Fill Out Your De459 Form

The DE 459 form, also known as the Sole Shareholder/Corporate Officer Exclusion Statement, serves a significant role for individuals in private corporations in California. This form provides an avenue for corporate officers who are either the sole shareholder or the only shareholder aside from their spouse to opt out of State Disability Insurance (SDI) contributions and associated benefits, including Paid Family Leave (PFL). Filing this form is a straightforward process that can be completed online through the Employment Development Department's e-Services for Business portal. It's important to note that this exclusion applies only to SDI taxes and does not affect federal unemployment taxes. Once filed, the exclusion becomes effective on the first day of the calendar quarter in which the form is submitted and remains in effect for the rest of that year, plus two additional complete calendar years. Moreover, the form contains essential details such as the corporation's payroll tax account number, the Federal Employer Identification Number (FEIN), and specific signatures from the sole shareholder and their spouse, if applicable. This process not only streamlines the reporting requirements for the corporation but also informs the Employment Development Department (EDD) of the desired exemption from certain tax obligations. Understanding how to properly complete and submit the DE 459 form is crucial for compliance and ensuring that corporate officers do not inadvertently incur unwanted SDI contributions.

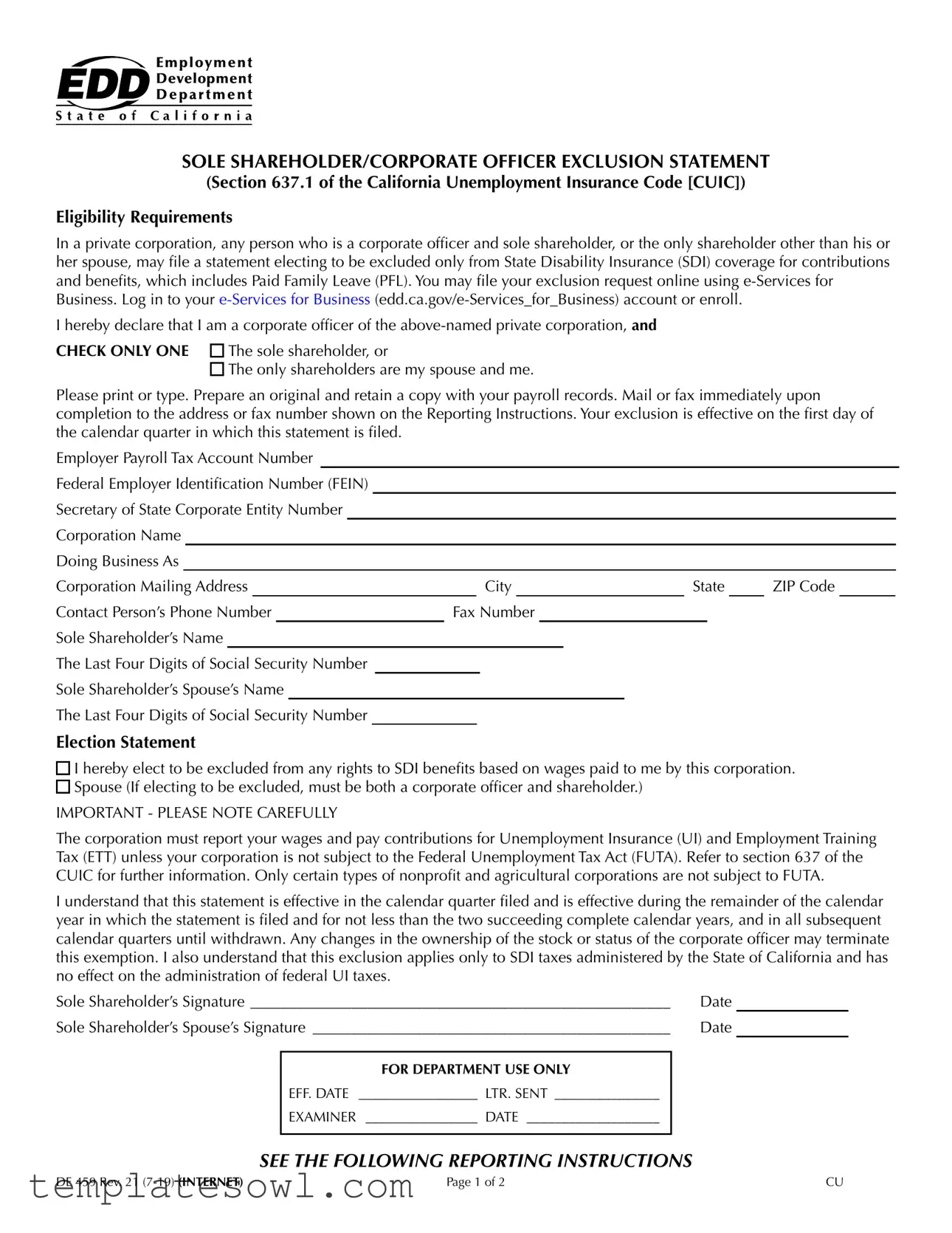

De459 Example

SOLE SHAREHOLDER/CORPORATE OFFICER EXCLUSION STATEMENT

(Section 637.1 of the California Unemployment Insurance Code [CUIC])

