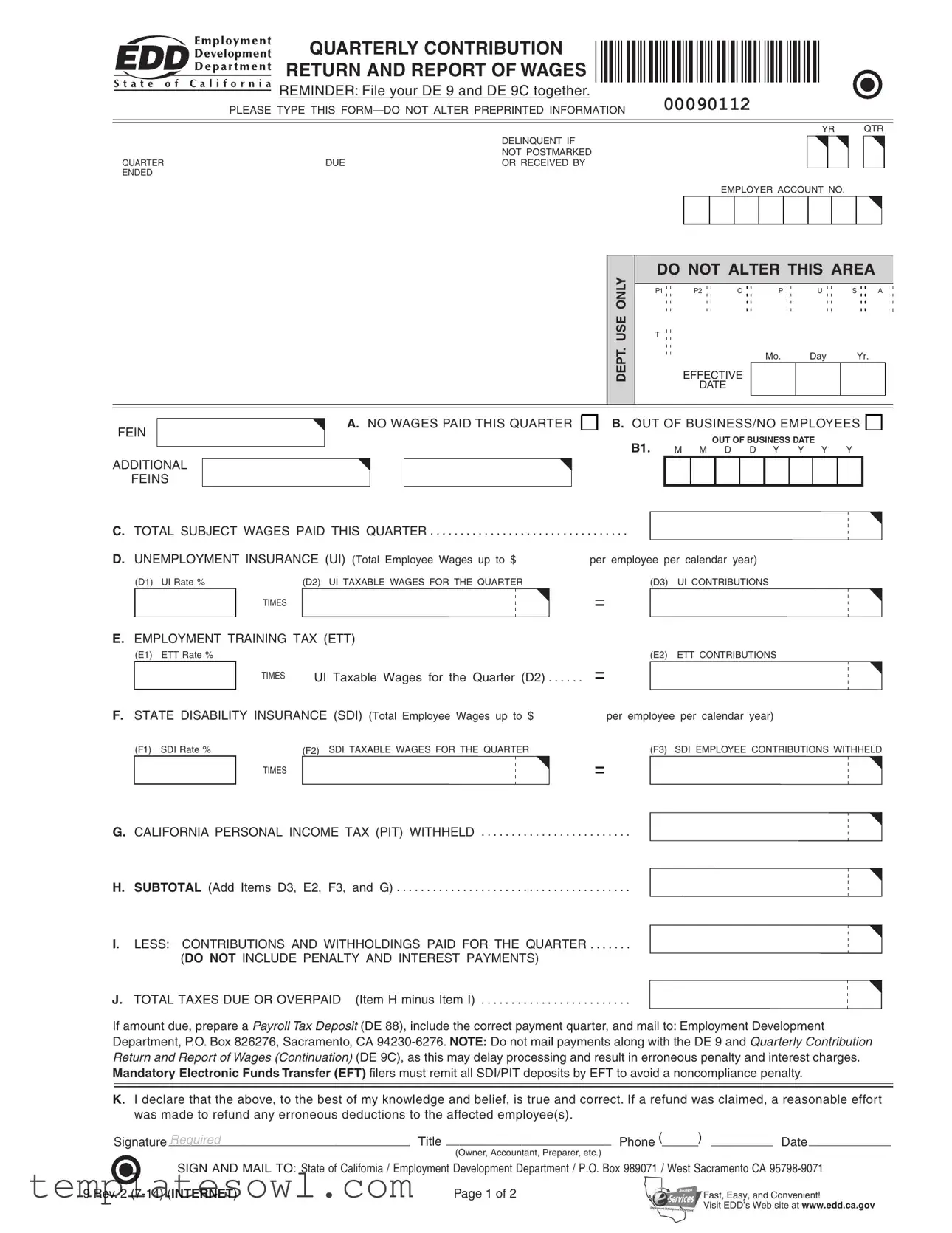

Fill Out Your De 9 Connector Form

The DE 9 Connector form serves as an essential tool for employers in California to report their quarterly contributions and wages paid to employees. This form consolidates critical information regarding unemployment insurance, employment training taxes, state disability insurance, and personal income tax withheld. It is mandatory for all employers, even those with no payroll, as they are required to file regardless of whether wages were paid. The DE 9 must be completed accurately and submitted on time to avoid penalties and interest charges. The form includes sections to detail wages, tax rates, and contributions, and it requires the employer's declaration of the accuracy of the information provided. Employers should also be aware of specific instructions regarding how to report an out-of-business status and the necessity of filing this form alongside the DE 9C for comprehensive reporting. Additionally, online filing options are available for added convenience, allowing for efficient submission of information to the Employment Development Department (EDD). Understanding the components of the DE 9 Connector is crucial for compliance and effective management of payroll tax obligations.

De 9 Connector Example

QUARTERLY CONTRIBUTION

RETURN AND REPORT OF WAGES

REMINDER: File your DE 9 and DE 9C together.

|

PLEASE TYPE THIS |

00090112 |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YR |

|

QTR |

||

|

|

DELINQUENT IF |

|

|

|

|

|

|

|

|

NOT POSTMARKED |

|

|

|

|

|

|

QUARTER |

DUE |

OR RECEIVED BY |

|

|

|

|

|

|

ENDED |

|

|

|

|

|

|

|

|

EMPLOYER ACCOUNT NO.

DEPT. USE ONLY

DO NOT ALTER THIS AREA

P1 |

P2 |

C |

P |

U |

S |

A |

T |

|

|

|

|

|

|

|

|

|

Mo. |

Day |

|

Yr. |

