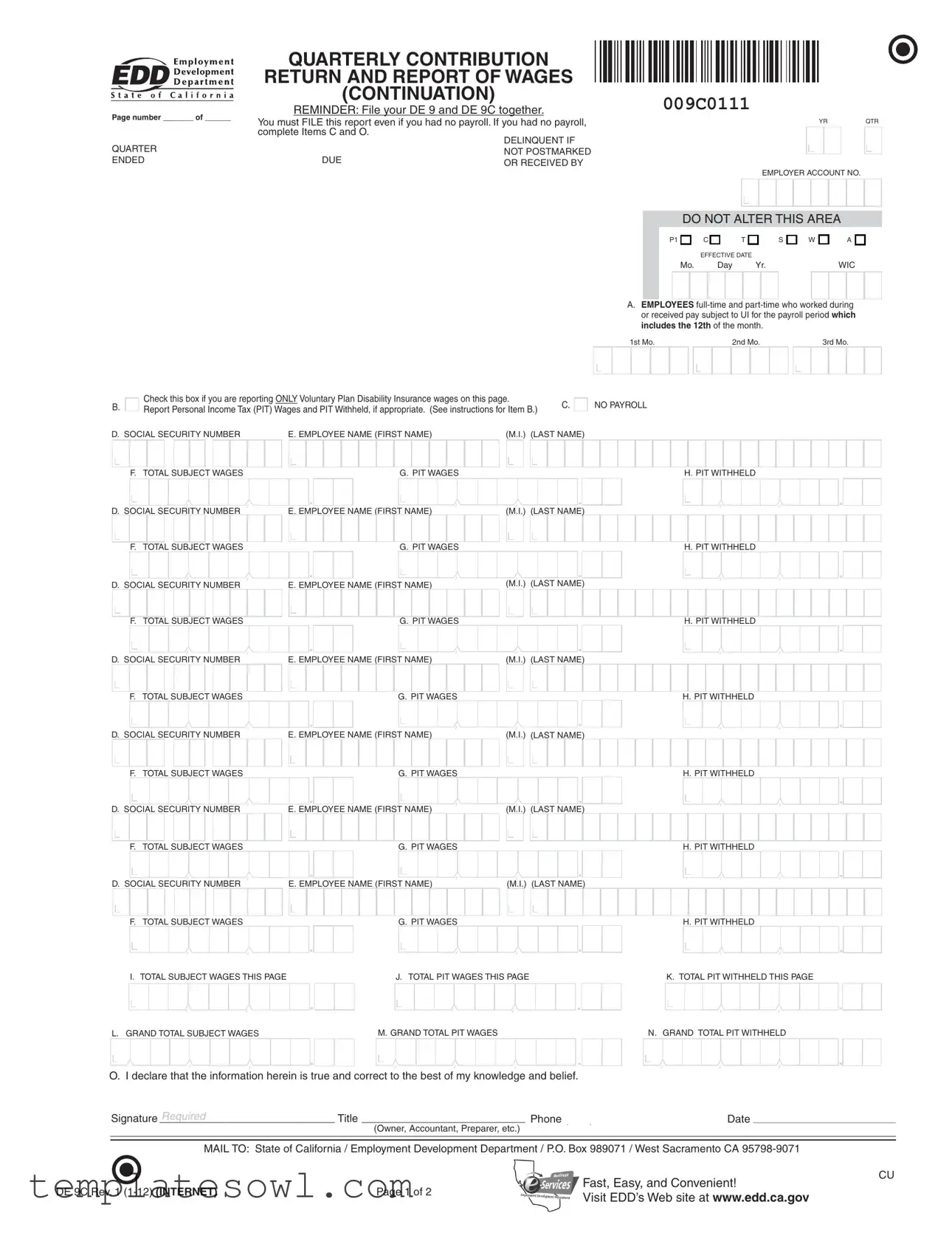

Fill Out Your De 9C Form

The DE 9C form, officially known as the Quarterly Contribution Return and Report of Wages (Continuation), is a crucial document for California employers to report their payroll data to the Employment Development Department (EDD). It should be submitted alongside the DE 9 form. Even if there was no payroll during the quarter, filing this form remains a necessity. The DE 9C captures vital information, including the total subject wages and Personal Income Tax (PIT) wages for each employee. Employers must also detail any PIT withheld from employee wages. Clear supervision is required as the form outlines specific entries for employees’ names, Social Security numbers, and the wages paid. If an employer participates in a Voluntary Plan for Disability Insurance, they must indicate this appropriately on the form. Attention to detail is essential; blank fields can be flagged as missing data, potentially leading to compliance issues. Employers are encouraged to file electronically for convenience and can reach out to the EDD Taxpayer Assistance Center for support or guidance on completing the form.

