Fill Out Your De 88 Form

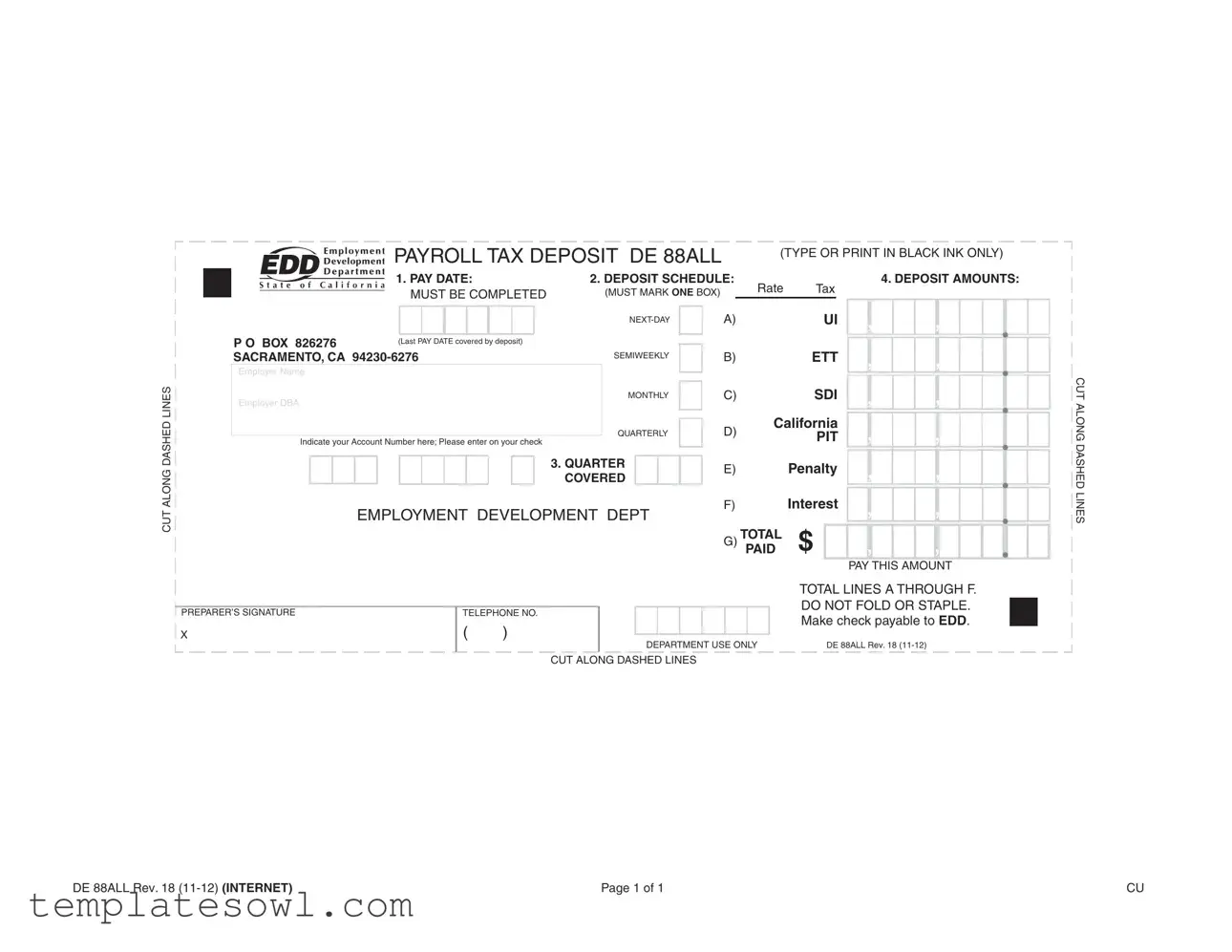

The DE 88 form is an essential document for employers in California tasked with reporting payroll tax deposits. Properly submitting this form ensures compliance with state regulations and assists in maintaining the integrity of your business's tax obligations. Key components of the DE 88 include critical information such as payment date, deposit schedule options, and various tax rates. Employers must indicate their chosen deposit schedule, which can range from next-day to quarterly, based on their payroll size and frequency. Additionally, the form requires the total deposit amounts, along with details regarding any applicable penalties or interest. This streamlined document ultimately serves as a record of payments made to the Employment Development Department (EDD), ensuring that all contributions to unemployment insurance (UI), state disability insurance (SDI), and personal income tax (PIT) are properly accounted for. Completing the DE 88 accurately not only fulfills legal requirements but also reinforces a commitment to responsible business practices.

