Fill Out Your Debt Management Services Birmingham Al Form

Navigating financial challenges can be overwhelming, and understanding the necessary steps to address debt can feel like an insurmountable task. For residents of Birmingham, Alabama, the Debt Management Services form provides a structured way to dispute any discrepancies associated with federal debt records. This form, issued by the Department of the Treasury's Bureau of the Fiscal Service, allows individuals to formally present their case and provide crucial information regarding their debt, including essential personal details like name, address, Social Security number, and unique FedDebt number. By attaching any supporting documentation, individuals can strengthen their claims and ensure their voices are heard. The submission process is straightforward, with options to fax or mail the completed form to the appropriate department, ensuring that every effort is made to resolve disputes efficiently. Additionally, the form emphasizes the importance of privacy, outlining how the information shared is protected and used strictly for identifying receivables and verifying the accuracy of records. As Birmingham residents take the first steps in addressing their debt, having a clear understanding of this form can make a significant difference in the effectiveness of their communication with federal and state agencies.

Debt Management Services Birmingham Al Example

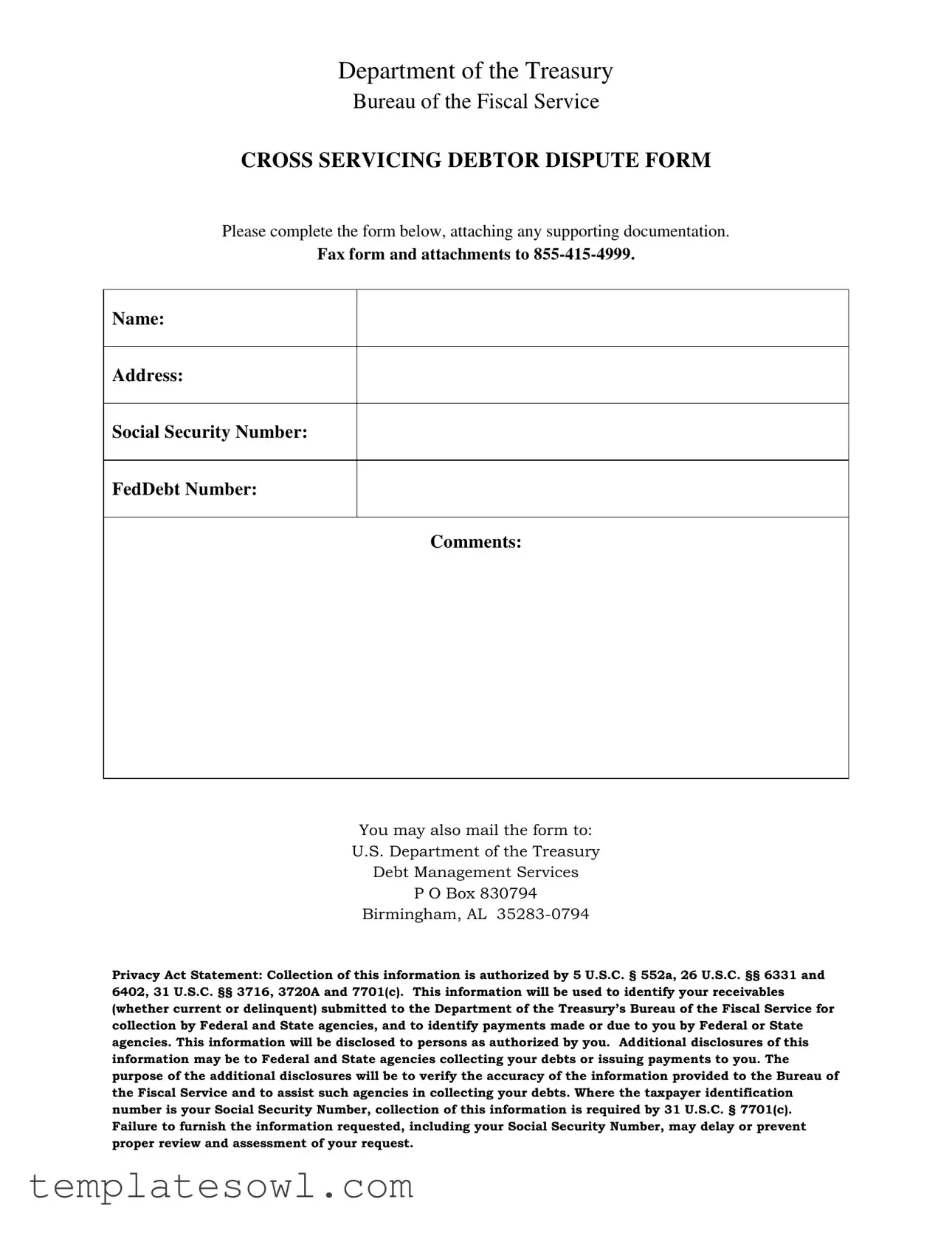

Department of the Treasury

Bureau of the Fiscal Service

CROSS SERVICING DEBTOR DISPUTE FORM

Please complete the form below, attaching any supporting documentation.

