Fill Out Your De 9Adj Form

The DE 9Adj form plays a crucial role for employers in California who need to make adjustments to their previously reported wages and contributions. This quarterly contribution and wage adjustment form allows businesses to correct errors that may have occurred in previous filings. For example, adjustments may be necessary due to misreported wages, incorrect withholdings, or errors in employee information. Understanding the timeframe within which these adjustments must be submitted is essential; claims for refunds or credits should be filed within three years of the last timely filing date for the quarter in question. The form requires specific details, such as business name, employer account number, and the reasons for adjustment. It must be filled out accurately to reflect the differences between what was reported and what should have been reported for various taxable wages. Additionally, the form addresses both State Disability Insurance and Personal Income Tax overpayments, providing separate sections for each. This ensures clarity when making adjustments, as well as compliance with the rules set forth by the Employment Development Department (EDD). Accessing the EDD's e-Services for Business portal offers a convenient way to complete and submit the DE 9Adj form online, streamlining the correction process while ensuring that businesses remain compliant with California tax laws.

De 9Adj Example

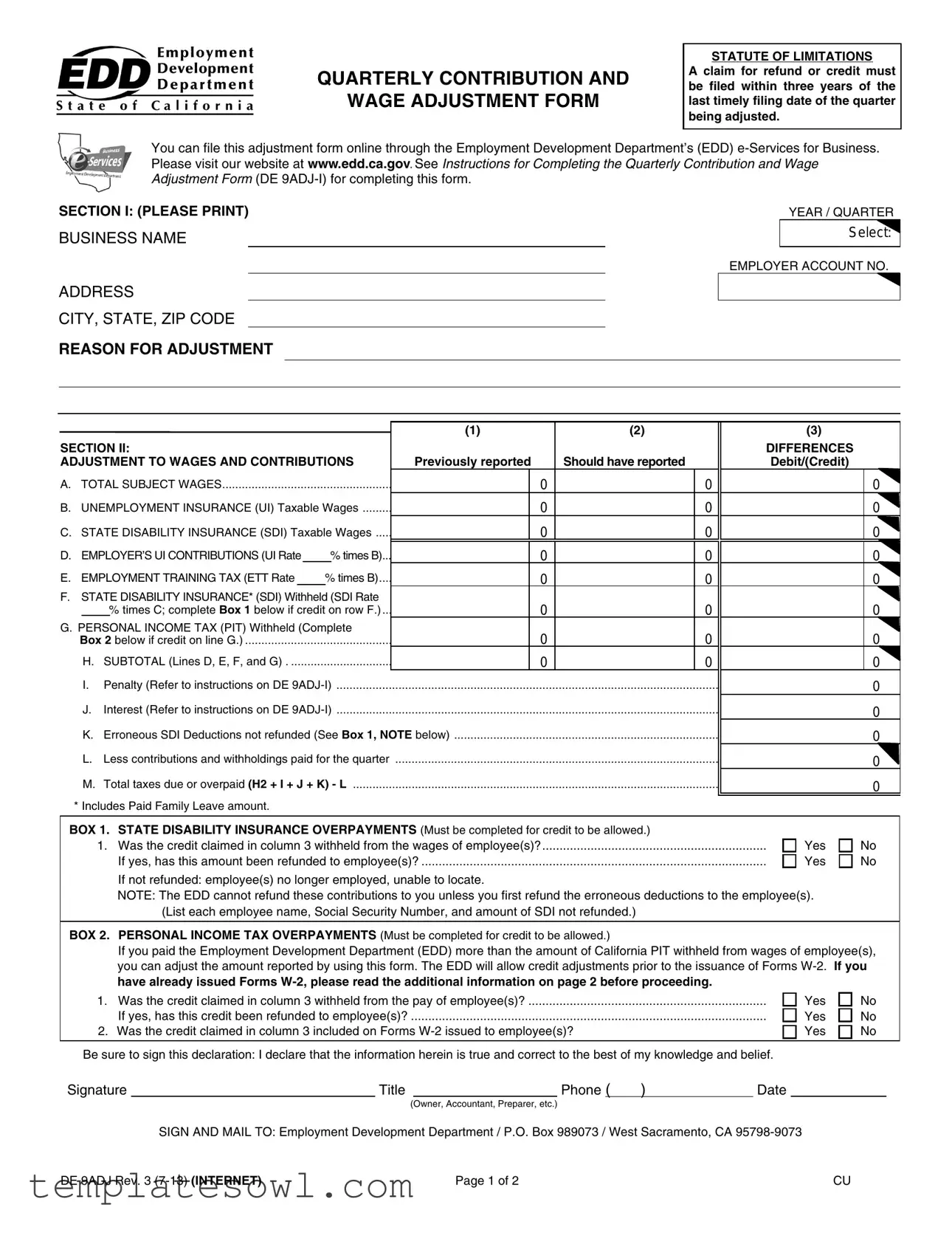

QUARTERLY CONTRIBUTION AND

WAGE ADJUSTMENT FORM

STATUTE OF LIMITATIONS

A claim for refund or credit must be filed within three years of the last timely filing date of the quarter being adjusted.

You can file this adjustment form online through the Employment Development Department’s (EDD)

SECTION I: (PLEASE PRINT)

BUSINESS NAME

YEAR / QUARTER

Select:

EMPLOYER ACCOUNT NO.

ADDRESS

CITY, STATE, ZIP CODE

REASON FOR ADJUSTMENT

|

(1) |

(2) |

(3) |

SECTION II: |

|

|

DIFFERENCES |

ADJUSTMENT TO WAGES AND CONTRIBUTIONS |

Previously reported |

Should have reported |

Debit/(Credit) |

