Fill Out Your De Ins Illinois Form

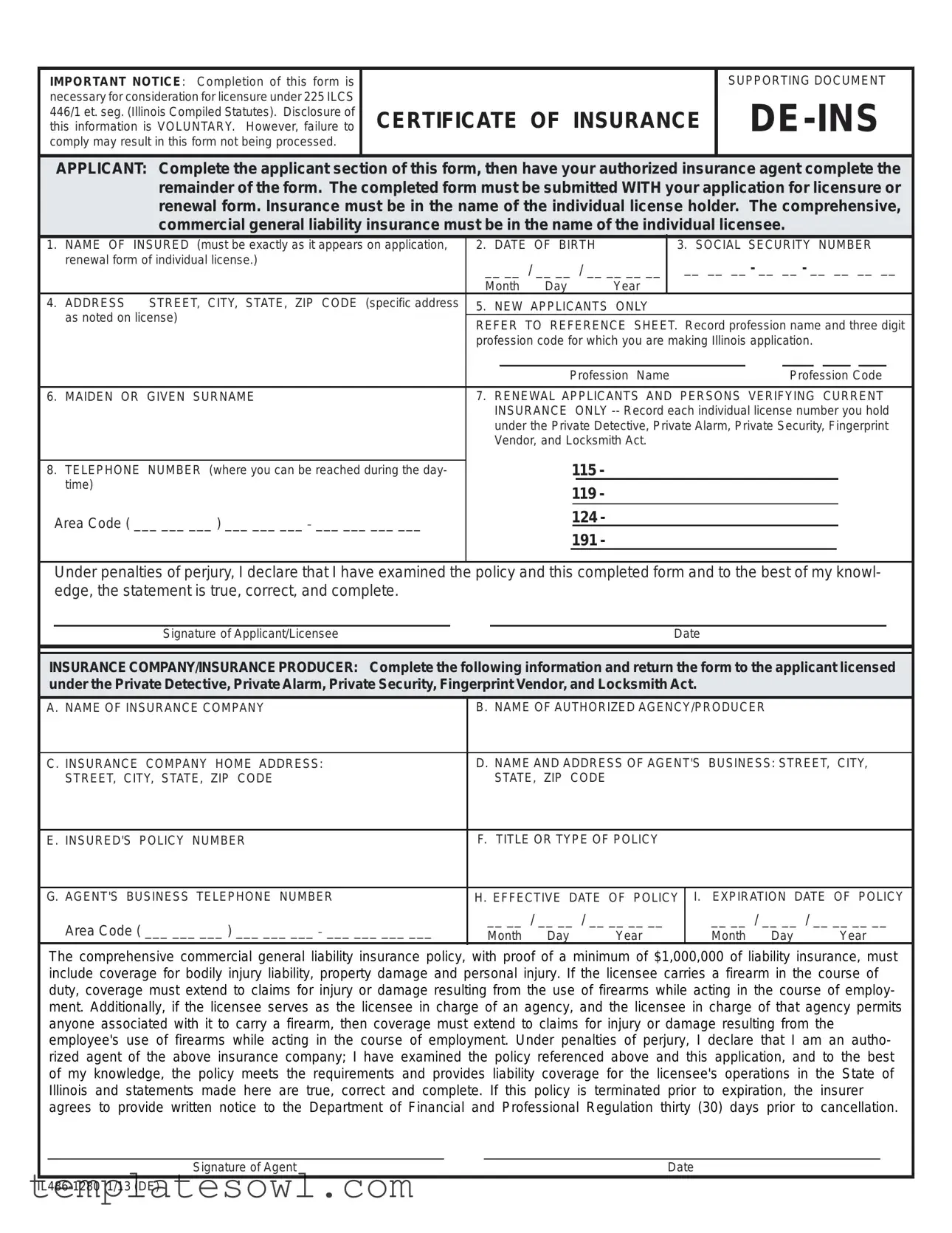

The De Ins Illinois form is a crucial document that plays a significant role in the licensing process for various professions in Illinois, including those in security and detective services. Applicants seeking licensure under the Private Detective, Private Alarm, Private Security, Fingerprint Vendor, or Locksmith Act must complete this form to demonstrate compliance with state requirements. The form requires the applicant's personal details, including their name, date of birth, social security number, and address. It also mandates the submission of proof of comprehensive commercial general liability insurance with a minimum coverage of $1,000,000. This insurance must cover bodily injury liability, property damage, and personal injury. If the licensee carries a firearm during their activities, additional coverage is required to protect against any claims related to firearm use in the course of employment. Additionally, an authorized insurance agent must verify and complete the relevant sections of the form, ensuring all information reflects the details stipulated by the law. Without the proper completion and submission of this form alongside the licensure application or renewal, applicants risk delays in processing their requests.