Eligibility Requirements

In a private corporation, any person who is a corporate officer and sole shareholder, or the only shareholder other than his or her spouse, may file a statement electing to be excluded only from State Disability Insurance (SDI) coverage for contributions and benefits, which includes Paid Family Leave (PFL). You may file your exclusion request online using

I hereby declare that I am a corporate officer of the

CHECK ONLY ONE |

The sole shareholder, or |

|

The only shareholders are my spouse and me. |

Please print or type. Prepare an original and retain a copy with your payroll records. Mail or fax immediately upon completion to the address or fax number shown on the Reporting Instructions. Your exclusion is effective on the first day of the calendar quarter in which this statement is filed.

Employer Payroll Tax Account Number Federal Employer Identification Number (FEIN) Secretary of State Corporate Entity Number Corporation Name

Doing Business As

Corporation Mailing Address |

|

|

|

City |

|

State |

|

ZIP Code |

|||||||||

Contact Person’s Phone Number |

|

Fax Number |

|

|

|

|

|

||||||||||

Sole Shareholder’s Name |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

The Last Four Digits of Social Security Number |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Sole Shareholder’s Spouse’s Name |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

The Last Four Digits of Social Security Number |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Election Statement

I hereby elect to be excluded from any rights to SDI benefits based on wages paid to me by this corporation. Spouse (If electing to be excluded, must be both a corporate officer and shareholder.)

IMPORTANT - PLEASE NOTE CAREFULLY

The corporation must report your wages and pay contributions for Unemployment Insurance (UI) and Employment Training Tax (ETT) unless your corporation is not subject to the Federal Unemployment Tax Act (FUTA). Refer to section 637 of the CUIC for further information. Only certain types of nonprofit and agricultural corporations are not subject to FUTA.

I understand that this statement is effective in the calendar quarter filed and is effective during the remainder of the calendar year in which the statement is filed and for not less than the two succeeding complete calendar years, and in all subsequent calendar quarters until withdrawn. Any changes in the ownership of the stock or status of the corporate officer may terminate this exemption. I also understand that this exclusion applies only to SDI taxes administered by the State of California and has no effect on the administration of federal UI taxes.

Sole Shareholder’s Signature ______________________________________________________ |

Date |

|||

Sole Shareholder’s Spouse’s Signature ______________________________________________ |

Date |

|||

|

|

|

|

|

|

|

FOR DEPARTMENT USE ONLY |

|

|

|

EFF. DATE |

_________________ |

LTR. SENT _______________ |

|

|

EXAMINER |

________________ |

DATE ___________________ |

|

|

|

|

|

|

SEE THE FOLLOWING REPORTING INSTRUCTIONS

DE 459 Rev. 21 |

Page 1 of 2 |

CU |

REPORTING INSTRUCTIONS

You are required to electronically submit employment tax returns, wage reports, and payroll tax deposits using

Please follow these reporting procedures:

1.File a single Quarterly Contribution Return and Report of Wages (DE 9) for the quarter and include wages and withholdings for all of the corporation’s employees, including the sole shareholder and sole shareholder’s spouse, if electing the exclusion.

2.If you have an approved

3.When filing electronically, one DE 9C for the quarter may be used to report wages and withholdings for all the corporation’s employees, including the sole shareholder and the sole shareholder’s spouse, if electing exclusion. Insert Plan Code “R” on the wage line(s) to designate the sole shareholder wages and sole shareholder’s spouse, if electing exclusion, only when reporting on an account that is subject to UI and SDI.

GENERAL INFORMATION

NOTE: A DE 459 is not required if services performed are not subject to California law for UI, ETT, or SDI purposes. Please

refer to Information Sheet: Multistate Employment (DE 231D) (PDF) (edd.ca.gov/pdf_pub_ctr/de231d.pdf) to determine whether the services are subject to employment taxes in California.