A. TOTAL SUBJECT WAGES |

0 |

0 |

0 |

B. UNEMPLOYMENT INSURANCE (UI) Taxable Wages |

0 |

0 |

0 |

C. STATE DISABILITY INSURANCE (SDI) Taxable Wages |

0 |

0 |

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

D. EMPLOYER’S UI CONTRIBUTIONS (UI Rate |

|

|

% times B) |

|

0 |

|

0 |

|

0 |

|||

|

|

|

||||||||||

E. EMPLOYMENT TRAINING TAX (ETT Rate |

|

|

% times B).... |

0 |

|

0 |

|

0 |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

F. STATE DISABILITY INSURANCE* (SDI) Withheld (SDI Rate |

0 |

|

0 |

|

0 |

|||||||

|

|

% times C; complete Box 1 below if credit on row F.) ... |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

G. PERSONAL INCOME TAX (PIT) Withheld (Complete |

0 |

|

0 |

|

0 |

|||||||

Box 2 below if credit on line G.) |

|

|

|

|

|

|||||||

|

H. SUBTOTAL (Lines D, E, F, and G) |

|

|

|

0 |

|

0 |

|

0 |

|||

|

I. Penalty (Refer to instructions on DE |

|

|

|

0 |

|||||||

|

J. Interest (Refer to instructions on DE |

|

|

|

0 |

|||||||

|

|

|

|

|

|

|

|

|

|

|

||

|

K. Erroneous SDI Deductions not refunded (See Box 1, NOTE below) |

|

|

|

0 |

|||||||

|

L. Less contributions and withholdings paid for the quarter |

|

|

|

0 |

|||||||

|

M. Total taxes due or overpaid (H2 + I + J + K) - L |

|

|

|

0 |

|||||||

|

|

|

|

|

|

|

|

|

|

|

||

* Includes Paid Family Leave amount. |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

BOX 1. STATE DISABILITY INSURANCE OVERPAYMENTS (Must be completed for credit to be allowed.)

1. Was the credit claimed in column 3 withheld from the wages of employee(s)? |

Yes |

No |

If yes, has this amount been refunded to employee(s)? |

Yes |

No |

If not refunded: employee(s) no longer employed, unable to locate.

NOTE: The EDD cannot refund these contributions to you unless you first refund the erroneous deductions to the employee(s). (List each employee name, Social Security Number, and amount of SDI not refunded.)

BOX 2. PERSONAL INCOME TAX OVERPAYMENTS (Must be completed for credit to be allowed.)

