the business uses a PEO, specific PEO information must be provided on the form. |

| Signature Requirement | The form mandates a signature from an authorized individual, affirming the accuracy of the information provided. |

| Online Services | Employers are encouraged to manage their payroll tax accounts online through the EDD’s e-Services for Business platform. |

| Legal Binding | The signer certifies that the information is true under penalty of perjury, emphasizing the seriousness of the updates. |

Guidelines on Utilizing De 24

After gathering the necessary information and ensuring compliance with requirements, the next step is to fill out the DE 24 form accurately. This form is utilized for notifying the Employment Development Department (EDD) of changes to employer account information. The following steps outline the process for completing the DE 24 form.

- Locate the DE 24 form. You can obtain it from the EDD website or your local Employment Development Department office.

- Fill in the EDD Account Number at the top of the form.

- Complete the section for Corporation/Owner’s Name and Business Name (DBA).

- Indicate the Banking Institution associated with your business.

- Mark the changes or corrections that apply to your business from section A through I, providing the required dates and information.

- For address changes, enter the new address in box 1, including number and street, city, state, and zip code.

- If there are ownership or corporation structure changes, fill out box 2 with the new owner's name(s), title, and business name (DBA) along with any new tax identification numbers.

- Complete the section for any changes in partners, officers, or managers, marking whether they are being added, changed, or deleted.

- Indicate if no wages were paid during any quarter(s) and provide the necessary year and quarter.

- If applicable, fill in the information regarding discontinuation of wage payments, including the date of the last wage payment.

- If you are using a Professional Employer Organization (PEO), provide their name, address, and EDD account number.

- Confirm if the business is out of business and provide a forwarding address if necessary.

- Lastly, sign the form, print your name, and indicate your title. Ensure the contact phone number and the date are included.

What You Should Know About This Form

What is the DE 24 form?

The DE 24 form is used to update account information with the Employment Development Department (EDD) for businesses in California. This may include changes related to business address, ownership, or other details that affect the employer's account. It ensures that the EDD has accurate information for tax purposes and communication.

Who needs to fill out the DE 24 form?

Any employer who has experienced changes in their business information should fill out the DE 24 form. This includes sole proprietorships, corporations, limited liability companies (LLCs), and partnerships. If there are modifications to information such as the business name, ownership, or address, it is essential to submit this form to keep the records up to date.

How do I submit the DE 24 form?

The completed DE 24 form must be mailed to the EDD Account Services Group at the specified address: P.O. Box 826880, Sacramento, CA 94280-0001. Ensure that all necessary changes and details are filled out accurately before mailing the form to avoid delays in processing.

What types of changes can be reported on the DE 24 form?

Several changes can be reported using the DE 24 form. These include address changes, changes to the business name (Doing Business As or DBA), changes in ownership, and alterations in partner or officer information. Additional relevant changes might include ceasing wage payments, discontinuation of the business, and providing details if a Professional Employer Organization (PEO) is being utilized.

What information is required when reporting a change of ownership?

When reporting a change of ownership, you will need to provide specifics such as the previous and new owner's names, the type of change (partial sale, complete sale, or corporation formation), and any new Federal Employer Identification Number (FEIN) if applicable. This section is crucial for ensuring the EDD records reflect the current ownership accurately.

Can I report more than one change on the DE 24 form?

Yes, the DE 24 form allows for multiple changes to be reported simultaneously. As long as the applicable sections are filled out correctly, you can report changes such as address, business name, and ownership on a single form. Just be sure to provide all necessary details for each change to ensure clarity and completeness.

What happens if my business is out of business?

If your business is out of business, you need to indicate this by checking the appropriate box on the DE 24 form. You will also need to provide the date your business ceased operations and a forwarding address if one is available. This informs the EDD to update your account status accordingly.

Do I need to provide a signature when submitting the DE 24 form?

Yes, the DE 24 form requires a signature from an authorized representative of the business, such as an owner or officer. Also, if an agent submits the form on behalf of the business, a power of attorney document must be attached or already on file with EDD. This ensures that the person signing has the legal authority to make changes to the business account.

How can I manage my payroll tax account online?