EFFECTIVE

DATE

FEIN

ADDITIONAL

FEINS

A.NO WAGES PAID THIS QUARTER

B.OUT OF BUSINESS/NO EMPLOYEES

B1. |

|

OUT OF BUSINESS DATE |

||||||

M M D D Y Y Y Y |

||||||||

|

|

|

|

|

|

|

|

|

C. TOTAL SUBJECT WAGES PAID THIS QUARTER . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

D. UNEMPLOYMENT INSURANCE (UI) (Total Employee Wages up to $ |

per employee per calendar year) |

||||

|

(D1) UI Rate % |

(D2) UI TAXABLE WAGES FOR THE QUARTER |

|

|

(D3) UI CONTRIBUTIONS |

|

|

TIMES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

E.EMPLOYMENT TRAINING TAX (ETT)

|

(E1) |

ETT Rate % |

|

|

(E2) |

ETT CONTRIBUTIONS |

|

|

|

|

TIMES |

UI Taxable Wages for the Quarter (D2) |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

|

|

|

|

|||

F. STATE DISABILITY INSURANCE (SDI) (Total Employee Wages up to $ |

|

per employee per calendar year) |

|||||

|

(F1) |

SDI Rate % |

(F2) SDI TAXABLE WAGES FOR THE QUARTER |

|

(F3) |

SDI EMPLOYEE CONTRIBUTIONS WITHHELD |

|

TIMES

G. CALIFORNIA PERSONAL INCOME TAX (PIT) WITHHELD . . . . . . . . . . . . . . . . . . . . . . . . .

H. SUBTOTAL (Add Items D3, E2, F3, and G) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

I. LESS: CONTRIBUTIONS AND WITHHOLDINGS PAID FOR THE QUARTER . . . . . . .

(DO NOT INCLUDE PENALTY AND INTEREST PAYMENTS)

J. TOTAL TAXES DUE OR OVERPAID (Item H minus Item I) . . . . . . . . . . . . . . . . . . . . . . . . .

If amount due, prepare a Payroll Tax Deposit (DE 88), include the correct payment quarter, and mail to: Employment Development

Department, P.O. Box 826276, Sacramento, CA

K.I declare that the above, to the best of my knowledge and belief, is true and correct. If a refund was claimed, a reasonable effort was made to refund any erroneous deductions to the affected employee(s).