De 88 Example

CUT ALONG DASHED LINES

|

|

|

|

|

PAYROLL TAX DEPOSIT DE 88ALL |

|

|

(TYPE OR PRINT IN BLACK INK ONLY) |

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

1. PAYDATE: |

2. DEPOSITSCHEDULE: |

Rate |

Tax |

|

|

|

|

4.DEPOSITAMOUNTS: |

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

MUST BE COMPLETED |

|

(MUST MARKONEBOX) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A) |

|

UI |

|

, |

|

|

|

, |

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

POBOX826276 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

(Last PAY DATE covered by deposit) |

|

|

|

|

|

|

|

|

|

ETT |

|

, |

|

|

|

, |

|

|

|

|

|

|

|

||||||||||||||

|

|

SEMIWEEKLY |

|

|

B) |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Employer Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C) |

|

SDI |

|

, |

|

|

|

, |

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

Employer DBA |

|

|

|

|

|

|

|

|

|

|

MONTHLY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D) |

California |

|

, |

|

|

|

, |

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

QUARTERLY |

|

|

|

PIT |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Indicate your Account Number here; Please enter on your check |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

3. QUARTER |

|

|

|

|

E) |

|

Penalty |

|

, |

|

|

|

, |

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

COVERED |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

EMPLOYMENT DEVELOPMENT DEPT |

F) |

|

Interest |

|

, |

|

|

|

, |

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

G) TOTALPAID |

$ |

|

|

|

, |

|

|

|

|

, |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PAY THIS AMOUNT |

|

|

|

|

|

|

|

|||||||

CUT ALONG DASHED LINES

PREPARER’S SIGNATURE

X

TELEPHONE NO.

( )

DEPARTMENT USE ONLY

CUT ALONG DASHED LINES

TOTAL LINES A THROUGH F. DO NOT FOLD OR STAPLE. Make check payable to EDD.

DE 88ALL Rev. 18

DE 88ALL Rev. 18 |

Page 1 of 1 |

CU |

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The DE 88 form is used for making payroll tax deposits in California. |

| Deposit Schedule | Employers must select a deposit schedule: Next-Day, Semiweekly, Monthly, or Quarterly. |

| Payment Details | Form requires information about the payment date and deposit amounts. |

| Tax Types | This form covers taxes such as Unemployment Insurance (UI), Employment Training Tax (ETT), State Disability Insurance (SDI), and Personal Income Tax (PIT). |

| Governing Law | The DE 88 form is governed by California Employment Development Department regulations. |

| Filing Instructions | Complete the form in black ink, then send payment to the state department at the specified address. |

Guidelines on Utilizing De 88

Filling out the DE 88 form is straightforward. This form is essential for making payroll tax deposits. Complete each section carefully to ensure accurate processing of your payment.

- PAY DATE: Enter the date of payment in the designated spot.

- DEPOSIT SCHEDULE: Mark one box to indicate your deposit schedule: Next-Day, Semiweekly, Monthly, or Quarterly.

- EMPLOYER NAME: Fill in the name of your business in the space provided.

- EMPLOYER DBA: If applicable, enter your Doing Business As name.

- ACCOUNT NUMBER: Write your account number in the specified area.

- QUARTER COVERED: Indicate which quarter your payment covers.

- DEPOSIT AMOUNTS: Fill in the amounts for UI, ETT, SDI, PIT, penalty, and interest as applicable.

- TOTAL: Calculate and write the total amount due by adding lines A through F.

- PREPARER’S SIGNATURE: Sign the form in the designated area.

- TELEPHONE NUMBER: Provide a contact number where you can be reached.

Once you complete the form, ensure you do not fold or staple it. Make the check payable to the Employment Development Department (EDD), and send it to the address listed on the form, which is P.O. Box 826276, Sacramento, CA 94230-6276.

What You Should Know About This Form

What is the DE 88 form and who needs to use it?

The DE 88 form is a payroll tax deposit form used in California. Employers, particularly those who pay state payroll taxes, need to use this form. It helps report and pay various payroll taxes, including Unemployment Insurance (UI), Employment Training Tax (ETT), State Disability Insurance (SDI), and Personal Income Tax (PIT). Completing this form accurately is essential for compliance with California tax laws.

What information is required when filling out the DE 88 form?

When completing the DE 88 form, certain critical information is necessary. You'll need your pay date, the deposit schedule you’re following (next-day, semiweekly, monthly, or quarterly), your employer name, and your account number. In addition, the form requires total amounts to be paid for various types of taxes, including penalty and interest, if applicable. Make sure all entries are clear and accurate to avoid complications.

How do I determine my deposit schedule?

Your deposit schedule depends on the amount of payroll taxes you report in previous periods. If you consistently report a lower amount, you may qualify for a monthly schedule. Those with larger payrolls might have to follow a semiweekly or next-day deposit schedule. If you're unsure, you can check the previous year's filing or consult with a tax professional for guidance.