If you paid the Employment Development Department (EDD) more than the amount of California PIT withheld from wages of employee(s), you can adjust the amount reported by using this form. The EDD will allow credit adjustments prior to the issuance of Forms

have already issued Forms

1. Was the credit claimed in column 3 withheld from the pay of employee(s)? |

Yes |

No |

If yes, has this credit been refunded to employee(s)? |

Yes |

No |

2. Was the credit claimed in column 3 included on Forms |

Yes |

No |

Be sure to sign this declaration: I declare that the information herein is true and correct to the best of my knowledge and belief.

Signature |

|

Title |

|

|

Phone ( |

) |

Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

(Owner, Accountant, Preparer, etc.) |

|

|

|||

SIGN AND MAIL TO: Employment Development Department / P.O. Box 989073 / West Sacramento, CA

DE 9ADJ Rev. 3 |

Page 1 of 2 |

CU |

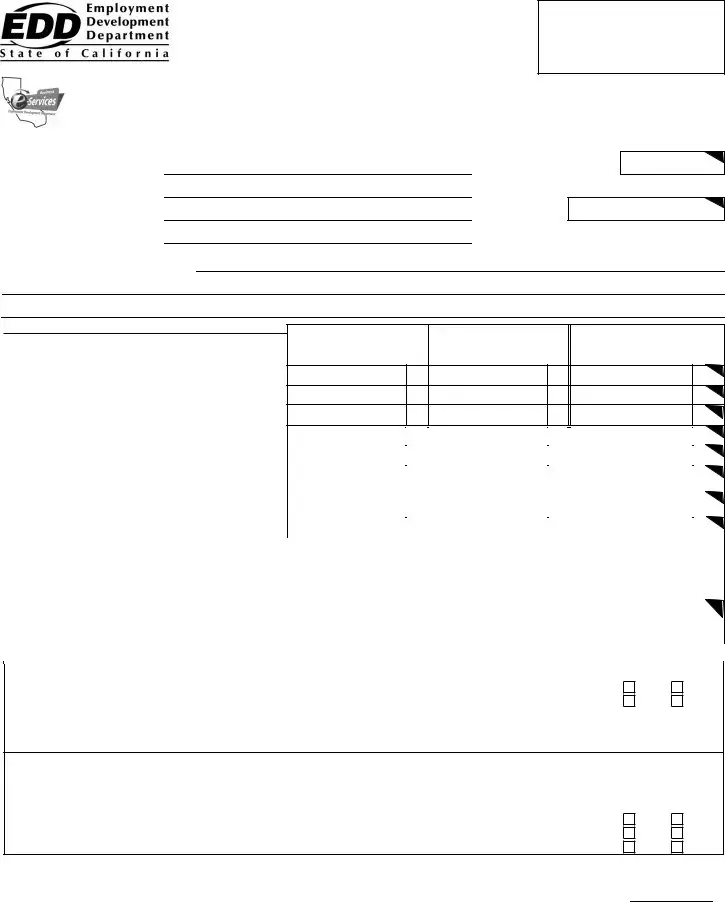

QUARTERLY CONTRIBUTION AND WAGE ADJUSTMENT FORM

EMPLOYER ACCOUNT NO.

BUSINESS NAME

SECTION III: QUARTERLY WAGE AND WITHHOLDING ADJUSTMENTS

Enter amounts that should have been reported; if unchanged, leave field blank. Correcting the Social Security Number or Name requires two entries. See Instructions for Completing the Quarterly Contribution and Wage Adjustment Form (DE