If the corporation does not have an employer payroll tax account number, please register online through

It is important to file the form during the calendar quarter in which you want the exemption to take effect. The exemption becomes effective the first day of the calendar quarter in which it is filed. A delay in filing this form may cause your exemption to take effect in the next calendar quarter. Do not file this form as an attachment to your DE 9, DE 9C, or any other Employment Development Department (EDD) form.

The EDD reserves the right to request additional information pertaining to this form.

The exemption may be terminated at any time by a change in stock ownership or status of the corporate officer as described in section 637.1 of the CUIC.

The exemption may be voluntarily terminated after two succeeding complete calendar years have passed. The corporate officer/sole shareholder must submit a written request to the EDD for termination.

If you have any questions concerning the exemption or reporting requirements, please contact the EDD at the address below.

Attention: Specialized Coverage Desk

Employment Development Department

Taxpayer Assistance Center

PO Box 2068

Rancho Cordova, CA

Phone:

Fax:

The EDD is an equal opportunity employer/program. Auxiliary aids and services are available upon request to individuals with disabilities. Requests for services, aids, and/or alternate formats need to be made by calling

DE 459 Rev. 21 |

Page 2 of 2 |

Form Characteristics

| Fact Name | Fact Detail |

|---|---|

| Form Purpose | The DE459 form is a Sole Shareholder/Corporate Officer Exclusion Statement for California. |

| Governing Law | This form is governed by Section 637.1 of the California Unemployment Insurance Code (CUIC). |

| Eligibility Criteria | A corporate officer must be the sole shareholder, or the only shareholder along with a spouse, to file this form. |

| Exclusion From Coverage | This statement allows exclusion only from State Disability Insurance (SDI), including Paid Family Leave (PFL). |

| Effective Date | The exclusion becomes effective on the first day of the calendar quarter in which the form is filed. |

| Filing Instructions | File the completed form by mail or fax to the designated address immediately after completion. |

| Duration of Exemption | The exclusion lasts for the calendar year filed and two consecutive complete years, unless terminated. |

| Impact on Other Taxes | This exclusion applies only to California's SDI taxes and does not affect federal unemployment taxes. |

Guidelines on Utilizing De459

Filling out the DE 459 form is a straightforward process. This step-by-step guide will help you complete the form accurately for your exclusion request from State Disability Insurance coverage. Ensure that you have all necessary information and documentation ready before you begin.

- Obtain the DE 459 form. You can find it on the California Employment Development Department (EDD) website.

- Print the form or prepare to fill it out electronically if you are using e-Services for Business.

- In the section titled “Employer Payroll Tax Account Number,” enter your account number.

- Provide the “Federal Employer Identification Number (FEIN)”.

- Fill in the “Secretary of State Corporate Entity Number.”

- Enter the “Corporation Name” as it appears in official documents.

- If applicable, include the “Doing Business As” name.

- Enter the corporation’s mailing address, including city, state, and ZIP code.

- Specify the contact person’s phone number and fax number.

- Provide the name of the sole shareholder.

- Fill in the last four digits of the sole shareholder’s Social Security Number.

- If applicable, enter the name of the sole shareholder’s spouse.

- Provide the last four digits of the spouse’s Social Security Number.

- In the “Election Statement” section, check the box indicating your election to be excluded from SDI benefits.

- Ensure that both the sole shareholder and, if applicable, the spouse sign the form and include the date of signature.

- Once completed, retain a copy of the form for your payroll records.

- Mail or fax the completed form to the address or fax number indicated in the Reporting Instructions.

After submitting the DE 459 form, expect your exclusion to be effective from the first day of the calendar quarter in which you filed it. Be aware of the importance of timely submission to ensure the exemption takes effect as intended.

What You Should Know About This Form

What is the DE459 form?

The DE459 form, known as the Sole Shareholder/Corporate Officer Exclusion Statement, allows individuals who are sole shareholders or corporate officers in a private corporation to opt-out of State Disability Insurance (SDI) coverage. This means they will not be eligible for SDI benefits based on wages paid to them by the corporation.

Who is eligible to file the DE459 form?

Eligibility is limited to individuals who are both the sole shareholder of a private corporation and a corporate officer. This includes individuals who are the only shareholders, aside from their spouse. Both the corporate officer and spouse must sign the form if the spouse is also a shareholder.

How do I submit the DE459 form?

You may submit the DE459 form online through e-Services for Business by logging into your account or enrolling if you do not have one. Once completed, you should print or type the form, retain a copy for your records, and either mail or fax it to the address provided in the Reporting Instructions.

When does the exclusion take effect?