De Ins Illinois Example

IMPORTANT NOTICE: Completion of this form is |

|

SUPPORTING DOCUMENT |

necessary for consideration for licensure under 225 ILCS |

|

|

446/1 et. seg. (Illinois Compiled Statutes). Disclosure of |

CERTIFICATE OF INSURANCE |

|

this information is VOLUNTARY. However, failure to |

||

comply may result in this form not being processed. |

|

|

|

|

|

APPLICANT: Complete the applicant section of this form, then have your authorized insurance agent complete the remainder of the form. The completed form must be submitted WITH your application for licensure or renewal form. Insurance must be in the name of the individual license holder. The comprehensive, commercial general liability insurance must be in the name of the individual licensee.

1. |

NAME OF INSURED (must be exactly as it appears on application, |

2. |

DATE OF BIRTH |

|

3. SOCIAL SECURITY NUMBER |

||||||||||||

|

renewal form of individual license.) |

__ __ / __ __ / __ __ __ __ |

|

__ __ __ - __ __ - __ __ __ __ |

|||||||||||||

|

|

|

|||||||||||||||

|

|

Month Day |

|

|

Year |

|

|

|

|

|

|

|

|

|

|

||

4. |

ADDRESS STREET, CITY, STATE, ZIP CODE (specific address |

5. |

NEW APPLICANTS ONLY |

|

|

|

|

|

|

|

|

|

|||||

|

as noted on license) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REFER TO REFERENCE SHEET. Record profession name and three digit |

||||||||||||||||

|

|

||||||||||||||||

|

|

profession code for which you are making Illinois application. |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Profession Name |

|

|

Profession Code |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

6. |

MAIDEN OR GIVEN SURNAME |

7. RENEWAL APPLICANTS AND PERSONS VERIFYING CURRENT |

|||||||||||||||

|

|

|

INSURANCE |

|

ONLY |

||||||||||||

|

|

|

under the Private Detective, Private Alarm, Private Security, Fingerprint |

||||||||||||||

|

|

|

Vendor, and Locksmith Act. |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

115 - |

|

|

|

|

|

|

|

|

|

|

||

8. |

TELEPHONE NUMBER (where you can be reached during the day- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

time) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

119 - |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Area Code ( ___ ___ ___ ) ___ ___ ___ _ ___ ___ ___ ___ |

|

|

|

|

124 - |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

191 - |

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Under penalties of perjury, I declare that I have examined the policy and this completed form and to the best of my knowl- edge, the statement is true, correct, and complete.

Signature of Applicant/LicenseeDate

INSURANCE COMPANY/INSURANCE PRODUCER: Complete the following information and return the form to the applicant licensed under the Private Detective, Private Alarm, Private Security, Fingerprint Vendor, and Locksmith Act.