YEAR / QUARTER |

SOCIAL SECURITY NUMBER |

EMPLOYEE NAME (FIRST, MIDDLE INITIAL, LAST) |

|

|

|

|

|

|

|

|

|

TOTAL SUBJECT WAGES |

PIT WAGES |

PIT WITHHELD |

|

|

|

|

|

YEAR / QUARTER |

SOCIAL SECURITY NUMBER |

EMPLOYEE NAME (FIRST, MIDDLE INITIAL, LAST) |

|

|

|

|

|

|

|

|

|

TOTAL SUBJECT WAGES |

PIT WAGES |

PIT WITHHELD |

|

|

|

|

|

YEAR / QUARTER |

SOCIAL SECURITY NUMBER |

EMPLOYEE NAME (FIRST, MIDDLE INITIAL, LAST) |

|

|

|

|

|

|

|

|

|

TOTAL SUBJECT WAGES |

PIT WAGES |

PIT WITHHELD |

|

|

|

|

|

YEAR / QUARTER |

SOCIAL SECURITY NUMBER |

EMPLOYEE NAME (FIRST, MIDDLE INITIAL, LAST) |

|

|

|

|

|

|

|

|

|

TOTAL SUBJECT WAGES |

PIT WAGES |

PIT WITHHELD |

|

|

|

|

|

YEAR / QUARTER |

SOCIAL SECURITY NUMBER |

EMPLOYEE NAME (FIRST, MIDDLE INITIAL, LAST) |

|

|

|

|

|

|

|

|

|

TOTAL SUBJECT WAGES |

PIT WAGES |

PIT WITHHELD |

|

|

|

|

|

YEAR / QUARTER |

SOCIAL SECURITY NUMBER |

EMPLOYEE NAME (FIRST, MIDDLE INITIAL, LAST) |

|

|

|

|

|

|

|

|

|

TOTAL SUBJECT WAGES |

PIT WAGES |

PIT WITHHELD |

|

|

|

|

|

YEAR / QUARTER |

SOCIAL SECURITY NUMBER |

EMPLOYEE NAME (FIRST, MIDDLE INITIAL, LAST) |

|

|

|

|

|

|

|

|

|

TOTAL SUBJECT WAGES |

PIT WAGES |

PIT WITHHELD |

|

|

|

|

|

YEAR / QUARTER |

SOCIAL SECURITY NUMBER |

EMPLOYEE NAME (FIRST, MIDDLE INITIAL, LAST) |

|

|

|

|

|

|

|

|

|

TOTAL SUBJECT WAGES |

PIT WAGES |

PIT WITHHELD |

|

|

|

|

|

YEAR / QUARTER |

SOCIAL SECURITY NUMBER |

EMPLOYEE NAME (FIRST, MIDDLE INITIAL, LAST) |

|

|

|

|

|

|

|

|

|

TOTAL SUBJECT WAGES |

PIT WAGES |

PIT WITHHELD |

|

|

|

|

|

YEAR / QUARTER |

SOCIAL SECURITY NUMBER |

EMPLOYEE NAME (FIRST, MIDDLE INITIAL, LAST) |

|

|

|

|

|

|

|

|

|

TOTAL SUBJECT WAGES |

PIT WAGES |

PIT WITHHELD |

|

|

|

|

|

YEAR / QUARTER |

SOCIAL SECURITY NUMBER |

EMPLOYEE NAME (FIRST, MIDDLE INITIAL, LAST) |

|

|

|

|

|

|

|

|

|

TOTAL SUBJECT WAGES |

PIT WAGES |

PIT WITHHELD |

|

|

|

|

|

YEAR / QUARTER |

SOCIAL SECURITY NUMBER |

EMPLOYEE NAME (FIRST, MIDDLE INITIAL, LAST) |

|

|

|

|

|

|

|

|

|

TOTAL SUBJECT WAGES |

PIT WAGES |

PIT WITHHELD |

|

|

|

|

|

DE 9ADJ Rev. 3 |

Page 2 of 2 |

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The DE 9ADJ form is utilized for reporting wage adjustments and correcting contributions related to California state taxes. |

| Governing Law | This form is governed by California Employment Development Department regulations pertaining to unemployment insurance and disability insurance. |

| Statute of Limitations | A claim for a refund or credit must be filed within three years of the last timely filing date for the quarter being adjusted. |

| Online Submission | The adjustment form can be filed online through the EDD e-Services for Business platform. |

| Required Information | Sections I and II of the form require specific information such as business name, employer account number, and reasons for adjustments. |

| PIT Overpayments | Employers can claim a credit for any excess California Personal Income Tax (PIT) withheld from employees' wages. |

| SDI Overpayments | The form includes provisions for requesting refunds for excessive State Disability Insurance (SDI) deductions, including instructions on employee refunds. |

| Signature Requirement | The form must be signed by an authorized person, such as the owner or accountant, certifying the accuracy of the provided information. |

| Mailing Address | Completed forms must be mailed to the Employment Development Department at their designated address in West Sacramento, California. |