To manage your payroll tax account online, you can enroll in e-Services for Business. This platform allows you to file reports, make deposits, update addresses, and perform various other tasks at your convenience. Visit https://eddservices.edd.ca.gov to get started.

Common mistakes

Filling out the DE 24 form can significantly impact your business's payroll tax account, so it is essential to avoid common mistakes. One frequent error occurs when individuals fail to complete the EDD Account Number section. Neglecting to provide this number can delay processing and lead to confusion in identifying the correct account. Each EDD account has a unique identifier that ensures accurate updates, so always double-check to make sure this information is included.

Another mistake often made involves incorrect or incomplete address changes. When entering a new address, ensure all components such as the street number, city, state, and ZIP code are accurate. Omitting any part or using the wrong format can jeopardize communication with the Employment Development Department (EDD). This might result in missed notifications or forms, which could further complicate your business’s tax situation.

Individuals may also overlook the section regarding changes in ownership or corporate structure. If you indicate a change, you must fill out the corresponding sections completely. Failing to do so may lead to miscommunication regarding tax obligations. For instance, if the ownership has changed but the details regarding the new owner are not provided, it can create issues with the tax records. It is important to be thorough in reporting these changes to reflect the current status of the business accurately.

Lastly, many forget to sign the form or provide the necessary contact information after completing it. A signature is required to certify the accuracy of the information reported. Leaving the signature section blank or failing to provide a phone number can result in significant delays. Ensure that you also include your title, as this identifies who has the authority to make changes on behalf of the business. Without proper identification, the form may be returned or deemed invalid.

Documents used along the form

The DE 24 form is a crucial document for businesses in California that need to update their employer account information with the Employment Development Department. However, several other forms and documents frequently accompany the DE 24 form to ensure compliance with state regulations. Below is a list of these associated forms, along with a brief description of each.

- Form DE 9: This is the quarterly contribution return and report of wages. Employers must file it to report wages paid and contributions owed for unemployment insurance.

- Form DE 964: This form is the employer’s report of contribution rate. It outlines the tax rate the employer must apply to calculate unemployment insurance contributions.

- Form DE 2088: This is the application for a tax rate assignment. When businesses need to request a different unemployment tax rate based on changes in ownership or other significant alterations, this form is used.

- Form DE 542: Known as the report of independent contractor(s), this form is submitted to report information about contractors who may be subject to unemployment insurance taxes.

- Form 941: This is the employer’s quarterly federal tax return. It reports income taxes, Social Security tax, and Medicare tax withheld from employees' paychecks.

- Form W-2: This form is used to report annual wages paid to employees and taxes withheld. Employers must provide this to employees for tax-reporting purposes.

- Form SS-4: This is an application for an Employer Identification Number (EIN). Businesses need this number for tax purposes and to establish their identity with the IRS.

- Form EDD 1000: This is the application for a business account number. Frequently required for new businesses, it sets up a record with the EDD for tax reporting.

- Form RRF-1: The report of charitable organizations that wish to solicit donations. Nonprofit organizations will need this form to comply with state regulations.

Having the right forms ready when updating your business information is essential. Completing the DE 24 form alongside these other documents provides a complete picture of your business's employment status and compliance with California laws. Always check for the latest requirements to stay informed.

Similar forms

- Form DE 7: Used for reporting changes to employees and specific payroll operations. Similar to the DE 24 in that both forms request updates regarding business information, though DE 7 focuses specifically on employee-related changes.

- Form DE 9: This form is for wage reports and is filed quarterly. Like the DE 24, it collects essential business information but does so in the context of wage reporting rather than ownership or address changes.

- Form DE 10: This form is used to report new employees. The DE 10 requests information about business changes in the context of employee filings, similar to how DE 24 tracks updates relevant to business ownership.

- IRS Form SS-4: Used for applying for an Employer Identification Number (EIN). This form overlaps with the DE 24 in scenarios where corporations change their ownership or structure, potentially affecting their tax identification.

- Form SS-8: This is used to determine worker status for purposes of federal employment taxes. It has parallels with DE 24 regarding ownership, helping clarify how changes in control may impact employee classification.