De 9C Example

Page number _______ of ______

QUARTER

ENDED

QUARTERLY CONTRIBUTION |

|

RETURN AND REPORT OF WAGES |

|

(CONTINUATION) |

009C0111 |

REMINDER: File your DE 9 and DE 9C together. |

You must FILE this report even if you had no payroll. If you had no payroll, complete Items C and O.

DUE

YRQTR

EMPLOYER ACCOUNT NO.

B.

Check this box if you are reporting ONLY Voluntary Plan Disability Insurance wages on this page. |

C. |

|

Report Personal Income Tax (PIT) Wages and PIT Withheld, if appropriate. (See instructions for Item B.) |

||

|

DO NOT ALTER THIS AREA

P1 |

C |

T |

S |

W |

A |

|

EFFECTIVE DATE |

|

|

|

|

Mo. |

|

Day |

Yr. |

|

WIC |

A.EMPLOYEES

|

|

|

1st Mo. |

|

|

|

|

|

2nd Mo. |

|

|

|

3rd Mo. |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NO PAYROLL

D. SOCIAL SECURITY NUMBER |

E. EMPLOYEE NAME (FIRST NAME) |

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

F. TOTAL SUBJECT WAGES |

|

|

|

|

|

|

|

|

|

|

|

G. PIT WAGES |

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

D. SOCIAL SECURITY NUMBER |

E. EMPLOYEE NAME (FIRST NAME) |

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

F. TOTAL |

SUBJECT WAGES |

|

|

|

|

|

|

|

|

|

|

|

G. PIT WAGES |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

D. SOCIAL SECURITY NUMBER |

E. EMPLOYEE NAME (FIRST NAME) |

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

F. TOTAL |

SUBJECT WAGES |

|

|

|

|

|

|

|

|

|

|

|

G. PIT WAGES |

|||||||||||||||||||||||

(M.I.) (LAST NAME)

|

H. PIT WITHHELD |

. |

. |

(M.I.) (LAST NAME)

|

H. PIT WITHHELD |

. |

. |

(M.I.) (LAST NAME)

H. PIT WITHHELD

|

. |

D. SOCIAL SECURITY NUMBER |

E. EMPLOYEE NAME (FIRST NAME) |

F. TOTAL SUBJECT WAGES |

G. PIT WAGES |

|

. |

D. SOCIAL SECURITY NUMBER |

E. EMPLOYEE NAME (FIRST NAME) |

F. TOTAL SUBJECT WAGES |

G. PIT WAGES |

|

. |

D. SOCIAL SECURITY NUMBER |

E. EMPLOYEE NAME (FIRST NAME) |

F. TOTAL SUBJECT WAGES |

G. PIT WAGES |

|

. |

D. SOCIAL SECURITY NUMBER |

E. EMPLOYEE NAME (FIRST NAME) |

F. TOTAL SUBJECT WAGES |

G. PIT WAGES |

|

. |

. |

. |

(M.I.) (LAST NAME)

|

H. PIT WITHHELD |

. |

. |

(M.I.) (LAST NAME)

|

H. PIT WITHHELD |

. |

. |

(M.I.) (LAST NAME)

|

H. PIT WITHHELD |

. |

. |

(M.I.) (LAST NAME)

|

H. PIT WITHHELD |

. |

. |

I. TOTAL SUBJECT WAGES THIS PAGE |

J. TOTAL PIT WAGES THIS PAGE |

K. TOTAL PIT WITHHELD THIS PAGE |

.

.

.

.

.

.

L. GRAND TOTAL SUBJECT WAGES |

M. GRAND TOTAL PIT WAGES |

N. GRAND TOTAL PIT WITHHELD |

.