|

Signature Required |

Title ________________________ Phone ( |

) |

|

|

Date ____________ |

|

|

|

(Owner, Accountant, Preparer, etc.) |

|

|

|

|

|

|

SIGN AND MAIL TO: State of California / Employment Development Department / P.O. Box 989071 / West Sacramento CA |

||||||

|

|

|

|

|

|||

DE |

9 Rev. 2 |

Page 1 of 2 |

|

|

Fast, Easy, and Convenient! |

||

|

|

|

|

|

Visit EDD’s Web site at www.edd.ca.gov |

||

|

|

|

|

|

|

|

|

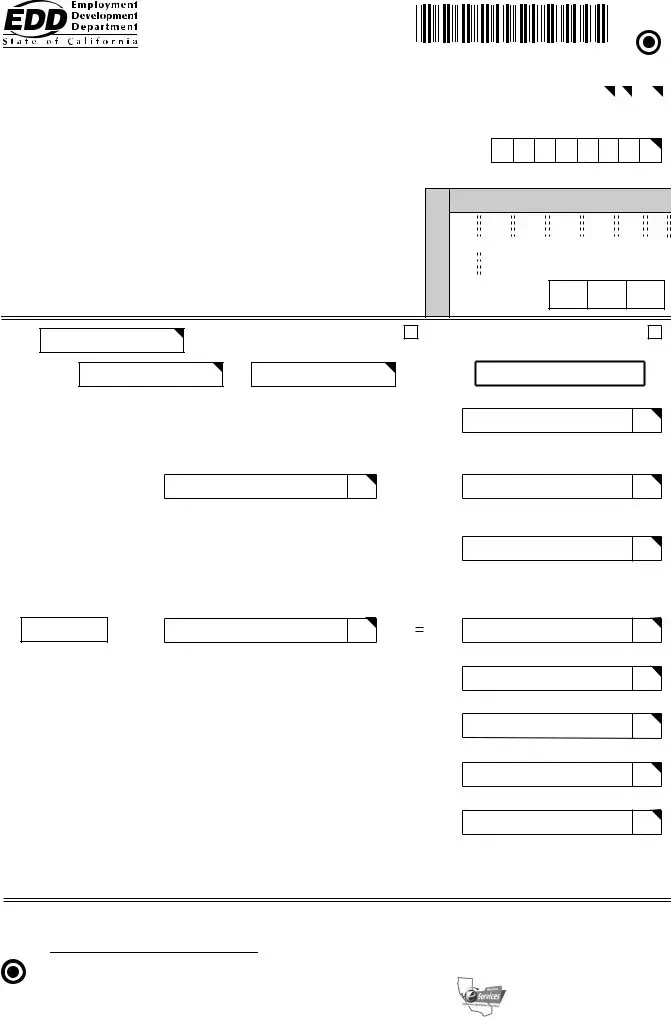

INSTRUCTIONS FOR COMPLETING THE

QUARTERLY CONTRIBUTION RETURN AND REPORT OF WAGES (DE 9)

PLEASE TYPE ALL INFORMATION

Did you know you can file this form online using the EDD’s

For a faster, easier, and more convenient method of reporting your DE 9 information, visit the EDD’s website at www.edd.ca.gov.

Contact the Taxpayer Assistance Center at (888)

reporting wages or the subject status of employees. Refer to the California Employer’s Guide (DE 44) for additional information.

If this form is not preprinted, please include your business name and address, State employer account number, the quarter ended date, and the year and quarter for which this form is being iled.

Verify/enter your Federal Employer Identiication Number (FEIN): The number should be the same as your federal account number. If the number is not correct, line it out and enter the correct number. If you have more than one FEIN relating to your State number, enter the additional FEINs in the boxes provided.

ITEM A. No Wages Paid This Quarter - You must ile this return even though you had no payroll. If you had no payroll, check

Item A and complete Item K. You must also complete a Quarterly Contribution Return and Report of Wages (Continuation) (DE 9C) indicating no payroll for this quarter.

ITEM B. Out of Business/No Employees - Check this box if you are out of business (OB) or no longer have employees (NE) and this is your inal return. You must complete B1 if you are out of business.

NOTE: If you select the Line B Out of Business/No Employees and have No Payroll for the quarter, you must complete Item C and Item O on the DE 9C.