- Form 941: This is a quarterly tax return filed by employers. Like the DE 24, it requires accurate business information and changes in operations or ownership can impact its contents.

- California Form 5500: This form is related to employee benefit plans. Both DE 24 and Form 5500 involve changes to business operations but serve different regulatory purposes, with 5500 focused on employee benefits.

Dos and Don'ts

When filling out the DE 24 form, it is essential to approach the task with care. This form is used for reporting changes in employer account information to the Employment Development Department. Here are seven guidelines to follow:

- Do provide accurate and complete information. Missing or incorrect details can lead to processing delays.

- Don't use abbreviations or shorthand. Use clear and complete names for all entities involved.

- Do double-check the dates you enter. Ensure all changes have the correct date to avoid confusion.

- Don't leave any sections blank. If a section does not apply, indicate that with “N/A”.

- Do attach any necessary additional sheets if you need more space to provide information.

- Don't forget to sign the form. An unsigned form will be considered incomplete and may be returned.

- Do maintain a copy of the submitted form for your records. Documentation is essential for future reference.

Misconceptions

- Misconception 1: The DE 24 form is only for large businesses.

- Misconception 2: Only changes in ownership require a DE 24 filing.

- Misconception 3: I can submit the DE 24 form by email.

- Misconception 4: It doesn’t matter when I file the DE 24 form.

- Misconception 5: The DE 24 form can be signed by anyone.

- Misconception 6: I only need to file the DE 24 form if my business is changing locations.

- Misconception 7: Once I submit the DE 24 form, I do not need to do anything else.

This is not accurate. The DE 24 form applies to all business entities, regardless of size. Sole proprietors and small businesses must also keep their employer account information updated to remain in compliance.

While changes in ownership do necessitate filing the form, other modifications also require attention. Changes to addresses, business names, and officer information must be reported to the Employment Development Department (EDD) using this form.

Submitting the DE 24 form via email is not permitted. The EDD requires that the form be mailed to the specified address, ensuring that all changes are recorded in a physical and verifiable manner.

Timeliness is crucial. Delayed submission of the DE 24 can lead to complications or penalties. Prompt filing ensures your business maintains compliance and prevents any disruption in services.

This is misleading. Only individuals with the authority to act on behalf of the business—such as owners or authorized agents—can sign the form. It is essential to have proper authorization to avoid legal issues.

Changes in location are just one reason to file the DE 24. Any alteration to the business’s structure, name, or ownership also requires a filing. Failing to do so can result in incorrect records with the EDD.

This is not entirely true. After submitting the form, businesses must continue to monitor and maintain accurate records with the EDD. Changes in information or operations may necessitate additional filings, ensuring the business remains compliant.

Key takeaways

Here are key takeaways regarding the use of the DE 24 form for changing employer account information.

- Correct Address Information: If there is a change in business address, fill in the relevant details in the specified box to update records accurately.

- Business Name Changes: Any change to the business name or DBA must be clearly indicated along with the date of change.

- Ownership Changes: If the business changes ownership, check the appropriate box. Provide necessary details about the previous and new ownership in the subsequent sections.

- New Tax Identifications: When applying for a new Federal Employer Identification Number (FEIN), explain the reason clearly on the form.

- PEO Information: If using a Professional Employer Organization, include their details to ensure a smooth payroll process.

- Date Tracking: Document the effective date of any changes. Ensure all dates are formatted correctly.

- Certification Requirement: A signed certification confirms the provided information is accurate. The signature must pertain to an authorized individual.

- Submission Process: Mail the completed form to the specified address at the Employment Development Department for processing.

Understanding these key aspects will help ensure that your changes are processed without unnecessary delays or issues.

Browse Other Templates

StarGlow Hotel Reservation Form,Celestial Stay Authorization Form,Galaxy Inn Reservation Document,Lunar Lodge Booking Authorization,Cosmic Comfort Reservation Form,Astral Escape Authorization Form,Stellar Suites Reservation Form,Nebula Retreat Author - Always include the name of the family member if applicable.

How Long Can You Be Flagged in the Army - Flags can be classified as non-transferable or transferable depending on the situation.

What Does Sole Physical Custody Mean - May provide a basis for filing for modification of custody.