.

.

.

O. I declare that the information herein is true and correct to the best of my knowledge and belief.

.

.

|

Signature Required |

Title ___________________________ Phone ( |

) _____________________ Date _________________________________ |

|

|

|

(Owner, Accountant, Preparer, etc.) |

|

|

|

|

|

||

|

MAIL TO: State of California / Employment Development Department / P.O. Box 989071 / West Sacramento CA |

|

||

|

|

|

Fast, Easy, and Convenient! |

CU |

DE 9C Rev. 1 |

Page 1 of 2 |

|

||

Visit EDD’s Web site at www.edd.ca.gov |

|

|||

|

|

|

|

|

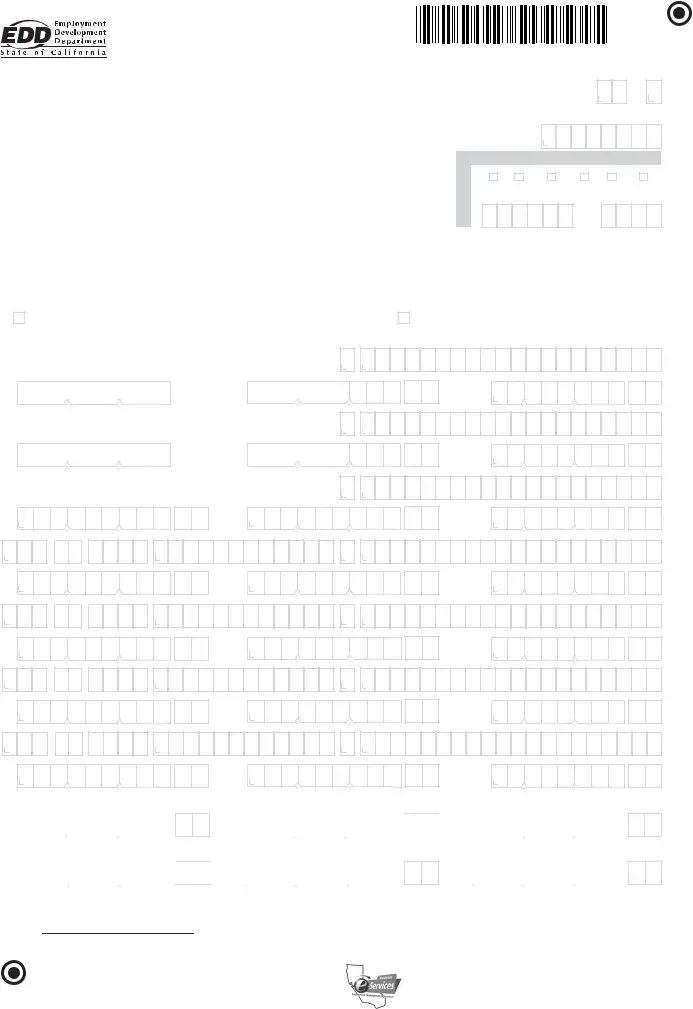

INSTRUCTIONS FOR COMPLETING THE

QUARTERLY CONTRIBUTION RETURN AND REPORT OF WAGES (CONTINUATION) (DE 9C)

PLEASE TYPE ALL INFORMATION

Did you know you can file this form online using the EDD’s

For a faster, easier, and more convenient method of reporting your DE 9C information, visit the EDD’s website at www.edd.ca.gov.

Contact the Taxpayer Assistance Center at (888)

reporting wages or the subject status of employees. Refer to the California Employer’s Guide (DE 44) for additional information.

Please record information in the spaces provided. If you use a typewriter or printer, ignore the boxes and type in UPPER CASE as shown.

Do not use dollar signs, dashes, commas, or slashes ($

EMPLOYEE (FIRST NAME) |

M.I. |

(LAST NAME) |

TOTAL SUBJECT WAGES |

IMOGENE |

A |

SAMPLE |

12345.67 |

If you must hand write this form, print each letter or number in a separate box as shown.