When is the DE 88 form due?

The due date for the DE 88 form depends on your deposit schedule. For next-day deposits, the form is due the day after your pay date. Employers using the semiweekly schedule must submit the form by the following Wednesday or Friday, depending on the pay period. Monthly and quarterly deposit deadlines are outlined by the California Employment Development Department (EDD). Always check the latest EDD guidelines for specific dates.

What happens if I file the DE 88 form late?

Filing the DE 88 form late can result in penalties and interest charges. The EDD will assess penalties based on the amount due, and late fees can accumulate over time. It’s crucial to submit your form and payment on time to avoid unnecessary costs. If you anticipate a delay, contact the EDD to discuss your situation; they may offer guidance or options based on your circumstances.

Can I pay online instead of using the DE 88 form?

Yes, employers have the option to pay payroll taxes online through the EDD’s e-Services for Business platform. This can be a more convenient option, allowing you to make payments electronically and often receive quicker confirmation. However, if you choose to pay using the DE 88 form, ensure you follow all instructions carefully and send it to the right address.

What should I do if I make a mistake on the DE 88 form?

If you realize you’ve made an error while filling out the DE 88 form, don’t panic. Make corrections clearly on the form. If possible, write a note indicating that it has been corrected. In some cases, you may need to file an amended return with the EDD. Always keep copies of your submissions in case of future discrepancies.

Who can I contact for assistance with the DE 88 form?

If you have questions or need help with the DE 88 form, reach out to the California Employment Development Department. Their representatives can provide guidance and clarification regarding any aspect of the form or payroll tax deposits. Alternatively, consider consulting a tax professional for personalized advice tailored to your business needs.

Common mistakes

Completing the DE 88 form may seem straightforward, but many people trip over common mistakes that can lead to delays and complications. Understanding these pitfalls can help ensure that your submission is accurate and timely.

One of the first mistakes individuals often make is failing to mark their deposit schedule correctly. The DE 88 requires you to choose one of the available options: *next-day, semiweekly, monthly,* or *quarterly*. If the box indicating the correct schedule is left unchecked, it can cause confusion and may result in penalties.

Additionally, accurately entering the pay date is crucial. This date should correspond with the last pay period covered by the deposit. An incorrect or missing pay date can lead to complications in reconciling tax obligations, making it imperative to double-check this detail before submission.

Some people forget to include their account number on the form. This number is essential for accurately directing the funds to the correct account. Omitting it can result in misallocated payments, and anyone submitting the form must ensure it’s clearly stated and correctly spelled.

Another common error arises in the deposit amounts section. People sometimes either miscalculate the total deposit or enter the amounts in the wrong format. It's vital to ensure that all entries are numerical and correctly reflect the amounts owed for each tax category. The total of lines A through F should be calculated and placed in the designated area to avoid potential discrepancies.

Also, the preparer's signature is often overlooked, especially when someone other than the primary taxpayer fills out the form. Forgetting to sign can render the entire submission invalid, leading to more issues down the line. Double-checking for a signature ensures that your submission will be processed without unnecessary delay.

One last common pitfall involves failing to read the instructions thoroughly. The DE 88 form includes specific requirements and guidelines that are there to aid in completing the document correctly. Neglecting to review these elements can lead to misunderstandings about how to fill out the form properly.

Ultimately, being aware of these common mistakes can streamline the process of filling out the DE 88. Taking a little extra time to review each section can save headaches later and facilitate smooth compliance with payroll tax obligations.

Documents used along the form

The DE 88 form is important for managing payroll tax deposits in California. However, employees and employers often need to use additional documents to ensure compliance with tax regulations. Below are five key forms and documents frequently associated with the DE 88 form.

- DE 9: This is a quarterly contribution return for reporting unemployment insurance, disability insurance, and personal income tax. Employers submit this form to summarize their payroll for the quarter and ensure that all taxes are properly accounted for.

- DE 9C: This form provides a more detailed report of wages and withholdings for each employee during the quarter. It is used alongside the DE 9 and helps track the amount of contributions for unemployment and disability insurance accurately.

- W-2 Form: Every employer must issue this form to their employees by the end of January each year. The W-2 summarizes an employee's annual earnings and the amount of taxes withheld. It is a vital document for individual tax returns and compliance with IRS requirements.

- Form 940: This is the employer’s annual federal unemployment tax return. Employers report their federal unemployment taxes on it. While it doesn't directly relate to state payroll tax, it's crucial for overall employment compliance.

- Form 941: This quarterly tax return is used to report income taxes, Social Security tax, and Medicare tax withheld from employees' paychecks. Employers file this form to communicate their payroll expenses to the IRS.