Guidelines on Utilizing De 9Adj

After completing the DE 9Adj form, it is essential to double-check all entries for accuracy. Ensure that the form is signed and submit it via mail to the Employment Development Department at the address provided. This process can also be completed online through the EDD's e-Services for Business. The submission must be made within three years from the last timely filing date of the quarter you are adjusting.

- Print the form. Ensure you have a current version of the DE 9Adj form.

- Fill out Section I with the following details:

- Business Name

- Year and Quarter

- Employer Account Number

- Address

- City, State, and ZIP Code

- Reason for Adjustment

- In Section II, complete the adjustment to wages and contributions. Enter amounts in the fields for:

- A. Total Subject Wages

- B. Unemployment Insurance (UI) Taxable Wages

- C. State Disability Insurance (SDI) Taxable Wages

- D. Employer’s UI Contributions

- E. Employment Training Tax

- F. State Disability Insurance Withheld

- G. Personal Income Tax Withheld

- H. Subtotal

- I. Penalty

- J. Interest

- K. Erroneous SDI Deductions

- L. Less Contributions and Withholdings Paid for the Quarter

- M. Total Taxes Due or Overpaid

- Complete Box 1 if applicable, for State Disability Insurance Overpayments. Answer the required questions.

- Complete Box 2 for Personal Income Tax Overpayments, answering the questions as necessary.

- Sign and date the form in the designated area. Include your title and phone number.

- Mail the completed form to: Employment Development Department, P.O. Box 989073, West Sacramento, CA 95798-9073.

What You Should Know About This Form

What is the purpose of the DE 9Adj form?

The DE 9Adj form is used to adjust previously reported wages and contributions for California employers. This includes corrections to the amounts of Unemployment Insurance, State Disability Insurance, and Personal Income Tax withheld from employee wages. Accurate adjustments are crucial for ensuring compliance with state laws and for rectifying any overpayments or underpayments made in previous quarters.

How long do I have to file a claim for a refund or credit?

You must file a claim for a refund or credit within three years from the last timely filing date of the quarter being adjusted. This statute of limitations is strictly enforced, so it’s important to act promptly if you believe an adjustment is necessary.

How do I complete the DE 9Adj form?

To fill out the DE 9Adj form, start by entering your business name, employer account number, and the year/quarter for the adjustments. Next, provide the reason for the adjustment in Section I. In Sections II and III, you will input the previously reported amounts and the amounts that should have been reported. Refer to the detailed instructions provided in the “Instructions for Completing the Quarterly Contribution and Wage Adjustment Form (DE 9ADJ-I)” for guidance on each step.

Can I file the DE 9Adj form online?

Yes, you can file the DE 9Adj form online through the Employment Development Department’s (EDD) e-Services for Business. This is a convenient way to submit your adjustments without the need for mailing a physical form.

What happens if I do not refund erroneous deductions to employees before filing the DE 9Adj form?

The EDD cannot refund overpaid State Disability Insurance contributions to you unless you first refund those erroneous deductions to the affected employees. This ensures that employees receive the funds they are entitled to before any credits can be processed on your end. Make sure to resolve these issues prior to submitting the form.

What is the significance of Boxes 1 and 2 on the form?

Boxes 1 and 2 are crucial for claiming credits for overpaid State Disability Insurance and Personal Income Tax. Completing these boxes accurately allows you to adjust any excess amounts that were withheld from employee wages. If these credits are applicable, complete the box to ensure the adjustments are recognized.

Where should I send the completed DE 9Adj form?

After completing the form, mail it to the Employment Development Department at P.O. Box 989073, West Sacramento, CA 95798-9073. Ensure that you sign the form, as it is a declaration of the accuracy of the information provided.