Do not use dollar signs, dashes, commas, decimal points, or slashes ($

EMPLOYEE (FIRST NAME) |

M.I. (LAST NAME) |

TOTAL SUBJECT WAGES |

||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

|

2 |

|

3 |

|

4 |

|||

|

|

I |

M |

O |

G |

E |

N |

E |

|

|

|

|

A |

|

S |

A |

M |

P |

L |

E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

5

6 7

Retain a copy of the DE 9C form(s) for your records. If you have more than seven employees, use additional pages or a format approved by the Employment Development Department (EDD). If using more than one page, number the pages consecutively at the top of the form. If the form is not preprinted, enter your account number, business name and address, the year and quarter, and the quarter ended date. For information, specifications, and approvals of alternate forms, contact the Alternate Forms Coordinator at (916)

ITEM A. NUMBER OF EMPLOYEES: Page 1 only: Enter the number of

Blank fields will be identified as missing data.

ITEM B. Check this box ONLY if the employees reported are covered by an employer sponsored Voluntary Plan for the payment of disability benefits. If you also have employees covered under the State Plan for disability benefits, report their wages and withholdings separately on another page of the DE 9C.

WAGES AND WITHHOLDINGS TO REPORT ON A SEPARATE DE 9C

Prepare a DE 9C to report the types of exemptions listed below. All three exemptions can be reported on one DE 9C. Write the exemption title(s) at the top of the form (e.g., SOLE SHAREHOLDER), and report only those individuals under these categories. Report all other employees or individuals without exemptions on a separate

DE 9C.

•Religious Exemption: Employees who file and are approved by the EDD for an exemption from State Disability Insurance (SDI) taxes under Section 2902 of the California Unemployment Insurance Code (CUIC).

•Sole Shareholder: An individual who elects and is approved by the EDD to be excluded from SDI coverage for benefits and taxes under Section 637.1 of the CUIC.

•

ITEM C. NO PAYROLL: Check this box if you had no payroll this quarter. Please sign and complete the information in Item O.

ITEM D. SOCIAL SECURITY NUMBER (SSN): Enter the SSN of each employee or individual to whom you paid wages in subject employment, paid Personal Income Tax (PIT) wages, and/or from whom you withheld PIT during the quarter. If someone does not have an SSN, report their name, wages, and/or withholdings without the SSN and TAKE IMMEDIATE STEPS TO SECURE ONE. Report the correct SSN to the EDD as soon as possible on a Quarterly Contribution and Wage Adjustment Form (DE 9ADJ).

ITEM E. EMPLOYEE NAME: Enter the name of each employee or individual to whom you paid wages in subject employment, paid PIT wages, and/or from whom you withheld PIT during the quarter.

ITEM F. TOTAL SUBJECT WAGES: Enter the total subject wages paid (including cents) to each employee during the quarter. Generally, most wages are considered “subject” wages. For special classes of employment and payments considered subject wages, refer to the California Employer’s Guide

(DE 44) under “Types of Employment” and “Types of Payments.”

ITEM G. PIT WAGES: Enter the amount of wages paid (including cents) that are subject to PIT, even if you do not withhold PIT from the

wages. You must enter PIT wages even if they are the same as total subject wages. For additional information regarding PIT wages, refer to the Information Sheet: Personal Income Tax Wages Reported on the Quarterly Contribution Return and Report of Wages (Continuation) (DE 9C) (DE 231PIT).

ITEM H. PIT WITHHELD: Enter the amount of PIT withheld from each individual during the quarter.

ITEM I. Enter the total subject wages paid (Item F) for each separate page. Do not carry this total forward from page to page.

ITEM J. Enter the total amount of PIT wages (Item G) for each separate page. Do not carry this total forward from page to page.

ITEM K. Enter the total PIT withheld (Item H) for each separate page. Do not carry this total forward from page to page.

ITEM L. ON PAGE 1 or the last page, enter the grand total of total subject wages paid (Item I) for all pages for the quarter.*

ITEM M. ON PAGE 1 or the last page, enter the grand total of PIT wages (Item J) for all pages for the quarter.*

ITEM N. ON PAGE 1 or the last page, enter the grand total of PIT withheld (Item K) for all pages for the quarter.*

*NOTE: Provide separate grand totals for Voluntary Plan Disability Insurance reporting and special exemption reporting (Religious Exemption, Sole Shareholder,

pages to arrive at the grand totals for Items L, M, and N.