Using these documents in conjunction with the DE 88 form helps ensure that employers remain compliant with both state and federal tax requirements, protecting both their interests and those of their employees.

Similar forms

- Form 941: This form is used to report payroll taxes and employee wages. Like the DE 88, it tracks amounts owed to the government based on employees’ income. Both forms require accurate reporting to avoid penalties.

- Form 940: This document relates to Federal Unemployment Tax (FUTA) and ensures compliance with federal unemployment tax requirements. While the DE 88 focuses on California-specific taxes, both forms serve to report employer obligations.

- Form W-2: Employers use this form to report annual wages and taxes withheld from employees to the IRS. Similar to DE 88, both documents play a crucial role in ensuring proper tax compliance for workforce compensation.

- Form W-3: This is a summary form that accompanies W-2s submitted to the Social Security Administration. Both W-3 and DE 88 serve to report wage and tax information, ensuring that the data is accurate and complete.

- Form DE 9: This form is specific to California and reports payroll taxes for periods that match those covered by the DE 88. Both forms are critical for ensuring that state employment taxes are reported correctly.

- Form DE 7: Employers use this form to report California Employee Wage and Withholding details. Like the DE 88, the DE 7 ensures that the State of California receives accurate information on employee-related tax obligations.

Dos and Don'ts

When filling out the DE 88 form, following specific guidelines can help ensure accuracy and compliance. Below is a list of things you should and shouldn't do.

- Do use black ink and print clearly.

- Don't use pencil or any other color ink.

- Do mark the appropriate deposit schedule box (e.g., next-day, semiweekly).

- Don't leave any required fields blank.

- Do double-check your calculations before submitting.

- Don't fold or staple the form.

- Do enter the total amount clearly in the designated area.

- Don't forget to sign the form where indicated.

- Do include your contact telephone number.

- Don't submit the form without ensuring quality check of all information provided.

Misconceptions

- Misconception 1: The DE 88 form is only for large businesses.

- Misconception 2: There is no deadline for submitting the DE 88 form.

- Misconception 3: You can submit the DE 88 form by mail at any time.

- Misconception 4: Once submitted, you cannot make changes to the DE 88 form.

- Misconception 5: The DE 88 form automatically calculates penalties and interest.

- Misconception 6: Employers can ignore the penalties section of the DE 88 form.

- Misconception 7: The DE 88 form is only necessary for wage taxes.

- Misconception 8: You can submit the DE 88 form electronically without prior registration.

This form is required for all employers, regardless of business size, to report payroll tax deposits.

Employers must submit the form according to their deposit schedule; deadlines vary based on frequency.

It is essential to mail the DE 88 form by the due date to avoid penalties. Check the mailing schedule.

Employers can submit a corrected form if needed, but prompt action is advisable.

Employers must manually calculate any penalties and interest owed if deposits were late.

Finding penalties on the form is crucial since reporting them is part of maintaining compliance.

This form covers unemployment insurance, SDI, and other relevant payroll taxes.

Some employers must register before electronic submission. Verify your eligibility beforehand.

Key takeaways

The DE 88 form is essential for employers in California to report payroll tax deposits. Here are some key points to consider when filling out and using this form.

- Pay Date: Always indicate the pay date on the form. This is crucial for matching your deposit with the appropriate payroll period.

- Deposit Schedule: Choose the correct deposit schedule based on your organization’s payroll. Options include next-day, semiweekly, monthly, or quarterly. Mark only one box.

- Deposit Amounts: Ensure all deposit amounts are accurately recorded. This includes contributions for unemployment insurance, state disability insurance, and withheld income taxes.

- Account Number: Clearly indicate your account number on the form and check. This helps the Employment Development Department (EDD) process your deposit correctly.

- Signature and Contact Information: The preparer’s signature must be included along with a contact phone number. This allows for follow-up if there are any issues with the submission.

- Payment Method: Make the check payable to the EDD. Remember, do not fold or staple the form as this could hinder processing.

Being attentive to these details when filling out the DE 88 form can ensure compliance and prevent potential issues with tax deposits.

Browse Other Templates

Unemployment Arkansas - The DWS Ark 209B is a vital tool for tracking employee wages and contributions in Arkansas.

Live Scan Fingerprint Application,Michigan Fingerprint Submission Form,Fingerprint Processing Request,Criminal Background Check Application,Applicant Fingerprint Authorization,Live Scan Submission Document,Michigan State Police Fingerprint Form,Finge - Visit the Michigan State Police website to find approved Live Scan vendors.

Landlord Verification Form Texas - Clear communication between tenants and landlords is encouraged throughout this process.