A. NAME OF INSURANCE COMPANY |

B. NAME OF AUTHORIZED AGENCY/PRODUCER |

|

|||

|

|

|

|||

C. INSURANCE COMPANY HOME ADDRESS: |

D. NAME AND ADDRESS OF AGENT'S BUSINESS: STREET, CITY, |

||||

STREET, CITY, STATE, ZIP CODE |

STATE, ZIP CODE |

|

|

|

|

|

|

|

|

||

E. INSURED'S POLICY NUMBER |

F. TITLE OR TYPE OF POLICY |

|

|

||

|

|

|

|||

G. AGENT'S BUSINESS TELEPHONE NUMBER |

H. EFFECTIVE DATE OF POLICY |

I. EXPIRATION DATE OF POLICY |

|||

Area Code ( ___ ___ ___ ) ___ ___ ___ _ ___ ___ ___ ___ |

__ __ / __ __ / __ __ __ __ |

__ __ / __ __ / __ __ __ __ |

|||

Month Day |

Year |

Month Day |

Year |

||

|

|||||

The comprehensive commercial general liability insurance policy, with proof of a minimum of $1,000,000 of liability insurance, must include coverage for bodily injury liability, property damage and personal injury. If the licensee carries a firearm in the course of duty, coverage must extend to claims for injury or damage resulting from the use of firearms while acting in the course of employ- ment. Additionally, if the licensee serves as the licensee in charge of an agency, and the licensee in charge of that agency permits anyone associated with it to carry a firearm, then coverage must extend to claims for injury or damage resulting from the employee's use of firearms while acting in the course of employment. Under penalties of perjury, I declare that I am an autho- rized agent of the above insurance company; I have examined the policy referenced above and this application, and to the best of my knowledge, the policy meets the requirements and provides liability coverage for the licensee's operations in the State of Illinois and statements made here are true, correct and complete. If this policy is terminated prior to expiration, the insurer agrees to provide written notice to the Department of Financial and Professional Regulation thirty (30) days prior to cancellation.

Signature of Agent |

Date |

Form Characteristics

| Fact Name | Details |

|---|---|

| Governing Law | The De Ins Illinois form is governed by 225 ILCS 446/1 et seq. (Illinois Compiled Statutes). |

| Purpose | This form is a supporting document required for licensure consideration in Illinois. |

| Submission Requirement | The completed form must be submitted along with the application for licensure or renewal. |

| Insurance Details | The insurance policy must provide coverage of at least $1,000,000 for liability, including bodily injury and property damage. |

Guidelines on Utilizing De Ins Illinois

Completing the De Ins Illinois form is essential for those applying for a license under Illinois law. It requires input from both the applicant and their authorized insurance agent. After properly filling out the form, submit it along with the application for licensure or renewal to ensure it is processed effectively.

- Provide the name of the insured as it appears on your license application.

- Enter your date of birth in the format Month/Day/Year.

- Fill in your Social Security number.

- Write down your complete address, including street, city, state, and zip code.

- New applicants must record the profession name and the corresponding three-digit profession code.

- If applicable, provide your maiden or given surname.

- For renewal applicants or those verifying current insurance, list any individual license numbers held under the applicable acts.

- Include a daytime telephone number where you can be reached.

- Sign and date the form, confirming the accuracy of the information provided.

Next, the authorized insurance agent will need to fill out their section of the form:

- Fill in the name of the insurance company.

- Enter the name of the authorized agency or producer.

- Provide the home address of the insurance company.

- Write down the agent's business name and address, including street, city, state, and zip code.

- Enter the insured's policy number.

- Describe the title or type of the insurance policy.

- Provide the agent's business telephone number.

- Fill in the effective date of the policy.

- Lastly, include the expiration date of the policy.

After completing these steps, the agent must sign and date the form, confirming their authorization and the accuracy of the information. The form is then ready to be submitted with your licensing application.

What You Should Know About This Form

What is the purpose of the De Ins Illinois form?

The De Ins Illinois form is a required document for individuals seeking licensure in certain professions in Illinois, such as private detectives and security personnel. It confirms the applicant holds liability insurance, which is essential for ensuring compliance with state regulations and protection against potential claims.

Who needs to complete this form?

Both new applicants and those renewing their licenses must complete the De Ins Illinois form. The applicant must fill out their personal details, while an authorized insurance agent must provide the insurance policy information. This ensures that all necessary data is reported for the application process.

What type of insurance is required on this form?

A comprehensive commercial general liability insurance policy is required, with a minimum coverage of $1,000,000. This policy must include protection against bodily injury, property damage, and personal injury. Additionally, specific coverage for firearms use is necessary if the licensee carries a firearm or supervises employees that do.

Is providing my information mandatory?

While disclosure of the required information is voluntary, failure to complete the form could result in the application not being processed. Therefore, it is in the applicant's best interest to fully comply with the form’s requirements.

What happens to the completed form once submitted?

After the form is filled out by both the applicant and the authorized agent, it should be submitted along with the application for licensure or renewal. The Department of Financial and Professional Regulation will review the information as part of the licensing process.

Can I submit this form electronically?