ITEM B1. Enter the OB/NE date where indicated and complete Line K.

NOTE: If you closed the business this quarter, you must ile the DE 9 and DE 9C within ten days of closing the business to avoid any penalties.

ITEM C. Total Subject Wages Paid This Quarter - Enter the total subject wages paid to all employees during the quarter.

ITEM D. Unemployment Insurance (UI)

D1. UI Rate - Enter the UI rate as a percentage if not already shown.

D2. UI Taxable Wages - Enter total UI taxable wages for the quarter. (Do not include exempt wages; refer to the California Employer’s Guide [DE 44] for details.)

D3. Employer’s UI Contributions - Multiply D1 by the amount entered in D2 and enter this calculated amount in D3.

ITEM E. Employment Training Tax (ETT)

E1. ETT Rate - Enter the ETT rate as a percentage if not already shown.

E2. ETT - Multiply E1 by the amount entered in D2 and enter this calculated amount in E2.

ITEM F. State Disability Insurance (SDI)

F1. SDI Rate - Enter the SDI rate as a percentage if not already shown (includes Paid Family Leave percentage).

F2. SDI Taxable Wages - Enter the total SDI taxable wages for the quarter. (Do not include exempt wages; refer to the California Employer’s Guide [DE 44] for details.)

F3. Multiply F1 by the amount entered in F2 and enter this calculated amount in F3.

ITEM G. California Personal Income Tax (PIT) Withheld - Enter total California PIT withheld during the quarter.

NOTE: If over $350 in PIT is withheld, it may be necessary to deposit more frequently. For additional information, visit the EDD’s website at www.edd.ca.gov/Payroll_Taxes.

ITEM H. Subtotal - Add Items D3, E2, F3, and G; enter the amount in the SUBTOTAL box.

ITEM I. Contributions and Withholdings Paid for the Quarter - Total of all deposits of UI, ETT, SDI, and PIT paid for the quarter. NOTE: Do not include any payments made for prior quarters or for penalty and interest.

ITEM J. Total Taxes Due or Overpaid - Item H minus Item I. If an amount is due, submit a Payroll Tax Deposit (DE 88) with your payment and mail to P.O. Box 826276, Sacramento, CA

NOTE: Mailing payments with the DE 9 form delays payment processing and may result in erroneous penalty and interest charges.

ITEM K. Signature of preparer or responsible individual, including title, telephone number, and signature date.

Employers and Payers of

INFORMATION

FILING THIS RETURN/REPORT - California law requires employers to report all UI/SDI subject California wages paid and California PIT withheld during the quarter.

A PENALTY of 15% (10% for periods prior to 3rd quarter 2014) plus interest will be charged for underpayment of contributions and California PIT withheld per Section 1112(a) of the California Unemployment Insurance Code (CUIC). In addition, a penalty of 15% (10% for periods prior to 3rd quarter 2014) of the unpaid contributions and California PIT withheld will be charged for failure to ile the return/report within 60 days of the due date pursuant to Section 1112.5 of the CUIC.

DE 9 Rev. 2 |

Page 2 of 2 |

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose of the Form | The DE 9 form is used by California employers to report quarterly wages and contributions for unemployment insurance, employment training tax, state disability insurance, and personal income tax withheld. |

| Filing Requirement | All employers must file the DE 9 form, even if no wages were paid in the reporting quarter. This requirement ensures accurate records are maintained for all businesses. |

| Filing Deadline | The DE 9 must be postmarked or received by the Employment Development Department (EDD) within a specified timeframe after the quarter ends. Failure to meet this deadline may incur penalties. |

| Notable Penalties | A penalty of up to 15% can be applied for underpayment of contributions and withholding. This penalty is in addition to any interest that may accrue. |

| Signature Requirement | The form must be signed by a responsible individual, including their title and contact information, affirming the accuracy of the information reported. |

| Payment Instructions | Payments cannot be mailed together with the DE 9 form. Doing so can delay processing and may lead to penalties or interest charges on unpaid balances. |

| Electronic Filing Availability | Employers have the option to file the DE 9 online through the EDD's e-Services for Business, providing a faster and more convenient method of submission. |

| Confidential Information | Do not alter preprinted information on the form. Accuracy is crucial, and any errors can lead to complications in processing the return. |

| California Specifics | The DE 9 is governed by the California Unemployment Insurance Code (CUIC), which outlines all obligations and penalties related to wage reporting. |

| Quarterly Updates Needed | Employers must keep records of all wages paid and contributions made each quarter. This ensures compliance and enables easy access to necessary information when disputes arise. |