Fax form and attachments to

Name:

Address:

Social Security Number:

FedDebt Number:

Comments:

You may also mail the form to:

U.S. Department of the Treasury

Debt Management Services

P O Box 830794

Birmingham, AL

Privacy Act Statement: Collection of this information is authorized by 5 U.S.C. § 552a, 26 U.S.C. §§ 6331 and

6402, 31 U.S.C. §§ 3716, 3720A and 7701(c). This information will be used to identify your receivables (whether current or delinquent) submitted to the Department of the Treasury’s Bureau of the Fiscal Service for

collection by Federal and State agencies, and to identify payments made or due to you by Federal or State agencies. This information will be disclosed to persons as authorized by you. Additional disclosures of this information may be to Federal and State agencies collecting your debts or issuing payments to you. The purpose of the additional disclosures will be to verify the accuracy of the information provided to the Bureau of the Fiscal Service and to assist such agencies in collecting your debts. Where the taxpayer identification number is your Social Security Number, collection of this information is required by 31 U.S.C. § 7701(c). Failure to furnish the information requested, including your Social Security Number, may delay or prevent proper review and assessment of your request.

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Title | The document is officially named the CROSS SERVICING DEBTOR DISPUTE FORM. |

| Submitting Method | Individuals can submit the completed form via fax at 855-415-4999. |

| Mailing Address | Forms can also be mailed to U.S. Department of the Treasury, Debt Management Services, P O Box 830794, Birmingham, AL 35283-0794. |

| Required Information | The form requires the individual's name, address, Social Security Number, FedDebt Number, and comments. |

| Legal Authorization | Collection of information on this form is authorized by various federal laws including 5 U.S.C. § 552a, 26 U.S.C. §§ 6331 and 6402. |

| Purpose of Information | The information collected will be used to identify receivables submitted for collection by federal and state agencies. |

| Disclosure of Information | Information may be disclosed to authorized persons or agencies for debt verification and collection purposes. |

| Taxpayer Identification | If the taxpayer identification number is the Social Security Number, it is required by 31 U.S.C. § 7701(c). |

| Consequences of Non-compliance | Failure to provide the requested information, especially the Social Security Number, may delay or prevent the assessment of requests. |

Guidelines on Utilizing Debt Management Services Birmingham Al

Once you have the Debt Management Services Birmingham AL form at hand, it's important to fill it out carefully. Make sure to attach any supporting documents that may help with your submission. After completion, you will need to send it through fax or mail as directed. The form ensures that all your information is accurately submitted for proper review.

- Start by entering your Name in the designated area.

- Fill in your Address, ensuring that all details are correct.

- Provide your Social Security Number.

- Input your FedDebt Number in the appropriate section.

- In the Comments section, add any relevant information or questions you may have.

- Attach any necessary supporting documentation to your completed form.

- Send the form and attachments via fax to 855-415-4999, or mail them to:

U.S. Department of the Treasury

Debt Management Services

P O Box 830794

Birmingham, AL 35283-0794

What You Should Know About This Form

What is the purpose of the Debt Management Services Birmingham, AL form?

The Debt Management Services Birmingham, AL form is designed to facilitate the dispute of debts managed by the U.S. Department of the Treasury. Individuals can use this form to contest information related to their debts, ensuring that their concerns are formally documented and addressed.

What information is required to complete the form?

To complete the form, you will need to provide essential personal information, including your name, address, Social Security Number, and FedDebt Number. Additionally, you may include comments that elaborate on your dispute. Providing thorough details will assist in the review process.

How should I submit the completed form?

The completed form and any supporting documentation can be submitted by fax to 855-415-4999. Alternatively, you can mail the form to the U.S. Department of the Treasury, Debt Management Services, at P.O. Box 830794, Birmingham, AL 35283-0794.

What supporting documentation should I attach?