ITEM O. ON PAGE 1 ONLY, signature of preparer or responsible individual, including title, telephone number, and signature date.

DE 9C Rev. 1 |

Page 2 of 2 |

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose of DE 9C | This form is used to report wages and the amount withheld for personal income tax (PIT). It complements the DE 9 form. |

| Mandatory Filing | Employers must file the DE 9C even if there is no payroll during the quarter. Specific sections must be completed if there are no wages reported. |

| Form Availability | The DE 9C can be filed online through the EDD's e-Services for Business for faster processing. |

| Governing Law | The DE 9C is governed by the California Unemployment Insurance Code (CUIC). |

| Employee Count Reporting | Employers must enter the total number of full-time and part-time employees who worked or received pay during the quarter. |

| Information Needed | Employers must provide employee Social Security numbers, names, total wages, and PIT wages on the form. |

| PIT Withholding | If PIT was withheld from an employee's wages, that amount must be reported in the form. |

| Signature Requirement | The DE 9C requires the signature of the preparer or responsible individual, along with their title and contact information. |

| Record Keeping | Employers should retain a copy of the DE 9C for their records after filing it with the EDD. |

| No Payroll Option | A box must be checked if the employer had no payroll during the quarter, and information must still be provided in specified sections. |

Guidelines on Utilizing De 9C

Filling out the DE 9C form is an essential step in reporting your employer payroll information. This form must be completed even if you had no payroll during the quarter. To ensure accuracy and compliance, follow the steps outlined below as you fill out your form.

- Gather Necessary Information: Collect details such as your Employer Account Number, the number of employees, and their wage information.

- Record Employer Information: If the form is not preprinted, write your account number, business name, and address, along with the year and quarter ended date at the top.

- Enter Employee Count: In Item A, note the number of full-time and part-time employees who worked during the payroll period that includes the 12th day of the month for each of the three months.

- Voluntary Plan Box: If you are reporting only Voluntary Plan Disability Insurance wages, check the box in Item B.

- Indicate No Payroll: If you had no payroll for the quarter, check the box in Item C and proceed to complete Item O.

- Fill in Employee Details: For each employee, enter their Social Security Number in Item D, followed by their first name (Item E) and last name.

- Report Wages: In Item F, enter the total wages subject to UI for each employee. Include cents, but do not use dollar signs, commas, or decimal points.

- Personal Income Tax Wages: In Item G, report the wages subject to Personal Income Tax for each employee.

- List PIT Withheld: Enter the amount of Personal Income Tax withheld during the quarter for each employee in Item H.

- Total Subject Wages: At the end of the page, fill in Item I with the total subject wages for that page, also provide totals for PIT wages (Item J) and PIT withheld (Item K).

- Grand Total: On Page 1 or the last page, enter the grand totals in Item L, M, and N for all pages combined.

- Signature Section: Complete Item O with the signature, title, phone number, and date of the person preparing the form.

- Mail the Form: Send your completed DE 9C form to the address provided at the bottom of the form.

After completing these steps, ensure you keep a copy of the form for your records. This will be helpful in case of inquiries or audits in the future. If you have additional employees or special exemptions, remember to adhere to the guidelines provided in the instructions.

What You Should Know About This Form

What is the DE 9C form used for?

The DE 9C form is a quarterly report that employers in California use to report wages paid and related information to the Employment Development Department (EDD). It’s essential for tracking unemployment insurance contributions and is part of the overall process of reporting payroll and tax information. Even if you had no payroll during the quarter, you still need to file the DE 9C form.

When is the DE 9C form due?

The DE 9C form must be filed by the end of the month following the close of the quarter. This means if you are reporting wages from the first quarter (January to March), the due date would be April 30. It’s crucial that you make sure the form is postmarked or received by the EDD by this deadline to avoid potential penalties.

How do I fill out the DE 9C form?

When completing the DE 9C form, it is important to provide accurate information. You'll need to report each employee's total subject wages, personal income tax wages, and any withheld taxes. Be sure to enter the data clearly, as incorrect entries can lead to complications. If you have more than seven employees, use additional pages as needed, making sure to number them correctly.