Guidelines on Utilizing De 9 Connector

Completing the DE 9 Connector form is an important step for employers to report wages and contributions accurately. It is essential to follow the form's requirements carefully to avoid penalties and ensure compliance with state regulations. Below are step-by-step instructions for filling out the form accurately and efficiently.

- Type all necessary information in the form. Do not alter any preprinted information.

- Verify your Federal Employer Identification Number (FEIN) is correct. If incorrect, cross it out and write the corrected number.

- Enter your business name and address if not preprinted on the form.

- Fill out the quarter ended date, the year, and the quarter for this report.

- For Item A, indicate if no wages were paid this quarter by checking the appropriate box.

- If you are out of business or have no employees, check Item B. Complete B1 with the appropriate date.

- In Item C, report the total subject wages paid during the quarter.

- For Item D, enter the Unemployment Insurance (UI) rate percentage in D1. In D2, report the total UI taxable wages.

- Calculate the employer’s UI contributions by multiplying D1 by D2. Write this amount in D3.

- Move to Item E; enter the Employment Training Tax (ETT) rate in E1 and calculate E2 using D2.

- Next, complete Item F for State Disability Insurance (SDI). Fill in F1 with the SDI rate and F2 with total SDI taxable wages. Calculate F3 by multiplying F1 by F2.

- In Item G, report the total California Personal Income Tax (PIT) withheld for the quarter.

- Add Items D3, E2, F3, and G to get the subtotal and place the total in Item H.

- In Item I, list the contributions and withholdings paid for the quarter. Do not include payments for previous quarters.

- Calculate the total taxes due or overpaid in Item J by subtracting Item I from Item H.

- If applicable, prepare a Payroll Tax Deposit (DE 88) and mail it to the correct address listed in the form.

- Lastly, sign the form in Item K, including your title, phone number, and date.

After you complete the DE 9 form, it is critical to ensure that all information is accurate and submitted on time to avoid penalties. If filing online is an option, consider utilizing the EDD’s e-Services for a more convenient process. For any questions or assistance, reaching out to the Taxpayer Assistance Center can provide additional support.

What You Should Know About This Form

What is the DE 9 Connector form and when is it due?

The DE 9 Connector form, also known as the Quarterly Contribution Return and Report of Wages, is a document that employers in California must file to report employee wages and employment tax contributions for a specific quarter. It is crucial to submit this form as it details unemployment insurance contributions, employment training taxes, and state disability insurance. The form is due on the 1st day of the month following the end of a quarter and must be postmarked by that date to avoid penalties.

What information do I need to complete the DE 9 Connector form?

To fill out the DE 9 Connector form, you will need several key pieces of information. This includes your employer account number, Federal Employer Identification Number (FEIN), and the total wages paid to employees during the quarter. You also need to indicate if you had no payroll, are out of business, or if this is your final return. Additional figures such as unemployment insurance rates, employment training tax rates, and any California personal income tax withheld will also be necessary to accurately complete the form.

What happens if I miss the filing deadline for the DE 9 Connector?

If you do not file the DE 9 Connector form by the deadline, you may incur penalties. California law imposes a 15% penalty on any unpaid contributions, plus interest. If you fail to file the form within 60 days after the due date, you may face an additional penalty of 15% on the unpaid amount. To avoid these penalties, it’s important to submit the form on time and ensure that all information is accurate.

How can I file the DE 9 Connector form?

You can file the DE 9 Connector form either by mail or online. For a more efficient and faster method, consider using the Employment Development Department’s e-Services for Business, which allows online filings. If you choose to file by mail, ensure to send the completed form to the designated address provided for the Employment Development Department in Sacramento, California. Remember to file the DE 9 form together with the DE 9C (Continuation form) if applicable.