Attach any relevant documentation that supports your dispute. This may include payment records, correspondence with creditors, or any other documents that provide evidence of your claim. Comprehensive documentation strengthens your dispute and aids in a thorough review.

What privacy protections are in place for my information?

The form collects personal information under specific legal authority, ensuring that your data is used solely for identifying and resolving debt issues. The Privacy Act Statement outlines how your information may be disclosed to authorized parties, primarily to verify the accuracy of debt-related information.

What happens if I do not provide my Social Security Number?

Providing your Social Security Number is essential for processing your request. If this information is not furnished, it may delay or prevent proper review and assessment of your dispute. Be aware that this requirement is mandated by federal law.

What will happen after I submit my form?

Once your form is submitted, the Bureau of the Fiscal Service will review the information provided. They will investigate your dispute and respond accordingly. You should receive communication regarding the outcome of their review, which may take some time depending on the complexity of your case.

Common mistakes

Completing the Debt Management Services Birmingham, AL form can be a straightforward process; however, people often make common mistakes that can hinder their requests. One prevalent error is failing to include the Social Security Number. This number is essential for identification purposes and without it, the review process cannot proceed efficiently. Without this critical piece of information, delays in assessing the dispute can occur.

Another typical mistake is neglecting to attach supporting documentation. The instructions clearly state the need for additional documents, yet many individuals overlook this requirement. This oversight can lead to incomplete submissions. Consequently, the absence of relevant evidence often results in a request being postponed or denied outright.

Many also forget to fill out the FedDebt Number section of the form. This number is vital for linking the dispute to the correct account within the system. A missing FedDebt Number complicates the process of tracking and resolving the debt in question. Individuals may find themselves confused by the lack of response if this detail is omitted.

While filling out the name and address sections, some people make the error of providing inaccurate information. Typos or incorrect addresses can lead to significant delays, as the form may be sent to the wrong location. Ensuring these details are precise is crucial for timely correspondence and resolution.

Additionally, individuals often inadequately complete the Comments section. A vague or unclear explanation of the dispute may result in misunderstandings. Clear and concise comments help clarify the nature of the dispute, making it easier for the reviewing agency to address the issue.

Lastly, sending the form via the wrong method is a common misstep. The instructions provide multiple avenues for submission, including fax and mail. Some people may either use mail when a quicker response is desired or forget to fax the form altogether. Understanding and following the preferred method of submission can significantly affect the speed and efficiency of the review process.

Documents used along the form

When dealing with debt management services, several forms and documents may prove essential in supporting your case. Each piece of documentation plays a vital role in ensuring that the process runs smoothly and efficiently. Below is a list of documents commonly associated with the Debt Management Services Birmingham AL form.

- Debt Repayment Plan: This document outlines proposed terms for repaying outstanding debts. It includes details such as payment amounts, payment frequency, and total estimated time for repayment.

- Credit Report: A credit report provides a comprehensive view of an individual’s credit history. It includes information on previous debts, payment history, and credit scores, which are pivotal in assessing debt management options.

- Contact Information Form: This form collects essential contact details to ensure that all correspondence concerning debt management reaches the right person. It typically includes phone numbers and email addresses.

- Authorization for Release of Information: This document allows individuals to authorize third parties, such as financial advisors or attorneys, to access their debt information. It is crucial for managing disputes and negotiations.

- Financial Statement: A financial statement gives an overview of an individual's financial situation, including income, expenses, assets, and liabilities. This information helps in evaluating one's ability to repay debts.

- Proof of Income: Documentation such as pay stubs or bank statements showing current income is necessary for assessing the feasibility of proposed payment plans.

- Debt Validation Letter: When debts are disputed, a debt validation letter confirms or disputes the legitimacy of the debt claimed. This document is essential for ensuring transparency in debt collection.

- Payment History Documentation: This document lists all previous payments made towards the debt. It is useful for both verifying payment status and understanding the remaining balance.

- Bank Statements: Recent bank statements provide insight into an individual's financial activities, showcasing deposits, withdrawals, and overall cash flow.

- Consumer Credit Counseling Agreement: This agreement outlines the terms of services provided by a credit counselor, including fees and responsibilities. It helps set expectations and develop a structured plan.

Utilizing these forms can greatly enhance the clarity and effectiveness of communication with Debt Management Services. Each document contributes to building a comprehensive picture of one's financial obligations, making it easier to navigate the complexities of debt management.

Similar forms

- Debt Validation Letter: Similar to the Debt Management Services form, a Debt Validation Letter allows individuals to dispute a debt and request verification of the amount owed. Both documents aim to establish the legitimacy of a debt that is being reported.