Common mistakes

Filling out the DE 9ADJ form can be straightforward, but common mistakes often lead to complications. One frequent error occurs in Section I, where individuals may fail to accurately enter their Employer Account Number. This number is crucial for the Employment Development Department (EDD) to identify the correct employer’s account. If the number is incorrect, it could delay processing or lead to adjustments being applied to the wrong account.

Another common mistake involves the reason for adjustment section. Individuals sometimes provide vague or insufficient reasons for their adjustments. This lack of detail may cause confusion and can result in the EDD requiring additional information before processing the adjustment. Providing a clear and concise reason helps streamline the adjustment process and reduce the likelihood of delays.

People also often overlook the importance of completing the adjustment amounts accurately in Section II. A common oversight here is failing to ensure that total subject wages, unemployment insurance wages, or state disability insurance wages are correctly recorded. Errors in these figures can lead to incorrect tax calculations and possibly result in penalties or the need for further adjustments down the line.

Additionally, many submitters neglect to check that they have signed the declaration at the bottom of the form. An unsigned form will not be processed. Therefore, verifying the signature is essential before mailing the form to the EDD. This small step can save a lot of time and frustration.

Lastly, it’s important to remember to file the DE 9ADJ within the specified time limits. Claims for refund or credit must be filed within three years of the last timely filing date of the quarter being adjusted. Missing this deadline can prevent any refunds or adjustments from being processed, making punctuality especially crucial.

Documents used along the form

When submitting the DE 9ADJ form, which is used to report quarterly contribution and wage adjustments in California, several other documents and forms may accompany it to ensure accurate reporting and compliance with state regulations. Below are five important forms you might encounter.

- DE 9: This is the Quarterly Contribution Return form, which businesses use to report wages, contributions, and payroll taxes for a given quarter. It provides the foundational information that the DE 9ADJ form adjusts, making it critical for overall payroll reporting.

- DE 9C: This form is the Contribution Continuation form used for reporting the continuation of wages and contributions if a business has multiple tax rates or has made significant employee changes. Accurate completion helps ensure that tax liabilities are correctly assigned.

- W-2 Form: The Wage and Tax Statement reports annual wages and tax withholdings for employees. Adjustments to payroll reported on the DE 9ADJ may necessitate changes to W-2 forms if incorrect figures were previously reported to employees.

- DE 88: The Payroll Tax Deposit form is utilized for making payments for unemployment insurance and disability insurance taxes. This document often needs reconciliation with the DE 9ADJ to ensure all obligations are met accurately.

- EDD Online Services Portal: While not a traditional form, the online portal provides businesses with tools to submit documents like the DE 9ADJ and track their filings. Utilizing this service enhances efficiency and provides access to detailed instructions and support resources.

Understanding the various forms and documents associated with the DE 9ADJ is essential for accurate payroll management and compliance with California labor laws. By ensuring that all related documents are correct and submitted in a timely manner, businesses can avoid penalties and streamline their reporting processes.

Similar forms

The DE 9Adj form focuses on wage and contribution adjustments, similar to various documents used in reporting and correcting employee wage data. Here are ten documents that share similarities with the DE 9Adj form:

- Form W-2: Used to report annual wages and income withheld. Like the DE 9Adj, it adjusts employee wage information but at the end of the fiscal year instead of quarterly.

- Form W-3: This summary form accompanies W-2s and reports total earnings to the IRS. It requires correct wage data, similar to the adjustments necessary in DE 9Adj.

- Form 941: This is the Employer's Quarterly Federal Tax Return. It accounts for federal taxes withheld and is frequently adjusted, much like the DE 9Adj for California state taxes.

- Form 944: This annual form is for smaller employers to report annual federal employment taxes. Adjustments can be made similar to those in the DE 9Adj form.

- Form 1099: Used for reporting various types of income other than wages. Adjustments can be necessary if errors occur, echoing the intent of the DE 9Adj.

- State Unemployment Insurance (SUI) forms: These specific state forms report wages for unemployment benefits and can be amended similarly to the DE 9Adj.