Common mistakes

When completing the DE 9 Connector form, many people unwittingly make mistakes that can lead to processing delays or even penalties. One common error involves incorrect entry of the Federal Employer Identification Number (FEIN). This number is crucial for the identification of the business. If it does not match what the IRS has on file, it could cause issues with tax calculations and reporting. It is essential to verify that this number is accurate before submission. If there are additional FEINs, make sure to include them in the designated boxes.

Another frequent oversight stems from the misunderstanding of wage reporting. Some individuals fail to report all employee wages correctly, particularly those wages that are subject to Unemployment Insurance (UI), State Disability Insurance (SDI), or Employment Training Tax (ETT). Underreporting or omitting these amounts can lead to significant penalties. It's vital to carefully calculate and include total subject wages to ensure compliance with California law.

Many also neglect to check the appropriate boxes regarding 'No Employees' or 'Out of Business.' If one of these scenarios applies, it is necessary to accurately indicate this on the form. Failing to do so not only results in incorrect reporting but may trigger audits or penalties. If a business has closed, completing the form within the required ten-day timeframe is crucial to avoid further complications.

Another common mistake lies in the subtotal and total tax calculations. Using incorrect totals or failing to subtract the contributions and withholdings can lead to incorrect reporting of taxes due. This can cause confusion and result in additional tax liabilities or overpayments. Double-checking calculations will ensure that all amounts are correct and reduce the risk of mistakes.

Lastly, failing to sign the form or omitting important details such as the preparer's title and contact number can delay processing or even render the form invalid. A handwritten signature is required, confirming the information's accuracy. Therefore, before mailing the DE 9 Connector form, it is crucial to review it thoroughly and ensure that all information is complete and correctly entered.

Documents used along the form

The DE 9 Connector form is a critical document for employers in California, as it provides essential information about quarterly wage contributions and employee withholdings. Along with this form, there are several other documents that employers may need to file or reference. Below are descriptions of six important related forms and documents.

- DE 9C (Quarterly Contribution Return and Report of Wages Continuation): This form is used to provide additional details for the DE 9. If an employer has a larger number of employees or complex wage structures, they may need to complete this form to report all wages and contributions accurately.

- DE 88 (Payroll Tax Deposit): This document is for employers to report and pay the taxes owed for Unemployment Insurance (UI), Employment Training Tax (ETT), and State Disability Insurance (SDI). It is essential for timely tax remittance to avoid penalties.

- DE 44 (California Employer’s Guide): This guide serves as a comprehensive resource for California employers. It includes important information on filing requirements and employer responsibilities, making it a valuable reference for understanding the filing process.

- EDD Registration Form (DE 1): New businesses must complete this form to register with the Employment Development Department (EDD). This registration is necessary for employers to obtain an employer account number and to start reporting wages.

- Form 941 (Employer's Quarterly Federal Tax Return): This federal document is used to report income taxes, Social Security tax, and Medicare tax withheld from employee paychecks. Employers must file this form quarterly to comply with federal regulations.

- W-2 Forms: These forms report wages paid to employees and the taxes withheld throughout the year. Employers must issue W-2s to their employees annually and also submit a copy to the Social Security Administration.

Using these forms in conjunction with the DE 9 helps ensure compliance with both state and federal regulations regarding employee wages and tax contributions. Proper filing is crucial to avoid penalties and maintain smooth business operations.

Similar forms

The DE 9 Connector form serves an important function in reporting wages and contributions for California employers. It shares similarities with several other documents used in the payroll and tax landscape. Here are four forms that closely relate to the DE 9 Connector:

- DE 9C - Quarterly Contribution Return and Report of Wages (Continuation): This form accompanies the DE 9 and provides additional details about wages paid, especially when the information exceeds the space available on the DE 9. It ensures thorough reporting for employers.

- DE 88 - Payroll Tax Deposit: The DE 88 is used to make payments for unemployment insurance, employment training tax, state disability insurance, and California personal income tax. It complements the DE 9 by facilitating the actual payment of the taxes reported on the DE 9 form.