- Consumer Assistance Request: This form serves to request assistance from consumer protection agencies. It shares similarities with the Debt Management Services form in that it collects personal information and explains the reason for the request, often in disputes related to debt.

- Financial Hardship Letter: This document outlines a borrower’s current financial difficulties, similar to the Debt Management Services form. It serves to communicate the inability to pay debts, seeking potential relief or consideration.

- Request for Debt Forgiveness Form: This form is used to petition for the cancellation of a debt. Like the Debt Management Services form, it typically requires personal and financial information to assess eligibility.

- Bankruptcy Petition: A Bankruptcy Petition is submitted to declare the inability to repay debts. This legal document, while more formal, includes detailing financial situations and personal identification, akin to the information requested in the Debt Management Services form.

- Claim of Exemption Form: This form is filed to protect certain assets from being claimed by creditors. Both forms involve detailing personal information and circumstances affecting finances in a bid to protect individuals from escalated collection actions.

- Resolution Agreement Form: This document aims to create a formal agreement between a debtor and creditor for repayment terms. Similar to the Debt Management Services form, it requires personal information to negotiate the terms of debt repayment effectively.

Dos and Don'ts

When filling out the Debt Management Services Birmingham, AL form, it’s crucial to proceed with care. Here’s a list of important dos and don’ts to ensure your submission is complete and accurate.

- Do read the entire form thoroughly before you begin.

- Do provide accurate and truthful information.

- Do double-check your Social Security Number for correctness.

- Do include any supporting documentation that may strengthen your dispute.

- Do ensure your contact information is accurate and current.

- Don't leave any required fields blank.

- Don't forget to sign and date the form where indicated.

- Don't submit the form without making copies for your records.

- Don't rush through it; take your time to avoid mistakes.

- Don't ignore any specific instructions related to submitting the form, whether by fax or mail.

Misconceptions

-

Misconception 1: Completing the form is unnecessary.

Many believe that filling out the Debt Management Services Birmingham, AL form is optional. In reality, submitting the form is essential for disputing a debt or for any inquiries about your financial standing with the Department of the Treasury.

-

Misconception 2: Privacy concerns are unfounded.

Some may think that their personal information is not protected. However, this form is subject to the Privacy Act, which ensures that your details are handled carefully and shared only with authorized individuals.

-

Misconception 3: You can submit the form without documentation.

It is a common misunderstanding that submitting the form alone suffices. Supporting documentation is crucial as it helps substantiate your dispute or concern regarding the debt being questioned.

-

Misconception 4: The form is only for delinquent debts.

Some people think this form is applicable only to overdue debts. However, it can be utilized for both current and delinquent receivables, making it a valuable resource for various financial situations.

-

Misconception 5: Once submitted, the information cannot be changed.

Another misconception is that once the form is sent, no modifications can occur. In truth, you can reach out to clarify or amend your submission if needed, as long as it’s in a timely manner.

-

Misconception 6: Responses will take an excessive amount of time.

Some worry that the review process may drag on indefinitely. Although processing times can vary, the Department of the Treasury aims to respond as swiftly and efficiently as possible.

-

Misconception 7: Sending the form via fax is the only option.

There's a belief that faxing is the sole method for submission. In addition to faxing, individuals can also mail the completed form to the specified address, providing flexibility in how you choose to communicate.

-

Misconception 8: I don't need to include my Social Security Number.

Some may think that omitting their Social Security Number is acceptable. This is incorrect, as providing this information is vital for the accurate review and assessment of your request. Failure to provide it may delay processing.

Key takeaways

When filling out the Debt Management Services Birmingham, AL form, keep these key takeaways in mind:

- Complete all required fields. Ensure you provide your name, address, Social Security Number, and FedDebt Number accurately. Missing information can delay your request.

- Attach supporting documentation. Any additional documents that substantiate your dispute should accompany the form. This helps in the timely processing of your request.

- Choose your submission method carefully. You can either fax your form and attachments to 855-415-4999 or mail them to the U.S. Department of the Treasury. Select the method that is most convenient for you.

- Understand the privacy implications. Be aware that your information will be used to identify your debts and payments. This data may also be shared with Federal and State agencies involved in debt collection.

Browse Other Templates

South Carolina Tax Forms - Filing by the due dates is essential to avoid unnecessary penalties.

Layoff Letter Sample - Confidentiality is maintained throughout the completion and handling of this form.