The exclusion will be effective on the first day of the calendar quarter in which the DE459 form is filed. If you file the form after the start of a quarter, the exclusion might not take effect until the next calendar quarter.

Can the exclusion be revoked?

Yes, you can revoke the exclusion, but only if the corporate structure changes or at least two complete calendar years have passed. To revoke the exclusion, a written request must be submitted to the Employment Development Department (EDD).

What if my corporation does not have an employer payroll tax account number?

If your corporation lacks a payroll tax account number, it is necessary to register online through e-Services for Business before submitting the DE459 form. This number is important for processing the exclusion correctly.

What happens if I do not file the DE459 form in time?

If the DE459 form is not filed during the desired calendar quarter, the exemption will not take effect until the following quarter. This could result in potential SDI contributions that you might have wanted to avoid.

What reporting requirements follow the filing of the DE459?

After submitting the DE459, your corporation must continue reporting wages and paying contributions for Unemployment Insurance (UI) and Employment Training Tax (ETT) as applicable. This includes filing the Quarterly Contribution Return and Report of Wages (DE 9) that reflects your wages and any withholdings.

Common mistakes

Filling out the DE459 form can seem straightforward, but there are common mistakes that can cause issues down the line. One frequent error is not checking the eligibility box properly. When declaring your status as a sole shareholder or the only shareholder aside from a spouse, it’s essential to select only one of the provided options. Failing to do so might lead to confusion and potential disqualification of the exemption.

Another mistake is submitting the form without a valid employer payroll tax account number. It’s critical to have this number before filing. Without it, your submission could be rejected, delaying your exclusion from State Disability Insurance (SDI) coverage. Always make sure to register for an employer payroll tax account online through e-Services for Business prior to completing the form.

People often overlook the deadline for filing. The DE459 form must be filed during the quarter in which you want the exemption to begin. If it is filed late, the exemption will take effect only in the next calendar quarter. This can impact financial planning if you expected immediate relief from SDI coverage.

It's also important to ensure all required personal information is filled out correctly. Submitting the form with missing or incorrect names, Social Security numbers, or other personal details can lead to processing delays. Taking time to double-check all entries can save a lot of hassle later.

Another common issue arises from misunderstanding the implications of the exemption. Many believe that opting out of SDI will also exempt them from other state or federal payroll taxes. In reality, this exclusion only applies to SDI taxes in California, and all other taxes, such as Unemployment Insurance (UI), must still be reported and paid. Being aware of this distinction is vital for compliance and avoiding penalties.

Finally, individuals sometimes forget to retain a copy of the DE459 form for their records. Keeping a signed original is not just a good practice; it’s necessary for future reference and verification. By maintaining organized records, you can easily address any discrepancies or questions that may arise later on.

Documents used along the form

The DE 459 form, which is used by sole shareholders and corporate officers in California to elect exclusion from State Disability Insurance (SDI) coverage, often coexists with several other important documents. Each of these documents serves distinct purposes, yet they collectively facilitate compliance with state tax regulations and support proper payroll management. Below are a few key forms that are typically associated with the DE 459.

- DE 9 - Quarterly Contribution Return and Report of Wages: This document is essential for employers, as it summarizes wage information and tax contributions for all employees, including those who have elected exclusion through the DE 459. It must be filed quarterly.

- DE 9C - Quarterly Contribution Return and Report of Wages Continuation: For those with an approved waiver to file by paper, this return includes additional wage details. If the sole shareholder or spouse is excluded, a separate DE 9C must be filed to accurately report their wages.

- DE 231D - Information Sheet: Multistate Employment: Employers with multistate operations may use this information sheet to determine tax obligations. It helps clarify whether services performed are subject to California's employment taxes and regulations.

- Employer Payroll Tax Account Registration: Before submitting the DE 459 form, corporations must obtain an employer payroll tax account number. This registration process ensures compliance with California's payroll tax requirements.

These documents provide a critical framework for corporate officers and shareholders to navigate their obligations under California tax law. By ensuring that all relevant paperwork is completed and submitted on time, businesses can avoid potential penalties and ensure a smoother financial operation.

Similar forms

The DE459 form, known as the Sole Shareholder/Corporate Officer Exclusion Statement, has similarities with several other documents related to corporate tax and employment reporting. Here’s a list of ten documents that share similar purposes or processes:

- DE 9: This is the Quarterly Contribution Return and Report of Wages. Like the DE459, it requires detailed reporting of wages and provides a mechanism for reporting and paying employee taxes, including those of sole shareholders.