- DE 44 - California Employer's Guide: The DE 44 serves as a comprehensive resource for employers regarding their responsibilities related to wage reporting and unemployment insurance. It includes guidelines on filling out the DE 9 and related forms, helping employers stay compliant.

- W-2 Form - Wage and Tax Statement: The W-2 form reports annual wages and taxes withheld for employees. While the DE 9 focuses on quarterly reporting, both forms are essential in ensuring proper tax compliance and employee reporting throughout the year.

Dos and Don'ts

When completing the DE 9 Connector form, there are several important guidelines to follow to ensure accuracy and compliance. Here are four key things to do and avoid:

- Do: Type all information clearly on the form to avoid any misinterpretation.

- Do: Verify your Federal Employer Identification Number (FEIN) for accuracy; it should match your federal account number.

- Don’t: Alter any preprinted information on the form, as changes can lead to processing delays.

- Don’t: Mail payments with the DE 9 form to prevent potential penalties and interest charges due to processing delays.

Misconceptions

1. You only need to file if you have employees. Many think the DE 9 Connector form is only necessary if you have payroll. However, every employer must file, even if no wages were paid during the quarter.

2. Online filing isn’t an option. A common misconception is that you must file using paper forms. In fact, you can file this form electronically for a more efficient process.

3. Information on the form does not need to be accurate. Some believe that it's okay to estimate figures. This is not the case. The information provided must be true and accurate to avoid penalties.

4. You can ignore the deadlines if you don’t owe anything. It's a mistake to think that deadlines are irrelevant if there are no taxes owed. All employers must submit the form by the due date to stay in compliance.

5. You can combine payments and the DE 9 form. Many mistakenly think they can send their tax payments with this form. Doing so can delay processing and lead to penalties.

6. It’s only about unemployment insurance. While unemployment insurance is included, the DE 9 also covers other important contributions, like state disability insurance and employment training tax.

7. No need to include signature and date if I’m using a third-party preparer. All forms must be signed and dated, even if a third-party is preparing them. This maintains accountability.

8. Once filed, it’s set in stone. Some think they can’t amend their submission. If mistakes are discovered, employers can, and should, file an amended return to correct inaccuracies.

9. I don’t need to keep records of what I file. This is misleading; employers should maintain records of submitted forms and payments for at least four years in case of audits.

10. It’s just a formality. While some view it as a bureaucratic requirement, the DE 9 Connector is crucial for keeping accurate accounts of payroll taxes and ensuring compliance with state laws.

Key takeaways

Filling out the DE 9 Connector form is essential for maintaining compliance with California's employment tax regulations. Here are six key takeaways:

- File on Time: Ensure that the DE 9 form is postmarked by the due date for the quarter to avoid penalties.

- Use the Correct Information: Double-check that all preprinted information, such as your employer account number and FEIN, is correct before submitting.

- Filing Requirements: Even if you have no wages to report for the quarter, you must still file this return to stay compliant.

- Out of Business Procedures: If you are no longer in business, indicate this clearly on the form and complete the necessary sections regarding your final return.

- Clarify Tax Calculations: Calculate unemployment insurance and state disability insurance contributions accurately based on the provided rates and taxable wages.

- Submit Separately: Do not mail payments with the DE 9 form to prevent delays, as payments need to be sent separately to the appropriate P.O. Box.

Staying informed and meticulous while filling out the DE 9 Connector is crucial for avoiding penalties and ensuring timely payments. Engage with the California Employment Development Department’s resources for any further assistance.

Browse Other Templates

Broker Partnership Application,Mortgage Broker Network Enrollment,UWM Affiliate Registration,Wholesale Mortgage Broker Signup,UWM Collaboration Form,Broker Integration Application,Wholesale Lending Partnership Form,Mortgage Broker Support Document,UW - UWM ensures a quick and smooth transaction process.

Nafta Certificate of Origin Canada - Using clear language when describing goods can prevent misunderstandings.

Dj-le-330 - Submission of false information is a significant concern addressed in the certification section.