What should I do if I have no payroll for the quarter?

If you had no payroll during the quarter, check the box indicating "No Payroll" on the form. Even with no payroll, you must still file the DE 9C and complete Item O with your information. This ensures compliance and prevents penalties for failing to report.

Can I file the DE 9C form online?

Yes, you can file the DE 9C form online through the EDD’s e-Services for Business. This method is encouraged as it offers a faster and more convenient way to submit your information. For assistance or to find additional resources, you may visit the EDD’s website or contact their Taxpayer Assistance Center.

Common mistakes

Filling out the DE 9C form can be a straightforward task, but there are common mistakes that individuals often make, which can lead to complications. Awareness of these errors can help ensure that the form is completed correctly.

One frequent mistake is failing to report accurate Social Security Numbers (SSNs) for employees. Each SSN must be entered precisely. If an employee does not have an SSN, it is still necessary to provide their name and wages but without the SSN until it can be secured. Delays in correcting SSN issues can lead to problems with the Employment Development Department.

Another mistake occurs when individuals neglect to include all employees in the counts. Item A on the form requires a tally of full-time and part-time employees who received pay within the reporting period. Not reporting this accurately may result in penalties or miscommunication with state agencies.

Additionally, it is common for filers to overlook the requirement to sign the form in Item O. This signature verifies that the information provided is accurate and true, so neglecting this step can render the submission invalid. Furthermore, providing a contact number is essential for any follow-up that may be needed.

Finally, some individuals forget to file the DE 9 and DE 9C together, which is a critical part of the process. Filing these forms as separate documents can lead to delays in processing and potential penalties. Ensure both forms are submitted at the same time to avoid issues.

In conclusion, attention to detail when completing the DE 9C form is crucial. By avoiding these common pitfalls, individuals can help ensure their submissions are processed smoothly, making for a more efficient interaction with the Employment Development Department.

Documents used along the form

The DE 9C form, officially known as the Quarterly Contribution Return and Report of Wages (Continuation), is vital for reporting wages and contributions in California. Certain other forms accompany it to ensure comprehensive reporting and compliance with state regulations. Below are some of the key supplementary documents often used alongside the DE 9C form.

- DE 9: This form is the primary Quarterly Contribution Return that summarizes an employer’s payroll tax obligations. It must be filed alongside the DE 9C, even if there is no payroll for the quarter.

- DE 9ADJ: The Quarterly Contribution and Wage Adjustment Form is used to make corrections to previously filed DE 9 or DE 9C forms. It helps ensure all wage and tax information is accurate.

- DE 44: Known as the California Employer’s Guide, this document provides detailed instructions regarding employer responsibilities and options related to contributions, including the use of alternative reporting forms.

- DE 231PIT: This information sheet clarifies the specifics surrounding Personal Income Tax (PIT) wages reported on DE 9C. It assists employers in understanding taxable amounts.

- Form 940: This is the Employer's Annual Federal Unemployment (FUTA) Tax Return. Employers use it to report annual unemployment tax obligations, differing from the state-level focus of the DE 9 forms.

- Form W-2: Wage and Tax Statement, which provides a summary of earnings, withholdings, and taxes for employees at year-end. It is crucial for individual tax reporting.

- Form 1099: This form reports various types of income other than wages, salaries, and tips. Businesses issue it to independent contractors and other non-employee service providers.

Understanding these accompanying forms significantly simplifies an employer's compliance obligations. Proper filing ensures accurate tax reporting and minimizes potential issues with the Employment Development Department (EDD).

Similar forms

- DE 9 Form: The DE 9 is a summary report of wages and taxes for employers in California. Similar to the DE 9C, it specifies wages paid and withholdings, but is submitted less frequently and is not as detailed about individual employee wages.

- W-2 Form: The W-2 form is used to report an employee's annual wages and withheld taxes. Like the DE 9C, it provides detailed income information, but it covers an entire year rather than a quarterly period.

- 1099 Form: The 1099 form is used to report income received, typically for independent contractors or freelancers. While the DE 9C focuses on employee wages and withholdings, the 1099 captures payments made outside of a W-2 employment relationship.