- DE 9C: The Quarterly Contribution Return and Report of Wages (Continuation) allows corporations to report additional information if the primary DE 9 does not cover all employees. It is similar in that it pertains to payroll reporting.

- DE 231D: The Multistate Employment Information Sheet helps determine which services are subject to California employment taxes. Similar to the DE459, it provides guidance on tax obligations for businesses.

- FUTA Form 940: This annual form is used to report and pay federal unemployment taxes. It works alongside the DE459 for companies exempt from state taxes, highlighting the interplay between state and federal tax obligations.

- W-2 Form: The W-2 details annual wages and tax withholding for employees. It aligns with the DE459 by delineating how wages are reported based on shareholder status.

- W-4 Form: Used by employees to withhold the correct federal income tax, the W-4 is important for managing exempt status similar to that indicated in the DE459.

- Form 941: This quarterly federal tax return reports income taxes, social security tax, and Medicare tax withheld from employee's paychecks. It's similar as it involves payroll reporting.

- Form 1099-MISC: Used for reporting income paid to independent contractors. Although distinct from employees, it shares the purpose of reporting remuneration associated with corporate structures.

- State Disability Insurance (SDI) Claims Form: Employees use this form to apply for benefits. Similar to the DE459, it highlights the exclusion of certain individuals from benefits eligibility.

- Employment Development Department (EDD) Registration Form: This document allows businesses to register for employer payroll tax accounts. It connects to the DE459 as it is a prerequisite for filing.

Understanding these documents can help clarify the tax responsibilities and eligibility for various exemptions, much like what the DE459 establishes for sole shareholders in California.

Dos and Don'ts

Do's when filling out the DE459 form:

- Ensure all information is accurate and complete before submission.

- Use legible print or type for clarity.

- Sign and date the form where indicated.

- File the form during the calendar quarter you intend for the exemption to begin.

- Keep a copy of the completed form for your payroll records.

Don'ts when filling out the DE459 form:

- Do not submit the form without an employer payroll tax account number.

- Avoid filing this form as an attachment to any other EDD forms.

- Do not delay filing, as it may affect the exemption start date.

- Do not forget to check only one election statement option.

- Do not leave any required fields blank; ensure all necessary information is filled out.

Misconceptions

- The DE 459 form excludes from all benefits. This statement is incorrect. The DE 459 form only allows for exclusion from State Disability Insurance (SDI) benefits, not from other benefits such as Unemployment Insurance (UI).

- Filing the DE 459 is optional for sole shareholders. This is a misconception. If a sole shareholder seeks exclusion from SDI benefits, they must file this form. Failing to do so means they will remain subject to SDI contributions.

- The exemption takes effect immediately upon filing. Actually, the exemption becomes effective on the first day of the calendar quarter in which the form is filed. Timing matters.

- Only the sole shareholder can file the DE 459. This is not accurate. The sole shareholder’s spouse, if they are both corporate officers, can also elect to be excluded by signing the form.

- The DE 459 form can be filed at any time. In reality, it's important to file the form during the specific calendar quarter when the exemption is desired. Late filings may delay the exemption to the next quarter.

- The exclusion from SDI is permanent. This isn't true. Changes in ownership or corporate officer status can terminate the exemption at any time. Additionally, the exclusion can be voluntarily terminated after two complete calendar years.

- Filing the DE 459 cancels all tax responsibilities. This is misleading. While the form allows for SDI exclusion, corporations must still report wages and pay contributions for Unemployment Insurance and Employment Training Tax unless they are specifically exempt under federal law.

Key takeaways

Here are key takeaways about filling out and using the DE 459 form:

- The DE 459 form allows sole shareholders and corporate officers in a private corporation to opt-out of State Disability Insurance (SDI) coverage.

- You can file your exclusion request online through e-Services for Business by logging into your account.

- Be precise while filling out the form; check only one option regarding your status as a sole shareholder or spouse.

- Retain a copy of the completed form with your payroll records for future reference.

- Submit the completed form immediately by mail or fax to ensure timely processing.

- Your exclusion is effective from the first day of the calendar quarter in which the statement is filed.

- Remember, this exclusion only pertains to SDI taxes and does not affect federal Unemployment Insurance (UI) taxes.

- If your ownership or corporate officer status changes, the exemption may terminate automatically.

- To intentionally end your exclusion after two calendar years, a written request must be submitted to the Employment Development Department (EDD).

Browse Other Templates

Small Business Workers Compensation Insurance Companies - Obtaining the U-26.3 may involve specific steps outlined by the New York State Insurance Fund.

Unclaimed Savings Bonds Search by Name - The form includes a section on tax implications related to the reissue of bonds.