The submission method may vary based on the specific guidelines provided by the Illinois Department of Financial and Professional Regulation. Applicants should refer to their official website for the latest information on submission procedures, including whether electronic submissions are accepted.

What details are required from the insurance agent?

The insurance agent must provide their agency name, contact information, the policy number, type of insurance coverage, the addresses associated with the insurance company and the agent's business, as well as the effective and expiration dates of the policy. This information verifies that the insurance meets the legal requirements.

How can I ensure my insurance policy is compliant?

To ensure compliance, review the policy's terms carefully and confirm with your insurance agent that it meets state requirements. The insurance must specifically cover the scope of your profession and include any necessary extensions for firearms, if applicable.

What if my insurance policy is canceled?

If the insurance policy is terminated before its expiration date, the insurer is mandated to provide written notice to the Department of Financial and Professional Regulation at least 30 days prior to cancellation. This requirement helps maintain updated information on the applicant's insurance status.

What consequences may arise from false information on this form?

Under penalties of perjury, any false statement made on the De Ins Illinois form can lead to serious legal consequences, including denial of the application or revocation of an existing license. It is imperative that all information provided is truthful and accurate.

Common mistakes

Filling out the De Ins Illinois form can be a straightforward process, but mistakes often occur that can delay application processing. One common error is related to personal information. Applicants frequently miswrite their name or other identifying information. It’s crucial to fill in your name exactly as it appears on your application and renewal forms. Even a small typo can lead to significant complications in the review process.

Another prevalent mistake is omitting required information. Applicants sometimes forget to include key details such as their social security number or date of birth. Failing to provide this information can result in the form being deemed incomplete, which may prevent timely processing. Always double-check that all necessary fields are filled out accurately.

In addition to personal details, errors can also occur in the insurance section. It is essential to ensure that the insurance policy listed is indeed in the name of the individual license holder. Applicants sometimes list policies in their company’s name or in a different individual’s name, which does not comply with the requirements of the form. Proof of insurance must reflect the licensee's credentials directly.

Moreover, many people overlook the section for renewal applicants and individuals verifying current insurance. They fail to record their individual license numbers, which is particularly critical for demonstrating compliance with the Private Detective, Private Alarm, Private Security, Fingerprint Vendor, and Locksmith Act. Missing this step could halt your application.

Lastly, applicants often neglect to have their authorized insurance agent complete the necessary sections of the form. This oversight can happen when individuals mistakenly believe they can fill out everything themselves. It's important to remember that some parts specifically require the agent's input, and without this information, the form may not be valid. Involving the right people in this process is vital to ensure that the form is filled accurately and submitted without hiccups.

Documents used along the form

When applying for licensure under the Illinois Private Detective, Private Alarm, Private Security, Fingerprint Vendor, and Locksmith Act, various forms and documents accompany the main De Ins Illinois form. Each of these documents serves a specific role in the application process, contributing to a comprehensive submission that meets state requirements.

- Application for Licensure or Renewal: This form is essential for both new and existing applicants. It provides personal information about the individual seeking licensure, including professional history and references, ensuring the applicant meets the necessary qualifications.

- Certificate of Insurance: This document proves that the applicant has the required liability insurance coverage. It must be completed and submitted along with the De Ins Illinois form to ensure compliance with state insurance requirements.

- Proof of Training or Certification: Depending on the profession, this document verifies that the applicant has completed necessary training or certification programs. It supports the applicant's qualifications and shows compliance with industry standards.

- Criminal Background Check Authorization: This authorization allows the state to conduct a background check on the applicant. It is a critical component, as it ensures the individual does not have a criminal history that would disqualify them from licensure.

- Employment Verification Letter: For applicants with prior experience in the field, this letter is a testament to their employment and role in previous positions. It provides insight into their work history and skills relevant to the profession.

- Reference Letters: These letters from professional colleagues or mentors support the applicant's character and qualifications. They are valuable in assisting the licensing board in making an informed decision regarding the applicant's suitability for licensure.

Submitting these documents alongside the De Ins Illinois form creates a well-rounded application. Ensuring that everything is accurate and complete is crucial, as it helps streamline the review process and contributes to a successful licensure outcome.

Similar forms

- Proof of Insurance Form: Like the De Ins Illinois form, this document affirms that an individual has active and adequate insurance coverage necessary for professional practices.