- State Disability Insurance (SDI) forms: Similar in purpose, these forms facilitate adjustments related to state disability contributions, directly connecting with the DE 9Adj adjustments.

- Form 940: The Employer’s Annual Federal Unemployment (FUTA) Tax Return. This form summarizes yearly payroll taxes, and adjustments might be necessary like those in DE 9Adj.

- Employee withholding certificates (Form W-4): While primarily used for withholding adjustments, they indirectly relate to the adjustments made in DE 9Adj concerning employee wages and contributions.

- Form 1095-C: This is the Employer-Provided Health Insurance Offer and Coverage form. Adjustments may be required similarly to ensure compliance with reporting standards like wage reports in the DE 9Adj.

Dos and Don'ts

When filling out the DE 9ADJ form, adhering to specific guidelines can prevent unnecessary complications. Here are some recommendations and pitfalls to avoid:

- Do ensure accurate information: Provide correct business details and the employer account number to avoid processing delays.

- Don't leave fields blank unnecessarily: If an amount should have been reported, enter it. Leaving fields blank may cause issues with your adjustment.

- Do comply with the statute of limitations: Remember, claims for refunds or credits must be filed within three years from the last timely filing date.

- Don't forget to sign the declaration: A signature is required to validate that the information provided is accurate and complete.

- Do review for any incomplete references: Ensure all necessary sections, such as Boxes 1 and 2, are filled out correctly if applicable.

- Don't submit the form without understanding the instructions: Familiarize yourself with the instructions for completing the form to avoid potential mistakes.

Misconceptions

Understanding the DE 9ADJ form is essential for anyone involved in managing payroll and tax reporting. However, misconceptions about this form can lead to confusion and mistakes. Here are five common misconceptions about the DE 9ADJ form:

- Filing a DE 9ADJ will automatically correct payroll errors. Many believe that just submitting this form will fix any payroll mistakes. In reality, it's crucial to ensure that the information reported on the DE 9ADJ aligns with documented payroll records. Simply filing the form doesn't rectify issues unless correct information is provided.

- You can file the DE 9ADJ anytime. It's easy to think there are no time limits, but that's not true. You must file claims for adjustments within three years of the last timely filing date of the quarter you want to change. Missing this window means losing the chance to correct errors.

- The DE 9ADJ form is just for adjustments, not for updating employee info. Some people assume it only serves to adjust taxable wages and contributions. However, it can also be used to correct employee information, such as Social Security numbers or names. Therefore, it's vital to be thorough in your reporting.

- You don't have to refund overpaid employee deductions. Many mistakenly believe they can simply take the overpaid amounts for themselves. In fact, to claim certain credits, you must refund any erroneous deductions back to the affected employees. The EDD requires proof of these refunds before processing claims.

- Submitting a DE 9ADJ is a one-step process. It's a common error to think that sending in the form alone is sufficient. Properly filling out the form involves specific calculations and sometimes additional documentation, like verifying any disputes regarding employee deductions. This requires careful attention to detail.

By addressing these misconceptions, employers can navigate the DE 9ADJ process more effectively and ensure accurate adjustments to their payroll processes. Remember, clear communication and meticulous record-keeping are key to success!

Key takeaways

Understanding the DE 9ADJ form is crucial for employers looking to correct previous wage and contribution reports. Here are six key takeaways to keep in mind:

- File for refunds or credits within three years of the last timely filing date for the relevant quarter.

- The form can be submitted online via the Employment Development Department's (EDD) e-Services platform.

- Clearly state the reason for adjustment in Section I to ensure proper processing.

- Complete all relevant sections, providing accurate figures for taxes due or overpaid, and any necessary adjustments.

- Pay attention to the boxes for State Disability Insurance (SDI) and Personal Income Tax (PIT) overpayments. Refunds must be issued to employees before requesting these credits.

- Upon submission, sign and date the form, then mail it to the designated EDD address to initiate the adjustment process.

Browse Other Templates

Does New Jersey Have Sales Tax - This form must be signed by a designated officer from Indiana University.

Express Scripts Refill - Only authorized individuals should handle this form and its contents.