- Quarterly Wage Report: Similar to the DE 9C, a quarterly wage report provides details on wages paid to employees during a specific quarter, including hours worked and deductions. However, it may vary by state in format and requirements.

- Form 941: The IRS Form 941 reports income taxes, Social Security tax, or Medicare tax withheld from employee paychecks. This form aligns with the DE 9C in that both track payroll taxes withheld, but 941 is required federally rather than state-specific.

Dos and Don'ts

Filling out the DE 9C form can undoubtedly feel overwhelming, but taking the right steps can simplify the process. Here’s a guide highlighting important do’s and don’ts to ensure you submit accurate and complete information.

- Do check all boxes appropriately based on your reporting requirements.

- Do use the correct Social Security Number for each employee.

- Do ensure that all names are spelled correctly and are consistent across your records.

- Do provide total subject wages, PIT wages, and PIT withheld accurately for each employee.

- Do file the DE 9 and DE 9C together, even if you had no payroll for that quarter.

- Do sign the form and provide your contact information before sending it in.

- Don't use dollar signs, commas, or decimal points when entering wage amounts.

- Don't leave any fields blank as they may be counted as missing data, which can cause delays.

By following these essential tips, you can confidently navigate the DE 9C reporting process, ensuring your information is both correct and complete. This will help avoid potential penalties and keep your payroll reporting in good standing.

Misconceptions

Misconceptions surrounding the DE 9C form can lead to confusion and potential reporting issues. Understanding the facts can clarify the obligations tied to this important document.

- It's optional to file the DE 9C if there were no employees. This is incorrect. Every employer must submit this form even if no payroll was processed during the quarter. Filling out specific sections is required if there was no payroll.

- All wages must be reported on a single DE 9C form. In fact, wages need to be documented across separate DE 9C forms depending on various exemptions. For example, if employees are covered by a Voluntary Plan for disability benefits, they should be reported on a different page.

- Only full-time employees are included in wage calculations. Part-time employees also count. Any worker who earned wages subject to Unemployment Insurance during the payroll period must be reported.

- The DE 9C can be submitted without the DE 9. This is a misconception. Both forms must be filed together to ensure comprehensive reporting of wages and contributions.

- All employees need to have Social Security Numbers (SSNs) to be reported. While it is essential to report SSNs for each employee, if someone does not have an SSN, employers can still report their name and wages but are required to take steps to secure an SSN immediately.

- Reporting Personal Income Tax (PIT) wages is only necessary if PIT is withheld. This is misleading. PIT wages must be reported regardless of whether withholding occurred. Accurate disclosure of PIT wages is crucial.

- Handwritten submissions of the DE 9C are acceptable without standards. This is false. When submitting a handwritten form, specific guidelines must be adhered to, including printing each letter or number in designated boxes and avoiding specific characters.

- A single grand total is sufficient for reporting despite using multiple pages. This is incorrect. Employers must provide separate grand totals for each reporting category. Each page should have its own totals, culminating in a grand total on the first or final page.

- There are no consequences for late submissions of the DE 9C. Actually, not filing on time can lead to penalties. Timely submission is essential to avoid these potential fines and maintain compliance with state regulations.

Key takeaways

- Ensure you file the DE 9C form together with the DE 9. Even if you had no payroll, it’s crucial to complete the necessary sections and submit the report.

- When filling out employee details, avoid using dollar signs or any special characters. Stick to plain numbers and letters to maintain clarity.

- Use UPPER CASE letters for typing or writing the form, and remember to print each character in its own box if filling it out by hand.

- If you are reporting only Voluntary Plan Disability Insurance wages, check the appropriate box. Make sure to keep any State Plan wages separate on a different DE 9C form.

- Keep track of the total subject wages, Personal Income Tax (PIT) wages, and PIT withheld amounts on each page. These figures should not be carried over from page to page.

- Retain a copy of the completed DE 9C for your records. It’s beneficial for reference and any future inquiries regarding submitted information.

Browse Other Templates

Audition Forms - Understanding your experience helps us place you in the right role.

Georgia State Tax Form - It’s crucial for distributors to keep track of the stamps purchased to meet bond obligations.

California Health Insurance Penalty Exemptions - Form 8965 plays a crucial role in the intersection of healthcare and taxes.