- Liability Release Form: This document serves as a safety measure to protect against claims and is submitted in situations where services are rendered, similar to how insurance requirements are enforced in the De Ins Illinois form.

- Certificate of Insurance: Similar to the proof required in the De Ins Illinois form, this certificate explicitly verifies the type and extent of coverage that a licensee holds.

- Professional License Application: Both documents are essential for aspiring professionals seeking licensure, requiring similar personal information along with confirmation of compliance.

- Insurance Application Form: Just as the De Ins Illinois form demands insurance details, this form gathers specific information regarding coverage for individuals or businesses.

- Continuing Education Verification Form: A license renewal might require proof of completed education courses, akin to how the De Ins Illinois form necessitates current insurance status.

- Employment Verification Letter: In a manner comparable to confirming licenses, this letter establishes an individual’s job status and qualifications within a specific field or industry.

- Background Check Authorization Form: This document, like the De Ins Illinois form, is often required for licensure and confirms that an applicant has disclosed the necessary personal information.

- State-Specific Compliance Forms: Each state might have unique compliance documents that ensure professionals adhere to local regulations, similar to the Illinois-specific requirements in the De Ins Illinois form.

- Fee Payment Receipt: This document validates that an applicant has paid the necessary fees for processing their license, paralleling the need for verification in the De Ins Illinois form.

Dos and Don'ts

When filling out the De Ins Illinois form, following certain guidelines can help ensure your application is processed smoothly. Here is a list of recommendations to follow and avoid:

- Do clearly write your name as it appears on your application.

- Do include your complete and accurate date of birth.

- Do provide your Social Security Number as required.

- Do ensure the insurance policy is in your name.

- Do submit the completed form with your application or renewal form.

- Don't leave any fields blank unless specifically instructed.

- Don't use nicknames or initials; provide your full legal name.

- Don't forget to check that your insurance policy meets the required coverage limits.

- Don't delay in submitting your application; processing may take time.

- Don't forget to communicate with your insurance agent for clarity on any doubts regarding the policy.

By following these dos and don’ts, you can minimize the risk of delays in your licensure process. Attention to detail will make a significant difference in how efficiently your application will be handled.

Misconceptions

There are several misconceptions surrounding the DE INS Illinois form that can lead to confusion for applicants. It is crucial to address these misunderstandings to ensure the proper completion and submission of the form. Here are five common misconceptions:

- Misconception 1: The DE INS Illinois form is optional.

- Misconception 2: Any insurance policy can be submitted with the application.

- Misconception 3: The insurance information can be filled out by anyone.

- Misconception 4: The completion of this form can be done after submitting the application.

- Misconception 5: If I do not disclose my insurance information, it does not really matter.

This form is actually a required supporting document for licensure. While completing it may feel like an additional step, it is necessary to ensure the application is processed correctly.

It is important to note that the insurance policy must specifically be a comprehensive commercial general liability insurance policy, which provides at least $1,000,000 in coverage. Other types of insurance will not satisfy the requirements.

The insurance portion of the form must be completed by an authorized insurance agent. This ensures that the information provided is accurate and legally binding.

This is incorrect. The completed DE INS form must be submitted with the application for licensure or renewal right from the start to avoid delays in processing.

While disclosure of certain information may be labeled as voluntary, failing to provide the necessary information will likely result in the form not being processed. This could have significant implications for your application.

Key takeaways

Key Takeaways for the De Ins Illinois Form:

- Completing this form is essential for obtaining or renewing a license under Illinois law. Missing this step may lead to delays or denial of your application.

- Insurance coverage must specifically be in the name of the individual applying for licensure and includes comprehensive general liability with a minimum of $1,000,000 in coverage.

- It’s important for both the applicant and the insurance agent to sign and date the form, certifying that the information provided is accurate and complete to the best of their knowledge.

- The form must be submitted along with your licensure or renewal application; ensure all details are filled out correctly to avoid complications.

Browse Other Templates

Dc Payroll Tax - Any discrepancies or corrections should be reported immediately to avoid complications in records.

Vics Bol - It is essential for maintaining organized shipping records.

Dd2765 - This form is instrumental for accessing annual military events and recreational activities.